The European market potential for finance and accounting services

More and more European companies, mostly small to medium-sized enterprises (SMEs), are discovering finance and accounting outsourcing (FAO) as a cost-effective way to improve their business. The trends on the market are automation, real-time services and the demand for added value partners.

Contents of this page

1. Product description

Finance and accounting outsourcing services support businesses in managing their financial processes more effectively.

There are 2 types of finance and accounting services: services covering transaction-intensive processes and those covering knowledge-intensive processes.

Transaction-intensive processes are processes with lower added value, such as:

- Accounts payable/receivable accounting;

- General accounting;

- Payroll accounting;

- Fixed assets accounting; and

- Tax preparation.

Knowledge-intensive processes are processes with higher added value, such as:

- Budgeting/forecasting;

- Capital budgeting;

- Internal auditing;

- Management reporting/analysis;

- Regulatory reporting/compliance; and

- Treasury/risk management.

Most outsourced finance and accounting services cover:

- Transaction processing;

- Financial reporting;

- Month-end closing; and

- Financial planning and analysis.

These are all considered knowledge-intensive processes. Relatively simple, rule-based and repetitive tasks are increasingly automated.

European companies are mainly looking for high-quality services, expertise, and compliance with regulatory standards, knowledge-intensive processes such as financial reporting and analysis, tax compliance and advice, and risk management. However, these processes require specialised knowledge, expertise, and attention to detail, making them harder to offer than transaction-intensive processes.

Outsourcing gives European companies access to specialised expertise and advanced technologies. As a finance and accounting outsourcing provider you can give them accuracy, efficiency and compliance with industry standards and regulations.

Outsourcing enables European organisations to scale resources up and down as needed, without the obligation to pay salaries or other employee benefits, and without the need to hire, train and retain accounting staff.

2. What makes Europe an interesting market for finance and accounting services?

The market offers good opportunities for FAO providers from developing countries because the demand for finance and accounting services is growing, the labour market is tight and working from home has made it easier to outsource finance and accounting services.

Outsourcing finance and accounting services is relatively common for European companies. Around 51% outsources financial services and 61% outsources tax-related services. Europe is the second biggest finance and accounting market in the world, after North America.

The demand for finance and accounting services is growing

Research shows that the European FAO market was estimated to grow by a CAGR of 8.8% from 2022 to 2028. It is expected that by 2025, the European FAO market will be worth €921 million, with Germany alone making up half of this market. Finance and accounting services are the most commonly outsourced services in European companies.

The market is growing because of the following 4 reasons:

Focus on core business

European businesses are increasingly outsourcing finance and accounting functions to third-party service providers, both domestically and internationally. Outsourcing allows companies to access specialised expertise, reduce costs, and focus on core business activities.

Globalisation and market expansion

With the increasing globalisation of business operations, European companies are expanding into new markets and regions. This leads to more complex financial transactions and reporting requirements. When these companies have to work with international regulations and compliance standards, they rely on finance and accounting services to ensure compliance with regulations, reduce risks, and optimise financial performance.

Technological advancements

Advances in technology, such as cloud computing, automation, and artificial intelligence, are transforming finance and accounting processes. European businesses are choosing digital solutions to streamline financial operations, and improve efficiency and decision-making capabilities. This digital transformation is driving demand for technology-driven finance and accounting services, including software implementation, process automation and data analytics.

Focus on cost optimisation

European companies are looking for ways to lower costs and improve operational efficiency. Outsourcing finance and accounting functions helps them to achieve cost savings and access economies of scale.

Tight labour market in the sector

Finance and accounting skills are among the most in-demand skills in the European labour market. The tight labour market in the finance and accounting sector is due to the increasingly high demand combined with the fact that there are not enough available people with the right skills. This has led to a large increase in labour costs for most finance and accounting roles. To fill the gap, many companies in Europe try to hire professionals from abroad. An easier option, which provides more flexibility, is to outsource tasks to offshore providers like you.

Research by finance online revealed that the top skills needed by accountants in 2024 are technological literacy (57%), relationship building skills (46%), business advice skills (44%), industry experience outside accountancy (43%) and project management skills (36%). The same research found out that the 4 most in-demand training goals for accountants are client service and management (63%), financial business advice (63%), business management (59%) and project management (56%).

However, even with the tight labour market, many European companies hesitate to outsource finance and accounting jobs to companies in other countries. This is mainly due to buyers’ privacy concerns and new regulations such as the green deal and governmental privacy regulation.

Tips:

- Find the right people. Consider hiring people with the necessary talents who still need to attain the required competencies. You can train them on the job.

- Also, make sure you have access to the right people to scale up operations and service clients at short notice.

