Entering the European market for sustainable materials

Many buyers in Europe are increasing their requirements for socially responsible and sustainable production. This shift is driven by growing consumer awareness of the negative social and environmental impacts of fashion, as well as stricter regulations.

Contents of this page

1. Brand commitments

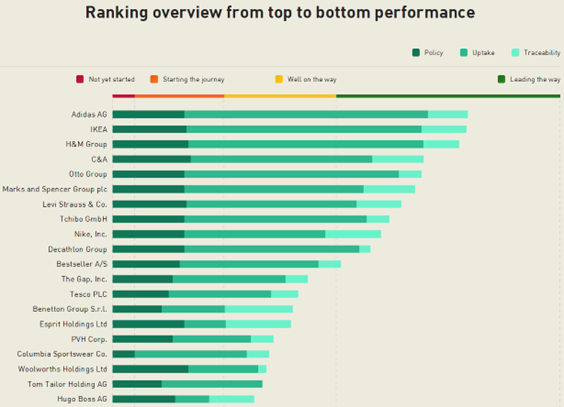

Major apparel brands and retailers across all price/value segments are stepping up their commitments to use more sustainable materials. In the sustainable cotton ranking, for instance, Adidas, IKEA, H&M, C&A and OTTO Group lead the way. European fashion companies are also providing more information to end consumers about the materials used in their products (e.g. in manufacturing location, fabric composition, finishing and production methods).

Industry-wide initiatives

Fashion brands and retailers, pressure groups, solution providers and individuals throughout the industry have come together in several platforms, programmes and pledges to implement solutions to fashion’s most pressing issues. Examples include:

- Cascale (formerly known as the Sustainable Apparel Coalition): a multi-stakeholder non-profit alliance that promotes social justice and works to reduce environmental impact.

- ACT: an agreement between unions, brands and global retailers to improve working conditions and wages in garment-producing countries.

- ZDHC (Zero Discharge of Hazardous Chemicals): a multi-stakeholder organisation dedicated to reducing the industry’s chemical footprint.

- Fashion For Good (FFG): an innovation platform that connects sustainable innovators with brands, retailers, manufacturers and funders.

- H&M Global Change Award: an accelerator for early-stage sustainable innovation.

- The Textile Exchange’s 2025 Sustainable Cotton Challenge to source 100% of their cotton from the most sustainable sources by 2025.

- CanopyStyle: an industry collaboration to stop the sourcing of materials from endangered forests.

- The German Textile Partnership, in which apparel companies agree to use 70% sustainable cotton by 2025, of which 20% must be organic cotton.

- The Charter for Climate Action: a pledge of over 40 large fashion brands to achieve net zero emissions by 2050.

- The Fashion ReModel initiative to boost circular apparel, led by the Ellen MacArthur Foundation.

Figure 1: Sustainable Cotton Ranking: how global brands score on policy, traceability and actual uptake of sustainable cotton

Source: Sustainable Cotton Ranking 2020. ©WWF ©Solidaridad ©PAN UK

EU legislation pushing for more sustainable fashion

The European Union’s ‘Green Deal’ aims to make Europe the first climate-neutral continent by 2050.

This collection of new laws and regulations includes legislation on:

- Ecodesign for Sustainable (textile) Products.

- A ‘right to repair’ for consumers.

- Due diligence regarding human rights and environmental protection (CSDDD).

- Traceability and reporting (CSRD).

- Deforestation-free products (EUDR). Currently, this only applies to the import of leather (skins).

- Extended producer responsibility (EPR), an initiative to make companies financially responsible for the environmental costs of textiles during their lifecycle.

- A ‘Green claims’ directive to stop companies from using vague or misleading claims about the sustainability of their products.

Why are sustainable materials important?

Materials can have a direct negative impact at each stage of the garment lifecycle, from the cultivation and production of fibres to the garment’s end of life phase.

Table 1: Negative impacts at each stage of the apparel-making process

| Raw materials extraction/cultivation | Materials production | Garment production | Use | Disposal |

| Water usage | Water usage | Post-industrial material waste/scraps | Lack of fabric durability | Non-recyclable composition |

| Fertiliser usage | Energy usage | Dry-clean only | Non-biodegradable | |

| Pesticide usage | Use of harmful chemicals/dyes | Microplastics shedding/ pollution | ||

| Land usage | Air pollution/ Greenhouse gases | |||

| Use and/or treatment of animals | Water pollution | |||

| Depletion of resources | ||||

| Poor working conditions | ||||

Source: FT Journalistiek

Garments that are not recycled, upcycled or repaired often end up in landfill or are incinerated. Many materials are not biodegradable. Fabric composition is also a big part of recyclability because many blended fabrics are harder to recycle.

