Entering the Scandinavia market for apparel

Scandinavian countries are renowned for the high quality and practical designs of their apparel products. End consumers in Denmark, Sweden and Norway appreciate quality and durability. This is not just to minimise environmental impact but also to meet the high expectations of consumers engaging in activities like hiking, skiing, and other sports. From a young age, Swedes, Norwegians, and Danes are encouraged to connect with nature, embracing the concept of ‘friluftsliv’, or ‘open-air living’, which is central to Scandinavian culture.

Contents of this page

Moderation is another core value in Scandinavian culture. The Swedish word ‘lagom’ means ‘just the right amount’ or ‘in balance.’ This principle can be seen in Sweden’s relatively low clothing consumption rate, which is in contrast with the fast-fashion culture seen in other European markets. Note that some of the biggest European apparel retailers are headquartered in Scandinavia, including H&M (Sweden), Bestseller Group (Denmark), and Varner Group (Norway). These companies follow the consumer preferences of the many markets they service.

Figure 1: Scandinavia has a relatively cold climate with fluctuating temperatures. As Scandinavians are known for their appreciation of the outdoors, outerwear in functional designs is a popular apparel category

Source: Photo by Ferhat Deniz Fors on Unsplash

1. What requirements and certifications must apparel meet to be allowed in the Scandinavian market?

You need to comply with several requirements when exporting apparel to Scandinavia. These include legal requirements, based on European Union (EU) laws and regulations, as well as national laws and regulations. Note that Norway is not an EU member, but still enforces EU regulations (including REACH) through its membership of the European Economic Area (EEA). Some requirements are not prescribed by law, but are expected by buyers. Other requirements are voluntary but meeting them can give you a competitive advantage.

What are mandatory requirements?

There are many legal requirements for exporting apparel to Europe, including EU regulations concerning product safety, the use of chemicals (REACH), quality and labelling. Children’s wear has special EU consumer safety requirements (see below). Check the EU Access2Markets online helpdesk for an overview.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dye, flame retardants, waterproofing and stain-repelling chemicals and nickel. Test input materials before production to prevent non-compliance;

- Pay special attention to the following safety standard that applies to apparel for children: EN 14682 (contains requirements to ensure that cords and drawstrings are placed safely on apparel for children aged up to 14 years);

- Specify the material composition of every apparel item that you export to the EU, in line with Regulation (EU) 1007/2011;

- Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate a property right.

National regulations

Concerning chemicals in textiles, Norway has specific regulations for the use of formaldehyde, and Denmark has specific regulations for Pentachlorophenol (PCP). Sweden introduced an Extended Producer Responsibility (EPR) law in 2022, forcing apparel companies to collect and recycle garments. This country also has a lower VAT on repair services for textile products to promote reuse. In Norway a Transparency Act came into effect in 2021 to ensure human rights and decent working conditions in business operations, requiring companies to conduct regular due diligence assessments and report publicly.

Note that many Scandinavian apparel brands and retailers sell in other European markets too. This is true for multinationals such as H&M (Sweden), Bestseller Group (Denmark), and Varner Group (Norway), but it also applies to smaller Scandinavian brands that are popular outside of Scandinavia. These apparel companies need to comply with the national laws and regulations that apply in the markets to which they export.

Tips:

- Read the CBI study on buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of apparel to Europe, including Scandinavia.

- Check the EU Access2Markets online help desk for an overview of all legal requirements for your product that apply in the EU.

- Check the Norwegian Customs Authority website for more information on exporting apparel to Norway.

What additional requirements and certifications do buyers often have?

Scandinavian buyers may confront you with additional, company-specific terms and conditions. Such requirements are usually written down in a buyer manual. By signing a contract, you confirm that you will comply with all the requirements listed in the manual. You will be held accountable in case of a problem after the delivery of an order. If a buyer does not have a manual, make sure all terms and conditions are clear and agreed beforehand to avoid unpleasant surprises. The following topics may be included in a buyer manual.

