What is the demand for outbound tourism on the European market?

Today, international tourist arrivals are 96% of what they were in 2019. It was expected that they would reach 100% by the end of 2024. Germany and the UK are the top European outbound markets. European arrivals to Latin America recovered faster than those to Asia and Africa. Turkey is the most popular developing destination in European markets. Adventure, culture, food, wellness and nature are the most popular travel experiences for the European market.

Contents of this page

1. What makes Europe an interesting market to target?

Europe is interesting to target as it is the largest outbound travel market. Europe’s tourism sector has been one of the fastest to recover, behind that of the Middle East and Africa.

UN Tourism expected that international tourist arrivals would recover to 2019 levels by the end of 2024, although this varies between regions. Challenges to the sector’s recovery included the state of the global economy and thus personal travel budgets. The ongoing war in Ukraine and Russia and conflict in the Middle East have also created uncertainty.

Embedding sustainability in tourism will remain a challenge as the sector needs to meet global net zero commitments by 2050.

Current status of worldwide tourism

The tourism sector is a highly resilient industry. Tourism is on track to recovery fully; an estimated 790 million tourists travelled internationally between January and July 2024. This represents 11% more than the same period in 2023 and just 2% less than in 2019.

Table 1: Status of international tourism arrivals, 2022 to 2024

| Region | % change 2019 vs. 2022 (whole year) | % change 2019 vs. 2023 (whole year) | % change 2019 vs. 2024 (Jan to July) |

| World | -34% | -11% | -2% |

| Europe | -18% | -5% | 0% |

| Asia and Pacific | -74% | -35% | -14% |

| North America | -31% | -14% | -8% |

| Central America | -15% | -5% | 17% |

| South America | -37% | -6% | -5% |

| Africa | -32% | -4% | 8% |

| Middle East | -5% | 31% | 24% |

Source: UN Tourism, 2024

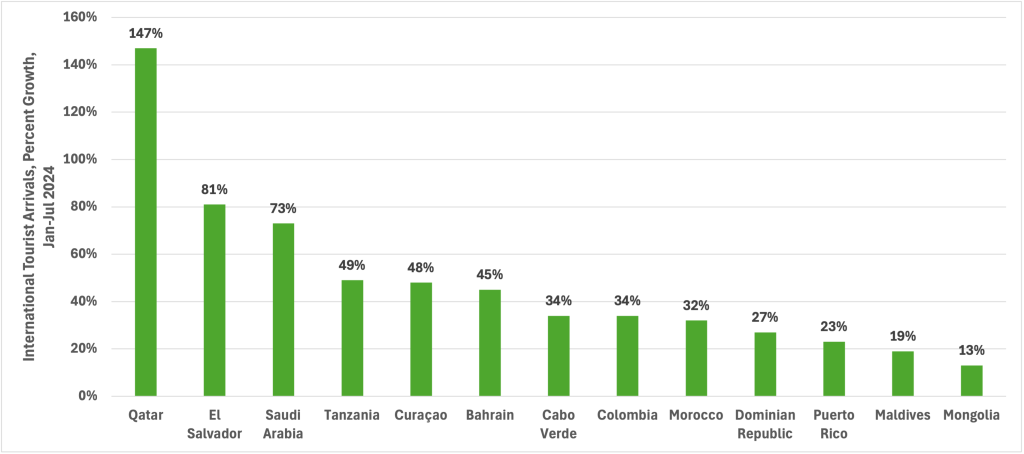

- The Middle East experienced the strongest performance between January and July 2024. Arrivals exceeded the same period in 2019 by 24%. Arrivals to Qatar (+147%), Saudi Arabia (+73%) and Bahrain (+45% until the end of June) increased. Demand was boosted by investments in major tourism projects, enhanced air capacity, strong marketing and greater ease to get visas.

- Arrivals to Europe reached >99% of pre-pandemic levels at the end of July 2024, with an estimated 410 million arrivals. Recovery was driven by strong intra-regional demand as more Europeans travelled within Europe than to long-haul destinations. Western European countries exceeded pre-pandemic figures by 1%.

- Some of the strongest performing destinations were lesser-visited countries, including Albania (+93%), the Republic of Moldova (+50%, to end June) and Serbia (+34%). Popular summer destinations also saw good growth. Greece welcomed 24% more arrivals (until the end of June), Portugal 18%, Denmark 16% and Turkey 15%. Germany saw a 4.5% increase in overnight stays in July 2024, a result of hosting UEFA Euro 2024.

- Africa performed well, arrivals exceeding those of 2019 by 8% between January and July 2024. The North Africa subregion was one of the best performing subregions, with 21% more international arrivals than in 2019. Sub-Saharan Africa reached 97% of pre-pandemic arrivals during this period. By country, Tanzania, Cape Verde, Morocco and Kenya all exceeded their 2019 international tourist arrival figures by +49% (to end June), +34%, +32% and +10% respectively.

- North America saw 92% of international tourist arrivals in January–July 2024 compared to the same period in 2019.

- Central America performed very well as a subregion between January and July 2024, reporting 17% more international arrivals than the same period in 2019.

- South America recovered to 96% of pre-pandemic levels, driven by performing countries like Colombia, which has exceeded 2019 arrivals.

- Although Asia was the slowest growing region, recovery in certain destinations and subregions is rapid. Arrivals in Asia reached 82% of 2019’s levels between January and July 2024. South Asia enjoyed the best recovery (92%), with East Asia at 88% and Oceania at 83%. North East Asia (including China) reported 75% growth.

Figure 1: Countries outside Europe that reported the most growth between January and July 2024, exceeding arrivals in the same period in 2019. (Tanzania, Bahrain and Colombia figures until the end of June 2024.)

Source: UN Tourism, 2024

The International Air Transport Association (IATA) reported growing revenues and a positive outlook. Total revenues were expected to reach $996 billion (USD) in 2024, a record high and an increase of 9.7% compared to 2023. Passenger numbers were forecast to reach 4.96 billion at the end of 2024, another record high.

Future projections and challenges

It was expected that global tourism would recover by the end of 2024. Some regions took longer to recover fully, particularly in Asia, which was slower to reopen to tourism following the pandemic.

Nevertheless, global challenges to tourism remained, linked to the global economy. Experts predicted growth would fall to 2.1% in 2024, from 3% in 2023. The US economy continued to experience reasonably strong growth although it was slow. Europe’s economy barely grew in 2024, at just 1%. Germany entered a recession in 2023 and growth was not expected until 2025. The UK economy was expected to grow by 1.1% in 2024.

Other factors include consumer confidence levels, which are usually affected by high prices, inflation and interest rates. While inflation and interest rates have fallen, prices are still high, which affects how much people can spend on luxuries like travel.

