Entering the European market for cinnamon

Complying with European regulations is a minimum requirement to access the European market. Special attention should be paid to controls on contamination, pesticide residues, heavy metals and food additives like flavourings. Food fraud has also become an important issue on the market and it is crucial for you to be transparent about your supply chain. Indonesia, Vietnam and Sri Lanka are the main suppliers of both whole cinnamon sticks/quills and crushed/ground cinnamon to Europe. China, Madagascar and India are small suppliers and pose more limited competition to new entrants. Unique origins, storytelling and sustainability remain important, but having high-level product safety, quality and diverse ranges will also give you a competitive edge in Europe.

Contents of this page

1. What requirements must cinnamon comply with to be allowed on the European market?

What are mandatory requirements?

When exporting to Europe, you have to comply with the legally binding requirements regarding food safety, as specified in the General Food Law. This law relates mainly to traceability, hygiene and control. Compliance with this legislation ensures that the spice is safe to eat. Related to this are the legal limits for food contaminants.

Official border control for cinnamon imported to the European Union

Official food controls include regular inspections that can be conducted at import or at any further stage of marketing. In case of non-compliance with the European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is freely accessible to the general public.

You should be aware that repeated non-compliance with the European food legislation by a particular country might lead to special import conditions or even suspension of imports from that country. Those stricter conditions include laboratory tests for a certain percentage of shipments from specified countries.

The New Official Controls Regulation entered into force in December 2019. New official controls regulations will extend its scope to organic products. As an exporter from a country outside of the EU, you will have to use the single standard Common Health Entry Document for the prior notification of exports.

Contaminant control in cinnamon

The European Regulation on Contaminants sets maximum levels for certain contaminants in food products. This regulation is frequently updated and, in addition to the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products, including cinnamon. The most common requirements regarding contaminants in cinnamon relate to presence of pesticide residues, mycotoxins, heavy metals and microbiological organisms. There were eleven notifications regarding food safety issues with cinnamon in the RASFF database between 2021 and 2022. The notifications related to pesticide residues and antibacterial substances exceeding maximum levels, undeclared sulphites, naturally occurring coumarin (a sweet-smelling compound that is moderately toxic and found in higher levels in the cassia species) in very high levels, among others.

Contaminant levels must be kept as low as can reasonably be achieved following recommended good working practices:

- Pesticides: Consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each product (see the relevant levels for cinnamon). Note that in June 2020 new specific binding MRLs were set for chlorate;

- Mycotoxins: Limits for mycotoxins are set by EC Regulation 1881/2006. The general specification for aflatoxin B1 and total aflatoxin (BI + B2 + GI + G2) are 5 ppb and 10 ppb, respectively;

- Heavy metals: Until recently, specific limits for the presence of heavy metals in spices and herbs were not set in the European legislation on contaminants. However, this changed in 2021, following a review process for the maximum allowed levels of cadmium. No specific levels are applicable to cinnamon;

- Microbiological contamination (PDF): Salmonella and other bacteria (for example Bacillus cereus) must be absent from cinnamon destined for the European market.

Note that:

- The use of sulphur dioxide (SO2) fumigation in the processing of Cinnamomum zeylanicum is allowed, but the maximum residue level is 150 mg/kg (PDF). Its use is not allowed for other cinnamon varieties;

- Coumarin is a moderately toxic, fragrant organic chemical compound naturally found in cinnamon, especially in cassia. In response to health concerns, the amount of coumarin in finished products is limited by European legislation (European Regulation (EC) No 1334/2008, PDF). As mentioned above, bulk cinnamon containing very high levels of coumarin can be rejected at the EU border;

- Styrene occurs naturally in cinnamon (around 0.1 mg/kg). The level of styrene can increase significantly (up to 40 mg/kg) when cinnamon is subjected to high temperatures and humidity during drying, storage and transport. Styrene is not considered dangerous at normal levels of daily intake, therefore no limits have been set in the EU. However, if levels rise above 20 mg/kg it affects the flavour of cinnamon as it adds a foreign, solvent-like odour. Affected batches are less attractive for buyers. Styrene off-notes can be prevented by controlling the moisture content throughout the supply chain;

- European buyers might require their suppliers to use steam sterilisation to combat microbiological contamination of cinnamon. An important downside of steam sterilisation is that it negatively affects the volatile oil content, which produces the flavour in the product. It can also change the colour and properties of cinnamon. For example, the food thickening properties of cassia are reduced by steam sterilisation. It therefore depends strongly on your buyer whether they will require steam sterilisation and are willing to pay for it.

Irradiation: This process is legally allowed in many EU countries under restrictive conditions. However, in practice, irradiation is not applied to cinnamon destined for the European market, as consumers do not always accept this treatment. Only discuss this option with your buyer when other types of treatment such as fumigation and steam sterilisation are not possible.

Food additives

Buyers and European authorities can reject products if they have undeclared, unauthorised or excessive levels of added substances. There is specific legislation for additives (like colours and thickeners) and flavourings that list which E-numbers and substances are allowed for use. Authorised additives are listed in Annex II to the Food Additives Regulation.

Although you might consider using food additives in the production of cinnamon, keep in mind that European traders and consumers demand spices that are additive-free. As mentioned above, the limits for the naturally occurring coumarin are controlled for finished products under the flavourings regulation and this affects the checks on cinnamon supplies by customs authorities. Note that other forms of chemical colouring or flavouring, for example, are not allowed unless explicitly named in the positive list of the Food Additives Regulation.

Food fraud

Food fraud in the spices and herbs sector is a serious issue and European buyers are increasingly attentive to it. Many laboratories around Europe have increased testing to discover this type of fraud in spices and herbs. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics, and a combination of detection methods.

Cinnamon can also be intentionally adulterated with such substances as low-grade bark, which can be toxic. An important reason for intentional adulteration is economic gain. This is considered a serious malpractice. Another potential adulterant of cinnamon, especially in ground form, is tonka beans. Tonka beans contain high levels of coumarin, which enhances the sensory properties of cinnamon, but are toxic. In recent years, cinnamon has also been adulterated with coffee husks and lead. The mixing of high-quality with low-quality cinnamon is also a regular occurrence and is closely monitored by authorities and the industry.

The above actions all constitute food fraud and will affect a supplier’s reputation on the European market.

