Which trends offer opportunities or pose threats on the European processed fruit and vegetables market?

Over the past year, leading trends influencing the processed fruit and vegetables market in Europe involved sustainability. Leading trends are related to environmental issues such as waste reduction, changing consumer habits towards more personalised and healthier diets, food safety, transparency and convenience. Exporters from developing countries can increase their opportunities by investing in more sustainable production and partnerships with European buyers to develop and promote healthy and sustainable products.

Contents of this page

- Sustainability has transformed from an emerging to a mainstream trend

- Consumers are becoming sustainability-sensitive

- Cost pressure is shifting consumers towards more efficient spending

- Europe is going vegan

- A clean label trend continues to put pressure on suppliers

- Changing consumer priorities: from immune support to mood boosting and healthy aging

- New processing technologies and digitalisation are entering the market

- New sourcing origins and vertical integration are happening more frequently

1. Sustainability has transformed from an emerging to a mainstream trend

Since environment, the climate, biodiversity and social responsibility are global issues, Europe cannot achieve sustainability standards alone. The European Union (EU) will support developing countries in their transition to sustainable food systems. One of the actions will be the addition of a sustainability chapter in all the bilateral trade agreements.

Continuous legal changes and challenges for improved sustainability

Sustainability has become one of the most important topics in the world driven by the urgent need to protect the environment, maintain our quality of life, and preserve natural resources for further generations. To overcome the challenges of climate change, the EU has set official policies to become the world’s first climate-neutral continent by 2050, called the European Green Deal. For the processed fruit, vegetables and edible nuts (PFV) sector, the most relevant policies are the Farm to Fork strategy, the biodiversity strategy and the circular economy action plan.

Figure 1: Farm to Fork strategy aspects

Source: European Commission

As the food supply chain includes the importing of food, the proposed measures will also influence farmers, processors and exporters from developing countries. If you are exporting processed fruit and vegetables to Europe, be prepared for the following long-term market changes:

- Consumption of organic food will increase in Europe - According to the organic action plan, at least 25% of the EU’s agricultural land will be under organic farming by 2030.

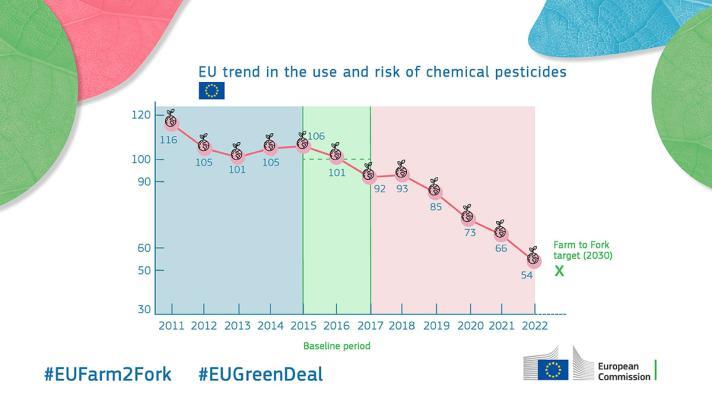

- Pesticide use will decrease, but initial plans will be changed - In 2022, the European Commission (EC) put forward a proposal for the sustainable use of pesticides (SUR). However, the European Parliament rejected it and the Commission announced its withdrawal in 2024.

- The supply chain will be more transparent and players will have to improve labour conditions and respect human rights - The European Directive on corporate sustainability due diligence entered into force in July 2024. This directive requires large companies in and outside Europe to provide proof of their suppliers’ sustainable practices. Reporting is officially required as from 2026 financial year. In practice, this means developing-country suppliers will increasingly be required to have social audits, such as SMETA or BSCI.

- Food packaging materials will change - The EC made a proposal for a revision of the EU legislation on packaging and packaging waste. The main aim of the directive is that “all packaging in the EU is reusable or recyclable in an economically viable way by 2030.” This also includes all packaging that enters the EU from abroad.

Figure 2: EU trends in the use and risk of chemical pesticides

Source: European Commission, July 2023

Tips:

- Be aware of the new organic food regulations and new rules on organic production, the updated list of authorised substances and new rules on import documentation requirements for organic and in-conversion products.

- Read CBI’s tips to go green and CBI’s tips to become a socially responsible supplier for the legislative changes in line with the European Green Deal.

The processed fruit and vegetables sector is supporting sector-specific sustainability practices

Several trade associations in Europe have created guidelines and codes of conduct for specific sectors to accelerate the European Geen Deal implementation. The European Association of fruit and vegetables processors (PROFEL) created a Climate Change Brochure for the frozen and canned industry. The European Federation of trade in dried fruit and nuts (FRUCOM) has published several presentations, position papers and product-specific information on sustainability. The European Juice Association has created a specific Juice CSR platform.

There are other initiatives, such as the Sustainable Juice Covenant and Sustainable Nut Initiative by IDH. FRUCOM performed a risk analysis working on the industry-specific code of conduct in cooperation with the German sector-specific trade association: Waren-Verein.

In the next five years, many industry practices are expected to become more sustainable in the following ways:

- Agricultural practices will be changed to reduce carbon emissions. The smart use of fertilisers and water resources will become more common. Organic agriculture and the use of bees for pollination and integrated pest management will increase.

- Renewable energy will be used more in processing facilities. This includes solar, wind energy and biopower. New energy-saving technologies and processing lines will be implemented.

