Entering the Dutch market for cocoa

The Netherlands is Europe’s largest importer of cocoa beans and derivatives from producing countries. Dutch imports mainly come from Côte d’Ivoire, Cameroon, Nigeria, Ghana and Ecuador. Most of the imported cocoa is re-exported, as cocoa beans, derivatives or final chocolate product. As such, it is important that the cocoa meets Dutch requirements, European Union (EU) requirements and possibly also requirements for other European countries. The Netherlands mainly imports bulk, mainstream chocolate. Rainforest Alliance or Fairtrade certification is very important for the Dutch market.

Contents of this page

1. What requirements and certification must cocoa comply with to be allowed on the Dutch market?

There are a lot of requirements and certifications for exporting cocoa to the Netherlands. These requirements can be mandatory (meaning you have to comply with them for entry into the Netherlands) or voluntary (meaning your buyers can ask for them). The EU can ask for them (meaning they are the same for all countries in the EU) or required by Dutch law (meaning they are specific to the Netherlands).

This study focuses on requirements and certifications specifically for the Netherlands. Read our study on What requirements must cocoa beans comply with to be allowed on the European market for more details about the requirements and certifications relevant for Europe.

It is good to consider that your Dutch importer might re-export large quantities of cocoa beans to other destinations in Europe. These other buyers will pass on their requirements, and this might increase the need for other specific certifications or standards. This all depends on the final market and the market channel.

What are mandatory requirements?

Legal rules necessary for entry to the Netherlands

It is important to comply with food safety laws. EU food laws are set by Regulation No 178/2002 at the EU level. All the rules in the General EU Food Law are described in Dutch food safety requirement.

A new legal requirement is the EU Regulation on deforestation-free products (EUDR). As of 30 December 2024 (or six months later for micro or small businesses), products on the EU market will need to comply with the deforestation-free requirements set out in the EUDR. This applies to all countries in the EU, including the Netherlands. It also applies to imported and re-exported cocoa, which involves a large share of Dutch cocoa imports.

The Nederlandse Voedsel en Warenauthoriteit (NVWA) will play a key role in the implementation and enforcement of the regulation. You can read more about the regulation in our study on 8 tips to go green in the cocoa sector.

Quality requirements for the Netherlands

Quality requirements are determined at the EU level. There are some small differences at country level.

One example is on fumigation. Pest species can infest cocoa beans at their origin. If they untreated, these species can survive shipment to chocolate factories in Europe. Disinfestation can be done throughout the supply chain, and it is often also done in Europe to stop the spread of pests. The Netherlands has more stringent requirements surrounding fumigation than other European countries. Read Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements and the Pesticide Use in Cocoa Practical Manual (fourth Edition) for more details.

Labelling and packaging requirements for the Netherlands

The labelling on cocoa beans exported to the Netherlands should comply with the European Union’s general food labelling rules.

The EU has also defined rules for cocoa and chocolate products in Directive 2000/36/EC. These are described in Dutch law in the Warenwetbesluit Cacao en Chocolade. It includes rules on the minimum cocoa content required for a product to be labelled as ‘chocolate’, which includes local products that are usually produced locally, like sprinkles and chocolate flakes with low cocoa content. This law is only relevant to suppliers of chocolate or semi-finished cocoa products like cocoa butter or cocoa powder.

Payment and delivery terms for the Netherlands

Payment and delivery terms can differ depending on the exporting and importing country. The EU’s website Access2Markets provides the necessary information on tariffs, taxes, requirements, trade barriers and more. On this website, you can search for the relevant taxes and tariffs for export from your country to the Netherlands.

The relevant taxes and tariffs for cocoa beans, paste, butter and powder from the main export countries are shown in the table below.