The production of petroleum-based materials creates a lot of greenhouse gases. These materials include polyester, nylon and acrylic. When washed, clothing made from these fibres also releases microplastics.

Some fibres and materials (e.g. cotton) require a lot of water, land, energy and chemicals to produce. Animal-derived natural fibres and materials (e.g. down feathers and wool) are often obtained from animals that have been subjected to unnecessary suffering (e.g. live plucking, force feeding or mulesing).

What makes a material sustainable?

A material can be considered more sustainable if it is produced and can be maintained or disposed of in a way that is considerate of humans, social justice and the environment. These materials may be:

- Manufactured using inputs and materials that cause less harm to the environment during production.

- Manufactured from materials that are already in circulation (non-virgin materials, waste materials and manufacturing by-products).

- Manufactured from inputs and materials that cause less harm to the environment during disposal (e.g. biodegradable).

- Manufactured using sustainable processes that use less water, energy, pesticides, fertilisers and/or harmful chemicals.

- Obtained from animals that have been treated in an animal-friendly manner.

- Of decent quality and durability to lengthen the product lifecycle.

- Manufactured by organisations that employ socially-compliant practices, including:

- Workplace health and safety

- Payment of a living wage/fair wage

- Lack of child or forced labour

- Decent working conditions

Tips:

- Look at the ITC Standards map for a full list of independent standards that cover environmental impact and traceability.

- Check Solidaridad’s Wet Processing Guidebook for an extensive overview of industry initiatives, tools, certificates, guidelines and strategies for reducing social and environmental impacts during the wet-processing stage of material production.

- Study the ‘Five Freedoms’. This framework is commonly used in Europe for assessing animal welfare. Animal rights advocacy group Four Paws has translated the five freedoms into a set of recommendations for animal welfare.

- Read the CBI studies The sustainable transition in apparel and home textiles, Tips to become a socially responsible manufacturer and Tips to go green for background information about the growing market for sustainable apparel in Europe and practical tips.

2. What requirements and certifications must sustainable materials meet to be allowed on the European market?

All apparel exported to the EU, made with sustainable materials or not, must comply with several legal requirements, including ones that concern product safety, the use of chemicals (REACH), quality and labelling. Apparel for children has special consumer safety requirements. Check the EU Access2Markets online helpdesk for an overview. Other requirements are voluntary, but meeting them can give you a competitive advantage.

What are mandatory requirements?

Follow these steps to ensure that your product complies with the relevant legal requirements to export apparel to the EU:

- Make sure your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC).

- Make sure you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel.

- Pay special attention to the following safety standard that applies to apparel for children: EN 14682.

- Specify the material composition of every apparel item that you export to the EU in line with Regulation (EU) 1007/2011. Check the EU Access2Markets online helpdesk to learn how to do it.

- Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers.

Additional regulations for the use of chemicals

Some EU countries have extra regulations for specific chemicals. For example, Austria, Finland, Germany, Norway and the Netherlands have specific regulations for formaldehyde in textiles. Austria, Denmark, Germany and the Netherlands also have specific regulations for PCP, while Germany has regulations for dispersing dyes in textiles. Switzerland has its own regulation for chemicals: the ORRChem. The UK’s REACH regulationcame into force on 1 January 2021 after it left the EU.

Non-legal mandatory requirements

Buyers may have additional, company-specific terms and conditions. These requirements can usually be found in a buyer manual. By signing a contract with your buyer, you confirm that you will comply with all the requirements listed in the manual. If there is a problem at your or one of your suppliers’ facilities or with the product, you will be held accountable.

- Brands and retailers may need social and environmental audits of raw materials production facilities to be conducted, either by the brand/retailer itself or by an independent third party. These audits can be announced or unannounced. Factories and mills that do not allow full access will often be blacklisted and will not receive orders in future.

- As well as REACH, many brands have created their own Restricted Substances Lists (RSLs), based on industry and regulatory standards, which suppliers of both materials and garments need to follow.