Other challenges to tourism growth include the ongoing conflicts occurring around the world. The Russia-Ukraine conflict has now been going on for more than two years. Domestic and international tourism to both Ukraine and Russia has been severely affected. Russian airspace is still closed to most western airlines, making flights more expensive and longer.

The conflict in the Middle East led travel bookings to drop. International tourist arrivals to Israel and Jordan have fallen, and airlines review and cancel flights depending on the situation. Currently, the situation is extremely volatile and fast-changing.

Other geopolitical tensions, such as relations between the USA and China, may threaten tourism’s recovery. The change of government in January 2025 may impact on tourism if travel bans are re-issued in Trump’s second term. Safety and security have become more important as tourists actively assess potential threats to their safety while travelling.

Tips:

- Keep abreast of global, regional and national issues that might affect tourism in your destination. Understanding these issues will help you reassure your buyers if they are concerned. Be sure to act to address issues when necessary.

- Keep you risk management policy up to date. The world is unpredictable, and you should be prepared for all eventualities. Use the CBI study How to manage risks in tourism to help you.

Sustainability requirements

At the global level, adopting sustainable business practices to mitigate against climate change has never been more important. 101 countries have pledged to net zero targets, including all the European Union Member States (27 countries) and the UK. The issue has been well publicised, and there is high awareness throughout Europe.

The EU Green Deal was launched in 2019 with a series of sustainability actions to help Europe become the first climate-neutral continent by 2050. This affects European tour operators too, as they must meet these standards. For them to do so, they need their partners to operate sustainably. This includes local tour operators.

If you want to supply the European market, being a sustainable tour operator has become very important. Some tour operators, like Austria’s ASI Reisen, plan to only work with sustainably certified businesses. It takes a long time to meet all the requirements to be certified, so it is important to factor this into your sustainability journey.

Tips:

- Learn more about sustainability in tourism and how the sector is responding. The CBI study Which trends offer opportunities or pose threats on the European market explains more.

- Find out how to implement sustainable actions in your business in the CBI study How to be a sustainable tourism business.

Analysis of outbound tourism volumes from Europe

In 2023, European international arrivals from Europe reached 707.4 million (95% of 2019 levels), accounting for 54% of global outbound tourism (1,305 billion international arrivals in 2023). This rise is a good indicator of the strength of the European market.

Air passenger traffic in Europe grew by 19% in 2023 compared with 2022, with 979 million passengers. Almost half of these passengers flew to international destinations outside of Europe.

Source: Eurostat, 2024

Europeans made 1.14 billion overnight trips in 2023, a 5.7% increase from 2022. Almost three quarters of these were domestic trips (73%), meaning 23% of overnight trips (262 million trips) were to international destinations.

In 2022, Europeans predominantly took trips within Europe (89.9%). This is not surprising. Most Europeans prefer to travel to short haul destinations, and neighbouring countries are plentiful, easily accessible, familiar to European nationals and have excellent tourism facilities. Outside of Europe, Africa was the most popular continent for European travel trips, accounting for 3.2% of trips. This was followed by Asia (2.6%), North America (2.5%), and South and Latin America (1.7%).

Source: Eurostat, 2024

You can see from the chart below that trips to destinations outside of Europe are still some way off pre-pandemic levels. Interestingly, European arrivals to Central and South America are recovering faster than other regions. The number of trips to Central and South America are 16% lower than pre-pandemic, while trips to Asia are still 55% lower and trips to Africa are 29% lower.

Source: Eurostat, 2024

Turkey, Egypt and Morocco are the most popular destinations for Europeans, accounting for 12%, 4% and 3%, respectively. All these countries have been popular destinations for European travellers for many years. They are all conveniently located in relation to the European continent and have minimal time differences. They are well served by air and by low cost carriers (LCCs). They appeal to tourists on different budgets. They all have favourable, warm climates that appeal to Europeans.

33 million Europeans travelled to Turkey in 2022, making it the most popular destinations by a clear margin. Arrivals from Europe have almost returned to 2019 levels (33.5 million). Egypt was the next most visited destination, accounting for 7.3 million Europeans, followed by Morocco (4.1 million). Thailand has been a top destination for Europeans for many years. Arrival figures from Europe to Thailand in 2022 are currently unknown and thus excluded from this study.

Source: UN Tourism, 2024

Further analysis shows there are differences in where Europeans go. This can be seen below. Lessons include the following:

- The most popular for German nationals in 2022 were Turkey (5.6 million arrivals) and Egypt (1.3 million).

- British tourists' most-favoured destinations were Turkey (3.3 million) and Mexico (0.6 million).

- By contrast, most French tourists travelled to Morocco (1.5 million) and Tunisia (0.8 million).

- Spanish tourists prefer Morocco (0.9 million) and Mexico (0.4 million).

This figure shows distinct differences in preferences between European nations. Language is clearly one factor. Morocco has a high proportion of French-speakers while Spanish is the common language in Mexico. These factors are more fully explored in the section below, Which European markets offer the most opportunities for tourism suppliers in developing countries.

Source: UN Tourism, 2024

Analysis of global and European value of tourism

International tourism expenditure amounted to €1,417 billion in 2023, a 6.6% increase compared to 2019.

European countries are big spenders on outbound tourism. The six major European markets are all in the top 15 countries in terms of outbound expenditure, with Germany, the UK and France representing the top spending markets after the US and China. All the markets reported increased expenditure abroad in 2023 compared to 2019. British people spent almost one third more abroad than in 2019 (32.8%), followed by Germans (28.2%) and the Dutch (25.7%). This is another indicator of the strength of these markets’ recovery.

Table 2: International tourism expenditure by top source markets, 2019 and 2023

| Country | 2019 (€ billion) | 2023 (€ billion) | % change 2019 vs. 2023 |

| China | 227.4 | 181.7 | -20.1% |

| United States (USA) | 117.9 | 146.7 | 24.4% |

| Germany | 83.3 | 106.8 | 28.2% |

| United Kingdom (UK) | 76.8 | 102.0 | 32.8% |

| France | 48.3 | 51.8 | 7.2% |

| Australia | 31.5 | 39.5 | 25.4% |

| Canada | 31.6 | 36.2 | 14.6% |

| Russia | 32.3 | 31.8 | -1.5% |

| Italy | 27.1 | 31.6 | 16.6% |

| India | 20.5 | 30.8 | 50.2% |

| South Korea | 29.2 | 25.7 | -12.0% |

| Spain | 24.8 | 25.7 | 3.6% |

| Singapore | 24.4 | 23.3 | -4.5% |

| United Arab Emirates (UAE) | 13.1 | 23.2 | 77.1% |

| Netherlands | 18.3 | 23.0 | 25.7% |

Source: UN Tourism, 2024

In 2024, Germany and the UK continued to spend more on outbound tourism, with German expenditure up 38% between January and July 2024, and UK expenditure up 40% between January and March 2024.