Payment terms

For first-time orders, Scandinavian buyers may give you a down payment via bank transfer (for instance 30%). They will pay the rest (70%) after the order has been completed, again via bank transfer. Buyers may also give you a bank guarantee. This statement guarantees that the sum will be paid at a certain date.

Another payment method is the L/C (Letter of Credit). With an L/C the buyer’s bank must pay the supplier when both parties meet the conditions they have agreed upon. This is the safest payment method for a manufacturer. An L/C can also be used to get funding for the purchase of materials. However, many buyers no longer favour L/C payments, because they block their cash flow. Also, the administrative cost in case of changes in delivery terms is high. Be aware that L/Cs do not offer financial protection against bankruptcies.

For any further orders, most European buyers will ask for a TT (Telegraphic Transfer/Open Account) after 30, 60, 90 or sometimes even 120 days. This means you as the manufacturer finish the production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed on with the buyer. This is a risky payment agreement because you, as the manufacturer, take on the full financial risk.

Delivery terms

Free on Board (FOB) is the standard Incoterm used by buyers and sellers to agree on the delivery of goods. With FOB, the buyer becomes responsible for the goods once you have delivered them to the vessel. Due to rising shipping costs and risky sea travel via the Red Sea, some buyers may ask you to agree on Delivery Duty Paid (DDP). This means you, as a seller, are responsible for the goods during the entire journey, except for unloading by the buyer. This is the riskiest Incoterm for you as a manufacturer, so beware!

Nominated suppliers

Some buyers may require you to source materials (fabrics, trims, labels, packing materials) from a specific supplier. This means that you are responsible for the ordering, delivery and payment of the materials (but not the quality, as this is confirmed in advance by the buyer). This may negatively impact your flexibility, cost, speed and liquidity. Always discuss locally available solutions with your buyer to possibly replace nominated suppliers.

Acceptance quality limit

To guarantee product quality, your buyer may set an acceptance quality limit (AQL). This refers to the worst quality level that is still acceptable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the items are defective. Defects are classified as critical, major and minor defects. Buyers will specify their expectations in the inspection protocols. Industry network Eurofins gives the following general definitions:

- Critical: a defect that fails to meet mandatory regulations and/or affects the safety of (end) consumers;

- Major: a defect that leads to product failure and reduces the product’s useability and/or saleability;

- Minor: a defect that shows deviation from quality standards but is not likely to reduce the useability or saleability of a product.

Packaging requirements

Typically, your buyer will give you instructions on how to package the order. If you agree on delivering Free on Board (FOB), your buyer will clear customs in the country of import. It is their responsibility to ensure the instructions on the packaging comply with EU import procedures. Always try to reduce the environmental impact (and financial cost) of packaging materials. You can, for instance, try using materials made from recycled cardboard (including hangers) or biodegradable plastics (polybags).

Restricted substances

Ask your buyer if they use a Restricted Substances List (RSL). These lists are often inspired by the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Transparency

Supply chain transparency is key for the European apparel industry, motivated by ever stricter laws at EU and national levels. For instance, the EU’s new Corporate Sustainability Due Diligence Directive (CSDDD), the Corporate Sustainability Reporting Directive (CSRD) and Norway’s Transparency Act require larger apparel companies to report on how they manage social and environmental risks. Disclose information about your own operations to buyers, but also help them gain insight into their (and thus your) entire supply chain.

Equality

Scandinavian buyers will require that you pay special attention to diversity and inclusion in your workforce. All individuals in your company should have equal opportunities, regardless of gender, race, religion or other characteristics. This can result in more creativity, innovation, and problem-solving. Female empowerment is a particularly important topic in Scandinavia, with Nordic countries ‘leading the world in closing the gender gap’, by enacting equal opportunity laws and family-friendly policies.

Animal welfare

If you use wool, animal welfare is an important concern. Buyers may require that you only use RWS-certified wool. If you use merino, buyers may require that you only use non-mulesing wool.