Table 1: Taxes and tariffs for cocoa beans and cocoa products for key import countries (2023)

| Beans (1801) | Paste (1803) | Butter (1804) | Powder (1805) | |

| Cameroon | 0% tariffs 9% VAT* | 9% Third country duty 0% Tariff preference 9% VAT | 7.7% Third country duty 0% Tariff preference 21% VAT | 8% Third country duty 0% Tariff preference 9% VAT |

| Côte d’Ivoire | 0% tariffs 9% VAT | 9% Third country duty 0% Tariff preference 9% VAT | 7.7% Third country duty 0% Tariff preference 21% VAT | 8% Third country duty 0% Tariff preference 9% VAT |

| Ecuador | 0% tariffs 9% VAT | 9% Third country duty 0% Tariff preference 9% VAT | 7.7% Third country duty 0% Tariff preference 21% VAT | 8% Third country duty 0% Tariff preference 9% VAT |

| Ghana | 0% tariffs 9% VAT | 9% Third country duty 0% Tariff preference 9% VAT | 7.7% Third country duty 0% Tariff preference 21% VAT | 8% Third country duty 0% Tariff preference 9% VAT |

| Nigeria | 0% tariffs 9% VAT | 9.6% Third country duty 6.1% Tariff preference 9% VAT | 7.7% Third country duty 4.2% Tariff preference 21% VAT | 8% Third country duty 2.8% Tariff preference 9% VAT |

Source: Access2Markets 2023.* VAT is Value Added Tax.

What additional requirements and certifications do buyers often have?

Rainforest Alliance and Fairtrade certification

Certification standards like the Rainforest Alliance and Fairtrade are important on the Dutch chocolate market. Almost 100% of the cocoa used in private label chocolate products sold in supermarkets is certified. Large brands sold in the Netherlands are also usually certified or produced under a corporate sustainability scheme (company programme).

As a producer or exporter, being part of a certification programme or corporate sustainability programme can help you get access to the Dutch market. However, only a small share of the cocoa imported into the Netherlands is consumed there. The share of the cocoa re-exported to other European countries could require less in terms of certification. See our study on Certified cocoa for more information about certification.

Organic

In order to market your cocoa as organic in the European market, it needs to comply with the European Union’s regulations on organic production and labelling. EU Organic is the minimum legislative requirement for marketing organic cocoa in the European Union.

There is no mandatory national organic label, but the Netherlands has one private organic label: EKO Quality Mark. This private label can be used alongside the EU organic label on final products if you fulfil the EKO Quality mark requirements. It is important to understand how your organic products are marketed in the Netherlands. However, your importer will take care of adding the EKO Quality Mark.

Supplier Code of Conduct

Many cocoa suppliers and chocolate manufacturers have a Supplier Code of Conduct. Examples include the Barry Callebaut Supplier Code of Conduct, the Ofi Supplier Code of Conduct and the Cargill Supplier Code of Conduct. These supplier codes deal with different topics. They can involve human rights and environmental protection. Make sure that you comply with their Supplier Code of Conduct to get access to the Dutch market through these manufacturers.

Other additional sustainability requirements

One important initiative is the Dutch Initiative on Sustainable Cocoa (DISCO), which aims to increase the level of sustainability for all cocoa that enters the Dutch market. Companies that are members of DISCO commit to addressing living income, child labour and deforestation. These commitments could mean that Dutch importers ask for specific requirements related to these topics from their suppliers.

For producers and exporters, this could mean that several sustainability requirements are needed to enter the Dutch market. The specific requirements will depend on the cocoa buyer.

Tips:

- Take a look at the EU’s website Access2Markets. This website provides all the trade information you need to know, including tariffs, taxes, procedures, requirements, rules of origin, export measures, statistics, trade barriers and more. Enter the product code (e.g. 180100 for cocoa beans), origin country and destination country to search for the relevant details for your country.

- For the full buyer requirements, read the study on Buyer requirements for cocoa beans on the European market. It describes details about mandatory European legislation on food safety, food hygiene and food contaminants (including cadmium and pesticide residues), food labelling and packaging. It also explains extra requirements for quality, CSR and certification.

