The European market potential for cloves

The popularity of Asian cuisines and the growth of new spice mixes contribute to the increasing demand for cloves in Europe. The Netherlands is the largest clove importer in Europe. It provides specific opportunities for suppliers of several clove types and qualities as it acts as a European trade hub. Other opportunities for new suppliers from developing countries can be found in other large and growing markets, such as Germany, the United Kingdom, France, Spain and Poland. Providing proof that your cloves are produced in a sustainable way can improve your export chances.

Contents of this page

1. Product description

Cloves (Syzygium aromaticum) are the dried, unopened flower buds of the Eugenia caryophyllus tree (Myrtaceae family). The tree is native to the Moluccas, which are part of Indonesia. Nowadays, cloves are also grown in many other tropical countries like Madagascar, the Comoros and Sri Lanka.

Cloves are processed in multiple steps. First, the buds are harvested just before they fully bloom when they have turned from green to a pinkish-red colour. After harvesting, the clove buds are dried and sorted, and the stems are removed. After that, the cloves are graded based on size and quality. Cloves can be packaged and sold whole or ground and sold as powder.

It is worth noting that traditional clove processing methods may vary between regions, and modern facilities often use machinery to streamline the process. Proper processing is crucial in ensuring that cloves maintain their characteristic aroma, flavour and quality.

Cloves have a wide range of applications in the European market. In the food and beverage industry, cloves are a key ingredient in a variety of sweet and savoury European dishes. They are commonly used in desserts, spice blends and various meat-based dishes consisting of cold cuts and cured meats. They are also a crucial ingredient in traditional holiday recipes, such as gingerbread cookies and mulled wine.

Cloves are also used to produce essential oils. These oils are used in the food and beverage industry to produce cosmetics, aromatherapy products and even natural pesticides. This study focuses on the market for cloves used as a spice in food and beverages.

The statistical data in this document is based on Combined Nomenclature (CN) codes. The CN codes use Harmonised System (HS) codes to classify products.

Table 1: Clove types and product codes

| HS Code | Description |

| 09071000 | Cloves, whole fruit, cloves and stems, neither crushed nor ground |

| 09072000 | Cloves, whole fruit, cloves and stems, crushed or ground |

2. What makes Europe an interesting market for cloves?

Europe has a stable demand for cloves, providing a reliable and enduring market for clove suppliers. Unlike some other regions, several European companies value high-quality cloves, resulting in comparatively higher prices. Additionally, there is increasing interest in sustainably produced cloves and supply chain transparency. This creates opportunities for long-term partnerships that benefit all the actors in the supply chain.

Europe accounts for approximately 9% of the world’s total clove imports (based on data from 2021). South Asian and Southeast Asian countries are the main global consumers. Both regions account for 67% of the world’s imports.

Cloves are mainly used in Europe by the food industry as an ingredient in spice mixtures, cured meats, marinades and for bakery products. The food industry in Europe uses cloves for a wide variety of products during the Christmas season. These include cakes, biscuits, mulled wine and Christmas versions of a number of products, from chocolate to infusions.

Cloves are also sold as a single spice, both whole and ground, in the retail and catering sectors.

Source: UN Comtrade (August 2023)

Between 2018 and 2022, the European imports of cloves from developing countries grew by an average of 2.5% every year, with some fluctuations. During this period, cloves imports from developing countries were relatively stable, between 2,900 and 3,100 tonnes. In 2021, these imports reached their peak in the last 5 years, with 3,500 tonnes. This dropped slightly to 3,400 tonnes in 2022.

The increases between 2020 and 2022 were related to the higher availability of cloves from Madagascar. The quality of Malagasy cloves is considered better, and transportation costs to Europe are lower compared to Indonesia. The Malagasy cloves used to have higher prices than Indonesian cloves. Due to the high availability of crop materials, the price gap between the 2 origins became smaller. The lower price for good quality cloves, which can be stored for 2 years, motivated buyers to speculate and buy some extra volumes.

Europe mainly imports whole cloves from developing countries. The share of whole cloves in imports from developing countries was stable between 87% and 91% in the last 5 years. Of the other 10% of the imports that consisted of ground cloves, around 70% came from other European countries in 2022.