- Many buyers have a supplier Code of Conduct in their supplier manual. This Code of Conduct outlines the buyer’s values and policies regarding key topics. It is intended to ensure that suppliers understand and comply with required ethical standards. It may cover the following aspects:

- Child labour

- Forced labour and overtime

- Health and safety

- Discrimination

- Fair remuneration

- Environment

- Business integrity and conflicts of interest

- Intellectual property

Tips:

- Ask your buyer if they have a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemical use by the ZDHC foundation. Download the ZDHC’s Conformance Guidance here. Share your buyers’ RSL with your raw material suppliers.

- Search online for documents created and published by brands that outline their expectations of suppliers in terms of conduct (i.e. Codes of Conduct) or chemical use (i.e. RSLs).

- Ask buyers for their supplier manual, which should include all their requirements.

- Develop your own Code of Conduct, for instance based on the BSCI principles, and communicate this to your suppliers.

What additional requirements do buyers often have?

European buyers are always looking for special materials or production methods that will help them stand out in the market in terms of sustainability. Suppliers should be active in finding, developing and implementing new solutions that facilitate the development and marketing of more sustainable products.

Certifications

Ever more European buyers require facilities, products and/or materials to be independently certified for social responsibility, environmental impact and use of harmful substances. The certification process can be time-consuming and costly. However, getting certification shows a commitment to sustainable practices throughout your supply chain. The most popular standards and certifications for base materials in the European apparel market can be found in the table below.

Table 2: Key certifications for sustainable materials in the European apparel market

| Name | Logo | Description | Further information |

| OEKO-TEX® 100 |

| Tests fabrics and accessories for substances considered harmful to human health. Most European brands require products to carry the Oeko-Tex quality mark. | Check the STANDARD 100 by OEKO-TEX® application process here |

| OEKO-TEX® STeP |

| Social and environmental certification system for brands, retailers and manufacturers in the textile and leather industry. Certification is suitable for production facilities at all processing stages. | Check the OEKO-TEX® STeP application process here |

| EU Ecolabel |

| The EU Ecolabel is a voluntary label for products and services with a reduced environmental impact. It is only awarded to products with the lowest environmental impact in a particular product range. | Check the EU Ecolabel application process here |

| BCI | The Better Cotton Initiative (BCI) is a non-profit, multi-stakeholder governance group that promotes better standards in cotton farming. It is active in 21 countries. | Check the BCI membership process here | |

| GOTS |

| The Global Organic Textile Standard (GOTS) is the leading standard for organic textiles. It applies to the harvesting of raw materials, environmentally and socially responsible manufacturing, and labelling. | GOTS provides a list of organisations that can perform an audit |

| C2C |

| Cradle to Cradle Certified® is a third-party certification programme and a standard for materials and products considered to be safe, circular and responsibly made. | Check the C2C® certification process here |

| Bluesign® |

| The use of Bluesign®-approved chemical products and materials increases the safety of products and minimises risks for companies throughout the value chain. Bluesign®-approved textiles are sustainably produced and assessed according to the Bluesign® criteria. | Learn more about the Bluesign® assessment process here |

| ZDHC | A multi-stakeholder programme that leads the apparel industry in eliminating harmful chemicals from supply chains. | ZDHC provides a guide that outlines the requirements for indicating ZDHC MRSL conformance | |

| Sedex |

| An online platform for companies to manage and improve working conditions and environmental protection in global supply chains, from raw material production to garment manufacturing. | Check the Sedex certification process here |

| Fair Wear Foundation |

| This certification is for brands committed to improving labour conditions in their supply chains. FWF works with brands, factories, trade unions, NGOs and sometimes governments. | Check the FWF membership process here |

| Fair Trade |

| Fair Trade is a non-profit organisation that focuses on smallholder farmers and workers in developing countries. It is a movement to reduce poverty and promote fair and equal opportunities. | Check the Fair Trade certification process here |

| regenagri |

| regenagri is a regenerative agriculture programme supporting farms and organisations transitioning to holistic farming, increasing soil health, encouraging biodiversity, reducing greenhouse gas emissions and sequestering carbon dioxide. | Learn more about getting certified here |

Source: FT Journalistiek

Supply Chain Transparency

Supply chain transparency is key for the European apparel industry. It is motivated by ever stricter laws at EU and national levels. New EU legislation, including CSDDD, CSRD and the Green Claim Directive (GCD), requires companies to investigate Corporate Social Responsibility (CSR) risks, report on abuses, mitigate risks and communicate truthfully with end consumers. Transparency means you should disclose information about your operations to buyers and help them gain as much insight into their supply chain as possible.

