Entering the European market for healthtech

In order to enter the European market, you need to comply with mandatory statutory and other requirements, such as copyright law and the General Data Protection Regulation (GDPR). Buyers may also have requirements regarding quality management and corporate social responsibility as well as industry-specific standards, technologies and frameworks. European service providers and intermediaries are your most realistic market entry channels.

Contents of this page

1. What requirements should healthtech comply with to be allowed on the European market?

Requirements vary per industry, per segment and even per country. New legislation is always in the making. This makes it impossible to list (or to know) all possible requirements. The health care market is extremely complex. It is a large market with a lot of segments with their own standards, specialisations and terminology.

Software development requirements

Healthtech software development is a form of software development. Therefore, all requirements that apply to software development also apply to healthtech software development. These include rules concerning copyright, the GDPR, personal data protection and cyber security. Refer to the software development study to read more about these requirements and what they might mean for your company.

What are mandatory requirements?

Mandatory requirements are rules you must follow, even if you are located outside of the European Union.

Health technology assessment (HTA)

The health technology assessment helps authorities find out if the new or existing technology is effective. It focuses on the added value of a health technology compared to other new or existing health technologies. Thanks to health technology assessments, national health authorities can take informed decisions on the pricing or reimbursement of health technologies.

The main purpose of an HTA is to provide policymakers with evidence-based information, so they can formulate health policies that are safe, effective, patient-focused and cost-effective. It is also used by national authorities to help decisions on which technology should be reimbursed at national level.

Health technologies include medicinal products, medical devices (such as pacemakers, dialysis equipment or infusion pumps) or medical and surgical procedures, as well as measures for disease prevention, diagnosis or treatment used in health care. This means an HTA does not apply to all health tech products or services.

The proposal for this regulation was adopted by the European Commission in January 2018. In June 2021, the European Commission and the European Parliament agreed to work together on making this proposal come into effect.

IEEE 11073

This standard was originally developed for in-hospital patient monitors, but it has been expanded into a set of specifications for personal health devices. Because most healthtech solutions are personal health devices, this standard is very important for you.

Sets of standards can be layered together to provide the best type of connectivity for the devices. IEEE 11073 is adopted by ISO and CEN member countries.

Radio Equipment Directive (RED)

The RED is a regulatory framework that equipment vendors must follow to sell electronic equipment on the EU market.

The European commission is currently updating the RED. The proposed new standard is scheduled to come into effect in 2024. It lists three new security measures that device makers must incorporate in the design of their product:

- Improved network resilience

- Better protection of customers’ privacy

- Reduced risk of monetary fraud

Tips:

- Stay up to date with the latest changes regarding the above-mentioned rules to find out what they might mean for your product or service. Some EU Member States have implemented directives into national legislations. Although they are generally the same, there could be minor differences.

- Pay attention to copyright and infringement (the act of breaking or disobeying the contract) clauses in the contracts you sign with European buyers.

- Check the websites of Health Level 7 (HL7) and the Health Insurance Portability and Accountability Act (HIPAA) to see if these rules apply to your healthtech product or service.

- Also read our ME reports on (I)IoT, big data, ML/AL, VR/AR, blockchain, software development and mobile applications if you work with those technologies or products.

What additional requirements do buyers often have?

Quality management

Some European buyers only do business with companies that have a quality management system in place. Such a system shows that you are well organised and able to deliver the required service quality. Examples of quality management include backup and recovery schemes, network and infrastructure security, communication plans and relocation options.

Obtaining ISO certification will help you do business in Europe. It shows your commitment to quality. If European companies have to choose between ten different healthtech developers or providers and only one has an ISO certification, they will prefer the ISO certified company unless that company is twice as expensive.

ISO/TS 82304-2 has been developed particularly for health and wellness apps.

Acknowledged and common systems are ISO 9001:2015 and the Capability Maturity Model Integration. Other ISO standards that might apply to health tech services are ISO/IEC 9126, ISO/IEC 9241-11, ISO/IEC 25000:2005 and ISO/IEC 12119. Also check the overview page of ISO for health-related standards.

Tips:

- If you aim to specialise, find out which certifications are relevant. When considering a particular quality certification, ask yourself three questions before working out the details: is it good for my company? Is it good for my clients? Does it have marketing value?

