The European market potential for mace

Mace is used in ethnic dishes and (often traditional) recipes that require a touch of sweetness in Europe. The European market is being shaped by a growing interest in international cuisines and an increasing demand for sustainability, traceability, and sustainably-produced ingredients. Europe’s main importers of mace are Germany and the Netherlands, which partly re-export their imported mace to other markets across Europe.

Contents of this page

1. Product description

Mace is a delicate spice from the same tree as nutmeg (Myristica fragrans). This is why mace is often known as ‘nutmeg’s sister spice’. The nutmeg seed's outer layer (called the ‘aril’) is removed and dried to produce mace. This process is where mace gets its yellowish-brown to reddish-orange colour, which was deep red when the aril was fresh.

Native to the Moluccas, mace is now cultivated in many other tropical regions. Countries such as Indonesia, Vietnam, Sri Lanka, India and Grenada are the biggest cultivators of mace, taking care of the production of the spice from tree to yield. These regions are the most suitable climates to grow mace in, as the Myristica fragrans tree thrives in high humidity and temperatures between 25 and 35 degrees Celsius. The amount of rainfall and the soil type largely contribute to the maturing process of the trees. They produce fruit around 7-9 years after planting. Fruit collection occurs twice a year, with full production after 20 years, yielding around 1kg of mace every year.

Once dried, mace can be used as whole blades or as ground powder, which results in two different flavours. Flavour intensity also differs according to the region of origin. For example, Grenadian mace is known for being rich and robust, similar to standard mace (Myristica fragrans) but with a more refined flavour and aroma.

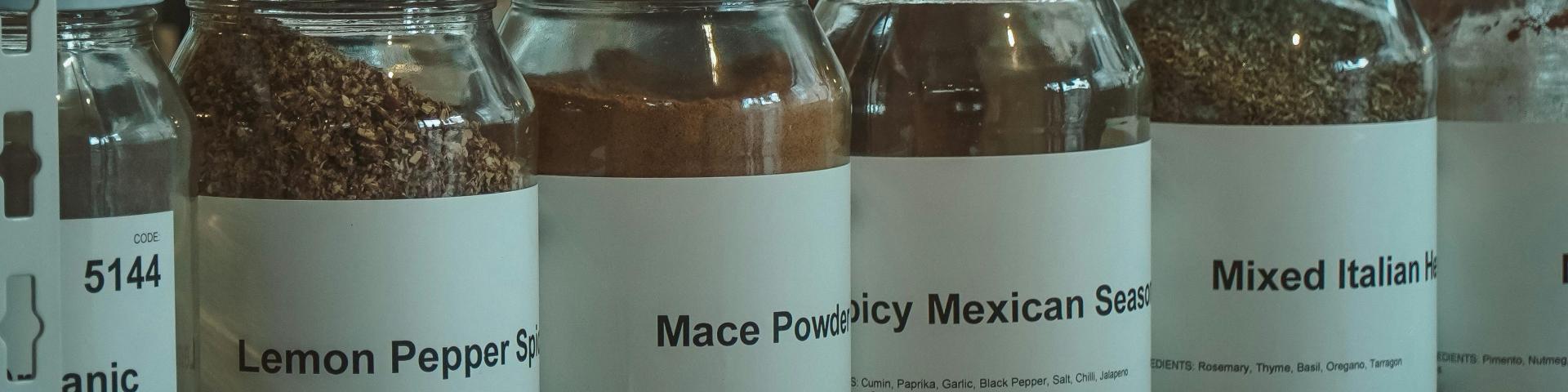

Figure 1: Dried whole mace blades

Source: Globally Cool, August 2024

Mace has a subtly sweet flavour, and it can enhance both sweet and savoury dishes without being overpowering. It complements other spices such as cinnamon, cloves, and allspice. Mace is also widely used as an ingredient in sausages and processed meats. In addition, it can be used in non-culinary products such as traditional medicines, aromatherapy, essential oils, perfumes, and fragrances.

This study uses the following Combined Nomenclature (CN) or Harmonised System (HS) codes for the trade in mace.

