Entering the European market for dried chillies

Food safety certification combined with reliable and frequent laboratory tests creates a positive image for dried chilli exporters to Europe. Sustainable production and certification under a social responsibility management system will provide additional advantages for emerging suppliers. China is the strongest competitor to new dried chilli suppliers. Chinese companies are combining price competitiveness with investment in safe and high-quality production.

Contents of this page

- What requirements and certifications must dried chillies comply with to be allowed on the European market?

- Through which channels can you get dried chillies on the European market?

- What competition do you face on the European dried chillies market?

- What are the prices of dried chillies on the European market?

1. What requirements and certifications must dried chillies comply with to be allowed on the European market?

To enter the European market, you must comply with several mandatory (legal) requirements. Buyers often have additional requirements and may ask for certifications. In Europe, mandatory requirements for dried chillies centre on consumer health and safety, and sustainability requirements are also becoming increasingly important.

What are the mandatory requirements?

Most mandatory requirements for the import of dried chillies are related to food safety. The European Commission for Health and Food Safety is responsible for European Union policy and for monitoring the implementation of related laws.

Official food controls

Dried chillies undergo official food inspections when imported into the European Union (EU). Non-compliance with European food laws is reported through the Rapid Alert System for Food and Feed (RASFF). In 2022 and 2023, there were 12 food safety issues related to dried chillies. Most concerned pesticides: one was about mycotoxins, two were about unauthorised agents and one was about documentation.

If imports of dried chillies from a particular country repeatedly violate European food regulations, the frequency of official border checks increases. This is currently the case for dried chillies from India (CN codes 0904 21 10 and certain products under codes 0904 21 90 and 0904 22 00), where 10% of products are subject to temporary increases in official checks for aflatoxins.

Dried chillies and dried sweet peppers from the following countries have been subject to stricter import controls:

- Ethiopia – 50% of all shipments of 0904 - pepper of the genus Piper; dried or crushed or ground fruit of the genus Capsicum or of the genus Pimenta must be officially tested for the presence of aflatoxins.

- India – 20% of all shipments of 0904 - pepper of the genus Piper; dried or crushed or ground fruit of the genus Capsicum or of the genus Pimenta must be officially tested for the presence of pesticide residue.

- Sri Lanka – 50% of all shipments of 0904 21 10 - peppers of the genus Capsicum (sweet or other than sweet) must be officially tested for the presence of aflatoxins.

- Sri Lanka – 50% of all shipments of 0904 21 90 - dried fruit of genus Capsicum or Pimenta, neither crushed nor ground (only a few products) must be officially tested for the presence of aflatoxins.

- Sri Lanka – 50% of all shipments of 0904 22 00 - peppers of the genus Capsicum (sweet or other than sweet) (only a few products) must be officially tested for the presence of aflatoxins.

Tip:

- Search the RASFF database for examples of product withdrawals from the European market. You can find common issues that have led to withdrawals in Europe in the past. This information can help you strengthen your quality control and compliance efforts and so reduce the risk of recalls or rejections. By proactively addressing these issues, you can protect your brand reputation, build trust with buyers and avoid costly disruptions.

Contaminant control in dried chillies

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated, and apart from the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products, including dried chillies. The most common requirements regarding contaminants in dried chillies are related to the presence of pesticide residues, mycotoxins, heavy metals, microbiological organisms and food additives.

- Mycotoxins: The Presence of mycotoxins (aflatoxins and ochratoxin A) is the main reason for banning dried chillies from the European market. The maximum level of aflatoxin for dried chillies must be between 5 μg/kg for aflatoxin B1 and 10 μg/kg for the total aflatoxin content (B1, B2, G1 and G2). For ochratoxin, the maximum level is 15 μg/kg. To prevent mycotoxin development, sweet peppers should be dried, packaged and stored properly to ensure water activity stays below 0.65.

- Microbiological contaminants: The EU regulation on microbiological criteria for foodstuffs does not set specific limits for dried chillies. The general limits apply. The main microbiological risk is salmonella, which must be completely absent.

- Metal contaminants: Since 2021, the EU has lead residue limits for spices. For dried chillies, this limit is 0.9 mg/kg.

- Polycyclic aromatic hydrocarbons (PAH): PAH can increase the risk of cancer. The EU has therefore set PAH limits for spices and herbs, including dried chillies, of 10μg/kg for benzo(a)pyrene and 50μg/kg for the sum of all PAHs.