The GCD is a particularly interesting piece of new legislation, because European end consumers still lack clear information about sustainable fashion and materials. This is not surprising given that only 44% of the industry’s leading 250 brands define what they mean by ‘sustainable materials’. The GCD aims to prevent brands and retailers from making false sustainability claims to consumers, and it requires companies to back up their environmental claims with data.

This kind of legislation is particularly relevant to claims about recycled polyester, viscose, deforestation-free leather, ‘responsible’ or ‘eco’ materials, and ‘vegan’ leather.

Read more about how to comply with transparency requirements on the Clean Clothes Campaign and Human Rights Watch websites. Many European companies have published the names of their suppliers in the Open Apparel Registry. To see how European brands are doing according to Fashion Revolution, read their Transparency Index.

There are many different tools that can help you map your supply chain. A few examples are given below.

- Sourcemap helps you maintain an up-to-date visualisation of raw material producers, mills, wet-processors and manufacturers, their compliance with industry standards and CSR risks.

- Supplyshift offers a cloud-based platform to help companies measure risks and improve supplier performance throughout the supply chain.

- ChainPoint is a software platform for monitoring and securing supply chains. It lets you manage and share product, process and supplier information, from raw materials to finished products.

- String3 | Historic Futures helps you find out where and how your products are made, and to pinpoint high-risk areas and focus your solutions.

- Ecovadis profiles and maps your supply base for ethical, social and environmental risks using predictive intelligence to manage CSR risks.

- Amfori BEPI is an online platform for environment-related supply chain information that enables companies to add their producers and map their supply chains.

- Sedex offers an ethical data platform and support to companies that want to map their supply chains.

Tips:

- Provide buyers with as much information about your product as possible. The more information you can give about the origin of your materials, the better.

- Incorporate standards and certifications into your collections. Showcase innovations with hang tags and product explanations. Group collections by sustainable fabric theme.

- Keep up to date with the latest in voluntary certification schemes by researching brands and how they market their products, and by attending tradeshows.

- Look at how brands and retailers market themselves in terms of sustainability. Position yourself as a sustainable, ethical supplier and reflect this in your marketing and storytelling.

- Create a professional English language website. Share information about the initiatives you are involved in and the sustainable materials you use through a journal or blog.

Innovation in sustainable materials

The industry is constantly innovating so fibres, other raw materials and wet-processing techniques are becoming more sustainable. Next-generation eco-fibres can be used alone or blended with other types of fibres to make new materials. Many of these are branded or patented, and some offer interesting additional features and properties.

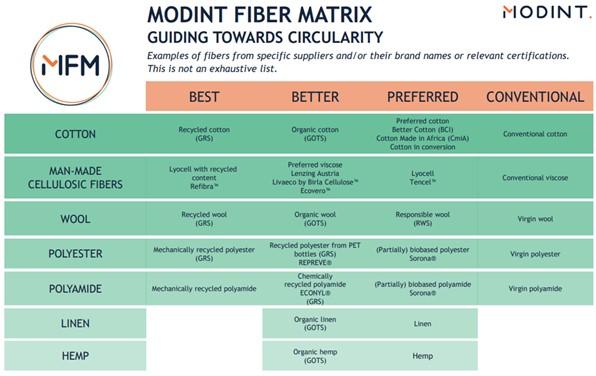

To help buyers, product developers and designers choose more sustainable fibres, the Dutch industry association Modint has developed a helpful benchmark called the Modint Fibre Matrix (MFM, see below). The MFM focuses on the most-used and commercially available fibre materials and ranks them as conventional, preferred, better and best options. Other tools that can help you assess materials include the Modint bAwear Score, the Higg Materials Sustainability Index and Preferred Fiber & Materials (PFM) Benchmark.

The MFM only covers raw material extraction and primary processing. The materials have been assessed using five parameters: climate change, energy use, water use, land use and circularity. Read the free online report for more information about the methodology used to rank the fibres.

Several fibres that are listed in the MFM and several materials that are not are described in more detail in the following sections.

