Entering the European market for bulk cocoa

Bulk cocoa is primarily imported in Europe as cocoa beans, but large volumes of bulk cocoa paste, butter and powder are also imported. The key exporting countries are Côte d’Ivoire, Ghana, Cameroon and Nigeria. Imported beans are processed by large processors or chocolate manufacturers. Bulk cocoa derivatives are used to produce chocolate tablets, confectionery, bakery, ice cream, drinks, and other food and beverage products. The requirements to enter the European market are the same for all cocoa products, although bulk cocoa is often of a lower quality and sold in larger shipments.

Contents of this page

1. What requirements and certifications must bulk cocoa meet to be allowed on the European market?

There are many relevant requirements and certifications if you are exporting cocoa to Europe. These requirements can be mandatory (which means you must comply with them for entry into Europe) or voluntary (which means they can be asked for by your buyers). They can be required by the EU (which means they are the same for all countries in the EU) or they can be required by local laws (which means they are specific to the country to which you are exporting).

What are mandatory requirements?

Most of the requirements that are relevant for bulk cocoa also apply to all cocoa exported to Europe. This section will only cover the requirements that are specific to bulk cocoa.

What are the legal rules necessary for entry?

Legal rules for entry include requirements on food safety, food contaminants, heavy metals, pesticide residues, and labelling and packaging. These requirements apply to all cocoa imported to Europe. For more details about the legal requirements, read the CBI study meet to be allowed on the European market?

What are the quality requirements?

The quality requirements are the same for all imported cocoa. However, the methods to ensure quality can be different for bulk cocoa.

Cocoa beans can become infested by insects and other pests. These pests must be treated to avoid infestation of the beans during shipment or spread further beyond the port of entry. For bulk cocoa, extra measures can be sieving the cocoa before storage. This can remove unwanted small material and a high proportion of insects.

For more details about the quality requirements, read the CBI study meet to be allowed on the European market?

What are the labelling and packaging requirements?

Cocoa beans can be shipped in different ways:

- Bags loaded in a container. Specialty cocoa is often shipped this way. Bags are typically 60-65 kg each.

- Bulk in a container. Loose cocoa beans are loaded in a container that has a topless plastic inner lining.

- Break-bulk. With this shipment method bags of cocoa are loaded onto a ship, without the use of containers. The bags can be tied together in large packages of 25 bags to facilitate loading and unloading.

- Mega-bulk. Cocoa can also be shipped in mega-bulk shipments of several thousand tonnes per shipment. Loose cocoa beans are loaded directly into the hold of a ship. This method is often used by large cocoa processors.

When shipping cocoa in bulk (in a container or mega-bulk), it is important to closely monitor condensation levels. Bulk cocoa needs to be well-protected from mould and bacterial growth. Moisture levels should not exceed 8%. Beans shipped and stored in bulk are less protected than beans stored in bags. This means that extra precautions should be taken.

If moisture levels are too high in bulk shipments, it is difficult to separate the spoiled cocoa from the unaffected cocoa. Mega-bulk has the highest risk of condensation. The advantage of break-bulk is that the cocoa can still be separated more easily, since it is stored in separate 60-65 kg bags. The advantage of liner bags in bulk containers is that they help protect the cocoa against moisture.

The EUDR traceability requirements could have a large impact on bulk cocoa. The entire shipment needs to be EUDR-compliant. If one part of the shipment is not compliant, that part must either be separated or the entire shipment is considered non-compliant. Larger bulk shipments therefore become riskier. This could lead to changes in how bulk cocoa is shipped. Bulk shipments could become smaller, or importers become more careful about which batches are combined per shipment. The impact will become clearer when the EUDR starts on 30 December 2024.

Manifests must clearly state that the contents of the container are in bulk. For more information about shipping and packaging requirements for bulk cocoa, read the Cocoa Cargo Handbook. For more details about the packaging requirements, read the CBI study What requirements must cocoa meet to be allowed on the European market?