Tips:

- Check if there is specific national legislation on dried chillies in your target countries using the EUAccess2markets' My Trade Assistant tool.

- Prevent microbiological contamination by complying with the Codex Alimentarius Code of Hygienic Practice for Low Moisture Food (CXC 75-215) and the International Organisation of Spice Trade Associations’ General Guideline for Good Agricultural Practices on Spices and Culinary Herbs.

- Consider heat sterilisation as a natural, chemical and radiation-free option. Since heat sterilisation equipment is rather expensive, you could use a third party.

Pesticide residues

The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in or on food products. Products with residues exceeding these levels are withdrawn from the European market. Between January 2021 and September 2024, three pesticide residue cases were reported in RASFF for dried chillies: in ground chilli peppers from Mexico and in chilli peppers from Nigeria and Uganda.

Tip:

- For a list of relevant MRLs, select your product or the pesticide you use in the EU pesticide database. Chillies are not on this list, but the code for sweet peppers (not covered in this study) is 0231020. Therefore, check MRL requirements with your buyers extra carefully.

Labelling requirements

Each export package should declare the following:

- Name of product, such as ‘ground dried chillies’

- Batch code

- Net weight in the metric system (kilograms in most cases)

- Shelf life of the product or best-before date and recommended storage conditions

- Lot identification number

- Country of origin and name and address of the manufacturer, packer, distributor or importer

The lot identification and name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark. A label can also include details such as brand, drying method and harvest date. These batch details can also be included on the Product Data Sheet (alternatively called a Technical Data Sheet, Product Specification Sheet or similar), specifying the characteristics of your product, which buyers will ask for to assess your product. For an example, see dried chillies (organic bird’s eye, germ-free).

Consumer packaging product labels must comply with the EU regulation on the provision of food information to consumers. This regulation clearly defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information.

Figure 1: Chilli packaging varieties offered by a Dutch manufacturer for the food retail and foodservice segment in the Netherlands

Source: GloballyCool, from Verstegen, August 2024

If you supply organic dried chillies, your label must include the name/code of the inspection body and certification number.

Tip:

- See our study on Requirements for spices and herbs for a full overview of all consumer packaging and labelling requirements.

What additional requirements and certifications do buyers often have?

European buyers often have their own requirements in addition to the mandatory legal requirements. In many cases these include the European Spice Association’s (ESA) minimum quality requirements, or ‘quality minima’, for spices. Others relate to food safety and sustainable and ethical business practices.

Quality requirements

The minimum requirements for dried chillies are described in the Codex Standard CSX 353-2022 for Dried or Dehydrated Chilli Pepper or the UNECE standard. This standard document describes many more variables, such as classification and maximum moisture content. The Codex Alimentarius Standard committee is currently working on a new standard for dried or dehydrated chilli and paprika.

The most common parameters for dried chilli quality include:

- Cleanliness or purity: The European Spice Association (ESA) proposes that the quantity of external matter should not exceed 1% of the weight of all spices.

- Colour: The intensity of colour is one of the most important determinants of the quality of dried chillies, especially for chilli powder. The colour of dried chillies is commonly expressed in units established by the American Spice Trade Association (ASTA). Colour is usually determined by standardised laboratory tests (such as ISO 7541)) and using colour charts. The industry commonly accepts that high-quality chilli powder should have an ASTA unit value higher than 120.

- Pungency: The pungency of dried chillies is determined by their capsaicin content. The most preferred method of measuring capsaicin content is high-performance liquid chromatography (HPLC). The pungency level is expressed in Scoville heat units (SHU) and ranges from 900-3000 for mild chillies (such as ancho) to >100000 for extra hot chillies (such as habanero).

- Mesh count: The size of the crushed flakes is typically between 5 and 8.

Packaging requirements

Dried chillies are mostly exported in bulk and packed in cartons or jute or polypropylene bags. Polythene cannot be used, as the flavour components diffuse through it. The size of the bulk varies according to the buyer’s requirements but usually varies between 3 and 40 kg, most commonly 20 or 25 kg.

Dried chillies should be stored in dried and cool places, protected from the sun, heat, moisture, insects and other animals.