Intra-European imports (imports from other European countries) have been growing annually by 16%, going from 1,000 tonnes in 2018 to 1,800 tonnes in 2022. Over half of these imports accounted for whole cloves.

Imports from other parts of the world are negligible, accounting for less than 1% in 2022.

Western Europe is the most interesting region for cloves due to the wide use of the product in sweet products and the interest in international (especially Asian) cuisines. Furthermore, several big food processors are based in Western Europe.

3. Which European countries offer most opportunities for cloves?

The Netherlands is the largest importer of cloves and an important trade hub. Germany is the second largest importer. Germany can be interesting for your exports because it has a large consumer market and the highest share of imports from developing countries and their imports from other European countries are limited. The United Kingdom has a large ethnic food market where cloves are used in their popular curry dishes. France, Spain and Poland are other important markets for cloves, although they are smaller in terms of volume.

Source: UN Comtrade

The Netherlands: Europe’s spice trade hub

The Netherlands is the largest European importer of cloves. It had a share of 21% of the European imports in 2022. Imports of cloves have grown by an annual rate of 17.8% since 2018. Dutch imports dropped in 2020 but grew significantly in the following 2 years. In 2022, imports reached 1,100 tonnes and with a worth of €5.2 million. Over 93% of the imports were whole cloves, while the rest were ground.

The Netherlands imports 67% of its cloves from developing countries. The remaining part is imported from other Europian Union (EU) countries. Madagascar is the leading supplier of cloves to the Netherlands with a share of 37%. They are followed by France (21%) and Indonesia (15%). All 3 countries have increased their exports to the Netherlands during the past 5 years. Madagascar’s export growth reached an average of 39% per year, reaching a total volume of 414 tonnes in 2022. France’s exports grew by an average of 26% per year, while Indonesia’s exports grew by 81%.

The Netherlands re-exports most of its clove imports (65% in 2022). The remaining part is used for domestic consumption, which amounted to 380 tonnes in 2022. The United Kingdom is the biggest destination country for the Netherlands. In 2022, 53% of the exports went to the United Kingdom. Most of these were ground cloves, which they began exporting in larger amounts starting from 2022. Other destination countries are Sweden (9.8%), Spain (6.1%), Italy (3.7%) and France (3.6%).

The Netherlands is an important spice trading country. In terms of cloves, it is the largest re-exporting country in terms of volume in Europe. Re-exports of cloves doubled in 2022 over 2021, making the Netherlands the second largest supplier of cloves to Europe. It is Europe’s second largest after Madagascar and took Indonesia’s position.

Important Dutch spice traders are Catz International and Nedspice. They supply whole and ground cloves. Other trading companies include H.J. Albring, Keyzer & Company and Dani Food Ingredients B.V. Traders of spices in the Netherlands are organised by the Dutch Spice Association. A list of the members can be found on their website.

Verstegen and Euroma are well-known spice companies in the consumer market. These companies source cloves from Madagascar (Euroma), Sri Lanka and Comoros (Verstegen) directly. They offer whole and ground cloves, and cloves for spice mixes (for example, for cookies) and curry pastes. Cloves are used in various dishes, ranging from traditional dishes (for example, stews, game dishes, red cabbage, minced meat and sausages) to Asian dishes, and there is also a variety of Dutch cheese that uses cloves.

Figure 3: Clove cheese in a Dutch supermarket

Source: Picture by Globally Cool

Along with nutmeg and cinnamon, cloves are a major ingredient in ‘speculaaskruiden’. ‘Speculaaskruiden’ is a popular and traditional spice mix used in the bakery industry to produce a variety of Dutch treats, including ‘speculaas’ (a type of cookie) and ‘kruidnoten’ (spiced mini cookies). Spice mixes for meat products (for example, minced meat and sausages) also often contain cloves.

Sustainability is an important trend. For example, Euroma wants to transform all its products into sustainable products by 2025. Euroma purchases cloves from Madagascar. There, the training and direct communication with farmers has contributed to the preservation of the Maroantsera forest, the improvement of the farmers’ standards of living and women’s income.