- Read our study 8 tips to go green in the cocoa sector and 9 tips to become more socially responsible in the cocoa sector for more details about the new EU Deforestation Regulation (EUDR), Corporate Sustainability Due Diligence (CSDDD) and the European Green Deal. Read the CBI study Exporting certified cocoa to Europe for more details about certification schemes. Alternatively, you can also follow our webinar on meeting European sustainability requirements.

- Read the DISCO 2021 annual report and visit the DISCO website to read other reports and to keep track of the latest developments. These reports give insight into which companies are present in the Dutch market and what their commitments are.

2. Through what channels can you get cocoa on the Dutch market?

There are different channels to get your cocoa on the Dutch market. Cocoa beans are used for processing in four different industries: confectionery, food, cosmetics and pharmaceutical. Most cocoa is sourced for chocolate confectionery. This study focuses on the chocolate industry in the Netherlands.

How is the end-market segmented?

The chocolate produced and sold in the Netherlands is segmented by quality.

Bulk: low-end segment

The low-end segment is for cheap chocolate products, usually with lower cocoa content. Most of these products are produced by large chocolate manufacturers. Most cocoa is imported in bulk from West Africa. Bulk cocoa is available in high volumes, low value and standard quality. Rainforest Alliance certification is common for this segment. Consumers buy the products as conventional chocolate brands or private label chocolate products in supermarkets.

Examples of multinational brands in the confectionery category are KitKat, Smarties and Rolo (Nestlé), Mars, Snickers and M&M (Mars), Cadbury and Milka (Mondelēz), Kinder (Ferrero) and Reese’s (Hershey).

Figure 1: A selection of low-end segment chocolate products

Source: Photo by Denny Müller on Unsplash

Many chocolate bars sold at retailers are also in the low-end segment. At Dutch retailer Albert Heijn, these products typically cost between 0.50 EUR and 2.00 EUR for a typical chocolate product (based on Albert Heijn's retail prices in 2023). See the table below for some examples.

Table 2: Examples of low-end segment chocolate products sold at Albert Heijn (a Dutch retailer) in 2023

| Product | Retail price | Retail price per kg | Packaging |

| Milka (100g) | 0.89 EUR | 8.90 EUR |

|

| Verkade Tablet Pure (111 grams) | 1.89 EUR | 17.03 EUR |

|

| AH Tablet Pure (100 grams) | 0.59 EUR | 5.90 EUR |

|

| AH Delicata ReepPure (100 grams) | 1.29 EUR | 12.90 EUR |

|

Source: Albert Heijn's retail prices in 2023. Photos: Long Run Sustainability

Middle range segment

The middle-range segment includes chocolate products of a higher quality. These are often also made with certified cocoa.

Storytelling and the origin of the cocoa beans are important in this segment. Certified beans do not need to physically be in the product for storytelling. Many brands and retailers buy mass balance cocoa, which means that the certified cocoa might not physically be in the final product. Brands and retailers can support a specific farmer group and benefit from the storytelling for this farmer group if they are buying mass balance cocoa.

The cocoa beans for the middle range segment can still be purchased in bulk at mainstream quality. The quality of the chocolate is influenced by the production process for the cocoa and the percentage share of cocoa in the final product. The chocolate quality is also improved by using higher quality non-cocoa ingredients.

Examples of multinational brands in the middle range segment include Lindt (Lindt & Sprüngli), Côte d’Or (Mondelēz), Ritter (Ritter Sport) and L’Atelier (Nestlé). The Dutch brand Tony’s Chocolonely is also in the middle range segment. See the table below for some examples.

Table 3: Examples of middle range segment chocolate products sold at Albert Heijn (Dutch retailer) in 2023

