The European market potential for sustainable materials

According to the European Environment Agency, European textile consumption in 2020 had the fourth-highest negative impact on the environment and climate change, after food and drink, transport and housing. It caused the third-highest pressure on water and land use and had the fifth-highest impact in terms of raw materials and greenhouse gas emissions. Apparel accounts for up to 81% of the EU’s total textile consumption.

Global textile fibre production doubled from 58 million tonnes in 2000 to 116 tonnes in 2022. It is expected to grow to as much as 147 million tonnes by 2030. Raw materials are responsible for up to two-thirds of fashion and apparel brands’ climate impact. A 2020 report highlighted that the fashion industry accounts for around 4% of global carbon emissions. Raw materials production, preparation and processing are responsible for almost 70% of these emissions.

According to Statista, total European consumer spending on clothing and footwear is expected to increase by more than 18% between 2014 and 2029. The need for European brands and retailers to scale up their adoption and development of sustainable materials has never been more urgent.

Contents of this page

1. Product description

‘More sustainable’ or ‘preferred’ materials are ones that are sourced, designed and produced with minimal negative environmental and social impact. The following factors influence how sustainable a material is.

- The use of non-renewable resources in the production of raw materials or fabrics (e.g. fossil fuels).

- How much the cultivation or production of raw material leads to the destruction of forests, land degradation, soil depletion and/or harm to biodiversity.

- How much the cultivation or production of raw material encourages biodiversity, replenishes soil quality and/or captures and stores carbon from the atmosphere.

- Amount of carbon released during production.

- The use of water and energy during the growing of fibres and fabric production.

- Contribution to microplastic pollution.

- Biodegradability.

- The use of inputs already in circulation (non-virgin (non-new) materials, pre-consumer waste materials/cutting waste, post-consumer waste and manufacturing by-products).

- Use of hazardous chemicals (including fertilisers and pesticides) in fibre production.

- Use of hazardous chemicals (including dyes and finishes) in fabric/material production.

- Treatment of animals from which raw materials are obtained.

- Transportation distance between stages of production.

- Durability of the material (lengthens garments’ lifecycle).

- Recyclability of the material.

- Degree of raw material and fabric producers’ social compliance (decent working conditions).

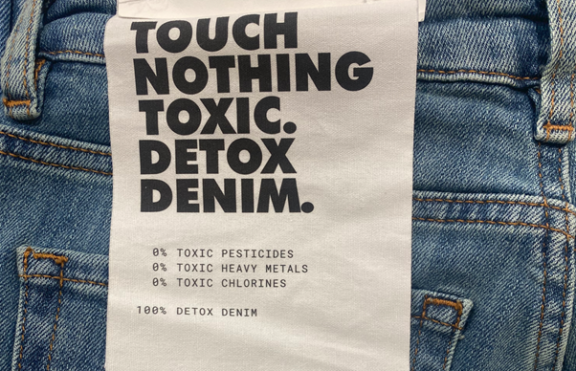

Figure 1: Organic cotton is a popular base material for use in sustainable denims

Source: Forward in Fashion

Alternative natural fibres

The versatility, strength, absorbency, breathability and anti-bacterial qualities of hemp and linen fibres make them good alternatives to virgin (new) cotton. They also require far less energy, water and pesticides to grow than cotton, and while cotton cultivation reduces biodiversity, these fibres encourage it.

Hemp

Hemp is a bast fibre made from the stems of non-psychoactive varieties of the Cannabis plant. Hemp is one of the most eco-friendly natural fabrics. It is a high-yield, fast-growing plant that is thought of as a carbon-negative raw material. This means it absorbs more carbon dioxide from the atmosphere than it produces. Hemp cultivation uses around 90% less water than conventional cotton. Due to the recent relaxing of regulations on hemp cultivation, hemp is experiencing something of a come-back. China is the largest producer of hemp fibre in the world.