Tips:

- For a complete overview of requirements, refer to our study on buyer requirements for spices and herbs or consult the specific requirements for cinnamon on the Access2Markets website.

- Apply the general guidelines for Good Agricultural Practices (GAP) on spices & culinary herbs (PDF) of the International Organisation of Spice Trade Associations (IOSTA).

- Check the Rapid Alert System for Food and Feed (RASFF) database for examples of cinnamon withdrawn from the market and the reasons behind these withdrawals. This will help you identify and analyse your own risks in compliance with EU regulation and border controls.

- Always discuss with your potential buyers whether they want steam sterilisation. If your buyer requires steam sterilisation, look for local sterilisation companies that can provide this service for you.

- Comply with food safety requirements during drying, storage, processing (such as sieving, mixing, grinding or crushing), packaging and transport. This will help prevent contamination with mycotoxins and other contaminants. Not even steam sterilisation can fully remove these substances.

- Read the Guide on Authenticity of Herbs and Spices (PDF) published by the UK Food and Drink Federation to find out more about actions and initiatives that can help you prevent fraud in your supply chain.

What additional requirements do buyers generally have?

Quality Minima

The European Spice Association represents the interests of the European spices industry. It has established non-legal minimum quality requirements for spices, including cinnamon, in its Quality Minima Document. These requirements are not legally binding and non-compliance will not result in rejections by border controls. However, compliance is expected by most European buyers and often enforced through purchasing contracts which include product specifications.

The document specifies the legal European requirements for unprocessed cinnamon (except for crushed/ground cinnamon and cinnamon treated for microbial reduction) as well as additional buyer requirements not laid down in legislation. The document can be used to find out which chemical and physical parameters unprocessed cinnamon (both Ceylon cinnamon and cassia) needs to comply with when sold in Europe before crushing and grinding. The specific requirements are:

| Chemical/physical parameter | Value |

| Ash (% Weight for Weight Max) | 7.0 |

| Acid insoluble ash (% Weight for Weight Max) | 2.0 |

| Moisture (% Weight for Weight Max) | 14 |

| Volatile oil ml/100G Min | 0.7–1.0 (ISO 6539/ISO 6538), depending on botanical species |

There are other parameters generally related to spices that also apply to cinnamon. These cover chemical/physical parameters, contaminants/residues and purity. Among the main ones are:

specifications for cinnamon stated by the American Spice Trade Association (ASTA):

| Whole insects dead | Excreta mammalian | Excreta other | Mould | Insect defiled/infested | Extraneous foreign matter |

| By count* | By mg / lb | By mg / lb | % by wgt. | % by wgt. | % by wgt. |

| 2 | 1 | 2 | 1 | 1 | 0.5 |

*per sub-sample

Quality grading

The International Standard for Standardization (ISO) also has 2 specific standards for cinnamon:

- ISO 6538-1997: applicable to cassia, Chinese type, Indonesian type and Vietnamese type [Cinnamomum aromaticum (Nees) syn. Cinnamomum cassia (Nees) ex Blume, Cinnamomum burmanii (C.G. Nees) Blume and Cinnamomum loureirii Nees];

- ISO 6539-2014: applicable to Cinnamon (Cinnamomum zeylanicum Blume).

In addition, cinnamon is graded in accordance with the relevant national standard of the country of production. Each producing/exporting country will have different quality grades depending on the type of product.

Indonesian cassia has 7 main grades that will vary mainly in the parameters like colour, moisture and volatile oil content:

- Cassia Vera AA;

- Cassia Vera A;

- Cassia Vera B;

- Cassia Vera C;

- Cassia KA;

- Cassia KB; and

- Cassia KC.

Sri Lanka has a standard specification for different grades of Ceylon cinnamon under SLS 81:2010 (PDF). There are 12 different grades which are determined according to maximum allowed diameter, whole sticks per kg and maximum foxing allowed (in %). According to the standard, cinnamon should have a maximum moisture content of 15%. The essential oils (volatile oil content) are specified at a minimum of 1%.

Additional food safety requirements

Only very few cinnamon buyers require suppliers to implement an advanced food safety management system and obtain a certificate from an accredited certifier. This is mostly if the cinnamon is crushed/ground and pre-packed at origin. Examples of such advanced food safety management systems are Food Safety System Certification (FSSC 22000), BRCGS Food Safety, International Featured Standards (IFS Food) and the Safe Quality Food programme (SQF). These standards are all part of the Global Food Safety Initiative (GFSI).

Implementation and certification of these standards usually costs thousands of euros and are only recommended for large-scale processors targeting major European retail chains. For those processors, such a certificate shows professionalism. Smaller buyers in niche markets for cinnamon are likely to have more relaxed food safety requirements as they prioritise other aspects such as authenticity.

Labelling

Clear labelling of the cinnamon you are exporting to Europe is very important. For bulk cinnamon, your product label must include:

- Product name;

- Details of the manufacturer (name and address);

- Batch number;

- Date of manufacture;

- Expiry date;

- Weight of contents;

- Other information required by the exporting and importing countries, such as producer and/or packer code, and any extra information that can be used to trace the product back to its origin; and

- If your product is organic and/or Fairtrade certified, the label should contain the name/code of the inspection body and the certification number.

Packaging requirements

The packaging must not be a source of contamination or migration, should be food grade and must protect the product quality during transportation and storage.

Whole cinnamon quills must be packed in new, clean, sound and dry double-layered jute bags (42-50 kg), cloth-laminated bags with polyethylene or polypropylene or high-density polyethylene bags/pouches (42-50 kg). Cinnamon powder can be packed in new, clean, sound and dry containers made of glass, tin or aluminium, or in pouches made of laminated, metallised, multi-layered food-grade plastic material.

The containers must be free from insect infestation, fungus contamination, undesirable or bad smells, and substances that may damage the contents. Strong-smelling foods, detergents and paints may not be stored in the same room, as they will spoil the delicate aroma and flavour of the cinnamon.

Consult with your buyer for any specific packaging specifications.

Sustainability

Companies have different requirements for sustainability, which may include signing their code of conduct or following common standards such as the Farm Sustainability Assessment/SAI Platform, SMETA/Supplier Ethical Data Exchange (SEDEX), Ethical Trading Initiative (ETI) or Business Social Compliance Initiative (BSCI).