- Circular economy practices will be common, such as the use of by-products in processing facilities. Examples are the use of pits, husks and shells for boiler heating in drying processes. Surplus produce such as fruit peels will increasingly be used to produce value-added ingredients such as essential oils, cosmetic ingredients, health ingredients etc.

One company employing environmentally friendly practices is Kenyan Afrimac. During macadamia processing, the shells are removed and re-used to heat the boilers. This is a common practice in the Kenyan macadamia industry. Afrimac additionally introduced the use of solar energy in their processing plants to make them even more sustainable. In fact, 70% of the energy used to run machines comes from the sun. In this way, the company saves 3.3 tonnes of CO2 emissions annually.

Figure 3: Sorting of macadamia nuts with the use of solar lighting at Afrimac

Source: Autentika Global

Tip:

- Read CBI’s tips to go green study to learn how to turn environmental challenges into opportunities by reducing your environmental impact.

Importers are increasingly asking for sustainability audits and certifications

More and more European companies are requesting sustainability certification and audit schemesfrom their suppliers to ensure that food imported into the European Union is produced in a sustainable way. Importers, traders and retailers independently use and promote different certifications. For suppliers from developing countries, this could mean increasing certification requirements and a more complicated sourcing process.

Examples of different sustainability schemes relevant for the sector focus on:

- Social and ethical impacts (Monitoring and auditing) - SA 8000 (standard), Fairtrade (standard) SMETA (audit) Ethical Trading Initiative (code of business practice), amfori BSCI (audit), BCorp and Fair for Life (standard), World Fair Trade Organisation (standard).

- Organic and pesticide free food - EU organic, KRAV, Naturland, Demeter, AB France, Soil Association, SCS Pesticide Free or Zerya.

- General environmental aspects - Cradle to Cradle, Planet Proof, ISO 14000. These include private schemes of European retailers such as ProPlanet (REWE) or Edeka Panda (EDEKA).

- Forest resource preservation - Rainforest Alliance, FSC, PEFC. These certification schemes are important for packaging materials.

- Biobased and recyclable packaging - OK biobased, DIN-Geprüft biobased, OK compost, RSB, Recycled Content Certification.

- CO2 emission reduction - Verified Carbon Standard, myclimate, ICT Carbon Footprint Certification. The certification schemes usually follow standards for measuring greenhouse gas emissions such as ISO 14067.

With so many types of certifications focused on sustainability, you cannot obtain all of them. Use the most common one in your industry. For example, if you are collecting wild products (e.g. pine nuts or mushrooms), you can opt for certification related to the preservation of forest resources. It is always good to ask your buyers to recommend a type of certification that is easy to get based on the implemented activities in your company.

There are many examples of food processors from developing countries which successfully implement sustainable practices. A good example is the company Target Agriculture which processes and exports coconut products, tropical fruit and cashew nuts in Sri Lanka, Thailand, Vietnam and Indonesia. The company supports more than 3,000 rural families. It implements organic agriculture but also supports rural communities by opening schools, providing scholarships for students, supporting plastic reduction and producing biogas.

Tip:

- Become familiar with the social and ethical standards on the International Trade Centre’s Sustainability Map portal. You can use ISO 26000 guidance to improve your business sustainability.

Packaging is becoming more sustainable

In November 2022, the European Commission made a proposal for a revision of the EU legislation on Packaging and Packaging Waste. The current directive will be changed to a regulation and will set new targets for packaging collection, packaging recycling and packaging waste reduction. The main aim of the directive is that “all packaging in the EU is to be reusable or recyclable in an economically viable way by 2030”. This has a practical implication for suppliers from non-European countries, as it includes all packaging that enters the EU. The list below describes the different types of packaging in more detail:

- Recyclable – can be reprocessed into products, materials or substances whether for the original or other purposes. Examples include paper, glass and aluminium.

- Reusable – can be used again. The most commonly reusable type of packaging in the consumer market is the glass bottle. For export, some types of plastic packaging can also be reused, for example plastic barrels.

- Compostable – can be biologically broken down into a humus-like material. Paper is the only compostable packaging.

- Biodegradable – can be decomposed rapidly by microorganisms under natural conditions.

Within the processed fruit and vegetable sector, sustainable solutions are being implemented across the following categories:

Beverage cartons are already the most popular recyclable material for the retail packing of fruit juices. If a carton is used, it should preferably be produced from responsible sources, such as FSC certified. As beverage cartons are made of different materials laminated together, the industry is searching for new materials that are easier to recycle. One example of such a material is reZorce.

Steel is recyclable and used for packaging canned fruit and vegetables, in the bulk packaging of juices (bag-in-drum) and the bulk packaging of vegetable oils (drums). Steel can be recycled multiple times without losing strength or quality. Since steel is not a renewable material, responsible sourcing is stimulated with certifications such as ResponsibleSteel.

Aluminium tins used for beverages are now the most recycled packaging in Europe with a 74% recycling rate. Like steel, aluminium is not a renewable material, so producers of tins should preferably follow responsible sourcing programmes such as the Chain of Custody Standard. Aluminium is also used in the inside coating of beverage cartons. Heat resistant carton packaging such as Heat and Go (by SIG) or Tetra Recart (by Tetrapak) are also used instead of tins for vegetables.