Labelling

Each export package shall declare the following:

- Name of product, e.g. ‘dried whole chilli peppers’

- details of the manufacturer (name and address)

- batch number

- date of manufacture

- product grade

- producing country

- harvest date (month/year)

- net weight.

Figure 2: Consumer labels on dried chilli flakes available in a mainstream supermarket in Germany

Source: GloballyCool, August 2024

Other information that exporting and importing countries may require include the bar, producer and/or packager code, as well as any extra information that can be used to trace the product back to its origin.

If your product is organic and/or Fairtrade-certified, the label should contain the inspection body's name/code and the certification number.

Food safety certification

Food safety is essential in the European market. While legislation already prevents many risks, it is not sufficient. Importers therefore prefer working with producers and exporters that have a food safety system certificate recognised by the Global Food Safety Initiative (GFSI) .

The most popular certification programme for spice and herb processors and traders trading in dried chillies is Food Safety System Certification (FSSC 22000). A third-party certification programme like this is an asset to your company and appreciated by new buyers. Nevertheless, serious buyers may also visit and/or audit new suppliers’ production facilities.

Sustainability compliance

Although less important than product and food safety requirements, more and more European buyers are demanding social and environmental compliance as well. Often, this means the supplier must sign the buyer’s code of conduct. Buyers may also ask for certification by organisations such as the Rainforest Alliance.

Codes of conduct (CoC) vary from company to company, but tend to be similar in setup and scope. In 2022, the European Spice Association (ESA) published a guideline for its members. Since many European spice and herb companies are ESA members, you are likely to encounter this guideline sooner or later.

Under ESA’s sustainability code of conduct, members have to monitor their own and their suppliers’ operations.

Tips:

- For an in-depth understanding of the ECE Standard for dried chillies, read the explanatory brochure (109 pages).

- Always ask your buyer for their specific packaging requirements.

- To determine quality parameters for dried chillies, use the analysis and sampling methods recommended by ESA in Appendix 2 of their Quality Minima Document.

- Read more about payment and delivery terms in the CBI Tips for organising your spices and herbs exports to Europe.

What are the requirements for niche markets?

Additional buyer requirements apply mostly to the mainstream spices and herbs markets. However, some niche markets have their own specific requirements. Ethnic certification can be interesting for the large and growing ethnic food segments. Fairtrade sets requirements for sustainability in the social, environmental and ethical domains. Product certification for the organic market mainly focuses on environmental requirements.

Ethnic certification

Islamic dietary laws (Halal) contain specific dietary restrictions. If you want to focus on this market segment, consider implementing a Halal certification scheme.

Organic certification

If you want to sell your spices and herbs as organic in Europe, they must be grown using organic production methods that comply with EU organic legislation. An accredited certifier must audit your growing and processing facilities.

Figure 3: Three varieties of organic chilli peppers available in mainstream supermarkets in Germany

Source: GloballyCool, August 2024

Fairtrade

The Fairtrade market is based on Fairtrade certification. Every company in the supply chain has to be certified to participate in this market. The Fairtrade market is privately regulated.

Fairtrade International has a specific standard for herbs, herbal teas and spices from small-scale producer organisations. This defines minimum prices and price premiums for conventional and organic products from several countries and regions. Chillies are not included in this scheme, however as of October 2024 there are around eight Fairtrade-certified dried chilli producers worldwide, most in Thailand and India.

Tips:

- Read CBI’s study on requirements for exporting spices and herbs to the European market for a complete overview of requirements, including organic and Fairtrade certification.

- See the guidelines for imports of organic products into the EU to familiarise yourself with requirements for European traders.

- Consult the ITC Standards Map for a full overview of relevant certification schemes and requirements.

- Check Fairtrade International’s standard for herbs, herbal teas and spices and other Fairtrade Standards relevant to your production, processing and trade.

- Try to combine organic certification with other sustainable initiatives to increase your competitiveness.

2. Through which channels can you get dried chillies on the European market?

Using the right channels can help maximise your reach in the European market. You can sell dried chillies through several types of companies, including importers, processors and agents.

How is the end-market segmented?

