Entering the Belgian market for cocoa

The Belgian cocoa market is dominated by three companies: Barry Callebaut, Cargill and Puratos. They supply 90% of the chocolate in Belgium. The largest exporters of cocoa beans to Belgium are Côte d’Ivoire, Ghana, Nigeria and Ecuador. Most of the imported cocoa is re-exported, as cocoa beans, derivatives or as Belgian Chocolate. It is therefore important that the cocoa meets Belgian requirements, European Union (EU) requirements, and potentially requirements from other European countries too. A large part of the cocoa in chocolate sold in Belgium is certified.

Contents of this page

1. What requirements and certification must cocoa comply with to be allowed on the Belgian market?

There are many important requirements and certifications if you are exporting cocoa to Belgium. These requirements can be mandatory, meaning that you have to comply with them for entry into Belgium, or voluntary, meaning your buyers can ask for them. They can be required by the EU, meaning they are the same for all countries in the EU, or required by Belgian law, meaning they are specific to Belgium.

This study focuses on requirements and certifications specifically for Belgium. Read our study on What requirements must cocoa beans comply with to be allowed on the European market for more details about the requirements and certifications that are relevant for Europe.

It is good to consider that your Belgian importer might re-export large quantities of cocoa beans to other destinations in Europe. These other buyers forward their requirements, which might increase the need for other specific certifications or standards. This will depend on the final market and the market channel.

What are mandatory requirements?

Legal rules necessary for entry to Belgium

It is important to comply with food safety laws. EU food laws are set by Regulation No 178/2002 at the EU level. The regulation is transposed to Belgian law in the Food legislation.

A new legal requirement will be the REU Regulation on deforestation-free products (EUDR). From 30 December 2024 (or six months later for micro or small businesses), products on the EU market need to comply with the deforestation-free requirements set by the EUDR. This applies to all countries in the EU, including Belgium. However, since Belgium re-exports a large share of the cocoa that it imports, it is particularly relevant for exports to Belgium.

You can read more about the regulation in our study on 8 tips to go green in the cocoa sector.

Quality requirements for Belgium

Quality requirements are determined at the EU level. There are some small differences at country level.

One example is fumigation. Cocoa beans can be infested at their origin by pest species. If they go untreated, these species can survive shipment to chocolate factories in Europe. Disinfestation can be done throughout the supply chain and is often also done in Europe to stop the spread of these pests. One fumigant registered for use on stored cocoa in Belgium is sulfuryl fluoride. Read Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements and the Pesticide Use in Cocoa Practical Manual (fourth edition) for more details.

Labelling and packaging requirements for Belgium

The labelling on cocoa beans exported to Belgium should comply with the general food labelling rules of the European Union.

The EU has also defined rules for cocoa and chocolate products in Directive 2000/36/EC. This is written into Belgian law in the Royal Decree on cocoa and chocolate products for human consumption. This includes rules on minimum cocoa content for labelling a product as ‘chocolate’. This includes typically local products such as sprinkles and chocolate flakes with low cocoa content. Extra requirements are also described here.

There are also strict obligations for the weight and disposal of packaging in Belgium. These are only relevant for exporters if you place more than 300 kg of industrial/commercial packaging on the Belgian market per year. This includes targets of 80% recycling and 85% recovery of waste. You can find more details in the Cooperation Agreement on the prevention and management of packaging waste.

Payment and delivery terms for Belgium

Payment and delivery terms can differ depending on the exporting and importing countries. The EU’s website Access2Markets provides necessary information on tariffs, taxes, requirements, trade barriers and more. On this website, you can search for the relevant taxes and tariffs for export from your country to Belgium. In 2023, the relevant taxes and tariffs for cocoa bean exports (180100) from the main export countries were:

- Côte d’Ivoire: 0% tariffs and 6% Value Added Tax (VAT);

- Ghana: 0% tariffs and 6% VAT;

- Nigeria: 0% tariffs and 6% VAT;

- Ecuador: 0% tariffs and 6% VAT.