Glass is mostly used for packaging fruit juices, jams and pickled vegetables. Currently, juices packed in glass bottles are mostly sold in restaurants and bars, while in supermarkets they are widely replaced by carton packaging. Nevertheless, most European consumers consider glass the most environmentally friendly packaging. The main advantage of glass is that it is fully and infinitely recyclable. To promote the recyclability and inertness of glass, the European Container Glass Federation has introduced the Glass Hallmark.

Bioplastic is used in many different types of packaging. In the beverage industry, Polyethylene Furanoate (PEF) is one of the most promoted sustainable solutions for plastic materials. PEF is made entirely from plants, is fully recyclable, and degrades in nature much faster than normal plastic. PEF plastic is also stronger than PET plastic.

It is expected that new solutions will be available soon even for bulk packaging. Currently, most bioplastics are made from sugar cane, although the scope of new raw materials is constantly increasing. For example, by-products in oil production, olive pits and sunflower seeds can be used for the production of bioplastics.

Tip:

- Follow the leading packaging trends in Europe by connecting to information sources such as Packaging Europe.

2. Consumers are becoming sustainability-sensitive

Sustainability is becoming an important issue for consumers. An increasing number of consumers are highly concerned about the environment and willing to make more efforts to reduce waste. According to Innova Market Insights, there has been 37% annual growth in foods making forest protection-related claims and 40% in those making reduced water-use claims. In this study, nearly two-thirds of consumers stated they “would like to see straightforward communication about companies’ efforts in sustainability on pack”.

Different generations of consumers define sustainability differently and set sustainability priorities based on their unique perspective. Younger generations of consumers are especially worried, with 60% of Gen Z (born 1970s to early 1980s) and Millennials (born between 1981 and 1996) reporting they feel anxious about the environment.

According to Kantar SIAL 2024 Insights, in 2024 40% of consumers surveyed said they had made radical changes for environmental or ethical reasons. Their main daily concern is the issue of plastic packaging (19% prefer refillable packaging and 18% prefer reduced plastic packaging). There is also an upward trend in looking at carbon footprint claims. Fair-trade products are also increasingly popular, with 59% of consumers saying they prefer them.

Label reliability

Unfortunately, many companies use non-reliable labels on purpose to give a false impression to consumers about their positive environmental impact. This unethical behaviour is called “greenwashing. Innova Market Insights research shows that 49% of consumers are concerned about greenwashing and 53% cannot tell when companies are greenwashing. An EU assessment on environmental claims published in 2024 also found that 53.3% (80 out of 150) of selected environmental claims were potentially misleading.

In order to prevent greenwashing and to harmonise voluntary green claims, the European Commission published a proposal for a Directive on Green Claims in March 2023. According to the new proposal, companies must substantiate the voluntary green claim they make in commercial practices by submitting recognised scientific evidence, using accurate information and taking into account relevant international standards (e.g. taking a life-cycle perspective).

The EU Green Claims directive is still being discussed, as there are many opposing opinions. For example, in June 2023 the European Consumer Organisation (BEUC) requested an explicit ban of carbon neutral claims (PDF). According to the BEUC, carbon neutral claims are highly misleading to consumers as they imply neutrality and no impact of the products on the environment, which is impossible to achieve from a scientific point of view.

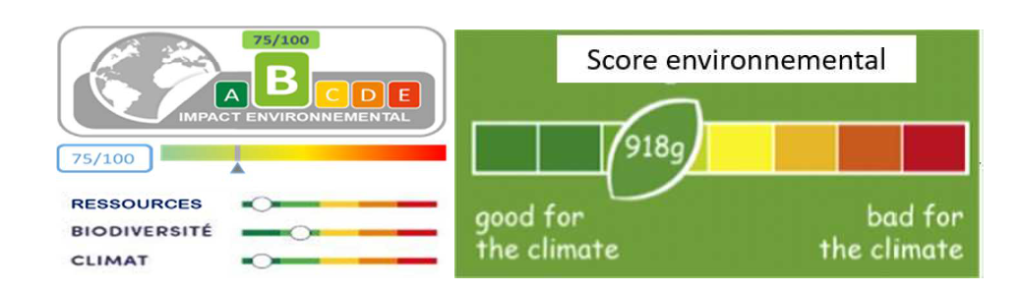

Some of the most popular labels assessing the environmental impact of products are Eco-Score, Eco Impact, Planet-score and ENVIROSCORE. Eco Score is currently used by big European retailers such as Colruyt, Lidl, Carrefour and Intermarché for certain products. Planet Score is used by several retail brands such as Lidl, Carrefour, Système U, Auchan, Picard, Franprix, Naturéo, Naturalia, Monoprix, Biocoop and Sojasun.

Figure 4: Possible environmental labelling formats

Source: French Ecological Transition Agency (ADEME)

If you are implementing sustainability practices, you should inform importers how to interpret it for consumers in a language that is easy to understand. You can use the following ideas for inspiration:

- Inform consumers how they contribute to better social conditions when buying a product. For example: “By purchasing this juice, you give €0.50 to the farmer who picked the fruit.”

- Show the environmental impact of your product. For example: “Our Brazil Nuts protect forests – they are not grown but collected from Amazonian forests.”

- Measure your contribution. For example: “Each of our date trees absorbs 200 kg of CO2 every year, making our planet cleaner.”

- Illustrate your sustainability certification. For example: “We don’t use monkeys to harvest our coconuts.”

Tips:

- Provide specific information to end consumers about your sustainability approach. You can use your website, social media and even product packaging to tell your story and promote the positive effects on the communities where the production takes place.