Figure 1: Cocoa stored in bulk and in bags

Source: Ruben Bergsma at Long Run Sustainability

What are the payment and delivery terms?

Bulk cocoa is usually cheaper than ‘fine flavour’ or specialty cocoa. This is largely due to the quality, flavour, and other aspects of the cocoa itself. It is also because bulk cocoa has lower transport and shipment costs. Shipping in bulk reduces the cost of handling too.

What additional requirements and certifications do buyers often have?

There are fewer additional requirements for bulk cocoa than for specialty or fine flavour cocoa. This could make it easier to export bulk cocoa to Europe. This section only covers the requirements that are specific to bulk cocoa.

Lower quality requirements for bulk cocoa

Quality is important for bulk cocoa. However, the requirements for taste and flavour are lower than those for fine flavour cocoa. By mixing bulk cocoa with other origins, a consistent taste can be created.

Certification is often required as a basis for bulk cocoa

The sustainability and quality requirements for bulk cocoa are usually lower than those for fine flavour and specialty cocoa. Many European importers will require certification as the base level for imported cocoa. This way, they can have some assurance that the cocoa is produced more sustainably than non-certified bulk cocoa.

However, bulk cocoa usually does not need to have information in as much detail as is sometimes required for fine flavour cocoa. Chocolate products made from bulk cocoa do not commonly have stories about the farmers that produced the cocoa. Storytelling linked to the content of a bulk cocoa chocolate product is rare. This is more common for single origin or specialty chocolate products.

Tips:

- Speak with your buyers about the requirements they have for bulk cocoa. There may be fewer demands for bulk cocoa than for specialty or fine flavour cocoa.

- Read the CBI study What requirements must cocoa meet to be allowed on the European market? for more details about the requirements and certifications that are relevant for Europe. This article with cocoa shipping and packaging tips also includes helpful information.

2. Through which channels can you get bulk cocoa on the European market?

Most bulk cocoa is not imported for a specific buyer, but rather to meet the demand of several buyers and regions. As an exporter, you usually have no control over which segment the cocoa is purchased for.

How is the end market segmented?

The cocoa market can be segmented into low-range, middle-range and high-range cocoa. All low-range cocoa is bulk cocoa, as well as most of the middle-range cocoa. Specialty cocoa is used to produce chocolate in the high-range segment. Fine flavour cocoa is used for the highest-quality chocolate products.

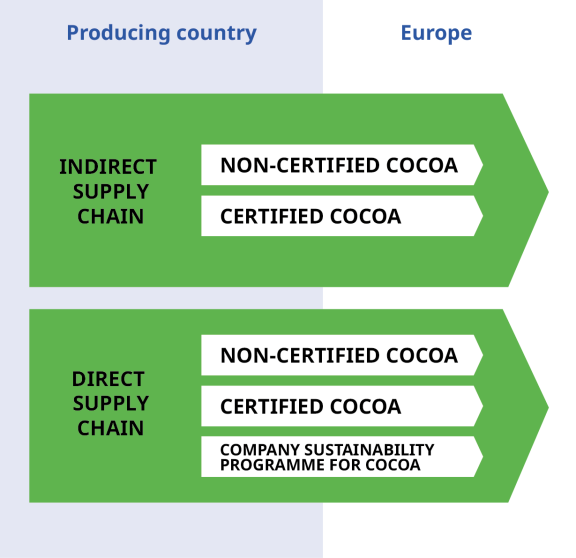

In addition to quality, bulk cocoa can be segmented by its traceability aspects. Bulk cocoa can be traceable or untraceable to its source. Untraceable cocoa means that the cocoa is bought indirectly, from unknown sources. This can include cocoa purchased through independent middlemen or purchased from producers outside of companies’ longer-term sustainability-related programmes. This is also called the indirect supply chain. In the direct supply chain, buyers know where the cocoa comes from.

