The Scandinavian market potential for apparel

The population of individual Scandinavian countries is small. But combined, the area referred to as Scandinavia ranks 7th within Europe. Denmark and Sweden together imported around 9 billion euros worth of apparel in 2023 (up from 7.6 billion euros in 2018).

Contents of this page

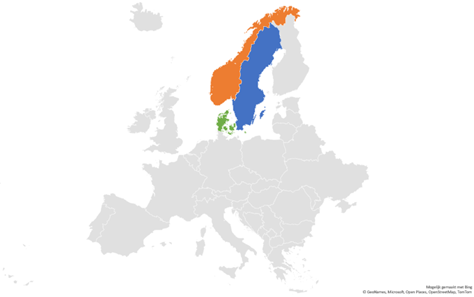

Figure 1: Scandinavia is a region in Northern Europe with a high standard of living, whose people generally love the outdoors and appreciate basic designs and sustainable production

Source: Photo by Linus Mimietz on Unsplash

1. Country description

Scandinavia is a subregion of Northern Europe consisting of three countries that share strong cultural, historical, and linguistic ties: Norway, Sweden and Denmark. While each country has its own identity, they all embrace certain values that form the basis of the Scandinavian ‘lifestyle’. These values include simplicity, a good work-life balance, mindfulness, functionality, equality, and a strong connection to nature.

Scandinavian countries are all characterised by high standards of living, high-quality democratic institutions, socio-economic equality, high literacy levels, strong social welfare systems and well-developed environmental policies and standards.

While Norway (unlike Denmark and Sweden) is not a member state of the European Union (EU), under the European Economic Area (EEA) agreement, the country benefits from the same terms as EU member states when it comes to the free movement of goods in the region.

Figure 2: Scandinavia: Location and population

Source: World Population Review

Because of Eurostat data limitations, only statistics for Sweden and Denmark are included in the analysis of the region’s trade statistics in detail in this report. Comparisons to other countries are also limited to EU member countries for the same reason.

2. What makes Scandinavia an interesting market for apparel?

The population of individual Scandinavian countries is small. But combined, Scandinavia ranks 7th within Europe (including EEA, Switzerland and the United Kingdom (UK)) with a population that is larger than its neighbour – and key regional trading hub - the Netherlands. At the same time, the combined value of Scandinavian apparel imports places the region as the 11th-largest importer globally and the 8th-largest within Europe (7th among EU member countries).

Table 1: Top 24 European countries by population (EEA + Switzerland + UK) 2024; ranking by import value 2023

| Country | Population (million) 2024 | Rank (world) population | Rank (EEA + Switzerland + UK) population | Share of global imports | Rank import value (world) 2023 | Rank import value (EEA + Switzerland + UK) |