- Use environmental labelling schemes which are based on scientific evidence and recommended calculation methods such as a Product Environmental Footprint. Kindly note that labelling schemes should not be seen as a marketing strategy, but as a tool to encourage you and your suppliers and buyers to become more sustainable.

3. Cost pressure is shifting consumers towards more efficient spending

European consumers are being put to the test by the cost-of-living crisis that has been a constant presence since the end of the Covid-19 pandemic. One of the ways in which European consumers are adapting to turbulence is by embracing strategies and techniques that enable them to live more cost-efficient lives.

Europe experiencing slow economic growth and high inflation

The European region is struggling with the effects of slow economic growth, high inflation and financial instability, triggered partly by the energy crisis following the Ukraine war. However, price inflation has been decreasing. It reached a peak in October 2022 (11.5%) and gradually decreased to 2.1% in September 2024.

The International Monetary Fund (IMF) forecasts that inflation in Europe will return to the target rate of 2% sometime in 2025. However, this forecast remains uncertain since many factors could negatively affect this expectation. For example, a higher wage growth, higher profit margins and sudden spikes in commodity prices could mean that reducing inflation could require more time.

Europe’s economic growth was expected to be 1% in 2024. This is significantly lower than the global economic growth projection of 3.2% for the same year. There are a number of reasons for this, including the ongoing war in Ukraine. At the same time, there is a growing market for processed fruits, vegetables and edible nuts in Europe, driven by health trends and consumer preferences.

Consumers are looking for ways to reduce their spending

The YouGov cost of living tracker shows that the large majority of consumers in Western Europe have had to make cuts to their household spending. The tracker monitors attitudes on this issue across seven European countries: Britain, France, Germany, Spain, Italy, Sweden and Denmark. Although most households surveyed said they have already had to make cuts in their usual spending, the situation is better than in 2023. For example, 35% of British citizens made cuts in their household budgets in 2024, down from 42% in 2023.

European consumers are becoming more resource-savvy. In order to make full use of limited financial resources, they are learning new ways to economise. Some of these solutions include finding new ways to use some fruits and vegetables that they would have previously discarded, learning to cook to reduce expenses on prepared foods and eating out, as well as switching to new ways of preparing food, such as using air fryers or more energy-efficient ways of cooking.

According to various Tetra Pak Tetrapedia reports, many retail food producers shrank product sizes to keep prices stable. 46% of consumers noticed this trend, which relates not only to shrinking package sizes, but also the use of thicker or heavier lids or bottoms, adding space between units or packaging items separately that were previously sold together. This is a common tactic, because consumers are much more sensitive to price than they are to package sizing.

Private labels growth

Finally, these trends are also increasing the importance and market positioning of private label sales. According to NielsenIQ, private labels accounted for 19.4% of overall fast-moving consumer goods value sales globally. In 2024, 53% of retailers expected private labels to be their number one growth driver.

Besides promotions, the most common money-saving tactic is to stop buying certain categories such as non-essential, premium products, with 26% of consumers identifying this as a way of saving. Alternatively, 20% of consumers seek private label products because of more favourable prices and good quality.

Table 1: Private label value share in selected European countries in Q1 2023

| Country | Private label retail value share (%) |

| Switzerland | 52% |

| UK | 46% |

| Germany | 37% |

| Netherlands | 34% |

| France | 33% |

| Italy | 31% |

| Sweden | 25% |

| Norway | 18% |

Source: NielsenIQ, 2024

Tips:

- Try to reduce the costs along the supply chain to make your products more affordable. A good option is to avoid the use of intermediaries in both buying and selling. At the buying end, try to buy your products from farmers directly. On the selling end, try to connect with the packers and ingredient users.

- Make your offer unique. Try to be unique by focusing on the sustainability aspects of your product, as sustainable sourcing is still important despite price inflation.

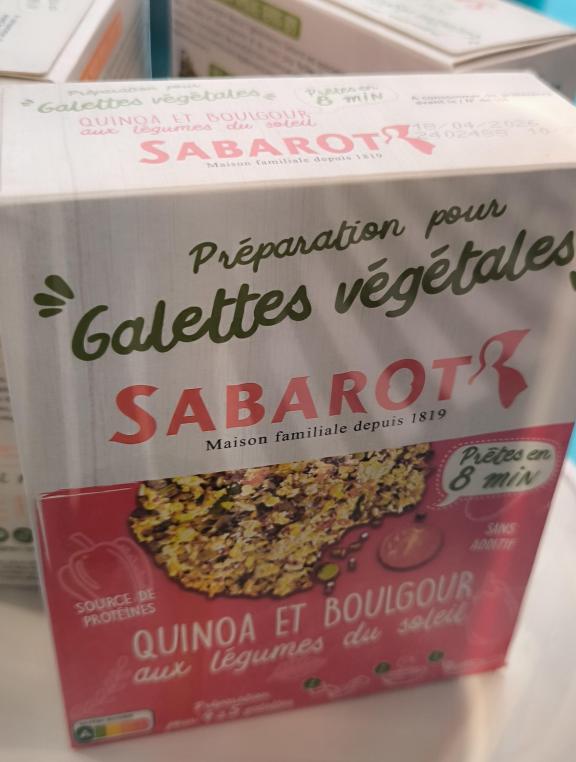

4. Europe is going vegan

Many Europeans are adopting a more vegan lifestyle. Vegans avoid animal-based foods (like meat, eggs dairy and fish). They only consume plant-based foods such as vegetables, fruit, pulses, mushrooms, seeds and grains. According to Food Ingredients Europe’s analysis of retail sales, the vegan market has been growing rapidly in Europe. Data from six European countries show that sales of plant-based foods grew 5.5% in 2023, reaching €5.4 billion. Germany is the fastest growing market for plant-based foods, with 11% growth in volume in 2023 compared to 2022.

