Entering the European market for organic cocoa

The largest organic cocoa bean suppliers to the EU in 2020 were the Dominican Republic, Sierra Leone and Peru. Most larger importers, cocoa processors and chocolate manufacturers will handle organic cocoa beans in their portfolio, but there are also traders specialised in organic cocoa beans only. It is important to ensure that your partner is licensed to handle organic cocoa, as all actors in the supply chain must be certified and must comply with EU organic regulation for your organic cocoa to be marketed as such.

Contents of this page

1. What requirements must organic cocoa comply with to be allowed on the European market?

Cocoa beans exported to Europe must comply with strict European requirements. For a complete overview of standards, including packaging and quality requirements, refer to our study on buyer requirements for cocoa beans. Below are the requirements that apply specifically to organic cocoa beans.

European organic legislation

From the perspective of European authorities and buyers, ‘organic by default’ does not exist. This means that it is not enough just to have your cocoa beans ‘naturally grown’ and pesticide-free to achieve organic-certified status. In order for a company to market cocoa beans as ‘organic’ on the European market, it must comply with European organic legislation, which includes regulations for production, processing and trade. Regulation (EC) 2018/848 lays down rules on organic production and labelling. Regulation (EC) 1235/2008 describes the implementing rules of the EU legislation for imports of organic products from third countries.

Before you can market your cocoa beans as organic, an accredited certifier must audit your growing and processing facilities. Refer to this EU-issued list of recognised control bodies and authorities to ensure that you always work with an accredited certifier. After being audited and after receiving an organic certificate, you can use the EU organic logo on your products.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control body prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. You can obtain COIs by using the European Commission’s electronic Trade Control and Expert System (TRACES).

If you want to export to countries outside of the EU, check the law in that country. For instance, Switzerland has its own Swiss Organic Law.

Regarding organic logos, many European countries have their own national organic logos besides the EU organic logo. Examples of these include Bio-Siegel (Germany), AB mark (France), and the Ø logo (Denmark).

Private organic standards

There are also private organic standards that go beyond the traditional EU standard. Examples of these are Naturland (Germany), Bio Suisse (Switzerland), KRAV (Sweden), Soil Association (United Kingdom), Demeter (specifically for biodynamic farming, not country-specific) and Regenerative Organic Certification (integrates soil health, animal welfare and farmworker fairness into one standard, not country-specific).

Most private standards include stricter rules than those in the EU organic legislation. For instance, you can check the additional requirements asked for by Naturland and compare them to the EU legislation. Always check the requirements asked for by the official website of the standard itself to be up to date with the latest regulation.

European Green Deal

The EU is implementing its European Green Deal, which aims to make Europe climate-neutral by 2050. One of the cornerstones of the Green Deal is the From Farm to Fork (F2F) strategy, which aims to create a healthier and more sustainable food system. F2F includes targets to reduce the use and risk of chemical pesticides by 50% and convert 25% of agricultural land in Europe to organic farming by 2030. There are also specific programmes to promote the consumption of organic products in schools and public institutions across Europe. These policies and actions will drive up interest in organic products in Europe, and consequently will also influence international food production and trade with Europe.

Organic labelling for cocoa beans

When you export cocoa beans as organic, it is mandatory to label the batch with the organic logo and the name and code number of the control body. Labels for cocoa beans should be written in English.

Figure 1: Example of organic labelling for cocoa beans

Source: Zorzal, 2021

Tips:

- For a complete overview of EU requirements, refer to our study on buyer requirements for cocoa beans or consult the specific requirements for cocoa beans in Access2Markets.

- Learn more about organic farming and European organic guidelines on the websites of the European Commission and IFOAM Organics Europe.

- Only use a certifier accredited by the EU. Otherwise, you run the risk that your certificate will not be recognised by European buyers.

- If you have any questions about obtaining a COI, and what this means for your exports, it is best to contact your control body. This is the first point of contact for further questions. Your potential client may also have information that can help you.