Outside the top 15, Switzerland, Belgium and Norway are the next most important European outbound tourism spenders, making them interesting European markets.

Tip:

- Monitor the tourism trends in your target markets. Google Trends and Looker Studio (previously Data Studio) have free online tools to help do this. Google Trends shows the popularity of top search queries in Google search. Looker Studio creates graphs, charts and tables to help visualise this data. CBI has created several Data Studio Dashboards to help you understand demand and recovery of the biggest outbound markets. Read the study How to forecast tourism demand with Google Trends and Data Studio for more information. You can also view the video How to use the dashboard for additional support.

2. Which European markets offer the most opportunities for tourism suppliers in developing countries?

The European markets that offer the most opportunities for tourism suppliers in developing countries are Germany, the UK, Italy, France, the Netherlands and Spain. They are the largest outbound overnight tourism markets from Europe. Please note that the UK figures in the chart below include overnight tourists and day visitors.

Sources: UN Tourism, 2024

Research conducted by CBI in 2022 indicated that these source markets have high numbers of travellers who go to developing countries. It is interesting to note that all these markets expressed increased intent to travel to developing countries, particularly the UK, Spain, Italy and France.

Table 3: Europeans’ travel plans, 2022

| Travel habits and plans | Germany | UK | Italy | France | Netherlands | Spain | ||

| Have travelled to developing countries | 9.4% | 14.2% | 8.8% | 11.8% | 13.1% | 14.3% | ||

| Plan to travel to developing countries | 19.0% | 24.7% | 21.7% | 21.7% | 19.5% | 23.2% | ||

Source: CBI, 2022

Germany

Germany has Europe’s largest population, with 84.4 million residents. It also has the continent’s largest economy, representing 17.4% of the European economy, the third largest in the world after the USA and China. However, the country is currently in recession as a result of current global trade challenges. It is expected to return to growth in 2025.

Generally, Germans enjoy a high standard of living. Like most of Europe, Germany was affected by high energy costs, rising inflation and high interest rates. These factors usually lead to low consumer confidence, which affects consumer spending. However, many Germans expected their personal attitudes to travel to remain the same or improve (71%), and 73% of the population planned to travel in 2024.

German outbound travel market

Germany is Europe’s largest outbound travel market. In 2022, German nationals made 86.6 million overnight trips. In the same year, the outbound tourism market was valued at $114.9 billion (USD), and it is projected to reach $292.8 billion by 2034. This represents a CAGR (compound annual growth rate) of 9.8% during this period.

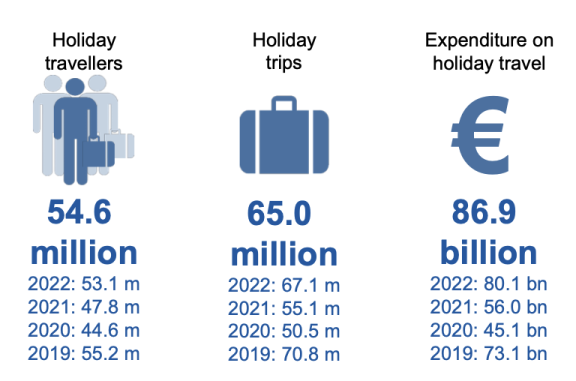

In 2023, Reise Analyse reported that German nationals took 65 million holiday trips of five or more nights. 78% of trips were to destinations abroad (50.7 million), a figure just below that of 2019. While the number of trips was slightly down on 2022, spending was at a record high. Germans spent €86.9 billion in 2023, €6.8 billion more than in 2022.

Figure 8: Volume and value of German holiday travel in 2022

Source: Reise Analyse, 2024

Germans travel to a variety of destinations, and the share of international travel is now the highest it has ever been (78%) compared to domestic travel (22%). Europe is the main destination (57%), while long haul destinations account for 9.3%, a 3.3% more than 2022. Turkey is the most popular. It accounted for 8.2% of all outbound trips in 2022.

Egypt, Mexico, Tunisia and South Africa are popular with German tourists, although there is still some way to go before German arrivals to these destinations recover, as can be seen in the table below. Other popular destinations include Morocco, Indonesia and Vietnam. German is still spoken in certain areas in Namibia, which adds to its appeal.

Table 4: Outbound arrivals of German nationals to developing countries, 2019 vs. 2022

| Country | Arrivals 2019 | Arrivals 2022 | % Change 2019 vs. 2022 |

| Turkey | 4,992,815 | 5,580,541 | 11.8% |

| Egypt | 1,729,051 | 1,302,240 | -24.7% |

| Mexico | 286,331 | 247,595 | -13.5% |

| Tunisia | 275,872 | 187,880 | -31.9% |

| South Africa | 322,720 | 173,146 | -46.3% |

| Morocco | 413,384 | 171,219 | -58.6% |

| Indonesia | 277,653 | 128,634 | -53.7% |

| Vietnam | 226,792 | 83,598 | -63.1% |

| Costa Rica | 80,580 | 79,701 | -1.1% |

| Namibia | 97,111 | 62,691 | -35.4% |

| Colombia | 77,161 | 57,091 | -26% |

| Sri Lanka | 129,345 | 55,542 | -57.1% |

Source: UN Tourism, 2024

German travel trade

The German travel trade market is mature. It is comprised of three main segments:

- Service providers: hotels, airlines, railways, car rental companies and long-distance coaches

- Travel agencies and tour operators

- Online travel agents (OTAs)

There are around 2,300 tour operators on the German market and 9,000 travel agencies. A few operators control around 50% of the market, including TUI, a leading European travel agency, and DER Touristik. However, in recent years, two major German brands, Thomas Cook and the FTI Group, went into administration. GetYourGuide is Germany’s best known OTA, and it has a strong presence in the European market.

Figure 9: Top 10 tour operators in Germany, 2022–2023

Source: FVW Travel Talk, 2024

To identify tour operators and travel agents on the German market, look at this listing, which is segmented by holiday type.

Germany is home to the largest travel trade show in the world, ITB Berlin. It is hosted every March. In 2024, it attracted 100,000 attendees and 5,600 exhibitors from 190 countries. It also hosts regional shows, like ITB Asia, ITB China and ITB India.

German travel behaviour

Germans now stay longer and spend more when they travel. Reise Analyse reported that the average length of stays in 2023 rose to 13.1 days, up from both 2022 (12.6 days) and 2019 (12.4 days). The average amount spent per trip also increased from € €1,194 in 2022 to €1,337 in 2023.

A breakdown of expenditure found that Germans spend more than a third of their budgets on accommodation (35.6%), more than the other source markets. This was followed by flights and other transport (23.9%). Activities account for 12.8% of German budgets, more than all other source markets except France.

Source: CBI, 2022

Online sales channels have become more important in the German market. In 2023, 51.3% made bookings online, in line with current trends. At the same time, face-to-face bookings remained at similar levels to 2022 (37.2%).