The direct and indirect supply chains can be further segmented by the sustainability aspects of the cocoa. This includes independent third-party verified programmes such as Fairtrade or Rainforest Alliance certification. It can also include company sustainability programmes.

The indirect supply chain is commonly sourced without any certification or sustainability programme. It can also be certified, but only as ‘mass balance’ cocoa. Mass balance means that the certified cocoa can be mixed with non-certified cocoa, as long as the company never sells more mass balance cocoa than they buy as mass balance. Indirect supply can be mass balance-certified even if it isn’t traceable, since the certification is only administrative and not physical.

The direct supply chain is more likely to have sustainability aspects. It is more common for certified cocoa and for cocoa sourced through a company sustainability programme. However, there is also cocoa sold in the direct supply chain that is not part of any certification or company programme.

Figure 2: The end-market segmentation of bulk cocoa beans (relevant from the perspective of the exporter)

Source: Design by Bart Wortel

Indirect supply chains

Indirect supply chains make up around half of all cocoa exports. An estimated 56% of cocoa is sourced through indirect supply chains. In Côte d’Ivoire, the indirect supply chain is estimated at 60% of total exports. Cocoa sourced through indirect supply chains is considered bulk cocoa.

The large traders and processors are the main buyers of indirect supply. The share that is indirect isn’t commonly reported. In 2021, the indirect supply accounted for one-third of the Olam supply, 60% of the cocoa sourced by Barry Callebaut and 40% of the Cargill supply. Together, these three companies accounted for over half of global cocoa sales in 2021.

The share that is indirect supply has probably decreased since 2021. The industry is improving the traceability for its cocoa supply. The EUDR is also encouraging companies to invest in traceability and to shift to direct supply chains.

Indirect supply is purchased for products that have low quality or sustainability demands. Often these are products with a low cocoa content, although some chocolate tablets are also made from cocoa coming from indirect supply chains. When certified cocoa is purchased indirectly, it is usually for products with a low cocoa content. It can also be used by companies that are further down the supply chain, such as retailers.

Direct supply chains

Traders and processors that buy cocoa from the direct supply chain can have higher sustainability demands. This cocoa is more commonly bought as certified or through a company sustainability programme. Many large traders and processors make sustainability claims or commitments only for their direct supply chain.

The large traders and processors sell a large share of their direct supply chain as certified or through their company sustainability programme. In 2020-2021, Cargill sold 49% of its entire cocoa volume as certified, and its entire direct supply chain was covered by Cargill Cocoa Promise (its company sustainability programme). For Barry Callebaut, around one-third of cocoa was sold through its programme in 2023. Sucden purchased 31% of its cocoa through direct supply chains and sold 11% as certified in 2023. Ofi’s Cocoa Compass programme reports most impact only for its direct supply chain.

Tips:

- Knowing where your supply comes from is needed to become part of your buyer’s direct supply chain. It can be interesting for buyers if this cocoa is also certified or produced under a company programme. When the EUDR comes into force in 2025 it will be a requirement to know the origin for all cocoa imported to the EU. For more information, read the CBI study How to comply with the EUDR in cocoa.

- Read the other CBI tips and studies on cocoa export. The study on tips for organising your cocoa export to Europe gives more information on payment terms, insurance and customs policy. It also describes the logistical and distribution process and packaging aspects. The study on tips for doing business with European cocoa buyers is about European business culture, sales pitches and marketing information. It also covers quotes, pricing strategies, margins and promotions.

Through which channels does a product land on the end market?

Most bulk cocoa is not imported for a specific buyer. It is usually shipped to one of the main ports in Europe and stored in large quantities in warehouses. Bulk cocoa is processed in large quantities. Much of the cocoa that arrives at a European port is not consumed in that country as a final product. Amsterdam has the largest cocoa port in the world, but only a fraction of that cocoa is consumed in the Netherlands as a final product. As an exporter, you therefore have little control over which segment the cocoa is purchased for.