- Help your European client by getting your labelling right, by sending your documents in time and by always keeping your master certificate valid.

- Try to combine audits in case you have more than one certification, saving time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Consult the International Trade Centre’s Standards Map for a full overview of certification schemes.

- Read more about payment and delivery terms in our study on organising your cocoa exports to Europe.

2. Through what channels can you get organic cocoa on the European market?

Exporters can use different channels to bring their organic cocoa beans to the European market. Entering the market will vary according to the quality of your cocoa beans and your supplying capacity. Suppliers in producing countries mainly enter the European market through an importer, cocoa processor or chocolate manufacturer that has organic product lines.

How is the end market segmented?

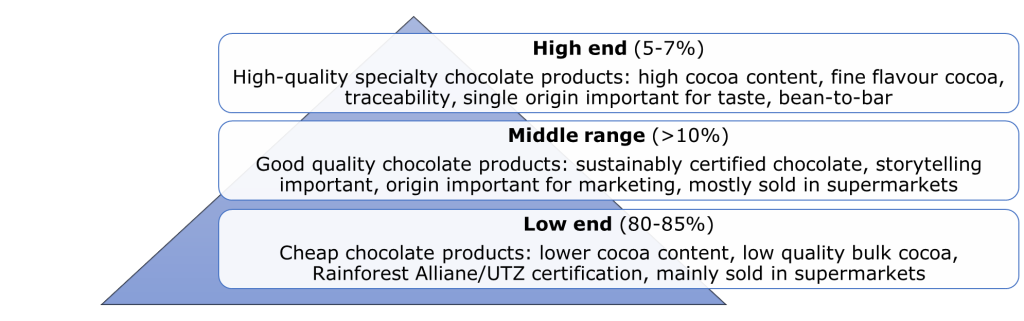

Organic cocoa beans and organic chocolate belong to the mid-range and high-end segments of the European market. The figure below shows the general segmentation of the chocolate end market.

Figure 2: Cocoa beans end market segmentation by quality

Source: ProFound, 2022

Middle range: the mid-range segment includes chocolate products of good quality that are commonly certified against sustainability standards, including organic. Storytelling and the origin of the cocoa beans are important in this segment, mainly for marketing purposes.

Mid-range products are mainly sold through supermarkets and are usually the most premium chocolate products found on supermarket shelves. Organic chocolates are found in both mainstream retailers (examples: REWE (Germany), Carrefour (France) and Delhaize (Belgium)) as well as organic retail shops (examples: Bioshop (Belgium), Biocoop (France), Biomarkt (Germany), Natura Si (Italy), Ekoplaza (the Netherlands), Veritas (Spain)).

In addition to an offer of branded chocolate products, supermarkets also increasingly offer private-label premium chocolate with organic certification. These products offer similar quality and characteristics as branded products, but are usually offered at more competitive prices.

Examples of products and prices in the mid-range segment, based on Biocoop's retail prices in 2022, include:

| Product | Picture* | Price (€/kg) | |

| Middle range | Brand: Biocoop (retailer’s private label) Type: dark chocolate, 85% Cocoa bean origin: Dominican Republic Certification: fair trade and organic Weight: 100 grams |

| €18/kg |

| Brand: Terra Etica Type: dark chocolate, 75% Cocoa bean origin: Nicaragua Certification: SPP and organic Weight: 100 grams |

| €28.50/kg | |

| Brand: Kaoka Type: dark chocolate, 80% Cocoa bean origin: Ecuador Certification: Biopartenaire and organic Weight: 100 grams |

| €29/kg |

* Source of pictures: Biocoop

High-end: smaller, more specialised chocolate makers produce high-end chocolate products, mainly using gourmet cocoa (usually Criollo and Trinitario varieties and/or to a lesser extent Forastero). These products are usually characterised by a high cocoa content. Single origin of the cocoa beans is important, both for the taste and the traceability of the cocoa. Single origin means that the buyer knows exactly where the cocoa beans are from and that it is a specific cocoa rather than a blend. Single origin often means that the cocoa can be traced back to single estates, cooperatives or specific regions. Bean-to-bar chocolate is a good example of a high-end chocolate product.