There are many influencers promoting a vegan diet and lifestyle. The European Vegetarian Association published the Plant-Based Manifesto for the EU elections in 2024. To support a vegan lifestyle, many celebrity chefs in Europe are including separate chapters on vegan food or publishing vegan cookbooks. The Netherlands-based Pick Up Limes app allows users to customise plant-based recipes to meet their nutritional needs.

Plant-based diets are also in line with the European Sustainable Consumption aim of the Farm to Fork Strategy. Moving to a more plant-based diet with less red and processed meat will reduce risks of diseases and the environmental impact on the food system. The European Commission has called on its Member States to develop a national protein strategy. Currently, the Netherlands, Spain and Belgium have adopted national protein strategies, while France and Austria published proposals for them.

The continued success of plant-based products is bolstered by flexitarianism. Unlike strict vegans or vegetarians, flexitarians consume plant-based food only a few days per week. For example, 15% of meat consumers buy both meat and meat alternatives. Similarly, 39% of milk consumers buy both milk products and dairy alternatives

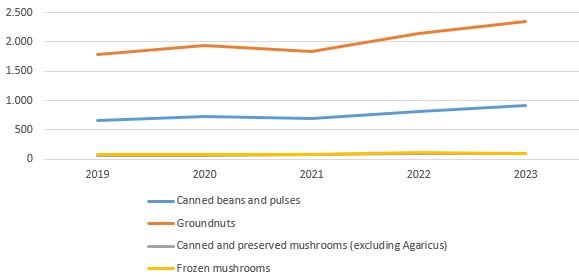

All processed fruits and vegetables are vegan, but a vegan diet needs to be supplemented with plant-based proteins that have the same nutritional value as animal proteins. Plant-based proteins are being imported, produced and consumed in Europe at higher levels than before. Pea protein has become the top plant protein ingredient, followed by soy protein. Fava bean protein, vegetable protein, wheat protein and seed protein are amongst the fastest growing plant protein ingredients.

Figure 5: A vegan alternative for a meat burger (SIAL, 2024)

Source: Autentika Global

Edible nuts, beans, mushrooms and some vegetables are also a good source of protein. Consumers are therefore increasingly consuming different types of nuts and nut-based products. Nut pastes are progressively produced as ingredients for products such as plant-based drinks (like almond milk), desserts, yogurt, ice cream and spreads.

Figure 6: European imports of selected protein-rich processed fruits and vegetables from developing countries, in tonnes

Source: ITC Trade Map and Eurostat COMEXT

The European industry is continually developing new plant-based proteins. Recent examples of products that were selected as innovative taste winners at the 2024 ANUGA and SIAL exhibition competition include the following:

- Glazed vegan dessert (with tofu)

- Vegan egg substitutes

- Vegan sushi bites

- Vegan smoked salmon

- Vegan fish fillets

- Vegan raw cakes

An interesting example of a processed fruit which is used as a meat substitute is jackfruit. Jackfruit is often imported as frozen or canned in brine and used in plant-based products. An example of a company from a developing country which has successfully tapped into this plant-based trend is the Indonesian company Ceylon Plant Food Private Limited. Another example is the Indian company Wakao. Recently, the company revealed its Continental Jack Burger Patty, which is made from 53% jackfruit.

Tip:

- Take advantage of the opportunities in the growing demand for foods of non-animal origin. Edible nuts, coconut products and beans can be promoted as healthy alternatives to animal protein.

5. A clean label trend continues to put pressure on suppliers

The European market for products directed at food intolerances and allergies has recently experienced significant growth, driven largely by the dramatic rise in food allergies and sensitivities. Many processed fruit and vegetable products are naturally free from additives and allergens, but producers increasingly emphasise the adding of claims on labels and packaging using expressions such as gluten-free, lactose-free, allergen-free, trans-fat free, preservative-free, pesticide-free and others.

According to NielsenIQ, clean label products are outperforming other products, increasing by 8% in 2023. According to Kantar SIAL Insights, 74% of people believe foods they eat could be harmful to their health, and this figure is rising. Consumers still want reassurance that products are in fact healthy and use simple methods to confirm this, such as paying closer attention to ingredient lists (44%) and opting for less processed products (72%) and more local and in-season products (53%).

Suppliers from developing countries can profit from these trends. You can start by developing product formulations without preservatives and other additives. You can also promote products produced through simple processing without additions (e.g. frozen fruit or not-from-concentrate juices) as natural and “free from”.

Natural forms of processing such as sun-drying and fermentation are also gaining ground in the processed food industry. Preservative-free (sulphite-free or sorbate-free) dried fruit is becoming popular. In addition, fruit preparations are using more natural ingredients. For example, the company Döhler uses apple and citrus fibre powders as ingredients for bakery and confectionary products. These products are minimally processed and can be used instead of ingredients such as pectin, starch, locust bean, xanthan and guar gums.