| Product | Retail price | Retail price per kg | Packaging |

| Lindt Excellence 70% Pure (100 grams) | 2.79 EUR | 27.90 EUR |

|

| Côte d'Or L'original Milk (200 grams) | 2.99 EUR | 14.95 EUR |

|

| Ritter Sport Milk hazelnut (100 grams) | 1.49 EUR | 14.90 EUR |

|

| Tony's Chocolonely 32% Milk (180 grams) | 2.39 EUR | 13.28 EUR |

|

Source: Albert Heijn's retail prices in 2023. Photos: Long Run Sustainability

Figure 2: Lindt chocolate products

Source: Photo by Moses Rukshan on Unsplash

High range segment

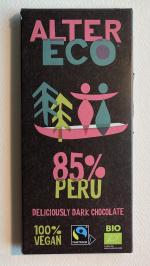

The high range segment includes specialty and craft chocolate products. These are often used with fine flavour cocoa and usually have high cocoa contents. Chocolate makers in this segment are usually smaller and more specialised. They often use fine flavour cocoa (usually from the Criollo or Trinitario cocoa tree varieties or Nacionál cocoa from Ecuador).

Bean-to-bar is an example of a high-end product. The cocoa beans usually come from a single origin, with full traceability throughout the supply chain. This helps to tell the story behind their product in a way that is attractive for consumers. The high range segment usually has higher standards for sustainability as well. Certification is not necessary, but these products can be sold with Fairtrade and Organic certification.

Examples of high-end chocolate products (based on retail prices of Chocoladeverkopers in 2023) include Chocolatemakers’ Puur Sierra Leone 85% (80 grams) for 3.95 EUR, Original Beans Esmeraldas (70 grams) for 4.50 EUR and Mesjokke DARC Angel (40 grams) for 4.50 EUR.

Tip:

- Read the CBI study 9 tips for finding buyers on the European cocoa market for more background information on how the cocoa market is segmented.

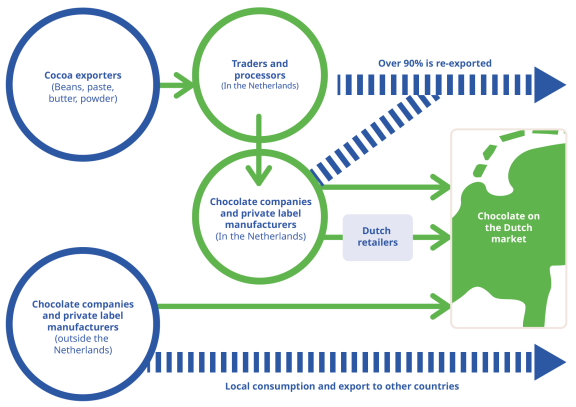

Through what channels does the cocoa end up on the end-market?

If producers or exporters want to access the Dutch market, it is important to be aware that most of the chocolate produced in the Netherlands is exported to other countries. Generally speaking, cocoa beans, cocoa products and chocolate enter and/or leave the Netherlands in four different ways.

- Beans or cocoa products imported to the Netherlands and re-exported to other countries. These enter the Netherlands at the Port of Amsterdam and are shipped onwards before being used to produce chocolate.

- Chocolate produced in the Netherlands for export. Together with the first option, this is the largest share of all cocoa that enters the Netherlands (96% for DISCO members).

- Chocolate produced in the Netherlands for local consumption. Smaller chocolate companies focused on the Dutch market dominate this channel.

- Chocolate produced in other countries for consumption in the Netherlands. This is the case for large multinational brands that do not have factories in the Netherlands.

The easiest way for exporters to reach the Dutch market is through the mainstream market, although the specialty bean-to-bar market is also interesting.

Figure 3: How cocoa and chocolate enters the Netherlands (simplification)

Source: Long Run Sustainability, DISCO. Design by Bart Wortel

Importers

Ofi, Cargill and ECOM are large importers in the Netherlands. For Ofi, the Netherlands is the main European cocoa distribution point. ECOM owns a factory for Dutch Cocoa B.V. and a Theobroma sales office in Amsterdam and the Tulip Cocoa plant based in Ede. Cargill was established in Amsterdam in 1959 and still has its head office there. Cargill has processing plants in Zaandam, Deventer and Wormer. Barry Callebaut also has a production facility in the Netherlands for chocolate decorations but does not have grinding facilities. Barry Callebaut has a large grinding facility in Belgium (the largest in the world).

