The European market potential for cardamom

Europe is a growing market for cardamom exporters. The United Kingdom, Germany, the Netherlands, Sweden, France and Norway are the most promising European markets for cardamom exporters in developing countries. All combine high import levels, well-developed spices and herbs markets and use of cardamom for growing ethnic markets or traditional recipes. The European market is shaped by trends in sustainably sourced spices, and organic certification is a particularly growing niche. Interest in single origin also influences the high-end market.

Contents of this page

1. Product description

Cardamom (or cardamom) is a tropical plant of the ginger family Zingiberaceae. The spice refers to a range of plants in the Elettaria (small cardamom) and Amomum (large cardamom) genera.

Both types are imported to Europe. Small cardamom, Elettaria cardamomum Maton, is often referred to as the ‘Queen of Spices’. Its pods are small with a light green colour. Black or large cardamom, Amomum subulatum, is recognised by larger pods of a dark brown colour.

Figure 1: Green cardamom pods

Source: GloballyCool, August 2024

Guatemala and India are the main cardamom producers worldwide. Guatemala only produces small cardamom, while India produces both types. Other producing countries are Nepal, Indonesia, Tanzania, Sri Lanka, Laos, Bhutan, and Malaysia, as well as other smaller producers. Ethiopia produces Korerima (Ethiopian cardamom or false cardamom), whose botanical name is Aframomum corpora; its seeds are black or brown.

Cardamom is one of the world’s most expensive spices, surpassed only by saffron and vanilla. It is mainly used in ethnic cuisine (Indian and Middle Eastern) and health products.

This study uses the following Harmonised System (HS) codes for the cardamom trade.

Table 1: Products in the cardamom product group

| HS Code | Description |

| 090831 | Cardamoms, neither crushed nor ground |

| 090832 | Cardamoms, crushed or ground |

The trade data presented in this factsheet combine whole and crushed/ground cardamoms unless otherwise specified.

Important notice

This study was updated in August-October 2024. At the time of writing, preliminary forecasts for the cardamom harvest in Guatemala, the world’s leading cardamom production country, indicated a decline in production output of up to 50%. The present analysis does not consider the impact of this situation.

Guatemala’s total production is expected to reach between 17,000 and 20,000 tonnes in the 2024-2025 harvest season, down from the normal average of 36,000 tonnes per year. This drop is expected to have a huge impact on global cardamom prices in the short to medium term.

The production decline is primarily a result of substantial damage from thrips, with crop losses estimated at 34%. Another contributor is early crop harvesting by growers to capitalise on higher prices, resulting in a reduced litre weight of around 340 grams.

2. What makes Europe an interesting market for cardamom?

Europe has a massive and diverse food and beverage industry, providing a broad range of applications for cardamom. The spice is becoming increasingly popular due to the growth of Asian and Middle Eastern cuisines in Europe, but it is also used in traditional European recipes. European imports of cardamom have grown significantly in recent years, registering double-digit figures both in value and volume. Although whole cardamoms represent the majority of European imports, there are opportunities for crushed/ground cardamom.

Europe offers a wide industry for cardamom

The European food and drink market is one of the largest globally. According to Food and Drink Europe, industry turnover was nearly €1.1 trillion in 2023. However, Europe is not the world’s main market for cardamom and accounts for only around 8% of global imports. China accounts for 20% (mostly cardamom from Indonesia), and countries in the Middle East and North Africa for a combined 55% of global imports.

The growth in cardamom consumption is related to the increasing demand for Asian and Middle Eastern food, but also to traditional European dishes. In Scandinavia, for example, the typical dishes using cardamom are Finnish pulla, Swedish cardamom buns kardemummabullar and Norwegian Christmas bread julekake. In Germany, cardamom is used in the traditional spicy cake Kuchen. Cardamom is also increasingly used in fusion-flavoured jams, compotes and crème brûlée.

A growing European demand fuelled by imports

Europe does not produce cardamom, so it depends on imports. In 2023, Europe imported 2.7 thousand tonnes of cardamom from developing countries, both whole and ground cardamom.

Import volumes from developing countries decreased at a compound annual growth rate (CAGR) of 3.9% between 2019 and 2023. By contrast, imports of cardamom from within Europe increased by a CAGR of 5.2% in this same five-year period, reaching 861 tonnes in 2023. Overall, 75% of 2023 imports were supplied by developing countries, 24% from within Europe and a small share that was registered from other origins.