The European Union is also supporting this trend by decreasing the allowed levels of food additives. It can however be a challenge for the fruit, vegetable and nuts processing industry to produce products with the same quality if some additives are not used. For example, a common option to replace preservatives is to use heat pasteurisation, although it significantly decreases a product’s shelf life. As retail chains in Europe often require a shelf life over 6 months, this creates many difficulties for suppliers along the supply chain.

Heat pasteurisation/sterilisation is a common method used in the production of juices and canned fruit and vegetables. However, in the nut and dried fruit processing industry, it requires changing the standard manufacturing and trading practices. This change of practices is often not favoured by European importers and retailers as it is can be difficult to use with standard bulk packaging. For example, the pasteurisation of dried fruit is possible in tightly closed packaging (such as retail bags), though not possible in common foil in carton export bulk packaging.

One recent development is a possible decrease in permitted level of sulphites as additives because they are allergens. In November 2022, the European Food Safety Authority (EFSA) warned against an excessive consumption of additives containing sulphur (more than 0.7 mg SO2 equivalents/kg bw per day). In view of the EFSA report, it is to be expected that the previous values will be reduced. The European Commission started to work on this topic in spring 2023. Sulphites are used as preservatives and antioxidants in dried apricot, mango and pineapple production.

Another “natural label” trend is the use of “sun-dried” on the packaging. This claim attracts consumers, as sun drying looks more natural and environmentally friendly. However, sun drying increases the risk of contamination by insects, birds and vermin. Industry standard air-drying in tunnels is still the preferred method although there are options to introduce solar heating for boilers.

Figure 7: Sugar-free fig juice (SIAL, 2024)

Source: Autentika Global

Figure 8: Tapioca biscuits with acai berries (SIAL, 2024)

Source: Autentika Global

Figure 9: Yeast alternative to salt (SIAL 2024)

Source: Autentika Global

Tips:

- Consider investing in technology to shorten production processes, simplify the supply chain and increase the use of natural processes, thereby increasing the perceived value for consumers. This includes, for example, using not-from-concentrate juices, high-pressure processing of juices and smoothies and pasteurising dried fruit without preservatives.

- Consider investing in natural ways of preservation, such as drying fruits and nuts without preservatives or bleaching. Vegetable juices can be preserved with natural acid, and vegetables by natural fermentation.

6. Changing consumer priorities: from immune support to mood boosting and healthy aging

Interest in health benefits in Europe is a long-term trend that is constantly evolving. The Covid-19 pandemic has motivated consumers to purchase food and drinks that would support their immune system. Ingredients such as vitamins C and D, zinc, probiotics and functional foods are increasingly used in product formulations. Now, consumers are increasingly starting to look for ingredients that can reduce stress and improve the general mood.

Immune-boosting food

Foods rich in vitamin C, vitamin D, Zinc and probiotics are still popular amongst European consumers. If the mentioned vitamins are not naturally present in the original product, processors frequently add them to enhance health benefits. This often happens in the fruit and vegetable juice sector. Citrus and tropical juices are popular ingredients in “immunity-boosting” drinks. Popular ingredients in drinks and smoothies are acerola, matcha, turmeric, beetroot, spirulina, red berries, fibres and probiotic cultures.

An important development connected to juice functionality is the rising popularity of so-called “juice shots”. These are juices in small packaging (usually of 100 ml) with functional ingredients and vitamins. Common ingredients in juice shots are ginger and curcumin. Some of these shots are specifically created with ingredients that support the immune system. Some examples are the German brand Live Fresh with added vitamin D and the UK brand Plenish with “Ginger Immunity” and “Turmeric Defence” shots.

Cognitive enhancers and stress-relief ingredients

Another ongoing trend is the rising interest for “nootropic” and “adaptogen” ingredients. Nootropics are ingredients used to improve mental performance while adaptogens are substances that are believed by some consumers to help the body adapt to stress. The most popular nootropic product is caffeine, which is naturally found in coffee, cocoa, tea, kola nuts and guarana. Examples of companies following this trend are the UK brand Exalt, which uses nootropics in its Higher Energy smoothie, and Brite’s nootropic drinks.

In recent years, increasing stress and mental health concerns have led to a growing popularity of products with ingredients that support mood and cognitive function, such as vitamins B and D, zinc and magnesium. Other popular ingredients that can potentially act as adaptogens and are used in food formulations are ashwagandha, Rhodiola Rosea, St John’s wort, Kava and curcumin.

Healthy aging

According to Mintel’s 2024 Global Food and Drinks Trends study, Gen X consumers, currently in their mid-40s-to-late-50s (born between around 1965 and 1979) are the age-group most interested in food and ingredients that will help them live long and healthy lives. Popular ingredients that can support healthy aging are blueberries, vitamin B12 or maca. Ingredients that can help during the menopause period are also popular among this age group, such as maca or ginseng.

Functional ingredients in processed fruit, vegetables and nuts

Foods that contain many functional ingredients are known as “superfoods”. Many processed fruits and vegetables are often marketed as superfoods, including coconut water, edible nuts, dried tropical fruit, prunes and superfruit juices. Superfruit juices is a wide category that covers berries, tropical fruits and coconuts as well as fruit and vegetable combinations, including carrots, red beet and green vegetables such as spinach and kale, as well as cucumbers. Superfruits are also finding their application in the cosmetics industry.

Suppliers can take advantage of this trend by promoting their products to importers and end-consumers using online campaigns. Some examples of information that is relevant to consumers can be found on the websites of the Fruit Juice Science Centre of the European Fruit Juice Association and the Nutfruit Power campaign of the International Nut and Dried Fruit Council.