Regenerative agriculture

The use of organic cotton is popular among Scandinavian brands. Efforts to make cotton production more sustainable have expanded to include ‘regenerative agriculture’. This is a concept with a focus on phasing out harmful fertilisers and pesticides and ‘regenerating’ nature, including biodiversity, soil health and water. Several Scandinavian apparel retail groups have set goals in this area, including H&M and Bestseller. Control Union recently introduced the first certification for regenerative agriculture: regenagri.

Carbon footprint

Many Scandinavian brands are committed to climate neutrality. Check, for instance, H&M’s climate goals, which have been verified by the Science Based Targets Initiative. Calculating the CO2-footprint of an apparel item is a complicated process. It starts with carefully measuring your emissions before reducing them. Several organisations have set benchmarks for certain materials and/or products. Check the CBI study tips on how to go green for more information.

Recycling

The EU is introducing new legal measures to increase circularity, including new directives on the durability and ecodesign of textile products and a ‘right to repair’. The EU is also considering the introduction of an EU-wide EPR for apparel (EPR stands for extended producer responsibility). This makes companies responsible for the way their products are disposed of, recycled or repaired. Sweden already has a national EPR scheme. Recycling and repurposing materials helps your buyers reduce waste and save resources.

Certification

Many Scandinavian buyers require suppliers to get certified for sustainable and/or fair production or the use of sustainable materials. The following standards and certifications are the most popular in Europe. Note that social compliance through certification is a standard requirement for Scandinavian apparel companies. BSCI and Sedex are the most popular standards. Certifications such as FWF or Fair Trade are mostly unknown in Scandinavia. For a more elaborate overview of popular standards, check the CBI study on buyer requirements.

Table 1: Scandinavia´s most popular standards

| Name of standard | Logo | Type of compliance | Further information on getting certification |

| Amfori BSCI | Social | On invitation by buyers. Amfori provides a list of organisations that can perform an audit | |

| Sedex | Social, environmental | Check the Sedex certification process here | |

| B-Corp |

| Social, environmental | Check the B-Corp certification process here |

| OEKO-TEX® STeP | Social, environmental | Check the OEKO-TEX® STeP application process here | |

| GOTS |

| Social, environmental (organic production) | GOTS provides a list of organisations that can perform an audit |

| Recycled Claim Standard |

| Environmental (material recycling) | Check how to get certified |

| Nordic Swan Eco label |

| Official ecolabel of the Nordic countries, including Sweden, Norway, and Denmark. | Check how to get certified |

Source: FT Journalistiek

Product design and development

The term ‘Scandinavian apparel handwriting’ refers to a design language often associated with fashion and textile design in Scandinavia. This style is recognised for its minimalism, functionality, and connection to nature, reflecting the region's cultural and environmental values. Note that the following characteristics apply to end consumer preferences in the Scandinavian market. Brands that export to other European markets often expand their collections to include designs that follow consumer preferences in these other countries.

Table 2: Apparel design characteristics in Scandinavia

| Minimalism | Clothing often has simple, clean lines with a focus on structure rather than excessive decoration. The colour palette tends to be mainly shades of white, black, grey, and earthy tones. Decorative elements are minimal and understated, with details such as subtle stitching, small logos, and refined trims. |

| Functionality | Designs are often practical and comfortable, offering weather-resistant materials, layering options, and versatile pieces suitable for different occasions. Scandinavian apparel brands focus on durable, high-quality materials such as wool, cotton, linen, and sometimes technical fabrics. Norwegian brands are especially keen on high-quality natural materials. |

| Sustainability | Eco-friendly materials are highly appreciated, with a focus on organic, recycled, and locally-sourced materials. Designs are created to last beyond trends. |

| Connection to nature | Fabrics often have a natural feel, with visible textures that connect to the region’s landscapes and climate. |

| Silhouettes | Silhouettes are usually relaxed and comfortable, but with a sense of refinement. Layering is a key aspect of Scandinavian apparel, accommodating the region's weather conditions. |

| Craftsmanship | Even with minimal designs, Scandinavian brands require craftsmanship and high-quality stitching, cutting, and finishing. Traditional Scandinavian patterns and techniques, like in knitting or weaving, are sometimes subtly integrated into modern designs. |

Source: FT Journalistiek

Figure 2: Scandinavian brands are known for their clean and basic designs using neutral colours. Scandinavian brands active in other European markets tend to expand their collections and follow more local trends

Source: Soft-Rebels.com

Communication

Smooth communication is an unspoken requirement of all buyers. Always reply to every email within 24 hours. Even if it is just to confirm that you have received the email and will send a more complete reply later. If you have a problem with a production order, immediately notify the customer and try to offer a solution. Another good tip is to create a critical path for every order and share it with your buyer. This file will help you to manage expectations, monitor progress and is the best guarantee of on-time delivery.