There are also many small and medium importers active in the Netherlands. ETG/Beyond beans imports beans from many countries and has its global headquarters in Amstelveen. Ascot Amsterdam is a cocoa trading company with a dedicated sales office in the Netherlands for the Cocoa Abrabopa Association. Tradin Organic is a smaller importer that focuses on organic beans. Another example of a small importer is Facta International, a Dutch-based trader of cocoa beans and semi-finished cocoa products.

Importers in the specialty segment usually deal with smaller quantities and often work directly with producers and producer cooperatives. Examples of specialty trading companies in the Netherlands are Daarnhouwer, Crafting Markets, Gaia Cacao, Campo Lindo and Dietz Cacao Trading B.V.. DO-IT Organic and Huyser Möller B.V. are Dutch companies that import cocoa derivatives.

Processors

Examples of cocoa bean processors/grinders in the Netherlands are Cargill, Dutch Cocoa (a subsidiary of ECOM Agroindustrial) and Olam Agri. Baronie has a factory in Rotterdam. More specialised cocoa processors are the Crown of Holland (the cocoa processing facility of Tradin Organic, focused on processing of organic cocoa) and JS Cocoa (mostly focused on the pharmaceutical and cosmetic industries). A full list of processors based in the Netherlands is available here.

Multinational brands with products on the Dutch market

Ferrero, Lindt & Sprüngli, Mars, Mondelez International and Nestlé are the largest chocolate companies in the world and all have a large market share in the Netherlands. However, most of the chocolate from these brands is produced in other countries. Only Mars and Mondelēz have factories in the Netherlands. Milka and Côte d’Or (both owned by Mondelēz) are popular A-brands in the Netherlands. Other popular brands include Lindt, Kinder (Ferrero), KitKat (Nestlé) and Mars.

The Mars factory in Veghel is one of the largest in the world and produces chocolate for many countries. Only a small percentage of the chocolate produced here will end up on the Dutch market. Ofi produces the cocoa powder for Oreo cookies (Mondelēz) in the Netherlands.

For exporters, it is important to know that these brands work with preferred suppliers. Important factors are stable and reliable quality and supply. It could be difficult for SME exporters to enter the Dutch market through these multinational brands without a preferred supplier. It is helpful to sell your products via these preferred suppliers.

National brands with a large market share on the Dutch market

There are also many brands available on the Dutch market that are not owned by one of the five large multinational chocolate manufacturers.

One example is Tony’s Chocolonely. Tony’s Chocolonely is much smaller internationally than these multinationals but became the largest chocolate brand in the Netherlands in 2020. Tony’s Chocolonely had an 8.2% market share in 2021–2022. It is a very well-known brand among Dutch consumers, 82% of which are aware of Tony’s Chocolonely.

Tony’s Chocolonely has opened their supply chain to other chocolate brands through the Tony’s Open Chain. The open chain consists of five sourcing principles: Traceable beans, a higher price, long-term commitments, productivity & quality, and strong farmers.

Several companies in the Netherlands have joined the Tony’s Open Chain as mission allies, including Ben & Jerry’s, Albert Heijn’s Delicata chocolate, Aldi’s Choco Changer, and the retailers Plus and Hema. Barry Callebaut has been the processor for Tony’s Chocolonely and the Open Chain since the beginning but, in 2023, Natra and Cemoi joined as potential suppliers (enablers) of the Tony’s Open Chain.

While Tony’s is a relatively young brand, the Netherlands has a long history of chocolate companies, dating back to the 1800s. Many companies are still around today, although many are now owned by companies outside the Netherlands.

Famous Dutch brand Van Houten was established in 1828. Barry Callebaut currently owns it. Another well-known Dutch brand is Droste, which has its factory in Vaassen. Droste was established in 1863. Production still takes place in the Netherlands. 65% of their products are sold outside the Netherlands. Droste is currently owned by the German company Hasta.

Another well-known Dutch brand is Verkade, which was established in 1886. Verkade is currently owned by Pladis, which is part of the Turkish conglomerate Yildiz Holding. Verkade still has its headquarters in the Netherlands. Koetjesreep is another Dutch brand with ownership outside the Netherlands. It is owned by Belgian Chocolate Group, and production takes place in Belgium too.