| Germany | 83.2 | 19 | 1 | 9.10% | 2 | 1 |

| United Kingdom | 67.9 | 22 | 2 | 4.50% | 6 | 4 |

| France | 64.8 | 23 | 3 | 5.70% | 3 | 2 |

| Italy | 58.6 | 25 | 4 | 4.40% | 7 | 5 |

| Spain | 47.4 | 32 | 5 | 4.50% | 5 | 3 |

| Poland | 40.2 | 37 | 6 | 2.70% | 9 | 7 |

| Scandinavia | 22.1 | 61 | 7 | 2.60% | 11 | 8 |

| Romania | 19.6 | 66 | 7 | 0.60% | 30 | 16 |

| The Netherlands | 17.6 | 72 | 8 | 3.60% | 8 | 6 |

| Belgium | 11.7 | 82 | 9 | 1.90% | 13 | 8 |

| Sweden | 10.6 | 88 | 10 | 1% | 22 | 12 |

| Czech Republic | 10.5 | 90 | 11 | 0% | 24 | 13 |

| Greece | 10.3 | 93 | 12 | 0.50% | 32 | 18 |

| Portugal | 10.2 | 94 | 13 | 0.70% | 27 | 14 |

| Hungary | 9.9 | 95 | 14 | 0.40% | 39 | 20 |

| Austria | 8.9 | 191 | 15 | 1.40% | 18 | 10 |

| Switzerland | 8.8 | 102 | 16 | 1.90% | 14 | 9 |

| Bulgaria | 6.6 | 110 | 17 | 0.20% | 50 | 23 |

| Denmark | 5.9 | 115 | 18 | 1.10% | 21 | 11 |

| Slovakia | 5.7 | 117 | 19 | 0.40% | 37 | 19 |

| Finland | 5.5 | 118 | 20 | 0.30% | 47 | 22 |

| Norway | 5.5 | 120 | 21 | 0.50% | 31 | 17 |

| Ireland | 5.0 | 125 | 22 | 0.70% | 29 | 15 |

| Croatia | 3.9 | 130 | 23 | 0.40% | 41 | 21 |

Sources: Trademap, World Population Review, 2024

Denmark and Sweden together imported around 9 billion euros worth of apparel in 2023 (up from 7.6 billion euros in 2018) which equates to 1.25 billion units of clothing (up from 1.24 billion). Of the total value of imports in 2023, 46.8% was trade in knitted or crocheted apparel and 53.2% was in non-knitted/woven apparel (no change between 2018 and 2023). During the same period, the market grew by an average of 3.3% per year.

Source: Eurostat 2023

High purchasing power and retail prices

Denmark, Sweden and Norway all have a high GDP per capita (ranking 5th, 7th and 4th within Europe respectively) as well as higher than average wages (ranking 4th, 12th and 5th within Europe respectively).

Among European countries in the single market or with access to it (EEA and Switzerland), Denmark had the 3rd-highest retail prices for clothing and footwear in 2023, after Switzerland and Iceland (Danish prices were 31% higher than the EU average). Norway and Sweden ranked 6th and 10th respectively, higher than any of the top 6 EU importers of apparel, with the exception of the Netherlands (ranked 8th).

Higher retail price levels translate to higher import prices. The average price paid by Denmark for apparel imported from developing countries is the highest among the top 10 EU apparel importers. At the same time, the average price paid by Sweden for apparel imported from other EU countries is the highest among the top 10 EU apparel importers.

Table 2: 2023 average unit prices paid by Scandinavian importers

| Apparel imported from within the EU | Apparel imported from developing countries | Price difference (premium paid for apparel imported from EU) | |||

| Country | Intra-EU average price 2023 | Intra-EU 5-year price change | DC average price | 5-year price change | |

| Germany | €9.87 | + €2.32 | €4.87 | + €1.10 | €5.00 |

| France | €9.30 | + €2.57 | €5.35 | + €0.82 | €3.95 |

| Spain | €11.22 | + €3.52 | €5.20 | + €0.49 | €6.02 |

| The Netherlands | €13.99 | + €5.26 | €4.36 | + €0.99 | €9.63 |

| Italy | €10.7 | + €2.10 | €5.04 | + €0.82 | €5.66 |

| Poland | €9.31 | + €2.29 | €2.50 | + €0.57 | €6.82 |

| Belgium | €9.39 | + €1.93 | €5.32 | + €1.88 | €4.07 |

| Austria | €10.86 | + €1.82 | €4.12 | + €1.37 | €6.74 |

| Denmark | €13.40 | + €2.30 | €5.63 | + €0.38 | €7.77 |

| Sweden | €15.04 | + €3.88 | €4.51 | + €0.44 | €10.52 |

Source: Eurostat 2023. Calculated by dividing value by volume.

Real disposable income and household consumption are expected to increase in Scandinavia in 2024 and 2025 due to falling inflation and easier financing conditions. Inflation in Sweden is forecast to fall from 5.9% in 2023 to 1.8% in 2025 while Denmark’s inflation is forecast to fall from 3.4% in 2023 to 1.9% in 2025.

Sourcing from developing countries is established and diversifying

Both Sweden and Denmark purchase a higher percentage of their apparel (by value) from developing countries compared to the EU average. For Denmark this figure is as high as 63.2%, second only to Spain among the EU’s top 10 apparel importers.

