Entering the European market for mace

Important requirements for the European market relate to low-level requirements for pesticides and mycotoxins. Food safety certification is very important, combined with sterilisation and reliable and frequent laboratory tests. Sustainable production and meeting social responsibility standards will provide additional advantages for up-and-coming suppliers. Indonesia is the main competitor. Smaller volumes come from Vietnam, Sri Lanka and India.

Contents of this page

1. What requirements and certifications must mace meet to be allowed on the European market?

To enter the European market, you must comply with several mandatory legal and other requirements. Buyers will probably have additional requirements, and they may ask for certification. Mandatory requirements for mace in Europe strongly focus on consumer health and safety. Sustainability requirements are also becoming increasingly important.

What are mandatory requirements?

Most mandatory requirements for the import of mace are related to food safety. The European Commission for Health and Food Safety is responsible for the European Union’s policy and monitoring of the implementation of related laws.

Official food controls

When mace is imported into the European Union (EU), it undergoes official food controls. Non-compliance with European food laws is reported through the Rapid Alert System for Food and Feed (RASFF). Since 2020, there has been one issue related to mace. This issue was the presence of Aflatoxins and ochratoxin A in organic mace powder from Sri Lanka.

If imports from a specific country repeatedly violate European food legislation, the frequency of official checks at the border goes up. India is the only country that is subject to these extra checks for mace. There are also more frequent checks for other spices and herbs within Combined Nomenclature code paragraphs 0905, 0906, 0907, 0908 and 0909. India has a 20% testing frequency for pesticide residues.

The rules for Indian mace are very strict. For Indian goods that contain a mix of produce where 20% of the quantity is mace, the rule already applies, regardless of the origin. The increased frequency still applies even if the mace does not come from India, but does include other ingredients of Indian origin.

Tip:

- Search the RASFF database for examples of removals from the European market.

Contaminant control

Food contaminants are substances that have not been intentionally added to food. They may be present in mace as a result of the various stages of production, packaging, transport or holding, or environmental contamination. Contaminants can pose a health risk to consumers. To minimise these risks, the EU has set maximum levels for certain contaminants in foodstuffs. Mycotoxins are the most relevant.

- Mycotoxins: The maximum level of aflatoxin for mace is between 5 μg/kg for aflatoxin B1 and 10 μg/kg for the total aflatoxin content (B1, B2, G1 and G2). For ochratoxin A, a maximum level of 15 μg/kg is in place.

- Microbiological contaminants: The EU regulation on microbiological criteria for foodstuffs does not set specific limits for mace. The general limits apply. The most important microbiological risk is salmonella, which must be completely absent.

- Polycyclic aromatic hydrocarbons (PAH): PAH can increase the risk of cancer. Because of this, the EU has set PAH limits for spices and herbs, including mace: 10μg/kg for benzo(a)pyrene and 50μg/kg for the sum of all PAHs.

Tips:

- Check the “My Trade Assistant” tool at EUAccess2markets for country-specific legislation for mace.

- Comply with the Codex Alimentarius Code of Hygienic Practice for Low-Moisture Foods (CXC 75-215) and the International Organisation of Spice Trade Associations’ General Guideline for Good Agricultural Practices on Spices and Culinary Herbs to prevent microbiological contamination.

- Consider heat sterilisation as a natural, chemical-free and radiation-free option. Since the equipment is rather expensive, you could use a third party.

Pesticide residues

The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in or on food products. Products containing more pesticide residues than allowed are removed from the European market. In the period from January 2020 to October 2023, no issues with pesticide residues were reported in RASFF for mace.

Tip:

- Select your product (mace or code 0870010) or the pesticide you use in the EU pesticides database for a list of relevant MRLs.