Most bulk cocoa is exported as beans, although it can also be exported as paste, butter or powder. Cocoa paste and butter exports from producing countries are growing. In 2015, Côte d’Ivoire passed the Netherlands as the world’s largest grinder. Grinding in Asia has increased from 586,000 tonnes in 2011 to 859,000 tonnes in 2023. Indonesia is a net importer of cocoa beans to meet its grinding capacity. Many exporters are therefore also able to export paste and butter.

Imported beans are further processed by processors based in Europe. The processors then sell the paste, butter and powder (and in some cases chocolate) to manufacturers in Europe. Some chocolate manufacturers also use the beans to produce chocolate.

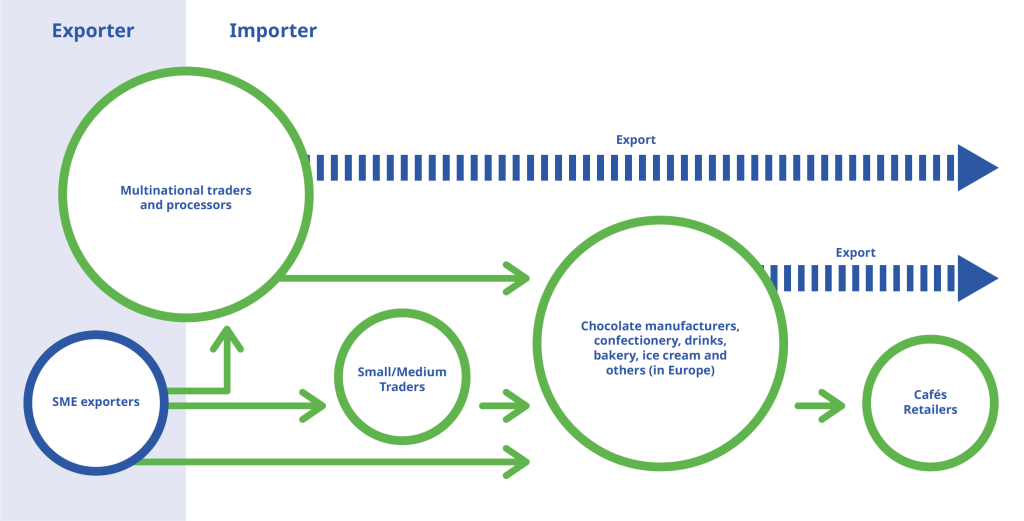

The key channels for bulk cocoa import in Europe are multinational traders and processors, chocolate manufacturers and retailers.

Figure 3: Visualisation of the supply chain for bulk cocoa in Europe

Source: Design by Bart Wortel

Multinational traders and processors

The most important channel is through multinational traders and processors. These companies purchase most of the world’s bulk cocoa, either as importers or as exporters.

The largest traders and processors in 2021 were Olam Food Ingredients (ofi) (1,019,000 tons), Barry Callebaut (988,000 tons), Cargill (875,000 tons), ECOM (800,000 tons), Sucden (525,000 tons), Touton (328,000 tons), Fuji Group (including Blommer) (200,000 tons) and ETG (102,000 tons). These companies dominate the global cocoa market, so selling to these companies is the most interesting channel for bulk cocoa.

Many large processing factories are located near the ports of Amsterdam, Antwerp-Bruges and Hamburg. Ofi has 29 facilities across the group in Europe. They trade mostly bulk cocoa. Their specialty cocoa is mostly sold through the small company Twenty Degrees Cacao, which is part of the Olam group.

Large chocolate manufacturers

Most of the cocoa for large brands is purchased from one of the multinational traders and processors listed above. Key chocolate confectionery manufacturers are Mars, Nestlé, Ferrero and Mondelēz. Key brands include Lindt Excellence (Lindt & Sprüngli), Milka (Mondelēz), Cote d’Or (Mondelēz), Ritter Sport, Tony’s Chocolonely, and Godiva (Pladis). Chocolate confectionery products are mostly sold by retailers.

