Entering the European market for spice mixes

Most mixing of spices is done in Europe by spice importers and food manufacturers. They are your competition as a spice mixes supplier. In addition to their cost-efficient sourcing, they have set the bar high for the quality of spice mixes. Buyers expect suppliers to meet stringent requirements for purity, contaminants and consistency in taste.

Contents of this page

1. What requirements must spice mixes comply with to be allowed on the European market?

What are mandatory requirements?

When exporting to Europe, you have to comply with the legally binding requirements of the EU. The most crucial requirements relate to food safety and the basis for EU legislation is laid down in the General Food Law. This law relates mainly to traceability, hygiene and control. Compliance with this legislation ensures that the spice is safe to eat. Related to this are the legal limits for food contaminants.

Official border control for spice mixes imported to the European Union

Official food controls include regular inspections that can be carried out at import or at all further stages of marketing. In case of non-compliance with European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is freely accessible to the general public.

You should be aware that repeated non-compliance with European food legislation by a particular country might lead to special import conditions or even suspension of imports from that country. These stricter conditions include laboratory tests for a certain percentage of shipments from specific countries.

The New Official Controls Regulation will extend its scope to organic products. You will have to use the Common Health Entry Document to notify authorities in Europe before you export your products.

Contaminants control in spice mixes

The European Regulation on contaminants sets maximum levels for certain contaminants in food products. This regulation is frequently updated and, apart from the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products, including spice mixes. The most common requirements regarding contaminants in spice mixes relate to the presence of pesticide residues, mycotoxins, heavy metals, microbiological organisms and food additives. There were 36 notifications of issues with spice mixes in the RASFF database in 2020-2022. The notifications ranged from excessive levels of aflatoxins and salmonella to unauthorised substances such as ethylene oxide.

Contaminant levels must be kept as low as can reasonably be achieved following recommended good working practices.

- Pesticides: The European Union regularly publishes a list of approved pesticides applicable to specific products (see the maximum levels for spices) that are authorised for use in the European Union. This list is frequently updated. Note that in June 2020, new specific binding maximum residue levels (MRLs) were set for chlorate. Products containing more pesticide residues than allowed will be withdrawn from the European market. However, excessive residues of pesticides don’t happen very often in the trade of spice mixes.

- Mycotoxins: Limits for mycotoxins are set by EC Regulation 1881/2006. For chilies, pepper, nutmeg, ginger and turmeric or mixes containing these spices, maximum levels for mycotoxins are set for aflatoxin (between 5.0 μg/kg for aflatoxin B1 and 10 μg/kg for the total aflatoxin content B1, B2, G1 and G2) and for ochratoxin A (the maximum level is 15 μg/kg).

- Food additives and adulteration: Spices and spice mixes are rejected by custom authorities for containing undeclared, unauthorised materials or excessive levels of extraneous materials, which is all matter from the specific plant other than the desired part.

- Maximum levels of polycyclic aromatic hydrocarbons (PAHs): Contamination with PAHs stems from bad drying practices. Importers usually claim the costs of such withdrawals back from their suppliers or discontinue the trade completely.

- Heavy metals: Until recently, specific limits for the presence of heavy metals in spices were not set in the European legislation on contaminants. However, this changed in 2021, following a review process for the maximum allowed levels of heavy metals. The new maximum level for lead (in mg/kg) depends on the types of spices in the mix.

- Microbiological contamination (PDF): Salmonella must be absent from spices for the European market.

European buyers increasingly require their suppliers to use steam sterilisation to combat microbiological contamination of spice mixes. You could earn a significant premium if you can supply spice mixes that are sterilised at the source. However, investments in the necessary equipment can have a high cost of up to €1 million.

Research is conducted into alternatives to steam sterilisation, as this treatment negatively affects the taste of spices. Currently, it is still the cheapest and safest method to combat microbiological contamination.

Irradiation: This process is legally allowed in many EU countries under restrictive conditions. However, in practice, irradiation is not applied to spice mixes for the European market, as consumers do not always accept this treatment. Only discuss this option with your buyer when other types of treatment such as fumigation and steam sterilisation are not possible.

Food additives

Buyers and European authorities can reject products if they have undeclared, unauthorised or excessive levels of added substances. There is specific legislation for additives (like colours and thickeners) and flavourings that lists which E-numbers and substances are allowed. Authorised additives are listed in Annex II to the Food Additives Regulation.

Although you might consider using food additives in the production of spice mixes, keep in mind that European traders and consumers prefer spices that are additive-free.

Food fraud

Food fraud in the spices and herbs sector is a serious issue and European buyers are increasingly attentive to it. Many laboratories around Europe have increased testing to discover this type of fraud in spices and herbs. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics, and a combination of detection methods. For example, it has been reported that cardamom is sometimes imported from Bhutan or Nepal to India and presented as being of Indian origin. Such actions constitute food fraud and will affect a supplier’s reputation on the European market.