- Check if resources are available that might provide your company with financial support to achieve quality certification. Contact your national IT association (like TAG Georgia or BPESA from South Africa) or one of the business support organisations in your country that are responsible for IT export promotion. If you are an African IT service provider, take a look at the #FastTrackTech Africa Initiative by Intracen.

Corporate Social Responsibility

Corporate Social Responsibility (CSR) refers to companies taking responsibility for their impact on the world –not only in terms of the products or services they offer, but also when it comes to:

- consumer rights;

- education and training of staff;

- human rights;

- health;

- innovation;

- the environment;

- working conditions.

Documented CSR policy

CSR is becoming particularly important to large companies and governments in northern and western Europe. Many European companies involve their suppliers in their CSR policies. Having a well-documented CSR policy may give you a competitive advantage over companies without one. The ISO 26000 standard provides guidance on CSR. For small companies, the most relevant and practical aspects of this standard are labour practices, fair operating practices and community involvement.

Become an impact sourcing destination

The environmental impact of healthtech solutions consists of their energy consumption. You can easily limit this by designing/developing energy-efficient applications and carefully selecting/recommending (green) webhosts.

The social side of sustainability is the biggest challenge – but also an opportunity! You can make a social impact by becoming an impact sourcing provider. This is becoming a big trend in outsourcing. The impact sourcing model aims to improve the lives of people, families and communities by hiring and training people with limited employment opportunities.

However, sourcing and training these people requires considerable upfront investment and effort from you as their employer. You can look for support from local impact sourcing initiatives, work readiness programmes and non-profit training institutes like South Africa’s Maharishi Institute.

When you have tackled this challenge and set up an effective recruitment and training strategy, you can enjoy the benefits:

- Large(r) talent pool in a competitive market

- Loyal and motivated workforce

- Strong competitive advantage

- Positive social impact on your employees and community

For your buyers, this means:

- better supplier performance;

- stable/reliable supplier workforce;

- meeting inclusion and diversity goals;

- positive social impact.

Good examples are Techno Brain and Sama. Techno Brain is an impact sourcing pioneer and winner of the 2021 Global Impact Sourcing Award. It provides training and employment to underprivileged people in countries such as Kenya and Uganda. Sama (India, Kenya, Pakistan, South Africa, Uganda) lifts many employees out of poverty by providing training in topics like digital literacy and soft skills as well as a living wage.

Develop fair trade software

Another example of how CSR initiatives extend to small IT businesses is fair trade software. This refers to software that is developed for better prices, under decent working conditions, in support of local sustainability and with fair terms of trade. In essence, developing fair trade software is a way of impact sourcing. Impact sourcing has a wider reach than fair trade software.

Tips:

- Show that you care about your impact on society by implementing your own CSR policy. Clearly communicate your commitment in your marketing activities. It can be a unique selling point (USP). Emphasise how you, as an impact souring provider, match the CSR policy of your potential buyer.

- Look at examples of small software companies engaging in CSR. Telit has a Modern Slavery Statement at the bottom of its website, which means that you can see it on every page. Read more about CSR in practice on the website of the European Commission. Consult the ITC Sustainability Map for a full overview of certification schemes addressing sustainability in the IT outsourcing sector.

- For more information about fair-trade software, see the Fair Trade Software Foundation and Web Essentials video on what fair trade software development means.

Up-to-date knowledge and skills

As a healthtech product or service provider, you must stay on top of the developments in the market. European buyers expect you to be able to offer them the possibility to work with the latest technology. It is therefore very important to stay informed about relevant technologies, platforms, frameworks and innovation and to keep your skills up to date.

European buyers of your product or service also look for your motivation as to why you choose to work with certain coding programmes and technology. Your motivation should be clearly visible on your website.

Tip:

- Show you are a professional company. Have good references, obtain relevant industry certification, respond quickly, communicate regularly, offer constant quality, comply with contractual agreements and have a good and stable management team in place to lead the outsourcing project.

What are the requirements for niche markets?

European buyers often require you to comply with a sector-specific and/or industry-specific standard or code of practice (if available). There are also many technologies, technical standards, protocols and frameworks related to the technology that is used in healthtech. They are developed and maintained by a large number of organisations and they can differ significantly between niche markets.

Also, healthtech products are not only used in the health care industry. Some products are just for personal use or used in, for example, insurance companies to help employees with their mental or physical health. The end user segment of your healthtech product or service determines the requirements you need.

Tips:

- Look at our buyer requirements study for more information on the general IT outsourcing sector.