The Sustainable Spices Initiative (SSI), which includes some of the main spice companies worldwide, does not have its own standard for spices and herbs but has developed a SSI basket of standards (PDF) to broaden the possibilities for certification and verification of sustainable spices by member companies. The standards in this basket are recognised by SSI members to cover the main issues and are therefore considered sufficient to certify or verify sustainable production of spices.

The main certification scheme applicable to the mainstream market is Rainforest Alliance. The main European markets for products certified by the Rainforest Alliance are the United Kingdom, the Netherlands and Germany. There is no specific data available for cinnamon. On the supply side, there were 4 companies certified by the Rainforest Alliance (PDF) (2 from Sri Lanka, one from Indonesia and 1 from Bangladesh), producing a total of 110 thousand tonnes in 2019. By far the largest volume (over 99%) is supplied by Cassia Co-op from Indonesia.

Tips:

- Choose a food safety management system that is approved by the Global Food Safety Initiative (GFSI).

- Refer to the Sustainable Spice Initiative’s Basket of Standards (PDF) and the ITC Standards Map for an explanation and comparison of sustainability standards.

- Learn more about maintaining the quality of your cinnamon supplies during transportation on the website of the Transportation Information Service: Cinnamon.

- Check ESA’s Quality Minima Document (in English and Spanish) for more information on the chemical and physical parameters that your cinnamon needs to comply with when sold in Europe.

- Learn more about good practices for spices, including cleanliness and adulteration prevention, by reading the different Best Practices and Guidance documents offered by the American Spice Trade Association (ASTA).

What are the requirements for niche markets?

Certification

European buyers are increasingly paying attention to their social and environmental impact. Important issues at origin typically include restricted use of pesticides, fair payment, and healthy and safe working conditions.

European buyers have different definitions and priorities regarding sustainable sourcing, depending on their business strategies and end markets. Although there is no universal way to address these matters, many buyers will require transparency on sustainability issues. Some buyers will simply ask you questions about the sustainability of your business and others may require you to fill out forms to conduct a self-audit.

Certification of sustainability in cinnamon is gradually moving from niche to mainstream. The main certification systems in niche markets are organic and Fairtrade. Each certification scheme addresses different issues (social, environmental, economic) and serves different niches.

Organic certification

In order to market your cinnamon as organic in the European market, it must comply with the regulations of the European Union (EU) for organic production and labelling. Obtaining the EU organic certificate is the minimum legislative requirement for marketing organic cinnamon in the EU.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by border control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the EU and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

Refer to this list of recognised control bodies and control authorities (PDF) issued by the EU to ensure that you always work with an accredited certifier. To become organically certified you can expect a yearly inspection and audit, which aims to ensure that you comply with the rules on organic production.

If you want to export to countries outside of the EU, check the required legislations for that country. For instance, Switzerland has its own Swiss Organic Law and the Organic Products Regulations 2009 apply in the United Kingdom.

In addition to the EU organic standard, most European countries also have their own voluntary organic standards, such as Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, like Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden). But note that having the EU organic standard is usually sufficient for most buyers.

Fair trade certification

Fairtrade International (FLO) is the leading standard-setting organisation for fair trade certification. Fairtrade international has developed a specific standard for herbs, herbal teas and spices for small-scale producer organisations. FLOCERT is the accredited certifier for Fairtrade.

FLO has established a minimum price for cinnamon (PDF) (Cinnamomum sp.) from different countries: India, Sri Lanka and other (worldwide). For conventional cinnamon, a Fairtrade premium of 15% is offered on top of the commercial prices for all origins. For organic cinnamon, a minimum price of €3.64/kg plus a Fairtrade premium of €0.21/kg (ex-works) is offered for cinnamon from India and Sri Lanka. For other origins, a Fairtrade premium of 15% is offered on top of the commercial price.

There is growing demand for Fairtrade-certified spices in Europe, and cinnamon is an important spice in this market due to the high volumes it commands, as well as its value. There are more than 80 Fairtrade-certified suppliers around the world. Most are located in Sri Lanka (49 suppliers), followed at a distance by India (25 suppliers) and Madagascar (4 suppliers). Fairtrade finds its largest end market in the United Kingdom, but the main buyers operating in Fairtrade-certified cinnamon are also located in Germany, the Netherlands, Switzerland and France.

Fair for Life (by IMO/Ecocert) and Fair Choice (by Control Union) are other fair trade certifications available to producers and other operators. Although less recognised in the European market, Fair for Life and Fair Choice have the advantage that the control bodies Ecocert and Control Union can combine the fair trade audit with other audits, like organic or Rainforest Alliance. However, always check demand and interest for a specific certification with your existing or potential buyer.

Tips:

- If you have more than 1 certification, try to combine audits to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Refer to this full guidance to learn more on how to become a Fairtrade producer.

- Use this cost calculator to estimate what costs will be involved for your organisation to get Fairtrade-certified.

- Search the database of FLO-Cert to find specific Fairtrade-certified suppliers around the world and international/European buyers sourcing Fairtrade-certified cinnamon.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search at the organic movement in your own country and ask if they have their own support programmes or know about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- If you supply or are planning to supply organic cinnamon, visit trade fairs for organic products, like Biofach in Germany, and check out their website for a list of exhibitors, seminars and other events. At the fair you will also find booths of the organic certification bodies.

2. Through what channels can you get cinnamon on the European market?

How is the end market segmented?

The market segmentation of cinnamon follows a similar structure as other spices in Europe. The largest segment is the food and beverage industry (around 55% of the total market), followed by the retail sector (around 35%) and the catering sector (around 10%). In most markets, the industrial sector has been growing as a reflection of the rising popularity of ready-to-use spices and seasonings mixtures.

Low-end: The low-end segment comprises lower-valued cinnamon of a quality that just meets minimum requirements, usually lower-quality cassia species. These low-end retail products are not always certified and are packed in cheap materials, such as plastic or glass packaging, to lower the retail prices. Ground cinnamon is normally most common in this segment, but whole sticks are also offered by most brands.

Lower-end cinnamon products are mainly found in supermarkets. These are usually mass-market products by big brands and lower-quality private label products from the retailers themselves.