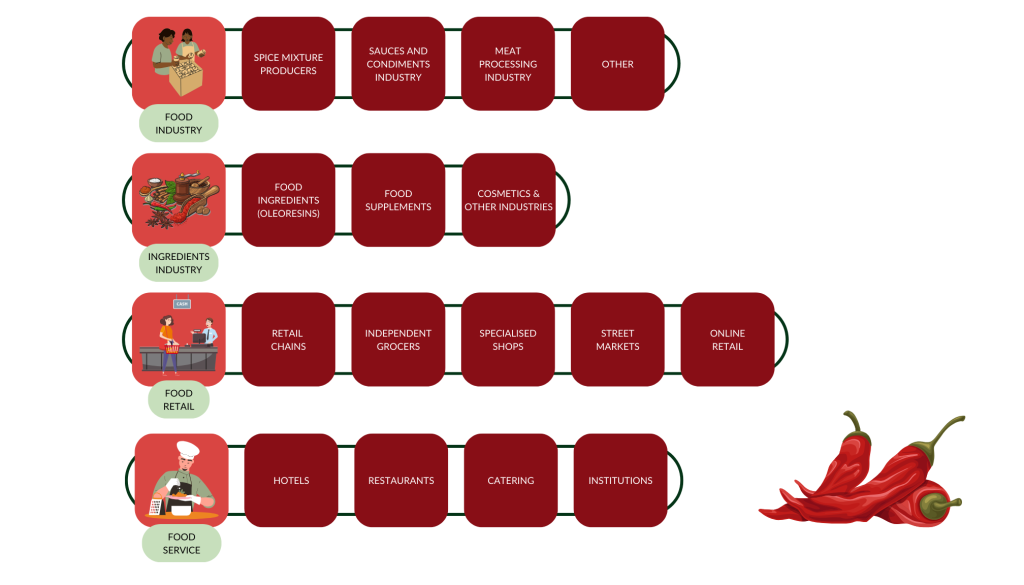

The largest user of dried chillies in Europe is the food-processing industry, followed by retail, food service and food ingredients (additive segments).

Figure 4: End-market segments for dried chillies in Europe

Source: GloballyCool, October 2024

Food-processing industry

The European food industry uses ground chillies in significant quantities, especially in the manufacturing of meat products like sausages, salamis and pâtés. These are also used as an ingredient in spice mixtures, sauces, soups and ready meals.

The food-processing segment is roughly estimated to account for 60-70% of the usage of dried chillies on the European market. The largest users within the food-processing segment include spice mixture producers, the meat industry and the sauces and seasonings industry.

Spice mixture producers are companies that specialise in the production of spices and seasonings for different applications. Those companies are constantly investing in research to develop custom formulations for food-processing companies and help launching new attractive tastes. They produce either dried or liquid spice ingredients. Some examples of companies specialised in spice mixes and ingredients are AVO (German producer, part of the European group), Meat Cracks, Kerry Ingredients, IFF, Farevelli Group, Food Ingredients Group, Kalsec, EHL Ingredients and Ion Mos.

The meat industry is the most important user of dried chillies. Most meat processors buy customised mixes from spice and food ingredient companies. However, some larger companies may import dried chillies directly. An example of such a group is OSI Food Solutions.

The European sauces and condiments industry is also an important user of dried chillies. This market is dominated by international brands such as Kraft Heinz, McCormick, and Maggi (Nestle).

An interesting development in the food-processing industry, particularly in dried chillies, is the increasing level of vertical integration. In order to maintain constant supply and stable prices when sourcing dried chillies, many European companies have started to invest in production sites in developing countries.

These investments are likely to increase in order to stabilise sourcing in the face of global climate change. Such investments in dried chilli production include the German Fuchs Gruppe in China (production unit in Anqiu city and technology centre in Shanghai), the Spanish companies Paprimur in production in China and Sabater in a sourcing location in China, the UK’s JLP in a food processing facility in China, and Poland’s Saran Enterprises in an office in Vietnam.

Ingredients industry

The ingredients industry comprises ingredient formulators that serve various end-using industries such as food, cosmetics and health. Ingredient formulators are often large-scale, globally operating companies such as Givaudan, DSM Firmenich and Symrise. These companies focus on cutting-edge technology and usually source from various global suppliers. They have very strict sourcing protocols for quality control and consistency, as well as sustainability.

Food retail

The retail and foodservice segments are dominated by European (often national) brands, such as Fuchs, Verstegen, Euroma, Santa Maria (Scandinavian countries, part of Paulig group) and multinational brands such as McCormick, Kraft Heinz etc. Some strong brands are also developing in Eastern Europe, such as Prymat.

