Entering the European market for certified cocoa

Certification is becoming a ‘license to operate’ when exporting cocoa to the European market. Rainforest Alliance is the largest certification scheme for cocoa. The Fairtrade and organic certifications are growing on the speciality market and may offer interesting opportunities for exporters. As an exporter, you should choose the certification schemes based on your buyers’ demands, to make sure that your certification is worth the investment.

Contents of this page

- What requirements and certifications must certified cocoa meet to be allowed on the European market?

- Through which channels can you get certified cocoa on the European market?

- What competition do you face on the European certified cocoa market?

- What are the prices of certified cocoa on the European market?

1. What requirements and certifications must certified cocoa meet to be allowed on the European market?

You can only export cocoa to Europe if you comply with strict European Union (EU) requirements. For a complete overview of these requirements, refer to the CBI study on Buyer requirements for cocoa. This study only includes the requirements that are specifically related to certified cocoa.

What are the mandatory requirements?

Certification schemes are voluntary. However, if you want to sell your product as certified in the European market, you need to comply with strict protocols and criteria specified by the certification programme that you choose.

Most of the requirements that are relevant for certified cocoa also apply to all cocoa exported to Europe. For more details about the legal and quality requirements, read the CBI study What requirements must cocoa meet to be allowed on the European market?. This section will only cover the requirements that are specific to certified cocoa.

Rainforest Alliance requirements

In order to sell your product as Rainforest Alliance certified, farmers and farmer groups must meet the 2020 Sustainable Agriculture Standard: Farm Requirements. This covers many social, environmental and economic sustainability issues. It includes mandatory and voluntary requirements. Some requirements are specific to certain contexts, for example for country risk levels or farm types, or have policies for specific products, like the Policy for Farm and Supply Chain Certification in Cocoa. The supporting annexes and guidance can be found on the certification programme website.

Companies, such as export and import companies, must follow the 2020 Sustainable Agriculture Standard: Supply Chain Requirements. These requirements are more focused on documentation and traceability, although the 2020 standard also includes requirements on supply chain sustainability issues.

Audits (checks) are done by certification authorities that are authorised by Rainforest Alliance.

Fairtrade International requirements

Farmers and farmer groups must follow the Small-scale Producer Organisations Standard and the Cocoa Product Standard for Small-scale Producer Organisations. These standards cover the production, purchase and sale of cocoa beans and processed cocoa.

Exporters must follow the Fairtrade Trader Standard. This standard applies to traders who buy and sell Fairtrade products and/or handle the Fairtrade price and premium.

All Fairtrade audits (checks) are done by FLOCERT, which is the global certification authority for Fairtrade.

In this study, Fairtrade International will simply be called Fairtrade.

Traceability levels

Companies that source certified cocoa must meet minimum traceability requirements. There are several levels of traceability used in the cocoa supply chain. The most common ones are:

- identity preserved (IP)

- mixed-IP

- segregated

- mass balance

IP is the highest traceability level and mass balance is the lowest. With IP and mixed-IP, the cocoa can be traced back to its origin. Segregated supply means that the cocoa comes from certified sources and has not been mixed with uncertified cocoa, but the origin cannot be traced. With mass balance cocoa, the cocoa may have been mixed with uncertified cocoa. However, a company tracks certified purchases and sales and can never sell more certified cocoa than they have purchased.

Rainforest Alliance offers all four traceability levels. Fairtrade gives the option between segregation and mass balance. Rainforest Alliance is shifting from mass balance to origin-matching mass balance in response to the flaws of mass balance. For organic cocoa, full traceability to organic sources is required.

Companies must choose one of these levels of traceability. Once cocoa has been downgraded to a lower traceability level, it cannot be upgraded. For more information about the traceability levels, see the ISEAL Guidance Chain of custody models and definitions. Rainforest Alliance also has a useful explanatory video about mass balance sourcing.

For exporters, it is important to know what level of traceability your buyer needs. Exporters can then ensure that they have this level available for the cocoa they supply.

Company sustainability Programmes

The requirements for company sustainability standards are not publicly available on their websites. Consult your buyers to check their latest requirements. Since company sustainability standards are not certification programmes, they will not be discussed further in this study. Read the CBI study What is the demand for cocoa on the European market? for more information about company sustainability standards.

What additional requirements and certifications do buyers often have?

Certification programmes also have optional or additional requirements that are not part of the core programme. Labelling requirements can differ depending on the type of claim a company wants to make. Minimum and optional prices and premiums can apply as well.

On-pack claims

Rainforest Alliance certified products can be marketed using the Rainforest Alliance seal. A chocolate product with a Rainforest Alliance claim only needs to contain Rainforest Alliance certified cocoa. The other ingredients (such as milk and sugar) do not need to be certified. If the Rainforest Alliance seal is printed on the pack, then it needs to include word “cocoa” next to the seal. Rainforest Alliance does not charge a fee for the use of the seal. The use of the seal is not mandatory.

If the company uses Rainforest Alliance mass balance cocoa, then 100% of the equivalent certified volume must be purchased as mass balance. If they use segregated and IP cocoa, then 90% of the cocoa needs to be certified. See the Labelling and Trademarks Policy for more details.