- Take steps to retain your people. Invest in education, create a good work environment. In short: keep your employees happy and skilled.

Now that remote working is common practice, outsourcing has become more acceptable

An increasing number of people in Europe work remotely or partly remotely. This means Europeans are more used to working with people that are in a different location.

Source: Statista

Working from home has become very accepted in many European countries over the last 4 years. This has made outsourcing easier and more acceptable as it makes the difference between in-house, nearshore and offshore teams smaller.

Outsourcing finance and accounting to an accounting service provider does not mean the European company is giving up its entire in-house team, in fact is it often the opposite. They can choose the areas to be outsourced. For some companies, this means they keep their entry-level bookkeepers and outsource a fractional Chief Financial Officer (CFO). For others, outsourcing finance and accounting means maintaining an in-house CFO but outsourcing all the transactional financial processes.

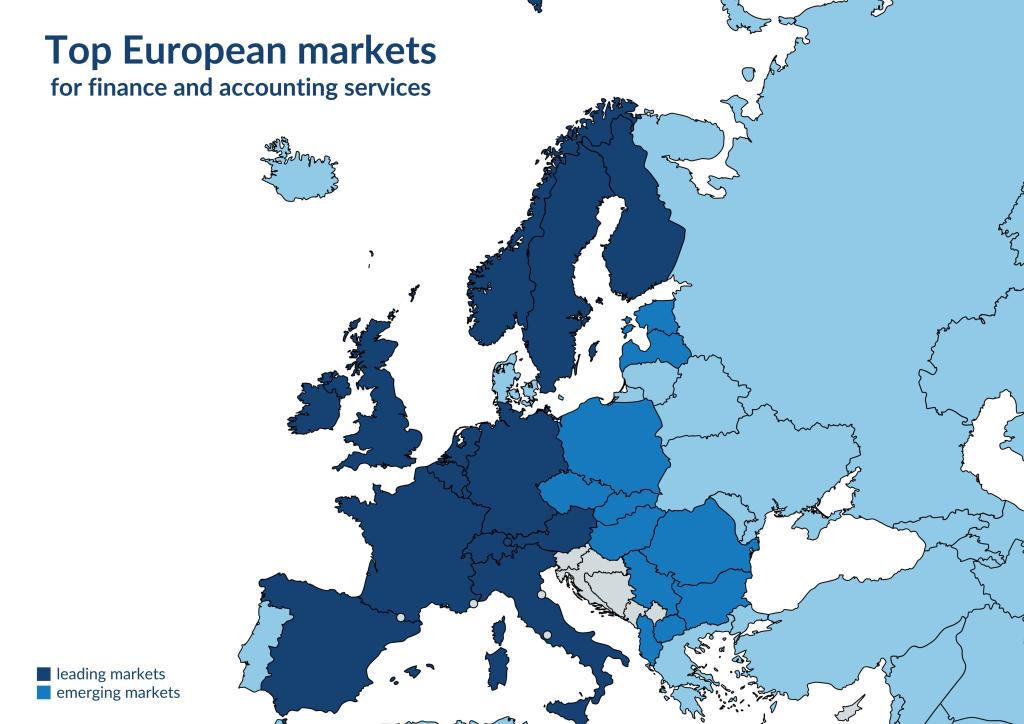

3. Which European countries offer the most opportunities for finance and accounting services?

Northern and western European countries are traditionally the biggest outsourcing markets. While the largest countries offer opportunities based on their size, some smaller countries are also interesting markets to focus on, because of their advanced economies or because their finance and accounting sector is relatively large.

Figure 2: Leading European markets for finance and accounting outsourcing (FAO)

Source: Globally Cool

Germany is Europe’s largest FAO market

Germany is also the largest FAO market in Europe. It is estimated to be worth around €45.3 billion at the end of 2024. The market grew with an average of 3.3% between 2019 and 2024. In 2024, the market is expected to grow by 6.3%.

Germany is the largest economy in Europe, home to almost 19% of the European Union’s (EU) population. The German economy is widely considered the stabilising force within the European Union, historically showing a higher growth rate than other member states. However, currently Germany’s economy is performing slightly less well compared to other European countries. But inflation is lower than average, as is the unemployment rate. Germany is generally a healthy economy with a large industrial sector.

Although its size makes Germany an interesting market, companies there are less open to offshore outsourcing than in countries like the United Kingdom (UK) and the Netherlands. However, as German businesses continue to face skills shortages and become more experienced in offshoring, their attitude to it is improving. In addition, the COVID-19 crisis has created more opportunities for you on the German market, as it has relaxed Germany’s generally stiff corporate culture and has shown companies what is possible with remote working and outsourcing. In 2022, almost a quarter of all employed persons in Germany worked from home sometimes.