Flexibility

If you want to start a business relationship with a Scandinavian buyer, be prepared to accept complicated orders first. Buyers will want to test your factory before giving you large, easy orders. Make sure at the start that a buyer will not continue to place only difficult orders with you and convenient orders elsewhere. Expect a European buyer to require for their first order:

- High material quality and impeccable workmanship;

- Order quantities below your normal minimum order quantity (MOQ);

- A price level that is lower than you would normally accept for small-quantity orders.

To increase flexibility, factories may install a sample room (to produce small orders), a modular production set-up (an ‘island’ instead of a production line), or a U-shaped set-up, where employees can control several machines at the same time.

What are the requirements for niche markets?

Apart from the Scandinavian design preferences described above, the region offers opportunities typical for markets with cold winters, moderate summers, and a well-to-do consumer population.

Heavy knitwear

Heavy knits are relatively popular in Scandinavia due to the cold season. The ‘Norwegian sweater’ is a well-known style that has even become popular in other markets. If you are selling knitwear to Scandinavia, note that end consumers in Norway are very keen on quality and desire natural fibres such as wool and alpaca. Synthetic fibres such as acrylic or polyester are not appreciated in Norway as knitwear yarns.

Second-hand apparel

The second-hand apparel market in Scandinavia has seen significant growth in recent years and is operated by independent organisations, but also by brands and retailers. The growth of this market is driven by increasing consumer interest in ethical consumption. The second-hand market may not be directly familiar to most manufacturers, but indirectly it drives a rising demand for high-quality materials and timeless designs. It can also offer opportunities for manufacturers that are able to offer refurbishing and recycling options.

Outdoor apparel

Due to its fluctuating temperatures in spring and autumn and cold weather in winter, Scandinavia offers many opportunities for manufacturers of outerwear, gloves, hiking apparel, raincoats and camping wear. Styles need to be practical, durable and they need to offer technical capabilities such as weather resistance and breathability.

Tips:

- Focus on the product category that best meets your manufacturing capabilities;

- Investigate which sustainable fabric options you could offer (potential) buyers, including organic cotton, Ecovero™ Viscose and rPET. Try to offer your buyers verifiable data about the environmental impact of these materials.

2. Through which channels can you get apparel on the Scandinavian market?

Before you approach Scandinavian apparel buyers, you need to determine which market segment fits your company best and through which sales channel(s) you want to sell your product.

How is the end market segmented?

Scandinavian apparel buyers can best be classified by price/quality level.

Table 3: Apparel consumer segments

| Consumer type | Price level | Fashionability | Material use | Functionality | Order Quantities |

| Luxury consumers | Very high retail prices | High comfort, fashionable designs and shapes | Natural, luxury materials | Very high requirements regarding durability | Low order quantities |

Mainstream fashionable consumers | Medium retail prices | Combination of practical multi-purpose items, and fashion | Good quality, often made from sustainable materials | High requirements regarding comfortableness | Medium/high order quantities |

Price-conscious consumers | (Extremely) low retail prices | Basic styles with a focus on comfort | Medium-low quality materials | Low functionality | High order quantities |

Source: FT Journalistiek

Luxury consumers

High-fashion consumers shop at luxury brands and retailers and high-fashion brands. These consumers expect their apparel to represent a strong brand image and the latest fashion trends, with a focus on maximum comfort. Brands in this segment require top-quality (natural) materials and manufacturing, the latest technical innovations and highly comfortable designs.