Examples of products and prices in the low-end segment for 2022:

| Product | Picture | Retail price (€/kg) | |

| Low-end | Verstegen, Ground cinnamon 37 gr |

| 67.30 |

Verstegen, Whole cinnamon sticks 20 gr |

| 84.50 | |

Ducros, Ground cinnamon 39 gr |

| 37.18 |

Mid-range: The mid-range segment includes cinnamon of good quality – cassia and Ceylon cinnamon which commonly are sustainably certified. Organic certification is showing particular growth in this segment. Packaging can vary, but more recyclable paper, for example, is increasingly seen in these mid-range products. Both ground cinnamon and whole sticks are commonly found in this segment.

Mid-range cinnamon is mainly sold through supermarkets, usually the high-quality category of retailers. Supermarkets increasingly offer their own premium private-label cinnamon, among other spices. These products offer similar quality and characteristics as branded products but are usually offered at more competitive prices.

Examples of products and prices in the mid-range segment for 2022:

| Product | Picture | Retail price (€/kg) | |

| Mid-range | Sonnentor, Ground cinnamon (Ceylon), organic 40 gr |

| 62.20 |

Sonnentor, Whole cinnamon sticks (Ceylon), organic 18 gr |

| 166.10 | |

Waitrose Cooks’ Ingredients, Whole cinnamon sticks 18 gr |

| 121.80 (£ 106.00) | |

Waitrose, Ground cinnamon, organic

36 gr |

| 64.30 (£ 55.50) |

High-end segment: Smaller, more specialised spice companies offer high-end cinnamon and other spices. Single-origin spices are growing in this segment, not only for their flavour but also because of the uniqueness and traceability of the product. Products are offered in more sophisticated packaging, such as metal tins. Higher-quality Ceylon cinnamon is most common in this segment, but there are also companies offering cinnamon with distinct flavours like Vietnamese cassia (Cinnamomum loureiroi).

High-end cinnamon is mainly sold at specialty shops and online specialty shops in Europe, like Good Food Shop (Belgium), Piccantino (Germany), The Artisan Food Company and The Spice Shop (UK).

Examples of products and prices in the high-end segment for 2022:

| Product | Retail price (€/kg) | ||

| High-end | Mill & Mortar, Ananda’s Cinnamon, Whole and ground, Forest Garden Harvest, Organic, Fair Trade – Sri Lanka 45 gr |

| 169.00 |

Mill & Mortar, Cinnamon Sticks, ALBA quality, Whole, Forest Garden Harvest, Organic, Fair Trade – Sri Lanka 45 gr |

| 169.00 | |

Zooze, Ceylon cinnamon, ground – Sri Lanka 60 gr |

| 99.10 | |

BooTree Farm, Royal Cinnamon – Vietnam 50 gr |

| 98.50 (£85.80) |

Tip:

- Check the websites of large retailers in your potential destination markets (for example Albert Heijn and Jumbo in the Netherlands, Carrefour and Auchan in France, Edeka and Rewe in Germany), as well as more specialised retailers like organic supermarkets (for example Ekoplaza in the Netherlands, Bio c’ Bon in France, Alnatura and Biomarkt in Germany) and high-end spice shops like Good Food Shop (Belgium), Piccantino (Germany), The Artisan Food Company and The Spice Shop (UK) to identify the main companies active in these market segments and to benchmark pricing and competition.

Through what channels does cinnamon land on the end market?

As an exporter you can use different channels to bring your cinnamon to the European market. Accessing the market will depend on the quality of your cinnamon, the level of processing you can implement (whole sticks or crushed/ground) and your supply capacity. There are a few market players that can be interesting for you.

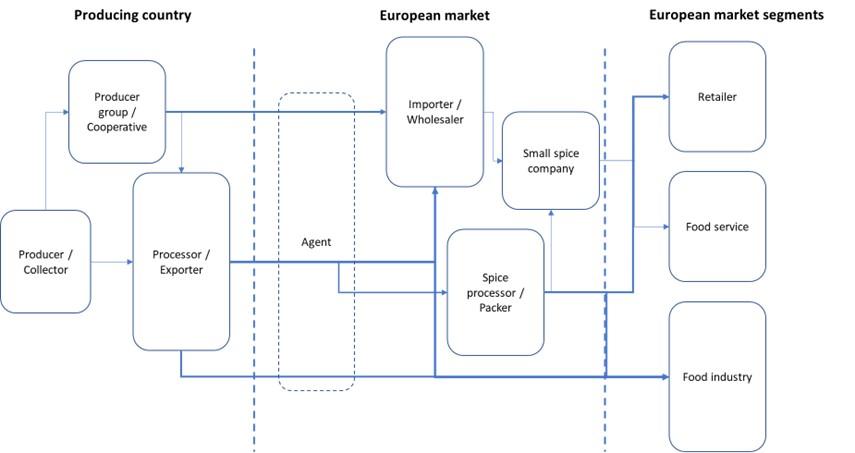

Figure 1: European market channels for cinnamon

Source: Gustavo Ferro

Importers/wholesalers

Importers of spices normally handle large quantities and have direct contact with exporters in producing countries, providing them access to all the different segments in Europe. These can be spice companies or the food and beverage industry. Importers either sell the spices to other local companies or export the product elsewhere in Europe. They can source whole sticks or crushed/ground cinnamon.

In most cases, importers have long-standing relationships with their suppliers. They are responsible for a wide range of services in the cinnamon/spices supply chain. These include logistics, customs clearance and documentation, risk management (sourcing from origin, price, exchange rate), quality control, and so on.

At the same time, they have a large network of suppliers from all over the world and can switch relatively easily to other suppliers. This gives them a lot of negotiation power. They are up-to-date on current price levels on the global market and offer low margins unless you can prove that your product is unique and is worth a price premium.

Importers are wholesalers that handle the product in bulk and do not have direct contact with, or finished products for, the consumer/retail market.

Some large spice importers handling cinnamon on the European market are Royal Polak Spices, Catz International, Nedspice (Netherlands), Worlée, Kräuter Mix (Germany) and Webb James (Italy).

Specialised importers are usually active in specific segments for high-quality and/or organic-/fair trade-certified cinnamon. They usually deal with smaller quantities compared to the bigger importers mentioned above, and often work directly with producers and producer cooperatives. Specialised importers on the European market include Organic Herb Trading (UK) and Comptoir des Épices (France).