Fairtrade has several versions of the Fairtrade mark. For chocolate products, this can be a Fairtrade mark with an arrow, which indicates that the product is only made with Fairtrade ingredients (if these are available). It can also be a Sourced Ingredient mark if only the cocoa is certified. The mark is the same for segregated and mass balance cocoa.

Fairtrade charges a license fee for the use of the Fairtrade mark. This applies to the wholesale value and can be up to 2% depending on the country of sale.

Table 1: Examples of chocolate products with different certification or company sustainability standard claims

| Product | Description |

| A chocolate product with the Rainforest Alliance seal (Albert Heijn private label product). |

| A chocolate product with the Fairtrade sourcing mark and the EU organic logo (Alter Eco). |

| A chocolate product with a company sustainability standard claim (Cocoa Life by Mondelēz). |

| A chocolate product with a generic sustainable sourcing claim (Ritter Sport). The cocoa is 100% covered by Rainforest Alliance and Fairtrade. |

Source: Long Run Sustainability

Price and premiums

There are several price and premium requirements that are relevant for producers and first buyers of the cocoa. Premiums are paid to farmer groups by the first buyer. In some cases, the exporter will be the first buyer (the licensed company that buys the cocoa from the farmer or farmer group). Minimum prices and premiums help to support producers in meeting the requirements for certification.

A cost for Rainforest Alliance certification is the premium paid to the farm certificate holder. Rainforest Alliance splits the premium between a sustainability differential (SD) and sustainability investment (SI). These can also be called a farmer premium and a group premium. A minimum SD of USD 70 per tonne must be paid. For countries in Africa using XOF (West African CFA Franc) or XAF (Central African CFA Franc) as their currency, the minimum SD is EUR 63 per tonne.

There are also costs for the royalty fee and audit (check) for Rainforest Alliance. Rainforest Alliance charged first buyers a royalty fee of USD 12.90 for every tonne of Rainforest Alliance certified cocoa beans they buy. After 1 October 2024, this increased to USD 15.70 per tonne. There are also audit (checking) costs to consider. Audit costs depend on the certification authority that you work with.

Fairtrade exporters may need to pay the Fairtrade minimum price and the Fairtrade premium. When the market price is higher than the Fairtrade minimum price, producers receive the current market price or the price negotiated at contract signing. For cocoa, there is also a Fairtrade minimum price differential. Fairtrade producers can also receive the Fairtrade living income reference price, although this is not mandatory. Fairtrade audit costs differ depending on the FLOCERT auditor who does the audit. You can estimate the costs using the Fairtrade fee calculator.

For products that are both Fairtrade and organic certified, the organic differential is added to the Fairtrade minimum price.

See the section on prices for exporters for a full breakdown of the costs.

Payment and delivery terms

Rainforest Alliance has payment terms for the SD and SI. These apply to the first buyer of the cocoa. The first buyer is the “initial certificate holder legally owning the certified product after the farm certificate holder”. In some cases, this could also be the exporter.

First buyers must specify the amount and payment terms for the SD and SI in a contract. The first buyer and the farm certificate holder must agree on the volume, the period that the premiums apply to (for example, which harvest), the time frame of payment, the method of payment and the currency. Payments must be made within 6 months of the shipment, unless otherwise required by local regulations. See Annex Chapter 3: Income and Shared Responsibility for more details.

Fairtrade has requirements on the payment terms in the Fairtrade Trader Standard. Contracts must include information on volume, quality, price, premium amount, form of payment, terms and conditions and more. Payments must be made relatively quickly. The full requirements are described in section 5 of the Trader Standard.

Rainforest Alliance and Fairtrade do not have payment and delivery requirements for buyers that are further down the supply chain. The programmes also do not have specific packaging requirements. See the CBI study What requirements must cocoa meet to be allowed on the European market? for more details about payment, delivery and packaging requirements.

What are the requirements for niche markets?

Organic cocoa

In the European Union, organic certification is regulated centrally by the EU. The EU has strict control and enforcement on organic products.

Before you can market your cocoa as organic, an accredited certifier must audit (check) your growing and processing facilities. For this, you must register with your local control authority. Check the list of recognised control authorities issued by the EU to ensure that you always work with an accredited certifier. All companies are checked at least once a year. Approved companies will receive a certificate to confirm that their products meet organic standards.

Imported organic food also goes through control procedures to guarantee that it is organic. Certificates of Inspection (COIs) must be issued by control authorities before the shipment is sent. If this is not done, your product cannot be sold as organic in the EU and will be sold as a regular non-organic product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

If you want to export to countries outside of the European Union (EU), check the required legislations for those countries. For instance, Switzerland has its own Swiss Organic Law, and the Organic Products Regulations 2009 apply in the United Kingdom.

The European Union has a logo for organic products (see table 1). This makes it easier for consumers to identify organic products and it helps to market them across the entire EU. Most European countries also have their own voluntary organic standards and labels. Examples are Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, such as Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden).