Linen

Linen is a natural bast fibre made from the flax plant. Flax is the second-most productive fibre crop after hemp. Flax plants absorb a great deal of carbon and can grow in poor soil that cannot be used for food production. In some cases, flax can even fix polluted soil. The coastal regions of France, Belgium and the Netherlands were used for up to 64% of the flax used for fibres in 2022. Other important flax fibre-producing countries include Belarus, Russia, Ukraine and China.

Recycled fibres and materials

Using recycled inputs in the production of raw materials diverts waste streams from landfills. It means far fewer resources are needed than in the production of virgin materials and there are fewer carbon emissions. While using recycled synthetic fibres is more sustainable, the materials remain non-biodegradable and still release plastic microfibres.

To claim that a product is ‘recycled’, the Recycled Claim Standard (RCS) needs the product to be at least 5% recycled content. The Global Recycle Standard (GRS) needs at least 50% recycled content to qualify for product labelling. The number of RCS-certified sites worldwide increased from 8,004 in 2021 to 10,139 in 2022. The number of GRS-certified sites increased from 25,763 in 2021 to 34,178 in 2022. In Europe’s five largest markets (including the UK), the number of clothing items available on the market made from recycled materials grew by an average of 147% per year between 2018 and 2021.

Recycled polyester (rPET)

Recycled polyester is made from recycled PET plastic bottles, other packaging waste or polyester textiles. Recycled polyester fibres accounted for 14% of all polyester fibres produced in 2022. Owing to the many challenges involved in textile-to-textile recycling, 99% of all recycled polyester feedstock comes from the mechanical recycling of plastic bottles. REPREVE® is the most widely used brand of performance polyester fibre made from recycled bottles. PrimaLoft Inc. produces alternatives to down made from 100% recycled PET.

Recycled nylon (ECONYL®)

Recycled nylon accounted for 2% of all nylon produced in 2022. ECONYL® (by Aquafil) uses nylon waste from old carpets, fishing nets, marine debris and pre-consumer waste to create regenerated nylon that has the same properties, performance and quality as new nylon.

Mechanically recycled cotton

Recycled cotton accounted for 1% of all cotton produced in 2022. The quality of mechanically recycled cotton may be lower than that of new cotton because the process shortens the staple length of the fibres. As a result, recycled cotton is usually blended with virgin cotton or other natural fibres. Leaders in mechanically recycled cotton include Swiss Säntis Textiles Texloop™ and Recover™.

Recycled wool

Recycled wool is made by shredding woollen fabrics and re-spinning the resulting fibres. It made up around 7% of the global total wool market in 2022.

Recycled leather

Recycled leather is made by shredding pre-consumer leather scraps into a pulp. This pulp is then meshed between a fibre cloth and a polyurethane coating, which is then embossed with a leather-like texture. Although the use of synthetic binders may affect its biodegradability, the process provides an alternative to landfill for the huge amount of potentially hazardous waste materials that are created during the production of leather. Salamander is a well-known producer of recycled leather.

Chemical recycling of cotton textile waste

Chemical recycling is still in the early stages. Processes have improved to ensure that less energy and water are used, and a high percentage of the chemicals are recycled. Examples of commercial-scale chemical recycling of cotton or cotton-rich textiles include:

- Cupro – made from either recycled cotton garments or cotton linter, a by-product from cotton farming.

- Circulose® (by Renewcell) – a pulp from recycled cotton, used to make synthetic cellulosic fibres.

- Infinna™ (by Infinited Fiber) – breaks cotton’s cellulose down into a liquid to create filament fibre.

- NuCycl™ – cotton waste is shredded, liquified and purified before being turned into fibre.

- OnceMore® (by Södra) – the world’s first large-scale process for recycling polycotton blended fabrics.

European brands that currently use one or more of these fibre technologies include Arket, Tommy Hillfiger, Ganni, H&M group, Filippa K, Zara, Pangaia, Jack & Jones, Bestseller, Adidas, Armedangels, Reuben Selby and Reima.