Tips:

- Perform a laboratory analysis of the nutrients in your products and use it as part of your product specification. If your product is specifically rich in particular nutrients, you can use this as a unique selling proposition (USP).

- Avoid health or nutritional claims that are not substantiated by scientific evidence. Claims that a food product prevents, treats or cures any disease cannot be made on labels in the European Union.

Consumers become more health conscious and better informed

Consumers are increasingly watching what they eat and trying to reduce their intake of fat, sodium and sugar. As they become better informed about food, health and nutrition facts on the packaging of products become necessary. European consumers also want to have more information about how the product was made. According to the Innova Market Insights Trends of 2024, one in three consumers globally say they always check ingredients of interest on product packs.

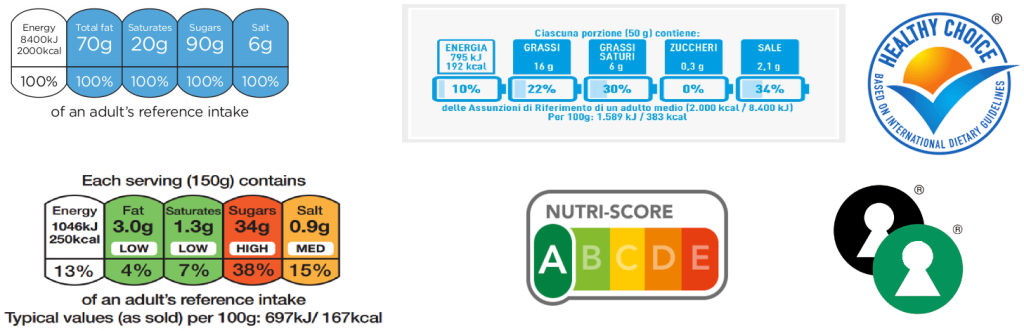

The front-of-pack nutrition labelling is part of the “Farm to Fork” strategy. The aim behind this labelling is to improve consumer understanding of the nutritional value of foods and help them make healthier food choices. Different countries and companies already use different schemes that are not harmonised at an EU-level. The most popular schemes are Nutri-Score (France, Benelux, Germany, Spain), NutrInform battery (Italy), Traffic Light Labelling (the UK) and Keyhole (Scandinavia, Norway, Iceland, Lithuania).

Most of the schemes use a simplified letter and colour system. Still, this can be confusing to consumers, so the EU will propose a harmonised labelling system.

Figure 10: Examples of front-of-pack nutritional labelling used in Europe

Source: Author’s compilation from several sources

Consumers’ need for information goes beyond health-related aspects, and an increasing number of them would like to know where and how the product is produced. To inform consumers about the origin of the product, some food companies have started to place quick response tracking codes, such as a QR or barcodes, on their products. For example, Tanzanian cashew nut producer YYTZ Agro-Processing uses blockchain technology to guarantee single origin. Each cashew pack has a QR code that can be scanned to see exactly from which farmer it came.

An interesting example of scanning QR codes on orange juice packaging comes from Albert Heijn, the leading retailer in the Netherlands. The consumer can track the supply route from the producer in Brazil (Louis Dreyfus), through the bottler (Refresco) and to the supermarket (Albert Heijn).

Belgian retailer Colruyt Group offers another interesting application. They have developed a smartphone application Smart With Food, which offers its customers personalised nutritional advice and recipes. The consumer can create a profile in the app according to their personal nutritional needs. When purchasing a product, consumers can scan a product’s barcode and the app will show the nutritional values, ingredients and its Nutri-Score.

7. New processing technologies and digitalisation are entering the market

The main technology trends in the processed fruit and vegetable sector are in the areas of energy efficiency, the preservation of nutrients and digitalisation. To achieve sustainable food processing, the EU supports new innovative technologies. An example is the HiStabJuice project, focusing on juice colour and nutrient stability, which aims to provide research training to food juice industry players.

More sustainable and nutrient-saving technologies

The main advantage of new technologies is better nutrient preservation and energy saving. Freezing, canning and drying are still typically done using standard technologies, as emerging techniques are not yet suitable for large-scale production. For example, solar heating solutions in fruit-drying technology are of much smaller capacities compared to standard continuous air tunnel drying. Examples of emerging new technologies are:

- Rapid testing for contaminants – To increase food safety in processing facilities, speed-testing methods have been developed. Standard laboratory methods to check the levels of microbiological pathogens or mycotoxins often require several days. New rapid testing kits are therefore used frequently for daily operations.

- UV pasteurisation – UV pasteurisation techniques have an advantage over heat pasteurisation as there is no significant impact on the flavour and aroma of the final product. They are also more energy efficient. However, current solutions are not as efficient in the microbial kill rate compared to heat treatment. While in the dried fruit, nuts and canning industry, heat treatment is still the preferred method, there is an advancement in fruit juice processing – such as the Raslysation method.

- Sugar reduction in juices – On the front-of-pack nutritional labelling, most fruit juices have a “C” grade due to the presence of naturally occurring sugars. To decrease the level of natural sugars and make products more attractive to final consumers with a “B” Nutri-Score level, processors are now using sugar/calorie reduction techniques. The three authorised processes are filtration, fermentation and the enzymatic treatment.

- Ohmic heating – This technology uses electric current for product sterilisation. It is much faster than classical heating and it is suitable for canned fruit and vegetables, fruit preparations and jams, as it enables a better colour and hardness of fruit pieces.

