The European market potential for healthtech

An ageing population and technological developments laid the foundation for a thriving healthtech market in Europe. COVID-19 accelerated it. Opportunities can be found across various segments in the United Kingdom, France, Germany, the Netherlands, the Nordic countries and Switzerland. The shortage of skilled specialists combined with the increasing openness towards outsourcing continues to drive outsourcing demand.

Contents of this page

1. Product description

Healthtech includes all software, data and physical solutions that are enabled by technological innovations and that support the health care sector. There is a difference between healthtech and medtech. Healthtech is mostly used for monitoring and prevention (mostly outside medical facilities), while medtech is mostly used for diagnosis and treatment (within medical facilities).

Healthtech is mainly about personal health. This means it makes patients engage with their personal health and everything that happens outside of the hospital. Examples are telehealth and remote monitoring.

The line can be quite thin. For example, if a wearable device is used at a patient’s home, it is healthtech. But if this same wearable is used and monitored in a hospital, it is medtech. This thin line is also why the terms healthtech, health care IT, medtech and digital health are often used interchangeably.

Technology in health care can be used for many different things:

- Monitoring heart signals

- Creating breakthrough medicine

- Making new DNA discoveries

- Treating patients remotely

- Speeding up the diagnostic process

- Organising workflow

Technologies that are used for healthtech solutions:

- Machine learning

- Artificial intelligence

- Web development

- Big data

- Nanotech

- Robotics

- 3D printing

- Internet of Things

- Mobile applications

2. What makes Europe an interesting market for healthtech?

The growth of the European health care market and the growing acceptance of tech solutions in health care fuel the demand for healthtech solutions. On top of that, existing skills shortages mean there is extra room for outsourcing. These developments are expected to continue in the short and long term because of the ageing population and the continuous acceptance of digital healthtech solutions.

The European market is ready for healthtech

The health care sector is often considered somewhat behind when it comes to the adoption of digitalisation for the processes between specialists and patients. When the rapid adoption of smartphones enabled the digitalisation of consumer engagement in many other sectors, health care mostly resisted the trend because:

- regulation for the health care sector was often challenging;

- providers were not focussed on healthtech solutions;

- the market was perceived to be too fragmented and complex.

But this has changed. The recent pandemic triggered a much quicker adoption of healthtech solutions in Europe. In addition, entrepreneurs and developers are increasingly aware of the opportunities the healthtech sector offers.

Between 2016 and 2021, the value of Europe-based healthtech companies grew sixfold. The shift was led by telemedicine, surgery software and insurtech. It is important to realise this data is about the value of European healthtech companies, not of the European healthtech market in general. That said, Figure 1 does give an indication of the strong growth in the sector.

*converted from USD

As healthtech solutions become more mainstream, the related technology becomes cheaper and therefore more accessible to people and companies worldwide.

European patients are beginning to trust remote health care. At the same time, the relatively conservative health care industry is increasingly embracing digitalisation. While big investments were temporarily put on hold during the pandemic, healthtech solutions proved to be more relevant in that period than ever.

Tips:

- When researching healthtech yourself, be aware that sources are not always consistent in how the words healthtech, medtech or digital health are used.

- Move fast and build your capabilities and experience in healthtech now to establish a position in the market while it is still heating up.

- Subscribe to newsletters in the healthtech segment, for example this one by Data Science.

- Read more about regulatory requirements for the sector in the market entry part of this study.

Demographic changes have increased the need for healthtech solutions

The European population is ageing. Old people generally need much more health care than young people. Also, around one third of Europeans aged over 16 say that they have a chronic illness. This means Europe has a growing market for health care solutions.