- Check the exact rules that apply in your European target market. The ePing website provides an overview of country-specific measures that affect trade and differ from the international standards.

- There are many good online resources to read more about specific healthtech products and services and the corresponding requirements, for example about HL7 standards and IHE Profiles that complement the IEEE 11073 series, the International Health Terminology Standards Development Organisation that works closely with the ISO organisation, and the Healthcare Standards Directory,

- Regularly check the Digital Health Standards website to see if there is any new or updated legislation.

2. Through what channels can you get healthtech on the European market?

How is the end market segmented?

Healthtech is such a large business segment that specialisation is key. It is unrealistic to want to become an all-round healthtech specialist.

Healthtech affects all segments of the European health care market, but some segments are more promising than others. One indication of the most promising segments can be found in Figure 1. The figure shows the segments that saw the most increase (in value) in investments in 2021.

Other promising segments for the next five years include:

Women’s health

Globally, funding for women’s health start-ups doubled in the third quarter of 2020. Examples of women’s health healthtech solutions are fertility tracking wearables, menopause tech and digitally enhanced breast pumps. Women’s health healthtech solutions are often also referred to as ‘femtech’.

Consumer health and wellness

European consumers are increasingly motivated to gain control over their own health care. Consumer health and wellness tech solutions can help them achieve that control. Examples are solutions based on digital biomarkers from wearables, continuous glucose monitors or diagnostic tests.

Workplace health

Workplace health solutions are moving upmarket, both for physical and mental health. This is primarily driven by the rising demand that derived from lengthy lockdowns and home office regulations. This sector is expected to continue to grow and is being adopted by companies of all sizes.

Online drug sales

The market for online drug sales is growing. This is driven by consumer demand for convenience and fast delivery. The market is currently focussed on over-the-counter products.

Despite the identification of these key markets, there are tangible business opportunities for healthtech across the health care sector, including enabling tech, digital therapeutics (DTx), pharma R&D and trials, elderly care, on-demand care, mental health and specialist and chronic care.

Opportunities can also be found at the intersection of biopharma and healthtech. Examples include DeepMind (acquired by Google in 2014), Healx (specialises in rare disease treatments) and digital therapeutics company Kaia Health.

This market segmentation applies to all countries in the European Union (unless specifically stated), although there are significant differences between the countries. For more country-specific information, also read our market analysis study.

Tips:

- Monitor developments within the European healthtech market that are relevant for your company by conducting Google searches that combine your product or service with a particular niche market.

- Research the end market segment that you want to focus on. This will allow you to market your company effectively.

- If your healthtech product or service is a relative commodity, you should focus on a niche market, especially if you can find a niche market that is underserved or has the room/need for digital innovation/transformation.

Through what channels does healthtech end up on the end market?

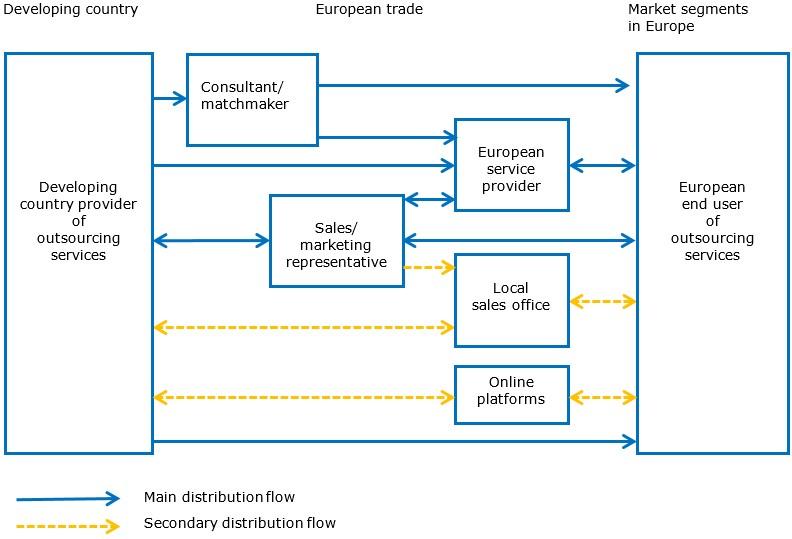

As a service provider in a developing country, you can use several trade channels to enter the European market. Figure 2 provides an overview of the trade structure for outsourcing. This structure is more or less the same in every European country.