Spice processors

Large spice processors source their cinnamon and other spices directly from producing countries. Since these companies often have large portfolios and work with several spice origins, they often have designated departments for sourcing. In most cases they will have more than 1 supplier per spice, so as to spread their risks for product consistency, quality and availability. These companies process spices by cleaning, sterilisation, grinding, blending and packaging.

Spice processors may supply cinnamon both as an ingredient or as a finished product (as a single spice or in mixes such as Chinese Five Spice powder, Garam Masala and Indian Chai Tea), under their own brand or under a private label. Some large-scale processors in Europe are Euroma (Netherlands), Fuchs (Germany), which has 1 product line for retail and another 1 for the industrial sector; Ducros (France); and Verstegen (Netherlands).

Small-scale spice companies

Smaller-scale spice companies will not always have their own processing facilities. They sometimes source cinnamon and other spices from processors in producing countries, but will mainly source from European processors or importers. These companies may also outsource processing to another (European) company that has its own processing facilities, like those mentioned above. Small-scale spice companies include Bold Spices and the Good Spice (Netherlands), Spice Mountain (United Kingdom), Hanse & Pepper (Germany) and Spice Life (Switzerland).

Food industry

Large industrial users mostly source their spices, including cinnamon, directly from exporters in producing countries. They may also use a hybrid model, sourcing part of their spices from producing countries directly and partly from European traders or European processors. Companies like Unilever, known for brands like Knorr, Nestlé and Maggi, usually purchase processed spices from exporters in producing countries.

Smaller industrial users with smaller volume needs often make use of importing wholesalers in Europe or European spice processors. This is because the import of small amounts of cinnamon is relatively expensive and adds a lot of cost to the final product for consumers. Also, their core business lies in activities like product development, marketing, sales, and so on. and not in imports and import procedures.

Agents and brokers

Agents and brokers act as intermediaries between you, spice importers and spice processors or buyers in the food industry. They are actors with vast market knowledge and can help you assess and select interesting buyers. Some agents are independent, others are hired to make purchases on behalf of a company.

Agents or brokers who look for buyers on your behalf are particularly interesting if you lack capacity in sales. However, once you have established a trade relationship through an agent or a broker you cannot establish a direct relationship with the buyer anymore, as buyers’ sales network is protected by law.

European agents and brokers involved in the spices sector include Van der Does Spices, AVS Spices and Victoria.

What is the most interesting channel for you?

As mentioned above, the selection of the most interesting market channel for you will depend mainly on your capacity as an exporter of cinnamon, in terms of quality and consistency, volume availability and processing capacity.

Importing wholesalers are the most interesting channel for cinnamon exporters that have a large product range and volume. Importers are also suitable when you have less processed products and limited experience on the European market. If you are a processor offering crushed/ground cinnamon, there will also be importers interested in sourcing your product, often both whole and processed.

Importing wholesalers source large amounts of cinnamon and break these bulk imports into smaller amounts for the smaller end users, including spice companies and other food industry. Although many exporters from developing countries often aim to supply European smaller industrial users directly to obtain higher margins, this bulk-breaking function can contribute to an increase in trade volumes and, eventually, to higher profits. Importing wholesalers can be specialised in 1 origin/species like Indonesia (cassia) or Sri Lanka (Ceylon cinnamon), or offer several origins at different qualities.

If you export higher-quality cinnamon, specialised importers focusing on higher-end markets will be more suitable. This is also the case if you supply organic and fair trade-certified products. There are importers that specialise in this market segment.

Exporting directly to spice processors will require high quality consistency and volume availability, usually starting at a few containers per year. Depending on their specifications, capacity and end product, spice processors may purchase whole, broken or even ground cinnamon. They will process cinnamon further and offer value-added products to the retail and food industry as single spices or mixes.

Establishing contact with smaller spice companies that do not have processing facilities might be interesting for some exporting processors, especially if you offer cinnamon at smaller volumes and higher quality, or from special origins. Food safety will be an important aspect here and some buyers may require extra certification such as FSSC 2000, BRCGS and IFS.

Last, large food industry users are interesting to exporters of processed cinnamon. High volume and consistent availability, high quality consistency and high food safety will be very important here. Industrial buyers are also expected to be very strict in the implementation of food safety certifications like FSSC 2000, BRCGS and IFS.

If you have limited experience exporting to European countries, agents and brokers can play a very important facilitating role. They can evaluate and facilitate connections with buyers and finance institutions. Working with an agent or a broker is also useful if you need a trusted and reputable partner within the spice sector. Be prepared to pay an extra commission for their work, usually ranging between 3 and 10%.

Tips:

- Search for importing wholesalers in the member lists of the national spice associations of Europe. Go to the member section of the European Spice Association (ESA) for an overview of associations.

- Consider working with an agent, broker or sales representative with a good reputation. You can look for commercial agents and brokers on the website of Internationally United Commercial Agents and Brokers (IUCAB). The IUCAB website lists all their national member organisations. You can use the services of these organisations to find an agent or representative in a specific country.

3. What competition do you face on the European cinnamon market?

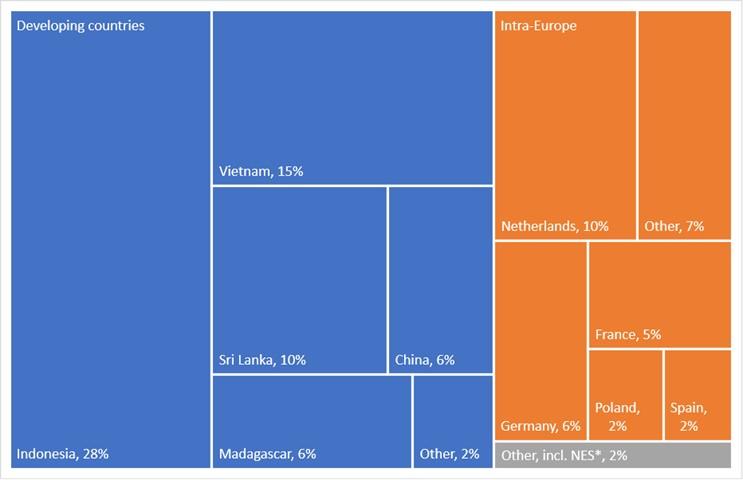

The European cinnamon market is consolidated around 3 main supplying countries: Indonesia, by far the largest supplier, followed by Vietnam and Sri Lanka. Other suppliers to Europe also play an important role, mainly China, Madagascar and, to a lesser extent, India. These countries operate in different market segments, at different product qualities and in different volumes. See Figure 2 to understand the map of main cinnamon suppliers to Europe, including developing countries and intra-European suppliers.