For an organic claim, a chocolate product needs to contain at least 95% organic ingredients (Article 30 of regulation 2018/848). If a chocolate company wants to sell their chocolate products as organic, then (most of) the other ingredients also need to be organic. This includes sugar, milk and other ingredients. As an exporter, it is therefore important to know whether your customers can also buy the other ingredients as organic. If they can’t, then they might not need organic cocoa.

For more information about requirements for organic cocoa, read the CBI study Exporting organic cocoa to Europe.

Craft chocolate

Bean-to-bar and tree-to-bar chocolate are niche segments that could require certification. However, certification is less common in the high-quality cocoa segment. This is because craft chocolate products often already include and go beyond certification in many aspects. This makes certification no longer necessary. An exception is organic certification, which is growing among craft chocolate makers.

For more information, read the CBI study on Exporting tree-to-bar chocolate to Europe.

Tips:

- Exporters usually need to be certified to buy and sell certified cocoa. Check with your certification programme whether this is required for you. See the Rainforest Alliance step-by-step approach and the Fairtrade step-by-step approach for all the relevant information you need to become certified.

- When you schedule an audit, make sure that the audit covers the right traceability level. Audits for mass balance cocoa are often easier and cheaper than audits for segregated cocoa because they don’t require physical traceability. However, you are not allowed to trade segregated cocoa if you are not certified for that traceability level. The Rainforest Alliance origin-matching mass balance requirements could require traceability at the country level, even for mass balance products. Read the requirements to make sure that you can offer the right level of traceability.

- If you have more than one certification, try to combine your audits to save time and money. Check if group certification with other producers and exporters in your region is possible.

- Contact the local offices and staff of the certification programmes in your country. This will help you learn about the programme, receive support and possibly get involved with local sustainability projects.

- Certification programmes have requirements for the marketing of certified products. See the Rainforest Alliance 2020 Labelling and Trademarks Policy and the Fairtrade website about selling your finished products with the Fairtrade mark.

- Check the International Trade Centre (ITC) Standards Map for more information about certification programmes. The IFOAM website is a useful source for information about organic products. Learn more about organic farming and organic guidelines on the European Union website and the Organic Export Info website.

2. Through which channels can you get certified cocoa on the European market?

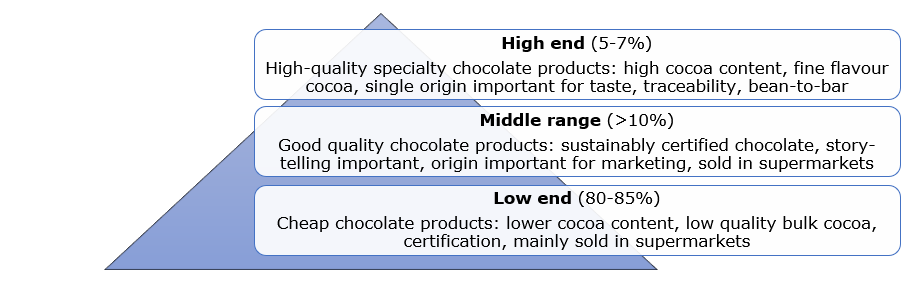

The chocolate confectionery market can be segmented into high-end, mid-range and low-end chocolate. Most low-end and mid-range cocoa is imported by multinational traders and processors. High-end cocoa is sold in smaller volumes in more dedicated supply chains. As an exporter, you can use different channels to bring your certified cocoa to the European market. This will depend on the quality of your cocoa beans and how much volume you can supply.

How is the end market segmented?

Cocoa and cocoa products are mainly used for chocolate confectionery. Other large product groups are drinks and food products. The pharmaceutical industry uses a very small share of the cocoa supply. This study will focus on chocolate confectionery, because this is the most important product group.

The confectionery industry can be segmented by quality. Certified cocoa is used in both the mainstream and the speciality cocoa market. Certified cocoa beans used in the speciality market are mainly used for high-end chocolate products.

Figure 2: Segmentation of the chocolate market based on quality

Source: ProFound – Advisers In Development

Low-end: Low-end segment chocolate is cheaper and usually has a lower cocoa content. The products are often produced by large chocolate manufacturers and mainly use bulk cocoa. Bulk cocoa is cocoa that is sold in high volumes, with low value and standard quality. See the CBI study on Exporting bulk cocoa to Europe for more details on bulk cocoa. Rainforest Alliance certified cocoa is the most common certification programme in the low-end segment.

Low-end chocolate products are usually mass-market products made by big brands and lower-quality private label products from supermarkets. Examples of big brand products include Milka and Toblerone (manufactured by Mondelēz), M&Ms and Twix (Mars) and KitKat (Nestlé). These products are mostly sold in retail.

Examples of low-end brands and consumer chocolate prices in European supermarkets are shown in the table below.