Chocolate sprinkles are a typically Dutch product. The main brands are de Ruijter and Venz. De Ruijter was established in 1860 and Venz in 1890. Both companies are now owned by Kraft Heinz Foodservice, which is one of the largest food and beverage companies in the world.

A well-known Dutch brand of chocolate milk is FrieslandCampina. They sell and own brands globally, but a strong cocoa brand in the Netherlands is Chocomel.

Fairtrade Original is a small food brand with products available in the Netherlands and a few other countries in Western Europe. They also sell chocolate products. Ritter Sport is a German brand also sold in the Netherlands.

Supermarket brands

There are many supermarket chains in the Netherlands. Albert Heijn (part of Ahold Delhaize) had the largest market share in 2022 with 36.5%. Jumbo was second at 21.6%, and Superunie had a combined 26.6% market share for all their members. Superunie is a purchasing organisation representing 12 retail organisations in the Netherlands (see Figure 7). Discounters have a combined market share of 16.2% in 2022. This includes Lidl, which had a 10.7% market share one year earlier in 2021. Aldi is another large discounter in the Netherlands.

Figure 4: Market share of supermarkets in the Netherlands

Source: IRI Worldwide

Almost all the private label chocolate sold in supermarkets in the Netherlands is certified. Albert Heijn, Jumbo and Superunie are all members of Beyond Chocolate, where they report that they buy 100% certified cocoa. At Aldi, over 99% of the cocoa sold in the Netherlands was certified. At Lidl, 100% of the cocoa in their products was certified in 2021.

Ahold Delhaize has a large focus on sustainability. In 2022, 89% of their own-brand cocoa products were bought through a sustainability scheme (including cocoa products for other European countries).

For exporters, this means that private label manufacturers may be an interesting entry point for your cocoa beans. Examples of private label manufacturers in the Netherlands are Baronie, Delicia, Choco Support, the Candy Store and Colbrand.

Niche segments

Bean-to-bar: in the specialty and fine flavour segment, most cocoa beans are traded directly from producers to chocolate makers. Although direct trade is growing, it is still a very small part of the cocoa market. Bean-to-bar brands have direct relationships with producers. Quality is the most important aspect of the chocolate, but these brands usually have a high standard of sustainability as well.

However, not all chocolate makers can set up direct trade. They therefore outsource their logistics, documentation and pre-financing to traders. Direct trade can also happen with an importer serving as intermediary. They can be a service provider and point of contact between the producer and the chocolate maker.

Examples of specialised chocolate (bean-to-bar) makers in the Netherlands are Original Beans, Lovechock, Krak Chocolade, Heinde & Verre, Johnny Doodle, Chokay, Alter Eco and the Chocolate Makers.

Chocolatier shops: High-end products are mainly sold at chocolate events and in specialty shops. Examples of specialty shops in the Netherlands include Chocoladeverkopers, The Chocolate Shop, The High Five Company and De Chocolade Meisjes.

Figure 5: Chocolate brand Alter Eco with country of origin information

Source: Long Run Sustainability

What is the most interesting channel for you?

Bulk cocoa

If you are an exporter of high volumes of bulk beans, then your direct trading partner is usually a cocoa trader or grinder/processor. These companies tend to buy high volumes of standard quality. The main buyers for the Dutch market are the same as the largest traders globally. Many will also have cocoa-buying stations in producing countries to which you can sell your cocoa beans directly.

Specialty cocoa

Producers or exporters with specialty or certified cocoa are best positioned to sell cocoa beans directly to specialised cocoa importers. Many specialised importers prefer to work directly with producers and not through exporters.

If you produce or have very high-quality cocoa beans and are working through an importer, it might be interesting to discuss the possibilities to directly link up with high-end chocolate makers. This is mainly an opportunity for those that have invested and expertise so can access the market directly.