Tips:

- For a complete overview of requirements, refer to our study on buyer requirements for spices and herbs or consult the specific requirements for spice mixes on the Access2Markets website.

- Apply the general guidelines for Good Agricultural Practices (GAP) on spices & culinary herbs (PDF) of the International Organisation of Spice Trade Associations (IOSTA).

- Check the Rapid Alert System for Food and Feed (RASFF) database for examples of spices withdrawn from the market and the reasons behind these withdrawals.

- Always discuss with your potential buyers whether they want steam sterilisation. If your buyer requires steam sterilisation, look for local sterilisation companies that can provide this service for you. Sterilisation at your own facility is very expensive. Investments in the necessary equipment can cost up to €1 million.

- Comply with food safety requirements during drying, storage, processing (such as sieving, mixing, grinding or crushing), packaging and transport. If you do not comply, steam sterilisation will not work. You also need to prevent contamination with mycotoxins and other contaminants, because steam sterilisation cannot take these substances out.

What additional requirements do buyers often have?

Quality Minima

The European Spice Association, which represents the interests of the European spices industry, has established non-legal minimum quality requirements for spices in its Quality Minima Document. While these requirements are not legally binding and non-compliance will not result in rejections by border controls, compliance is expected by most European buyers and often enforced through purchasing contracts which include product specifications.

| Chemical/physical parameter | Value |

| Ash (% Weight for Weight Max) | Species-specific |

| Acid insoluble ash (% Weight for Weight Max) | Species-specific |

| Moisture (% Weight for Weight Max) | Species-specific |

| Volatile oil ml/100G Min | Species-specific |

| Water activity | Water activity is a key parameter that affects microbiological growth. Therefore, ESA recommends a target value of max. 0.65. |

| Microbiology | The product must be free from microorganisms at such levels that may represent a hazard to health. Specific requirements to be agreed between buyer and seller. |

| Adulteration | Must be free from adulteration. |

| Infestation | Should be free in practical terms from live and/or dead insects, insect fragments and rodent contamination visible to the naked eye |

| Extraneous matter (all matter from the specific plant other than the desired part) | Spices max. 1% by weight. |

| Sensory properties | Must be free from off-odour and off-flavour. |

The ESA has not developed cleanliness specifications. As a result, European buyers often use the specifications for cleanliness stated by the American Spice Trade Association (ASTA).

Taste

It is possible with spice mixes to create a limitless number of different tastes by mixing different spices and changing processing methods. Buyers usually have preferences for a certain taste profile. For example, some buyers want an authentic taste that is similar to the taste of the spice mix used in the country of origin, which may have a very unique taste to European consumers. Others prefer a mild taste that is more acceptable for a wider group of consumers. The search for the right taste is often a process of co-creation in which food manufacturers research the taste expectations of their target group and suppliers of spice mixes show possibilities in terms of which spices to use and processing methods.

Sizes

Spices come in many forms, from whole spices to granules and powder. Many buyers require a specific form and even particle size. Inconsistency in particle size is a major buyer concern as it affects the product’s suitability for certain applications. To achieve consistency in particle size, you must use high-quality equipment and apply strict sorting and grading. Whether a hammer mill, beater cross mill or penn mill is most suitable for grinding a spice depends on the type of spice and the required particle size. Since heat can affect properties of spices, heat generation by different mills is important to consider when selecting the right type. Cooling the mill, for example with nitrogen, can reduce heat during grinding.

Additional food safety requirements

Only very few spice mixes buyers require suppliers to implement an advanced food safety management system and obtain a certificate from an accredited certifier. Some advanced food safety management systems are Food Safety System Certification (FSSC 22000), BRCGS Food Safety, International Featured Standards (IFS Food) and the Safe Quality Food programme (SQF). These standards are all part of the Global Food Safety Initiative (GFSI).

Implementation and certification of these standards usually costs hundreds of thousands of euros and is only recommended for large-scale processors targeting large European retail chains. For those processors, such a certificate shows professionalism. Smaller buyers in niche markets for spice mixes are likely to have more relaxed food safety requirements as they prioritise other aspects such as authenticity.

Labelling

Clear labelling of your spice mix is important for both bulk and pre-packed consumer products. The European labelling legislation applies to pre-packed consumer products. This regulation (EU No 1169/2011) relates to labelling, presentation and advertising of foodstuffs, as well as providing information on nutritional content. The information must be in the language of the country you are selling to. You can also use multi-language labels if you sell your product in more than one country. Regulation (EU) 341/03 (PDF) sets out the guidelines for the labelling of foodstuffs using Protected Geographical Indications (PGI).

For bulk spice mixes, your product label must include:

- Product name;

- Details of the manufacturer (name and address);

- Name of the Protected Geographical Indication (PGI) (only allowed when GI is registered with the EU);

- Batch number;

- Date of manufacture;

- Expiry date;

- Weight of contents;

- Other information required by the exporting and importing countries, such as producer and/or packer code, and any extra information that can be used to trace the product back to its origin; and

- If your product is organic- and/or Fairtrade-certified, the label should contain the name/code of the inspection body and the certification number.