Some chocolate manufacturers also source beans. For example, Lindt & Sprüngli sources cocoa beans from five different origin countries. Hershey’s direct suppliers include Ecuakao (an exporter in Ecuador that sells bulk and specialty cocoa), Atlantic Cocoa Processing and Export Company (ACPEC) (a bean exporter from Liberia) and Tafissa (a cocoa processor in Côte d’Ivoire). The direct suppliers of Mars include Rizek Cacao (Dominican Republic). Ferrero includes COFINA (Ecuador) and Colcocoa (Colombia) as direct suppliers.

The ice cream market is dominated by one company. Unilever owns five of the top-10 selling global ice cream brands, including Wall’s, Cornetto, Magnum and Ben & Jerry’s. Unilever is planning to separate their ice cream business by 2025.

Chocolate manufacturers like Nestlé, Mars and Mondelēz also sell chocolate ice cream products. Dreyer’s Grand Ice Cream is a branch of Nestlé, as is Häagen-Dazs. Many supermarkets also sell private label ice cream products with chocolate.

Figure 4: Chocolate confectionery products made with bulk cocoa

Source: Photo by Denny Müller on Unsplash

Retail

Retailers often sell many different private label (house brand) products that contain cocoa. Some retailers may have a specialty cocoa single origin chocolate brand, but most products are made with bulk cocoa.

Chocolate tablets have the highest percentage of cocoa content and the largest cocoa volume per product. Examples are supermarket brands and private label products like AH and Delica (Ahold Delhaize), Everyday (Colruyt), Fin Carré and J.D. Gross (Lidl), and Choco Changer and Moser Roth (ALDI). Private label products are produced by manufacturers like Baronie, Stollwerck and Storck.

However, most of the products with cocoa sold by retailers are bakery, snacks and candy, ice cream and drinks. The cocoa content percentage is much smaller, but there are many more products containing cocoa in these categories. Retailers usually only have a small selection of chocolate tablets or chocolate confectionery.

Most large retailer chains in Europe sell bakery products with cocoa. Chocolate bakery products are also sold by foodservice companies like Starbucks and McDonald’s.

Tips:

- Regularly check the website of the International Cocoa Organization (ICCO) and read its monthly review of the cocoa market to find out about the latest developments in supply and demand for cocoa beans and cocoa products. Check the website of the European Cocoa Association for more data on grinding activities in Europe.

- If you export chocolate, read the CBI study on Exporting chocolate to Europe, expected to be published on the CBI website in late 2024. Read the CBI study on trends in the European cocoa market to learn more about which trends offer opportunities in the market.

What is the most interesting channel for you?

The most interesting channel is bulk cocoa beans sold to multinational traders and processors. They buy bulk cocoa in large quantities to satisfy customer demand.

Even though processing in producing countries has increased, most bulk cocoa is still exported as beans. In 2023, Europe imported 1,681,000 tonnes of cocoa beans from producing countries, compared to 336,000 tonnes of paste, 237,000 tonnes of butter and 48,000 tonnes of powder. Most of these beans are imported by the nine largest traders and processors. At least 90% of these beans are estimated to be bulk cocoa.

Source: Eurostat and Trade Map 2024

The top traders and processors are based across Europe. Ofi has locations in many countries, including Germany, Italy, the Netherlands, Poland, Spain and Switzerland. Barry Callebaut has facilities and offices in more than 40 countries worldwide, including Belgium, France Germany, Italy, the Netherlands, Spain, Switzerland and the UK. Cargill is present in 70 countries and Sucden operates in 25 countries. Smaller global traders like Touton (Germany, France and Russia) are more focused on specific countries. The most interesting countries are described in the CBI study on the European market potential for bulk cocoa.

Multinationals have a strong negotiating position. They can hedge their risks on the futures market, which smaller exporters may not be able to do. They have more financial resources available to them and can secure large loans more easily. They also have greater flexibility in their sourcing, especially for bulk cocoa that is less origin-specific.