Table 1: CN codes for mace

| CN Code | Description |

| 090821 | Mace, neither crushed nor ground |

| 090822 | Mace, crushed or ground |

2. What makes Europe an interesting market for mace?

The increasing interest in traditional spices for culinary and non-culinary purposes drives European demand for mace. Mace’s warm, aromatic sweetness makes it a popular ingredient among European consumers. Europe is the largest importer of mace, followed by North America. Developing countries supply most of Europe’s mace imports. As mace is not produced in Europe, intra-European trade consists of re-exports.

Although a seasonal demand pattern for mace is visible, with peak demand in November-December, exports to Europe occur all year round.

Source: GloballyCool, based on UN Comtrade statistics, July 2024

From 2019 to 2023, European imports of mace were relatively stable at about 1.4 thousand tonnes. About two-thirds of this was ground mace. Developing countries supply most of this mace to Europe – any intra-European trade consists of re-exports.

Europe’s mace imports from developing countries fluctuated from 2019 to 2023. Despite bouncing back from a dip in 2020, they dropped from 1.2 thousand tonnes in 2019 to 940 tonnes in 2023. This translated to an average annual growth rate (CAGR) of -5.9%. The COVID-19 pandemic is one of the most significant factors in this. It disrupted international trade in 2020, causing restrictions, delays, and supply chain disruptions. Import volumes from developing countries for mace have not fully recovered since then.

At the same time, intra-European trade grew from 226 tonnes in 2019 to 449 tonnes in 2023, at a CAGR of 19%. This consisted of re-exports, distributing previously-imported mace from developing countries across the continent, mainly to a few countries (Belgium, the Netherlands, the United Kingdom, and France).

Outlook for the European mace market

European demand for mace will likely remain relatively stable in the short (2024) to medium term (2027), as it is a niche spice primarily used in spice blends, processed foods, and baking. A very large share of the market is still conventional mace, for which price sensitivity will be high, with European buyers seeking a consistent and affordable supply. At the same time, Europe will show a growing demand for sustainably-produced and certified mace, for which exporters can receive higher prices.

Tip:

- See our study on What is the demand for spices and herbs in the European market? to understand why Europe is an attractive market for herbs in general.

3. Which European countries offer the most opportunities for mace?

Germany and the Netherlands are Europe’s leading importers of mace. Germany is a particularly interesting market due to its large food industry, which uses many food ingredients, including mace. The Netherlands is known for being Europe’s spice trade hub. Other, somewhat smaller, interesting markets are Belgium, the United Kingdom, Austria, and France.

Source: GloballyCool, based on UN Comtrade statistics, July 2024

Germany: largest importer of mace in Europe

Germany is Europe’s leading importing country of mace, with a 28% market share in 2023. Its mace imports have been relatively stable at about 430 tonnes, except for a drop to 354 tonnes in 2021.

Almost all (99%) of Germany’s mace imports come directly from developing countries. Indonesia is the leading supplier, contributing 42 tonnes (an 82% share) in 2023. Vietnam follows with 11% in 2023, India with 3.2%, Sri Lanka with 1.9%, and Grenada with 1.1%. Germany re-exported 78 tonnes of its imported mace in 2023, making it the fifth-largest mace supplier to European countries with a 5.1% market share. Its mace exports grew at a CAGR of 26% between 2019 and 2023.

Germany mainly imports ground mace, 317 tonnes in 2023, compared to 105 tonnes of whole mace imports. Ground mace imports grew at a CAGR of 4.2% between 2019 and 2023, whereas whole mace imports declined by a CAGR of 4.0%.

Germany mostly uses mace (‘Muskatblüte’ in German) in the food industry. To a lesser extent, it also uses mace in traditional product preparations like perfumes, soaps and ointments. Mace is still used in traditional German (Christmas) holiday baking. Particularly to enhance the warm, sweet, and peppery flavour of ‘Lebkuchen’ (gingerbread), ‘Stollen’ (Christmas fruit bread), and Christmas cookies. Mace is also used in the traditional German ‘Glühwein’ (mulled wine), a popular hot winter beverage with a mix of spices.