Packaging requirements for spice mixes in bulk

Spice mixes are packaged in new, clean and dry multi-wall laminated bags made of food-grade material such as polypropylene. Do not use polythene bags, as they result in flavour loss. Premium-grade spice mixes are often packed in vacuum-sealed bags. The size of the packaging can range from 1 to 50 kg and must be agreed with the buyer.

Tips:

- Choose a food safety management system that is approved by the Global Food Safety Initiative.

- Always ask your buyer for their specific packaging requirements.

- Add website links and QR codes on your package to provide more information about the product.

- Learn more about maintaining the quality of your spice mix during transportation on the website of the Transportation Information Service.

What are the requirements for niche markets?

Packaging requirements for spice mixes in retail packaging

Requirements for consumer-packaged spice mixes are more demanding than for spice mixes in bulk. The most common types of consumer packaging for spices are:

- Glass bottles with metal or plastic caps. These bottles often have additional features to dispense or grind spice mixes. This packaging is popular among consumers that are looking for convenience.

- Printed plastic pouches. Polyester and polypropylene laminate are especially popular in this type of packaging, as they are lightweight and hygienic, can be heated/sealed, and are easily available.

- Printed tinplate containers, which may include a dispensing system.

- Plastic and composite containers. These often contain ground or cut spices. This packaging includes a seal that shows if the packaging has been tampered with.

- Lined cartons, which usually contain small quantities of whole spices.

Consumer packaging usually ranges from 5 to 100 gr but can reach up to 2 kg when targeted at food service providers. Packaging needs to be functional (to protect the product from infestation, spoilage and quality loss) and of high quality to enhance the selling appeal of the product. The design and feel of the product are just as important as the quality of the packaging material.

Additional liability requirements for retail products

Retailers supplying directly to European consumers are responsible for the safety of the product and can be held liable if the product has any defects. If the product is unsafe for consumption and results in injury to European consumers, they can hold the retailer responsible for the injury. The retailer may also be required to recall and/or destroy products that are unsafe.

When you supply spice mixes in retail packaging through a legal representative in Europe, such as a distributor, your buyer can pass the claim on to you, especially if you are supplying retailers directly. You will then have to reach an agreement with the consumer about compensation. You need to have logistics in place to resolve these issues. For example, make an agreement with your buyer that they will act as your agent. In case of problems, they can act on your behalf and transfer the costs back to you.

Tips:

- Visit the website of the European Commission for additional information on food labelling legislation. Note that this requirement only applies to final products that are sold directly to consumers.

- Obtain insurance for product liability if the risk of liability claims is big, for example when you supply directly to retailers or when you have a valuable brand or reputation. In other situations, European importers will often be held liable.

Certifications and sustainability

European buyers are increasingly paying attention to their social and environmental impact. Important issues at origin typically include the correct use of pesticides, fair payment, and healthy and safe working conditions.

Depending on their business strategies, European buyers have different definitions and priorities regarding sustainable sourcing. Although there is no universal way to address these matters, many buyers will require transparency on sustainability issues. Some buyers will simply ask you questions about the sustainability of your business and others may require you to fill out forms to conduct a self-audit.

Certification of sustainability in the spice mixes market is still a niche. However, the interest in sustainability in the spices market is stimulated by initiatives such as the Sustainable Spices Initiative. The major certification systems are Organic, Fairtrade and Rainforest Alliance. Each certification scheme addresses different issues (social, environmental, economic) and serves different niches.

Organic certification

To market your spice mix as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Obtaining the EU organic certificate is the minimum legislative requirement for marketing organic spice mixes in the European Union.

Note that a new EU organic regulation came into force on 1 January 2021. Producers in all developing countries will now have to comply with the same set of rules as those producing in the EU. Also, inspections of organic production and organic products have become stricter to prevent fraud.

Before you can market your spice mix as organic, an accredited certifier must audit your growing and/or processing facilities. Refer to this list of recognised control bodies and control authorities (PDF) issued by the EU to ensure that you always work with an accredited certifier. To become organic-certified, you can expect a yearly inspection and audit that aims to ensure you comply with the rules for organic production.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. This requires you to get the necessary information, such as importer address and TRACES number, first consignee, seal and vessel number of your container. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES), where you will also have to register as an organic exporter.

If you want to export to countries outside of the European Union (EU), check the required legislations in that country. For instance, Switzerland has its own Swiss Organic Law, and the Organic Products Regulations 2009 apply in the United Kingdom.

In addition to the EU organic standard, most European countries also have their own voluntary organic standards, like Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, like Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden).