Sustainability practices are often commonplace among buyers in the high-end segments. Long-term contracts between suppliers and buyers characterise these segments, as well as higher prices. Buyers and suppliers also often agree on projects for communities or on conservation efforts. For instance, check the sustainability commitments of chocolate makers Domori (Italy) and Friis-Holm (Denmark) to see how they communicate their sustainable practices.

Because of the above, certification is not common in the high-end segment, although organic certification is considered an exception. This is because organic farming and trading addresses aspects that are complementary to high quality, such as the prohibition of synthetic inputs and ethical trade practices.

High-end chocolate products are mainly sold directly by craft chocolate makers through their own physical and/or web shops. There are also specific high-quality chocolate web shops in Europe with a diverse offer of bean-to-bar chocolate products. Examples include Schokov Shop (Austria), Chocolats De Luxe (Germany), Craft Chocolate Shop (the Netherlands), Kakaw (Sweden), Club del Chocolate (Spain) and Cocoa Runners (United Kingdom).

Examples of organic chocolate products in the high-end market segment, based on 2022 prices, include:

| Product | Picture* | Price* (€/kg) | |

| High-end | Brand: Zotter Type of chocolate: dark chocolate, 65% Cocoa bean: Forastero Cocoa bean origin: Togo, Gebana cooperation Certification: fair trade, organic Chocolate made in: Austria Weight: 70 grams |

|

€61.40/kg |

| Brand: Chocolate Tree Type of chocolate: dark chocolate, 70% Cocoa bean: Criollo Cocoa bean origin: Peru, Chililique Certification: organic Chocolate made in: Scotland Weight: 40 grams |

| €89.47/kg | |

| Brand: Omnom Chocolate Type of chocolate: dark chocolate, 70% Cocoa bean origin: Tanzania, Kakao Kamili Certification: organic Chocolate made in: Iceland Weight: 60 grams |

| €103.30/kg |

*Pictures and prices found on Chocolats De Luxe

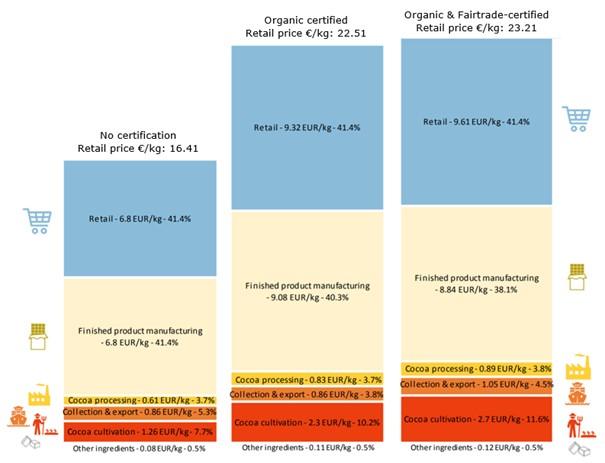

Value distribution: it is important to realise that trade prices and retail prices behave independently and are not directly linked. Typically, export prices of organic cocoa beans account for 5% to 20% of the end-market prices, depending on the quality and volume of the cocoa beans and the supplier’s relationship with the buyer.

Organic certification offers a premium to producers and exporters, usually at USD 300/tonne. Premiums might differ based on the quality of the cocoa bean and the negotiation power of the supplier. The share of the end-market price is typically highest for high-quality organic cocoa beans used in craft chocolates. The value share for organic cocoa beans used in the mid-range chocolate segment only varies moderately when compared to conventional cocoa.