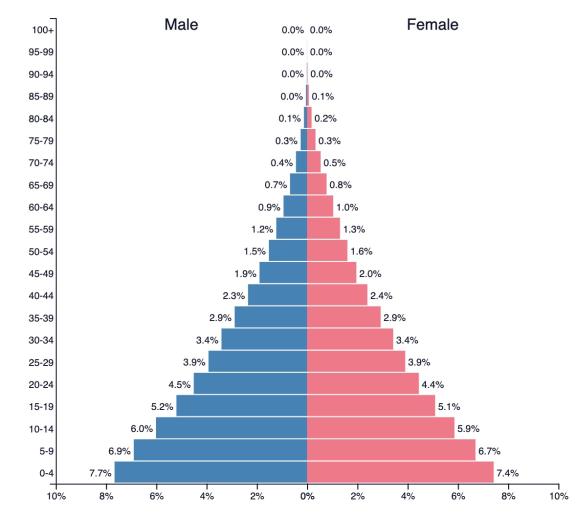

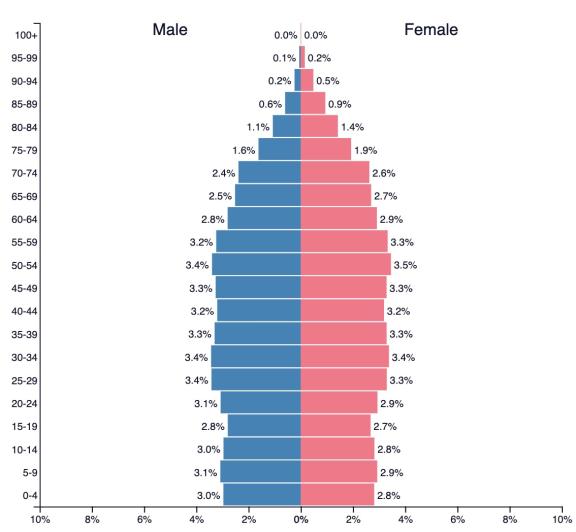

At the same time, Figure 2 shows that the number of people that are of working age is getting smaller. This means that more work needs to be done with fewer people. Digitalisation can be a solution to many problems in the European health care sector.

Figure 2: Population pyramids for Africa and Europe

Source: populationpyramid.net

Skills shortages and lack of expertise

As the variety of healthtech applications continues to expand, there is an increasing need for specialised developers and specialists. Key skills include data analytics, machine learning, artificial intelligence, hardware expertise and software development skills in general.

However, there is a considerable lack of IT training, certification and experience among the European workforce. Due to the rapid technological innovations in IT, the skills of IT graduates do not match the needs of the market. A 2021 study by Udacity revealed that 59% of the enterprises that responded claimed that not having enough skilled employees had a major or moderate impact on their business.

Initially, skills shortages were most common in western and northern Europe, but they have now also become apparent in other areas, such as eastern Europe. Countries such as Poland, Bulgaria and Romania have grown to become common nearshore destinations for northern and western Europe, but they are now facing skills shortages as well.

According to a 2021 survey by Randstad, the nine most in-demand IT skills are:

- Artificial intelligence and machine learning

- Augmented and virtual reality

- Blockchain

- Cloud computing

- Cybersecurity

- Data science

- IoT

- Robotic process automation

- User interface/experience design

Because the shortages are all in major areas, the situation is only likely to get worse. All these shortages have a relationship with and an impact on the healthtech segment.

Tips:

- Closely follow IT developments in your target countries. We recommend that you set up a Google alert and follow large consulting companies, such as Kearney, Gartner, Deloitte, ATOS, Accenture and Capgemini. Signing up for newsletters from these firms is another way of retrieving relevant information.

- Develop consulting skills to advise potential buyers on how they can benefit from healthtech solutions and how you can help them with it. The earlier you are involved in the project, the better.

- Build up expertise in your company. Offer solutions locally and regionally first to get references and confidence in your capabilities. Keep your skills up to date. If possible, get certified and clearly communicate that you are certified in your marketing and client interactions.

- Read Stack Overflow’s annual Developer Survey, which shows which developer skills are in demand and provides demographic information on software developers worldwide.

3. Which European countries offer most opportunities for healthtech?

The United Kingdom (UK) and France are currently the biggest investors in healthtech solutions and they are expected to remain the biggest investors for the next five years. Germany is the largest market, but currently quite behind in terms of healthtech digitalisation. It is expected to start investing to catch up, but the market will warm up slowly. The Nordic countries, the Netherlands and Switzerland are interesting markets because of their innovative health care sectors and their openness to outsourcing, which is expected to remain relevant.