A leading group of spice importers in the Netherlands and the nongovernmental organisation (NGO) IDH established the Sustainable Spices Initiative (SSI). It aims to sustainably transform the mainstream spices sector, secure future sourcing and stimulate economic growth in producing countries.

Germany: Number one developing country importer

Over the past 5 years, German imports of cloves saw relatively steady growth. The highest import volume was reached in 2020, a volume of 1,100 tonnes. In 2022, the imported volume amounted 1,080 tonnes with a total value of €7.1 million. Like the Netherlands, Germany mainly imports whole cloves (92%). About 73% of the imported cloves are used for the domestic market while the rest are re-exported to other countries.

Germany imports 94% of its cloves directly from developing countries. This is the highest percentage compared to other leading importing countries. With a market share of 59%, Madagascar is by far the largest supplier of cloves to Germany. Madagascar also showed strong growth in the past 5 years (+10% on average annually). Sri Lanka (13%), Comoros (11%) and Indonesia (5.6%) are the next leading suppliers to Germany, but their exported volumes are much lower.

The German Spice Association is a group of all the German companies engaged in refining spices, producing spice blends, spice preparations and the manufacture of other seasoning ingredients. The German Fuchs Gruppe is a large and strong spice company; it is Europe’s biggest spice manufacturer. Other companies that import cloves include Husarich and Enes Gewürze GmbH.

In the German retail sector, cloves are sold under a variety of brands and private labels. Fuchs Gruppe sells cloves under the well-known brands Fuchs and Ostmann. Other brands that can be found on the shelfs of German retail chains are Hartkorn, Kirchner and Kotanyi (Austrian brand). In terms of private label, the following brands are present: REWE Bio (organic, REWE), REWE Beste Wahl (REWE) and GUT Bio (organic, Aldi Süd).

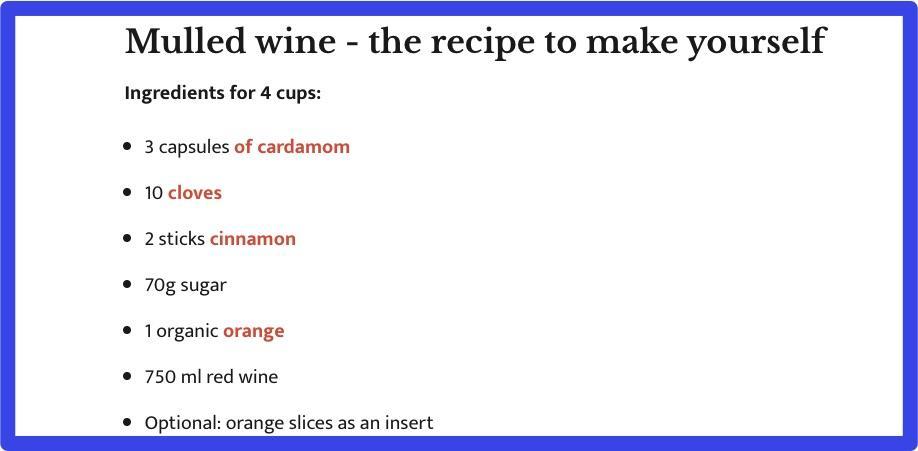

In the retail sector, cloves are sold both whole and ground. They are used to add flavour to a wide range of dishes, both sweet and savoury. They are included in many spice blends, varying from spice mixes used in cookies, chai latte and gingerbread to spice mixes used for meat dishes and Asian cuisine (for example, Madras curry and Tandoori Masala). Cloves are also a key ingredient in making Glühwein (mulled wine), a popular hot drink during the winter and Christmas season.

Figure 4: Traditional German recipe for Glühwein (mulled wine)

Source: Lecker.de

Sustainability and niche products play an important role in the German market. Germany is the largest European market for organic food. As such, in the spices category, there are several companies that offer organic certified clove products. For example, the brand BioWagner from Fuchs and Hartkorn’s BIO version. Several supermarket chains also offer organic cloves under their own brand labels, such as GUT Bio from Aldi Süd and REWE Bio from REWE.