Figure 3 shows that farmers of conventional cocoa used in a non-certified premium dark chocolate tablet receive about 7.7% of the final retail price. Farmers of organic cocoa beans used in organic-certified premium dark chocolate tablets receive a little over 10% of the final retail price. Farmers of both organic and fair trade-certified cocoa used in similar products can typically count on a share of around 11%. If you handle fair trade and organic-certified cocoa beans, buyers pay the Fairtrade Minimum Price plus a fair trade premium and a fixed organic differential.

Figure 3: Value distributions for premium dark chocolate tablets with and without certification

Source: adapted from Basic and FAOSTAT, 2020

Tips:

- Learn more about the difference in retail prices for organic chocolate of standard quality and that sold in the high-end segment. To compare organic chocolate prices, you can check the websites of Dutch retailers such as Albert Heijn (mainstream retailer), Ekoplaza (organic retailer) and Chocolade Verkopers (specialty chocolate shop).

- Price premiums for organic cocoa beans may range widely, depending on quality. If you move towards organic cocoa bean production, make a thorough cost calculation with and without the certification expenses, using various scenarios with different volumes of organic cocoa beans sales to calculate the possible extra profit.

- Refer to our study on trends in the cocoa beans market to learn more about developments within different market segments.

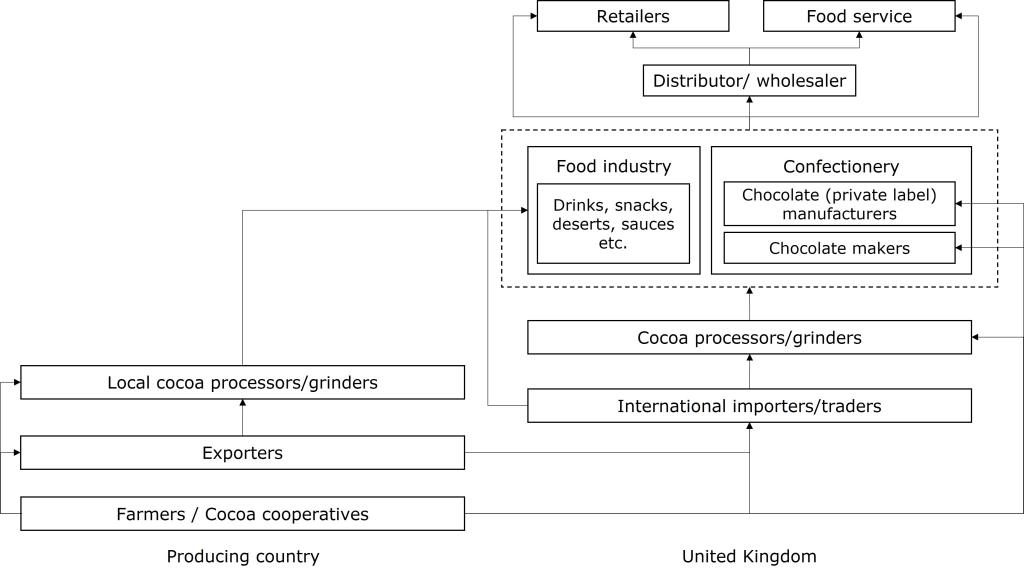

Through what channels does organic cocoa end up on the end market?

Exporters can use different channels to bring their organic cocoa beans to the European market. Entering the market will vary according to the quality of your cocoa beans and your supplying capacity. Note that for cocoa beans to be imported as organic, all operators in the product chain must be certified and acting in conformity with the organic standard (chain of custody).

In general, organic cocoa beans are imported through similar market channels as conventional cocoa beans. The figure below shows the most important market entry channels for cocoa beans into Europe. It is important to realise that the European market is moving towards shorter supply chains. This means retailers and cocoa-processing companies are increasingly sourcing their cocoa beans directly.

Figure 4: The main channels for exports of cocoa beans to Europe

Source: ProFound, 2022

Importers

Importers play a vital role in the cocoa bean sector, functioning as supply chain managers. Importers pre-finance operations, provide logistics support, perform quality control, manage price fluctuations and establish contact between producers and end buyers, such as chocolate makers. In most cases, importers have long-standing relationships with their cocoa bean suppliers and customers.