Language barriers are relatively high, especially in the sales process. But finance and accounting services in themselves are not very language dependent. You can increase your chances of success by collaborating with a German-speaking partner rather than approaching end users directly. If you meet these language requirements, you could also target German-speaking companies in Austria and Switzerland.

The United Kingdom is Europe’s second largest FAO market

The United Kingdom is suffering from a finance and accounting skills shortage. And on top of that, there is a so-called war on talent due to rising wages. The UK FAO market is expected to grow at a CAGR of 7.9% from 2022 to 2028.

Around 90% of finance and accounting recruiters in the United Kingdom believe skills shortages will be their main hiring challenge for 2024. This is the highest percentage ever seen in the industry. Payroll, accountancy support and partly-qualified accountant roles have seen the greatest increases in pay. Finance and accounting is the most outsourced service in the UK after IT support (34%), payroll (28%) and printing (24%).

The significant rise in average wages of finance and accounting professionals (5.6% in 2023, while in the same year, the average UK salary only rose by 3.5%) is causing many finance and accounting professionals to switch jobs to get a better salary, resulting in an even higher rise of salaries. Many companies are struggling to keep their finance team together.

The United Kingdom is the second-largest economy in Europe. The finance and banking sector is one of the highest contributing sectors to the UK’s GDP. Outsourcing finance and accounting services is a common practice for many UK companies. This boosts the demand for FAO services in the United Kingdom.

Of all European markets, the United Kingdom is the most open to offshore outsourcing and the least cautious about doing business with developing countries. This openness is due to the nation’s cost-saving business culture and historical ties to many countries across the globe. Language barriers are low, as the United Kingdom’s official language is English. This makes the British market relatively accessible for offshore providers.

The Netherlands is a fast-growing hub for finance and accounting services

The Netherlands is considered to be the fastest-growing hub for finance innovation. Some examples of successful Dutch financial innovations are Mollie and Adyen. Dutch companies are also leaders in adopting tech innovations. This means there are many potential buyers of finance and accounting services and that number is also growing fast.

The main reasons for Dutch companies to use external service providers are access to resources and talent (56%, up from third place in 2023). Second in priority is scalability (51%), followed by focus on core business (49%).

Research done in 2024 shows this, as well as that cost reduction has seen a significant decline in importance, dropping by 16% to its lowest point to date at 23%.

The Netherlands has the sixth-highest GDP per capita in Europe. The country has a relatively large business process outsourcing market that is expected to reach a revenue of €6 billion by the end of 2024. From 2024 to 2028 it is expected to grow at a CAGR of 2.64%.

Companies in the Netherlands are traditionally fairly open to outsourcing. Language barriers to doing business in the Netherlands are generally low, as most Dutch people speak English.

France’s already large FAO market is expected to grow fast

France is an interesting market because of its size. France has the third largest Gross Domestic Product (GDP) in Europe and the third largest population. On top of that, the FAO market in France is very large and is expected to grow with a CAGR of 9.6% from 2022 to 2028.

Speaking the language of your target country is always a plus, but when you want to offer your FAO services to France, it is especially important to speak the language. For French decision makers, trusting the outsourcing service provider to work independently is the most important selling point.

Nordics: Often overlooked region that has lots of potential

The Nordic countries consist of Norway, Sweden, Finland and Denmark. With the highest finance and accounting agent salaries in Europe, Nordic companies can achieve considerable cost savings by outsourcing their finance and accounting services, especially by offshoring to developing countries.

You will face less competition of other FAO providers in the Nordic markets than in eastern European countries. There is a particular large demand for FAO services in the fields of financial crime and compliance.

The Nordic countries individually are smaller than other European markets, but they are relatively open to outsourcing their finance and accounting services. Sweden and Denmark are the region’s powerhouses, but Finland and Norway are also strong performers in the finance and accounting market.

In the Nordics, language barriers are generally not an issue, because their English language skills are excellent.

Switzerland’s large financial sector is facing a skills shortage

The Swiss are struggling with their labour market. The skills shortage is very high, especially in technology and accounting. This means that Swiss companies are looking for technology and accounting talent abroad.

Switzerland is known for its finance and banking market and has a very strong economy; its GDP per capita is among the highest in Europe. Swiss companies are very internationally oriented and doing business in English comes naturally to them, so there are relatively few barriers to outsourcing.

4. What trends offer opportunities or pose threats in the European finance and accounting services market?

The biggest trends in the European finance and accounting outsourcing market are technology-abled business models, the move from multiple suppliers to preferred suppliers and the high demand for added-value providers.