Private label (supermarket) brands are also important. Production for all these brands is conducted by European spice packers and blenders. Since supermarkets often require large quantities and have very specific packaging requirements, it is very difficult to supply them directly. Products already packed in origin countries are mainly found in European ethnic markets.

The retail sector can be further segmented into supermarkets, independent grocers, and speciality shops. Most retailers sell individually packed spices or herbs or specific mixtures. Overall, spice and herb mixtures are becoming more popular in the retail segment, partly due to the increasing interest in ethnic food.

Foodservice

The food service segment (hotels, restaurants, and catering) is usually supplied by specialised importers (wholesalers). The food service segment often requires specific dried chilli packaging different from bulk or retail packaging (for example, packs ranging from 0.5 to 3 kg).

Tip:

- To find potential buyers for your dried chillies within the food ingredient segment, search the list of exhibitors at the specialised trade fair Fi Europe.

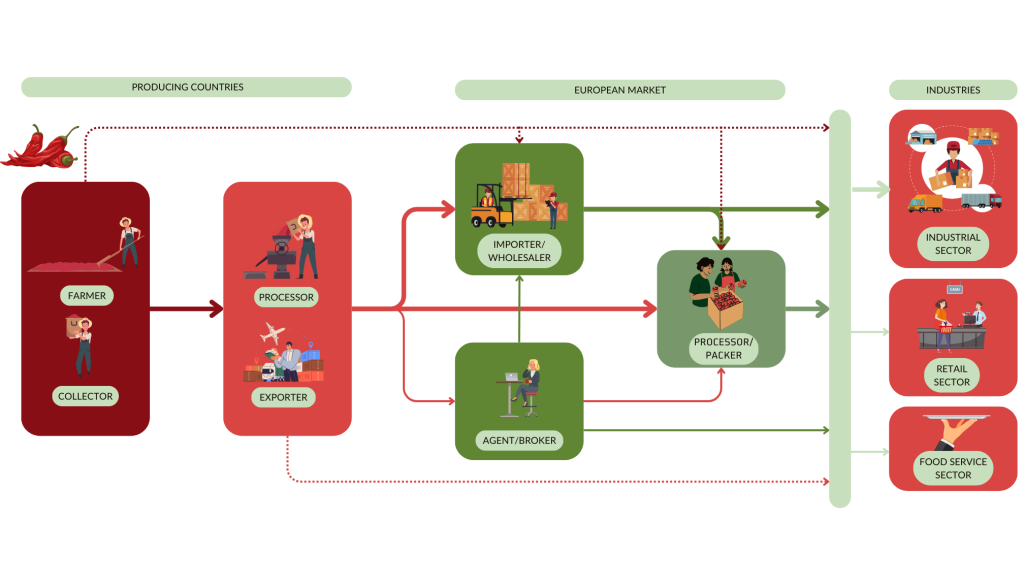

Through which channels does a product end up on the end-market?

The most important channel in Europe for dried chillies is specialised spice importers. The second main channel is direct supply to food processors and agents/brokers.

Figure 5: Trade channels for dried chillies in Europe

Source: GloballyCool, October 2024

Importers / Wholesalers

Importers and wholesalers can be general spice importers or further specialised. Some now exclusively deal with ingredients aimed at the processing industry, while others pack dried chillies for retail chains. Some importers also deal with a broader range of products apart from spices, such as beans or seeds.

Examples of bulk importers of dried chillies in Europe include Albarracin (Spain), Nedspice (the Netherlands, specialises more in the sourcing of dried sweet peppers), European Spice Services (Belgium), Husarich (Germany) and Saran Enterprises (Poland).

Examples of importers specialised in spice mix production are Culinar (Sweden), Epos (the Netherlands) and Colin Ingredients.

An example of a general spice importer supplying several different segments is ISFI Spices (Belgium).

Processors/packers

Large spice processors source their dried chillies and other spices directly from producing countries. Since these companies often have large portfolios and work with several spice origins, they tend to have designated departments for sourcing. In most cases, they have more than one supplier per spice due to risk management for product consistency, quality and availability. These companies process spices by cleaning, sterilisation, grinding, blending and packaging.