Figure 2: Main suppliers of cinnamon to Europe, in % of total European imports, in value, 2021

*NES: Not elsewhere specified

Source: ITC Trademap / Eurostat, 2022

In general, it is difficult for small and medium-sized companies, for example those exporting a few containers per year, to compete in volume- and price-oriented markets. Those markets are dominated by well-established suppliers with years of experience. But note that many European companies aim to diversify their sources in order to mitigate risks of supply problems in 1 production country. This can open up opportunities for suppliers from alternative origins.

In any case, smaller exporters will often find more opportunities in the niche markets where volumes are smaller, like high-quality and/or organic and fairtrade spices. In these niches the focus lies more on unique flavour aspects, storytelling and sustainability.

Entering the market as a newcomer requires you to have extensive knowledge of your product assortment and your market, stable quality and volumes, and good communication skills to start building your own relationships with buyers. It is also crucial to get to know your competition and learn from their strengths and weaknesses.

Which countries are you competing with?

Indonesia: largest producer and supplier to Europe

Indonesia is by far the main supplier of cinnamon to Europe, accounting for 28% of total European imports in 2021. Considering only suppliers from developing countries, Indonesia accounted for more than 40% of total European imports. According to FAOSTAT, Indonesia is also the largest global producer and accounted for 41% of the total cinnamon production worldwide in 2020, at 91,242 tonnes. While Europe is an important target market, the USA and Vietnam are Indonesia’s main global destinations. However, in the last decade Indonesia lost market share in the USA, seeing a decline of nearly 20% between 2011 and 2021, according to ITC Trademap data.

Most Indonesian cinnamon comes from the Indonesian island of Sumatra and consists of cassia cinnamon. Due to its cheaper price compared to Sri Lankan Ceylon cinnamon, Indonesian’s cassia cinnamon is more widely used by the food industry and traded in higher volumes. Indonesia is also the largest exporter of processed (crushed or ground) cinnamon, accounting for around 30% of total global exports. This reflects the high processing capacity of Indonesian exporters and adherence to international quality standards. At the same time, the country faces challenges in declining yield and harvested area. This threatens its competitiveness, particularly against suppliers like China and Vietnam. This decline is also reflected in the country’s exports, which totalled 46,050 tonnes in 2011 but was down to 32,554 by 2021.

Institutional support is expected to boost the Indonesian spice sector, including cinnamon, in the coming years. The Indonesian government recently launched the Indonesia Spice Up the World (ISUTW) programme. This programme aims to increase investments in the spices and herbs sector and boost exports, with a focus on processing industries. In addition to cinnamon, 4 other spices are prioritised: turmeric, nutmeg, pepper and vanilla.

Vietnam: growing exporter to Europe

Vietnam is the second-largest supplier of cinnamon to Europe, at 15% of total European imports in 2021. If only suppliers from developing countries are considered, this percentage rises to 22%. According to FAOSTAT, Vietnam was the third-largest cinnamon producer worldwide, just behind China, at 31,429 tonnes in 2020.

In addition to Cinnamomum zeylanicum and Cinnamomum cassia, Vietnam also produces Cinnamomum loureiroi (known as Vietnamese or Saigon cinnamon). Compared to other species, Cinnamomum loureiroi, a variety of cassia, has the highest concentration of essential oils and a more pronounced flavour than other varieties. Cinnamon is produced in the Central Highlands regions of the country, particularly the Yen Bai Province. In this region, small-scale farmers also grow other valuable crops such as coffee, tea, cocoa and black pepper.

In the last decade, Vietnam changed its position on the international cinnamon market. Vietnamese exports totalled 1,377 tonnes in 2011. According to ITC Trademap data, India (4,867 tonnes) and the USA (815 tonnes) were its main partners. In 2021, Vietnam’s exports to the USA increased to 5,597 tonnes. In addition, Vietnam expanded further into European markets, particularly the Netherlands and Germany, but still maintains a stronger presence in Asia. In 2021, Vietnamese exports of cinnamon amounted to 33,264 tonnes and mainly consisted of unprocessed (non-crushed or ground) cinnamon.

Exports to Europe have been particularly supported by international projects that benefitted the Vietnamese cinnamon industry, like BioTrade. These projects resulted in the expansion of organic certification and compliance with other international sustainability certifications. The removal of the import tariffs resulting from the 2019 European Union – Vietnam Free Trade Agreement (PDF) has been a critical factor in boosting cinnamon exports to Europe. However, compliance with food safety requirements remains a challenge for Vietnamese exporters.

The development of Vietnamese exports is also supported by an increase in cinnamon production in the country. According to FAOSTAT, Vietnam’s cinnamon production rose from 18,000 tonnes in 2008 to more than 31,000 tonnes in 2021. The sector has also received support from the Vietnamese government, particularly the Ministry of Industry and Trade and the Ministry of Agriculture and Rural Development, in the form of technical and financial support and trade promotion. Note that the Vietnamese government promoted cinnamon cultivation to encourage stewardship of the country’s forest land.

Sri Lanka: supplier to high-quality and sustainable markets

Sri Lanka is the third-largest supplier of cinnamon to Europe, accounting for 10% of total European imports in 2021. This rises to 14% when only suppliers from developing countries are considered. According to FAOSTAT, Sri Lanka was the fourth-largest cinnamon producer worldwide, at 22,910 tonnes in 2020.

Cinnamon is Sri Lanka’s iconic product and is the most important and valuable spice produced in the country. It is also highly export-oriented: an estimated 90% of the production is exported (PDF). Sri Lanka produces the cinnamon species Cinnamomum zeylanicum Blume (syn. Cinnamomum verum Berchthold & Presl), known in the market as true or Ceylon cinnamon. Just as for other spices, cinnamon production in the country is dominated by smallholders (PDF), including small farms and home gardens.