Labelling requirements

Each export package should state the following:

- Product name, for example ‘ground mace’

- Batch code

- Net weight in the metric system (usually kilogrammes)

- Shelf life or ‘best before’ date and recommended storage conditions

- Lot identification number

- Country of origin and name and address of the manufacturer, packer, distributor or importer

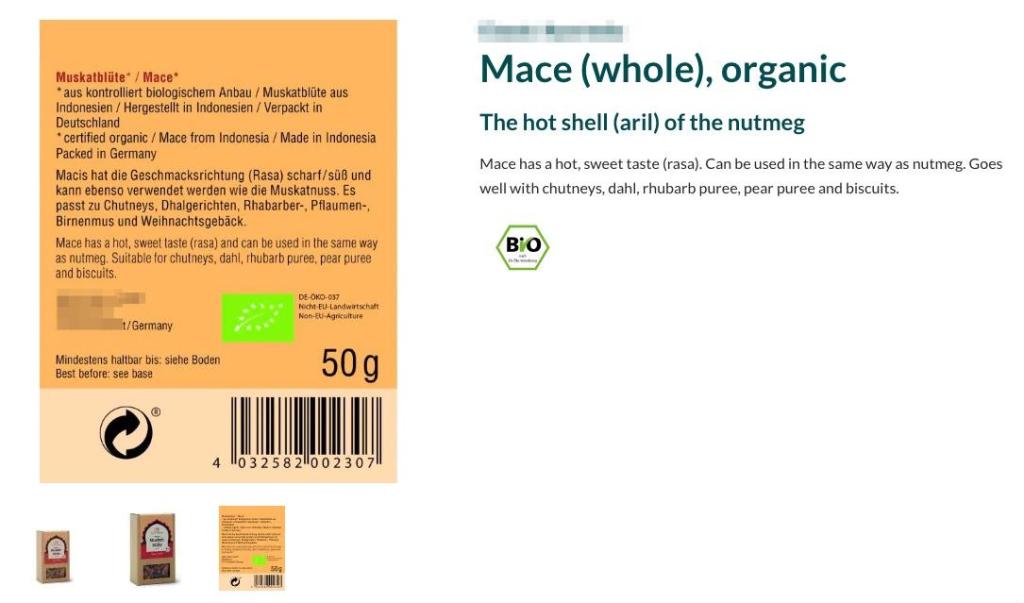

The lot identification and the name and address of the manufacturer, packer, distributor, or importer may be replaced by an identification mark. A label can also include details like brand, drying method, and harvest date. These can also be included in the Product Data Sheet (or Technical Data Sheet, Product Specification Sheet, or something similar). This contains the specific characteristics of your product, which your buyer will ask for in order to assess it. Check this example for organic mace.

In the case of consumer packaging, product labelling must comply with the EU Regulation on the provision of food information for consumers. This defines nutrition, origin, allergen labelling, and minimum font size for mandatory information. Organic mace labelling must include the name/code of the inspection body and certification number.

Figure 1: Consumer label of whole mace packed in Germany for the European market

Source: Globally Cool, September 2024

Tip:

- See our study on the requirements your spices and herbs should comply with for a broader overview of legal requirements in the European market.

What additional requirements and certifications do buyers often have?

European buyers often have additional requirements, for example the European Spice Association’s (ESA) minimum quality requirements. Others relate to food safety and sustainable and ethical business practices.

Quality requirements for mace

Several factors determine the quality of mace, some as subjective as taste or flavour. Agricultural practices, climatic conditions during the production season, and post-harvest operations also influence the quality of the mace. ESA’s Quality Minima Document lists non-legal minimum quality requirements for spices, including mace.

Table 1: Specific minimum quality requirements applicable to mace

| Chemical/physical parameter | Value |

| Ash (% Weight for Weight Max) | 4.0 |

| Acid insoluble ash (% Weight for Weight Max) | 1.5 |

| Moisture (% Weight for Weight Max) | 10 |

| Volatile oil ml/100G Min | 5.0 |

Source: ESA Quality Minima Document

Packaging requirements

Ground mace is mostly exported in bulk and packed in multi-wall laminated bags of different weights. Common weight classes are 12.5 and 25kg. The dimensions of the selected packaging size should conform to conventional pallet sizes (80 x1,200mm and 1,000x1,200mm). In some European countries, labour health and safety legislation allow workers to lift a maximum of 20kg, so smaller weights like 10-20kg are increasingly common. Contrary to ground mace, whole mace is exported in carton boxes.