Larger-scale importers offer wide portfolios of cocoa beans from various origins with different certifications. Importers that handle bulk cocoa beans normally manage large quantities. Examples of larger-scale importers in Europe that handle organic cocoa beans are Albrecht & Dill (Germany), Naturkost Übelhör (Germany, organic only), Walter Matter (Switzerland) and Tradin Organic (the Netherlands, organic only).

Specialised importers usually buy smaller volumes and only volumes of higher quality. There are a few specialised cocoa bean importers that are active on the European market. Their portfolio includes organic-certified cocoa. Examples of specialised importers are Bohnkaf (Germany), Silva Cacao (Belgium), Uncommon Cacao (USA, with warehouses in the Netherlands) and Twenty Degrees Premium Cacao (UK).

There are also specialised importers that supply end-consumer brands. They focus on fair trade and/or organic produce. These companies include but are not limited to importers of cocoa. Examples of such companies are Gepa, Rapunzel (Germany) and Alter Eco (France).

For whom is this an interesting channel? The most interesting type of importer for you will depend on the quality of your cocoa beans and your supply capacity in terms of volume. If you are an exporter working with high volumes of mainstream organic quality, you should look into entering the European market through larger importers.

Farmers or farmers’ cooperatives/associations that supply high-quality organic cocoa can best sell their cocoa beans directly to specialised importers. Many of these importers prefer to work directly with producers and/or cooperatives/associations rather than with exporters.

If you produce or sell very high-quality cocoa beans and are working through an importer, it might be interesting to discuss opportunities to link up with craft chocolate makers directly. This is mainly an option for those that have the financial means and technical know-how to access the market directly.

Cocoa bean processors/grinders

Large processors/grinders have integrated activities such as importing, processing and manufacturing, while also selling industrial chocolate to other businesses. This means they import cocoa beans directly from producing countries and process the beans into cocoa mass, cocoa butter and/or cocoa powder, which they distribute to the confectionery, food, cosmetic and pharmaceutical industries throughout Europe. Cocoa bean processors will often have minimum quantity requirements of two to three containers per order.

All of these large processors/grinders will also deal with organic cocoa. Examples of such processors in Europe are Cargill, Olam Food Ingredients (ofi) and Barry Callebaut. Crown of Holland, the cocoa processing facility of Tradin Organic in the Netherlands, is another example. This company only deals with organic cocoa.

In addition to the companies mentioned above, Mondelez and Nestlé are examples of multinationals that also engage in cocoa processing activities alongside manufacturing. These companies supply directly to the retail and/or food service sector.

For whom is this an interesting channel? If you are an exporter of high volumes of standard-quality organic cocoa beans, your trading partner could be a cocoa grinder/processor. Grinders/processors usually have cocoa-buying stations in producing countries to which you can sell your cocoa beans directly.

Medium-sized and large (private-label) chocolate manufacturers

Large chocolate manufacturers that are active on the European market are Mars, Mondelez and Nestlé. These companies all have their own importing departments and source their cocoa beans directly from producing countries. They can also have hybrid importing models, which means that their cocoa beans may also be sourced via importers. Large chocolate manufacturers usually blend different qualities of cocoa beans to safeguard quality consistency. The end product is distributed to retailers and the food service industry.

Chocolate manufacturers may operate under their own brands or manufacture for a private label. Examples of private-label chocolate manufacturers that handle organic cocoa are KIM’s Chocolate (Belgium), Ibercacao (Spain), ICAM (Italy) and Chocmod (France).

Examples of medium-sized chocolate manufacturers on the European market that are focused on organic chocolate lines are Stella Bernrein (Switzerland), Ethiquable (France), Vivani (Germany) and Belvas (Belgium).