Fairtrade certification

There is a growing demand for Fairtrade-certified spices in Europe, and the United Kingdom is the largest market. Fairtrade International (FLO) is the leading standard-setting organisation for Fairtrade certification. Fairtrade international has developed a specific standard for herbs, herbal teas and spices for small-scale producer organisations. According to this standard, a premium price of 15% over and above the negotiated price between producer and seller must be established. FLOCERT is the accredited certifier for Fairtrade. Refer to this full guidance to learn more on how to become a Fairtrade producer.

Fair for Life (by IMO/Ecocert) and Fair Choice (by Control Union) are other fair trade certifications available to producers and other operators. Although less recognised on the European market, Fair for Life and Fair Choice have the advantage that the control bodies Ecocert and Control Union can combine the fair trade audit with, for instance, organic or Rainforest Alliance audits. However, always check demand and interest for a specific certification with your existing or potential buyer.

Tips:

- Provide information on your website and through company documentation when you aim to be transparent to potential buyers. Additionally, consider the Supplier Ethical Data Exchange (SEDEX), which enables you to declare that you do business in a responsible way and in a uniform format that is acceptable to many larger buyers, such as retail chains.

- Refer to the Sustainable Spice Initiative’s Basket of Standards (PDF) and the ITC Standards Map for an explanation and comparison of sustainability standards.

- If you have more than one certification, try to combine audits to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Use this cost calculator to estimate what costs will be involved for your organisation to get Fairtrade-certified.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search at the organic movement in your own country and ask if they have their own support programmes or know about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of fair exhibitors, seminars and other events. Here you will also find booths of the organic certification bodies.

2. Through what channels can you get spice mixes on the European market?

How is the end market segmented?

Most spice mixes are produced in the European Union, where large producing companies like Verstegen import a variety of spices and herbs that are mixed according to their recipes. Large spice companies like Verstegen supply both the retail and food industry. Thanks to their ability to mix spices according to their customer’s demand, these companies are able to supply tailor-made spice mixes to various industrial users. This ensures food industry users a stable and reliable quality and composition of their mixes.

Additionally, all major brands of retail spice mixes are owned by these large spice companies. Imported spice mixes are thus very much a niche product and will mainly be sold at the retail level to consumers that are looking for something specific or unique.

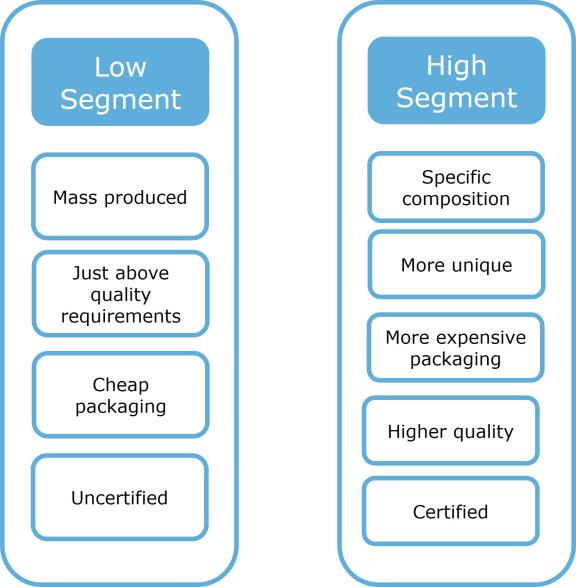

Figure 1: Visualisation of market segments

Source: ProFound

Price segments at the retail level

Low-end segment

The low-end segment comprises cheap mass-produced spice mixes of a quality that just meets minimum requirements. These are usually produced on a large scale. While prices in the low-end segments are low, the quality of the mixes meets all food safety requirements and is consistent. These low-end retail products are usually packed in cheap materials such as plastic jars or paper bags to lower costs. Additionally, these low-end spice mixes are often uncertified.

Spice mixes for the low-end segment are often sold in supermarkets and by the food service industry. Private labels of retail chains play a large role in the low-end segment. Private labels are brands owned by the retail chains themselves.

Examples of products and prices in the low-end segment for 2022:

ALDI (spice mix for chicken, 160-gr package, uncertified)

| Product | Picture | Retail price (€/kg) | |

| Low end | Albert Heijn (Fajita seasoning mix, 30-gr package, uncertified) |

| 18.33 |

Globus (Ciao Bella Fuccili mix, 25 gr, Bio certified) Produced by: JUST SPICES GMBH |

| 39.60 | |

| ALDI (spice mix for chicken, 160-gr package, uncertified) |

| 6.19 | |

| Tesco (Mixed spice, 37-gr package, uncertified) |

| 30.44 |

High-end segment

In the high-end segment of the spice mixes market, more unique, special products can be found. These products are branded in such a way that they stand out and are unique because of their specific composition. They sell at higher prices.