Materials made using more sustainable production processes

The following materials are considered more sustainable because they have been produced using fewer inputs.

More sustainable viscose

EcoVero™ (by Lenzing) comes from wood and pulp sources that are Forest Stewardship Council or Programme for Endorsement of Forest Certification Schemes certified. EcoVero™ also claims to require 50% less water to produce than standard viscose fabrics and emits 50% less carbon dioxide.

Lyocell (also known as TENCEL™)

Lyocell is a man-made cellulosic fibre produced from the pulp of the eucalyptus tree, which does not require much in terms of water, fertiliser or pesticides to grow. The manufacturing process also requires less water than standard rayon or viscose, and it occurs in a ‘closed-loop system’ where up to 99.5% of dissolving agents can be reused. Lenzing AG (Austria) produces most of the world’s Lyocell under its Tencel® brand name.

Organic fibres

Organic farming is a farming system that protects the environment where the crops are grown. It restricts the pesticides that farmers can use, prohibits the use of GMOs and petroleum-based fertilisers, and it maintains high animal welfare standards.

- Organic cotton production uses 62% less energy, 91% less water and offers a 46% reduction in global warming potential compared to conventionally farmed cotton, according to a Life Cycle Assessment conducted in 2014. Global organic cotton fibre growth was up 37% in 2021 compared to the previous year. Turkey was the biggest contributor to this growth.

- When organic practices are applied to hemp and flax production, they can be some of the most sustainable fibres on the market.

- Organic silk is made from silkworm cocoons, which are only fed with organically grown mulberry tree leaves, produced without the use of synthetic pesticides or fertilisers.

The main certifications for organic textile fibres are the Global Organic Textile Standard (GOTS) and Organic Content Standard (OCS). The number of GOTS-certified facilities increased by almost 300% between 2017 and 2023, totalling 14,676 in 2023. India, China, Turkey and Bangladesh topped the list of countries with the highest number of certified factories.

Regenerative agriculture

Efforts to make cotton production more sustainable have expanded to include ‘regenerative agriculture’. This is a concept that focuses on phasing out harmful fertilisers and pesticides and ‘regenerating’ nature, including biodiversity, soil health and water. Multiple large European apparel retail groups have set goals in this area, including H&M and Inditex. Control Union introduced the first certification for regenerative agriculture: regenagri. More than 250,000 farms are currently regenagri-certified.

Chrome-free leather tanning

For reasons of both sustainability and consumer safety, ever more European buyers require chrome-free tanned leathers. This is to avoid the risk of Chromium VI forming in leather (which is restricted by REACH). Between 2014 and 2020, the proportion of chrome-tanned leather fell from 85% to 75%, and this trend is expected to continue. Chrome-free can be either vegetable tanned or wet-white tanned leather.

‘Responsible’ Standard materials

Responsible Standards (e.g. Responsible Down Standard and Responsible Wool Standard) recognise best (most humane) practices for farmers. When a brand commits to complying with these standards, all of its suppliers along the entire supply chain must be audited and certified to ensure product compliance and traceability from farm to factory. The Responsible Down Standard had a 3.2% market share of the total down market in 2022, while the Responsible Wool Standard had a 3.9% share in the same year.

Next generation bio-based materials

Bio-based materials are partly or completely made from renewable materials of biological origin. Many are biodegradable but not all. Some are lab-grown, such as Galy, which uses biotechnology to create cotton. Other bio-based materials focus on replacing fossil-based, non-renewable inputs with biological inputs. The use of inputs like plants and food crops can have negative effects on water, land, fertiliser and pesticide use, and it competes with food production. This is not the case for materials made from agricultural waste and by-products.

Agraloop™ BioFibre™

The Agraloop™ system processes waste from various food and medicine crops, including oilseed, hemp, flax, CBD hemp, banana and pineapple, and turns them into a textile-grade fibre called Agraloop™ BioFibre™.