European imports of cardamom peaked in 2021. This was related to the lower prices for cardamom in that year, following record prices in 2020, and also to some extent to the Covid-19 pandemic and traditional and widespread use of cardamom for its reputed health effects. European stock levels of cardamom also increased substantially in 2021. However, the European economy has been under pressure since then, which has negatively impacted consumption levels and resulted in lower imports in 2022 and 2023.

Source: GloballyCool based on UN Comtrade statistics, August 2024)

Cardamom is mainly imported and consumed in whole form. In 2023, whole cardamoms accounted for around 74% of imports and crushed/ground cardamom for the remaining 26%. The European food-processing industry buys large amounts of crushed cardamom. European importers/wholesalers add value to cardamom through further processing, including crushing and packaging in smaller units.

Processing and heating treatments, such as steam sterilisation, are mainly done by European processors. More and more, however, these processes are performed in countries of origin too. Especially heat treatment is becoming an important buyer requirement. As an exporter, you must comply with such requirements if you want to successfully export crushed/ground cardamom.

Tips:

- If you want to enter the market for crushed cardamom, be aware that you are competing directly with European processing companies. Buyers may ask you to provide the same service as European re-exporters, so expect requirements on short supply times, small orders, steam sterilisation, further processing, and so on.

- Explore opportunities to work together with European processing companies, especially large ones that have the size and resources required to invest. You can find these companies in the membership lists of the national spice associations in Europe. For an overview of associations, see the member section of the European Spice Association (ESA).

- Read more about the European food and beverage market in the Food and Drink Europe sector association's annual publication. Read more about the general developments in the spices and herbs market in our study ‘What is the demand for spices and herbs on the European market?’.

3. Which European countries offer the most opportunities for cardamom?

The United Kingdom, Germany, the Netherlands, Sweden, France and Norway are the most promising European markets for cardamom exporters in developing countries. These countries have the largest cardamom imports in Europe, with a significant share of these imports sourced in developing countries. These are countries with a sizeable food and beverage industry and developed spices and herbs markets. Cardamom is also used in traditional recipes, particularly in the Nordic markets, the Netherlands and Germany.

Source: GloballyCool based on UN Comtrade statistics, August 2024

United Kingdom: wide market for South Asian cuisine and herbal infusions

Although imports of cardamom peaked in 2021 and have declined since then, the United Kingdom has recently become the largest importer of cardamom in Europe. The 2021 peak was related to a variety of factors, including turbulence and uncertainties caused by the pandemic and a subsequent drop in cardamom prices.

The United Kingdom accounted for up to 21% of total European imports in 2023, at nearly €7.2 million or 785 tonnes. Around 85% of supplies were sourced directly from developing countries, mainly Guatemala (55%) and India (30%). Though annual import volumes will likely continue fluctuating in the future, volumes are expected to grow to between 900 and 1,000 tonnes per year.

The United Kingdom has one of the largest consumer markets in Europe. According to the UK Food and Drink Federation (FDF), the country’s food and beverage sector generated around €120 billion in turnover in 2020. Ethnic food plays a very important role in the sector, particularly Indian food, which represents an important demand for cardamom in preparing basmati rice and in several curries such as garam masala.

Indians were one of the largest non-UK nationalities in the UK in 2022, with a population of 795,000. Indian food is also popular in Britain as a whole, especially among people who eat a vegan diet. There are thousands of Indian restaurants in cities across the United Kingdom.

Several spice companies in the United Kingdom offer cardamom and spice mixes containing cardamom, including Schwartz (part of McCormick), British Pepper & Spice, Quay Ingredients and Natco, which focuses specifically on the ethnic market. Most tea and herbal infusion companies also use cardamom in their products, such as Pukka Herbs and Twinings.

Many UK importers also have cardamom in their product range, offering either conventional cardamom, such as Rye Spice Co. and The Spice Company, or focusing on organic cardamom, such as Organic Herb Trading. The UK’s organic market is among the largest in Europe and its Fairtrade market is the largest in the region, making it a very promising market for certified cardamom. One of the main spice companies in this segment in the UK is Bart Ingredients Company.