Examples of spice mixes in the high-end market segment:

| Product | Picture | Retail price (€/kg) | |

| High-end | Albert Heijn (Euroma Jonnie Boer African dark smokey & spicy, 80-gr package, vegan) |

| 61.13 |

Globus (Just Spices Italian all-rounder spice, 57-gr package, uncertified) Produced by JUST SPICES GMBH |

| 105.09 | |

| Tesco (Schwartz Mixed Spice, 28-gr package, uncertified) |

| 77.27 | |

| Carrefour (Organic 4 Spice Mix, 50-gr package, organic-certified) |

| 151.80 |

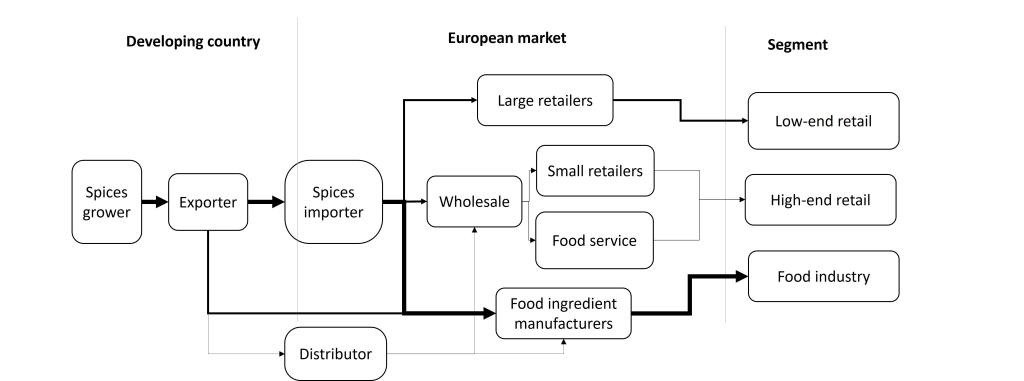

Through what channels does a product land on the end market?

Food industry

Large food (ingredient) manufacturers dominate the market for spice mixes. They include Unilever, known for many brands like Knorr, and Nestlé, known for many brands like Maggi. These companies mostly blend their own spice mixes or work together with major spice importers to prepare custom spice mixes. These food manufacturers often blend spice mixes with other (e.g. texturizing) ingredients to prepare mixes that provide taste, functionality and nutrition. They prepare spice mixes for a wide range of foods, such as sauces and marinades, that are easy to prepare for consumers. Or, they use spice mixes as ingredients for their foods, such as soups or ready meals. These products are adapted to local consumer preferences based on consumer research and research with sensory panels. This research & development is a costly yet important process, as food manufacturers will make large investments in the branding of the product, and once a product is on the market consumers expect the product to remain the same.

Smaller food manufacturers, like Hela, offer more unique products. As the core business of food manufacturers, both large and small, is to create brand value through marketing and/or to manufacture the foods, they often outsource the sourcing of ingredients to specialised importers or other wholesalers.

Specialised spices importers are importing wholesalers that source large amounts of spices and break these bulk imports into smaller amounts for their clients, including mostly food manufacturers. Although many exporters from developing countries often aim to supply European food manufacturers directly to obtain higher margins, this bulk-breaking function can contribute to an increase in trade volumes and eventually higher profits. Importing wholesalers include Nedspice, Jost Bauer and Colin Ingredients.

In addition to importing wholesalers, such as the specialised spices importers, regular wholesalers who do not import play a major role in the European market. The added value of these wholesalers is often that they offer a one-stop-shop where food manufacturers or retailers can purchase all the products they need.

Retail

Large retail chains dominate the European retail market, like Tesco and Sainsbury’s in the UK, Edeka and Lidl in Germany, Carrefour in France, Biedronka in Poland, and Albert Heijn in the Netherlands. These companies have a large share in the low-end retail segment, with some speciality products in their assortment. In addition to their physical shops, they increasingly have webshops where consumers can order products online to be home-delivered. They source almost all their spice mixes from large importers like British Pepper & Spice in the UK or Fuchs in Germany.

Another channel that uses a lot of spices are foodservice providers, such as restaurants. Restaurants use a lot of spices and spice mixes in their recipes. Depending on the type of restaurant, they will either mix their own spices or buy them premixed. One brand of spice mixes within this segment is Metro, a large cash-and-carry conglomerate.

Figure 2: Market channels for spice mixes

Source: ProFound

Tip:

- Only start targeting the retail market when you are successfully supplying to the food industry. The retail market is more demanding and you will need to show retailers that you can already comply with the requirements of food manufacturers.

What is the most interesting channel for you?

If you are interested in entering the European market, spice importers are the most interesting channel for you. These companies often buy large amounts of individual spices and mix them according to their own recipe. They are sometimes interested in buying those spice mixes directly from origin. They then order a combination of individual spices and spice mixes together to enlarge the total order. This will lower transportation and administration costs per kg of spice. Usually these importers have a large network of suppliers, which reduces their risk of gaps in supplies. When one particular supplier is unable to supply, another supplier can take over. Since they are continuously looking for new suppliers, they are relatively easy to find. Examples of such importers are Verstegen and Schwartz.