The United Kingdom: Europe’s start-up champion

Between 2016 and 2021, UK healthtech investment increased ninefold. At the same time, investments in the United States of America (USA) increased by a factor of 3.4. In the past ten years, 164 healthtech start-ups were founded in the UK. This makes it the European leader in healthtech start-ups.

UK’s healthtech growth is mainly concentrated in the ‘golden triangle’ of London, Oxford and Cambridge. This region is home to five universities in the world’s top 25 for life sciences and medicine and a world-leading hub for research and development.

The fastest-growing segment in the UK is remote monitoring and wearables. Other fast-growing healthtech segments in the UK include drug development with AI, home test start-ups and digital health insurance.

Brexit has resulted in a large number of people with a working visa leaving the UK. This has left it with a shortage of skilled people in various industries, including in healthtech solutions. This makes the UK an extra interesting market for the outsourcing of healthtech products and services.

Of all European countries, the UK is the most open to offshore outsourcing and the least cautious about doing business with companies in developing countries. Its openness is influenced by its cost-cutting business culture and its long-standing business relations with many countries.

Babylon Health is one of the UK’s biggest healthtech companies.

France: second largest single market for healthtech investments in Europe

France is the second largest single market in Europe when it comes to healthtech investments, surpassed only by the UK. Currently, screening and diagnostic software is the fastest-growing healthtech segment in France. One niche within that segment is radiology analytics. Another promising niche is general diagnostics for chronic pathologies.

Other interesting healthtech segments in France are telemedicine, digital therapeutics, workplace health, consumer health, elderly care and family health (including women’s health).

Although France has a large market size, the French prefer to collaborate and work in their own language. Speaking French or finding a partner that is able to do so will increase your chances of success when entering the French market.

Alan is one of France’s largest healthtech companies.

Tip:

- Note that many websites in France are available only in French, because the French prefer to do business in their own language. If you would like to research potential French customers, make sure to install a translation extension on your browser or use a translation tool.

Germany: Europe’s healthtech giant

German’s digital health market is expected to grow at a CAGR of 17.5% between 2021 and 2027. Germany is home to an increasing number of old people and people with chronic diseases.

In 2019, Germany’s parliament passed the Digital Health Care Act to transform its health care system. This initiative gave users in remote areas access to both face-to-face and digital health care. The new law was a big driver for market expansion in Germany. Furthermore, COVID-19 catalysed the need for digital health in the country and the law helped the government to provide proper remote care to its citizens. The law also helped German citizens submit claims for their medical bills online and made it easier for start-ups to establish their business.

Germany is also a very interesting market due to its large market size, but the country remains risk-averse and less open to offshore outsourcing compared to other European countries, such as the United Kingdom and the Netherlands. This is changing as German companies face skills shortages and become more experienced in offshore outsourcing. The COVID-19 pandemic has also created more opportunities for outsourcing companies, as it has been a crucial to showing what is possible with remote working and outsourcing. The COVID-19 crisis has softened Germany’s generally stiff corporate culture.

German companies naturally prefer to work and collaborate in German, which is one of the reasons they prefer nearshoring when they do outsource. You can increase your chances of success in Germany by collaborating with a local German-speaking partner rather than approaching end users directly.

Wefox is one of Germany’s largest healthtech companies.

Tip:

- Note that many websites in Germany are available only in German, because Germans prefer to do business in their own language. If you would like to research potential German customers, make sure to install a translation extension on your browser or use a translation tool.

The Nordic countries: ambitious health care sector

The Nordic Council of Ministers aims to make the Nordic region the most sustainable and integrated health region in the world by 2030. The Nordic region consists of four countries: Norway, Sweden, Finland and Denmark. They aim to provide the best possible personalised health care for all their citizens. They are also establishing cross-border standards. Their goal is to enable patients to live and act in an open, seamless, cross-border health care ecosystem.

Denmark likes to present itself as the go-to place for innovation in health care. The country invests in talent and innovation, while promoting good business ethics and trust. If you want to enter the Danish market, it is important that you share the same values. For a long time, Denmark was a pioneer in telehealth. Today, it is very focussed on healthtech solutions.