Figure 2: Trade structure for selling healthtech products or services on the European market

What is the most interesting channel for you?

Your most common and most promising market entry channels are European service providers and consultants/matchmakers. Another option is to work with a local sales office or direct sales (possibly through online platforms).

Selecting a channel depends on your type of company, the nature of your product or service, your target market and the available resources for market entry. You must understand that, regardless of the channel you choose, your own marketing and promotion are a vital part of your market entry strategy, for which you are responsible.

European service providers

Many healthtech service providers from developing countries find a European service provider (ESP) to partner with, either directly or by working together with a matchmaker and/or a sales representative. Because many European companies prefer to deal with a local contact person, an intermediary is a good option. A European service provider that is similar to your company would be your most suitable contractor. Ideally, this company designs, develops, markets, sells and maintains healthtech solutions that are similar to yours.

The relationship between an ESP and a subcontracted supplier is generally characterised by:

- Trust;

- Interdependence;

- a structured relationship (functions, tasks, communication and procedures);

- potentially limited marketing visibility and market access opportunities for the subcontracted supplier;

- no intellectual property (IP) rights, or a loss of IP rights for the subcontracted supplier;

- work orders on an if/when necessary basis.

Tips:

- Approaching European service providers directly is only recommended if you have experience in the target market. Otherwise, you should consider working with a consultant/matchmaker.

- Attend relevant industry events in your target country or online to meet potential partners. This will also allow you to learn more about their business culture. Use IT industry associations to find potential customers in Europe, such as Bitkom in Germany, NL Digital in the Netherlands and Tech UK and BIMA in the United Kingdom. If you specialise in a particular industry, you can also use associations for those specific niches, such as the Association of British HealthTech Industries.

- Use outsourcing associations to find potential customers, such as the Global Sourcing Association, the German Outsourcing Association and Sourcing Nederland.

Consultants/matchmakers

A consultant/matchmaker is a person or a company with many relevant contacts in a specific market segment or industry. As an intermediary they are a door opener, not an agent to make cold calls or send cold emails. Always inform your consultant/matchmaker properly about your company. They speak with many potential customers and are often involved in creating long lists of potential outsourcing providers. The more information they have on your company and the better they understand your capabilities, the more they can spread the word about you.

If you work with a consultant/matchmaker:

- the consultant/matchmaker makes appointments with prospects for you;

- the presentation and sales process remains in your own hands;

- you pay a retainer and success fee (which can be expensive);

- the consultant/matchmaker usually has multiple clients;

- you need to set clear expectations and objectives to measure their performance.

A retainer and success fee construction can be expensive. While the success fee depends on what the intermediary has delivered, you have to pay the retainer (usually a fixed monthly payment) regardless of their performance. Together, they should provide a strong motivation for the intermediary to deliver: the retainer should be high enough to cover some of the costs, but low enough to encourage delivery. A contract properly drafted by a lawyer is a must.

Matchmakers make appointments with prospects for you. However, the presentation and sales process remains in your own hands. This means that a consultant or matchmaker is a good option for you if you feel comfortable taking care of the presentation and sales process yourself.

You also need to determine an exit strategy in the contract. It is in the absolute interest of the service providers clearly to define a period after which the contract can be terminated without any further consequences. This period is usually not longer than three or four months (after which the contract will be evaluated and can be terminated – for non-delivery, for instance – or prolonged for another period). For this period, there should be clearly defined delivery expectations and targets for the consultant or matchmaker, such as the number of relevant contacts, meetings and leads. You could also negotiate a trial period.

Tips:

- Work with a good lawyer who knows the applicable law of the country where the intermediary resides and has previous experience with this type of contracting. Pay special attention to exit clauses, success criteria, deliverables and payments. Avoid marketing coverage and activities limitations in your contracts.

- Think about who would be a good sales representative for your company. Although convenient, your uncle who lives in Germany might not be the best choice.

- Pre-COVID-19, various organisations organised matchmaking sessions or missions in which companies from developing countries could participate. Find out if there are any organisations in your country that offer matchmaking sessions (online or offline).

Direct sales and online marketplaces

It is generally not easy to sell your own health care products directly on the European market. It is possible for some mobile applications or wearables, but it is much more difficult for things such as more complex monitoring equipment.