Intellectual property (IP) rights for Belgium

Belgian Chocolate: The term ‘Belgian chocolate’ refers to chocolate produced by the rules of the Belgian Chocolate Code. According to the code, Belgian Chocolate is chocolate for which the complete process of mixing, refining and conching are done in Belgium. This code was developed to protect the reputation of Belgian Chocolate manufacturers and their products, and to inform buyers. The claim is not legally protected by Belgian legislation but is agreed by members of the Choprabisco association.

What additional requirements and certifications do buyers often have?

Rainforest Alliance and Fairtrade certification

Certification standards like the Rainforest Alliance and Fairtrade are important on the Belgian chocolate market and have a large market share. Fairtrade had a 20% market share in 2022. Rainforest Alliance had 99 Belgian members in Belgium in 2022. Beyond Chocolate members represent just over half of the Belgian chocolate market, and 76% of the chocolate they sell is certified or part of a corporate sustainability programme.

Fairtrade Original is a small food brand with products available in Belgium and a few other countries in Western Europe. Their mission is to establish local, fair and sustainable supply chains.

As a producer or exporter, being part of a certification programme or corporate sustainability programme can help you get access to the Belgian market. However, only 40% of the cocoa beans imported to Belgium remain in Belgium for further processing. The share of the cocoa re-exported to other European countries could have a lower demand for certification. See our study on Certified cocoa for more information.

Organic

In order to market your cocoa as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. EU Organic is the minimum legislative requirement for marketing organic cocoa in the European Union.

Supplier Code of Conduct

Many chocolate manufacturers and brands have a Supplier Code of Conduct. This is true of the three main chocolate makers in Belgium: the Puratos Supplier Code of Conduct, the Barry Callebaut Supplier Code of Conduct and the Cargill Supplier Code of Conduct. These supplier codes deal with different topics, including human rights and environmental protection. Make sure you comply with their Supplier Code of Conduct to get access to the Belgian market through these companies.

Other additional sustainability requirements

Beyond Chocolate is a voluntary partnership, but its members have committed to several things that are interesting for producers and exporters. This includes a commitment that all chocolate produced and/or sold in Belgium will comply with a certification standard or company sustainability scheme by 2025. The companies that are part of Beyond Chocolate will need to buy chocolate that is part of a certification standard or corporate sustainability scheme. 76% of the chocolate produced in 2021 by Beyond Chocolate members was part of a corporate programme or certification, which means that 24% was not yet part of a scheme.

Beyond Chocolate members also have to comply with applicable agreements between governments and companies in the regions included in the Cocoa & Forests Initiative (CFI).

Tips:

- Take a look at the EU’s website Access2Markets. This website provides all the trade information you need to know, including tariffs, taxes, procedures, requirements, rules of origin, export measures, statistics, trade barriers and more. Enter the product code (180100 for cocoa beans), origin country and destination country to search for the relevant details for your country.

- For the full buyer requirements, read the study on Buyer requirements for cocoa beans on the European market. This includes details about mandatory European legislation on food safety, food hygiene and food contaminants (including cadmium and pesticide residues), food labelling and packaging. It also explains extra requirements for quality, CSR and certification.

- Read our study 8 tips to go green in the cocoa sector and 9 tips to become more socially responsible in the cocoa sector for more details about the new EU Deforestation Regulation (EUDR), Corporate Sustainability Due Diligence (CSDDD) and the European Green Deal. Read the CBI study Exporting certified cocoa to Europe for more details about certification schemes. Alternatively, you can also follow our webinar on meeting European sustainability requirements.

- Find out which companies are part of Beyond Chocolate. Speak with your buyers to see if they sell to companies with brands that need more certified cocoa or cocoa that is part of a corporate sustainability scheme. If this is the case, speak with your buyers to see if it could be worth joining a certification scheme, your buyer’s corporate sustainability scheme or the brand’s scheme. Read the CBI study Exporting certified cocoa to Europe for more details about certification schemes.

2. Through what channels can you get cocoa on the Belgian market?

There are different channels to get your cocoa on the Belgian market. Cocoa beans are used for processing in four different industries: confectionery, food, cosmetics and pharmaceutical. Most of the cocoa is sourced for chocolate confectionery. This study focuses on the chocolate industry in Belgium.

How is the end-market segmented?

The chocolate produced and sold in Belgium is segmented by quality.