Plant-based leather alternatives

According to carbon footprint consultancy Sustamize, the carbon footprint of plant-based leather is just 0.8-8 kg per square metre, compared to 110 kg for cow skin leather. Examples of plant-based leather alternative materials made from agricultural by-products include: Piñatex (which uses fibres from pineapple leaves), Vegea (made from grape leftovers from winemaking, vegetal oils and natural fibres from agriculture) and Uppeal (made from apple waste).

Orange fibre is a soft and high-quality silk-like material made from orange skins, a by-product of the juice industry. Orange Fiber has also partnered with the Lenzing Group to create lyocell fibres made from orange and wood pulp.

Other largely experimental materials made from agricultural by-products include S.Cafe (made from waste coffee grounds) and Woocoa (‘vegan wool’ made from coconut and hemp fibres).

Tips:

- Use assessment tools to evaluate the materials you work with. Assessment tools include the Higg Materials Sustainability Index, the Preferred Fiber & Materials (PFM) Benchmark and the sustainable materials guide by MODINT.

- Learn about the ZDHC restricted substances list by requesting access to the ZDHC Gateway here.

- Research the requirements of various sustainability standards, such as Global Recycle Standard (GRS), Recycled Content Standard (RCS), Global Organic Textile Standard (GOTS), Better Cotton Standard and Oeko-Tex.

- Check the list of licensed certification bodies for RCS and GRS here. If you want to be certified, you first need to obtain a scope certificate (valid for 12 months), which allows transaction certificates for each shipment.

- Follow the Textile Exchange for news and information regarding more sustainable materials.

2. What makes Europe an interesting market for sustainable textiles?

Europe is a very interesting market for apparel made from sustainable materials because of its size and its high demand for sustainable apparel. There are no specific trade data available for sustainable textiles, but we can understand the EU’s market potential based on a combination of other factors: apparel market size, regulatory landscape, consumer demand for sustainable materials and industry initiatives.

The world’s largest apparel import market has a responsibility to act

The European Union is the world’s biggest importer of apparel. According to Trademap and Eurostat data, the EU represents 27% of all global imports of apparel, and the market grew by an average of 6.75% per year between 2017 and 2022. On average, Europeans consume 26 kg of textiles per person per year (clothing, shoes, household textiles). EU countries also generate more than 5 million tonnes of textile waste per year, just over 11 kg per person.

Government pressure is driving change

The EU is stepping up legislation to make sustainable and circular products the norm. Any manufacturer that wants to enter the European market has to develop a sustainability strategy that includes sustainable materials.

The EU 2020 Circular Economy Action Plan (CEAP) considers textiles a key value chain that has an urgent need and significant potential for the transition to sustainable and circular production. Under the CEAP, the EU Strategy for Sustainable and Circular Textiles aims to ensure that, by 2030, textile products placed on the EU market will be long-lived, recyclable, mainly made from recycled fibres, free of hazardous substances and produced with respect for social rights and the environment.

Key measures are laid down in the new Ecodesign for Sustainable Products Regulation. This regulation includes requirements for:

- product durability, reusability, upgradability and reparability

- minimums for recycled fibre content

- energy and resource efficiency

- carbon and environmental footprints

- information requirements, including a Digital Product Passport

In addition to regulation, the EU stimulates sustainability by funding projects that work on eco-friendly textile innovations. Examples include the Herewear project (Belgium), Fibersort (the Netherlands), New Cotton Project (EU), T-Rex Project (EU), OnceMore® (Sweden/Austria) and the ZeroF project (Switzerland).

Figure 2: A growing number of Europeans see sustainable apparel as fashionable, but not all consumers are willing to spend more on such items

Source: Unsplash

Consumer demand for sustainable materials is increasing

Consumer awareness regarding sustainability is increasing in Europe. Studies show that 38% of consumers in Europe’s five largest markets take fashion brands’ social and environmental impact into account when shopping. 46.5% of Europeans bought sustainable fashion items in 2022, and more people see sustainable products as fashionable. Consumer awareness of the harmful effects of conventional fibre production is also increasing.