Table 3: Top 10 EU apparel importers in 2023; developing country share of imports; developing country imports average annual growth

| Import Value 2023 | Import value growth (5-year average) | Imports from developing countries (% of total imports) | Growth in imports from developing countries (% change over 5 years) | Change in importance of developing countries as source country (change in share 2018-2023) | |

| Germany | €38.94 bn | 4% | 49% | 2.4% | -3.9% |

| France | €23.7 bn | 2.6% | 43.3% | 2.1% | -1.2% |

| Spain | €19.14 bn | 3.2% | 63.6% | 0.7% | -8.2% |

| Italy | € 18.04 bn | 5% | 44.7% | 2.3% | -6.4% |

| The Netherlands | €17.3 bn | 2.9% | 58.4% | 1.5% | -3.9% |

| Poland | €12.51 bn | 12.3% | 30.8% | 14.2% | 2.4% |

| Belgium | €7.67 bn | -0.7% | 47.8% | -3.3% | -6.7% |

| Austria | €6.04 bn | 0.9% | 13.3% | -3.7% | -3.5% |

| Denmark | €4.54 bn | 2.6% | 63.2% | 2.9% | 0.8% |

| Sweden | €4.48 bn | 4% | 46.8% | 1.5% | -5.9% |

| EU Total | € 176.9 bn | 4.1% | 44.4% | 2.3% | -4.0% |

Source: Eurostat 2023

Denmark is one of only two top 10 EU importers for which developing countries were able to grow their market share between 2018 and 2023. Both Denmark and Sweden’s purchasing from China declined during the same period. Developing-country exporters to Denmark that increased their share of exports include Bangladesh, Egypt, Indonesia, Laos, Pakistan and Thailand. Developing-country exporters to Sweden that increased their share of exports include Bangladesh, Indonesia, Myanmar, North Macedonia, Serbia and Türkiye.

Table 4: Scandinavian apparel imports: major exporters

| DENMARK | SWEDEN | NORWAY |

| Major exporters (% share) | Major exporters (% share) | Major exporters |

| China (-22.4%), Bangladesh (+18.7%), Germany (-7.4%), Türkiye (-7.1%), Sweden (+5.7%), Poland (+5.2%) | China (-18.3%), Bangladesh (+11.7%), Denmark (+10.3%), Germany (-9.6%), Netherlands (+6%), Poland (+5.4%) | No data |

| Top DC (% share of all exports) | Top DC (% share of all exports) | Top DC exporters |

| China (-22.4%), Bangladesh (+18.7%), Türkiye (-7.1%), India (+4.2%), Myanmar (-2.6%), Pakistan (+2.5%) | China (-18.3%), Bangladesh (+11.7%), Türkiye (+4.9%), India (-2.5%), Myanmar (+2%), Vietnam (-1.8%) | No data |

| Top EU exporters (% share of all exports) | Top EU exporters (% share of all exports) | Top EU exporters (% share of all exports) |

| Germany (-7.4%), Sweden (+5.7%), Poland (+5.2%), Netherlands (-3.9%), Italy (+3.6%), Portugal (+1.8%) | Denmark (+10.3%), Germany (-9.6%), Netherlands (+6%), Poland (+5.4%), Italy (+4.3%), Norway (+2.7%) | No data |

| Top EU exporters (% share of EU imports) | Top EU exporters (% share of EU imports) | Top EU exporters (% share of EU imports) |

| Germany (20.8%), Sweden (16%), Poland (14.6%), Netherlands (11%), Italy (10.2%), Portugal (4.9%) | Denmark (21.3%), Germany (19.9%), Netherlands (12.4%), Poland (11.2%), Italy (8.8%), Norway (5.6%) | Sweden (44.7%), Denmark (13.5%), Poland (13.1%), Germany (6.1%), Netherlands (5.6%), Italy (4.9%) |

Source: Eurostat 2023

The influence of Scandinavian fashion goes beyond that which trade volumes indicate

Scandinavia is home to two of the world’s largest international fast fashion giants, H&M Group (Sweden) and Bestseller Group (Denmark), which both have a presence in more than 70 markets worldwide and own 26 individual brands between them. A large proportion of orders designed and placed by these brands are distributed directly from manufacturers to regional logistics centres and are not included in Scandinavia’s apparel import statistics.