Bulk: low-end segment

The low-end segment is for cheap chocolate products, usually with lower cocoa content. Most of these products are produced by large chocolate manufacturers. Most of the cocoa is imported in bulk from West Africa. Bulk cocoa is available in high volumes, low value and standard quality. Rainforest Alliance certification is common for this segment.

Consumers buy the products as large multinational brands or private label chocolate products in supermarkets. Private label is a large segment in Belgium, where 55% of the products sold in supermarkets were private label products.

Examples of multinational confectionery brands are KitKat, Smarties and Rolo (Nestlé), Mars, Snickers and M&M (Mars), Cadbury and Milka (Mondelēz), Kinder (Ferrero) and Reese’s (Hershey).

Figure 1: A selection of low-end segment chocolate products

Source: Photo by Denny Müller on Unsplash

Many chocolate bars sold at retailers are in the low-end segment. At Belgian retailer Delhaize, these products typically cost around EUR 0.50 to 2 EUR for a typical chocolate product (based on Delhaize retail prices in 2023). See the table below for examples.

Table 1: Examples of low-end segment chocolate products sold at Delhaize (Belgian retailer) in 2023

| Product | Retail price* | Retail price per kg |

| Milka Melkchocolade (100g) | 1.59 EUR | 15.90 EUR |

| Delhaize Chocolate Puur (100 grams) | 0.49 EUR | 4.90 EUR |

| 365 Essential (200 grams) | 0.85 EUR | 4.25 EUR |

| Delicata Chocolade Puur (100 grams) | 1.29 EUR | 12.90 EUR |

| Jaques Chocoladetablet Puur (100 grams) | 1.89 EUR | 18.90 EUR |

Source: Delhaize retail prices in 2023

Middle range segment

The middle-range segment includes higher quality chocolate products, which increasingly includes certified cocoa. Storytelling and the origin of the cocoa beans are important in this segment. The certified beans do not need to physically be in the product for storytelling. Many brands and retailers buy mass balance cocoa, which means that the certified cocoa might not physically be in the final product. Brands and retailers can support specific farmer groups and benefit from the storytelling for this farmer group if they are buying mass balance cocoa.

Cocoa beans for the middle range segment can still be purchased in bulk at mainstream quality. The quality of the chocolate is influenced by the production process for the cocoa and the higher share of cocoa in the final product. The chocolate quality is also improved by using higher quality non-cocoa ingredients.

Examples of multinational brands in the middle range segment are Lindt (Lindt & Sprüngli), Côte d’Or (Mondelēz), Ritter (Ritter Sport), and L’Atelier (Nestlé). Regional brands Tony’s Chocolonely (the Netherlands) and Godiva (Belgium) are also in the middle range segment. See the table below for examples.

Table 2: Examples of the middle range segment chocolate products sold at Delhaize (Belgian retailer) in 2023

| Product | Retail price | Retail price per kg | Packaging |

| Lindt Excellence 70% Pure (100 grams) | 2.19 EUR | 21.90 EUR |

|

| Côte d'Or Melk Chocolade (150 grams) | 2.49 EUR | 16.60 EUR |

|

| Godiva MP Hart Puur (86 grams) | 4.15 EUR | 48.26 EUR |

|

| Tony's Chocolonely 70% Puur (180 grams) | 3.99 EUR | 22.17 EUR |

|

| Ritter Sport Puur hazelnoot (100 grams) | 1.25 EUR | 12.50 EUR |

|

Source: Delhaize retail prices in 2023. Photos: Z Graphica on Unsplash (Godiva) and Long Run Sustainability (all other photos)

High range segment

The high range segment includes specialty and craft chocolate products. These are often used with fine flavour cocoa, and they usually have a high cocoa content. Chocolate makers in this segment are usually smaller and more specialised. They often use fine flavour cocoa, usually from the Criollo or Trinitario cocoa tree varieties or Nacionál cocoa from Ecuador.

Bean-to-bar is an example of a high-end product. The cocoa beans usually come from a single origin, with full traceability throughout the supply chain. This helps to tell the story behind their product in a way that is attractive to consumers. The high range segment usually has higher standards for sustainability as well. This helps to tell the story behind their product in a way that is attractive for consumers. Certification is not necessary, but these products can be sold with Fairtrade and Organic certification.