Due to their dominant position in the market, these companies are price-setters. Farmers are price-takers in the cocoa market. SME exporters also have much less negotiating power compared to multinational traders and processors.

Tips:

- Build a relationship with the large importers, traders and processors based in Europe. These are the main way to access the European market for bulk cocoa. The largest traders and processors are ofi, Barry Callebaut, Cargill, ECOM, Sucden, Touton, Fuji Oil/Blommer, ETG/Beyond Beans and Cémoi. Together they dominate the bulk cocoa market, importing most of the bulk cocoa that enters the European market. Read the CBI studies on tips to find buyers and tips to do business to learn more about how to work with these buyers.

- If you sell to a large trader or processor, ensure that you can fulfil the terms of the contract. Avoid breaching your contract for short-term gains. This could damage your reputation and trustworthiness in the long run.

3. What competition do you face on the European bulk cocoa market?

The main exporters of bulk cocoa are Côte d’Ivoire, Ghana, Cameroon and Nigeria. Most export is dominated by multinationals. However, there are some local exporters that are able to export bulk cocoa to Europe.

Which countries and companies are you competing with?

Over 80% of the global cocoa industry depends on West and Central Africa for bulk cocoa. The largest cocoa bean exporters in 2023 were Côte d’Ivoire, Ghana, Cameroon, Nigeria and, across the globe, Ecuador. Of these countries, only Ecuador is listed by the ICCO as a fine flavour country with a percentage (75% of production). Ghana and Cameroon are also listed as fine flavour countries, but the percentage of cocoa available as fine flavour has not been determined.

After accounting for the fine flavour share of production, the top bulk cocoa bean exporters in 2023 were Côte d’Ivoire (851,000 tons), Ghana (245,000 tons), Cameroon (211,000 tons), Nigeria (180,000 tons) and Guinea (41,000 tons).

Source: ICCO, Trade Map and Eurostat 2024

In 2023 an estimated 93% of cocoa bean imports were bulk cocoa. This is a slight decrease from 94% in 2019. However, the bulk cocoa market is expected to remain above 90%. As such, Europe will remain an interesting market for bulk cocoa bean exports.

The share of bulk cocoa bean imports per country has not changed significantly. In 2019-2023, the percentage of overall bulk bean imports in Europe from Côte d’Ivoire decreased from 53% of total imports to 51%, bulk bean imports from Ghana (17%) and Cameroon (11%) stayed the same, and imports from Nigeria decreased from 12% to 9% of total imports. Bulk bean imports from the rest of the world rose from 7% to 8%, mostly due to an increase in bulk beans from Ecuador.

Source: ICCO, Trade Map and Eurostat 2024

Regulating bodies of producing countries play a role in affecting the market potential of bulk cocoa. In countries like Côte d’Ivoire and Ghana, local regulators play a large role in regulating the market. In other countries, like Cameroon and Nigeria, there is hardly any state influence on the cocoa trade. The level of influence can affect the price and attractiveness of the cocoa.

The largest cocoa traders and processors globally also dominate exports from the key bulk cocoa countries. This is described further in the country sections below.

Côte d’Ivoire: largest exporter of bulk cocoa

Côte d’Ivoire is the strongest country for bulk cocoa supply in terms of volume. The cocoa industry has made significant investments in the country. Côte d’Ivoire is the main target country of certification programmes and initiatives, such as the Cocoa & Forests Initiative (Côte d’Ivoire and Ghana).

However, production is under threat in Côte d’Ivoire, as it has declined significantly. The introduction of the Living Income Differential of $400 per tonne in 2020-2021 has also affected sales from the country. With production increasing in Latin America and Central Africa, Côte d’Ivoire is losing some strength as the main supplier of bulk cocoa.

The conseil du Café-Cacao (CCC) is the regulating body in Côte d’Ivoire. The CCC is responsible for the management and promotion of the country’s cocoa sector. The CCC sells 70-80% of the main crop before the harvest starts. The farmgate price is set based on the selling price of these harvests. If cocoa prices change during the harvest, this could change how attractive Côte d’Ivoire cocoa is to European importers.