Figure 2: Modint Fibre Matrix

Source: Modint Fibre Matrix. ©Modint

Preferred man-made regenerated cellulose fibres

Man-made cellulosics are primarily made from wood pulp or other sources of cellulose, such as bamboo. The chemical process for creating fibres like rayon, modal and viscose can be very toxic, even though it is more sustainable than for petroleum-based fibres such as polyester. Preferred man-made cellulosics are ones that are derived from sustainably managed forests and/or have a production process that is efficient and not chemically intensive. Austrian company Lenzing is the industry leader in preferred man-made cellulosics.

- Lyocell is a man-made cellulose fibre derived from wood pulp, most commonly from eucalyptus trees. Unlike modal or rayon, it is obtained by using an organic solvent spinning process in a closed-loop system that recovers 99% of the required solvent. Lyocell is already widely used across the fashion industry. Lyocell brand TENCEL™ (by Lenzing) uses sustainably sourced wood certified by the Forest Stewardship Council (FSC).

- ECOVERO™ is a viscose fibre produced by Lenzing that uses eco-responsible production practices that have lower water impact and carbon dioxide emissions than conventional viscose. ECOVERO™ fibres are certified with the EU Ecolabel.

- SeaCell™ (by SmartFiber AG) is a fibre made from renewable resources – wood and seaweed – using energy and resource-saving methods.

Bio-based fibres and materials

An increasing number of bio-based substitutes for leather, fossil fuel-based synthetics and other less sustainable fabrics are entering the market. Many are marketed as ‘vegan’ and use by-products from other industries, including the agricultural and food industries. Several are bio-degradable, but some use synthetic binding materials or coatings. Note that the biggest portion of the current ‘vegan leather’ market is made up of bonded materials made entirely from oil-based synthetics like polyurethane (PU) or polyvinylchloride (PVC).

Always investigate the material composition of new innovative materials. Many patented bio-based materials are only known by their brand names, including the following:

- Piñatex® (by Ananas Anam) is a natural textile made from the leaves of the pineapple plant, which are usually discarded or burned. In addition to being circular, it creates new income streams for subsistence farmers.

- Wine or grape leather is a vegan leather made by VEGEA® that uses waste products from the Italian winemaking process. It has a high content of vegetal, renewable and recycled raw materials. It is 100% recyclable.

- Orange Fiber is a silky fibre made from citrus juice by-products. It was first included in the H&M Conscious exclusive collection in 2019. Recently, Orange Fiber started a collaboration with Lenzing to produce a TENCEL™ branded lyocell fibre made from orange pulp and wood sources.

- Woocoa is an animal-free wool made using excess coconut fibre from the food industry and hemp fibres.

- Brewed Protein™ (by Spiber Inc.) fibres are made from structural proteins produced by microbial fermentation in a process that uses plant-based materials, such as sugars.

- QMILK is a milk protein fibre made from non-food milk and renewable raw materials. It is silky, soft and has anti-bacterial properties.

- S.Café® is a bio-based textile fibre made from leftover coffee grounds.

- Polylactic acid is a biodegradable natural polymer produced using renewable sources. It is mainly extracted from corn, cassava, wheat, straw and other crops that contain starch, and it is spun into polylactic acid fibre.

- FLOCUS™ is the brand name for kapok textile fibres and materials. Kapok fibre is picked directly from the kapok tree, which needs no irrigation, pesticides or fertilisers, can grow on difficult terrain including mountains and absorbs carbon dioxide from the atmosphere. FLOCUS™ materials also offer other properties, including moisture management, temperature regulation and insect repellence.

- Mycotex by Neffa is a mycelium-based material that allows for seamless, custom-made 3D-manufacturing items for the textile and apparel industry.

- Soybean protein fibre is made from by-products in the soy food industry that produces soymilk, soybean oil, tofu and so forth. Left-over fibres from the wet-spinning process are used as animal feed so there is no waste.

Figure 3: Conventional cotton and polyester still dominate the apparel industry, but sustainable materials are increasing, including fibres made from wood pulp, cotton cuttings and agri-food by-products such as pineapple leaves

Recycled fibres and recycling technologies

Brands and retailers in Europe are increasingly demanding recycled content in their products, in line with new EU regulations that aim to promote a ‘circular economy’. Fibres can be recycled from pre-consumer waste (e.g. fabric scraps from the cutting room) and post-consumer waste (garments used and discarded by consumers). Fibres can also be produced by recycling other materials (e.g. plastic bottles) to make new fabrics.