For whom is this an interesting channel? Selling to large chocolate manufacturers is interesting if you offer cocoa beans of a standard quality that are available in large volumes.

Small (craft) chocolate makers

In the specialty and gourmet segment, there has been an increase in the cocoa bean trade directly from farmers (or farmer associations and cooperatives) to chocolate makers. Note that not all chocolate makers are able to sustain direct trade and all the responsibilities that are usually outsourced to traders, such as logistics, documentation and pre-financing. For this reason, direct trade still represents a very small part of the cocoa market, although it is growing.

This form of direct trade happens more often with an importer as intermediary. This importer acts as a service provider and contact point in the transactions between the producer and the chocolate maker. Importers can also safeguard traceability and communicate the story of the cocoa beans accurately along the chain.

Examples of chocolate (bean-to-bar) makers in Europe that import organic cocoa beans directly from countries of origin include Blanxart (Spain), Original Beans (the Netherlands), Friis-Holm (Denmark) and Georgia Ramon (Germany).

For whom is this an interesting channel? Targeting specialty chocolate makers directly is recommended for producers and exporters that handle specialty cocoa beans. This requires financial means and technical know-how to organise export activities. It also requires thorough documentation of your farming, processing and trading practices. To work with chocolate makers directly, you need to be willing to engage in long-term partnerships.

Agents

Agents act as intermediaries between you, cocoa bean importers and chocolate makers. Some agents are independent, but others are hired to procure cocoa beans on behalf of a company. An agent acts as an intermediary and has the knowledge to evaluate and select interesting buyers for you. An example of a broker/agent is Amius, located in the United Kingdom. Before engaging with agents, make sure they have organic licenses that enable them to handle organic cocoa beans.

For whom is this an interesting channel? If you have limited experience exporting to European countries, agents can play a very important role. Agents are also interesting if you lack the financial and logistical resources to carry out trade activities. Working with agents is also useful if you need a trusted and reputable partner within the cocoa sector. Be prepared to pay a commission for their work.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and organic certification. For more tips on finding the right buyer for you, see our study on finding buyers on the European cocoa market.

- Find importers that specialise in organic products on the Organic-bio website.

- Check the Organic Market Info website to find a list of several distributors of organic food in Europe.

- Try to visit trade fairs for organic products, like Biofach (Germany), Natural & Organic Products (United Kingdom) and Nordic Organic Food Fair (Nordic region). Check out their websites for a list of exhibitors, seminars and other events. Other interesting trade fairs in Europe include Salon du Chocolat (France) and Chocoa (the Netherlands). These do not focus specifically on organic cocoa.

- Invest in long-term relationships. Whether you are working through an importer or directly with a chocolate maker, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality/price balance.

- See our study on doing business with European cocoa buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

3. What competition do you face on the European organic cocoa market?

The organic cocoa market has developed significantly in recent years and has increased in both mainstream and specialty segments. In terms of farming area, the organic cocoa sector reached around 385,000 hectares, or 3.1%, of the global cocoa sector farming area in 2020. About 56% of global organic cocoa production took place in Africa, followed by 43% in Latin America. The main suppliers of organic cocoa beans to the EU in 2020 were the Dominican Republic (37%), Sierra Leone (24%) and Peru (13%).

The Dominican Republic: a well-known country of origin for organic cocoa

In 2020, the Dominican Republic was the largest supplier of organic cocoa beans to the EU, with 28,000 tonnes. Total EU imports from the Dominican Republic reached 35,000 tonnes in 2020, meaning that 79% of the country’s exports to the EU were organic. Between 2018 and 2020, organic exports to the EU increased at an average year-to-year rate of 1.6%.

The Dominican Republic has been a major organic cocoa producer for years. In 2020, an estimated 67,000 hectares were dedicated to organic cocoa farming –over 44% of the country’s total cocoa farming area. This makes it the country with the third-largest organic cocoa farming area in the world.