Mainstream fashionable consumers

Brands and retail companies sell collections created around a brand image and offer a quality product for a mid-level price. Products must have the technical look of a high-end product, but retail prices are substantially lower. Sustainable materials are appreciated. Social compliancy is a must.

Price-conscious consumers

The budget market caters to price-conscious consumers. Design, quality and sustainability are less important, but the apparel item needs to give the impression that it is fit for purpose and in line with the latest fashion trends. Prices are low and competition is heavy in this market segment, both with regard to retail and to manufacturing.

Tips:

- Check online shopping platforms such as Yoox (luxury and upper middle market segments), Zalando (all market segments) or Asos (middle and budget market) for inspiration on styles and colours.

- Collaborate with Scandinavia-based distributors, wholesalers, or retailers to gain market access. Don’t forget to choose an entry strategy, whether it is exporting directly to retailers, participating in trade fairs, or establishing a local presence.

Figure 3: Scandinavia offers a big market for high-quality outdoor apparel

Source: Giovanni Beatrice

Through which channels does a product end up on the end market?

There are many different ways to sell apparel to European buyers, depending on their place in the apparel value chain. Each type of buyer has unique requirements, so always be aware of what type of buyer you are dealing with and find out if you can meet their demands.

Table 4: Apparel sales channels in Europe

| Sales channel | Who’s your buyer? | Requirements | Examples |

| 1 | European end consumer | You will need to invest in a web shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness. Note that online B2C platforms may require a percentage of each sale and/or a monthly fee. | Alibaba, Wish, Amazon, Wolf & Badger |

| 2 | Online multi-brand platform | Online multi-brand platforms sell existing brands and often develop their own private collections, mostly value brands. They can detect market interest very quickly and will immediately react to sales data. Usually, such companies will place a small test order first. If the item is selling well, they will place the actual production order. Fast delivery is a must. | Boozt, Nelly, Stadium, Zalando, Asos, Fashion Fifteen |

| 3 | Retailer | Apparel is sold by big retail chains in shops and online and by smaller boutique shops that can be found in almost every European city. Retailers sell existing brands and may order collections specially developed and manufactured for them. | H&M, Jack & Jones |

| 4 | Brand | Apparel brands typically develop a collection 6 to 9 months in advance. You will need a sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be an exact copy of the product they will sell in their shop. It may take many months before orders are placed. | Gina tricot, Samsoe Samsoe, Gudrun Sjoden |

| 5 | Intermediary | Agents, traders, importers and private label companies sell your product on to buyers up the value chain. They are extremely price focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily handle purchasing and logistics, others work from Europe and also do market research, design, and stock keeping. Their service level determines the commission rate they charge. | Norse Fashion Agency, S7 agency, Morch fashion |