Outside of the fast fashion segment, Scandinavian fashion brands have a unique style, characterised by simplicity, timelessness, elevated basics, comfort, practicality and clean lines. It is based on the philosophy that ‘less is more’. Apparel items should complement each other seamlessly. This type of styling is a good fit for more sustainable fashion trends such as slower fashion and extending the product lifecycle through longer use, rental and resell. Pioneers of the minimalist look include Acne Studios and Filippa K.

Figure 4: Scandinavian fashion is well known for its focus on sustainability

Source: Unsplash

Sustainability is a core value of most Scandinavian brands

Scandinavia benefits from robust environmental policies and government initiatives aimed at tackling environmental sustainability issues. According to the United Nations’ Global Sustainable Development Report (2024), the three Scandinavian countries all rank within the top 10 countries worldwide in terms of progress towards achieving the UN’s 17 Sustainable Development Goals. Sweden and Denmark occupy 2nd and 3rd place.

As a result, protecting the environment is important to the Scandinavian consumer and has become a core value for Scandinavian fashion brands. The region has many sustainable fashion brands committed to changing the fashion industry for good. These brands focus on high-quality products, sustainable materials, chemicals management, waste minimisation and fair and transparent supply chains.

As much as 15% of apparel companies within the European Economic Area (EEA) that hold a B Corp certification (which measures a company’s entire social and environmental impact) are Scandinavian. Among these, Son of a Tailor’s made-to-order business model puts a stop to overproduction and Ganni is working towards a 50% reduction in total greenhouse gases by 2027 and generating at least 5% of sales from circular business models by 2025.

While not a B Corp, Swedish brand ASKET is famous for its focus on restoring the value and appreciation of clothing through what it calls “The Pursuit Of Less®”: a permanent collection of seasonless, high quality, “zero compromise” essentials that are designed to last. Its business model includes post-purchase care, repair and take-back programmes as well as transparent cost analysis, full traceability and even an “impact receipt” which gives consumers a breakdown of the product’s environmental costs and impact.

In 2014, fast fashion retail giant H&M Group established the H&M Foundation, a non-profit organisation dedicated to accelerating and scaling up innovative solutions for a planet-positive textile industry. Through its Global Change Award, which was launched in 2016, the foundation has supported as many as 46 start-ups from 21 countries.

Scandinavian brands’ sustainability efforts are supported by various initiatives and events, including:

- Textile and Fashion 2030 (Sweden) - a multi-stakeholder platform initiated by the Swedish Government and led by the University of Borås that promotes the transition to a more sustainable and circular industry;

- Science Park Borås - an open collaborative arena focusing on sustainability within textiles, consumption and societal development. Stakeholders include the University of Borås, the City of Borås, and the Research Institutes of Sweden (RISE);

- Re:textile (Sweden) - a project within Science Park Borås which aims to develop new design principles, business models, and production systems that allow for circular flows in the textile industry;

- The Scandinavian Textile Initiative for Climate Action – a platform with 59 brand members that is dedicated to sharing best practices and facilitating reporting on progress towards greenhouse gas reduction goals.

- Copenhagen’s Fashion Week - the world’s most sustainable fashion week. Currently, a brand that wishes to participate must ensure that at least 50% of its collection is made from certified, preferred, upcycled or recycled materials. It must also be able to demonstrate a high level of commitment to due diligence across its supply chain.

Tips:

- Gain insights into the latest in sustainable innovation and design trends by visiting the Copenhagen International Fashion Fair (CIFF). The fair showcases forward-thinking international as well as local Scandinavian brands.

- Subscribe to the newsletters of the above industry initiatives to keep up to date with new developments and opportunities. Explore their websites to understand who the key brands are in the apparel sustainability sphere.

3. Which apparel items offer the most opportunities on the Scandinavian market?

Trousers and shorts, knitwear, outerwear, and T-shirts are the most common product categories that developing countries export to Scandinavia. Together, these four categories have a developing-country import value of €2.8 billion (2023), which amounts to almost 58% of all apparel exports from developing countries to Scandinavia.