Tips:

- Read the CBI study 9 tips for finding buyers on the European cocoa market for more background information about how the cocoa market is segmented.

- Find out which bean-to-bar producers fit your unique selling points and organisation. For example, to Belgian Patisserie Zuut the focus lies on honest and good treatment of producers. You can find a list of producers on the bean-to-bar website.

Through what channels does the cocoa end up on the end-market?

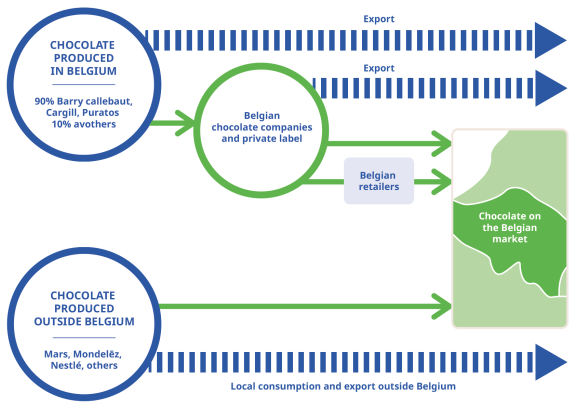

If producers or exporters want to access the Belgian market, it is important to know that there are two main ways that cocoa products and chocolate ends up on the Belgian market:

- Chocolate produced outside and sold in Belgium.

- Chocolate produced and sold in Belgium.

It is difficult to enter the Belgian market if the chocolate is produced outside Belgium (Option 1). A large share of this segment is produced by multinationals in other European countries. This includes brands like KitKat bars from Nestlé, Mars bars from Mars or Milka bars from Mondelēz. These are often produced in large factories and exported to multiple countries. These products could end up in Belgium, but they could also end up in another country.

It is easier to enter the Belgian market with chocolate produced and sold in Belgium (Option 2). Chocolate that is produced in Belgium is either exported to other countries or sold on the Belgian market, mainly through brands, chocolatiers or retailers.

Figure 2: How chocolate ends up on the Belgian market (simplification)

Source: Beyond Chocolate and Long Run Sustainability. Design by Bart Wortel

Suppliers and processors

Barry Callebaut, Cargill and Puratos are the main suppliers of cocoa and chocolate to the Belgian market. Together, they are responsible for 90% of the chocolate produced in Belgium.

Almost two-thirds (65%) of the chocolate produced by these companies contains cocoa that is certified or is part of a corporate programme. This share is expected to keep increasing, since these companies committed to sourcing 100% through a certification or corporate programme by 2025.

One company in the remaining 10% is the Japanese supplier Fuji Oil, which has European headquarters and a production site in Ghent. Natra and Baronie are examples of suppliers that sell chocolate products in Belgium but do not produce in Belgium.

The dependency of the Belgian Chocolate market on three main suppliers makes the Belgian market vulnerable to disruptions. In 2022, two salmonella outbreaks affected the Belgian chocolate market. Production was stopped at the Ferrero Kinder chocolate factory in Belgium. A few weeks later, production was stopped at the Barry Callebaut chocolate plant, the biggest chocolate factory in the world. Since Belgian Chocolate has to be produced in Belgium in order to be sold as ‘Belgian Chocolate’, the shortage affected both the local and export chocolate market, leading to a shortage of pralines for example. Both factories have restarted production, but these events show how the local market can be affected by external events.

Large multinational brands

Most large multinational brands produce outside Belgium. One exception is Ferrero, which produces Kinder chocolate in a factory in Belgium. These products are sold in Belgium and exported to Europe and the USA. Mondelēz has production facilities in Herentals and Namur and produces Cote d’Or chocolate in Belgium. Nestlé, Mars and Lindt & Sprüngli do not have chocolate factories in Belgium. If you want to sell cocoa to these brands, you will need to sell it to importers and factories in other countries.

Barry Callebaut, Cargill and Puratos represent 90% of the chocolate market. 65% of their volume was certified in 2021, which represents 59% of total Belgian chocolate production (65% of 90%). It is unknown how much of the remaining 10% is certified.