In 2022, Sri Lanka received its first-ever Protected Geographical Indication (PGI) certification from the European Commission through Regulation (EU) 2022/144 (PDF). This is meant to differentiate Ceylon Cinnamon on the EU market from its lower-quality substitutes. Parallel to the PGI process, the cinnamon sector in the country has received strong institutional support for trade promotion. For example, the Sri Lanka Export Development Board (EDB) has established Pure Ceylon Cinnamon as a global brand in the international market. Among other criteria, companies that are licensed to use the logo in their products must have a GMP/HACCP/ISO certificate for the processing of cinnamon. This reinforces Sri Lanka’s commitment to promoting quality internationally.

Sri Lanka’s Ceylon cinnamon plays an important role in high-quality markets and niche markets for sustainably certified products. For example, the FLO-CERT list of operators reveals that 49 producer groups and traders handling cinnamon in Sri Lanka are Fairtrade-certified or licensed. Several of these also hold an organic certification.

However, international demand for Ceylon cinnamon from Sri Lanka (PDF) has been gradually decelerating in favour of the lower-priced cassia . The high price of Ceylon cinnamon results not only from limited production volume, but also from the high costs and inefficiencies of the Sri Lankan industry as well as a lack of proper production infrastructure and technology. Exporters also face difficulties complying with international/European regulations on food safety.

China, Madagascar and India: important cinnamon producers, but smaller suppliers to Europe

Despite being the second-largest cinnamon producer worldwide, at 33% (72,531 tonnes) of the total production according to FAOSTAT, China is only the fourth-largest developing-country supplier to Europe. In 2021, China accounted for 10% of total European imports and 8.9% when only suppliers from developing countries are considered.

In addition to the production that is consumed by its massive consumer market, China’s exports are primarily targeted at Vietnam, where over 30% of Chinese cinnamon exports (in volume) went in 2021. In terms of value, Vietnam accounted for more than half of China’s cinnamon exports in that same year, followed at a distance by Bangladesh (7.3%) and the United Arab Emirates (4.7%). China’s largest European destination in 2021 was Germany, accounting for only 1.5% of Chinese cinnamon exports.

Madagascar supplied 5.7% of total European imports, and 8.5% when considering only suppliers from developing countries. Its cinnamon production reached 3,666 tonnes in 2020, accounting for 1.7% of global production. Besides Sri Lanka, Madagascar is one of only a few countries where Cinnamomum zeylanicum grows in abundance. Madagascar’s main target market is Europe, which represented nearly 80% of the country’s cinnamon exports in 2021. Germany and France are the main destinations. Madagascar’s cinnamon competes mainly with Sri Lankan cinnamon in high-quality markets.

India is a strong global competitor, as it is the largest exporter of spices globally, yet does not hold a strong position in exports of cinnamon to Europe. In 2021, the country only accounted for 1.8% of total European imports – and 2.7% when only considering supplies from developing countries. India’s main cinnamon export destinations are the USA, Canada and Australia, followed by the United Kingdom, its largest export market in Europe. India’s total cinnamon exports amounted to 2,030 tonnes in 2021, up from 1,280 tonnes in 2017.

India’s cinnamon production is not reported by FAOSTAT, but the Spices Board of India reports that cinnamon is grown in 1 or 2 locations in Kerala. India highly depends on imports for its domestic consumption and spice industry (where cinnamon is mixed with other spices). According to ITC Trademap, cinnamon supplies are mainly imported from Vietnam and, to a lesser extent, China.

Which companies are you competing with?

Indonesia, Vietnam and Sri Lanka are by far the largest exporters of cinnamon to Europe, each with their own profile. For other suppliers aiming to access the European market, it is important to observe and learn from the different companies representing these countries. All countries rely on traditional and large-scale exporters with access to a wide raw material base and excellent processing capacity. But there are also companies with specific business models or characteristics like food safety, origin and sustainability that give them an interesting competitive advantage on the European market.

Indonesian companies

Indonesian companies combine volume, processing capacity, food safety, sustainability certificates, and a wide offer of several grades and presentations of cinnamon. Many Indonesian companies active on the European market have years of experience and an established position and relationship with buyers.

For example, Rempah Sari is 1 of Indonesia’s largest cinnamon exporters. It was founded in 1964 and specialises in cassia cinnamon. Its annual export capacity is estimated at around 2,500–3,500 tonnes of different grades.

Cassia Co-op is the first cinnamon-processing and -exporting enterprise to establish itself in Kerinci, Indonesia’s centre of cinnamon production. Cassia Co-op’s business model prioritises more direct and transparent relationships with end buyers, with fewer intermediaries, and a fair and efficient supply chain with long-term positive impact. It is 1 of the main companies producing organic cinnamon in Indonesia, as well as the world’s first and largest supplier of Rainforest Alliance CertifiedTM cinnamon.

TRIPPER is another leading and competitive cinnamon exporter in Indonesia, formed in 1992. The company has developed 2 processing facilities in Indonesia (Bali and Jakarta). It has achieved several food safety (non-GMO, FSSC 22000) and sustainability certificates, including organic, Fair for Life, Rainforest Alliance and Regeneratively Cultivated, plus it holds Halal and Kosher certificates. Tripper is highly focused on value addition at origin, as well as positive social and ecological impact.

Some of the other existing exporters of cinnamon in Indonesia are companies involved in the conventional trade of spices and other commodities, like Subur Anugerah, Injama and Ramnu.

Vietnamese companies

As the cinnamon sector develops in Vietnam and exports and market share increase, Vietnamese companies are becoming more diversified and competitive. They range from spice commodity traders handling higher volumes and standard qualities to highly specialised companies focusing on high-quality and sustainable products.

For example, Vilaconic is 1 of Vietnam’s top cinnamon suppliers, delivering other commodities like rice, cashew nut, pepper and star anise. It was established in 1980 and has extensive manufacturing facilities and export capacity, supported by high food safety standards, including BRCGS. K‑Agriculture is among the most established Vietnamese companies, specialising in the manufacturing and export of cinnamon, as well as other agricultural products like rice, coffee, anise and pepper, to more than 80 countries worldwide. A company with a similar product portfolio is Hanoi Spices. There is also Agrideco, which was established in 2015 and has a wide product portfolio ranging from handicraft to agricultural products, like cinnamon.