- The fastest-growing category being exported by developing countries is ensembles, followed by sports and activewear;

- The outerwear, shirts and blouses, and trousers and shorts categories, on the other hand, are growing at below average growth rates for all apparel from developing countries;

- China’s market share of developing-country imports declined for all categories by between 5.3% and 19.7%, which presents opportunities for other developing country suppliers. The highest decline was seen in the ensembles and outerwear categories;

- Purchasing is already diversified for the T-shirts, trousers and shorts, shirts and blouses and babywear categories. On the other hand, China maintains a market share of more than 50% of developing-country exports to Scandinavia in the sports and activewear, outerwear, and suits and jackets categories. These are categories with more complex and/or technical products.

Table 5: Scandinavian imports from developing countries by product category; price developments; top exporters

| Product category | Value 2023 | 5-year average growth | 2023 average price | 5-year price change | Top developing country exporters (market share of DC imports change 5 yr) |

| Trousers and shorts | €1.1 bn | 2.00% | €7.93 | €0.79 | Bangladesh (10.2%), China (-5.3%), Türkiye (-4.8%), Pakistan (0.9%), Vietnam (-0.9%), Laos (1.3%) |

| Knitwear | €717.4 m | 2.70% | €7.27 | €0.74 | Bangladesh (6.5%), China (-5.5%), Türkiye (0.3%), Cambodia (-2.5%), Myanmar (0.8%), India (-0.4%) |

| Outerwear | €522.3 m | 0.50% | €16.36 | €1.79 | China (-8.7%), Myanmar (2.2%), Bangladesh (1.8%), Vietnam (2.1%), Cambodia (0.4%), Laos (1.8%) |

| T-shirts | €472.1 m | 2.50% | €3.17 | €0.46 | Bangladesh (7.7%), Türkiye (-3.4%), China (-2.4%), India (-0.5%), Pakistan (0.6%), Myanmar (1%) |

| Shirts and blouses | €450.3 m | 0.10% | €6.69 | €1.06 | Bangladesh (10.8%), China (-6.3%), India (-1%), Türkiye (-2%), Indonesia (0.9%), North Macedonia (1%) |

| Underwear and nightwear | €250.6 m | 3.80% | €2.10 | €0.16 | China (-6.4%), Bangladesh (7.4%), Türkiye (0.3%), India (-0.4%), Sri Lanka (2%), Vietnam (-0.6%) |

| Suits and jackets | €216.3 m | 4.60% | €15.43 | €2.05 | China (-7%), Türkiye (4.1%), Bangladesh (4.7%), Myanmar (3.3%), Vietnam (-1.9%), India (-0.6%) |

| Babywear | €93.8 m | 3.00% | No data | No data | Bangladesh (5%), China (-8.2%), India (0.8%), Türkiye (-0.3%), Ukraine (2.9%), Myanmar (0%) |

| Sports and activewear | €60.5 m | 6.90% | €6.22 | €1.34 | China (-7.8%), Bangladesh (7.2%), India (0.3%), Türkiye (0%), Vietnam (-0.4%), Myanmar (1.7%) |

| Ensembles | €11.5 m | 7.70% | €8.35 | €0.16 | China (-19.7%), Bangladesh (4.9%), Türkiye (2.8%), Thailand (2.6%), Pakistan (5.2%), India (2.6%) |

Source: Eurostat 2023

Trousers and shorts

The largest product category is trousers and shorts, which has grown on average by 2% each year between 2018 and 2023. It makes up 22.3% of all Scandinavian apparel imports from developing countries. At €7.93, the average import unit price of trousers and shorts from developing countries is €1.13 higher than the EU average, having increased by €0.79 over the past five years.

This is a volume category. It is no surprise that Bangladesh is the largest developing-country exporter with a 31.9% share which has grown by 10.2% in the same period. Within this segment, denim is an important niche market. In 2023, denim made up almost a quarter of the total value of trousers and shorts imports to Scandinavia from developing countries.

The European Union is at the centre of global industry efforts to make denim more sustainable. Considered to be one of the most sustainable denim brands in the world, Sweden’s Nudie Jeans operates 29 repair shops in 19 cities globally with additional locations run by 19 partners. The company repaired as many as 73,368 pairs of jeans in 2023. During the same year, 93% of all fibres used were ‘preferred’ fibres (organic, certified or recycled). The brand’s website lists the average carbon emissions and water usage per product.