Table 2: examples of low-end segment chocolate products sold at Albert Heijn (Dutch retailer) in 2024

| Product | Certification or company programme | Retail price | Retail price per kg | Packaging |

| Albert Heijn dark chocolate tablet (100 grams) | Rainforest Alliance | EUR 0.99 | EUR 9.90 |

|

| Delicata dark chocolate tablet (200 grams) | Rainforest Alliance | EUR 2.59 | EUR 12.95 |

|

Source: Albert Heijn (September 2024)

Mid-range: The mid-range segment includes chocolate products of good quality. These products are commonly certified. Certification, storytelling and the origin of the cocoa beans are important in this segment, mainly for marketing purposes. Storytelling can be done on the packaging of the product, on the website or through other promotions. Through storytelling, consumers learn more about the origin of the cocoa and feel more connected to your cooperative or business. See the CBI study Tips on how to become more socially responsible in the cocoa sector for more information about storytelling.

Examples of mid-range products available in Europe include Lindtand Côte d’Or (owned by Mondelēz). Some supermarkets also sell private-label premium chocolate products with Fairtrade and/or organic certification. These products offer the same quality and characteristics as branded products but are usually sold at lower prices. Mid-range products are also mainly sold in supermarkets, usually in the high-quality category.

Table 3: examples of mid-range segment chocolate products sold at Albert Heijn (Dutch retailer) in 2024

| Product | Certification or company programme | Retail price | Retail price per kg | Packaging |

| Lindt Excellence 70% dark chocolate tablet (100 grams) | Lindt company programme | EUR 2.99 | EUR 29.90 |

|

| Côte d'Or L'original milk chocolate tablet (200 grams) | Mondelēz Cocoa Life | EUR 3.29 | EUR 16.45 |

|

Source: Albert Heijn (September 2024)

High-end: Smaller, more specialised chocolate makers produce high-end chocolate products, mainly using fine flavour or speciality cocoa. These products usually have a high cocoa content. Single-origin cocoa beans are important, both for the taste and for the traceability of the cocoa.

Bean-to-bar is one of the categories of the high-end chocolate market. Organic certification is especially relevant in this niche segment. See our studies on Exporting specialty cocoa to Europe and Exporting organic cocoa to Europe for more information.

Examples of bean-to-bar brands that work with organic cocoa in Europe are Original Beans (the Netherlands), Michel Cluizel (France), Fjåk Chocolate (Norway) and Friis Holm (Denmark).

Examples of speciality web shops in Europe are Chocolats-de-Luxe (Germany) and Craft Chocolate Store (the Netherlands). Trade fairs where high-end chocolate can be bought include Salon du Chocolat (with fairs in France, Belgium, Italy and the United Kingdom) and Chocoa (the Netherlands).

Table 4: examples of high-end segment chocolate products sold at Ekoplaza (Dutch retailer) in 2024

| Product | Certification or company programme | Retail price | Retail price per kg | Packaging |

| Chocolatemakers milk chocolate tablet (80 grams) | Organic, Fairtrade | EUR 3.99 | EUR 49.88 |

|

| Lovechoc 99% dark chocolate tablet (70 grams) | Organic, vegan, direct trade | EUR 4.49 | EUR 64.14 |

|

Source: Ekoplaza (September 2024)

Tips:

- There can be big differences in price premiums for certified cocoa beans depending on the certification programme. If you decide to trade certified cocoa, make a careful cost calculation first. Calculate the fees, learning costs and workload. Make sure that you provide the quality that buyers demand and that you meet the standards.

- Read the CBI study 9 tips for finding buyers on the European cocoa market for more background information about how the cocoa market is segmented.

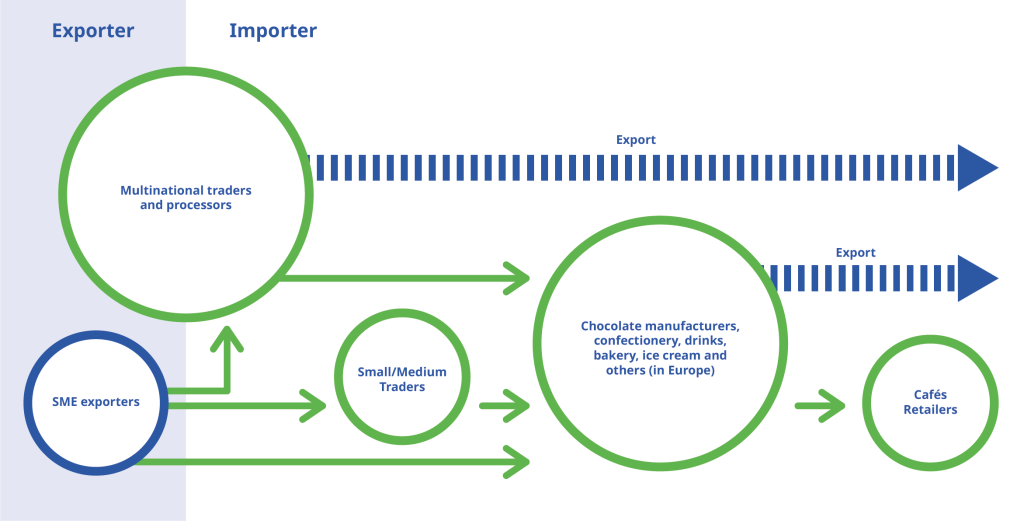

Through which channels does certified cocoa end up on the end market?