Every Danish patient has an electronic health record that can be accessed by both the patient and the doctor. An example of a successful healthtech project in Denmark is Telecare North. This is aimed at COPD patients and offers monitoring at home. This project has improved the quality of life of patients and reduced the number of hospitalisations by 11%.

Due to the openness of the Nordic countries to outsourcing, their growing markets could be interesting for you. Experts believe that the competition in the Nordic countries will be less strong than in the UK, making them easier targets to consider.

In the past ten years, 94 healthtech start-ups were founded in the Nordic countries. This makes it the third largest European region for healthtech start-ups, after the UK and DACH (DACH is a contraction of Germany (Deutschland), Austria and Switzerland (Confoederatio Helvetica)).

One of the largest healthtech companies in the Nordic countries is Kry from Sweden.

Tip:

- For more information on the digital health market in the Nordic countries, please read the market report on digital health across the Nordic countries from 2021.

The Netherlands: fast adopter taking healthtech seriously

The Netherlands is known for its fast adoption of technical innovations. It has the highest rate of IT adoption by hospitals in the world. The government has policies in place to support the development of e-health further.

The Netherlands is facing challenges concerning the ageing population, the number of chronically ill people and the high costs of health care. Healthtech innovations can therefore be an important time and cost saver for the Dutch health care industry.

Companies in the Netherlands are traditionally fairly open towards outsourcing. Language barriers for doing business in the Netherlands are generally low, as the Dutch are very proficient in English.

Switzerland: advanced technology market

Switzerland has a strong economy, with high growth levels year on year and low unemployment. Its political stability, predictable economic policies and efficient capital markets are an important factor in this. In addition, Switzerland has a flexible labour market and a highly educated work force.

The health care sector is a prominent part of the Swiss economy. Its centre is Basel, where Swiss pharmaceutical giants such as Roche and Novartis have their headquarters. Pharma is the export driver of the Swiss economy, covering 38% of the export volume.

The Swiss health care system is of a very high quality, but it is very expensive. Healthtech solutions could therefore provide much-needed cost savings.

Like in the Netherlands, opportunities in the Swiss healthtech market can be found in mobile health, personalised medicine, home care, elderly care and e-mental health.

The main Swiss national bodies involved in health and e-health policies are:

- eHealth Suisse: the competence and coordination organisation that streamlines e-health developments at the federal level and in the cantons (provinces).

- Swiss Conference of Cantonal Health Directors (GDK): the coordinating body for health care in the cantons.

Companies in Switzerland are traditionally fairly open towards outsourcing.

Tips:

- Determine which are the best countries to target by looking at cultural similarities, how many people from you country live there, what historical ties you may have with them and what languages are spoken there. These factors will influence which countries are more suitable than others.

- Identify which countries have the greatest demand for your particular expertise by seeing which specific healthtech events are taking place in different countries.

- Read more about opportunities in Switzerland and the Netherlands in the report about the digital health market in the Netherlands and Switzerland.

- Online healthtech initiatives can help you find customers. Several European countries have launched or are launching national initiatives to stimulate digitalisation in the health care sector. These include the Nordic Interoperability Project in the Nordic countries, Health2020/2030 in Switzerland and the European initiative Digital Health Europe. They can have a positive effect on the different segments and often invite companies to participate, for example in working groups with stakeholders.

4. What trends offer opportunities or pose threats on the European healthtech market?

COVID-19 is the most important trend that has made the demand for healthtech solutions grow. Other trends are the development of lower cost/higher performance hardware and the advancing technological applications. The market is expected to keep growing quickly for at least the next 10 years.

Accelerated digital transformation has lowered the threshold for using healthtech solutions

COVID-19 has accelerated the digital transformation. The mass adoption of working from home, online shopping, food deliveries and virtual events has significantly lowered the threshold for using tech solutions in people’s everyday life. This also counts for health care and for both the users of health care and health care professionals.

The digital transformation is also very present in the health care industry. Patients are increasingly used to high digitalisation in other industries and are expecting the same from health care, thus increasing the demand for healthtech solutions and services. Now is a good moment to enter the market, because it is just heating up.