Mace is not as commonly used as other spices since its usage is more specialised and usually in traditional recipes. Even in culinary recipes, it is only used in small quantities compared to other spices, as its flavour is very strong and concentrated.

Mace is only available in the very large supermarkets. However, some products, mainly private labels, may be available on the shelves of medium-sized to large outlets. The online marketplace of Kaufland offers an interesting and wide range of mace products for the German retail market, sold by various suppliers (mostly independent web shops and brands).

Speciality stores are more common sales channels for mace. Gewürzmühle Rosenheim is a small spice mill processing and packing a wide variety of spices and herbs in relatively low volumes. Their products are available in their web shop and to resellers, like gourmet shops and speciality (web) shops like Orlandos Idee, which focuses on more specific and exquisite flavour spices.

Brands like Lebensbaum (ground) and Culinarico (whole blades) sell organic mace, while Pfeffersack & Soehne offers premium mace blades in ceramic jars, as well as refill bags.

Germany is one of Europe’s top markets for organic spices and, therefore, offers opportunities to exporters of organic-certified mace. The country accounts for 15-20% of the European organic spices market. While for the most common spices, organic alternatives can be found both in regular retail chains such as REWE and Aldi Süd and organic retail chains such as Biomarkt and Alnatura, less common spices like mace are only available in the outlets of speciality stores, including the organic retail chains. For example, Alnatura sells organic coriander seeds under its own brand, Alnatura, and the brand Lebensbaum (Ulrich Walter).

The Netherlands: Europe’s spice trade hub

The Netherlands is Europe's second largest mace-importing country, with a 22% market share in 2023. However, despite a strong performance in 2021, Dutch mace imports dropped from 532 tonnes in 2019 to 330 tonnes in 2023. This came down to a CAGR of -11%. This is a slightly misleading decline, as imports showed a considerable peak in the reference year 2019. For the short to medium term, imports are likely to remain stable and reach between 350-400 tonnes per year.

The Netherlands acts as a key hub for the spice trade. Its well-developed infrastructure makes it the perfect country for importing and re-exporting spices. Because of this hub function, the Netherlands takes the second position as a supplier of mace to Europe after Indonesia. The country supplies 15% of the European mace imports, becoming the leading mace supplier to countries like Belgium and Austria.

In 2023, the Netherlands imported about two-thirds of its mace directly from developing countries. Indonesia (41% share in 2023) and Vietnam (25%) are its leading suppliers. The Netherlands also increasingly imports from European countries like Belgium (16%), Germany (8.9%), and the United Kingdom (7.7%).

Ground mace made up 75% of total mace imports (248 tonnes) to the Netherlands in 2023. Whole mace imports drastically declined. They went down from 288 tonnes in 2019 to 83 in 2023, while ground mace imports have been rather consistent.

In Dutch, mace is known as ‘foelie’. Several traditional Dutch sweet and savoury dishes include mace to add an extra depth of flavour. Mace is an essential ingredient in ‘speculaas’ (spice shortcrust biscuits), and it may be used in savoury dishes like ‘erwtensoep’ (pea soup) and ‘hachee’ (slow-cooked beef and onion stew). The spice is also widely used for mixtures to pickle vegetables and preserves. Mace can also be used in cheese production, for example in Leyden cheese (‘Leidse kaas’), in which mace as a substitute for cumin changes its distinctive flavour.

Supermarket Albert Heijn sells ground and whole blade mace in a resealable bag by Verstegen, while Jumbo offers private label whole mace blades and Verstegen ground mace at the same price. With a kg price of almost €400, whole blade mace is among the most expensive products in Albert Heijn.

Figure 4: Mace in one of the leading supermarkets in the Netherlands

Source: GloballyCool, July 2024

Many ethnic and speciality stores offer cheaper mace for more product inside its packaging, both in powder and whole blade forms. TRS Food is the most common brand in ethnic stores selling mace. Different stores offer different prices, even from this same brand. Examples are Geen Aardappels (organic and gluten-free products) Nisarga (Ethnic groceries) and Deli Spice (Indian groceries).