The net weight of retail packaging for mace is often between 5-50g, usually in glass jars or plastic sachets. For ground mace, the weight is of course usually higher than whole mace. Transparent packages that let consumers see the product are popular. In the food service segment, the weight is typically between 400-600 grams for ground mace, and around 100 grams for whole mace.

Figure 2: Mace packaging varieties offered by a Dutch manufacturer for the retail and food service segment in the Netherlands

Source: GloballyCool, from Verstegen (August 2024)

Food safety certification

Food safety is essential for the European market. In addition to legal compliance, importers may require a Global Food Safety Initiative (GFSI) recognised food safety system certificate.

For exporters of mace, the most relevant certification programme is Food Safety System Certification (FSSC 22000). FSSC 22000 is based on the ISO methodology (but not the same as ISO 22000) and offers the most structured and logical approach to an internationally recognised and used Food Safety Management System.

Within the European spices market, you may come across other certification programmes such as International Featured Standards (IFS) and British Retail Consortium Global Standards (BRCGS). The geographical scope of these programmes, however, is too limited for most mace exporters. Therefore, these programmes are less relevant.

Buyers may also visit and/or audit the production facilities of new suppliers.

Sustainability

European buyers increasingly demand compliance with social and environmental standards. This often means undersigning their code of conduct. They may also ask for certification against a third-party scheme like Rainforest Alliance (although not very common yet).

Codes of conduct (CoC) vary from company to company, but they are often similar in structure and the issues they cover. In 2022, the European Spice Association (ESA) published a sustainability code of conduct dedicated to the spices and herbs industry. It requires members to monitor their own operations and those of their suppliers. The code’s social criteria state, for example, that:

- companies must conduct business in an ethical way

- child labour and forced labour are not allowed

- any form of discrimination is forbidden

- the company and suppliers shall continue to make efforts to reduce the use of resources, energy, and emissions

Tips:

- Ask your buyer for their current and preferred packaging requirements and do your best to meet these requirements.

- Use analysis and sampling methods recommended in Appendix 2 of ESA’s Quality Minima Document.

- Read more about payment and delivery terms in our tips for organising your exports.

- Ensure compliance with buyer codes of conduct and consider certifications such as Rainforest Alliance for better credibility. Prioritise ethical practices by addressing key areas such as child labour, discrimination, and environmental impact to build long-term relationships with European buyers.

What are the requirements for niche markets?

The most common additional requirements relate to organic, fair trade, or ethnic certification.

Organic certification

The organic spice market in Europe has grown faster than the conventional spice market over the last five years. Although organic mace is hardly available to consumers in mainstream supermarkets and often also not in organic outlets, there are often many options for consumers for buying organic mace. The largest segment however for organic mace is the industrial segment, with mace ultimately ending up in products such as an organic meat marinade.

If you want to sell your mace as organic in Europe, you must use production methods that comply with EU organic legislation. An accredited certifier must audit growing and processing facilities.

Figure 3: Organic-certified and biodynamic-certified mace available in France

Source: GloballyCool, August 2024

Fairtrade certification

European demand for fairtrade-certified spices has grown. Fairtrade International has a standard for herbs, herbal teas and spices from small-scale producer organisations, defining minimum prices and price premiums for Fairtrade-certified mace. Organic mace from Sri Lanka and India has a fixed minimum price of 5.38 USD/kg and a 15ct premium. For all other certified mace, the premium is 15% of the commercial price. There are currently (as of August 2024) 14 Fairtrade-certified mace producers – eight in Sri Lanka and six in India.

Biodynamic certification

Biodynamic farming is an enhanced method of organic farming. Biodynamic farming uses traditional farming techniques and a prescribed list of biological or natural ‘preparations’ and works with universal or cosmic forces that have an influence in the farming environment. Demeter is the internationally recognised label for certified products from biodynamic farming. India and Sri Lanka in particular are home to Demeter-certified producers of spices and herbs.

Multiple certifications

Having more than one certification, for example, organic and fairtrade certification, is a clear asset in both niche markets. These consumers are typically more socially and environmentally conscious than mainstream consumers. In most countries, such dual-certified products are only available in organic supermarkets. One of the exceptions is Switzerland, where mainstream supermarkets offer quite a large range of multiple-certified spices, including mace.