However, it can be an opportunity for global market expansion, for example through innovation and development of disruptive technologies, attracting investments (possibly through crowdfunding) and establishing start-up companies as spin-offs of your company, often in partnership with the manufacturer of the physical machinery or sensors in question.

Crowdfunding is defined by Fundable as a method of raising capital thanks to the collective effort of friends, family, customers and individual investors through online channels, such as social media and crowdfunding platforms. By making use of different European crowdfunding platforms, you can find potential investment partners based in Europe and raise capital to help develop business ideas further.

You can try to sell your healthtech services directly to European end users, for example through online marketplaces. Many European companies are looking for cost reduction and delivery capacity, which developing countries can often provide. This is one of your unique selling points. However, you should be aware that these end users might not have qualified IT staff to work with.

Electronic marketplaces are a cheap marketing tool that may make direct sales easier. Although they mainly offer smaller projects for freelancers, they could lead to pilot projects for companies. However, you would need excellent end market knowledge.

The main characteristics of direct sales to end users are as follows:

- There must be a direct relationship between the service provider and the end customer.

- You must have a lot of exporting experience.

Direct sales to end users can be interesting if you:

- have experience with the European market;

- are a large company;

- want to target large European end users;

- focus on a small, underserviced niche market.

Tips:

- Find leads in online marketplaces. For freelancers and very small companies: UpWork, Fiverr and Freelancer. To find leads and to display your knowledge and skills: Github marketplace and LinkedIn. A good LinkedIn profile is the second most important thing after having a good website.

- Have a professional, high-quality company website on which you present full, accurate and up-to-date details of your product/service offering. Make it compatible with mobile devices such as smartphones and tablets, as these are increasingly popular in Europe. Also invest in search engine marketing and search engine optimisation, so potential customers can easily find you online.

- Take a look at sites such as Crowdsourcing Week and Silicon Canals to learn more about crowdfunding and to find the best European platforms. Different platforms are used in different countries. For more information on finding business through online marketplaces, read our study about finding buyers on the European outsourcing market.

3. What competition do you face on the European healthtech market?

Which countries are you competing with?

India, Malaysia, Brazil, Vietnam and Egypt can be considered your strongest competition, but the Baltic countries and Central and Eastern European (CEE) countries can also be strong competitors.

In general, European companies prefer to outsource services to providers within the same country (also known as homesourcing, or simply outsourcing). When they do outsource to companies abroad, they generally prefer nearshore locations because of their proximity, language, cultural similarities and minimal time difference.

The Global Services Location Index (GSLI) ranks the competitiveness of information technology outsourcing/business process outsourcing (ITO/BPO) destinations based on four categories: financial attractiveness, people skills and availability, business environment and digital resonance. In this chapter, we linked the country scores in the GSLI to the most competitive countries for healthtech service providers.

Table 1: Global Services Location Index

|

Financial attractiveness (35%) |

People skills and availability (25%) |

Business environment (25%) |

Digital resonance (15%) |

|

Compensation costs |

ITO/BPO experience and skills |

Country environment |

Digital skills |

|

Infrastructure costs |

Labour force availability |

Country infrastructure |

Legal and cybersecurity |

|

Tax and regulatory costs |

Educational skills |

Cultural adaptability |

Corporate activity |

|

|

Language skills |

Security of IP |

Outputs |

Source: Kearney analysis

India continues to lead the Global Services Location Index. This leading position is mainly due to the country’s unique combination of low-cost services and English language skills. This attractive profile makes India a particularly strong contender on the IT outsourcing market. To stay ahead, the country needs to prepare for the shift from lower-skilled jobs that may be replaced by robots to more creative and highly-skilled work. This applies to other low-cost countries as well.

Because healthtech generally concerns more high-skilled work, the country needs to step up its game if it wants to stay in the lead.

However, India is increasingly known to be a ‘bulk’ destination and not a place where you go to if you are looking for high-quality work. Besides, its language advantage is getting smaller. Many other countries are catching up, while India’s overall language skills have not improved.

European buyers often associate extremely low developer rates in Asian countries with poorer project quality. They think that cheap service providers must compromise on the skills and experience of the service developers, or even their working circumstances.

This illustrates that while offering competitive rates is important, you should not compete only on price. As relatively simple (and therefore cheap) tasks can be automated, your focus should be on excellent skills, knowledge and creativity, which have a higher value. Demonstrating your commitment to quality through references and quality management systems is key to building trust among potential European clients.