Asian and Middle Eastern grocery stores such as Nisarga and Deli Spice are called ‘tokos’ and often sell a wide range of exotic spices, usually packed in origin countries. The prices for mace in the ethnic retail segment are relatively low, whether sold in the large ethnic retail outlets of Amazing Oriental or in small independent stores like Tjin’s Toko.

Consumers who want to buy organic-certified mace, can either do so in outlets of the two leading groups of specialised organic retail chains in the Netherlands (Odin and Ekoplaza), or online from web shops that focus on natural ingredients such as Pit&Pit, in more broader-oriented web shops like drugstores (for example Koopjesdrogisterij), or in web shops of organic brands like Vitiv. The Netherlands is a smaller organic market than for example Germany and the United Kingdom. However, average growth of the organic mace market will remain higher than the growth of the conventional market, offering good opportunities for exporters of organic-certified produce.

Belgium: re-exporter of value-added mace

Belgium’s mace imports grew from 113 tonnes in 2019 to 183 tonnes in 2023, despite a dip in 2022. This resulted in a CAGR of 13% and a 12% share of European mace imports in 2023. Like Germany and the Netherlands, Belgium mainly imports ground mace. These imports reached 171 tonnes in 2023, compared to 12 tonnes of whole mace imports. Belgium’s large annual growth in imports can be considered an opportunity for exporters from developing countries, certainly if taken into account that at present only 20% of the mace comes directly from developing countries.

Belgium is an important part of the supply chain for mace in Europe, and re-exported 62 tonnes of mace to other European countries in 2023. This represented 4.1% of the total supplies to Europe. Before re-distribution, Belgian companies perform value-adding activities like packaging, labelling, and rebranding. Belgium is thought to be the largest value-adding country that rebrands imported mace for gourmet and premium lines, organic and sustainable brands, and artisanal products.

Most of Belgium’s mace imports are re-exports from the Netherlands (72%). After value-addition, the mace is then partly re-exported back to the Netherlands and to the rest of Europe. Indonesia (20%) is Belgium’s second-largest supplier. Belgium’s leading spice processor and packer is The Spice Factory, also the market leader in Belgium in private label herbs and spices in the food retail market. This company also has sizeable and growing positions in France, the United Kingdom and the Netherlands.

Besides re-distribution, mace is used in the Belgian food industry. Mace is relatively unknown among consumers as mace products are rarely sold in mainstream supermarkets. They can only be found in the spice isles of well-stocked large grocery stores. Big online stores like Amazon België are becoming increasingly important for the sales of spices that are difficult to find in physical stores.

The organic food market in Belgium is led by Bio-Planet, a dedicated organic supermarket chain under the Colruyt Group, offering a wide range of organic, ecological, and fair-trade products. The mainstream supermarket chain Delhaize also has a substantial organic section across its stores and offers a variety of certified organic products, particularly under its private label. Organic mace is only available in larger Bio-Planet outlets.

Organic-certified mace products are most likely available in gourmet or speciality stores, like Rob and ’t Lof der Kruiden. Some stores promote the origin of their mace products. For example, Louna highlights that its whole mace comes from the Moluccan islands, where mace originated.

Mace also serves as an ingredient for perfumes and essential oils. For example, Oshadhi sells organic essential mace oil from Indonesia.

The United Kingdom: a relatively stable mace importer

The United Kingdom imported relatively stable amounts of mace between 2019 and 2023. They averaged about 140 tonnes, except for a peak of 178 tonnes in 2021. Developing countries directly accounted for 73% of the imports in 2023, and the United Kingdom is the only European importing country with a growth of this share in the period between 2019 and 2023 (+2.9% per year).

Indonesia is the leading supplier, with a 56% market share in 2023. The United Kingdom also imports mace from other developing countries, like Vietnam (10%) and Sri Lanka (4.7%). Italy (17%) and the Netherlands (5.6%) supply mace through re-export. Ground mace accounted for 91% (133 tonnes) of the imports in 2023.