Although you should stay up to date on the latest trends and techniques in finance and accounting services, you cannot tap into each trend. Technology-related trends can change especially fast. Focus on those that suit your business and may boost your growth. For more information, see our study on trends for ITO/BPO.

Buyers want technology-abled business models

Accounting is a crucial area for automation. Of all business areas, European companies have adopted automation in accounting the most (29%). This compared to marketing (28%), sales (27%), customer service (25%) and operations (15%).

As technology continues to evolve, the role of finance professionals like you is undergoing a transformation. Today, you are expected to work with new technologies, such as data analytics and digital tools. It will increase your efficiency and accuracy.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and machine learning (ML) are shaping the FAO industry. They are taking over repetitive and simple manual tasks. AI-based accounting software offers FAO professionals intelligent tools to manage their accounting tasks. It helps them analyse large data volumes and generates more accurate analytics faster and cheaper.

Examples of AI or ML tools that are used in finance and accounting are:

- Automated data entry and invoice-processing tools. These use AI to automate the entry of financial data and processing of invoices, reducing errors and saving time.

- Predictive analytics for financial forecasting. Tools that apply machine learning to analyse historical data and predict future financial trends, helping with budgeting and forecasting.

- Fraud detection systems. AI algorithms that monitor transactions in real-time to identify and alert to potentially fraudulent activity, improving security.

Technological developments play an important role in European companies’ decision to outsource finance and accounting services. Technological innovations can enable them to increase their productivity and lower their overall operational costs. However, the investments required to stay on top of the latest developments are often too high. Outsourcing finance and accounting services allows European companies to benefit from technological developments without having to invest in IT resources, implementation and maintenance.

European buyers are also looking to improve the efficiency and/or functionality of their existing systems. This means service providers need to offer (add-on) tools that improve these systems and incorporate new technology.

There are good market opportunities for companies that can offer specific add-on tools.

Tips:

- The future of FAO does not lie in repetitive and simple tasks. If you want to stay relevant in this market, you have to stay on top of the technological developments and embrace AI technology.

- For more information on analysing large datasets, see our study about big data.

Example Pastel Africa

Pastel Africa is a company that uses AI to offer finance and accounting services. It is known for its Sigma suite, an advanced collection of AI-powered solutions designed for enterprises and financial institutions. The company operates under the trading name of DataServe AI Inc. and is registered in Nigeria as Infinity Labs Nigeria LTD. Pastel Africa's services are aimed at a wide range of clients, including e-commerce platforms, credit bureaus, fintechs, and banks.

Moving from multiple suppliers to one supplier

In the finance and accounting sector, there is a clear move towards preferring a single, main supplier instead of working with many. This change comes from the wish to make things simpler, achieve better deals, and improve efficiency by focusing on key partnerships.

Businesses are looking for suppliers who can provide more than just good prices; they want quality, dependability, and innovation. The goal of this approach is to build stronger, more beneficial relationships with fewer suppliers, making the process smoother and more effective for everyone involved.

Aim to become the preferred supplier for your current and potential buyers. You can do this by:

- Focussing on quality and reliability. Ensure your products or services meet high-quality standards consistently. Reliable delivery and support can set you apart and make you indispensable to your clients.

- Customise solutions. Understand your clients' unique needs and tailor your services to meet those requirements. Personalised solutions can significantly boost your value proposition.

- Build strong relationships. Invest in building solid and transparent relationships with your clients. Become a preferred supplier through regular communication, by understanding their business challenges, and being responsive to their needs.

High demand for added value providers

The most in-demand finance and accounting roles for 2024 are accounting manager, accounts receivable / accounts payable (AR/AP) roles, controller, financial analyst, internal auditor, loan administrator, payroll manager and staff and senior accountants. The specific demand for these finance and accounting roles shows the increasingly high demand for added value partners.

Besides these so-called hard skills, there is also an increasing demand for soft skills. Examples of soft skills in finance and accounting are communication, the ability to make good judgement and take quick decisions, ability to multi-task and problem-solve, and develop business partnerships.

For finance and accounting service providers like you these soft skills are most in demand:

- The ability to work independently in virtual teams;

- Attention to detail;

- Being comfortable with change;

- Commitment to continued learning;

- Creativity and innovation;

- Customer service capabilities;

- Problem-solving ability; and

- Writing and verbal skills.

Tips:

- Become an added value partner. Invest in the soft and hard skills of your employees and incorporate your (new) status as a value-added partner in your marketing.

- Offer analytical services, including Financial Planning & Analysis but also beyond that.

- Invest in the relationship with your clients to create a true partnership based on reliability and trust. Look for online sources on managing sourcing relationships.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research