Source: FT Journalistiek

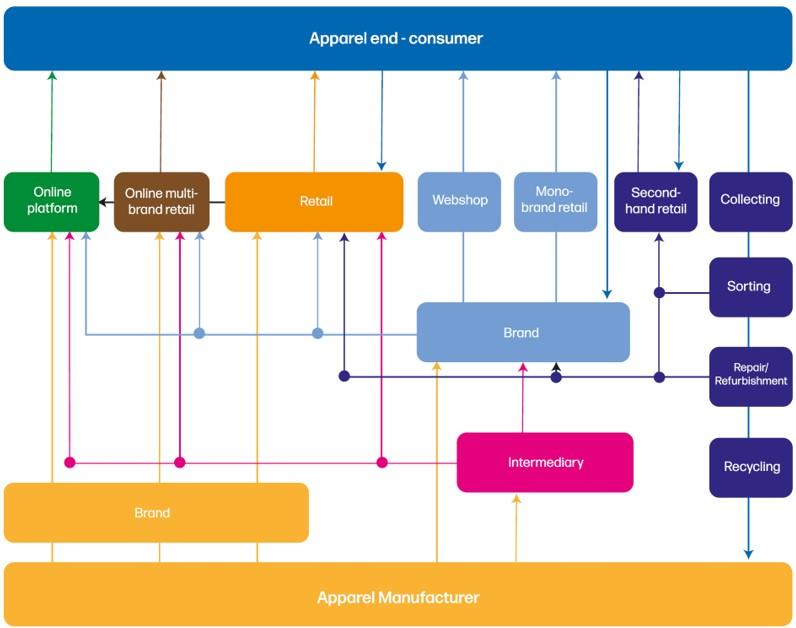

The figure below shows the many ways you can get your product on the Scandinavian market, either via an intermediary, your own brand, or via brands, retailers, or online (multi-brand) platforms. Notice how, ideally, consumers will return their apparel items to the seller after use, to be reused, repaired, refurbished or recycled.

Figure 4: Apparel market value chain

Source: FT Journalistiek

What is the most interesting channel for you?

As you move higher up the value chain, your margin will increase, but so will the service level that your buyer will require from you. When you have little experience with exporting to Europe, intermediaries and brands are likely the best starting point for you. Such companies have the largest market share, they service every price/quality segment of the market and they are used to working with suppliers in different production countries worldwide.

Tips:

- Find potential buyers on the exhibitor list of apparel trade fairs such as Copenhagen Fashion Week or Modefabriek, a fashion trade show in Amsterdam that is frequented by many Scandinavian brands.

- You can find intermediaries specialised in apparel by using an online search engine. Use keywords such as ‘full service’, ‘garment’ or ‘apparel’ plus ‘solution’. Trader’s websites usually show the brands they are working with.

- Be on top of new technological developments in the market. Be an advisor in addition to a producer to stay ahead of the competition.

3. What competition do you face on the Scandinavian apparel market?

Apparel is manufactured worldwide, so you will likely face stiff competition. The most important ways to create a competitive advantage over manufacturers in other countries are: technical knowledge, service level, flexibility to accept lower MOQs, efficiency and beneficial trade agreements.

Which countries are you competing with?

Scandinavia’s biggest trading partners include China, Bangladesh, Türkiye and India. Scandinavian countries import a relatively large amount of apparel from developing countries.

Table 5: apparel-producing countries, their strengths and weaknesses

| Country | Strengths | Weaknesses | Image in Europe | Future developments |

| China | Scale, technical innovation, high efficiency, excellent customer service and local availability of materials | Diversity in quality standards, rising labour and production costs and no General Scheme of Preferences (GSP) | Flexible and highly innovative | Increasing export limitations to the EU and United States (US). Even though companies are no longer fully focussed on China, it is still not possible to manufacture apparel outside China without some dependence on the Chinese supply chain |

| Bangladesh | Scale, experience, low production and labour costs and GSP | Lower technical skill than China, relatively high MOQs, political instability, relatively long production time due to import of synthetic fabrics from China | Fit for volume business. Challenging Corporate Social Responsibility (CSR) standards, difficult to control business standards for small-medium brands | Massive investment in sustainable manufacturing. Growing businesses and diversification. Large investments in fabric making |

| Türkiye | Close to the EU, very short lead times. High-quality apparel in small quantities. A European business culture. Turkish manufacturers accept payment in euros | Relatively high labour and production costs, inflation | High flexibility but becoming expensive due to inflation and increasing costs | Investment in sustainable production techniques and products. Shifting focus to the US market |

| India | Large and diverse manufacturing portfolio: all product categories and qualities | Diverse quality standards, challenging labour and environmental standards | High flexibility, inconsistent reputation for doing business | Forced to lower environmental impact and increase supply chain transparency |

| Pakistan | Price and vertical integration: local availability of cotton, fabric making, dyeing, finishing, etc. | Relatively low flexibility, political instability | Reasonable quality, issues with doing business | Improving flexibility. Investment in sustainable production techniques and products |

| Vietnam | High efficiency levels, relatively low production costs. No GSP but a new free trade agreement with the EU | High MOQs, lack of local fabrics, accessories and trims | Volume business and mainly focussed on the US export market | The Vietnamese apparel sector will remain an industry with a focus on exporting high-volume orders to the US market |

Source: FT Journalistiek

Tips:

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business, transparency, political stability, and general CSR compliance.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Most online search engines will let you create a news alert on a topic, so you can automatically follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

Neo-Concept is a Hong Kong-based company with a reputation of being a design-driven knitwear apparel manufacturer. The company has a reputation of being exceptional in innovation and product development. Its current manufacturing setup has expanded to include Cambodia and Vietnam, allowing them to service buyers in every part of the value chain and price/quality segment.