A large share of organically produced cocoa from the Dominican Republic is also fair trade-certified. One of its main suppliers is the Confederación Nacional de Cacaocultores Dominicanos (CONACADO), a union of cocoa cooperatives that promotes organic and fair trade certification.

Other cocoa exporters from the Dominican Republic are Rizek Cacao and Öko-Caribe.

Sierra Leone: steep increase in organic cocoa exports to the EU

Sierra Leone was the second-largest organic cocoa supplier to the EU in 2020. According to European Commission 2021 data on imports of organic agri-food products, imports by the EU reached 18,000 tonnes that year. In 2018, exports amounted to 7,700 tonnes, indicating an annual growth rate of over 50%.

Since 2015, the organic cocoa sector in Sierra Leone has been boosted in part by Dutch trader Tradin Organic. Since 2017, Tradin has had its own cocoa sourcing company in the country, which received an investment of USD 3 million from impact investor AgDevCo to continue to strengthen and expand organic cocoa production and export capacity from Sierra Leone.

In 2020, Sierra Leone was home to the world’s fourth-largest organic cocoa farming area, with a dedicated organic cocoa farming area of nearly 61,000 hectares. The share of organic cocoa cultivation of the total cocoa farming area in Sierra Leone is very small, indicating great potential for further growth in organic cocoa production.

Sierra Leone has been attracting greater interest from buyers as an alternative source of certified (organic) cocoa beans, with low incidence of cadmium contamination compared to Latin America.

An example of an organic cocoa exporter from Sierra Leone is Lizard Earth.

Peru: the world’s largest supplier of organic and fair trade-certified cocoa

Peru is the third-largest organic cocoa beans supplier to the EU, responsible for an estimated 13% of total EU organic imports. Total Peruvian exports to the EU amounted to 26,000 tonnes in 2020, of which 37% (9,600 tonnes) was organic.

Peru ranked as the country with the second-largest organic cocoa farming area globally in 2020, outstripped only by DR Congo. Peru’s organic cocoa farming area is 73,000 hectares – about 56% of Peru’s total cocoa farming area. Peru is regarded as the second-largest organic cocoa producer worldwide and the largest producer of both organic and fair trade-certified cocoa.

In addition to a strong position as a sustainable cocoa supplier, Peru has also managed strongly to promote the quality and unique origin of its cocoa beans. Peru’s cocoa association APPCACAO has been a driving force in developing the cocoa sector through a countrywide coordinated effort between cocoa associations/cooperatives, companies, support organisations and the government.

Examples of Peruvian cocoa exporters are Amazonas Trading, Ecoandino and Norandino.

DR Congo: established organic cocoa exporter to the EU

DR Congo had the world’s largest organic cocoa area in 2020, with an estimated 95,000 hectares. According to European Commission data, DR Congo supplied an estimated 11% of total EU organic cocoa imports in 2020, amounting to 8,600 tonnes. This makes DR Congo the fourth-largest supplier of organic cocoa to the EU.

DR Congo has grown from an emerging to an established organic cocoa supplier to the European cocoa market, after heavy investments in the country’s cocoa sector by donors and companies. Several associations have been formed, such as the Association of Cocoa and Coffee Exporters of the DR Congo (ASSECCAF), which defends the interests of exporters in the coffee and cocoa export sector. There have also been initiatives to establish DR Congo as a country of origin of gourmet cocoa.

The country’s combination of high-quality and organic cocoa has led several European bean-to-bar makers to source from DR Congo. Examples include Blanxart (Spain) and Original Beans (the Netherlands). An example of a cocoa exporter from DR Congo is Esco Kivu.

Ecuador: the largest gourmet cocoa exporter

Data on imports of agri-food products from the European Commission show that organic cocoa bean imports by the EU from Ecuador amounted to 3,100 tonnes in 2020, which was 4.0% of total EU organic cocoa bean imports. Ecuador’s organic cocoa farming area reached 7,300 hectares in 2020. However, this is only 1.4% of the total cocoa farming area in the country.