As an exporter, you can use different channels to bring your certified cocoa to the European market. This will depend on the quality of your cocoa beans and how much volume you can supply. The figure below outlines the most important channels for certified cocoa in Europe.

Figure 3: exporting to multinational traders and processors, importers and chocolate manufacturers

Source: Bart Wortel Design

Multinational traders and processors

The most important channel to get your certified cocoa on the market is through multinational traders and processors. They usually source their cocoa directly from producing countries. In addition to trading cocoa products, they also process cocoa beans into cocoa mass, cocoa butter or cocoa powder. These companies dominate the global cocoa market, so selling to these companies is the biggest and most relevant channel for certified cocoa.

The largest companies are Barry Callebaut, Ofi and Cargill. Together, these three companies accounted for more than half of global cocoa sales in 2021.

Importers

European importers buy cocoa beans that comply with a wide range of certified standards. Examples of cocoa trading companies that import certified cocoa are Walter Matter (Germany), Cocoasource (Switzerland) and Natra (Spain). The cocoa is sold onwards in their country or to other European countries. These importers normally handle large quantities and have direct contact with exporters in producing countries. In most cases, these importers have long-term relationships with their suppliers.

Importers that are active in the speciality segment usually deal with smaller quantities and often work directly with producers and producer cooperatives. Examples of speciality trading companies in Europe are Silva (Belgium), Uncommon Cacao (United States, with storage facilities in the Netherlands) and Naturkost Übelhör (Germany).

The best option for exporters that sell organic or Fairtrade certified cocoa is to sell cocoa beans directly to specialised cocoa importers. However, some importers may prefer to work directly with producers and not through exporters.

Chocolate manufacturers

Large chocolate manufacturers have factories where they produce their final chocolate products. They usually buy cocoa derivatives, such as cocoa paste, cocoa butter and cocoa powder. Some manufacturers also buy cocoa beans or couverture chocolate. They mostly buy from importers or trader processors based in Europe, although they do buy from exporters as well.

Many of the world’s largest chocolate manufacturers have facilities in Europe. This includes Mars, Nestlé, Lindt & Sprüngli, Ferrero and Mondelēz. Other buyers include Valrhona (France), Neuhaus (Belgium) and Unilever’s ice cream division (the Netherlands).

Small chocolate makers

A much smaller segment is direct trade to small chocolate makers. This cocoa is usually considered speciality or fine flavour cocoa. Although direct trade is growing, it still represents a very small part of the cocoa market. Not all chocolate makers can use a direct trade model. They often outsource responsibilities such as logistics, documentation and pre-financing to traders.

Direct trade can also take place with an importer as an intermediary. They act as a service provider and contact point between the producer and the chocolate maker. Importers can also ensure traceability and share the story of the cocoa beans. Examples of direct trade brands are Paccari (Ecuador, sold in Europe), Marou Chocolate (Vietnam, sold in Europe), Chocolatemakers (the Netherlands) and Meybol Cacao (Germany).

Tip:

- If you are an SME (small or medium-sized enterprise) exporter of bulk cocoa, the main buyers are most likely to be global traders and processors. Some SME exporters also export bulk cocoa directly to large brands. Research the supplier list of large brands to find possible new buyers. Focus on companies that have made public commitments to certification.

What is the most interesting channel for you?

The most interesting channels for exporters of certified cocoa are multinational traders and processors, importers and small chocolate makers.

Multinational traders and processors

Multinational traders and processors are responsible for most of the cocoa import to Europe. The largest traders and processors in 2021 were Olam Food Ingredients (Ofi) (1,019,000 tonnes), Barry Callebaut (988,000 tonnes), Cargill (875,000 tonnes), ECOM (800,000 tonnes), Sucden (525,000 tonnes), Touton (328,000 tonnes), Fuji Group (including Blommer) (200,000 tonnes) and ETG (102,000 tonnes), as reported in the 2022 Cocoa Barometer. When volumes are combined, they trade more cocoa than the amount that is produced per year (which is possible since cocoa traded between these companies is counted twice). All of these multinationals have offices in Europe, and many large processing factories are located near the ports of Amsterdam, Antwerp-Bruges and Hamburg.

Traders and processors that buy cocoa from the direct supply chain usually have higher sustainability demands. This cocoa is more commonly bought as certified. For example, Cargill sold 49% of their cocoa as certified in 2020-2021 and Sucden sold 11% as certified in 2023. Many large traders and processors only make sustainability claims or commitments for their direct supply chain.

Figure 4: Bags of Rainforest Alliance certified cocoa

Source: the Rainforest Alliance 2024

Large chocolate manufacturers

Much of the world’s certified cocoa is eventually sold to one of the large chocolate manufacturers. Although most of their volume is not bought directly from producing countries, but instead through intermediaries, they are still a very interesting channel for exporters.

It is not known how much certified cocoa each manufacturer buys. Most brands have stopped making specific public certification commitments and are now making more generic sustainable or ethical sourcing claims. However, Nestlé, Mars, Ferrero and Lindt publicly communicate that they buy Rainforest Alliance and/or Fairtrade certified cocoa.