Denim Expert in Bangladesh is a fully-certified denim manufacturer focused on the sustainable production of denim. Denim Expert is a contributor to ZDHC and invests in the recycling of water and chemicals. The factory is flexible with quantities and offers a competitive price.

Shirt by Shirt in Türkiye is a manufacturer of highly fashionable shirts. With a diversity of factories in different countries it services buyers all over the world, offering speed to market and competitive pricing.

Tips:

- Check the free online database Open Apparel Registry. This website lets you look up the suppliers of hundreds of European fashion brands.

- Read the CBI study 11 Tips on how to do business with European buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USPs and doing business with European buyers.

- Identify organisations manufacturing similar products for the same target market and try to seek cooperation.

- Diversify your fabric-sourcing portfolio to offer buyers more choice in fabrics.

Which products are you competing with?

Demand for durable (slow fashion) apparel items is on the rise, in line with a growing re-selling industry. Second-hand apparel is the fastest growing market in the apparel industry and directly competes with the manufacturing of new products. Several EU and national initiatives support the repair of apparel, ultimately lowering not only the amount of waste but also consumer demand for new apparel.

Second-hand apparel

Several brands and retailers in Denmark, Sweden and Norway are involved in collecting, repairing and reselling second-hand apparel, including Nudie Jeans (Sweden, offers repair services), Swedish Stockings (Sweden, collects second-hand apparel and offers discounts on next purchases), KnowledgeCottonApparel (Denmark, recycled materials), Filippa K (Sweden, reselling second-hand items). Tips:

- Research the growing second-hand market to understand consumer requirements for second-hand apparel. For example, check the Circular Design Guide by the Ellen MacArthur Foundation for inspiration on designing items that are easy to recycle and reuse.

- Check the CBI study on Recycled Fashion for more background information on recycled materials and circular business models.

Tips:

- Research the growing second-hand market to understand consumer requirements for second-hand apparel. For example, check the Circular Design Guide by the Ellen MacArthur Foundation for inspiration on designing items that are easy to recycle and reuse.

- Check the CBI study on Recycled Fashion for more background information on recycled materials and circular business models.

4. What are the prices of apparel on the Scandinavian market?

The factory price of your product is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin. For a step-by-step guide on how to calculate the FOB-price of an apparel item, check this CBI study on cost price calculation.

The average cost breakdown of your FOB price (Free On Board) should look like this:

Source: FT Journalistiek

Retail pricing

The retail price of an apparel item is on average 4-8 times the FOB price (this is called the ‘retail markup’). It follows that the FOB price is on average 12,5-25% of the retail price of the product. There are exceptions. In the budget market, some large European retail chains may only double the FOB price mark-up. Retailers mark up the FOB price by 4-8 times because they need to account for (among other things) import duties, transport, rent, marketing, overhead, stock keeping, markdowns, VAT (15-27% in EU countries).

These percentages may vary per factory, per order and in time. Some factories accept lower profit margins during the offseason, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Higher cost due to inflation, increasing taxes, sustainability requirements, lower quantities or near-shoring can also lead buyers to adopt bigger margins.

Source: Eurostat 2023

According to Eurostat’s 2023 comparison of retail prices for apparel in Europe, Denmark is the EU country with the highest price point (130.7), while Sweden comes second. Switzerland is the most expensive European country for apparel (144).

Tips:

- Check this CBI study on cost-price calculation for a step-by-step guide on how to calculate your FOB price and how to develop a pricing strategy.

- Read the CBI study 11 Tips on how to do business with European buyers to learn how to approach and engage with buyers.

This study was carried out on behalf of CBI by Frans Tilstra and Giovanni Beatrice for FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research