Ethnic certification

Islamic dietary laws (halal) prescribe specific dietary restrictions. If you want to focus on this market segment (the popular North African spice blend ras el hanout has mace as an ingredient), consider implementing a halal certification scheme.

Tips:

- For a complete overview of requirements, see our study on the requirements your spices and herbs should comply with.

- Check the guidelines for imports of organic products into the EU.Ensure that your products comply with the EU’s organic regulations, such as EC 2018/848, which governs organic production and labelling. Obtain certification from a control authority that is recognised by the EU and ensure that your organic products meet traceability and labelling requirements. Staying informed on updates to these regulations can help avoid delays or issues during import.

- Consult the ITC Standards Map and identify which certifications (e.g., Fairtrade, Rainforest Alliance, organic) align with your market targets. It also gives an idea of your readiness to meet certification standards. This can improve market access and credibility, especially for the European Union’s strict markets.

- Check Fairtrade International’s standard for herbs, herbal teas, spices and other relevant Fairtrade Standards.

2. Through which channels can you get mace on the European market?

Using the right channels can help maximise your access to various places in the European market. There are several types of companies that you can sell mace through, including importers, wholesalers and agents. Such companies make sure your mace finds its way to the food processing, retail, or food service segment.

How is the end market segmented?

The food processing industry in Europe is the largest consumer of mace. Similar to nutmeg, mace in the food industry is mostly used in the production of spice mixes and seasonings. Food retail is another important segment.

Food processing industry

Producers of spice mixtures and sauces focus on developing a wide range of seasonings tailored to culinary uses. Companies nowadays prioritise research and development to create specialised spice blends that meet the evolving needs of the food industry in terms of taste, product conservation and more.

Manufacturers in Europe include Verstegen (Netherlands), British Pepper (United Kingdom), Kräuter Mix and Hagesüd (Germany). Kräuter Mix from Germany is an example of a company with a range that includes more than only spices, as it also produces tea mixes. Another example of such a company with a wide range of products is Sleaford Quality Foods from the United Kingdom. Sleaford offers not only herbs, spices and seasonings but also dehydrated fruits and vegetables, savoury mixes, sweet mixes, coatings, pulses and seeds.

Food retail

Mace offered in the food retail segment is typically branded. This is in contrast with nutmeg, which is very often available under private labels. Not all large European supermarket chains offer mace. For example, in French supermarkets, mace is hardly available. Several Dutch supermarkets on the other hand, such as Jumbo (Netherlands), do offer mace, even private label whole mace blades, and in Austria, Spar sells whole mace with origin, organic and fairtrade certification.

Mace is more common in ethnic retail outlets. Many Asian speciality stores sell mace. Examples are Amazing Oriental, Tjin’s Toko (Netherlands), and TajSpices and Syldon Foods (ethnic food ingredients online wholesaler) from the United Kingdom. The most commonly found brand in online and ethnic retail all over Europe is TRS Javentry from TRS Food.

Since mace is not frequently available in traditional retail outlets, a relatively large share of mace is sold through online channels. Such companies have diverse profiles:

- independent grocery web shops (including those focused on the ethnic market as mentioned above)

- online sales of spice brands (Verstegen has its own web shop, for example)

- specialised spices web shops, such as Spice Mountain (United Kingdom), Voordeelkruiden selling consumer and food service-sized volumes of spices, herbs, and natural ingredients to clients in the Netherlands and Belgium, and Van Beekum Specerijen in the Netherlands

- online wholesalers such as Vehgro (an organic natural ingredients wholesaler with sales in several European countries).

Furthermore, there are also some platforms facilitating the sales of products directly from businesses to customer. Many of these are run by Amazon, including Amazon UK (United Kingdom), Amazon België (Belgium), and Amazon France (France). In Germany, the food retailer Kaufland also offers such a platform.

Food service

Specialised distributors supply the food service channel. This channel includes hotels, restaurants, catering companies, and institutions such as hospitals and schools. These distributors usually buy from wholesale bulk importers that often also process and pack the spices and herbs.