The digital transformation is supported by increased connectivity

5G, the next generation of mobile data infrastructure, will enable the rise in the number of devices connected to the internet and the amount of data they generate thanks to its higher bandwidth. The new 5G technology that will be rolled out in the coming years will allow more than 350,000 devices to be connected per square kilometre, which is 500 times more than comparable existing technologies. Although 5G may not provide any direct opportunities by itself, it is necessary for the expansion of most healthtech solutions and services.

Tip:

- Read more about the current status of the availability of 5G in different European countries and regions on the website of the European 5G Observatory. This gives you an indication of where the digitalisation is progressing the fastest and where the best opportunities lie.

People in Europe are increasingly aware of their mental and physical well-being

Patients try to take care of their own health and need resources to do so. Mental and physical well-being are important to all people. In Europe, many people are looking to take matters into their own hands. They are increasingly interested in health apps that track nutrition, sleep apps and stress apps that are supposed to help them calm their minds. These apps are more general health and wellness apps.

Then there are health management apps that can assist users in:

- monitoring their own health conditions, such as heart disease, diabetes, pregnancy, mental health etc.;

- reading their personal health records that health care providers have shared with them remotely;

- keeping track of their medication.

Tip:

- Consider entering the market with an app that contributes to people’s mental and/or physical well-being.

Low-cost/high-performance hardware is available

Hardware that is necessary for good healthtech solutions and services has become significantly cheaper over the past ten years. At the same time, the available hardware is now able to perform better. This lowers the threshold for the adoption of healthtech solutions and services.

However, the current global chip shortage has already lead to a negative impact on the delivery of new healthtech products. This shortage is not very likely to be resolved quickly. Experts predict that the shortage will last well into 2022 and quite likely into 2023. The chip shortage is also negatively impacted by the war in Ukraine.

For example, every healthtech device that uses IoT solutions makes use of a mobile connection (4G, 5G, LTE-M, NB-IoT) through a mobile IoT chipset. This chipset can be embedded directly into the device’s printed circuit board or into an IoT module that is placed inside the device.

Improvements in technology increase the possibilities for healthtech innovations and applications

Over the last ten years, the progress in terms of hardware has been matched by significant developments in big data analytics, machine learning (ML), artificial intelligence (AI) and virtual and augmented reality (VR and AR). This enables significantly faster and more detailed solutions and applications for healthtech.

Big data is the most important trend for the promotion of healthtech. It makes the implementation of many other healthtech trends possible. The use of big data in healthtech varies from assigning a unique treatment plan to each patient and tracking the dynamics of their condition to preventing epidemics, optimising costs and enhancing the work of separate branches and the health care system as a whole.

Virtual reality

The use of virtual reality is relatively new in health care technology, but the opportunities afforded by this technology are very promising. There are four main areas in which VR is used for health care; for staff training, to treat the patient, to help people with developmental disorders and for remote patient monitoring.

By 2024, it is estimated that more than 30 million patients will be using remote monitoring. By 2027, the global market is expected to be worth €1.6 billion, an increase of more than 125% from 2021.

Artificial intelligence

AI for health care can be described as computers and other machines that are capable of mimicking human cognition, learning, thinking, and making decisions or taking actions. AI in health care is the use of these machines to analyse and act upon medical data, usually with the goal of predicting a particular outcome.

In 2020,the global market for artificial intelligence in health care was valued at €6.4 billion. It is expected to expand at an annual growth rate of 41.8% between 2021 and 2028.

Telemedicine

Most telemedicine or telehealth interactions are centred around acute care, but there has been a rapid increase in its use for chronic disease. It is expected that telemedicine will play a very important role for people with diabetes.

But it is also promising for cardiology. Cardiovascular diseases are very prevalent in Europe. Remote monitoring of the patient’s condition and timely consultation with a doctor can save thousands of lives and significantly reduce costs.

Tips:

- Learn about new technologies and how they could improve your healthtech solutions. Staying on top of the newest technology gives you a competitive advantage.

- For more information about big data, read our study about exporting big data services to Europe.

- Consider combining different technologies to develop an even better healthtech product or service.

Globally Cool B.V. wrote this study in collaboration with Laszlo Klucs.

Please review our market information disclaimer.

Search

Enter search terms to find market research