There is no national policy promoting organic cocoa production in Ecuador. As a result, the country is not necessarily known for its high share of organic cocoa production. On the contrary, the country is better known for sustainable production efforts. For instance, Ecuador has distinguished itself in the region as a pioneer in the fight against deforestation and the development of sustainable agriculture, which also represents an added value for Ecuadorian cocoa.

Ecuador’s main focus is to be a large producer and exporter of gourmet cocoa, particular the Arriba Nacional variety. With as much as 75% of Ecuador’s cocoa exports considered to be gourmet, Ecuador is the world’s largest gourmet cocoa producer.

Examples of successful exporters of cocoa beans from Ecuador include UNOCACE, COFINA, Ecuacoffee S.A. and Cacaos Finos Ecuatorianos S.A.

Uganda has potential as an organic cocoa bean producer

Total Ugandan exports of organic cocoa to the EU reached 2,400 tonnes in 2020. An estimated 7,900 hectares are certified as organic cocoa farming area, amounting to about 11% of the total organic cocoa farming area in the country.

The cocoa sector in Uganda has developed itself rapidly since 2019, thanks in part to support provided by the MARKUP programme. A group of Ugandan cocoa experts has been trained to improve post-harvesting techniques, quality and marketing efforts for better access to the specialty market. One of the results is that Belgian specialty cocoa importer Silva has included Uganda as a new cocoa origin in their portfolio as of 2022. Part of the cocoa bean offer is organic-certified.

Another driver of organic cocoa production in Uganda is the existence of European cocoa processors and chocolate manufacturers in the country. For instance, Icam has its subsidiary Icam Uganda, with which it rolled out a large project to produce certified organic cocoa in Uganda. This cocoa is used for Icam’s own organic chocolate bars of the Vanini brand.

Learn from your potential competitors

To be successful as an exporter, it is important to learn from your potential competitors. Focus on their marketing strategies, the product characteristics they highlight, and how they use organic certification as a value addition approach. The text above gives examples of cocoa exporters to the European market. Learn from these companies how to promote your portfolio of certifications and sustainability practices.

Give detailed information about the growing region (origin) of your cocoa beans, the varieties, qualities, processing techniques and organic or other certifications. You can also talk about the history of your organisation, your cocoa growing farm(s) and the passion and dedication of the people working there. These are all elements that make your company unique.

Tips:

- If you are new to organic, make calculations to see if (or when) organic certification is something for you. You should weigh your certification against realistic future demand from potential clients. Also take into account the volume you can produce.

- Obtain price quotations from different control bodies in your region to compare prices and pick your best option.

- Consider adding fair trade certification to your organic certification. The combination fair trade/organic may increase your chance of selling more of your cocoa beans at a premium. Again, do all the necessary cost-benefit calculations and check for potential customers before deciding upon this.

- Learn about other fair-trade labels like Small Producer’s Symbol (SPP), World Fair Trade Organization (WFTO), and Fair for Life in The International Guide to Fair Trade Labels.

- Learn more about the developments in the organic sector. For specific information about cocoa, refer to pages 96–98 in the 2022 edition of The World of Organic Agriculture.

- Develop long-term partnerships with your buyer. This implies always complying with buyer requirements and keeping your promises. This will provide you with a competitive advantage, more knowledge and stability on the European market.

- Actively promote your company on your website and at trade fairs. Flavour quality competitions (such as the International Chocolate Awards of the Cocoa of Excellence Programme) also provide good opportunities to share your story.

- Check possible programmes to support your crop and its productivity. Refer to your national ministry of agriculture and other local programmes. Also check if there are local support programmes in your region from the Food and Agriculture Organization (FAO), International Finance Corporation (IFC), World Agroforestry Centre (ICRAF), the International Federation of Organic Agriculture Movements (IFOAM) or other organisations.

This study was carried out on behalf of CBI by ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research