Traditionally, British food was often strongly spiced with exotic blends of foreign herbs and spices – including mace. It can be found in traditional British puddings, cakes, and meat dishes. Another popular use of mace in the United Kingdom is for pickling and preserving vegetables, and for making chutneys. Mace is also commonly used in the winter months to create mulled drinks. During festivities, it is customary to drink warm, spiced drinks like mulled wine, cider, spiced hot chocolate, and eggnog flavoured with spices like mace, cinnamon, and nutmeg.

Since the United Kingdom has a large ethnic population, traditional foods from other countries are among the most popular nowadays, particularly curry dishes. The garam masala for Indian curries like Rogan Josh or Biryani often includes mace. Brands like TRS and Natco both focus on this ethnic market and offer a large range of spices and herbs, including mace, for this market segment.

Conventional mace is commonly sold in British stores, from big retail chains to smaller shops that specialise in spices. For example, large supermarket chains Sainsbury’s and Waitrose sell one product of ground mace under their own (private) label.

In general, the United Kingdom is one of the largest markets in Europe for organic and fair-trade products, including organic mace. One example of a company that imports organic mace is Steenbergs. Steenbergs specialises in organic and Fairtrade-certified spices, and also has its own web shop where consumers can buy its products, including mace. Since organic retailers such as PlanetOrganic don’t have mace in their product range, British consumers who want to buy organic mace depend on online web shops to a large extent.

Figure 5: Organic mace sold by a leading organic spices and herbs importer in the United Kingdom

Source: GloballyCool, July 2024

Through the platform Amazon UK, various suppliers offer a wide range of mace products in consumer and larger packages up to 1kg. Relatively large-sized packages are also found in specialised shops like Spices Supermarket, which sells whole Heera Javantry mace in packages of 400g. Other examples of web shops selling mace are Grape Tree (natural and healthy food ingredients), The Spiceworks (spices, herbs and teas), Gourmet Spice Co (gourmet ingredients) and Spice Mountain (spices retailer with two physical outlets and a web shop).

Austria: switched to intra-European trade

Europe’s fifth-largest mace importer, Austria, is a relatively small market. Its mace imports grew from 39 tonnes in 2019 to 63 tonnes in 2023, at a CAGR of 13%.

Austria relies on Indonesia for its mace supply, accounting for more than 80% of total mace imports. Vietnam and Guatemala take the second and third positions in the Austrian market, with 6.5% and 5.4% of total Austrian imports, respectively.

Most Austrian cuisine is related to German cuisine. Like in German food, mace is not a key ingredient in most Austrian dishes. However, it is often used as a substitute for other spices and to add an aromatic profile to certain foods. Classic meat dishes like Wiener Schnitzel, Tafelspitz and goulash may contain mace to add warmth to the mixture of spices. In baking, nutmeg and mace are often used to add festive flavours to winter confections such as Vanillekipferl, Weihnachtskekse and Semmelknödel.

Supermarket chain Spar sells whole mace under fair trade and organic labels. Spice brands like Van den Berg sell whole and ground mace under their own labels. Eder Gewurze sells organic mace in large packages of up to 1kg. TRS mace is sold all over Europe, Austria included. For example, Aekshea Foods (ethnic groceries) offers whole mace products of this brand.

France: leading importer of whole mace blades in 2023

France is Europe’s sixth-largest importer of mace. Imports have been relatively stable at about 40 tonnes per year. France mainly imports mace from the Netherlands (14 tonnes in 2023), Indonesia (8.7 tonnes), and Sri Lanka (6.2 tonnes).

Mace is known as ‘macis’ in French. Though not as commonly found in French cuisine, mace can be used to enhance the flavours of desserts and some traditional French cakes and pastries. Since nutmeg is an essential ingredient in a lot of French recipes, mace could serve as a subtle substitute. For example, the French dish quiche Lorraine may use a hint of mace to add depth instead of nutmeg. Other foods that may incorporate mace include sausages, soups or stews, and meat pies.