A smaller interesting channel for producers and exporters could be the small sustainability-minded brands. These companies sometimes work with or support cocoa farmers. This can be done directly or indirectly through their suppliers. These relationships are usually long-term (over several years), so it is worth investing in setting up these relationships.

Retailers

Supermarkets with head offices in the Netherlands could be another interesting channel to look at. The biggest ones are Albert Heijn, Jumbo and Superunie. Access to these supermarkets is mostly done through private label manufacturers and their suppliers. Certification would be a minimum requirement for imported cocoa beans.

These supermarkets do not have direct relationships with specific producers, Although Albert Heijn is connected with producers through Tony’s Open Chain. The other large supermarkets in the Netherlands are Aldi and Lidl, but sourcing decisions are usually managed from offices outside the Netherlands.

Tips:

- Use industry associations to find potential buyers in the Netherlands, such as the Dutch Association of Bakery Goods and Sweets (VBZ).

- Use the FLOCERT customer database to find Fairtrade buyers in the Netherlands.

- Look for bean to bar brands online. The website of the Fine Cacao and Chocolate Institute (FCCI) has a map where you can locate fine flavour chocolate brands in the Netherlands and other countries. Other useful sources are beantobar.be, which lists artisan bean-to-bar producers, and I Am Expat, which lists the best chocolatiers the Netherlands.

- Attend events where you can meet buyers. An example in the Netherlands is Chocoa, which includes a Trade Fair, European Markets Academy, Cocoa Export Training, the Sustainable Cocoa Conference, Chocolate Makers’ Forum, the Grand Diner du Chocolat, the Cacao of Excellence Awards Ceremony and the Chocolate Festival.

- For more tips on finding the right buyer for you, see our study on Finding buyers on the European cocoa market.

3. What competition do you face on the Dutch market?

Competition is generally high for bulk cocoa with low added value. This segment is dominated by major suppliers and cooperatives that can deliver large volumes so they can compete on price. It is difficult for small and medium-sized companies to compete with this segment. The main import countries are in West Africa, with only a small percentage coming from Latin America and Asia.

Which countries are you competing with?

The main import county for the Netherlands is Côte d’Ivoire which supplies 42% of the beans, followed by Cameroon (20%), Nigeria (12%), Ghana (11%) and Ecuador (3%). Cameroon increased the most between 2018 and 2022, while imports from Côte d’Ivoire decreased the most.

The main exporters of bulk beans are also the main chocolate processors in the Netherlands: Cargill, Ofi, Ecom and the other processors mentioned in the previous chapters. Global trade is dominated by these and four other traders (Sucden, Touton, Cémoi and ETG). These nine traders accounted for 4,917,000 MT in 2022, while global production was estimated at 4,818,000 MT in 2022. There is some double counting among the traders (as they also sell to each other), but most of the global cocoa supply will pass through one of these nine traders at some stage.

The export market in producing countries is dominated by multinationals. In Côte d’Ivoire, ten companies handle two-thirds of all exports, including the local exporter S3C. In Cameroon, Cargill and Olam export 84% of all beans, and Barry Callebaut represents 89% of all cocoa processing. One example of a local company in Cameroon is Nealiko. Other examples of processors and exporters in producing countries are FTN Cocoa Processing in Nigeria, Niche Cocoa in Ghana and EXPOAGMARSA in Ecuador.

For exporters, this means that these companies are the main competitors and buyers of your cocoa.

Source: Eurostat 2023

Competition is lower in the specialty cocoa market. In this segment, there is more focus on quality, taste and sustainability. The speciality market takes up less than 10% of the global market. Specialty cocoa is mainly sourced from Latin America and the Caribbean. Ecuador is the world’s largest exporter of fine flavour cocoa.

Only a small share of Dutch imports from producing countries came from Latin America. The total imports in 2022 were 21,000 tonnes from Ecuador, 14,000 tonnes from Peru and 12,000 tonnes from the Dominican Republic. Total bean imports from Latin America decreased by 10,000 tonnes between 2018 and 2022.