Germany: largest cardamom importer and European spice hub

Germany is the second-largest importer of cardamom in Europe, accounting for nearly 20% of total imports. In 2023, these imports amounted to €5.8 million or 683 tonnes. Much of these imports are sourced from developing countries, up to 97% in 2023. Germany’s economic recession led to a decline in 2023, due to lower spending on high-priced ingredients like cardamom. In the coming years, imports are likely to recover to annual volumes of around 900 tonnes.

Guatemala was Germany’s main supplier in 2023, accounting for 86% of total imports, followed by Tanzania (4.1%) and Honduras (3.6%). India used to be its second-largest supplier of cardamom, but has been exporting less to Germany since 2020. Up to 88% of cardamom imports are whole cardamoms that go through value-adding processes, while another share is re-exported as ground cardamom.

The port of Hamburg is an important hub for spice trade and an entry point into the German food and beverage industry. According to Food and Drink Europe, Germany had Europe’s second-largest food and drink market in terms of turnover in 2021, just behind France. Large spice companies involved in grinding, packing and other processing, like Fuchs, Husarich, Hamburger Gewürz-Mühle and ENES Gewürze, have a strong presence in the German market and often import spices directly from developing countries. There are also several relevant spice traders in the country, connecting suppliers to several end-using industries, like Worlée, Schuco and AKO The Spice Company. Most German spice companies can be found on the website of the German Spice Association.

Cardamom finds an interesting consumer market in Germany, which remains the largest consumer market in Europe in terms of the number of consumers and purchasing power. The country also has the highest GDP in Europe, with among the highest total purchasing power in the region. Moreover, Germany is a highly important market for sustainable and niche products. For example, the organic food market in Germany is the largest in Europe. As a result, there are several spice companies handling organic-certified cardamom active in the German market, like Spice Bar, Herbaria, Hartkorn and Grünberg. Specialised shops offering high-quality spices, like Gewürze der Welt, are also common in Germany.

Source: GloballyCool, based on FiBL, August 2024

Germany had the second-highest per capita consumption of organic food in 2022, after Sweden and on a par with France, at €181. However, Germany is the leading country in total organic retail sales, averaging a value of €13.3 billion, as shown above.

Netherlands: European spice hub

Dutch cardamom imports are similar to Germany's in volume, accounting for more than 17% of total European imports in 2023 and amounting to €5.5 million or 623 tonnes. These imports dropped significantly in 2023 (-35% compared to 2022). This was the largest decline among all leading import countries, caused by a combination of high stock levels and difficult economic conditions. Imports are expected to recover in the coming years, to reach around 900 tonnes per year.

More than 80% of the Netherlands’ cardamom imports come from developing countries. In 2023, the main countries supplying cardamom to the Netherlands were Guatemala (72%), the United Kingdom (15%, which is cardamom originally from India) and Honduras (4%). Whole cardamoms make up about 72% of overall imports.

The Netherlands is a significant entry point for spices into Europe. This is partly due to re-exports to other European countries and a strong ingredient-processing industry. In 2023, as much as half (313 tonnes) of imported cardamoms in the Netherlands were re-exported, and half of the exports were ground cardamoms. This positions the Netherlands as Europe’s largest exporter of cardamom, with an 8.7% share of total European imports, second only to Guatemala worldwide.

Silvo (part of the McCormick group) offers both cardamom and spice mixes containing cardamom, such as Garam Masala. Verstegen and Euroma are among the top spice companies in the Dutch market. These companies import spices directly from developing-country suppliers.

Important Dutch spice traders include Catz; smaller traders also distributing cardamom are companies like H.J. Albring and Keyzer & Company. A full list of Dutch spice-trading companies is available in the member section of the Dutch Spice Association.

The Dutch Spice Association strongly supports the sustainable sourcing of spices. The association is committed to Corporate Social Responsibility, and a leading group of spice importers in the Netherlands has set up the international Sustainable Spices Initiative with members from the Netherlands and other countries.

Sweden: a broad market for cardamom in traditional recipes

Compared to the big three – Germany, the United Kingdom and the Netherlands – Sweden is a smaller importer of cardamom (kardemumma in Swedish) but still an important market player in Europe. In 2023, Sweden’s cardamom imports amounted to €2.5 million or 223 tonnes. In value, this represented nearly 6.2% of European imports. Sweden has the highest per capita organic consumption in Europe, at €247 in 2022.