Six multinational traders dominate the Côte d’Ivoire cocoa trade: Cargill, Barry Callebaut, ofi, Ecom, Sucden and Touton. However, at least 20% of exports from Côte d’Ivoire must be exported by local processors and exporters. This would mean that at least 159,000 tons of total bean exports from Côte d’Ivoire to Europe should be available to local exporters. Ivorian exporters in the top-10 are AWAHUS, S3C and SCAT cooperative.

Some of the volume from Ivorian exporters goes to multinationals: SCAT cooperative sold to ofi and ETG in 2022.

Source: TRASE 2024

Ghana: second-largest exporter of bulk cocoa

Ghana has been the second-largest producer of bulk cocoa for several years. It has also been the target of many industry investments and programmes such as the Cocoa & Forests Initiative. However, production was also significantly affected in 2023-2024 due to climate change, pests and disease, and illegal gold mining. The farmgate price below the market price has also caused incentives for illegal smuggling of cocoa across the border.

Cocobod is the regulating body in Ghana. Its mission is to encourage and facilitate the production, processing and marketing of good-quality cocoa. Cocobod regulates the sale and export of cocoa through the CMC and LBCs. Ghana also sets a farmgate price before the harvest. Changes in the cocoa price can affect sales of bulk cocoa from Ghana.

In Ghana, the cocoa is purchased by Licensed Buying Companies (LBCs) and then taken over by the Cocoa Marketing Company (CMC). The CMC then sells the cocoa to registered buyers and delivers it to the ports. In 2022, there were over 44 active LBCs. Many LBCs are owned by multinational traders, including Cargill, ofi and Barry Callebaut. One local exporter in Ghana is Niche Cocoa.

Bulk cocoa from Ghana has historically had a reputation of good quality. It usually received a good country differential, although country differentials have decreased after the introduction of the Living Income Differential in 2017.

Cameroon export is dominated by three international traders

Cameroon has been approved by the ICCO as a fine flavour cocoa producer, although a percentage has not yet been determined. Their cocoa can therefore not yet be considered as fine flavour cocoa.

Cameroon has a reputation for producing cocoa that is well suited for cocoa powder. Cocoa from Cameroon can also vary in quality. Because of drying practices the cocoa can become smoky, which can make it less attractive.

Cocoa export from Cameroon is dominated by Cargill, Olam and Barry Callebaut: in 2019-2020, Cargill and Olam accounted for 84% of exported beans, and Barry Callebaut accounted for 89% of the cocoa processed. This leaves little cocoa available for SME exporters. One local company in Cameroon is Nealiko.

Nigeria has several local exporters

Production in Nigeria has remained stable. Production was 280,000 tonnes in 2021-2022, compared to 270,000 tonnes in 2022-2023. Nigeria exports mostly bulk cocoa.

International processors and exporters dominate the Nigerian market too. This is partly due to the advantages they have over local exporters, such as better access to funding and technology and better interest rates. Companies like Barry Callebaut and ofi have offices in Nigeria.

There are also many local processors and exporters in Nigeria, like FTN Cocoa Processing and Ile-Oluji. A local exporter is Sunbeth Global, which exports up to 35,000 tons of cocoa per year. Other large Nigerian exporters are Olatunde International (20,000 tonnes), SAO Agro (20,000 tonnes) and Starlink (20-25,000 tonnes). These four local exporters account for around 90-95,000 tonnes per year. Total production is forecast at 300,000 tonnes for 2023-2024, so almost one-third of total exported production.

Deforestation is a pressing issue in Nigeria. According to the United Nations, Nigeria has the highest deforestation rate in the world. Maps of classified forests are not always updated, which can make it difficult to determine legal compliance for EUDR purposes. Some companies and farmers are mapping cocoa plots to prepare for the EUDR. If exporters can supply cocoa with geolocations and prove that it comes from legal sources, that would help them get access to the EU market after the start of the EUDR.