Smaller Belgian chocolate brands

Smaller Belgian brands mostly buy bulk mass balance chocolate. Most smaller brands buy chocolate from one of the three large suppliers of Belgian chocolate. The best way to sell to these brands is through one of these suppliers. Examples are Galler, Guylian, Leonidas and Neuhaus.

Some small companies have relationships with specific co-operatives, such as Galler, Neuhaus and Belfine. See our study The Belgian market potential for cocoa for more details.

Figure 3: Neuhaus Chocolate

Source: Long Run Sustainability

Supermarket brands

The food retail market in Belgium is dominated by five retailers: the Colruyt Group, Ahold Delhaize, Carrefour Belgium, Aldi and Lidl. Together they capture about 85% of the market. The number of supermarkets in Belgium increased by 8% from 2015 to 2022.

Lidl, Aldi, Ahold Delhaize and Colruyt are large buyers of Fairtrade certified products. These four retailers generated the most Fairtrade premium in Belgium in 2022 and are seen as ‘Fairtrade Frontrunners’. Carrefour was sixth on the list of Fairtrade premium generated. Aldi, Lidl and Carrefour have headquarters outside Belgium. Decisions on sourcing and sustainability are usually made outside Belgium, which makes it difficult for producers and exporters to enter these supermarkets through Belgium. Colruyt and Ahold Delhaize have a presence in Belgium.

Ahold Delhaize has a large focus on sustainability. In 2022, 89% of their own-brand cocoa products were bought through sustainability schemes. The cocoa for the brand Delicata is sourced through Tony’s Open Chain.

Colruyt also has a large sustainability focus. All their private label chocolate products have a sustainability label. Colruyt’s Every Day brand is Rainforest Alliance certified, and their brand Boni is Fairtrade certified.

Private label chocolate

There is also a market for private label Belgian Chocolate for other markets than retailers. One of these markets unique to Belgium is the airport market. Brussels airport is the world’s largest sales outlet for chocolate. Private label chocolate is also sold to shops and other outlets of ‘Belgian Chocolate’. One example of a private label chocolate producer is the Belgian Chocolate Group (BCG). BCG produces Belgian Chocolate products for private label partners. They also have their own brand called The Belgian.

Private label chocolate manufacturers mainly focus on the price of chocolate. Many will ask suppliers for a quote and choose the cheapest option. They are usually not interested in the sustainability story behind the chocolate. However, if a customer asks their supplier for a certified product and/or a sustainability story then this is also possible. One example is Action Group which is 100% Fairtrade for all own brand cocoa products.

High-end and specialty chocolate products

Bean-to-bar brands have direct relationships with producers and usually have a high standard of sustainability. One example is Belvas, which uses 100% certified Fairtrade and Organic cocoa. Their projects in Peru and Côte d’Ivoire help pay farmers a decent income, without intermediaries.

Another example is Kim’s Chocolates. These companies often already have long-standing relationships with suppliers, so it could be difficult for producers and exporters to become part of these supply chains. Equitable is another small brand that is 100% Organic certified.

Deremiens, Millésime Chocolat, Coup de Chocolat and Legast are examples of Belgian brands and specialty chocolate makers that produce high-end products. These products are mainly sold through specialty brands and shops. Examples of Belgian specialty chocolate makers and shops include Chocolatier Reen, Hilde Devolder Chocolatier and Rob The Gourmets’ Market.

Tips:

- Attend trade fairs in Europe to meet potential buyers. Interesting trade events include Chocoa, Salon du Chocolat and Biofach (organic products). Attending these events can provide you with additional insight into the preferences of Belgium buyers with regard to origins, flavour and sustainability certification. By understanding the market better, you can ensure that your specific product corresponds to demand and requirements.

- For more tips on finding the right buyer for you, see our study Finding buyers on the European cocoa market.

What is the most interesting channel for you?

Barry Callebaut, Cargill and Puratos

The most interesting channel for producers and exporters is the Belgian chocolate producers channel: through Barry Callebaut, Cargill and Puratos. To enter the Belgian market, exporters and producers will most likely need to work with one of these companies. All three companies have employees and offices in producing countries.