Developing countries supplied 41% of Sweden’s cardamom imports, led by Guatemala (38%). The remaining supplies were imported via re-distribution through the Netherlands (37%), followed by Finland (13%) and Germany (5%), which supplied at the lesser end.

Swedish demand for cardamom is shaped by its wide use as a spice in Swedish food. It is used to scent doughs, add flavour to poaching liquids, and as a flavouring in drinks. Swedes are estimated to consume 18 times more cardamom per capita than the average country.

Bodén & Lindeberg is among the leading ingredient importers in Sweden, offering cardamom in several presentations and for different applications. One of the leading spice companies is Nordic Spice AB. There are also smaller importers of spices and herbs in Sweden, often focusing on products packaged at origin. These types of companies, like Lazzat Foods AB, tend to focus on specific types of spices, such as ethnic cuisine spices. Santa Maria (part of the Paulig Group) is another major player in the Swedish and generally the Nordic spice market.

France: a leading European food market

France’s growing cardamom imports have placed it on par with Sweden. Between 2019 and 2023, France had a CAGR of 4.7%, representing 6.1% of total European cardamom imports. French imports amounted to 220 tonnes, 91% of which were whole cardamoms and 59% of which were sourced from developing countries.

Guatemala (46%) is the dominant cardamom exporter to France among developing countries, with smaller amounts supplied by India (7%) and Honduras (4.2%). In recent years, France has been sourcing less cardamom from developing countries and more via intra-EU trade (+49%). The Netherlands (26%) and Germany (8.8%) are now the two main European suppliers to France.

France is the leading food and drink market in Europe, home to interesting and large spice companies that source directly from origin, such as Ducros. However, France is also characterised by a large number of small and medium-sized companies, which makes the role of traders significant. The French market has large mainstream importers like SOCO herb and more specialised importers like L’Arcadie and Comptoir des Épices. More companies involved in cardamom and other spices are listed on the website of the National Union of Processors of Pepper, Spices, Herbs and Vanilla.

Norway: a market where cardamom is culturally significant

Norway’s cardamom imports reached 176 tonnes in 2023, 63% of which came from developing countries, mainly Guatemala (59%), and a smaller share from India (3.9%). The Netherlands (21%) and Germany (13%) also supply cardamom to Norway. Norway imports more ground cardamom (86%) than whole cardamom, whereas all other European countries import more whole cardamom.

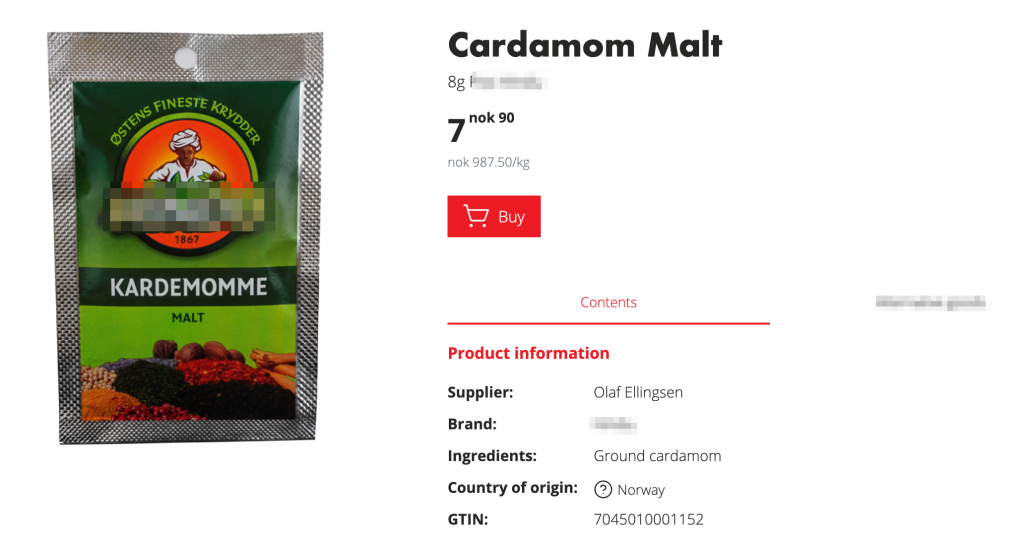

Figure 5: Conventional ground cardamom available in a Norwegian mainstream supermarket