Source: Eurostat 2023

The Netherlands is an interesting destination for cocoa from Sierra Leone. The total Dutch imports from Sierra Leone only amounted to 13,600 tonnes in 2022, but this was 88% of the total imports of beans from Sierra Leone to Europe. Cocoa production in Sierra Leone increased from 15,000 tonnes in 2018 to 18,000 tonnes in 2022, and most of this volume was imported to the Netherlands.

Sierra Leone has the largest organic cocoa area in the world, with about 34% of the total area being organic as of 2021. The organic cocoa sector in Sierra Leone has been subsidised by Dutch importer Tradin Organic since 2015. Since 2017, the trading company has its own cocoa sourcing company in the country.

4. What are the prices for cocoa?

The price of cocoa is determined by global supply, demand and several other additional factors. These include hedging, tariffs, trade agreements, taxes, global events and crises. Both cocoa supply and cocoa demand are highly inelastic. Changing production takes time because it requires planting new trees, as does changing cocoa processing capacity. The market is dominated by a small number of powerful companies.

The price of cocoa beans can be structured as follows:

Table 4: The structure of the price of cocoa beans

| Type of Cocoa | Description | Price structure |

| Bulk | Farmer processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador) or bulk centrally fermented (e.g. CCN-51 in Ecuador). | London or New York ICE + or – country differential. |

| Rainforest Alliance ‘Standard’ | Farmer processed (e.g. in heaps or baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador) with RFA certification. | London or New York ICE + or – country differential plus a differential of (on average) 100 USD per tonne. |

| Organic ‘Standard’ | Farmer processed (e.g. in baskets used in West Africa) or bulk centrally fermented (e.g. CCN-51 in Ecuador). Any presence of chemical residue detected in samples on arrival would lead to discontinuation of the organic premium. | London or New York ICE + or – country differential + approximately 300 USD per tonne organic premium. |

Organic ‘Premium’ | Also called ‘improved’ organic. On farm harvesting (ripe pods), traceability to bag level, summaries by gender, farmer profiles). Any presence of chemical residue detected on samples on arrival would lead to discounting the premiums. | London, New York ICE + or – country differential + approximately 300 USD organic + 100 to 300 USD premium for quality. |

| Fairtrade-Organic | Double certified beans. Farmer processed (e.g. in baskets used in West Africa). Any presence of chemical residue detected on samples on arrival would lead to discounting the organic premium. | Minimum FTO price (2,700 USD per tonne) plus a Fairtrade premium of 240 USD per tonne. In addition, extra premiums are possible (e.g. depending on quality). |

| Specialty | High quality beans (zero defects) for organic, hand-sorted, centrally fermented, solar dried, good sensory profile (often Criollo or Trinitario varieties) and a good story. | Prices would range from 3,000 to 6,000 USD per tonne, although there are cocoa beans of exceptional quality, origin and uniqueness sold at very low volumes that fetch higher prices (Ferro et al., 2021). |

| Specialty Organic | High quality beans (zero defects) hand-sorted, centrally fermented, solar dried, good sensory profile and a good story, plus organic certification. | Prices would range from 3,000 to 6,000 USD per tonne, although there are cocoa beans of exceptional quality, origin and uniqueness sold at very low volumes that fetch higher prices (Ferro et al., 2021). |

Source: Global Cocoa Market Study

For exporters, it is important to say that trade prices and retail prices are not directly linked. Only a small share of the value added goes to farmers and exporters.

In a study by Le Basic on value distribution for selected chocolate products sold in France in 2018, less than 7.5% of the total margin was generated in cocoa producing countries (from cocoa cultivation up to bean exports). 90% of the total margin was generated by brands and retailers. In general, export prices of cocoa beans and the share kept by cocoa producers will depend on cocoa bean quality, the size of the lot and the supplier’s relationship with the buyer. Chocolate companies and retailers keep the largest shares. This study was done for the French market, but the margins for the Dutch chocolate market are likely to be similar.

Molgo Research carried out this study in partnership with Long Run Sustainability and Amonarmah Consults on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research