Other Scandinavian denim-focused brands include Jeanerica, Tomorrow Denim and Livid. Brands that include denim as a key component of their collections include Asket, BITE Studios, Weekday, Acne Studios, Filippa K, Arket and Eytys.

Knitwear

The knitwear category has grown by an average of 2.7% each year between 2018 and 2023. It makes up 13.3% of all Scandinavian apparel imports from developing countries. At €7.27, the average import unit price of knitwear from developing countries is €0.27 higher than the EU average, having increased by €0.74 over the past five years.

Bangladesh is the largest developing-country exporter with a share of almost 45% of developing-country imports, with an increase of 6.5% in the 2018-2023 period. The second-largest exporter is China, with a 32.7% share (a reduction of 5.5% since 2018).

Knitwear made from man-made fibres has the highest share of the market, followed by knitwear made from cotton, accounting for 46.8% and 41.3% of the total value of knitwear imports to Scandinavia from developing countries in 2023 respectively.

Wool’s share of developing-country knitwear exports to Scandinavia is just 9.5%. Because of its climate, the Scandinavian region has its own long history of knitting, dating back to the 16th century. Norwegian wool in particular is known globally for its strength, lustre and chemical-free processing. There are many Norwegian specialist knitwear brands that use locally-produced wool, including Skappel, Oleana, O.A.D, Amundsen and Dale of Norway.

Outerwear

The outerwear category includes overcoats, car coats, cloaks, anoraks (including ski jackets), wind jackets and similar articles. Outerwear makes up 11.1% of all Scandinavian apparel imports from developing countries and has grown on average by 0.5% each year between 2018 and 2023. The average import unit price of outerwear from developing countries is €16.36 (€0.22 higher than the EU average) which represents a 5-year increase of €1.79.

China is still the largest developing-country exporter with a 54.4% share, but this is declining, by 8.7% in the 2018-2023 period. Myanmar has become the second-largest exporter with a 19.9% share and an increase of 2.2% since 2018. With production moving away from China and further potential for growth, outerwear offers opportunities for skilled manufacturers in other developing countries.

Within this category, the outdoor segment (outerwear worn for outdoor activities) such as anoraks, ski jackets, wind jackets, etc.) is an interesting niche. The Scandinavian lifestyle is characterised by participation in outdoor activities. The weather can be unpredictable and includes cold winters. As the Scandinavian saying goes ‘there is no such thing as bad weather, just bad clothing’. It is not surprising that within Europe, Scandinavian outdoor brands lead the way in terms of quality, functionality and innovation.

Nearly 75% of outdoor products imported into Scandinavia from developing countries are made from man-made/synthetic fibres. Most outdoor products make extensive use of synthetics to achieve higher performance functionality. Synthetics have a significant negative environmental impact during production, use, and disposal. The Scandinavian outdoor segment has been at the forefront of campaigning and innovating for increased environmental sustainability in products and processes.

Internationally well-recognised outdoor brands from Scandinavia include Houdini (Sweden), Haglöfs (Sweden), Helly Hansen (Norway), Fjällräven (Sweden), Norrøna (Norway), Bergans of Norway (Norway), Didriksons (Sweden) and Peak Performance (Sweden).

T-shirts

T-shirts make up 9.2% of all Scandinavian apparel imports from developing countries and the category has grown on average by 2.5% each year between 2018 and 2023. The average import unit price of a T-shirt from developing countries is €3.17 (€0.34 higher than the EU average) which represents a 5-year increase of €0.46.

Bangladesh is the largest developing-country exporter with a 53.1% share which represents an increase in share of 7.7% since 2018. Türkiye is the second-largest with a 17.6% share, down from 21% in 2018. This segment is highly competitive. However, niches include t-shirts made from more sustainable fibres such as organic or recycled cotton as well as higher-end t-shirts using alternative fibres (e.g., linen) and/or knitted with finer yarns.

Scandinavian brands that focus on elevated basics such as t-shirts, shirts and blouses include Colourful Standard, Asket, Arket, A Day’s March, Axel Arigato, COS and House of Dagmar.