Source: GloballyCool, November 2024

Norwegians use cardamom as an ingredient in several traditional pastries such as kardemommeboller (cardamom buns) and julekake (Christmas bread). Cardamom is sold at major supermarket chains in Norway, such as Meny and Spar. Most products in Norway are also available organically at both big food retail chains and smaller organic stores. For example, Helios specialises in organic and eco-friendly products, selling most spices in ground and pod form. Cardamom is also sold by Norway’s largest online grocery store, Oda, which offers a wide range of organic spices as well.

Tips:

- Focus on Western European countries when exporting cardamom, as they usually have the largest consumer markets and a robust food and beverage processing and manufacturing industry. These are also the countries where the main spice/cardamom importers are located and constitute important hubs in the European market.

- Conduct additional market research for more insight into the differences between the abovementioned countries. Use free statistical databases such as ITC Trade Map or Access2Markets.

- Visit trade fairs and/or check out their exhibitors’ lists to identify interesting buyers in individual European countries. Examples include Food Ingredients and Health Ingredients Europe, Anuga and SIAL for food products and ingredients, and Biofach specifically for organic products and ingredients. Consider attending the Nordic Organic Food Fair if you are targeting the Nordic market specifically. If possible, combine your trade fair trip with visits to existing and potential clients in the region.

- See the CBI study ‘Tips for finding buyers on the European spices and herbs market’ for valuable information on how to approach European buyers successfully.

- Read reports about the spices and herbs markets in these focus countries, for example: Germany Dried Spices market, Spices in France and Norway Herbs and Spices Market.

4. Which trends offer opportunities or pose threats in the European cardamom market?

Growth of the cardamom market is being driven by expanding interest in exotic flavours and cuisines. As the European population becomes increasingly multicultural, food and beverages containing cardamom are becoming more available to consumers. The demand for sustainably sourced spices also shapes the market for cardamom, where organic certification grows at an especially fast pace. In niche, higher-quality markets in Europe, the trend for single-origin spices lets you tell your story as a cardamom exporter.

More imports of ground cardamom from Guatemala

While whole cardamom dominates the European market in terms of volume, ground cardamom is a more stable market and appears to be a growing segment, particularly in Guatemala.

Whole cardamom is exported in much larger volumes than ground cardamom. This applies to all countries. However, exports of whole cardamom are more volatile and have shown declines in recent years, especially from Guatemala and Tanzania.

Although smaller in volume, exports of ground cardamom show more stability, with less fluctuation, especially in Guatemala, where ground cardamom exports remained strong at 380 tonnes in 2022 and 2023, even when whole cardamom exports dropped.

Source: GloballyCool based on UN Comtrade statistics, August 2024

Growing interest in exotic flavours and cuisines

There is growing demand in Europe for South Asian and Middle Eastern cuisines, which often use cardamom as an ingredient. This development is driving up the demand for cardamom.

This rise in demand for ethnic food is partly a result of Europe’s increasingly multicultural population. In 2014, 20% of immigrants to Europe were of Asian descent, while by 2020 this share had increased to 23%. In this context, Asia includes the Middle East.

Another driver for ethnic food demand in Europe is the growing interest in exotic cuisines. This trend is also fuelled by increasing demand for vegan food. Cardamom is known for its exotic effect in cooking.

Examples of accessible Asian foods and beverages that are popular in Europe and contain cardamom are easy to find. For infusions, Ayurvedic tea blends like those offered by Yogi Tea are highly popular in Europe. Several of Yogi Tea’s blends have cardamom as a key ingredient, including the Classic blend. Indian Chai/Masala Chai blends are also highly popular, and there are many popular brands available to consumers, ranging from mid-range to high-end products like Amala Chai and Pukka’s Original Chai.

Curries containing cardamom are also highly popular in Europe. Large retailers sell curry paste (such as Kaufland's range of curry products in Germany), ready-to-eat curry dishes (such as Waitrose’s Fruity Chicken Curry in the United Kingdom) and other curry components containing cardamom.