One of the most well-known brands for mace in Europe (TRS) can be found in online supermarkets like XL Marche. Wider options are also available at Amazon France, one of the most frequently-used online platforms for groceries and general shopping in France.

Most of France’s mace comes from Indonesia, via re-distribution from other European countries, but also imported directly. These products are found in delicatessen stores like Épicerie Sabah and Maison Gosselin. Gourmet fine food brand Sur Les Quais Paris sells whole Indonesian mace blades in premium spice jars.

The second most common mace origin for France is Sri Lanka. Organic-certified mace from Sri Lanka is sold in stores like Épices Roellinger. Bien Manger also promotes organic mace powder. Stores like Mon Épicerie Paris and L’Épicerie Gastronomique sell mace and nutmeg combined in one jar for gastronomic use.

France is Europe’s second-largest organic food market after Germany. Although there are no data to validate this position, France also takes a top-three position for organic-certified spices. The country is home to quite a number of organic retail formulas, including Biocoop, Naturalia, La Vie Claire, Les Comptoirs de la Bio, Bio C’Bon and NaturéO. In most of these outlets however, there is no organic mace on the shelves but only organic nutmeg. The French company Arcadie is the market leader in the organic segment, and also exports its spices, including mace, to organic retailers in the Netherlands and Belgium.

Tips:

- Consider focusing on markets that already import large volumes directly from developing countries: the United Kingdom, Germany, and the Netherlands. These countries import more than two-thirds of their mace directly from developing countries.

- Consider exports to Belgium, as Belgian importers still depend on mace imports from other European countries a lot.

- Consider entering the German, Dutch or French market if you want to export organic mace to Europe. These countries are among Europe’s top markets for organic spices.

- Explore the member lists of national associations to find leading importers of mace, such as the German Spice Association, the Dutch Spice Association, the National Union of Pepper, Spices, Herbs and Vanilla Processors (France), and the Seasoning and Spice Association (the United Kingdom).

- Find out more about the developments in the European spice sector from our study onthe demand for spices and herbs in the European market.

4. Which trends offer opportunities or pose threats in the European mace market?

A growing interest in international cuisines and an increasing demand for sustainability, traceability and organic products are shaping the European market for mace.

Growing market for international cuisines

European consumers are increasingly interested in trying new ways of preparing food and discovering new flavours, cuisines and exotic products. The COVID-19 pandemic temporarily put an end to restaurant visits, but it also boosted the consumption of exotic foods at home.

In the past decade, more Europeans travelled to Asian destinations and more tourists came to Europe. During the pandemic, people tried to compensate by cooking exotic dishes at home that reminded them of previous holidays. After the pandemic, consumers started travelling again, but some of the new recipes have become part of their home-cooking repertoire. Popular TV cooking programmes like MasterChef, food blogs like BBC Food and social media also encourage home cooking and experimentation with different products.

The growth of the ethnic food market across Europe contributes to the demand for mace as well. Mace is commonly used in Indian spice blends like garam masala and dishes like biryanis and curries. In Middle Eastern cuisine, mace is used in spice mixes like baharat and can be added to meat dishes, stews, and desserts like baklava. Mace is also a common ingredient in the North African spice blend ras el hanout.

Chefs are also experimenting with fusion dishes and new ways of using spices like mace in modern cooking. This can inspire adventurous dishes that combine new techniques and non-traditional flavour pairings. For example, the use of mace is being explored in craft cocktails, chai teas, herbal infusion teas, and more.

Sustainability and traceability are a must

Sustainability has become a requirement in the European market for spices and herbs. It includes environmental aspects like minimising pesticide use and more socially-responsible practices like fair wages and safe working conditions. This should benefit the quality and safety of the spices, as well as the circumstances of the producers and the planet. Mace is mainly produced by small farmers, who often do not have enough information to improve product quality and sustainability. They may also lack information about prices and have no negotiation power, leading to low incomes.