The food service segment requires larger packaging volumes than the food retail segment. The size of the packaging is related to its use in this segment. For example, cooks typically use low amounts of mace; the unit volume of ground mace is between 200-250 grams, compared to 300-1,000 grams for nutmeg. The unit volume for whole mace in this segment is between 50-100 grams. For example, in the food retail segment, most mace is sold under the brand names of large spice brands (such as Verstegen in the Netherlands).

Examples of distributors supplying the food service segment with mace are Bidfood, which operates through food service distribution (delivering to businesses) rather than cash-and-carry outlets. Examples of companies that sell to this segment through cash-and-carry outlets are the international Metro Group (in some countries also named “Makro”), the Booker Group (part of Tesco) in the United Kingdom, SligroFoodGroup in the Netherlands and Belgium, and the TransGourmet Group from France with outlets in Germany, France, Switzerland, Austria, and Eastern European countries.

The share of certified products, including organic-certified or fairtrade-certified spices, is typically low in the food service segment.

Tips:

- Study the exhibitor lists of large trade fairs, such as Food Ingredients or Biofach, to find potential buyers for your mace.

- If you intend to supply supermarket private labels, search for opportunities at PLMA, the world’s leading private label trade fair.

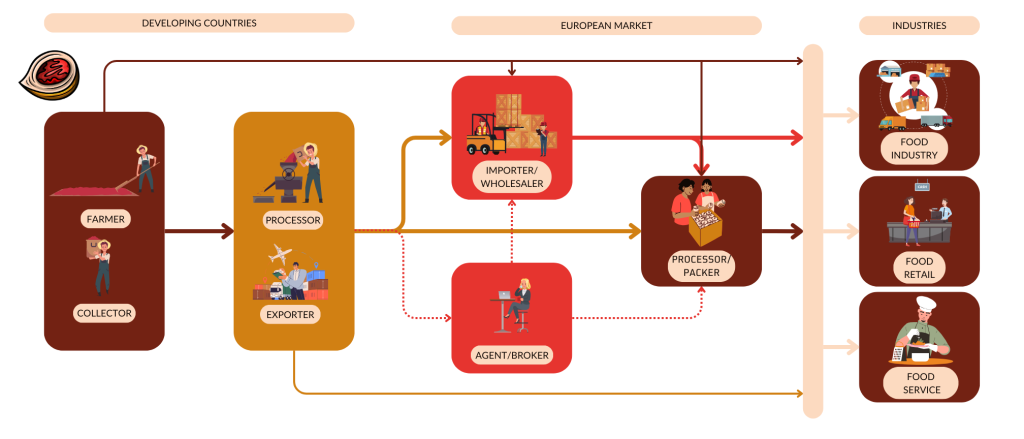

Through which channels does mace end up on the end market?

Different channels involve different processes and target segments. Specialised spice importers are the key channels for mace in Europe. Exporting mace through an intermediary is more effective than selling directly to food processors or retailers.

Importers and wholesalers

Importers and wholesalers manage mace distribution into different markets on a large scale. Importers primarily handle bulk purchases in a category and ensure the product meets the requirements for entering Europe.

Wholesalers make sure the mace in bulk reaches buyers further down the value chain. The mace may end up at the premises of food processors and packers, food retail or food service providers. The industrial buyers of mace that produce spice mixes and seasonings, typically need larger volumes than buyers in niche retail segments, such as organic food retail.

Importers that buy and trade mace in bulk include AKO and Husarich from Germany and Camstar Herbs from the United Kingdom. Other traders import in bulk and process the mace as an ingredient in spice mixes and sauces, or in smaller packaging, such as Worlée (Germany) and Epos (Netherlands). There are several European importers of spices and herbs that don’t mention mace as part of their product range, but in practice do trade mace in very small volumes.

Figure 4: Trade channels for mace in Europe

Source: GloballyCool, August 2024

Agents and Brokers

Agents and brokers help sellers and buyers to find each other. Brokers act independently as an intermediary between sellers and buyers, while the role of an agent is more niche as they are usually associated with a specific seller and help the supplier promote the products to find the right buyer.

Agents and brokers may serve different purposes depending on whether they are based in the supplier country (seller) or destination country (buyer). For example, Spice Solution Indonesia (although also acting as processor and exporter) can represent Indonesian mace suppliers in promoting and finding overseas buyers, while Van Der Does Spice Brokers works more on behalf of international buyers to find the right match of products.