- Cotton fabric can be mechanically recycled into cotton fibres for use in new textile products in a process that saves water and energy and diverts waste from landfills. The quality of recycled cotton fibres may be inferior due to shorter fibre lengths. This is why they are usually blended with virgin cotton. Branded recycled cotton fibres include Recover™.

- ECONYL® is the industry’s leading branded product that uses nylon waste from old carpets, fishing nets and pre-consumer waste to create regenerated nylon that has the same properties, performance and quality as new nylon. A large number of lingerie and hosiery brands have adopted it, as have high-performance swimwear, sportswear and outdoor apparel brands.

- REPREVE® (by Unifi, Inc.) is the world’s leading recycled fibre. It is a durable performance polyester fibre with wicking, thermoregulation and water repellent properties made from recycled post-industrial plastic waste. It is used extensively in the sports and activewear segments, but it has also been widely adopted in the fashion segment.

- The production of REFIBRA™ (by Lenzing) involves upcycling cotton scraps from garment production. These cotton scraps are turned into cotton pulp, which is added to wood pulp. The combined raw material is used to produce virgin TENCEL™ Lyocell fibres.

- Infinited Fiber’s patented technology takes cellulose-rich waste that would otherwise be landfilled or burned – old textiles, used cardboard, crop residues like rice or wheat straw, and more – and transforms it into premium-quality fibres for the textile industry.

The following standards are the most common in the European market for recycled base materials:

- The Recycled Claim Standard (RCS) tracks recycled raw materials throughout supply chains using the Content Claim Standard’s chain of custody requirements.

- The Global Recycled Standard (GRS) is a product standard that incorporates recycled material verification, social and environmental responsibility criteria, and chemical management.

More sustainable natural fibres and materials

On the one hand, natural fibres can be considered sustainable as they are renewable, biodegradable and often durable. On the other hand, depending on how they are extracted, cultivated and processed, they may be considered unsustainable. For example, the growing of conventional cotton requires large amounts of water, fertilisers, pesticides and chemicals.

- The use of organic cotton is increasingly becoming a requirement, particularly for mid to high-end fashion segments. This is cotton grown without the use of GMOs (Genetically Modified Organisms) and synthetic chemicals. The industry certification is GOTS (Global Organic Textile Standard). Read more about organic cotton in the CBI study on sustainable cotton.

- The Better Cotton Initiative (BCI) is a non-profit that promotes better standards in cotton farming and practices across 25 countries. Better Cotton is sourced from licensed BCI farmers who have proven their commitment to continuous improvements in sustainability. Better Cotton currently accounts for 23% of global cotton production.

- Hemp is a strong, natural, sustainable fibre produced from the stems of the cannabis plant. It requires little water and almost no pesticides or fertilisers. For an example of a producer, study Marmara hemp. Grown in France, it is the first hemp manufacturer to receive C2C certification.

- Linen is a strong, natural, sustainable fibre made from the fibres of the flax plant. Compared to cotton, linen requires less water to produce and can be grown without pesticides and fertilisers. Similar to hemp, linen also absorbs a large amount of carbon dioxide from the atmosphere. Every part of the plant is useful in manufacturing various products, so there is very little waste.

- Producing wool is resource-intensive. It requires large amounts of land for grazing sheep, water and chemicals. Furthermore, in many instances, animals are not treated humanely. Responsible wool is wool that meets certain animal welfare and land management standards. Recycled wool is another very responsible option. The industry certifications are RWS (Responsible Wool Standard) and GRS (Global Recycled Standard).

- Responsible down is down obtained from animals that have not suffered unnecessary harm (e.g. force-feeding or live plucking). The industry certification is RDS (Responsible Down Standard)

Sustainable textile dyeing techniques and non-synthetic dyes

Wet processing (sizing, de-sizing, pre-treatment, dyeing, printing and finishing of textiles) is the most chemical and water-intensive stage of textile manufacturing. Textile dyeing is also the second-largest polluter of clean water after agriculture. Some sustainable innovations in this area:

- Living Colour is a bio-design research project that explores the possibilities of natural textile dyeing with bacteria that produce pigments. Living Colour and PUMA have joined forces to present the first bacterial-dyed sportswear collection.