As the largest chocolate company in the world, Barry Callebaut is a major cocoa bean exporter from producing countries to Belgium. Barry Callebaut also owns local exporters in producing countries. These include Société Africaine de Cacao (SACO) in Côte d’Ivoire, Société Industrielle Camerounaise des Cacaos (Sic-Cacaos) in Cameroon, Nyonkopa Cocoa Buying Company in Ghana, BC Nigeria Cocoa & Chocolate in Nigeria, PT. Papandayan Cocoa Industries in Indonesia and Biolands International in Tanzania.

Small sustainability-minded brands

A smaller, interesting channel for producers and exporters could be small, sustainability-minded brands. These companies sometimes work with or support cocoa farmers. This can be done through their suppliers directly or indirectly. These relationships are usually long-term (over several years), so it is worth investing in setting up these relationships. See the section on smaller Belgian Chocolate brands above for more information about these brands.

Supermarkets

Supermarkets could be another interesting channel to look at, especially those based in Belgium (Ahold Delhaize and Colruyt). These supermarkets already have relationships with specific producers and may look to expand their producer range to other producers in the future.

Tips:

- Talk to Fairtrade or Rainforest Alliance. They might be able to help you find buyers for your cocoa. Find the contact details on the Rainforest Alliance contact page and the Fairtrade contact page.

- Contact the local offices of Barry Callebaut, Cargill or Puratos to discuss possibilities directly.

3. What competition do you face on the Belgian market?

Competition for bulk cocoa with low added value is generally high. This segment is dominated by major suppliers and cooperatives that can deliver large volumes so they can compete on price. It is difficult for small and medium-sized companies to compete with this segment. The degree of rivalry is lower in the specialty cocoa market. In this segment there is more focus on quality, taste and sustainability.

Which countries are you competing with?

The main import county for Belgium in 2022 was Côte d’Ivoire, which supplied 54% of the beans, followed by Ghana (19%), Nigeria (6%) and Ecuador (6%). Imports from Côte d’Ivoire (+42,000 tonnes) and Ghana (+38,000 tonnes) increased the most between 2018 and 2022, while imports from Nigeria (-6,000 tonnes) decreased the most.

The speciality market takes up less than 10% of the global market. Specialty cocoa is mainly sourced from Latin America and the Caribbean, where Ecuador is the world’s main exporter of fine flavour cocoa. Only a small share of Belgian imports from producing countries came from Latin America. The total imports in 2022 were 17,000 tonnes from Ecuador, 12,000 tonnes from the Dominican Republic and 4,000 tonnes from Peru. Imports from Ecuador more than doubled between 2018–2022, increasing by over 9,000 tonnes.

Source: Eurostat 2023

Since most of the chocolate in Belgium is produced by Barry Callebaut, Cargill and Puratos, it is also useful to look at where they source their cocoa from. Barry Callebaut and Puratos report the origins for cocoa produced under their sustainability scheme. Note that these are global purchases for each company and not purchases specifically for the Belgian market. Purchases for the Belgian market could be different.

- For Cocoa Horizons (Barry Callebaut), Côte d’Ivoire is also the largest country of origin with 59%, followed by Ghana (30%), Cameroon (7%) and Indonesia (2%). This is based on the number of producers that deliver Horizons cocoa in 2022.

- For Cacao Trace (Puratos), Côte d’Ivoire is also the largest country of origin with 79%, followed by Papua New Guinea (6%), Vietnam (5%) and Uganda (5%). Ghana is not part of Cacao Trace according to the 2022 annual report. This is based on the volume sourced in 2022 (tonnes).

- For Cargill Cocoa Promise, Côte d’Ivoire is also the largest country of origin with 57%, followed by Cameroon (17%) and Ghana (15%). This is based on the total number of farmers in the Cargill Cocoa Promise in 2021.

Source: Eurostat 2023, Cocoa Horizons, Cacao Trace and Cargill Cocoa Promise

Other multinationals that trade cocoa to Belgium are Cocoa Source, ECOM Trading, and Ofi (Olam), which are all Beyond Chocolate members.

There are many local competitors for exporters. However, most of the access to the Belgian market is through the multinationals Barry Callebaut, Cargill or Puratos. Local competitors are therefore not specific competitors for access to the Belgian chocolate market, but they are competitors for access to other European markets or the entire European market.