In several cases, the supplying country’s governments have taken initiatives to promote and facilitate sales. A few ministries of trade have launched B2B trade platforms where buyers and sellers can connect easily: InaExport (Indonesia) and Sri Lanka Export Development Board E-Market.

What is the most interesting channel for you?

The most relevant channels are spice importers. For new suppliers, spice importers are the best way to introduce your mace to the European market. This is because directly supplying European companies is not really possible for exporters from developing countries. For such a business model, you must be able to offer low volumes of mace in tailor-made packaging and labelling. This demands significant quality, processing/packaging and logistical investments.

Private labels can be an option for price-competitive producers who already offer retail packaging to clients in their home market and other countries. However, the private label market for mace is very small in Europe.

Tips:

- Search the member list of the European Spice Association to find buyers from different channels and segments.

- Check Flocert to find Fairtrade-certified importers for your mace if this is a relevant market segment for you.

3. What competition do you face on the European mace market?

Indonesia is Europe’s leading mace supplier with an almost 50% share in European imports in 2023. Other important suppliers include Vietnam, Sri Lanka and India.

Which countries are you competing with?

In 2023, nearly half of Europe’s mace imports came directly from Indonesia, the biggest mace producer in the world. Other suppliers include Vietnam (10%), Sri Lanka (1.6%), and India (1.4%). European countries such as the Netherlands and Italy also play an important role in the market, but their supplies consist of re-exports.

Source: GloballyCool, based on UN Comtrade statistics (July 2024)

Indonesia: Europe’s leading mace supplier

Indonesia is the world’s biggest mace producer and Europe’s leading supplier. However, its mace exports to Europe declined from 912 tonnes in 2019 to 735 tonnes in 2023. This translates to a CAGR of -5.3%. As a result, Indonesia’s share of European imports fell from 63% to 49%. Its main export markets are Germany and the Netherlands.

The drop in supplies was mainly due to a strong decline in whole mace exports, from 509 tonnes in 2019 to 231 tonnes in 2023. At the same time, ground mace exports grew from 402 tonnes to 503 tonnes in 2023. This represents a switch in focus from whole mace to ground mace exports, caused by the increasing demand for convenience, cost efficiency, and consistency in quality. Ground mace is ready to use and saves time in processing, reduces shipping costs due to the improved volumetric weight, and can be offered in a more consistent quality.

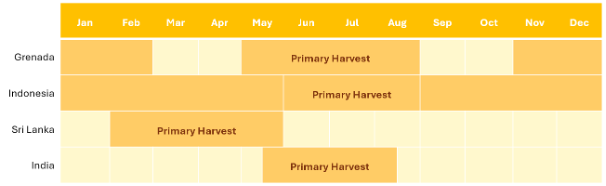

Figure 6: Harvest calendar for mace per mace-producing country

Source: GloballyCool, based on Nedspice (July 2024)

*Note: Primary and secondary harvest months may slightly differ depending on weather and growing conditions.

Indonesia produces mace year-round, hand-in-hand with the nutmeg harvest cycles. Nutmeg trees are grown by more than 180 thousand farmers in the five main provinces: North Maluku, Maluku, North Sulawesi, West Papua, and Aceh. These provinces provide an ideal tropical climate and fertile soil. Most nutmeg and mace producers are smallholder farmers who use traditional processing methods, which is also why the risk of aflatoxin contamination remains so serious.

The importance of nutmeg exports for the Indonesian trade balance made the government decide to encourage farmers in other provinces than the five provinces mentioned previously, to grow nutmeg trees too. This resulted in a growing number of provinces with nutmeg and mace production, reaching 10 in 2019.

Vietnam: a processer and re-exporter of Indonesian mace

Vietnam is the second-largest mace exporter to Europe. Interestingly, Vietnam does not produce nutmeg. Its exports consisted virtually exclusively of ground mace, with the raw material imported from Indonesia. This strategy is common in Vietnam and is also applied to products like cinnamon from China, Indonesia and Sri Lanka.