Malaysia ranks third in the GLSI, mainly due to its relatively highly educated work force, the size of the work force and English language skills. It also scores relatively highly on digital resonance.

It has a strong medical devices industry, both in research and development and on the production side. Combined with its strong position as an ITO and BPO destination, Malaysia is a strong competitor in the healthtech industry.

Brazil ranks fifth in the GSLI. This is a four-point increase from its 2019 position. Sao Paulo is rapidly becoming the digital hub of Latin America, attracting more start-up investment than Chile, Colombia, Argentina and Mexico combined. Brazil is not (yet) a very common healthtech outsourcing destination for European companies, but it is known for its excellent private health care, particularly in cosmetic surgery.

In 2019, the global IT sector registered a 5% growth. Brazil achieved an increase of 10.5% in that same year. In 2020, the sector achieved an even bigger growth percentage of 12%. While much of the world is struggling with a talent shortage, it is less of a challenge to find skilled healthtech professionals in Brazil.

Vietnam is a small, but strong IT outsourcing destination that currently ranks sixth in the GSLI. During the pandemic, the sector remained stable as well as operationally effective and continued to grow. The Vietnamese credit their loyalty, commitment to planning ahead and ability to adapt for this. This also gives them a good reputation as a reliable outsourcing partner.

Egypt ranks 15th in the GSLI. It is a strongly emerging African destination for IT outsourcing. Its time zone (GMT+2) partly overlaps with western and northern Europe, eliminating the time differences generally associated with offshoring. Its considerable investments in infrastructure and cybersecurity are boosting the country’s business environment performance. The new administrative capital (New Cairo) is designed as a Smart City using the Internet of Things and big data analytics and is meant to create an Egyptian Silicon Valley.

Wages in Egypt are still low, while its workforce is increasingly well-educated. However, the Egyptian government is encouraging tech graduates to become freelancers, which makes it challenging for companies to create a solid team.

Egypt is also home to several healthtech start-ups. There are several healthtech-related initiatives in the country, for example Health 2.0 Egypt, a non-profit group that promotes innovation in medicine in the country

Competition from Europe

In the outsourcing sector, competition from other European countries has always been strong – especially from CEE countries and more recently also from the Baltic countries. Two important competitive countries from Europe for healthtech are Estonia and Poland.

Poland has seen a 10-point increase in the GSLI, primarily due to its financial attractiveness and start-up activities. It also remains remain important for the ITO and BPO industry because of its cultural and linguistic similarities. Poland is the highest-scoring country from the CEE region (14th). Poland is an important contact centre outsourcing location for European companies, as the industry is maturing and able to offer good-quality services.

Estonia is another high-scoring country from Europe (12th). It is able to offer good language skills combined with relatively low wages. It is also considered more creative and innovative than some CEE countries.

Tips:

- Compete on the quality of your services, rather than just on costs.

- Specialise in specific technology for the healthtech segment, for example big data, remote patient monitoring, Artificial Intelligence (AI), Virtual Reality (VR), Internet of Medical Things (IoMT) and telemedicine.

- Visit leading European trade fairs regularly to meet competitors and potential customers. Do your homework and select the events very carefully. Only attend events that fit your profile well. Many trade events directories are available online, such as 10Times and UK Exhibitions. Create a list of relevant events and update this list regularly.

Which companies are you competing with?

Examples of healthtech service providers:

HealthTechIndia – an India-based IT company that provides reliable, cost-effective, result-oriented services for very demanding and internet-savvy clients in the health care sector across the globe. Its IT solutions promise increased efficiency and a competitive advantage for its clients’ businesses and end users.

7Keema –an example of an Egyptian tech company that has successfully built an app that provides home-based nursing care. It was developed in the first stage of the pandemic and has since then provided home care to more than 2,500 COVID-19 patients.

Sancy Berhad – a healthtech provider from Malaysia that presents itself as ‘not a start-up’. It leans on the experience of its employees, who have a long track record in both tech and financial services. It has now turned towards improving the health care industry with its solutions. It currently serves 28 hospitals across Asia.

Tips:

- You can check the websites of competing companies to find out how they achieved their success and which strategies they are currently following.

- If you want to help European health care workers to increase their efficiency, look at the websites of similar companies to find out what kind of solutions they provide and what they focus on (such as the above-mentioned companies Health Tech India and 7Keema).