Some Vietnamese companies compete in more specialised market segments, like Son Ha Spices and Vinasamex. Son Ha Spices is located in Northern Vietnam and focuses on high-quality spices, combining food safety (for example BRCGS) and organic certificates. It also develops sustainability projects in surrounding communities. Its spices are sourced directly from growers. Similarly, Vinasamex has a strong focus on sustainable spice production and sourcing. The company sources its cinnamon from communities in the Yen Bai and Long Son provinces. Collectors are organised into cooperatives, which receive technical training, seed supplies, organic fertilisers, containing bags and safe harvesting tools from Vinasamex. Targeting high-quality and ethical markets in Europe and internationally, Vinasamex has been a member of the Union for Ethical BioTrade (UEBT) since 2019.

Sri Lankan companies

Sri Lanka is estimated to have more than 250 registered private companies (PDF) that export cinnamon to several international markets. As such, the range of companies competing on the European market is very broad, ranging from very traditional and larger companies to companies operating in niche markets. The quality of the cinnamon offered by Sri Lankan companies is quite uniform across the various grades, and most exporters can meet similar quality standards (PDF). But several companies face a similar problem of undersupply, as raw material production is limited in the country.

On the other hand, Sri Lankan companies will increasingly leverage the monopoly of Ceylon cinnamon, which is now a Protected Geographical Indication (PGI) in the EU. In fact, nearly 20 Sri Lankan companies are already members of ‘Pure Ceylon Cinnamon’ and are licensed to use the logo.

Rathna Cinnamon, a family-owned company founded in 1985, is Sri Lanka’s leading producer and exporter of Ceylon cinnamon and other spices. Another traditional exporter is Cinnatopia, active on the market for more than 60 years and offering Ceylon cinnamon in different presentations (sticks/quills, broken, ground and tea bag cut). Cinnatopia holds an organic certification (in addition to Fairtrade and Rainforest Alliance, as well as BSCI) and sources from the Ceylon Organic Farmers’ Association (COFA). The company also complies with advanced food safety standards like IFS and FSSC 22000, making it suitable for the strictest segments. Joint Agri Products Ceylon, with 30 years of market experience, offers organic Fairtrade Ceylon cinnamon as well as cinnamon products with Bio Suisse, Demeter, Naturland and Kosher certifications.

A handful of Sri Lankan companies are highly specialised in sustainable and ethical markets. They offer unique stories to their buyers related to forest preservation, carbon emission mitigation, transparent supply chains, fair pricing and other elements. This is the case with Ekoland and the Small Organic Farmers’ Association (SOFA), for example. These companies operate in specific niche markets but still help propel the positive image of Sri Lanka’s cinnamon sector by associating quality with sustainability.

Check out the list from the Export Development Board (EDB) highlighting Sri Lankan companies that export cinnamon.

Which products are you competing with?

The main product substitution threat on the cinnamon market comes from more price-competitive species or products. Even though cassia and Ceylon cinnamon have very different product characteristics and quality, Ceylon cinnamon faces strong competition from cassia (PDF) on the main international markets. Cassia bark is coarser and less fragrant than Ceylon cinnamon, but is more affordable. Other than that, cinnamon is a very consolidated spice in the European market, with characteristic sensory properties and applications that cannot be substituted by other ingredients.

Tips:

- Develop and express your unique selling points as a supplier of cinnamon. Think about factors that set you apart from your competitors and create your marketing story around these factors. For example, they can be related to the origin of your cinnamon (including its botanical profile), the agroclimatic characteristics of the producing region, the profile of producing communities, the unique quality of your product, your post-harvest techniques, or a combination of these aspects.

- Be inspired by examples like Cassia Co-op (Indonesia), which has managed to establish processing facilities nearby cinnamon production areas, and safeguard direct and transparent relationships with end buyers. Another interesting example is the Sri Lanka-based Small Organic Farmers’ Association (SOFA), which practices a mixed cropping system with cash crops, shade trees, repellent crops and medicinal herbs to maintain the local biodiversity and support local farmers.

- Develop long-term partnerships with your buyer. This implies always complying with buyer requirements and keeping your promises. It will provide you with a competitive advantage, more knowledge and stability on the European market.

- Actively promote your company on your website and at trade fairs. See how TRIPPER (Indonesia) keeps it simple by using many visuals and graphs instead of text. The company’s website also has a balance between technical information like certificates and storytelling.

4. What are the prices for cinnamon on the European market?

The export prices of cinnamon in bulk differ widely per origin and per species/variety of the product. It is easy to notice the huge gap between the price of cassia (Cinnamomum cassia) and Ceylon cinnamon (Cinnamomum zeylanicum Blume). Ceylon cinnamon is considered to be of higher quality and it is usually traded in smaller quantities.

To contrast the export/international prices between these 2 species, Figure 3 compares the unit value of exports of cassia from Indonesia with Ceylon cinnamon from Sri Lanka over a 3-year period. The export prices for Sri Lankan Ceylon cinnamon, non-crushed or ground, averaged US$13,328 per tonne, while Indonesian cassia, non-crushed or ground, averaged US$4,684 per tonne (nearly 3 times less). As mentioned before, cinnamon prices have increased in recent years and this is the case for both species, as shown in the figure.

Source: ITC Trademap, 2022

It is also important to realise that trade prices and retail prices for cinnamon are not directly linked. The margins you can receive as an exporter may differ. They are influenced by factors such as:

- Country of origin;

- Current and expected future harvest situation;

- Quality of the raw material;

- Level of processing;

- Level of domestic demand;

- Level of international demand; and

- Trends in prices.

Despite being a higher-value spice, the price of cinnamon that consumers buy in the supermarket has a structure similar structure to other spices:

- Raw materials: 5-15%;

- Processing: 5-15%;

- Transport costs: 2-5%;

- Import and processing in Europe: 15-30%;

- Retail margin: 30-60%.

Margins and profits can be higher for you as an exporter if you are able to add value locally. For example, by additional processing (for example crushing or grinding) or certification (for example organic or fair trade) you can create a competitive edge and benefit more.

Tips:

- Keep up-to-date with price fluctuations and the global supply situation of cinnamon by reading the Nedspice Market Update Reports and by visiting the Mundus Agri, Sri Lankan Spice Council and International Trade Centre: Market Price Information websites.

- Make sure that your prices reflect the quality and level of value addition of your product. Benchmark your product price against that of your competing origins and direct competitors.

This study was carried out on behalf of CBI by Gustavo Ferro.

Please review our market information disclaimer.

Search

Enter search terms to find market research