Vietnam’s mace supplies to Europe dropped from 225 tonnes in 2019 to 151 tonnes in 2023, with a dip of 104 tonnes in 2022. This comes down to a CAGR of -9.6%. As a result, Vietnam’s market share in Europe declined from 16% to 10%. Nearly all of these exports went to Germany, the Netherlands and – to a lesser extent – the United Kingdom.

Sri Lanka: an important supplier of organic mace

Sri Lanka is another key mace producer. The country provides about 7% of the global demand for mace, which it mainly exports to India, Germany, and the United Kingdom. Its mace exports to Europe grew from 28 tonnes in 2019 to 73 tonnes in 2022 before dropping to 24 tonnes in 2023. This translates to an overall CAGR of -3.4% and a direct import market share that fell from as high as 5.4% in 2022 to 1.6% in 2023.

Sri Lanka’s exports of whole mace blades performed particularly well in 2022. Usually, its supplies of whole and ground mace are fairly balanced. The country is an important supplier of organic-certified mace to Europe. Fairtrade International has defined a fixed minimum price of 5.38 USD/kg and a 15ct premium for organic mace from Sri Lanka. Globally, most Fairtrade-certified mace producers are located in Sri Lanka.

Sri Lankan mace (or Ceylon mace) is mainly cultivated in the cooler central districts of the Matale, Kegalle, and Kandy regions. Most (80%) of the plantations are in the Kandy region, owned by small and mid-scale farmers.

Figure 7: Drying of mace in Sri Lanka

Source: GloballyCool, September 2024

India: small supplier to Europe with interesting initiatives

Another important mace-producing country is India. Its production is becoming more widespread across the country. Older plantations in the traditional growing areas are increasingly replaced by alternative crops, and new plantations are emerging in other regions. Nevertheless, most mace continues to be produced in the Kerala district.

India’s mace exports to Europe increased from five tonnes in 2019 to 33 tonnes in 2022 before dropping to 21 tonnes in 2023. Overall, this translated to an impressive CAGR of 46% and a direct import market share that grew from 0.3% to 1.4%. This strong performance is mainly due to India’s ground mace exports, which increased from two tonnes in 2019 to 16 tonnes in 2023. Most of India’s mace exports to Europe go to Germany.

One particularly interesting development in India’s mace and nutmeg industry is the development of the Pollachi cooperative of nutmeg and mace farmers in Tamil Nadu. Through their collaboration, almost 200 farmers can offer high-quality mace and nutmeg directly to international buyers.

Tips:

- Visit leading European trade such as Food Ingredients or Biofach (organic) to keep an eye on your competitors.

- Check this list for nutmeg and mace suppliers in Sri Lanka or find offers of Indonesian mace on InaExport.

- Visit the website of the Indian Spice Board to stay up to date on Indian production and supply.

Which companies are you competing with?

The biggest competition in the mace market comes from Indonesia. Other competitors come from Vietnam, Sri Lanka, and India. The companies listed below are among the leading suppliers from the leading production countries of Indonesia, Sri Lanka, and India.

Agri Spice Indonesia: one of Indonesia’s leading mace exporters

PT. Agri Spice Indonesia ASI is a spice processing and export company specialising in mace and nutmeg, cloves, cinnamon, and vanilla. The company is frequently listed among leading Indonesian exporters that prioritise product quality, organic, ethical, and sustainable production. ASI showcases its multiple business processes and sustainability developments like the seed nursery up to farmer assistance. ASI has partnerships with thousands of nutmeg farmers across Indonesia. The farmer training focuses on good nutmeg cultivation practices.

Mace exported to Europe by ASI is primarily of higher quality with a focus on consistency and significant volumes. The company has already set a strong presence in Europe, providing a broader range of spices with sufficient production capacity to meet the volume requirements of buyers.

Bughary Bio Spices: steam-treated high-quality mace with organic certification

Bughary Bio Spices from Sri Lanka is an exporter of mace, nutmeg, and other spices like pepper, cloves, and cinnamon. The company has obtained organic certification for the European and American markets. The company has also obtained Fairtrade certification (FLO ID: 39817). The company’s range includes mace and nutmeg, cinnamon, black pepper, cloves, tamarind and a range of exotic, dehydrated fruits, vegetables and culinary and medicinal herbs.