- DyeCoo uses carbon dioxide to dye textiles in a process that does not require any water. Carbon dioxide dyeing does not need extra chemicals to dissolve dyes. The technology uses 100% pure dyes and, with an uptake of more than 98%, produces very little waste. The carbon dioxide used is reclaimed from existing industrial processes, and 95% of it is recycled in a closed-loop system. The company has been able to scale the technology, and it is now being adopted by a range of mills and brands.

- The We aRe SpinDye® colouring method focuses on the colouration of recycled polyester materials before they are extruded into fibres and spun into yarn. By melting colour pigments and the recycled polyester mass together, solid-coloured yarns are created without the use of water. The method reduces the amount of water used throughout the textile production chain by 75%. We aRe SpinDye® only uses recycled polyester made from post-consumer water bottles or used clothing. This allows the company to have a truly circular production method.

- ColorZen’s revolutionary technology applies a patented treatment to raw cotton, making the cotton dyeing process faster, more efficient and less chemical, energy and water-intensive.

Natural colouring

To be naturally coloured, fabrics can be dyed using only natural raw materials. Examples of companies that innovate in this area include IndiDye®, Fibre Bio and Greendyes.

- Recycrom creates a full range of pigment powders that use textile fibres from used clothing and manufacturing waste. Through a sophisticated production process, fabric textile waste fibres are transformed into a fine powder that can be used as a pigment dye for fabrics and garments made of cotton, wool, nylon or any natural fibre and blend.

- Colorifix is the first company to use an entirely biological process to produce, deposit and fix pigments into textiles, eliminating the use of harsh chemicals.

Where to find information on sustainable materials?

It is important to constantly stay up to date with innovations in sustainable materials to maintain a competitive advantage. Information can be obtained from various sources, and there are tools available to help you to assess and communicate the environmental impact of your materials.

Trade fairs

Visiting a trade fair is a good way to keep up to date with innovations in sustainable materials. The main fairs that showcase sustainable materials include:

- The Future Fabrics Expo, London

- Texworld, Paris

- Premiere Vision, Paris

- The London Textile Fair, London

- Intertextile Shanghai Apparel Fabrics, China

Industry publications and initiatives

Online industry publications, such as the Sourcing Journal, Just Style and the Business of Fashion, publish information about new developments in sustainable materials. They also offer information about the developments, collaborations and activities of initiatives, brands and retailers in this area.

The H&M Global Change Award and Fashion For Good websites, and various online industry publications publish information about participants and winners of the H&M Global Change Award and the Fashion For Good/Plug and Play accelerator programme.

Tips:

- Study the environmental impact of different textile and non-textile materials in The Sustainable Apparel Coalition’s Materials Sustainability Index.

- Check the Material District or Springwise online databases to stay up to date on innovations in sustainable materials for apparel production.

- Check out the websites of sustainable and transparent brands to find information about sustainable materials, techniques and suppliers. Examples include Houdini, Patagonia and Asket.

3. What are the most important market segments for products made of sustainable materials?

Premium consumers across lifestyle segments are generally willing to pay more for sustainable products. At the same time, many more price-conscious consumers expect brands to improve their materials’ sustainability without any impact on price, colour variation, performance or ease of care.

Luxury segment

Paying a higher price for luxury goods does not necessarily mean that they are ethical or eco-friendly. The European luxury segment has made a certain amount of progress in this regard. Stella McCartney is a leader in the sustainable luxury apparel segment, which produces sustainable and cruelty-free designs and introduces innovative new sustainable materials.

Upper-middle and premium lifestyle segments

Premium consumers are generally willing to pay more for products made with sustainable materials. Several emerging brands have created brand identities around environmental and social awareness. Sustainable fashion brands in this segment include Organic Basics, ASKET, Mud Jeans, Ecoalf, Kings of Indigo, People Tree, Armedangels, Pangaia and Everlane.

Budget and lower-middle price/value segment

Large mainstream fashion players in the budget and lower-middle segments use readily available sustainable materials in their collections, such as organic cotton, recycled cotton and recycled polyester, at prices that do not differ significantly from the core collection. Examples include Zara’s ‘Join Life collection’, C&A’s ‘More Sustainable Collection’, Primark’s ‘Sustainable cotton programme’ and the ‘Primark Cares’ label.

Active, sports and outdoor segments

The promotion of sustainable and healthy lifestyles is an intrinsic part of the brand identity of sportswear, activewear and outdoor wear brands like Helly Hansen, Houdini, Haglöfs and Fjallraven. Petroleum-based synthetic materials and performance finishes are widely used in these segments, and there is a lot of motivation for the development of sustainably-produced high-tech performance fabrics.