European companies are trying to improve their supply chain to comply with consumer demands and new legislation, like the Corporate Sustainability Due Diligence Directive. In 2022, the European Spice Association (ESA) published a sustainability code of conduct. It requires members to monitor their operations and those of their suppliers. The code’s social criteria state that, for example:

- companies must conduct business in an ethical way

- child labour and forced labour are not allowed

- any form of discrimination is forbidden

- the company and suppliers shall put ongoing efforts into reducing the use of resources, energy, and emissions

Another sustainability initiative in Europe is the Sustainable Spice Initiative (SSI). It recognises a basket of sustainability standards as meeting the minimum social, environmental and economic criteria to be considered sustainable. Several companies that trade in mace are members of this initiative, such as Jayanti.

As an exporter from a developing country, you can start by mapping your own supply chain to facilitate traceability. First, you must list the farmers that are your suppliers. Then, you need to develop a system that relates the specific lots to their origins. For example, Verstegen uses smart technology like blockchain to create transparent chains. This way, they have now made their nutmeg, mace, white pepper, garlic and coriander chains partially or entirely traceable.

The community of nutmeg/mace farmers from the Pollachi region in Tamil Nadu (India) shows how collective farming can improve both transparency and quality in the production of mace and nutmeg.

Collective Farming and Transparency - over 170 farmers collaborate closely, ensuring transparency at every stage of primary production. This collective approach supports a sense of accountability, allowing for a well-coordinated supply chain.

Quality Adherence - each farmer strictly follows the same procedures, ensuring that the mace consistently meets or exceeds high quality standards. This also includes a very low moisture level of the mace, with most of the produce measuring a moisture content between 8.0-8.5%. The ideal conditions for drying nutmeg led to lower aflatoxin and fungal contamination compared to other Indian regions, such as Kerala.

Now that the farmers have united, they are able to offer a substantial volume of high-quality mace to international buyers directly, instead of selling low volumes to local traders. It has allowed them to compete on a global scale with mace from Indonesia, Sri Lanka, Grenada, and Kerala (the leading region for nutmeg and mace production in India).

Figure 6: How farmers in one Indian village crafted the most expensive mace and nutmeg

Source: Business Insider @ Youtube, November 2023

Increased demand for organic products

The increased interest in sustainability and healthy lifestyles also boosts demand for organic products. Organic retail sales value in the European Union (EU) more than quadrupled between 2004 and 2022, with particularly strong growth from about 2014 to 2020. It peaked at €4.6 billion in 2021 before dropping by 3.4% in 2022. This is likely because of a decline in consumer demand due to the cost of living crisis and rising food prices. Germany is the largest market, followed by France. Per capita spending on organic products reached €104.30 per person – up to about €400 in Switzerland and Denmark.

Similarly, EU imports of tropical fruit, nuts and spices (including mace) also dropped by 3.4% in 2022, from 903 thousand tonnes to 872 thousand tonnes. The Netherlands and Germany are the EU’s leading importers of organic agri-food products, accounting for a combined 53% of the imported volume. France follows in third place. As a key trade hub, the Netherlands re-exports a significant part of these imports to other EU countries. Germany’s organic imports declined in 2022 (-13%), while Dutch imports increased (+4.6%).

Some of the leading supermarkets in the top EU importing countries sell organic mace, such as REWE (Germany). More common retailers that sell organic mace include gourmet or speciality stores and organic supermarkets like Ekoplaza (the Netherlands).

Tips:

- Read our study on trends in the European spices and herbs market for more information about sector trends.

- See our tips for going green and tips to become socially responsible for more information on sustainability.

- Promote the sustainable aspects of your production process. To support your claims, consider investing in sustainability certification – such as Fairtrade, organic or Rainforest Alliance – or auditing initiatives like SMETA or BSCI. For more information, see our study on the requirements your product should comply with.

- Check whether there is sufficient demand for an organic version of your mace. Talk to your (potential) buyers and look for companies that trade in certified organic mace for example among exhibitors at the organicBiofach trade fair.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research