Bughary works closely with local growers and has its own collection centres spread around the country. At its main facility, Bughary runs an in-house laboratory. When necessary, for example when pre-shipment test analyses are required, the company consults the services of SGS and other recognised international laboratories such as EUROFINS. Bughary also has an in-house steam sterilisation unit, which enables them to offer spices of the highest quality.

GreenKera Condiments from India: well-managed traceability system for its organic mace

GreenKera Condiments offers a range of organic products including spices, coffee, cocoa, fruits and vegetables. The company took part in the 2024 Biofach exhibition (only accessible after registration) to promote its organic mace and other products to the international organic market community.

The company partners with 570 dedicated farmers, of which 360 are already organic certified. The others are currently in the transition phase. GreenKara’s core products include the spices black pepper, nutmeg and mace, and turmeric.

The company has obtained multiple certifications, including the EU organic certification. Although the company is not a large-scale exporter, its passion for sustainable practices and outreach is the reason for its growth.

GreenKera puts traceability at the heart of everything they do. Their traceability system ensures that every product is 100% organic, authentic, and sustainably sourced. With GreenKara’s traceability system, all mace can be traced back to its origin.

Figure 8: GreenKara’s traceability system explained

Source: GreenKara@Youtube

Tips:

- Participate in the International Spice Conference to learn more about mace competition and to get updates about the mace market.

- Use the services of your national export promotion agency and actively participate in the creation of export strategies. The Spices Board of India is a good example of an export support organisation.

- Visit BIOFACH to see existing companies and what they offer to the European mace market. Compare and adjust your product based on your research to enter the European mace market with a unique selling point.

Which products are you competing with?

The most common substitute for mace is nutmeg, as both spices come from the same tree. Since mace and nutmeg are more like siblings, farmers tend to see them as complementary harvests instead of competition. Nutmeg is often used in similar culinary applications, and their flavour profiles overlap, making them direct competitors.

There are more competing spices that both mace and nutmeg can be substituted with. These are also spices that are more commonly found in daily household uses. Cinnamon is one such spice that is frequently used in cooking. Other spices in this group are cloves, cardamom, allspice, and ginger. These spices can be used as alternatives for mace in certain recipes and spice blends.

Tip:

- Read our study on the European demand for spices and herbs to learn more about increasingly popular spices that could compete with mace.

4. What are the prices of mace on the European market?

Prices for mace in Europe are available at two points:

- when the mace enters Europe, prices can be calculated by dividing the value by the volume.

- when the mace is offered for sale at retail level. These prices can be observed in retail outlets and web shops.

Import prices

Trade prices for mace depend on the grading. There are three grades: top grade (first grade with higher prices), second grade, and lower grade (third grade and below with lower prices). The grading of mace depends on factors such as origin and the conditions during harvesting and processing.

Source: GloballyCool, September 2024

Figure 9 illustrates that import prices for mace from Sri Lanka are relatively high. This is mainly because Sri Lanka’s mace is of high quality and often certified (organic and/or fairtrade), which earns a premium. Vietnamese export prices are slightly higher than Indonesia’s export prices, representing the costs of processing in Vietnam.

Retail prices

Retail prices of mace depend on the quality of the raw material, type of packaging, packaging size, and brand. Ground mace can be priced lower than whole mace because processors may use low-quality blades or damaged blade pieces to produce it. Mace blades bring out maximum flavour but are quite fragile and are easily broken during transportation, processing and handling. Therefore, whole mace in retail packages is rather expensive compared to ground mace.

Due to its limited availability in several countries, a comprehensive overview of mace prices in large European supermarkets is not possible. As an indication, in the Netherlands, one of the European countries with good availability, the prices for ground mace vary from €130 to €300/kg, while for whole mace, prices vary from €380 to €460/kg. Prices mainly depend on the size of the packaging; the smaller the packaging volume, the higher the price. Prices in the ethnic retail outlets are typically lower, with prices between €100-€120/kg.

Tip:

- Support the farmers supplying your company in improving their quality. This will help them receive a better price and will help your company have a steady supply of high-quality mace.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research