German characteristics and travel motivations

Germans are particularly motivated by nature. They enjoy beautiful scenery and wildlife. Going to the beach is a particular favourite. They want to be active as well, with walking and cycling being important activities. Culture is also important. Visiting cities, shopping and enjoying local food and drink are all key activities.

Like many Europeans, sustainability is important in this market, and Germans like to minimise their impact on destinations when they travel. Research conducted by the EU in 2021 found that among German tourists:

- 54% would choose to consume locally-sourced products while on holiday.

- 47% would be prepared to pay to protect the natural environment.

- 45% planned to reduce waste while on holiday.

- 43% would travel to less-visited destinations.

United Kingdom

The UK has a large population of 67.6 million and the second largest economy in Europe. The economy is largely service driven, so it contracted more severely during the COVID-19 pandemic. Growth was slow during 2022, and a recession followed at the end of 2023. The economy grew again in the first half of 2024. Inflation and interest rates are still higher than many other European nations. This directly contributes to the current cost-of-living crisis, which, in turn, negatively affects consumer confidence.

British outbound travel market

The UK is the second largest outbound tourism market in Europe. In 2023, British nationals took 86.2 million trips, 93% of those taken in 2019. However, British tourists spent £72,436 billion in 2023, an increase of 23.7% compared to 2019.

Outbound tourism has good prospects despite economic difficulties. The outbound travel market was estimated to be worth $90.46 billion (USD) in 2024. It is projected to reach $206.43 billion by 2034, growing at a CAGR of 8.6%. However, continued economic uncertainties may affect tourism’s recovery. Affordability is now a major factor for British tourists when deciding where to go on holiday.

Britons travel to a diverse range of countries. They have the highest preference for developing destinations of all the key source markets. Turkey has been the most popular long-haul destination for British tourists for many years, followed by India. India and many African countries, like Kenya and Tanzania, are traditionally popular destinations for UK nationals owing to historic ties.

The table below shows that arrivals to developing destinations are beginning to recover. Arrivals to Turkey, India and Morocco in 2023 surpassed those in 2019, which is a positive reflection on the status of overseas tourism from the UK.

Table 5: Outbound arrivals of British nationals to developing countries, 2022–2023

| Country | Arrivals 2019 | Arrivals 2023 | % Change 2019 vs. 2023 |

| Turkey | 2,288,000 | 3,204,000 | 40% |

| India | 1,606,000 | 1,942,000 | 20.9% |

| United Arab Emirates | 1,293,000 | 1,305,000 | 0.9% |

| Morocco | 808,000 | 951,000 | 17.7% |

| Pakistan | 768,000 | 641,000 | -16.5% |

| Mexico | 685,000 | 538,000 | -21.5% |

| Thailand | 520,000 | 506,000 | -2.7% |

| Australia | 550,000 | 418,000 | -24% |

| Other China | 645,000 | 416,000 | -35.5% |

| South Africa | 487,000 | 377,000 | -22.6% |

| Nigeria | 265,000 | 332,000 | 25.3% |

| Hong Kong (China) | 342,000 | 331,000 | -3.2% |

| Egypt | 171,000 | 249,000 | 45.6% |

Source: ONS, 2024

British Travel Trade

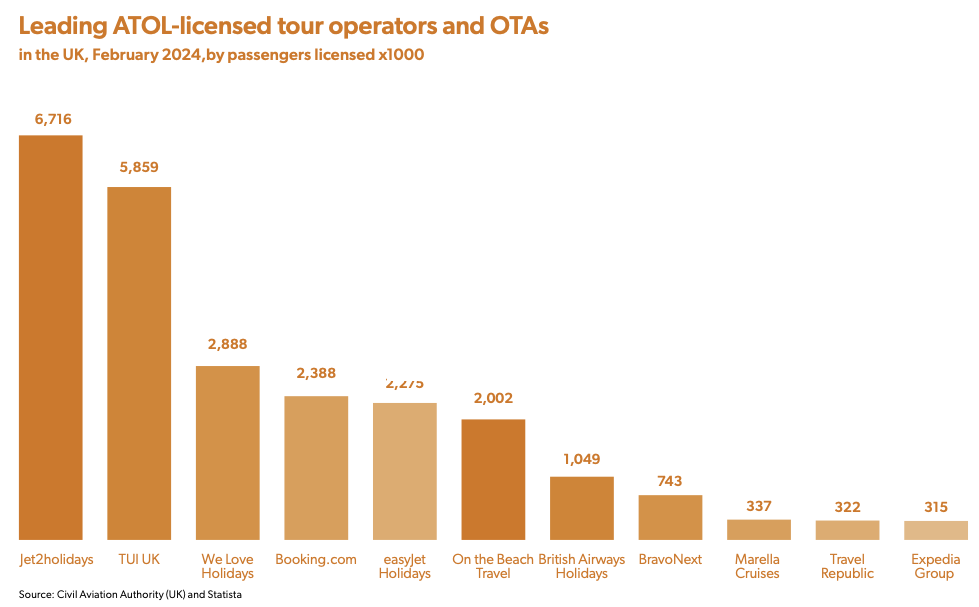

There are an estimated 8,350 travel agents, tour operators and other travel reservation services in the UK. It is estimated the revenue of the industry will increase to £44.4 billion in 2024, just below the pre-pandemic level of £46 billion. Leading tour operators include Jet2holidays, loveholidays and On the Beach Travel. Most UK tour operators and travel agents are members of the ATOL scheme (Air Travel Organisers’ Licensing), which provides financial protection to British consumers who book package holidays. Use the ABTA member search listing to find UK tour operators or use internet listings, like this one from TourRadar.

Figure 11: Leading tour operators and OTAs in the UK

Source: Netherlands Board of Tourism & Conventions, Trade Scan UK, 2024

The market of tour operators in the UK that specialise in holidays to developing countries is large. They have a global reach. This means their customer base extends beyond the UK to Europe and North America. Many specialise in ‘adventure travel’ and travel all over the world. Others specialise in specific regions, like Africa or Asia. Others specialise in certain activities, like cycling or hiking. Some focus on luxury, budget or solo travel. Examples include Explore UK, KE Adventure Travel, Intrepid Travel, World Expeditions and Kuoni.

There are several travel trade shows hosted in the UK. World Travel Market (WTM) is a global B2B (business to business) trade show that hosts more than 40,000 professionals from 184 countries every year. It is a good way to network with other businesses. It is held every November. There are regional WTM shows in the Middle East, Latin America and Africa.

Destinations is a holiday and travel show for consumers. It focuses on international destinations. LATA Expo and Experience Africa aim to link buyers from the UK and Europe with suppliers from each continent.