Some smaller brands still publish their certified share. Ritter Sport (Germany) sources 100% Rainforest Alliance cocoa, Tony’s Chocolonely (the Netherlands) sources 100% Fairtrade cocoa and Orkla (Norway) sources more than 80% as certified.

Small chocolate makers

Small chocolate makers are more likely to buy speciality cocoa. Many of these buyers will ask for organic cocoa, but Fairtrade or Rainforest Alliance certification is often not needed. This is because their operations already address sustainability in other ways. With their direct relationships with farmers, they can often go beyond what certification programmes offer.

Examples of small bean-to-bar brands are Blanxart, Original Beans, Domori, mi joya and Fjåk Chocolate. Examples of speciality cocoa traders are Bohnkaf-Kolonial, WalterMatter, Le Cercle du Cacao, Tradin Organic and Cocoanect. See the CBI study on Exporting specialty cocoa to Europe for more examples.

Tips:

- Build a relationship with the large importers, traders and processors based in Europe. These are the main ways to access the European market for bulk cocoa. The largest traders and processors are Ofi, Barry Callebaut, Cargill, ECOM, Sucden, Touton, Fuji Oil/Blommer, ETG/Beyond Beans and Cémoi. Together, they dominate the certified cocoa market. Most of the certified cocoa that enters the European market is imported by them.

- Read the CBI studies Tips to find buyers and Tips to do business to learn more about how to work with these buyers.

3. What competition do you face on the European certified cocoa market?

Most certified cocoa comes from Central and West Africa, followed by Latin America. The Ivory Coast and Ghana are the largest producers of both Rainforest Alliance and Fairtrade cocoa. Ecuador has grown in importance in both global cocoa production and in certification. Organic cocoa is grown mostly in smaller cocoa growing origins. The main sources are the Dominican Republic, Sierra Leone and the Democratic Republic of Congo.

Which countries and companies are you competing with?

Rainforest Alliance and Fairtrade certification have a large focus on West Africa, where many of the world’s largest producing countries are located. The largest exporters of Rainforest Alliance cocoa in 2023 were the Ivory Coast, Ghana, Nigeria and Ecuador. Together, they were responsible for 86% of total Rainforest Alliance exports. For Fairtrade cocoa, the largest exporters were the Ivory Coast, Ghana, Peru and the Dominican Republic. The main destination of these exports is the European market.

Organic producers usually work with smaller cocoa origins. The largest exporters of organic cocoa to the EU in 2023 were the Dominican Republic, Sierra Leone, the Democratic Republic of Congo and Peru. These four countries together accounted for 78% of total organic imports into the EU. They are not large cocoa producers, but have a major focus on organic production.

Source: Rainforest Alliance Cocoa Certification Report 2023

Source: Fairtrade Products Dashboard

Source: TRACES 2024

In this study, we will look at the biggest Rainforest Alliance and Fairtrade origins: the Ivory Coast, Ghana and Ecuador. We will also include the Dominican Republic, which is a key Fairtrade and organic origin and the 8th largest Rainforest Alliance origin.

The Ivory Coast is the most important exporter of certified cocoa

The Ivory Coast is the most important exporter of Rainforest Alliance and Fairtrade certified cocoa by a large margin. There have been significant investments in the country by the cocoa industry. The country is the main target country of certification programmes and initiatives such as the Cocoa & Forests Initiative (together with Ghana). Around two-thirds of all global sales of Rainforest Alliance and Fairtrade come from the Ivory Coast.

However, production overall is under threat in the Ivory Coast. Production has declined significantly in recent years. With production increasing in Latin America and Central Africa, the Ivory Coast is losing some strength as the main supplier of bulk cocoa. However, because of the significant investments that the industry has made and the reliance on the Ivory Coast for certified cocoa, it is expected to continue to be the main source of certified cocoa in the coming years.

Six multinational traders dominate the Ivory Coast cocoa trade: Cargill, Barry Callebaut, OFi, Ecom, Sucden and Touton. At least 20% of exports from the Ivory Coast must be exported by local processors and exporters. However, this percentage does not apply to certified cocoa exports. According to some reports, it is easier for multinational companies to buy certified cocoa. Local exporters cannot compete because multinationals have a monopoly on certified cocoa.

An example of a local exporter in the Ivory Coast is S3C, the 9th largest cocoa exporter in the country. They are certified for both Rainforest Alliance and Fairtrade. S3C can export their cocoa to 5 continents. They communicate about sustainability on their website, where it is explained as a key part of their strategy.

Ghana is the second-largest exporter

Ghana is the second-largest exporter of both Rainforest Alliance and Fairtrade certified cocoa. For both these programmes, Ghana represents around 10% of the total exports of certified cocoa. This is significantly smaller in volume than the Ivory Coast, but it is still a large export volume at 174,000 tonnes combined.

Production is also under pressure in Ghana, where cocoa production has declined significantly in recent years. Production has been affected by climate change, pests and disease and illegal mining. A farm gate price below the market price has also caused incentives for the illegal smuggling of cocoa across the border. Ecuador may surpass Ghana as the second-largest cocoa producer in the coming years.