Food manufacturers are an interesting channel to enter the market when you have a strong marketing department. Since food manufacturers, and particularly small food manufacturers, do not have many resources to spend on the sourcing of ingredients, they need a supplier they can rely on. Once they have identified a good supplier, they will not keep looking for other suppliers. This means that you need to make sure these food manufacturers can find you when they need a supplier. This requires strong promotion efforts.

Food manufacturers often need small orders. Because transport costs of small orders from a developing country to Europe are relatively high, you may consider a distributor in Europe to respond to the need for small orders. Distributors allow you to send full containers to Europe and then deliver small orders to clients from the distributor’s warehouse. However, distributors add costs as well and will reduce your costs only when you are supplying to a significant number of food manufacturers.

The consumer-packaged spice mixes market is the most difficult to enter. It is a market dominated by European companies that set the standards for cleanliness, quality, sterilisation, branding, marketing, packaging and price. To enter this market, you need to be able to compete with these European companies that have large resources to comply with stringent retail demands.

Within the retail market, your best chance of identifying retailers interested in your consumer-packaged spice mixes is the niche for delicatessen and ethnic food shops. Delicatessen shops are small retailers offering speciality products that consumers will not find in large retail chains. Ethnic food shops sell spices and spice mixes traditionally used in countries outside of Europe and primarily serve Europe’s ethnic communities. An advantage of targeting these retailers is that you often will not need to adapt your product to the mainstream European market, in terms of taste and packaging design. If you target the ethnic food shops with your consumer-packaged spice mixes, you also face competition from producers in other developing countries. Particularly, products of Indian suppliers of consumer-packaged spice mixes are already quite common in ethnic food shops. For example, the Amazing Oriental online retailer stocks various products from India, including spice mixes for traditional dishes.

Small retailers such as delicatessen and ethnic food shops usually source their spice mixes from wholesalers such as cash-and-carry’s that offer one-stop-shopping where retailers can purchase all their products. These wholesalers mostly purchase their spice mixes from the same spice importers that also supply to the large retailers and food manufacturers. However, the small retailers and wholesalers sometimes also purchase from distributors of consumer-packaged spice mixes from developing countries.

Before you consider consumer packing, make sure you can ensure:

- Excellent cleanliness;

- Digh and consistent quality;

- Steam sterilisation; and

- Grinding and blending with a very high consistency in particle size and composition.

Tips:

- Focus on supplying spice mixes to ethnic food shops when you have very limited experience working directly with European food manufacturers. Identify the spice importers that supply to these retailers, as the retailers usually do not import themselves.

- Look for importing wholesalers in the member lists of the national spice associations in Europe. Go to the member section of the European Spice Association (ESA) for an overview of associations.

- If you lack capacity in sales, hire an agent to look for buyers on your behalf. Do not use an agent when you plan to make a direct connection to a buyer. Once you have established a trade relationship through an agent, you cannot establish a direct relationship with the buyer anymore. The sales network of the agent is protected by law. You can find agents on the website of the Federation of German Commercial Agents and Distributors (CDH).

3. What competition do you face on the European spice mixes market?

European food ingredient manufacturers specialised in spice mixes and seasonings are your main competitors in the European spice mixes market. They mostly produce value-added spice mixes for other food manufacturers.

European food ingredient manufacturers primarily add value to imported spices through research & development. They provide close support to food manufacturers with product development. This allows food manufacturers to focus on the manufacturing and/or branding of their products. These food manufacturers rely on the expertise of the food ingredient manufacturers and their processing capabilities. Processing steps include:

- Cleaning;

- Sterilisation;

- Grinding;

- Blending; and

- Packing.

European food ingredient manufacturers have several competitive advantages over you, including:

- Knowledge about their domestic markets (in terms of consumer taste preferences and buyer requirements);

- Proximity to and close relationships with the food manufacturers; and

- A strong reputation among buyers of unadulterated products that comply with European food safety requirements.

Similarly to the market for spice mixes for food manufacturers, the European market for mainstream consumer-packaged spice mixes such as barbecue and curry mixes is extremely competitive. Large brands of spice importers, food ingredient manufacturers and retailers dominate the market. Capturing space on the shelves of large retail chains is virtually impossible for new market entrants with limited resources. The existing brands use big marketing budgets to identify or create consumer needs and develop spice mixes that respond exactly to these needs.

Competition is somewhat less fierce in the market for niche consumer-packaged spices, such as exotic or premium spice mixes. These are mostly sold in regular and online delicatessen shops and ethnic food shops.

Source: Eurostat

The sharp decline in reported supplies by India in 2020 shown in the above figure is in fact a misrepresentation of the trade. Due to Brexit (the UK leaving the European Union), data on trade by the UK is no longer included in the data reported by the EU. Since the UK is India’s main trade partner, this results in a sharp decline in reported trade. Actual trade in spice mixes between India and Europe is expected to have remained relatively stable.