Despite these sentiments, European end consumers are not always willing to pay more for sustainable apparel. They expect brands to improve sustainability without strong adverse effects on price, quality or design.

The European fashion industry is the ‘leading global pathway towards sustainable clothing’

According to the 2023 Fashion Transparency Index, 51% of the 250 surveyed leading global brands now have a sustainable materials strategy. These often include material use targets, which can guide you in creating your own material sourcing strategy. Examples include:

- Inditex has committed to achieving 100% use of sustainable or recycled linen and polyester by 2025 and to using only textile raw materials (preferred fibres) that have a lower impact on the environment by 2030.

- Irish Retailer Primark committed to having all the cotton in their clothing organic, recycled or sourced from its own sustainable cotton sourcing programme, and fully traceable by 2027.

- In 2023, H&M increased the amount of recycled materials in its products to 25%, up from 17.9% in 2021, and the share of recycled or sustainably sourced materials to 85%. The brand’s target is for 100% of its materials to be either recycled or sustainably sourced by 2030.

Europe is also home to some of the industry’s most active multi-stakeholder initiatives, including Fashion for Good, the Laudes (formerly C&A) Foundation, the H&M Foundation and the Ellen MacArthur Foundation. Through its Global Change Award, the H&M foundation works to find, support and scale early-stage sustainable innovations. As many as 29 of its 46 winning innovations have been directly related to sustainable materials since its launch in 2016.

3. Which European countries offer the most opportunities for sustainable textiles?

Europe’s top six apparel markets are Germany, France, Spain, Italy, the Netherlands and Poland. Together, they account for 73.6% of the total value of EU imports. Between 2018 and 2023, Germany, Italy and Poland experienced an average yearly import growth higher than the European average, with Poland achieving up to 12.3% growth. Poland is still a relatively young sustainable apparel market, while the other countries in the top six have much more established sustainable apparel production and retail scenes.

Source: Eurostat 2023

Germany: Europe’s largest apparel market

Germany is the largest market for apparel in the EU, with an apparel import value of €41.1 billion in 2023 and an average annual growth rate of 4.3% between 2018 and 2023. According to Statista, Germans spent about €180.4 million on fair-trade textiles in 2022. Germany is host to some of the biggest and most influential trade fairs dedicated to materials, including Munich Fabric Start, Innatex, Performance Days and Sustainable Materials Expo.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there are 57 German retailers that are GOTS-certified across all textiles product segments. This is the highest number of the top six European apparel importers.

A 2023 IMF-Premiere vision study about consumer behaviour in sustainable fashion concluded that, for German consumers, the materials used is the number one criterion for determining a product’s eco-responsibility. The percentage of German consumers who feel well informed about fashion sustainability issues has doubled since 2019, reaching 36%. 69% of German consumers say that environmental and social compatibility are fairly or very important to them when purchasing clothing or footwear.

65% of German consumers trust eco-labels, and 50% specifically look for eco-labels before making a purchase. Germany has its own government-run social and environmental certification label, the ‘Green Button’, which is displayed on garments at the point of sale. Green Button recognises the following standards as proof of compliance in the auditing process: Fairtrade, GOTS, Oeko-Tex, Global Recycled Standard, Fair Wear, Bluesign and Cradle2Cradle. Certification is an important requirement for suppliers of German brands.

Ethical German brands include Armedangels, LANIUS, Vatter, Infantium Victoria, Honest Basics, Anekdot, Jyoti, Jan ‘N June, Dawn Denim, NIKIN, LangerChen, ThokkThokk, Sense Organics and Vaude.