Tips:

- Determine the strengths and weaknesses of the country from which you are exporting. When the local regulator sets the prices, it becomes more difficult to compete on price. Some countries have a better reputation for quality, which could make it easier to export bulk cocoa or to find buyers.

- The largest competitors in key bulk cocoa-producing countries are mostly the same as the largest global cocoa traders and processors. Read the tips in the other sections of this study for more information on how to sell to these multinational traders and processors.

4. What are the prices of bulk cocoa on the European market?

The price of bulk cocoa beans can be structured as per the table below.

Table 1: The structure of the price of cocoa beans

| Type of Cocoa | Description | Price structure |

| Bulk | Farmer-processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador). | London or New York ICE + or – country differential. |

| Rainforest Alliance ‘Standard’ | Farmer-processed (e.g. in heaps or baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador) with RFA certification. | London or New York ICE + or – country differential plus an RA-certified differential of (on average) USD 100 per tonne. |

| Organic ‘Standard’ | Farmer-processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador). Any presence of chemical residue detected on samples on arrival would lead to discounting the organic premium. | London or New York ICE + or – country differential + approximately USD 300 per tonne organic premium. |

Source: Global Cocoa Market Study 2022

Shipping cocoa in bulk or mega-bulk can reduce the overall price per tonne of cocoa. This is because the cocoa can be transported and stored more efficiently. However, it also brings more risk. If moisture affects the cocoa during shipment, the entire shipment can be spoiled. This risk is also factored into the price. Larger shipments lower the costs, but heighten the risk of the cocoa being affected by condensation.

The price for bulk cocoa is based on the global market price. Global market prices are transparent, and companies can hedge against price volatility.

Quality requirements will be lower for bulk cocoa compared to specialty or fine flavour cocoa, but the quality can still influence the price. Between 2000 and 2018, export prices of bulk cocoa to the EU were 12% higher for Ghana and 6% higher for Côte d’Ivoire compared to Nigeria and Cameroon. These differences are paid through country differentials, which are not included in the price on the futures market. The country differentials are also influenced by other factors, including availability of a crop, the political and economic situation, cost of production, regional currencies, competition amongst suppliers, and competition amongst origin countries.

For exporters it is important to note that trade prices and retail prices are not directly linked. Only a small share of the value added goes to farmers and exporters.

In a study by BASIC on value distribution for selected chocolate products sold in France in 2018, less than 7.5% of the total margin was generated in cocoa-producing countries (from cocoa cultivation up to bean exports) and 90% of the total margin was generated by brands and retailers. At the beginning of the chain, cocoa farmers only receive 11% of the final price. This study was conducted for the French market, but the margins for other European countries are likely to be similar.

Source: BASIC

In general, export prices of cocoa beans and the share kept by cocoa producers will depend on the cocoa bean quality, the size of the lot and the supplier’s relationship with the buyer. The largest shares are kept by chocolate companies and retailers.

Tips:

- There are several websites that publish the price of cocoa. The futures price can be found on the ICE website and the ICCO website. CCC (Côte d’Ivoire) and COCOBOD (Ghana) publish the farmgate price. ONCC (Cameroon) publishes the daily cocoa price. Country differentials are not always public, although the CIGCI has published them for Côte d’Ivoire and Ghana in the past.

- Be aware of the certification premiums. Rainforest Alliance (RA) has a minimum Sustainability Differential of USD 70 per tonne. This is the premium that goes to the farmer. RA also requires that a Sustainability Investment be paid. Together, these account for the total premium paid to the certified cooperative per tonne of cocoa. Fairtrade sets the minimum price and the premium. The Fairtrade premium for April-September 2024 was € 221 per tonne for Côte d’Ivoire and € 240 per tonne for Ghana.

Long Run Sustainability conducted this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research