India: the origin of many curries

India is the main source of spices in the world. In the 2020-2021 spice season, India’s total spice and spice derivatives exports amounted to 1.6 million tonnes/€3.2 billion. Curry powders and pastes were India’s 7th largest spice export product in the 2020-2021 season. The spices were exported to 180 countries (Source: 2021 Annual Report of Spices Board of India (PDF). Europe is an important spice mixes export market for India. In 2021, Europe imported 2,516 tonnes of spice mixes from India. This is 50% of European spice mixes imports from developing countries. Note that this excludes data for imports by the UK.

The Spices Board of India represents 1,512 spice exporters. These spice exporters supply a wide range of spices produced in India and imported from other countries. India is a hub in the global spice trade and is able to supply almost all spices from around the world. This makes Indian spice exporters very attractive trade partners for European buyers who appreciate the possibility to order containers with different spices.

The large scale of the Indian spices industry has allowed Indian companies to invest in processing capacity to offer more value-added spices. Apart from cleaning, grinding, sterilisation and laboratory analysis, they can blend spices according to the specifications of their European buyers. They can even make spice pastes, which still contain a lot of moisture, but also volatile substances that are lost when the spices are completely dried.

Pakistan: competing for the European market with its neighbour India

Pakistan has a much smaller spices industry than India. In 2020-2021, Pakistani exports of spices amounted to €84 million. The list of coffee, tea and spices exporters (PDF) of the Trade Development Authority of Pakistan only includes 260 exporters compared to the more than 1,500 exporters in India. However, Pakistan plays a relatively large role in the spice mixes trade and is the second-largest supplier of spice mixes to Europe. In 2021, Europe imported 543 tonnes of spice mixes from Pakistan.

Some Pakistani companies are Zaiqa Food Industries, Laziza, Mehran Spice & Food and Shan Foods. Shan Foods’ brand is available in 70 countries through a network of distributors. The company has 2,000 employees and large research & development resources, including state-of-the-art equipment and sensory facilities. It is FSSC22000, BRC and Halal-certified, and has a sustainability strategy in place. Their spice mixes include mixes for many Asian dishes such as masala, tikka, bihari, korma and kofta.

China: large producer with modest presence of spice mixes in Europe

Traditionally, China played an important role in the international spice trade, dating back to when Chinese traders walked the silk road from Asia to Europe. Nowadays, the role of Chinese suppliers in the European spice mixes market is modest. China produces various spices including chillies, garlic and ginger. In 2021, Europe imported 374 tonnes of spice mixes from China.

Not all European buyers are interested in Chinese spice mixes. Some of them mistrust Chinese suppliers due to poor transparency in supply chains and rumours about poor management of quality management systems. Still, the quality of the products entering Europe is generally considered good.

An example of a Chinese spice mixes supplier is Tai Foong Foods. Tai Foong Foods is primarily a supplier of chillies. They offer a whole range of chillies products, but also offer spice mixes. The company regularly participates in leading international trade fairs, cooperates with local farmers, supervises traceability and quality, has its own advanced steam sterilisation equipment, and has a BRC certificate for their food safety management.

Sri Lanka: adding value to their spices

Sri Lanka is a rich spice country with a particularly large role in the global production of cinnamon, pepper, cardamom and cloves. In 2021, Sri Lanka produced 22.9 thousand tonnes of cinnamon, 23.4 thousand tonnes of pepper, 3.8 thousand tonnes of cloves, and 104 tonnes of cardamom.

The mission of the Spice Council, which has more than 100 members, is to make the country a global leader in value-added spices such as spice mixes. This focus on value-added spices is intended to prevent direct competition with its neighbour, India, which can offer larger volumes and lower prices than Sri Lanka. Another strategy of the country to improve its competitiveness is the nationwide switch to an organic farming system. In 2021, the government decided to ban the application of chemical inputs in agriculture and force the application of organic farming practices.

In 2021, Europe imported 443 tonnes of spice mixes from Sri Lanka.

Turkey: close to the European market

Turkey is a major supplier to Europe of Mediterranean herbs such as thyme and bay leaves. In addition to these typical Mediterranean herbs, Turkey produces significant amounts of chillies and cumin. In 2019, Turkish spice exports amounted to around €126 million. Europe’s imports of spice mixes from Turkey amounted to 256 tonnes in 2021.

The proximity to the European market is a strong competitive advantage for Turkish suppliers. This proximity gives them better access to European buyers and implies that transportation costs to Europe are relatively low.

Lebanon: zaatar and other Middle Eastern spice mixes

Lebanon is famous for its spice mixes for Middle Eastern dishes such as zaatar. Zaatar is made from the herb zaatar together with sesame seeds, sumac, salt and other spices. In 2021, European imports of spice mixes from Lebanon amounted to 234 tonnes. Similarly to Turkey, proximity to Europe is a competitive advantage of Lebanese spice mixes suppliers.