- Search company databases to find more competing companies. These databases can be free, like company.info, or paid, like the databases maintained by chambers of commerce (such as the Dutch Kamer van Koophandel in the Netherlands) or commercial databases like Bold data. Identify which databases will benefit your search and use them to create a list of potential customers to target.

Which products are you competing with?

Unless you are selling your own healthtech solution directly to the European market, your product is the service you offer. This means that the real question here is: what makes one service provider different from another? The answers include technical knowledge, available capacity, references, domain knowledge, flexibility, reliability, communication and language capabilities, quality management, security infrastructure, vertical and/or horizontal market focus and niche market orientation, among other things.

Most healthtech solutions come with a certain overhead of non-medical tasks. They require software updates, routine maintenance and continuous strategy for the development and implementation of new features. If you are able to take care of the non-medical tasks continuously so that the health professionals can focus on caring for patients, that will make you stand out from your competition.

There is space in the market for innovation and developing your own healthtech products. It is a challenging market, but there are good opportunities for companies that want to develop and sell their own innovative product.

Tips:

- Invest in country branding. For more information on this topic, see our tips on doing business with European buyers.

- Find out how you can get a competitive advantage based on factors such as cost, quality, technology or product characteristics. Look at this website by HackerRank, which presents its Developer Skills Report every year. Among other things, it shows the most popular programming languages, the most popular frameworks, the kind of frameworks hiring managers want versus the frameworks developers know (so you can see where demand outstrips supply) and much more.

4. What are the prices for healthtech outsourcing?

When trying to make a sale in Europe, it is very important to offer the right price. For many ITO or BPO services, price is often not the most important selection criterion, but the price has to be right and competitive. The price for healthtech is influenced by factors such as technology requirements, skill levels, complexity of the projects, length of the contract and other SLA requirements.

Healthtech projects are so diverse that it is impossible to make one price breakdown that suits all (or even most) projects. Also, it requires so much estimating and unforeseen elements that even the process itself is an estimate. If the project makes use of Agile methodologies, there is no pre-determined specification, which makes estimating a big challenge.

So how do you determine the price of a healthtech project?

It starts with determining the work that has to be done, the time it will take, the needed skills, the people who will do the work and their salaries. With this information, you can make a planned, detailed schedule (including milestones and a delivery schedule) so you know how many people will spend how many hours on the project. You can calculate the salary of the people working on the project by working with the links in the tips section. Do not forget the costs of overhead, unforeseen costs and other costs, and of course your profit expectations. These are all estimates.

Based on this process, you can calculate the total price, the hourly price as well as the average price for the project. This hourly price is the one you communicate to your prospects. In any case, talking with your prospects is the best way to make sure that your prices are competitive. And if they are not, what is the justification (one that the prospects will accept!) for that?

You must choose a price model for your product or service. For IT outsourcing, it is most common to work with all-inclusive offers, also known as a fixed-price contract. Other outsourcing models are the Time and Material Model, the Dedicated Team Model or an offshore development centre.

When you make your prospect an offer, include the price. Be transparent about the number of hours you expect to work on the project and the hourly tariffs. Break down your tariffs by stating the price for each person working on the project (such as junior developer, senior developer, designer or tester). For more information on pricing models in outsourcing, read this document. Also go beyond setting the right price. You should work out your pricing strategy, including your and your clients’ preferred pricing model, payment terms/expectations, how and when you provide discounts and so on.

The European health care sector is a sector that has a lot of money. Also, many European health care professionals feel they do not have enough time to tend to each patient as much as they would like. This means that if you are able to offer products or services that make their health care operations run smoother, they are willing to pay for them. This situation is expected to remain relevant for at least the next five years.

Tips:

- The price of healthtech mainly (sometimes only) consists of the price of man hours that is needed to finish the project, so the development of the price depends on the price of the needed labour. Study average prices in reports such as those by Cleveroad, IT Jobs Watch or Pricing Solutions. You can also research the average salaries for various roles in the software development process on platforms like Payscale. Next, analyse your costs and profit expectations to calculate your price and find the right price for your service.

- Create the “ideal” client personage to help you tailor your offer. For example: “a technology provider with fewer than 200 staff in the Rhineland area, specialised in wearables for healthtech purposes”.

Globally Cool B.V. wrote this study in collaboration with Laszlo Klucs.

Please review our market information disclaimer.

Search

Enter search terms to find market research