Spice processors may supply dried chillies both as an ingredient or as a finished product, under their own brand or under a private label. Large-scale processors in Europe include Euroma (Netherlands), and Fuchs (Germany).

Agent/broker

Brokers and agents are intermediaries who bring buyers and sellers together. They charge a commission for their services. European buyers can be trading companies, but they are mostly processors.

Tips:

- Consult the European Spice Association’s member list to find buyers.

- Consider working with an agent or representative with a good reputation for easier market entry. You can look for commercial agents on the International United Commercial Agents and Brokers (IUCAB) website. The IUCAB website lists all its national member organisations; you can use the services of these organisations to find an agent or representative in a specific country.

What is the most interesting channel for you?

Importers are the best contact for placing dried chillies in the European market. This is specifically relevant for new suppliers, as supplying the retail segment or industrial segment directly is very demanding and requires a lot of quality and logistical investments.

Packing for private labels can be a good option for well-equipped and price-competitive producers in origin countries. Still, private label packing is often done by importers who are making contracts with retail chains in Europe. As the cost of production in Europe is increasing, importers of dried chillies may search for opportunities to pack in developing countries if they can assure full traceability and quality control. High volume and consistent availability, high-quality consistency and high food safety will be very important here. Industrial buyers are very strict about the implementation of food safety certifications like FSSC 22000, BRCGS, and IFS.

3. What competition do you face on the European dried chillies market?

China is by far the main supplier of dried chillies to Europe, followed at a great distance by India, Zambia, and Peru. Zambia is not the only country from Southern Africa, also Zimbabwe, Malawi, and South Africa export dried chillies to the European market.

Which countries are you competing with?

China dominates the market, with a share of more than 70%. Chinese exports of dried chillies to Europe grew with a CAGR of 10% between 2019 and 2023. China is followed at a great distance by India (7.3%), Zambia (7.2%) and Peru (3.6%). Spain is also an important supplier of dried chillies, through re-exports.

Source: GloballyCool, based on UN Comtrade statistics (August 2024)

China is by far the leading supplier of dried chillies in Europe

China is the second-largest producer and exporter of dried chillies in the world, behind India. Most of the country’s dried chilli production is exported, and China is Europe‘s leading supplier. China produces around 320 thousand tonnes of dried chillies annually, almost 70% of which is for export.

Over the past five years, Chinese exports of dried chillies to Europe grew by an average annual rate of 6.4%, despite a slight decline in 2022. In 2023, Chinese exports of dried chillies and dried sweet peppers reached 243 thousand tonnes, almost 25% of which was exported to Europe. 65% of these exports go to Spain. One of the reasons for this high percentage is the investment in processing facilities in China by Spanish companies (such as Sabater or Paprimur).

China is the most competitive dried chilli supplier to Europe in terms of prices. Chinese export prices of dried chillies are relatively low. In addition, Chinese laboratory controls for contaminants seem to be more reliable compared to those performed by Indian laboratories (especially when it comes to measuring levels of aflatoxins). Additionally, many Chinese processors have introduced steam sterilisation to minimise contamination risks.

Major chillies production areas in China are Shandong, Xinjiang, Henan, Shanxi, Hebei and Gansu. Also, the province of Guizhou specifically started to promote Chinese chilli production by the organisation of the annual International Chilli Expo. Chinese chilli production is mostly limited to low-heat ones. Very popular chilli cultivars used for drying in China include ‘chaotic’ (‘facing heaven chilli’), more used for grounding into powder, and ‘you’, which is more used for crushing into flakes. Other varieties include Jinta, Tieban, Xian and Er Jing Tiao.

Apart from the competitive prices, Chinese companies are successful in international promotion. The majority of Chinese dried chilli producers actively participate in international trade fairs on the national pavilions. Also, many of them are efficient in terms of delivery (such as reaching the import destination within two weeks of signing the contract) or payment (asking only for partial advance payments).

Tip:

- Read more about the promotional activities of Chinese chilli suppliers on the website of the World Chilli Alliance.

Southern Africa shows some impressive growth rates.

Several countries in Southern Africa export dried, mostly whole, chillies to Europe. Figure 7 shows that exports from Zambia increased significantly in the last three years, from 209 tonnes in 2019 to almost 9,000 tonnes in 2023, a CAGR of more than 150%. Imports from Zimbabwe also increased significantly during the same period, with a CAGR of almost 25%. Imports from Malawi increased by a CAGR of 6.4%, while imports from South Africa decreased by a CAGR of -24%.