Case study: Ethiopian berbere

Ethiopia is a relatively small player on the global spice market. The country produced 356 thousand tonnes of spices in 2018 and exported only 13 thousand tonnes in 2017 (PDF), representing a value of €19 million. Production mainly consists of chillies (83% of production), turmeric (11%), ginger (3%), black pepper (1%), black cumin and black cardamom.

Some of the barriers to growth for the Ethiopian spices industry are weak infrastructure, limited access to finance and a lack of commercial orientation towards high-value international markets. Cultivation of spices by smallholder farmers is normally performed on small plots of land (< 0.5 ha), spice yields are low, and the smallholder farmers are generally not aware of the requirements of international markets.

Since Ethiopia is still an unknown origin, the country needs to build experience and trust before it can export spice mixes to Europe. This requires large investments in training of farmers on harvest and post-harvest practices, and on exporters’ cleaning, grinding, blending and sterilisation capacities.

The long-term opportunity for Ethiopia in the European spice mixes market is the export of indigenous spice mixes, such as berbere and mitmita, together with other spices. Berbere is a mix of chillies, ginger and fenugreek with other spices, including cumin, pepper and black cardamom. Ethiopian dishes are considered exotic in Europe, so the market for these mixes will be small. Trade in full container loads of berbere spice mix will not be feasible. However, some buyers may be interested in sourcing the berbere spice mix together with single spices. Such buyers are typically small spice importers that avoid competition with the larger players by offering exotic and authentic spice mixes through webshops or ethnic food shops.

Which companies are you competing with?

Examples of Indian companies: Diamond Masala exports blended spices and particularly Indian curry masala. The company has their own brand of consumer-packaged spice mixes. Their Premium Diamond Garam Masala is made with 25 different spices. Another Indian spice mixes manufacturer is Mida. Mida supplies a range of sauces, authentic pastes, original Indian curry powder, and ready-to-eat meals to Europe under their own brand.

Example of a Chinese supplier: Tai Foong Foods is primarily a supplier of chillies. They offer a whole range of chillies products, as well as spice mixes. The company has its own advanced steam sterilisation equipment and has a BRCGS certificate for their food safety management.

Example of a Sri Lankan exporter: New Lanka Cinnamon is a cinnamon processor that provides a range of cinnamon-based value-added products.

Examples of Turkish suppliers: EK Gida and Hazra Baharat.

Examples of Lebanese exporters: Adonis Spices and Abido.

Which products are you competing with?

Though the variation in possible spices mixes is endless, a limited number of spice mixes make up most of the spice mixes market in Europe. Some of the most popular spice mixes are mixed Italian herbs, barbecue mixes and curry mixes. One of the main reasons for European buyers to purchase spice mixes from outside Europe instead of mixing them themselves is the authenticity of the product. To illustrate, buyers can use the Italian origin of their mixed Italian herbs to position their product as an authentic Italian mix. This provides opportunities for suppliers in developing countries of popular spice mixes that originate in their country, as is the case for curry mixes in India and Pakistan or zaatar in Lebanon. However, other countries cannot benefit from this opportunity. This means that India cannot claim to supply authentic zaatar mixes, and vice versa, the same applies to Lebanon.

For countries that are not recognised as origins of popular spice mixes, it is difficult to position themselves as suppliers of authentic spice mixes. To get recognition in Europe for authentic spice mixes from their country, these countries will have to invest a lot in promotion and consumer education.

Tips:

- Learn from success stories to enter the European market. For example, the companies Laziza and Shan Foods from Pakistan have successfully entered the European market with spice mixes and other condiments.

- Develop long-term partnerships with your buyer. This means always complying with buyer requirements and keeping your promises. This will provide you with a competitive advantage, more knowledge and stability on the European market.

- Actively promote your company on your website and at trade fairs. Quality competitions also provide good opportunities to promote your spice mixes to a wider audience. Check out the Sofi Awards, Superior Taste Award and Great Taste Awards.

4. What are the prices for spice mixes on the European market?

Prices for spice mixes depend strongly on composition, the amount of value added through research and development, and branding. Final consumer prices are also strongly dependent on the number of intermediaries and volumes traded between the different players in the value chain. Margins for intermediaries are much higher for small volumes than for large volumes. Generally, more exclusive spice mixes for small retailers pass through more intermediaries and are traded in smaller volumes, leading to high consumer prices.

Rough price indications for a spice mix for the niche retail segment are as follows:

| Price point | Price in €/kg |

| Export price of spice mix in bulk from country of origin | 4 |

| Wholesale price in Europe for spice mix in bulk (~100 kg order) | 10 |

| Wholesale price in Europe for spice mix in consumer-packaging (~1 kg order) | 50 |

| Retail price at small retailer (~50 gr packaging) | 100 |

Tips:

- Make sure that your prices reflect the quality and level of value addition of your product.

- Check the market reports by Nedspice, Indian Spices Board and the International Trade Centre for the latest price developments and a price outlook.

This study was carried out on behalf of CBI by Kasper Kerver of ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research