Cardamom is likewise an ingredient of choice in new product launches, including beverage flavours, thanks to its earthy character. Some examples are Niets Co.’s Cardamom Syrup (Belgium), G’Vine (France) and Sacred Cardamom Gin (United Kingdom).

Tip:

- Make sure to provide complete documentation and specifications of your cardamom to European buyers. This information will allow them to assess the potential of your product in different applications. See the UK importer Organic Herb Trading Company's product specification sheet for an example of the type of data that can be useful to your potential buyers. Besides lab analysis parameters, note the importance of botanical identification and description of detailed organoleptic characteristics of cardamom.

Single-origin provides opportunities for suppliers to differentiate

The market for spices follows the trend for single-origin products already observed in products like coffee and cocoa. As customers seek premium and higher-quality products, they are also increasingly interested in their origins. Consumers have also become more interested in the agro-climatic features of production areas and the stories of producers and their communities. In the case of spices, particularly cardamom, single origin also highlights unique, potent and singular flavours that can only be grown in a specific region.

For importers and spice companies, single origin also means increasing traceability, which is translated into consistent quality and product safety. This is specifically relevant for organic spices, where identity preservation and cross-contamination prevention are crucial.

With cardamom, the single-origin trend provides opportunities for less traditional origins to tell their story, like the Danish Mill and Mortar organic and Fairtrade-certified cardamom from forest garden harvests in Sri Lanka. Suppliers from traditional production countries such as Guatemala and India can also find opportunities by showcasing specific regions, communities and profiles, such as Rooted Spices cardamom from Alta Vera Paz in Guatemala from the United Kingdom.

Figure 7: Single-origin cardamom from Rooted Spices (United Kingdom)

Source: Rooted Spices, August 2022

Tip:

- Explore the possibility of adding value to your cardamom by highlighting the characteristics that are unique to your company and to the producing regions you are sourcing from. This will make your cardamom more attractive, especially to buyers of higher-end spices who are interested in high quality and unique profiles. For example, the Colombian company Bioandes' website clearly highlights the environmentally and socially responsible aspects of its story, design, and product offerings, including cardamom. The company also has an Instagram account, which reinforces its storytelling. Activate the ‘Translate’ function of your browser if you cannot read Spanish.

Growing European demand for sustainable spices

Sustainable sourcing is a growing trend in Europe. As a supplier, you will be increasingly faced with sustainability requirements from your buyer. Organic certification is growing significantly for spices, particularly for high-value spices like cardamom. Growth is driven not only by consumer demand but also by European buyers who require more traceability and cross-contamination prevention in their supply chains.

North America and Europe are the largest markets for organic spices. In Europe, the organic spice market is expected to grow at an annual rate of almost 3.7% in 2024-2029. Growth of organic spice consumption is forecast to be particularly high in Sweden and the United Kingdom. These are among the main European markets for cardamom.

The Guatemalan Federation of Cooperatives of the Verapaces (FEDECOVERA) is the main producer and exporter of organic cardamom in the world, besides being involved with other products like coffee and cocoa. FEDECORA complies with the organic certification of several countries/regions worldwide, allowing it to diversify its markets, including EU organic certification, USDA Organic, JAS and BioSuisse. The federation also provides support to its producers in the form of technical assistance to assure compliance with organic practices and nature preservation.

The growth in organic spices reflects the overall growth in organic sales for food and beverages in Europe. The market share of organic spices has grown 40% and now represents 25% of all spice sales. Europe is the world’s second-largest region (after North America) for organic retail sales. The largest national markets for organic foods are Germany (with organic retail sales of over €15 billion in 2022) and France (more than €12 billion).

Source: Globally Cool based on FiBL, August 2024

Tips:

- Read the latest version of FiBL/IFOAM’s World of Organic Agriculture publication (2024) to learn more about the global and European organic sector.

- Explore the database of Organic-Bio to identify potential importers of organic cardamom, as well as competing suppliers from other producing countries.

- Look for possible partners to improve sustainability in your supply chain. You can use available programmes and subsidies from governmental or non-governmental organisations to invest in sustainability. For more information, visit websites like the Sustainable Spice Initiative, the Netherlands Enterprise Agency and the German Ministry for Economic Cooperation and Development.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research