However, Ghana is still expected to remain a key origin for certified cocoa. Ghana has a stronger link with Europe than Latin America. Since the main market of certified cocoa is still Western Europe, Ghana is expected to remain a key origin in the future. Ghana is also investing heavily in their cocoa production and is developing systems for EUDR compliance. This could also help Ghana remain an attractive cocoa exporting country for Europe.

In Ghana, the cocoa is purchased by licensed buying companies (LBCs) and then taken over by the Cocoa Marketing Company (CMC). The CMC then sells the cocoa to registered buyers and delivers it to the ports. In 2022, there were over 44 active LBCs. Many LBCs are owned by multinational traders, including Cargill, Ofi and Barry Callebaut.

Niche Cocoa is an example of a local exporter in Ghana. Niche Cocoa reports about their sustainability initiatives online, for example about their transparent payment system. Niche Cocoa offers Fairtrade and organic certified cocoa. Organic production is very small in the Ivory Coast and Ghana, so offering organic cocoa is unique in these countries.

Certification is growing in Ecuador

Ecuador is a key origin for certified cocoa. It is the third-largest exporter of Rainforest Alliance cocoa and the fifth-largest Fairtrade exporter. It is also the seventh-largest source of organic cocoa for the EU. In addition, Ecuador is the world’s main exporter of fine flavour cocoa, which could be important for exporters of niche cocoa products.

Ecuador has historically been the largest source of Rainforest Alliance certified cocoa in Latin America. This was the case for both UTZ and Rainforest Alliance in 2019, and this was still the case for the merged Rainforest Alliance programme in 2023. Sales remained stable in recent years, but with the growing awareness of Ecuador as a key cocoa origin, this is expected to increase in the coming years. Exports from Ecuador represented 7% of total global Rainforest Alliance cocoa exports.

Ecuador has a smaller Fairtrade presence. Sales from Ecuador only represented 2% of total global Fairtrade sales in 2022. It is the third-largest exporter in Latin America after Peru (7%) and the Dominican Republic (6%).

Eco-Kakao is an example of a cocoa exporter in Ecuador. They export 30,000 tonnes of cocoa annually, focusing on exporting Ecuadorian fine aroma cocoa. They implement 8 different sustainability programmes, including Fairtrade, Rainforest Alliance and organic certifications, and several private sustainability standards. Their website includes lots of information on sustainability, traceability and other topics for their possible buyers.

The Dominican Republic is important for both certified and organic cocoa

The Dominican Republic plays a significant role in the production and export of certified cocoa. There have been a lot of investments in organic cocoa production in the country. 51% of their cocoa supply was organic in 2021, which was the second-most in the world after Tanzania. The Dominican Republic had the third-largest area of organic cocoa production in the world after Sierra Leone and Peru. The country is the largest exporter of organic cocoa to the EU, at 17,000 tonnes in 2023.

The Dominican Republic is also a key origin of Rainforest Alliance and Fairtrade cocoa. It is the second-largest Latin American exporter for both certifications.

There has been a strong shift from North American exports to European exports. In 2002, 74% of the Dominican Republic’s cocoa was exported to North America, and only 24% to Europe. In 2020, this shifted to only 29% being exported to North America and 55% being exported to Europe, mainly to the Netherlands and Belgium. The global cocoa shortage has set the country up as a significant player for organic and premium cocoa.

Conacado is an example of an exporter in the Dominican Republic. They offer a large list of certifications, including Rainforest Alliance, Fairtrade, organic (USDA and EU), Fair for Life, Bio Suisse and others. They can also process cocoa, with a capacity of 26,000 tonnes per year. Conacado has partnered with Valrhona on a project to map farm plots.

Tips:

- Rainforest Alliance and Fairtrade publish annual data on production and export per country. This gives exporters a good idea of the size of the certified market from their country. Read the reports to learn more about the countries.

- Learn from other exporters how they market certified cocoa. Study how they communicate about certification on their website. To find other Rainforest Alliance certified exporters, visit the List of Certificate Holders and filter your search for cocoa, country and supply chain licenses.

4. What are the prices of certified cocoa on the European market?

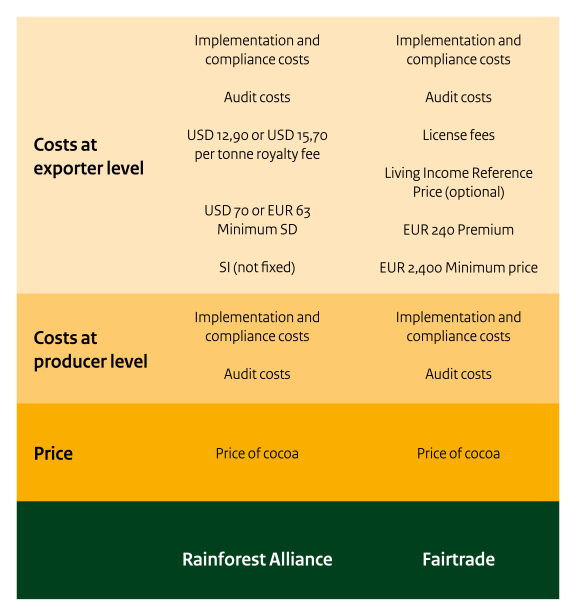

There are several costs that contribute to the market price of certified cocoa. These costs are spent on complying with the certification and implementing the requirements at the farm level. Premiums and minimum price levels are paid to the farmers and farmer groups. Exporters also have to pay costs to comply with the requirements and to ship certified cocoa. Many of these costs are passed on along the supply chain.