Read our studies What is the demand for cocoa on the European market and 9 tips for finding buyers on the European cocoa market for more information about local competitors for the European market.

4. What are the prices for cocoa?

The price of cocoa is determined by global supply and demand, and several additional factors as well. These include hedging, tariffs, trade agreements, taxes, global events and crises. Both cocoa supply and cocoa demand are highly inelastic. Changing production takes time because it requires planting new trees, and changing cocoa processing capacity takes time as well. The trade market is also dominated by a small number of powerful companies.

The price of cocoa beans can be structured as follows:

Table 3: The structure of the price of cocoa beans

| Type of Cocoa | Description | Price structure |

| Bulk | Farmer processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador) or bulk centrally fermented (e.g. CCN-51 in Ecuador). | London or New York ICE + or – country differential. |

| Rainforest Alliance “Standard” | Farmer processed (e.g. in heaps or baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador) with RFA certification. | London or New York ICE + or – country differential plus a differential of (on average) 100 USD per tonne. |

| Organic “Standard” | Farmer processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador). Any presence of chemical residue detected on samples on arrival would lead to discounting the organic premium. | London or New York ICE + or – country differential + approximately 300 USD per tonne organic premium. |

Organic ‘Premium’ | Also called ‘improved’ organic. On farm harvesting (ripe pods), traceability to bag level, summaries by gender, farmer profiles). Any presence of chemical residue detected on samples on arrival would lead to discounting the premiums. | London, New York ICE + or – country differential + approximately 300 USD organic + 100 to 300 USD premium for quality. |

| Fairtrade-Organic | Double certified beans. Farmer processed (e.g. in baskets used in West Africa). Any presence of chemical residue detected on samples on arrival would lead to discounting the organic premium. | Minimum FTO price (2,700 USD per ton) plus a Fairtrade premium of 240 USD per tonne. In addition, extra premiums are possible (e.g. depending on quality). |

| Specialty | High quality beans (zero defects) for organic, hand-sorted, centrally fermented, solar dried, good sensory profile (often Criollo or Trinitario varieties) and a good story. | Prices would range from 3,000 to 6,000 USD per tonne, although there are cocoa beans Of exceptional quality, origin and uniqueness, sold at very low volumes that fetch higher prices (Ferro et al., 2021). |

| Specialty Organic | High quality beans (zero defects) hand-sorted, centrally fermented, solar dried, good sensory profile and a good story, plus organic certification. | Prices would range from 3,000 to 6,000 USD per tonne, although there are cocoa beans of exceptional quality, origin and uniqueness, sold at very low volumes that fetch higher prices (Ferro et al., 2021). |

Source: Global Cocoa Market Study

It is important for exporters to say that trade prices and retail prices are not directly linked. Only a small share of the value added goes to farmers and exporters.

In a study by Le Basic on value distribution on selected chocolate products sold in France in 2018, less than 7.5% of the total margin was generated in cocoa producing countries (from cocoa cultivation up to bean exports). 90% of the total margin is generated by brands and retailers. In general, the export prices of cocoa beans and the share kept by cocoa producers depends on cocoa bean quality, the size of the lot and the supplier’s relationship with the buyer. The largest shares are kept by chocolate companies and retailers. This study was done for the French market, but the margins for the Belgian chocolate market are likely to be similar.

Seven members of Beyond Chocolate shared data on the price paid to farmer for cocoa. The average amount they paid to the farmer in 2021 was 1.461 USD per tonne of cocoa beans (farmgate price + premiums). Beyond Chocolate notes that these may be above market averages.

Thirteen members also reported data about the volumes and amounts of premiums they paid. The aggregated total was 167 USD per tonne of cocoa. The payment was higher in Ghana (184 USD) compared to Côte d’Ivoire (158 USD).

Source: Beyond Chocolate

The cost of chocolate in Belgium is rising. The price of chocolate increased by 12% from 2021 to 2022. This is partly due to inflation and rising costs of energy and raw materials. However, in the first part of 2023, this had not affected overall sales of Belgian chocolates.

Molgo Research carried out this study in partnership with Long Run Sustainability and Amonarmah Consults on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research