Workwear segment

Already heavily regulated in terms of performance and safety standards, the workwear segment is a pioneer in sustainability, in circular apparel in particular. It includes brands such as Blåkläder, Helly Hansen Workwear, Schoeller Textile AG and Schijvens. The biggest challenge is to source materials that are sustainable without compromising durability, protection or functionality. For more information about workwear, read CBI’s study on Exporting workwear to Europe.

Tip:

- Check CBI’s studies on Sustainable Cotton, Hemp, Recycled Fashion, Leather Fashion Accessories and Tips to go green for more background information and practical tips on how to source and process sustainable fibres and fabrics.

4. What are the prices for sustainable materials on the European market?

The price of sustainable materials is determined by the cost of inputs, farm practices, production processes, recycling after use, the need for certification and scale. Even though the industry invests heavily in research and development to bring new technologies and sustainable materials to the market, implementation and the scaling of new innovations is still limited.

The market for preferred fibres

According to the Textile Exchange’s Materials Market Report 2023, global fibre production grew from 112 million tonnes in 2021 to 116 million tonnes in 2022, and it is expected to grow to 147 million tonnes in 2030. Still, only a small portion is produced ‘sustainably’.

Polyester production volumes increased from 61 million tonnes in 2021 to 63 million tonnes in 2022. Polyester still makes up 54% of the total global fibre market (2022). Cotton from the programmes recognised by the 2025 Sustainable Cotton Challenge made up 27% of total cotton production in 2021/22. Wool produced in accordance with the Responsible Wool Standard (RWS), SustainaWOOL (GREEN and GOLD) and Climate Beneficial™ increased from around 3% in 2021 to 4.3% in 2022.

Manmade cellulosic fibres certified by FSC and/or PEFC had a market share of 60–65% in 2022.

Even though the production of recycled fibres has increased in recent years, its total market share is lagging. The number of RCS-certified sites worldwide increased from 8,004 in 2021 to 10,139 in 2022. Comparatively, the number of GRS-certified sites increased from 25,763 in 2021 to 34,178 in 2022. In Europe’s five largest markets, including the UK, the number of clothing items available on the market that were made from recycled materials grew by an average of 147% per year between 2018 and 2021.

Still, according to Textile Exchange’s Materials Market Report 2023, recycled textiles’ market share decreased slightly from around 8.5% in 2021 to 7.9% in 2022. Pre and post-consumer recycled textiles accounted for less than 1% of the total global fibre market in 2022.

Material prices

One of the most-used preferred fibres is organic cotton. The price for certified organic cotton differs per country of origin, but organic cotton is more expensive than conventional cotton in all cases. The price gap also differs per country. For example, organic cotton is approximately 10% more expensive than conventional cotton in India and Turkey. In China it is 15-35% more expensive according to the Textile Exchange (2022). Worldwide, the price of organic cotton is reaching all-time highs due to demand outstripping supply.

The price of recycled PET flakes that are used to make recycled polyester was around €200 per tonne cheaper than virgin PET, until 2019. Since then, demand and price have grown substantially, due to growing interest from brands and retailers in more sustainable materials. Currently rPET is more expensive than virgin PET, and recycled polyester is more expensive than virgin polyester.

The price point for sustainable materials like ECOVERO™ and REFIBRA™ is higher than their conventional virgin counterparts. Innovative and still relatively small-scale materials like Orange Fiber, Brewed Protein™ and Piñatex® can be substantially more expensive than the conventional materials they are considered to be alternatives to. Piñatex®, for instance, is currently sold for €50 per 1.55 m2. The same amount of conventional leather can be purchased in several production regions, for prices starting at €15.

Retail pricing

Preferred fibres and materials have broken into the mainstream European apparel market. Demand primarily comes from large European retail chains, such as C&A, H&M and Tchibo, and many smaller brand retailers, some with distinct sustainable profiles. Large retail chains can limit retail price increases by handling large-volume orders (for instance, C&A manages to sell organic cotton T-shirts for €6), while smaller brands compensate for their relatively expensive input material with marketing.

Tips:

- For more information on prices, pricing strategies and cost calculations, read CBI’s study on How to calculate the cost price of an apparel item.

- For the latest price and production landscape data on different fibres, take a look at the TextileExchanges’ Materials Dashboard.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research