British travel behaviour

In 2023, British tourists stayed for an average 8.5 nights while on holiday, 6.6 nights on business trips and 15.9 nights when visiting friends or relatives. In 2023, average expenditure rose to £894 per holiday trip and £1,037 per business trip. This is an increase of 21% and 49%, respectively, on 2019. These increases could be due in part to the cost of living increases. However, they may be a result of pent-up demand for travel experiences.

British tourists allocate almost a third of their travel budget to flights and transport, 28.3% on accommodation and 19.8% on food and drink. British people spend the least on accommodation of the source markets.

Source: CBI, 2022

OTAs were the preferred booking channels for British tourists (39%), followed by separate bookings for accommodation and flights (26%). Tour operator bookings accounted for 16%.

British characteristics and travel motivations

Travel is important to UK nationals, and they are experienced overseas tourists. Travel enables them to recharge, escape their routines and discover new experiences. While they like immersive experiences at destinations, hygiene, accessibility, convenience and safety are still important. British tourists like to take part in activities, which are vital to their final decisions. Value for money is also key for British tourists; they want cost-effective tours and experiences.

A 2024 survey about preferred holiday types found that summer beach holidays were the most popular (42%), multi-destination trips were popular for 17%, and 13% wanted their holiday to be activity-oriented.

British tourists are sustainably-minded. In a 2022 survey, 86% of British respondents stated that sustainability was important to them. Other research revealed that 32% of British travellers planned to avoid flying altogether on account of environmental concerns, and 62% would take more sustainable forms of transport if it was cheaper. 59% avoid busy destinations and are more interested in travelling to less-well known places.

France

France has a population of 66.5 million. French nationals enjoy a high standard of living and higher wages than the rest of Europe. Its economy is the third largest in Europe. Like the rest of Europe, French nationals are also affected by the cost-of-living crisis and high inflation. Economic growth was expected to be slow in 2024 (0.7%), and growth in 2025 is forecast to be 1.3%.

French outbound travel market

French people made 28 million trips in 2022, 92% of 2019. The outbound travel market was estimated to be worth $37 million (USD) in 2024 and projected to reach $56.8 million by 2034. This represents a CAGR of 4.4%.

Outside of Europe, Africa is a popular destination for French nationals. In 2022, Morocco was the most popular destination, alongside Tunisia and Egypt. Morocco and Tunisia are popular owing to historical ties and the French language. The table below shows that French tourism to most developing destinations has some way to go to reach 2019 levels, except for Turkey.

Table 6: Trips abroad by French nationals to developing countries, 2019–2021

| Country | 2019 | 2022 | % Change 2019 vs. 2022 |

| Morocco | 1,990,813 | 1,505,443 | -24.4% |

| Turkey | 862,134 | 964,777 | 11.9% |

| Tunisia | 890,455 | 841,693 | -5.5% |

| Egypt | 298,812 | 310,126 | 3.8% |

| Mexico | 305,384 | 294,649 | -3.5% |

| Indonesia | 283,814 | 134,541 | -52.6% |

| Lebanon | 181,127 | 132,746 | -26.7% |

| Vietnam | 287,655 | 81,575 | -71.6% |

| South Africa | 165,038 | 76,077 | -53.9% |

| Colombia | 86,657 | 66,226 | -23.6% |

| Costa Rica | 77,013 | 65,411 | -15.1% |

Source: UN Tourism, 2024

Countries with a history of speaking French are also popular options for outbound French tourists. France is the most significant source market for West Africa as a region according to UN Tourism data. In 2017, 32.1% of all tourist arrivals to Senegal were from France. Madagascar was also an important destination with 115,115 French visitors in 2019; however, there were just over 5,000 French arrivals in 2021.

French travel trade

The French travel trade is large and complex. All businesses that provide travel services must be registered with Atout France, a French tourism development agency. There are 3,427 tour operators and travel agencies in France. More than a quarter of tourism businesses are in Paris. The largest travel agents are TUI France and the Karavel Groupe, which has several brands.

Tour operators include Voyageurs du Monde, Havas Voyages, Voyages d’Exception and Continents Insolites. They travel to many destinations worldwide. You can find online listings of French tour operators, like this one on Europages. You can use this site to find tour operators in other source countries too. You can find information about the tour operator market through the French tour operator association, SETO.

France hosts several travel trade fairs every year, including IFTM Top Resa for the international and French markets. The ILTM is aimed at international and French luxury travel suppliers and buyers.

French travel behaviour

The average length of an outbound travel trip fell to 7.63 days in 2022 from 8.45 days in 2019. Flights and transport (30.2%) account for the largest expenditure, followed by accommodation (29.5%). French tourists also spend 19.4% of their budgets on food and drink and 13.1% on activities, the highest of the source markets.

Source: CBI, 2022

French tourists often plan their trips around six months in advance, depending on the destination. They value recommendations from friends and relatives (54%) and use websites to collect reviews and ratings from other tourists (29%). They are also keen users of traditional guidebooks alongside social media platforms. Generally, French tourists prefer to book with airlines and hotels directly (28%) and other online platforms (22%). If possible, they will use personal connections to book through a trusted source (26%).

French characteristics and travel motivations

French tourists value the natural environment and off-the-beaten-track destinations are becoming more popular. Culture is very important to them, as are sites of religious importance.

They are known for being independent. Many French tourists like to make their own decisions and prefer to travel solo. They are more formal and demanding of respect. They tend to speak less English than other nations – if you can speak French, it will be appreciated. Reassurance about health and safety precautions are important for French holiday choices and decision-making.

As a nation, France is concerned with sustainability. French tourists are more likely to pay more for sustainable travel and accommodation than other Europeans. According to EU research, almost half of French people (48%) feel that sustainably certified accommodation is important. Individually, French tourists travel less but stay longer. They may make different travel choices, for instance take the train instead of flying. French tourists like to:

- Eat locally source products while on holiday (52%)

- Take steps to reduce waste while on holiday (45%)

- Know that more of their money directly benefits local communities (39%)

- Take holidays outside of the main tourist season (39%)

Italy

Italy has a population of 59.3 million. Its economy is the eighth largest in the world. Economic growth slowed to 0.9% in 2023 and was expected to remain at 0.9% in 2024. Most people in Italy are well-educated and enjoy a high standard of living. They tend to speak English to a good level but appreciate information being available in Italian.

Italian outbound travel market

Italian tourists made 25 million outbound trips in 2022; around 72% of 2019’s levels. Recovery of travel to destinations beyond Europe has been slower than other countries, although travel to Europe in 2023 and 2024 was strong.

Despite this, according to the Banco d’Italia, outbound tourists spent €32 billion in 2023, exceeding 2019 expenditure by 18.1%.

Domestic travel is very popular in Italy; outbound travel accounts for 24% of tourism departures. Egypt, Turkey and Morocco are the most popular outbound developing country destinations.