France: a volume market with increasing sustainability standards

France is the second-largest market for apparel in the EU. It had an apparel import value of €23.9 billion in 2023 and an average annual growth rate of 2.5% between 2018 and 2023. While French luxury brands may have been slow to join the ethical fashion movement, smaller fashion labels are leading the way. France is also home to Premiere Vision, the world’s largest trade fair for apparel and textile materials.

France has introduced legislation that requires clothing companies to adhere to numerous sustainability requirements, including:

- a ban on the destruction of unsold clothes

- mandatory environmental score labels on all textile products sold in France, and

- notification (at point of sale) to customers about products that contain substances on the EU REACH Substances of Very High Concern list.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there are 52 French retailers that are GOTS-certified across all textiles product segments. This is the second-highest number of the top six European apparel importers.

A 2023 sustainable fashion consumer study revealed that there has been a significant increase in knowledge and understanding of fashion sustainability issues amongst the French public, particularly regarding sustainable materials. According to the study:

- 44.9% of French respondents purchased eco-responsible clothing in 2022

- Only 33% of people surveyed felt they did not know enough about the issue, compared to 50.4% in 2019

- 37.7% of respondents cite materials as the most important metric for eco-responsibility, up from 28.2% in 2019

According to another 2021 study, however, 58% of French consumers that never or rarely bought sustainable fashion did not do so because of the higher price point.

Ethical French brands include Hopaal, Veja, 1083, Bombón de algodón, caur, Marcia, Good Guys and émoi.

Spain: home to some of Europe’s largest fast-fashion retailers

Spain is the third-largest market for apparel in the EU. It had an apparel import value of €19.6 billion in 2023 and an average annual growth rate of 3.5% between 2018 and 2023. It is a world leader in fast fashion thanks to its flagship apparel groups Inditex (which owns Zara, Bershka, Massimo Dutti, Oysho, Pull&Bear, Stradivarius, Uterqüe and Lefties) and Mango.

A 2021 study revealed that sustainable fashion represents a small segment (8.65%) of the Spanish fashion market. A lack of trust in fashion companies and their sustainability claims is the main reason that Spanish consumers do not buy sustainable products or do so less often. The second main reason is the perceived higher cost of sustainable clothing.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there is only one GOTS-certified Spanish retailer across all textiles product segments. This is the lowest number amongst the top six European importers of apparel.

Despite these issues, there are several smaller ethical Spanish brands that cater to the growing European market. Ethical Spanish brands include SKFK, allSisters, The Nude Label, Cus, Beyond Skin, Ecoology, Lefrik, Swim Against, amt., Ecoalf, TwoThirds and Thinking Mu.

Italy: a large market for value-added products

Italy is the fourth-largest market for apparel in the EU. It had an apparel import value of €18.2 billion in 2023 and an average annual growth rate of 5% between 2018 and 2023. This is almost 1% higher than the EU average.

Apparel is a well-established industry in Italy, and the country has a standing long tradition of designing and producing high-end garments made using traditional, quality fabrics, including wool and leather. Although durability has always been important and concerns over the fashion industry’s environmental impact and working conditions are on the rise, sustainability has not become a big factor for Italian consumers yet.

A 2022 Statista survey found that the main factors that Italian consumers considered when buying clothes were price, fit and quality. The main reason for not buying sustainable apparel that consumers cited was the difficulty in deciding which brands were eco-friendly and the high prices of eco-friendly apparel. A 2023 study revealed that up to 46.7% of Italian consumers feel that materials are the most important metric for environmental responsibility.

According to another recent study, 74.7% of Italian consumers prefer to spend more on better quality items that last longer. More than 30% expected to reduce their spending on clothing and accessories in the coming months.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there are only two Italian retailers that are GOTS-certified across all textiles product segments. This is the second-lowest number among the top six European importers of apparel.

Ethical Italian brands include Womsh, Opera Campi, CasaGIN, Kampos, RE-BELLO, Souldaze, Zerrobarracento, Rifò, Gaia Segattini Knotwear, ID.EIGHT, Carmina Campus, Peninsula Swimwear and haikure.