Source: GloballyCool, based on UN Comtrade statistics (August 2024)

The main varieties of dried chillies produced in Southern Africa are bird’s eye chilli (Capsicum frutescens) and African red chilli. Bird’s eye chilli is the most popular variety and is often grown by relatively small-scale farmers, alongside a small group of small and medium-sized enterprises.

India, world leader in dried chilli production

India is the world’s largest producer, consumer, and exporter of chillies. However, due to increased control for aflatoxins presence by European authorities, Europe is currently not seen as a priority market for Indian dried chilli exporters. Instead, Indian exports of dried chillies are focused on Southeast and East Asia, with China as the main destination (44% share). Exports to Europe account for a share of only roughly 2%, with the United Kingdom as the leading target market (4.7 thousand tonnes of ground chillies in 2023).

Indian production of dried chillies is estimated to exceed 2 million tonnes on an annual basis in the last few years. Around 15-20% of this production is exported.

In India, major chilli-producing states are Andhra Pradesh, Telangana, Tamil Nadu, Karnataka and Madhya Pradesh. There are many dried chilli varieties grown in India, which are usually characterised by a higher pungency level than Chinese chillies. The most demanded variety by European buyers is Guntur Sannam S4 (also known as S-334), with a pungency level of 18,000-22,000 Scoville Units. Some other varieties include Dhani, Byadagi, Hindpur, Jwala, Kanthari White and Kashmir chilli.

The production and export of spices, including dried chillies, is monitored and supported by the Spices Board of India. The Spices Board of India is one of the best known spice industry organisations in the world and organises the World Spice Congress every two years. The Spice Board of India is also responsible for the mandatory testing of spices before exporting to the EU.

Peru, a dried chillies exporter with a strong promotion

Peru is the world’s fifth-largest exporter of dried chillies. Peru’s exports have fluctuated in the past few years. In 2023, total exports of dried chillies from Peru reached 33 thousand tonnes, with 13% of these exports, around 4.4 thousand tonnes, going to Europe. Nearly all Peruvian dried chilli exports to Europe are whole and go to Spain (93% share).

Peru, one of the original producers of chilli, produces and dries (and even collects from the wild) different types of chilli. The most famous Peruvian varieties used for drying are Panca (a low-heat variety), Charapita (collected from the wild and more expensive than others), Rocoto, Arnaucho, and Cherezo. Recently, the Mexican ancho variety has also been increasingly produced in Peru. The most popular chilli variety in Peru is Amarillo, but it is more commonly used as fresh and less for drying.

The Peruvian region of Piura, followed by the regions of Lambayeque and La Libertad, account for most of the Peruvian chilli exports. Peru is very strong in export promotion, as supported by the national export promotion organisation PromPeru. PromPeru has created a national brand, ‘Superfood from Peru’, promoted at all leading international trade fairs. Additionally, the Peruvian Association of Exporters (ADEX) actively promotes Peruvian chillies and organised the International Pepper Conference in 2016. There is also a National Day of Peruvian Peppers.

Which companies are you competing with?

There are many companies that export dried chillies. The three examples below are purely to illustrate.

Chinese companies

Some examples of Chinese dried chillies exporters to Europe are Qingdao Taifoong Foods, Qiang Da Foods, Boon Spices, Qingdao Johnson Foods, Hennan Sunny Food and Qiubei Yunnong Agro Products.

For example, good examples of successful promotion include Qingdao Taifoong Foods and Qiang Da Foods. Both companies regularly participate in leading international trade fairs, cooperate with local farmers, supervise traceability and quality, and use recognised food safety certification schemes. Also, they use advanced technologies such as processing equipment and steam or microwave sterilisation lines. Another strong point is cooperation with well-known control bodies or laboratories such as Eurofins or SGS to guarantee their quality.

Southern African companies

Some dried chilli exporters based in Southern African countries are Jande Enterprises Limited and Amatheon Agri, both in Zambia, Chilli Pepper Company in South Africa, and Tropha Malawi and Spice Corp, both in Malawi.