Table 7: Trips abroad by Italian nationals to developing countries, 2019–2021

| Country | 2019 | 2022 | % Change 2019 vs. 2022 |

| Egypt | 619,425 | 528,269 | -14.7% |

| Turkey | 361,498 | 369,714 | 2.3% |

| Morocco | 351,916 | 239,879 | -31.8% |

| Mexico | 163,885 | 122,634 | -25.2% |

| Tunisia | 124,060 | 104,741 | -15.6% |

| Indonesia | 91,229 | 47,415 | -48.0% |

| Colombia | 42,542 | 37,343 | -12.2% |

| South Africa | 64,764 | 32,357 | -50.0% |

Source: UN Tourism, 2024

Other popular Italian tourist destinations before the pandemic included Madagascar, Indonesia, Jordan, Vietnam and South Africa. Arrivals to Madagascar in 2019 were almost 100,000, making it a leading destination. However, in 2022 there were only 124 arrivals.

Italian travel trade

The Italian travel trade is very fragmented, and there are around 12,000 tourism companies. Rome is home to most, followed by Milan and Naples. OTAs are well established in the market, and Italian consumers are particularly heavy users of Booking.com, Expedia, Lastminute.com and eDreams. The largest tour operator in Italy is Alpitour, which has a turnover six times larger than the next biggest player, Gattinoni. Examples of tour operators that specialise in travel to developing destinations include The Labyrinth, Yana Viaggi and Viaggi Solidali.

The Italian Federturismo Confindustria represents tourism businesses, and you can find members in its listing here.

BIT Milan is the largest B2B travel trade show in Italy, which boasts more than 2,000 exhibitors and 50,000 visitors.

To find out more about the Italian travel trade and how to work with Italian tour operators, download Visit Britain’s Italy Market Profile.

Italian travel behaviour

The average length of stay was 9.63 nights in 2022, longer than in 2019 (8.28 nights). Average spend per night in 2022 rose to €103.6, which was an increase of 7.6% from 2019.

Italians spend most of their travel budget on accommodation and flights (30.6% and 27.1%, respectively). Around 12.8% of their budgets goes to activities. This is the highest amongst the source markets alongside France and Germany.

Source: CBI, 2022

Italian tourists like to book trips well in advance, sometimes up to 11 months. They value recommendations from friends and family (52%) and use review sites extensively (41%). They like to do a lot of online research before making decisions. They prefer to book travel arrangements themselves, using online platforms more than other European countries. They are also less likely to book package holidays.

Italian characteristics and travel motivations

Italians look for active and cultural trips and travel for personal discovery rather than just relaxation. They like the natural environment and enjoy natural attractions and wildlife experiences. They are also very outgoing and like to eat out and socialise.

The typical Italian tourist has at least one of the following characteristics:

- Older, wealthier Italians travel at any time of the year

- Italians like guided tours with Italian-speaking guides

- Security, high-quality accommodation and good food are important to them

- More than 25% of Italians like to travel outside of high tourist season

Italians are less sustainably minded than other European nations when they travel. However, as a nation of ‘foodies’, they are keen to consume locally-sourced produce while on holiday (42%). They also prefer to travel outside of high season (27%). This creates good opportunities to attract Italians in low and shoulder seasons.

Netherlands

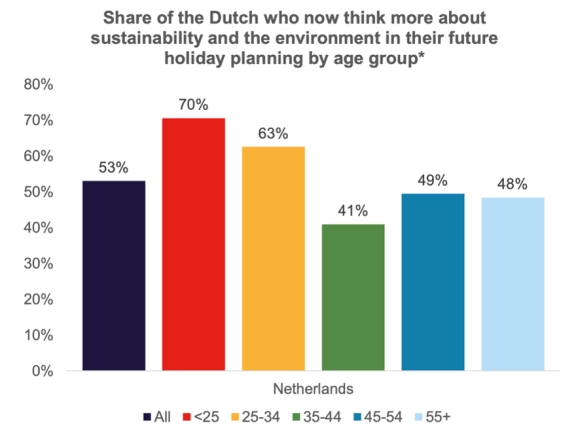

The Netherlands is a small country but is densely populated with 18.2 million people. It is a wealthy, highly developed nation, and its population is well-educated. The Dutch economy contracted in 2023 and growth in 2024 reached 0.8% in Q2. As a nation, the Dutch are highly environmentally aware, and adopting sustainable principles is more common in the Netherlands than many other European countries.

Dutch outbound travel market

Travel is extremely important to Dutch nationals; 85% of the population take tourism trips for personal reasons. In 2022, they took 23.1 million outbound trips, 5% more than in 2019. They are also big spenders on outbound tourism, which increased by 25.7% in 2023 compared to 2019.

Turkey was the most popular destination for Dutch tourists in 2022, and arrivals increased by 11%. Morocco and Mexico were also popular destinations for Dutch tourists. Other notable destinations for Dutch tourists both before and after the COVID-19 pandemic include Malaysia, Vietnam, India and Colombia.

Table 8: Trips abroad by Dutch nationals to developing countries, 2019–2022

| Country | 2019 | 2022 | % change 2019 vs. 2022 |

| Turkey | 1,101,270 | 1,223,868 | 11% |

| Egypt | 218,527 | 184,846 | -15% |

| Morocco | 241,065 | 129,922 | -46% |

| Indonesia | 215,287 | 115,052 | -47% |

| Mexico | 91,974 | 110,310 | 20% |

| South Africa | 144,071 | 90,289 | -37% |

| Colombia | 64,503 | 60,306 | -7% |

| Costa Rica | 34,712 | 34,518 | -1% |

Source: UN Tourism, 2024

Dutch travel trade

The Dutch travel trade is comprised of both travel agents and tour operators. The largest include TUI Nederland, Corendon and Sunweb. There are also many adventure tour operators that attract large Dutch adventure tourist market, including Vamonos and SNP Natuureizen. ANVR is the Dutch association of travel agents and tour operators. Online listings are useful to find tour operators and travel agents, like this one from Tripcook.

Vakantiebeurs is a major tourism and leisure fair held in Utrecht every year, and it is part of Dutch Travel Week. It is both B2B and B2C (business to consumer).

Dutch travel behaviour

According to Eurostat, the average stay length for Dutch trips abroad was 10.2 nights. They spent an average of €790 per trip. Dutch tourists are price conscious and look for good value. Like other European markets, most of the travel budget is spent on accommodation (30.2%), and flights and transport (28.2%). Dutch tourists also spend relatively more of their budget on food and drink (22.2%).

Source: CBI, 2022

When planning trips, Dutch people rely heavily on word of mouth recommendations from friends, colleagues and relatives (53%), and they use their personal experiences to help shape their decisions (40%). As tech-savvy consumers, Dutch tourists also use websites to collect customer reviews and ratings, like Tripadvisor, to gather information.