The Netherlands: a hub for sustainable apparel

The Netherlands is the fifth-largest market for apparel in the EU. It had an apparel import value of €17.2 billion in 2023 and an average annual growth rate of 2.8% between 2018 and 2023. By 2030, the Netherlands aims to have all textile products contain 50% sustainable materials (at least 30% of which being recycled content) and 50% of post-consumer material recycled. These targets provide incentives for Dutch brands and retailers to choose suppliers that have sustainable materials sourcing and development capabilities.

The Netherlands is also home to several industry support organisations focused on sustainability, including Fashion for Good. This organisation connects companies that work on sustainable innovations with brands, retailers, manufacturers and funders. Of the ten innovators selected for its 2024 Innovation Programme, all directly related to sustainable materials.

According to Statista, in 2024, 73% of the consumers in the Netherlands said they considered sustainability in their purchasing decisions and consumer behaviour. While this figure is relatively high, it indicates a decline compared to previous years.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there are 17 Dutch retailers that are GOTS-certified across all textiles product segments.

Ethical Dutch brands include MUD Jeans, Jackalo, Kuyichi, Kings of Indigo, Unrecorded, Saint Basics, A-dam, O My Bag, Goat Organic Apparel, RVDK and Noumenon. More brands can be found on thegreenlabels, which is an Amsterdam-based e-commerce platform that curates green labels.

Poland: fastest growing economy in Europe

Poland is the sixth-largest apparel market in the EU. It had an apparel import value of €12.5 billion in 2023 and an average annual growth rate of 12.3% between 2018 and 2023. With low GDP, low wages and lagging sustainability awareness, Poland is not the most suitable market for sustainable textile products.

According to a 2021 BCG and Vogue survey:

75% of Polish consumers say sustainability is an important factor that influences their purchasing decisions while just 40% of Polish consumers say they actually buy ethical apparel.- 20-30% of Polish consumers say that they do not understand what sustainability is.

About two-thirds of Polish consumers say they are willing to pay more for sustainable apparel, but a 20% increase in price reduces the initial demand for sustainable apparel by up to 62%.

As Poland has to comply with upcoming EU regulations, brands and retailers will be forced to expand their sustainable product offerings, make changes to their supply chains and communicate about the sustainable aspects of their products more effectively.

According to the Global Organic Textile Standard (GOTS) database of certified companies, there are only six Polish retailers that are GOTS-certified across all textiles product segments.

Ethical Polish brands include NAGO, Elementy, PULPA, GAU, ŁYKO, Seaside Tones, KOKOworld, Imprm Studio, Aleksandra K, Roe&Joe, Osnowa and Drivemebikini.

Tips:

- Visit European sustainable fashion trade shows to understand the offering and customers’ requirements and demands. The world’s largest sustainable fashion trade show, Neonyt, is typically held in Germany. Other shows worth visiting are Mint, a show area for sustainable brands at the Modefabriek, the Dutch Sustainable Fashion Week in the Netherlands, Green Fashion Week and Innatex in Frankfurt.

- Visit the websites of the main sustainable brands in each of the countries to understand which materials they are working with and what sustainability certificates they require.

- Visit the websites of accelerator programmes such as H&M Global Change award and Fashion for Good to keep up to date with new innovations in sustainable materials.

4. Which trends offer opportunities or pose threats in the European sustainable materials market?

Suppliers that can support their buyers’ needs for materials innovation, chemicals management, transparency and reliable data will have a competitive advantage. The need for collaboration between buyers and suppliers is highlighted in the BOF-McKinsey State of Fashion 2023 report. This report reveals that 61% of fashion executives considered forming strategic partnerships with suppliers. This would enable both parties to benefit from investment in innovation and mitigate risks.