The United Kingdom: Large market for ethnic food

The United Kingdom is the third largest importer of cloves. From 2019 to 2021, imports increased slightly. However, imports skyrocketed in 2022. The volume increased from 478 tonnes in 2021 to 833 tonnes in 2022, an increase of 74%. Overall, in the past 5 years, the imported volume grew at an average of 12% per year. The imported value reached €3.7 million in 2022.

The large growth in imports in 2022 can be explained by the increase in intra-European trade. Between 2018 and 2021, the United Kingdom imported most of its cloves directly from developing countries. Only between 23% and 30% were imported from other European countries. However, in 2022, this changed: 51% of the cloves were imported from European countries. Compared to 2021, imports from developing countries increased by 10%, while intra-EU trade grew by 294%.

The increase in 2022 can be explained by the importing of ground cloves from the Netherlands. In the 2018–2021 period, the Netherlands exported negligible amounts of cloves to the United Kingdom. However, in 2022, the exported volume reached 370 tonnes. The proportion of ground cloves rose in comparison to whole cloves. In 2021, imports were mostly whole cloves (79%). In 2022, this shifted towards the import of ground cloves (57%).

As of 2022, the Netherlands was the leading supplying country of cloves to the United Kingdom (47% share). It is followed by Madagascar and Sri Lanka, with 17% and 10% shares, respectively. Other supplying countries include Indonesia (6.5%), India (5.3%) and Tanzania (4.9%).

Three large British retail chains – Tesco, Sainsbury’s and ASDA – offer cloves under their private labels: Tesco, Sainsbury’s and COOK by ASDA. Brands that sell cloves in the supermarkets include Schwartz (owned by McCormick), East End, Indus (AIB foods), Fudco and Bodrum. In supermarkets, you can find whole cloves, ground cloves and cloves added to mixed blends (for example, curry spice blends, Chinese 5-spice and seasonings packets). There are also companies that specifically focus on selling cloves to ethnic stores (for example, Natco).

In the United Kingdom, it is common to use cloves for curry dishes. Cloves are particularly popular amongst the Indian community. The United Kingdom has the largest Indian diaspora in Europe. The UK is home to approximately 1.5 million people with an Indian background. Curry dishes are also popular amongst the rest of the population. The demand for South-Indian cuisine is growing by 97% per year, driven by the increase in popularity of vegan diets. In addition, the United Kingdom is home to thousands of Indian restaurants.

In general, the United Kingdom is one of the largest markets in Europe for organic and fair-trade products. Bart Ingredients was the first British spices and herbs company to bring fairtrade certified spices to British consumers. Examples of companies that import organic cloves include Steenbergs and Cotswold. Even though the United Kingdom has a big market for organic and fair-trade products, the large retail chains are still dominated by conventional cloves.

France: Imports growing again

French imports of cloves have fluctuated over the past 5 years. Import volumes were at their highest in 2018 at 520 tonnes. Imports dropped significantly in 2019 to 313 tonnes. Over the next 2 years, imports increased again. In 2022, the imported volume reached 416 tonnes, with a total value of €3.1 million. Overall, France’s clove imports decreased at an average of 5.4% per year.

France imports over three-quarters of its cloves from developing countries. Indonesia holds the strongest position in the French market. With a share of 29%, it is the leading supplier of cloves. Madagascar (26%) closely follows Indonesia. Both Indonesia and Madagascar’s exports to France have decreased in the past 5 years, at 8.5% and 7.7% on average per year, respectively. Other countries that supply cloves to France include Sri Lanka (share of 14%), Spain (12%), and Comoros (7.7%).

France mostly imports whole cloves. 79% of its total imports are whole cloves. It also re-exports a large part of its imports. Not much processing seems to take place, as the majority of exports is in the form of whole cloves. The Netherlands is the largest destination country by far (with a 64% share), followed by Italy (13%) and Spain (10%).

France is home to 2 major spice companies – Ducros and Cepasco – as well as many small and medium-sized enterprises, like La Conquête des Saveurs and Eric Bur. You can find more spice companies on the FEDALIM website, where members of the National Union of Processors of Pepper, Spices, Herbs and Vanilla (SNPE) are listed.