Dutch characteristics and travel motivations

Nature and culture are important to Dutch tourists. They are an adventurous market but look for destinations that are less crowded with sustainability credentials. Authentic experiences and value for money are also important to them. They prize relaxation and the opportunity to get away from the stresses of everyday life.

Many Dutch people speak multiple languages to a good level, particularly English. They are interested in other cultures and are careful with their money. They are direct and straightforward. Dutch tourists are well-organised when it comes to planning their holidays, often researching trips up to six months in advance. They are very comfortable using the internet to book their trips; few Dutch tourists use traditional travel agents to book their trips these days.

Dutch people are very concerned about the environment and like to travel sustainably. The younger age groups show the strongest intention to change their behaviour during travel. Actions include using forms of transport other than flying and minimising their use of plastic to help the environment. More Dutch people are becoming vegetarians (11% of the population), particularly the younger generation aged 18–24. Destinations with good vegetarian cuisines will be popular choices for conscious consumers.

Figure 16: Importance of sustainability to the Dutch

Source: Visit Britain

Additional EU research found that Dutch tourists like to take practical action to travel sustainably, and that they aim to:

- Take holidays outside of the high tourist season (45%)

- Eat locally-sourced products on holiday (44%)

- Reduce waste while on holiday (44%)

- Travel to less visited destinations (43%)

Spain

Spain has a large population (48.8 million people) and a well-diversified and resilient economy. It has the fourth largest economy in the EU, which is expected to grow by 2.1% in 2024 and by 1.9% in 2025. However, like other European consumers, Spanish tourists look for good value experiences as the cost of living continues to determine spending.

Spanish outbound travel market

Spanish tourists made 15.7 million trips in 2022, representing 79% of 2019’s levels. In 2023, expenditure on outbound tourism increased by 23.6% to €25.7 billion.

Spanish speaking countries, like Mexico, Colombia, Costa Rica and Chile, are popular outbound destinations for Spanish tourists. However, arrivals to these places are still below 2019. Arrivals to Morocco, Turkey and Egypt increased in 2022, most likely as they are most convenient.

Table 9: Trips abroad by Spanish nationals to developing countries, 2019–2022

| Country | 2019 | 2022 | % change 2019 vs. 2022 |

| Morocco | 880,818 | 901,672 | 2.4% |

| Mexico | 391,738 | 366,076 | -6.6% |

| Turkey | 230,153 | 264,486 | 14.9% |

| Egypt | 101,723 | 185,107 | 82.0% |

| Colombia | 129,263 | 121,347 | -6.1% |

| Costa Rica | 69,745 | 58,367 | -16.3% |

| Indonesia | 83,373 | 51,563 | -38.2% |

| Chile | 86,681 | 41,832 | -51.7% |

Source: UN Tourism, 2024

Other destinations that appeal to Spanish tourists include Vietnam, South Africa and Tunisia.

Spanish travel trade

The Spanish travel trade is comprised of ‘mayoristas’ (tour operators), ‘mayoristas-minoritas’ (tour operators/retailers) and ‘minoristas’ (retail travel agents). 20% of them are based in Madrid, and there were around 9,700 businesses in 2020. Personal relationships are very important to Spanish business people, and they take time to develop.

The largest tour operators in Spain are Travelplan, Tourmundial and Catai Tours. You can find out more about the Spanish travel trade in this Trade Market Profile. CEAV is the Spanish federation of tour operators and travel agents, and they feature a useful members’ list on their website.

FITUR (Feria Internacional de Turismo) is the leading international tourism fair in Spain, aimed at both B2B and B2C.

Spanish travel behaviour

The average stay length in 2022 was 8.5 days. However, expenditure per day fell to $112.9 (USD) from $123.9 in 2019.

Spanish tourists spend about half their travel budget on accommodation (30.3%), and flights and transport (27.5%), in line with other European nations. However, they spend more than one fifth of their budgets on food and drink (20.5%), more than other source nations.

Source: CBI, 2022

Spanish tourists value recommendations from friends and relatives. They use a variety of online websites to book their trips, including OTAs (online travel agents). Cultural offerings are the most important factor to them, closely followed by nature and price.

Spanish tourists largely make their bookings online, and they typically plan their trips abroad one to six months in advance, depending on the destination.

Spanish travel motivations

Beach destinations are the most popular (37%), followed by rural/nature destinations (17%). They are also keen on taking part in religious activities, most likely because many Spanish people are largely Catholic and take part in religious festivals and ceremonies. Food and drink experiences, CBT and ecotourism are also growing in popularity. Other trends following the COVID-19 pandemic include taking large trips and nomadic travel.

When choosing destinations, cultural offerings are the most important factor that Spanish tourists consider (44%), along with the natural environment (43%).

Spanish tourists are among the most sustainably minded when they travel. They like to:

- Consume locally-sourced products while on holiday (71%)

- Reduce waste while on holiday (68%)

- Take holidays outside of the high tourist season (53%)

- Travel to less-visited destinations (52%)

- Reduce water usage while on holiday (52%)

- Contribute to carbon-offsetting activities (52%)

Tips:

- Do research to find out more about European markets. Many countries’ tourism organisations publish market profiles and consumer insights, like Visit Britain, South Africa and Australia. Although the focus is on inbound markets, they can give you valuable information about tourists’ characteristics and motivations.

- Look out for tourism research published by the EU, such as the Eurobarometer series of European public opinion surveys. The Flash Eurobarometer 499 – Attitudes of Europeans towards tourism was published in 2021.

- To keep up with statistics, consult UN Tourism and Eurostat’s tourism database. UN Tourism has a tourism dashboard for statistics, but you will have to pay for the e-library for more detailed data. Eurostat publishes many statistics freely.

- Find buyers on the European market using the CBI study Tips for finding buyers on the European tourism market to help you.

3. Which tourism products from developing countries are most in demand from European markets?

The tourism products from developing countries most in demand from European markets are closely aligned with the adventure tourism segment. Adventure tourism is defined as a tourism trip that includes at least two of the following three elements: a physical activity, the natural environment and cultural immersion. Developing countries offer some of the world’s most exciting adventure tourism opportunities.

The top tourism products for European tourists are cultural tourism, wellness, food tourism, nature and ecotourism, and community-based tourism (CBT).

Cultural tourism

Cultural tourism involves travel to experience and learn about the culture of a country or region. It includes tangible features (built heritage) and intangible features of a destination’s history and heritage, such as music, local lifestyles, homestays and the arts.

It is possibly the largest tourism niche in the world today. It crosses over with many other niches, like CBT, visiting cities, religious tourism and food tourism. The market for European cultural tourists is also large, estimated to account for 40% of all European tourism. Tourists from Italy, France and the Netherlands are the most interested in cultural tourism. Germany has the largest market of European cultural tourists.

Cultural tourists have specific characteristics. They are typically well-educated, tech-savvy, affluent, active and frequent travellers. They also tend to stay longer in destinations and spend more per day. They look for personal interactions with local host communities.