Demand for sustainable materials is bigger than the supply

According to a 2023 report, demand for ‘preferred’ raw materials could exceed supply by up to 133 million tons by 2030. One of the key recommendations of the report is for brands to source different materials. For example, in 2021, just 1.4% of all cotton grown was certified organic. At the same time, a survey of brands already engaged in organic cotton sourcing revealed an 84% increase in forecasted organic cotton demand by 2030 compared to 2020.

By supporting in-conversion cotton – cotton produced by farmers in the process of moving towards organic practices and whose cotton is not yet certified – an increasing number of European brands are helping to foster a new generation of organic farmers and solve current supply issues.

Use materials designed for sustainability and circularity

According to the Ellen MacArthur Foundation, 80% of a product’s environmental impact is affected by decisions made at the material design stage. Natural fibres are often blended with other fibres to add strength, stretch properties and/or durability. However, blended fabrics are not currently easily recyclable or biodegradable.

Some brands seek to use a single type of fibre in fabrics and garments, where possible. Other brands focus on the use of natural/eco-friendly dyes in the production of their materials. This approach requires working closely with manufacturers on materials sourcing, development and production.

Figure 4: Denim jeans brand Nudie uses recycled cotton fibres and promises its customers a free repair service

Source: Forward in Fashion

Strict EU chemicals legislation presents opportunities for forward-thinking suppliers

Many chemical substances have strict allowable limits for finished products under EU legislation. As a result, brands are increasing their requirements for suppliers. Hazardous substances that are not yet restricted under legislation may be included in the AFIRM restricted substances list (RSL) and the ZDHC manufacturing restricted substances list (MRSL). These are the leading industry guidance documents.

Most brands have developed their own Restricted Substances Lists (RSLs) and Manufacturing Restricted Substances Lists (MRSLs), which they distribute to suppliers annually. Non-compliance can lead to ending the business relationship. On the other hand, suppliers that have effective chemical management systems will have many more opportunities in the future.

Transparency is central to the fight against ‘greenwashing’

European consumers still lack clear information about sustainable fashion and sustainable materials. This is not surprising given that only 44% of the industry’s leading 250 brands define what they mean by ‘sustainable materials’.

In March 2023, the European Commission adopted a proposal for a Green Claims Directive (GCD) aimed at preventing brands and retailers from making false or exaggerated sustainability claims towards consumers. This is a practice known as ‘greenwashing’. It will require companies to back up their environmental claims with data.

This kind of legislation is particularly relevant when it comes to claims about recycled polyester, viscose, deforestation-free leather, ‘responsible’ or ‘eco’ materials, and ‘vegan’ leather.

Collaborate to create scale

Sustainable brands and retailers are increasingly sharing information about their efforts to become more sustainable. These companies recognise that the only way to achieve a more sustainable industry is to create more demand that forces innovative new products (including sustainable materials) into mainstream supply and reduces their price. Brands that share information about materials innovations – such as H&M, Houdini and Pangaia – do so because they understand that the more companies use sustainable materials, the better.

However, globally in 2023, only 41% of consumers were willing to pay more for a product they believe to be sustainable, compared to 57% in 2020. The ongoing cost of living crisis is likely to continue this trend.

Tips:

- Make the use of sustainable materials part of your corporate story and demonstrate its positive impact. Create a business case that explains why buyers should buy your sustainable textiles or products.

- Source ‘transitional’ or ‘in-conversion’ cotton as an alternative to organic cotton if it is impossible to source organic cotton materials. Promote this to your buyers. More information can be found here.

- Participate in a short ZDHC training programme to understand and implement best practices in chemical management. Work towards eliminating the use of chemicals and dyes that are not ZDHC-approved.

- The AFIRM Restricted Substances List (RSL) is updated each year by 1 February. It is freely available and downloadable from the AFIRM website, and it is currently offered in six languages.

- Subscribe to ECHA (European Chemicals Agency) to receive automatic newsletter updates about changes to REACH and other chemical legislation in the EU.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research