Indian companies

According to the Spice Board of India, there are more than 5 thousand exporters of spices in total and more than 200 exporters to Europe. Therefore, it is difficult to make an illustrative list of selected exporters among many, but there is a published list of exporters selected for certificates of merit.

Peruvian companies

Examples of Peruvian dried chilli exporters include Uchu Spice, S&M Foods and Consorcio del Valle. Peruvian dried chilli exporters are investing into traceability and control of the whole supply chain in order to achieve high quality of the end product. To maintain the full control of the supply chain Peruvian dried chilli companies often produce chillies by themselves or closely cooperate with farmers and farmers’ associations.

Which products are you competing with?

There are several substitute products for dried chillies: fresh chillies and food additives based on chillies, such as chilli extracts or chilli oleoresins. There are also pickled chillies; however, these are used in a slightly different way and by different market segments than dried chillies, so are not a true substitute for dried chillies.

Tips:

- In order to successfully penetrate the European dried chilli market, you need to study the different strategies of your competitors. You may either offer competitive prices and safe products (like Chinese companies do), offer unique, high-quality chillies (like South American producers do), or customise your product to specific segments, such as organic. It is very important to learn from the Chinese companies, which strongly emphasise food safety control.

- Use the services of your national export promotion agency and actively participate in the creation of export strategies. Good examples include PromPeru in the promotion of the superfood country brand.

- Learn more about Indian dried chilli companies from the exhibitor list of the World Spice Congress.

- Regularly visit leading European trade fairs such as ANUGA, SIAL, Food Ingredients or Alimentaria to meet your competitors. Biofach is especially interesting if you are exporting organic chillies.

Fresh chillies

European consumers are becoming more familiar with fresh chilli peppers. The European market for fresh chilli peppers is still specialised, and it is supplied primarily by producers in southern Europe (especially Spain), Turkey, and North Africa. To find out more about fresh chillies competition refer to our study on Exporting fresh chilli peppers to Europe.

Food additives based on chillies

Paprika oleoresin (which includes sweet and chilli extracts) is manufactured by solvent extraction of the dried capsicum pods, followed by solvent removal. The seasonings and sauces industry sometimes uses chilli extracts instead of dried or fresh chillies in the product compositions.

The base for many chilli sauces on the European market is often tomato paste with the addition of different spices. Although the name of many chilli sauces indicates the high presence of chillies in reality sometimes chilli extracts are used in combination with other spices and flavour enhancers (such as monosodium glutamate), stabilisers, acidity regulators and preservatives. Sometimes chilli paste is used too.

Tip:

- Consider diversifying your offer to health and food ingredient industries by producing ingredients such as capsaicin or oleoresins. Prepare a good business plan, as this diversification requires additional technology investments. Read more about these market segments in the CBI study on Exporting paprika oleoresin to Europe. This study also tells you more about applications of chillies in the production of food colourings and pungency additives.

4. What are the prices of dried chillies on the European market?

Prices for dried chillies in Europe can be calculated at two points. One is when dried chillies enter Europe, where prices can be calculated by dividing the value by the volume. The other is the price at which they are offered for retail sale, as at retail outlets and webshops.

Import prices

The prices of dried chillies imported into Europe include the costs of insurance and freight (CIF price). Figure 8 shows CIF prices for dried chillies from the main developing countries.

Source: GloballyCool, August 2024

Figure 8 illustrates that:

- Prices for dried chillies grew in 2022 and dropped slightly in 2023. This temporary growth was strongly related to the high cost of energy, input materials and transport.

- Prices for dried chillies from India grew significantly between 2019 and 2023, which is clearly related to the lower volumes exported to Europe after the 2021 peak and strict checks on aflatoxins.

Retail prices

Retail prices of dried chillies depend on the variety and quality of the raw material, type and size of packaging and brand. The price of a 35 gram retail pack of dried chillies can be around €175 per kilogram, with average CIF prices on average below €3/kg. This means there are large margins in the import, processing, packaging, distribution and sales value chain of dried chillies.

Tips:

- For timely updates on dried chilli export prices, regularly visit S&P Global's Spices and Exotics Market Analysis or Mintec, two of the most respected market information services for food ingredients, including spices.

- Monitor the average weekly prices for dried chillies on the Spices Board of India website. Those prices are based on the reports of the USA-based spice broker A.A. Sayia &Co. Inc.Hoboken.

GloballyCool updated this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research