Figure 18: Cultural tourism at the Taj Mahal, India

Source: AussieActive, Unsplash, 2024

The market for European buyers is large. Most European tour operators offer cultural tourism opportunities, including Window to Travel and Nomade Aventure. Specialist cultural tour operators include Martin Randall (art, architecture and gastronomy) and Envoy Tours (cultural specialists for Armenia and Georgia). Online travel agents (OTAs) sell many cultural tours, including sightseeing tours, private guides, cooking classes and skip-the-line tickets to major attractions. Withlocals and Viator are two major OTAs.

Tip:

- Find out how to attract the European market in the CBI study What are the opportunities on the European cultural tourism market.

Wellness Tourism

Wellness tourism refers to wellness activities undertaken whilst on a leisure trip. Globally, people are now more interested in their health and look to stay fit, both physically and mentally. Wellness encompasses many traditional activities, including yoga, meditation, spa treatments, hot springs tourism, eating healthily and maintaining fitness. ‘Feel good’ activities like CBT, walking, cycling and swimming are also considered to be part of wellness, so its remit is very broad.

The European market for wellness is the largest in the world alongside North America’s. Wellness tourists are either primary wellness tourists or secondary wellness tourists. Primary wellness tourists usually stay in all-inclusive wellness resorts that focus on a whole package of wellness.

Secondary wellness tourists are a much larger group, accounting for almost 90% of wellness trips. They take part in wellness activities as part of wider trips and are more interested in the cultural link between a destination and the wellness remedies special to it. This group offers the best opportunities to local tour operators.

Germany, the UK and France are the most important source markets for wellness tourism. The Netherlands, Spain and Italy are also important. Germans are experienced wellness travellers, and spending time in nature is important to them. The UK market focuses on mental wellness and tourists often choose yoga and meditation retreats.

There are many specialist wellness tourism providers on the European market, such as Healing Holidays and Wellnessurlaub. OTA platforms like GetYourGuide and Musement offer wellness trips, tours and experiences. Supplying wellness products to Europeans demands adhering to strict regulations on health, safety, cleanliness and qualifications. These are key to keep wellness tourists safe and create confidence in local operators’ abilities and professionalism.

Tip:

- Discover more about the European wellness tourism market in the CBI study What are the opportunities on the European wellness tourism market.

Food tourism

Food tourism is a very large tourism niche that has become more popular amongst outbound tourists. It is diverse, and there are many activities, such as food festivals, food museums, cooking classes, wine trails and artisan producer visits.

Europeans that want immersive and authentic experiences often choose food experiences. Showcasing local cuisines provides lots of opportunities for local operators to develop unique food tourism products. It can also help stimulate year-round tourism for tourists that travel outside of high season. The European market is estimated to account for 35% of the food tourism niche. Tourists from Spain have the greatest propensity for food tourism (31%), followed by Italy (22%), France (20%) and Germany (18%).

Figure 19: Street markets are popular food tourism experiences

Source: Lisheng Chang, Unsplash, 2017

The European market of buyers is a mix of tour operators for longer trips and OTAs for short food experiences. Tour operators usually include food experiences within broader trips. Look at Original Travel and Essential Escapes for examples. There are fewer specialist food tour operators, although Gourmet on Tour is one. For short experiences, OTAs are the most common platforms. These include specialist platforms like Traveling Spoon and Eatwith, and larger activity-based OTAs like Viator.

Tip:

- You can find out more about the food tourism niche market in the CBI study What are the opportunities on the European food tourism market.

Nature and ecotourism

Nature and ecotourism are closely related. Both involve travel to enjoy natural areas and environmentally friendly experiences that are sustainable, low impact and help to protect the natural environment over the long term. Demand for authentic and immersive experiences in natural surroundings is particularly high on the European market.

Germany has the largest market for nature tourists, followed by France and the Netherlands. Ecotourists are often prepared to pay more for experiences if they are meaningful and immersive.

European tour operators usually offer a range of different experiences in nature packages, including trekking, cycling, wildlife safaris and bird watching. Ecotourism experiences are often included in a nature package, but they can be sourced directly, like ecolodges in rainforest destinations. Examples of European tour operators that specialise in nature and ecotourism include Better Places, Far and Wild Travel and ASI Reisen.

Tip:

- Research the nature and ecotourism market. Download the CBI studies What are the opportunities in the European market for nature tourism and What are the opportunities in the European market for ecotourism.

Community-based tourism (CBT)

CBT involves community-led tourism experiences in which communities own, host and manage tourism programmes. Local communities benefit through economic empowerment and skills development. CBT programmes inspire tourists and promote cross-cultural understanding. CBT is a very popular tourism activity today, particularly amongst Europeans motivated by authentic and immersive experiences.

Sustainability is an essential part of CBT. Local tour operators that sell CBT must develop sustainable products. Some European tour operators will only work with suppliers that are sustainably certified. There are many sustainability certification schemes on the market today, including Travelife for Tour Operators, the Good Travel Seal and TourCert, which are the best known by European buyers.

CBT offers particularly good opportunities for small communities to enter the tourism market. There are leaders in CBT provision, like Costa Rica, Vietnam and India, which have promoted CBT for many years. There are emerging destinations too, like Colombia, which offers CBT through helping remote communities become economically self-sufficient and promoting peacebuilding.

Figure 20: A community homestay in rural Colombia

Source: Acorn Tourism Consulting, 2023

European CBT tourists are motivated by the ‘feel good factor’ of immersive, cultural experiences and want to ‘make a difference’ to local lives. CBT tourists can be found in all age and consumer groups. Some like to travel independently as FITs (fully independent travellers) and book directly with communities or OTAs. Tourists from Spain have the highest preference for CBT, followed by the UK, France and the Netherlands.

European tour operators usually sell CBT as part of wider adventure packages, either scheduled or tailor-made tours. They often work with local CBT organisations in the destination. The UK has the largest market for operators that specialise in cultural and adventure trips, such as Culture Contact and Nomadic Tribe. OTAs are major platforms for CBT, and local providers can list their products directly on the platforms. Examples include Earth Changers and Like Local.

Tip:

- Find out more about CBT in the study What are the opportunities for community-based tourism from Europe.

Other interesting niches to be aware of

Other interesting niches for Europeans include agritourism, volunteering and educational tourism, sun and beach, honeymoons, wildlife watching and urban experiences.

Business tourism is also an interesting sector. Many business tourists include leisure in business trips. This phenomenon is known as ‘bleisure’. Other groups travel for leisure and do business at the same time, staying in a single place for longer. This group includes digital nomads, and it has similar communication needs so it can do business efficiently.

To find out more about trends in the tourism industry, read the CBI report Which trends offer opportunities or pose threats on the European market.

You can also read about other niche market segments and target groups on the CBI website.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research