Most retail chains sell cloves from several brands. Familiar brands present in multiple retain chains are Ducros (McCormick), Sainte Lucie, Albert Ménès and Fuchs (German brand). Some retail chains sell cloves under their own private label, such as Auchan and U (Système U). Cloves are typically sold in whole form. Ground cloves are also available, but to a lesser extent. There are a few organic cloves available, such as Ducros Bio and BioWagner (German brand, Fuchs).

Spain: Important market for private label

Spanish clove imports have increased yearly, between 2018 and 2021, peaking at 487 tonnes in 2021. In 2022, there was a large decline (-27%). Imports decreased to 354 tonnes, worth €1.9 million. Although imports decreased in 2022, over the past 5 years, Spain has shown a small growth of 3.7% on average per year.

72% of cloves are imported directly from developing countries. With a share of 57%, Madagascar is the leading supplier of cloves to Spain. Intra-EU trade mainly comes from the Netherlands (13%) and France (11%). They hold the second and third position in the Spanish market. Other supplying countries are Comoros (5.9%) and Indonesia (5.8%). About 195 tonnes of the imported cloves are sold on the domestic market.

Spain almost exclusively imports whole cloves. Whole cloves accounted for 96% of Spanish imports in 2022. About 195 tonnes of the imported cloves are used for consumption in the domestic market (55%). The rest are re-exported to other European countries, like France and the United Kingdom.

In retail, cloves are mostly sold under the private labels of the retail chains, such as Hacendado (Mercadona), El Corte Inglés, Carrefour and Auchan (Alcampo, part of Auchan). The most popular clove brands in Spain are Ducros (McCormick) and Carmencita (Jesús Navarro). Cloves are mainly available whole. Ground cloves are sold but seem to be less popular. Spanish supermarkets also offer a variety of teas and infusions to which cloves are added (for example, chai, rooibos, matcha teas and infusions).

Cloves are sometimes used to add flavour to paella, a traditional Spanish rice dish. They are often included in the spice blends of paella seasoning. Cloves can also be found in some Spanish desserts, including holiday treats like ‘roscón de reyes’, a cake traditionally eaten on Three Kings’ Day.

Poland: Small but stable market

Poland is a relatively stable market when it comes to clove imports. In the period under review, imports grew at a rate of 1.3% on average per year. In 2022, the import volume amounted 239 tonnes, valued at €1.9 million.

Madagascar is the top supplier of most European clove importers. However, for Poland, Sri Lanka is the most important trading country. In 2022, Sri Lanka accounted for 38% of all Polish clove imports. It was followed by Madagascar (16%), the Netherlands (15%) and France (13%). 80% of the imported cloves are whole; the rest are ground. France was the main supplier, followed to a lesser extent by Madagascar and Spain.

Poland hardly exports cloves to other European countries. This means most imported cloves are destined for the domestic market (78%).

Prymat Group is a leading spice and seasoning producer in Poland. They deliver products to all key supermarket chains (both Polish and international ones), the catering sector and business to business (B2B). McCormick Polska SA (part of McCormick) is also an important player in the Polish market. Its brand, KAMIS, is a well-known Polish spice brand.

Tips:

- Target the French and British markets to sell ground cloves. For whole cloves, all six markets mentioned above present opportunities.

- Learn more about the European clove market on the websites of national associations, such as the Dutch Spice Association (the Netherlands), the German Spice Association (Germany), the Seasoning and Spice Association (the United Kingdom) and the National Union of Pepper, Spices, Herbs and Vanilla Processors (France).

- Read our study ‘What is the demand for spices and herbs on the European market?’ to find out more about general developments in the European spice sector.

4. Which trends offer opportunities or pose threats on the European cloves market?

The growing interest in ethnic cuisines and new developments in spice mixes are the leading drivers behind the demand for cloves in Europe. Buyers’ need for a stable and sustainable supply chain creates opportunities for exporters with tangible sustainability claims. Read our study on trends in the European spices and herbs market to find out more about general trends.