Shirts and blouses

Shirts and blouses make up 9.2% of all Scandinavian apparel imports from developing countries and the category has grown on average by just 0.1% each year between 2018 and 2023. The average import unit price of shirts and blouses from developing countries is €6.69 (€0.13 lower than the EU average), which represents a 5-year increase of €1.06.

Bangladesh is the largest developing-country exporter with a 32.8% share which represents an increase in share of 10.8% since 2018. China is the second-largest with a 30.1% share, down from 36.4% in 2018.

Underwear and nightwear

Underwear and nightwear make up 5.7% of all Scandinavian apparel imports from developing countries and the category has grown on average by 3.8% each year between 2018 and 2023. The average import unit price of underwear and nightwear from developing countries is €2.10 (€0.14 lower than the EU average), which represents a 5-year increase of €0.16.

China is the largest developing-country exporter with a 47.5% share, which represents a decline in share of 6.4% since 2018. Bangladesh is the second-largest with a 29.8% share, up from 22.3% in 2018.

Scandinavian specialist underwear brands tend to favour comfort, natural fibres (or cellulose-based man-made fibres such as TENCEL™ and ECOVERO™), basic colours and minimalistic, practical styling. There is a strong trend towards the use of certified recycled and/or sustainably-sourced materials that are made without the use of toxic chemicals.

Scandinavian underwear brands include Woron (Denmark), Bread & Boxers (Sweden), CDLP (Sweden), Organic Basics (Denmark), Understatement (Sweden) and Lindex (Sweden).

Tips:

- Visit the websites of brands active in your product categories. Understand the different types of product and facility-level certification required by these brands (for example, GOTS, GRS, RCS, FSC certified, Oeko-tex 100, Bluesign, etc.). Research what is involved in achieving certification.

- If your facility has the right capabilities, take advantage of the shift away from China by supplying outdoor apparel that meets the sustainability credentials of Scandinavian brands. More than 70 sustainability-focused Scandinavian outdoor brand members of the Scandinavian Outdoor Group are listed on its website.

4. Which trends offer opportunities or pose threats on the Scandinavia apparel market?

The Scandinavian fashion market follows the general apparel industry’s trends and developments related to sustainability, circularity and corporate social responsibility, driven largely by policy initiatives under the EU Green Deal. In 2023, the Green Alliance was established between Norway and the EU to align domestic and international climate policies. Both sides confirmed a commitment to reducing greenhouse gas emissions by at least 55% by 2030, compared to 1990, and to achieving climate neutrality by 2050.

Scandinavian legislation is going beyond EU legislation, presenting opportunities

Several Scandinavian countries have introduced national laws that go beyond EU laws and regulations regarding more sustainable production.

Chemicals legislation

Many toxic substances have strict allowable limits for finished products and/or reporting requirements under EU legislation:

- EU POP regulation 2019/2021 - restricts the use of Persistent Organic Pollutants – substances that persist in the environment, accumulate in living organisms and pose a risk to human health;

- EU REACH regulation 1907/2006 - the world’s strictest law relating to chemical substances in consumer goods, including textiles.

While all three Scandinavian countries follow EU REACH legislation, Denmark and Norway also have their own legislation regarding the restriction of hazardous chemicals. Current and upcoming legislation in Denmark and/or Norway is stricter than EU legislation for the following substance categories:

- MCCP (Chlorinated Paraffins);

- Brominated Flame Retardants;

- Heavy metals (lead and mercury);

- Perfluoroakyl and polyfluoroalkyl substances (PFAS).

Suppliers that implement effective chemical management systems will have a competitive advantage when targeting the Scandinavian market.

Norwegian Supply Chain Transparency Act

In 2022, new legislation came into force in Norway which requires that companies registered in or selling in Norway, if they are of a certain size and level of business, must conduct - and report on - due diligence across the entire supply chain. The Norwegian Supply Chain Transparency Act is much stricter than the EU equivalent, the Corporate Sustainability Reporting Directive (CSRD). It affects companies with as few as 50 employees and an annual turnover of just €6.9m (compared to the EU directive which affects companies with 250 employees and €50m in turnover).