- High Pressure Processing (HPP) – This technology uses high isostatic pressure on retail-packed products. It is suitable for packed fruit juices as it preserves more nutrients than heat pasteurisation. A disadvantage is that the product must be retail-packed, which is not common in the overseas juice trade. Another disadvantage is that the products require cold storage.

- Mechanical Vapour Recompression (MVR) – This technology is specifically useful for the production of concentrated juices, as it can save more than 50% energy compared to common evaporation methods.

- Pulsed Electric Fields (PEF) – This technology uses short electricity pulses for microbial inactivation. It could be suitable for different types of processed fruits and vegetables, as nutrients are better preserved.

- Pulsed Light – This technology uses high-intensity light pulses of short duration on foods.

- Isochoric freezing – This is a new technology that preserves food products at subfreezing temperatures without damage due to the ice crystal formation inside the product. It is more energy efficient than traditional freezing methods.

- Vacuum-microwave drying – This technology uses a lower temperature than conventional drying methods. It is energy efficient and provides a better quality of the dried product. The company Bonduelle combines vacuum-microwave drying and freezing to give a better taste and texture to the vegetables after defrosting.

- More efficient freezing techniques – Some producers develop freezing solutions that save on electricity costs. One such solution is IceGen.

Everything is going digital

Digitalisation is another trend present across the whole value chain in the processed fruit, vegetables and edible nuts sector. The main digital applications in the supply chain are listed below:

- Agriculture - precision farming, robotics and smartphone apps are used to make production more efficient and sustainable.

- Fruit and vegetable processing - sensors are used to measure raw material quality, to sort products and automate production. On a sector level, big data is collected to establish quality parameters. Big data is also collected in processing facilities, often based on SCADA, and used to make better-informed decisions.

- Smart logistics - robots, sensors and blockchain technology are used to make warehousing easier and more efficient, to reduce the costs of intermediaries and to make the supply chain more transparent.

- Export - big data is used to gain market insights. For example, specialised companies collect enormous amounts of data from daily retail sales. This data is used to gain insight into trends and to forecast market developments.

- Retail sales - online shopping is booming around the world, especially under the influence of the Covid-19 pandemic. According to Statista, the grocery delivery market in Europe is projected to experience a steady growth rate of 10.05% annually in the 2024-2029 period.

- Consumer - many apps and devices are developed to inform consumers about the food they buy and to support personalised nutrition.

Tips:

- Always try to test machines and check their influence on quality before purchasing them. Be aware that there is no single processing recipe which you can copy from other companies.

- Read the CBI tips to go digital in the processed fruit and vegetables sector to learn more about specific digitalisation trends..

- Monitor the developments of blockchain applications in international transport and logistics from companies. Carry out cost and benefit analyses before deciding to use blockchain services.

8. New sourcing origins and vertical integration are happening more frequently

Fluctuations in raw material supplies are likely to increase due to climate change and global financial and political instability. To ensure more stable supplies, European processors are looking for new sourcing origins and invest directly in agricultural production in developing countries. Recent developments in new sourcing origins in the processed fruit, vegetables and nuts sectors are the following:

- Frozen fruit – Instability in berry prices concerns the industry, as berries are widely used as ingredients in jams, dairy products, smoothies and in the frozen and confectionery industries. European processors rely mostly on the production from Poland and Serbia, but European buyers are increasingly buying from new sourcing countries such as Bosnia, Ukraine and Egypt.

- Tomatoes and walnuts – Ukraine has become a growing sourcing origin of several products, including walnuts, tomato products, dried fruit and berries. Some experts expect Ukraine will increase its tomato processing capacity further to 1 million tonnes in the next few years. Ukrainian tomato exports has found inroads into Poland, Germany, Belarus and the Czech Republic.

- Dried tropical fruit – Until several years ago, sourcing of natural dried tropical fruit in Europe was mostly connected to South Africa. However, over the last 5 years, West Africa has become the leading supplier. The new trend is spreading from West to East Africa. For example, HPW, a Swiss dried mango, pineapple and coconut producer, opened a new processing facility in Kenya in 2022.

- Olive oil – Due to high prices and bad weather conditions, European processors cannot obtain sufficient quantities of olives for processing and bottling in the major European producing countries – Spain, Italy and Greece. In 2023, European countries therefore started importing significant amounts from South America, North Africa and the Middle East.

- Dried apricots and grapes – To decrease dependency on Türkiye, some European producers have started to increase the import of dried grapes and apricots from Central Asian countries such as Uzbekistan and Afghanistan.

- Apple juice – Apple juice is traditionally produced within Europe, especially in Poland. However, there is a trend to diversify sourcing, and European traders and processors increasingly source apple juice from Türkiye, Ukraine, Serbia and Moldova.

- Pineapple juice – Traditionally being sourced from Costa Rica and South–East Asia, pineapple juice is increasingly being bought from African origins such as Kenya and Eswatini.

- Canned beans – Canned beans are traditionally sourced from within Europe, mostly from Italy. Recently, however, they have been increasingly sourced from Türkiye, Kenya, Lebanon and Tanzania.

- Dates – Until recently, the main suppliers of dates to Europe were exclusively Tunisia and Algeria. The recent trend is to introduce a wider range of date varieties on the European market. New increasing sourcing origins include the Palestinian Territories, Iran, Morocco, the United Arab Emirates and Egypt.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research