International cuisines are becoming mainstream

Cloves are part of many spice mixes, sauces and dishes. They are still, to a large extent, consumed by people in Europe who have Southeast Asian, Middle Eastern and North African backgrounds. These consumers often buy spices and spice mixes from traditional brands found in ethnic retailers.

Over the years, these cuisines have become very popular among European consumers, who often prepare them using spice mixes or ready-made sauces. To cater to these new consumers, European brands have launched their own spice mixes, sauces and ready-to-eat meals.

The German supermarket chain REWE has several spice mixes for international dishes under their private label, such as a Garam Masala that contains cloves. Fairtrade also sells a Yellow Thai Curry mix that contains cloves under their own label.

Figure 5: Ras al Hanout spice mix with cloves in a German supermarket

Source: Globally Cool

Iglo Veggie Reis Curry is a vegan dish inspired by Southeast Asian cuisine that contains several spices, including cloves. The Iglo brand is a tradition brand of frozen foods in the German market. Iglo has expanded to ready-to-eat meals inspired by popular international cuisines, which include Asian recipes. New products require more spices to be used.

The food industry is a key part of this trend. Processors in Europe launching new products inspired by international cuisines use more spices than they used to. Clove importers benefit from this development.

Consumers are looking for convenient and healthy products

European consumers who have little time to cook value convenience products. At the same time, consumers want to eat tasty and healthy food prepared with natural ingredients. Spices play an important role because they improve the flavour of the food, are natural and, in many cases, have health benefits.

Consumers often do not have the time or skill to mix spices properly to achieve the tastes they want. Pre-made spice mixes help consumers cook healthy, well-seasoned meals with little effort.

This development has changed the spice shelves in the European retail sector. Today, you can find a wide variety of spice mixes alongside more traditional single spices. New brands like Just Spices or Ankerkraut have entered the retail offering spice mixes that promise fantastic flavours for little effort.

Traditional brands like Ostmann in Germany have launched spice mixes for traditional recipes like gingerbread and mulled wine.

Figure 6: Spice mix for gingerbread dough in a German supermarket

Source: Globally Cool

These new products raise the consumption of spices as consumers use these mixes for dishes they might have prepared without any spices previously. Some examples include ‘Allrounder Chicken’ for preparing chicken, ‘pumpkin spice latte mix’ for preparing coffee at home or the ‘scrambled egg mix’ for scrambled eggs.

The demand for sustainability grows

Sustainability is becoming increasingly important for companies that import goods into Europe. Consumers are now more aware of the unfair wages and poverty often faced by producers in developing countries. Additionally, public opinion is increasingly concerned about the environmental impact of agriculture.

The EU is developing a directive (Corporate Sustainability Due Diligence Directive, CSDDD) to make European companies accountable for sustainability issues in their supply chains. As a result, companies in Europe are looking to improve their supply chains to meet the upcoming regulation and consumer expectations.

European clove buyers often look at the sustainability of the exporters’ supply chain and not only for the quality of the cloves. One way of improving a supply chain is by buying from companies with internationally recognised sustainability certifications.

Jacarandas is a clove exporter of cloves from Madagascar. The company is certified organic and Fair For Life. Jacarandas is also part of Ecovadis, an internationally recognised platform to assess companies’ level of sustainability. It is also currently conducting a carbon footprint study to start compensating for its carbon production.

Jacarandas demonstrates its commitment to sustainability through these measures. This generates trust amongst buyers, facilitating sales. Moreover, these measures make it easier for buyers to check their supply chain and be sustainable. This way, sustainability has become a strong part of the company’s value proposition.

Figure 7: Jacarandas’ approach to working with small farmers in Madagascar

Source: Jacarandas YouTube Channel

Tips:

- Look for international certifications schemes and recognised standards to demonstrate the sustainability of your supply chain and attract European buyers. Use the ITC Standards Map tool to identify and compare the different sustainability standards.

- Read the CBI’s studies on how to go green and how to become a socially responsible exporter of spices to get tips for becoming more sustainable.

- Read our study on trends in the European spices and herbs market to find out more about general trends.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research