Aside from Norwegian brands, a number of other Scandinavian brands, Swedish ones in particular, may also be affected. While Norway ranks only 9th among Denmark’s top apparel export destinations (2.6% market share), it is the top importer of Swedish apparel, accounting for as much as 26.6% of Sweden’s apparel exports.

The ability to provide brands and retailers with credible, reliable data across the supply chain would create a valuable competitive advantage for a manufacturer.

Extended Producer Responsibility

As early as 2020, Sweden became the second European country to plan an Extended Producer Responsibility (EPR) scheme for textiles, due to be enforced from 1 January 2024. However, after the EU published a proposal in 2023 for an EU-wide EPR for textiles, the Swedish government decided to hold off on their plans. The Swedish EPR had been ambitious and included the following targets which reflect Sweden’s ongoing commitment to the transition to circularity in textiles:

- A minimum 90% of textile waste collected should be reused or sent for material recovery / recycling;

- A 70% reduction in textiles sent to landfill by 2028, compared to 2022.

To successfully serve the Scandinavian market, suppliers need to design products for recyclability. In addition to strict chemicals management, this means designing garments that are easy to disassemble, using trims and threads of the same fibre composition as the main garment where possible, and avoiding non-recyclable fibre blends. This involves in-depth (and continuously updated) knowledge about current textile recycling limitations and capabilities as well as new innovations in the market.

The use of certified sustainable and circular materials is becoming standard

Across all product and value segments, Scandinavian brands are setting and publishing ambitious sustainable material use targets. To be able to measure and prove progress towards these targets, they require that these materials be branded and/or certified.

Sports and outdoor wear brand Houdini (Sweden) has been making recycled garments since 2006 and claims that 100% of all the fabrics it uses are now recycled, recyclable, renewable, biodegradable or bluesign® certified for chemicals compliance.

Outdoor wear brand Haglöfs (Sweden) has set a target to use recycled or renewable materials in 100% of its main fabrics by 2025. For the last two seasons this stood at 72% and 78%.

H&M (Sweden) has set a goal of using at least 30% recycled materials in its production by 2025 and using only recycled materials or materials that are sustainably sourced (in terms of chemicals) by 2030. It already increased the share of recycled materials from 5.8% in 2020 to 25% in 2023. By 2020, it reached its goal of sourcing 100% of its cotton from ‘preferred’ sources. By 2022, 99% of its textile and leather supply chain was enrolled in ZDHC programmes, eliminating harmful chemicals from production.

Danish retail giant Bestseller’s Circular Design Guide (2023) sets out minimum requirements for raw material use. This includes the use of Bestseller-approved ‘Better’ or ‘Best’ certified materials. The company has pledged to source 50% of its polyester from recycled polyester or other certified and/or branded alternatives and 30% of its cotton from organic or in-conversion sources by 2025. By 2021, organic cotton made up 22% of the total cotton consumption and recycled polyester made up 13% of the total polyester consumption.

Manufacturers that want to supply apparel to Scandinavian brands need to be able to work with buyer-nominated international material suppliers. In addition, leading manufacturers will be those that have their own raw material sourcing, R&D and supply chain monitoring capabilities.

Best Practice example

Denim authority is a Tunisian factory that supplies to (among others) Swedish jeans brand Nudie Jeans, tracing their entire supply chain and working with recycled materials. Denim authority uses digital tools to track raw materials from supplier to final product. The factory only works with certified suppliers (GOTS, OEKO-TEX) and conducts regular audits. They share product origins with customers through QR codes or labels.

Tips:

- When targeting Scandinavian brands, investigate which end market they service. Is it their home market, or are you dealing with brands that export to other European markets? Be aware that consumer preferences differ from one Scandinavian country to the next and differ even more from other European markets.

- Make sure to offer sustainable products and production practices because Scandinavia values sustainable textiles. For background information, check the CBI studies on Sustainable Materials, Hemp, Sustainable Cotton and Recycled Fashion.

- Always research your potential buyers. Check their collections, overall design ‘handwriting’, target group and required certifications.

FT Journalistiek carried out this study in partnership with Frans Tilstra and Giovanni Beatrice on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research