What are the prices for exporters?

The certification price for exporters can be broken down into:

- Costs at the production level: These includes audit costs, implementation costs and any in-kind support received from companies.

- Costs at the supply chain level: The supply chain costs include price, premiums and other cash or in-kind payments to producers. They also include audit costs, fees paid to the certification programmes, costs paid to segregate the supply and investments made to store and transfer data.

These costs are paid on top of the price of cocoa and non-certification costs, such as the Living Income Differential (LID) or country differentials.

The price of Fairtrade cocoa includes:

- The Fairtrade minimum price of EUR 2,400 per tonne (or the price of cocoa, whichever is higher).

- The Fairtrade premium of EUR 240 per tonne. The Fairtrade premium for April to September 2024 was EUR 221 per tonne for the Ivory Coast and EUR 240 per tonne for Ghana.

- A license fee of up to 2% of the retail value depending on the country of sale.

- Audit costs via FLOCERT, for producers and suppliers.

- An optional extra premium is the Living Income Reference Price for cocoa from Ghana or the Ivory Coast.

The price of Rainforest Alliance cocoa includes:

- The minimum sustainability differential (farmer premium) of USD 70 per tonne or EUR 63 per tonne for countries that use the XOF currency (West African CFA Franc) or XAF currency (Central African CFA Franc).

- A royalty fee of USD 12.90 per tonne of cocoa beans before 1 October 2024 and USD 15.70 per tonne as of 1 October 2024.

- Audit costs for producers and suppliers.

- Any extra costs paid by suppliers along the supply chain.

The price for certified cocoa is not published, because it depends on negotiations and specific supply chains. Some examples have been published:

- The Global Cocoa Market Study estimates the Rainforest Alliance differential at USD 100 per tonne and the organic premium at USD 300 per tonne.

- Certified cocoa has been reported to cost between 950 CFA (USD 1.54) and 975 CFA francs per kilo in the Ivory Coast.

Figure 8: the costs that contribute to the price of Rainforest Alliance and Fairtrade certified cocoa for exporters

Source: Rainforest Alliance and Fairtrade 2024

What are the benefits for producers?

The premiums and price differentials benefit farmers and farmer groups. Premiums are usually paid to go towards the extra efforts needed to comply with the certification programme. The Fairtrade premium contributes to improving farmer incomes.

The premium that is received often does not make a large difference in the farmers’ income. A 2018 BASIC study found that the value distribution for certified products was only slightly higher than for non-certified products. Only 7.7% of the margin for a plain dark chocolate bar in France went to cocoa cultivation. For an organic certified product, this was only slightly higher, at 10.2%, compared to 10.4% for Rainforest Alliance certified and 11.6% for organic and Fairtrade multi-certification.

Many farmers do not receive the premium for all the cocoa that they sell, because not all certified production is sold as certified. When that happens, farmers receive a pro-rata (proportionate) share of the premium. If a farmer group sells 50% of their volume as certified, then each farmer will receive the premium for only 50% of the cocoa they sold to the farmer group. In 2023, Rainforest Alliance producers sold 57% of their cocoa production as certified. The ratio was 33% for Fairtrade in 2022.

When farmer groups do receive a premium, a large share of the premium goes towards complying with the certification. The administrative burden has increased in recent years. This share does not contribute to a higher income. The VOICE Network recommends providing a clear breakdown between the part that covers the farmer’s living income gap and the part that covers compliance costs and running the cooperatives.

Many farmers are still not earning a living income. An estimated 73% to 90% of cocoa farmers in the Ivory Coast and Ghana do not earn a living income. A 2020 Fairtrade study in the Ivory Coast found that 15% of farmers earn a living income. Premiums and minimum prices help, but they are not enough for all farmers to reach a living income.

Tips:

- There are several websites that publish the price of cocoa. The futures price can be found on the ICE website and the ICCO website. The CCC (Ivory Coast) and COCOBOD (Ghana) publish the farm gate price. The ONCC (Cameroon) publishes the daily cocoa price. Country differentials are often not public, although the CIGCI has published them for the Ivory Coast and Ghana in the past. Changes in Fairtrade prices and premiums are published on the Cocoa Fairtrade Minimum Price Differential page.

- If you are charged a certification premium when sourcing certified cocoa, ask your suppliers for a breakdown of the premium. It should contain some of the elements described above. This will give you more clarity on how the price was determined. It can also be useful to give this level of detail to your buyers. This extra transparency can build confidence and long-lasting business relationships.

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research