Entering the European market for semi-finished cocoa products

European consumers care very much about how their food, like cocoa, is sourced and made. They want cocoa products that are produced in a sustainable way. They also want to be able to trace cocoa products to where the cocoa was produced. Companies that provide semi-finished cocoa products with certifications can take advantage of this growing interest.

Contents of this page

- What requirements and certification must cocoa comply with to be allowed on the European market?

- Through what channels can you get semi-finished cocoa products on the European market?

- What competition do you face on the European market for semi-finished cocoa products?

- What are the prices for semi-finished cocoa products on the European market?

1. What requirements and certification must cocoa comply with to be allowed on the European market?

You can only export semi-finished cocoa products to Europe if your company or business complies with strict European Union (EU) sustainability regulations.

These include:

1. The EU green deal

In 2019, the European Commission started the European Green Deal (EGD). They want to have zero net emission of greenhouse gases in the EU by 2050. To know how it affects businesses, read The EU Green Deal – How will it impact my business?

2. The Corporate Sustainability Due Diligence Directive

The Corporate Sustainability Due Diligence Directive (CSDDD) proposal was adopted in February 2022 and is compulsory for all companies in the EU. Companies must identify and limit any bad impacts that their business and supply chains have on people and the environment.

The regulation also applies to companies outside Europe, if they sell products or services in EU countries. Following the CSDDD might require some investments, and you may need to check and improve your supply chains. But this can also help you stand out from others, and can give you a good reputation, new markets, and lower risks in the long term.

After checking where there might be problems in your supply chains, you need to make rules to fix them. It is very important that you talk with your suppliers and support them to also follow the CSDDD. In this way you can make sure you are doing business in a responsible and good way for people and the planet.

3. The EU regulations on deforestation-free products (EUDR)

The main cause of deforestation is the expansion of farmland to produce e.g. soy, beef, palm oil, wood, cocoa, coffee and rubber. The EU is a big user of these products, so they play a part in the issue. The EU wants to be part of the solution.

With the regulation, anyone selling or trading agricultural products in the EU needs to show that their products didn't come from deforested land. Specifically, the product should not be associated with any deforestation that took place after 31 December 2021. The EUDR is part of important strategies like the EU Green Deal, EU Biodiversity Strategy for 2030 and the Farm to Fork Strategy.

The plan was first discussed in 2019 and came into full force on 23 June 2023. As of that date, traders have 18 months (up to 30 December 2024) to implement the new rules.

For a complete overview of these standards for cocoa beans, refer to our study on tips to go green and to be a socially responsible supplier in the cocoa sector.

European Union requirements for imported semi-finished products

Requirements that apply to semi-finished products are more complex than those for cocoa. Refer to buyer requirements for cocoa or consult the specific requirements for cocoa on the European commission's Access2Markets website.

In general, the requirements can be divided into:

1. Musts: legal and non-legal requirements you must meet to enter the market;

2. Additional requirements: those you need to comply with to keep up with the market;

3. Niche requirements: these apply to specific niche markets.

Highlights for these requirements are given below.

Legal and non-legal requirements

Semi-finished cocoa products must follow the requirements that apply to other food ingredients. Traceability and food safety and hygiene are the most important themes.

Relevant requirements for cocoa products include:

- General Food Law: This law focuses on basic food safety rules, including traceability.

- Hygiene of foodstuffs: Through the processing of cocoa, producers and exporters must follow hygienic standards. This is based on HACCP principles (Hazard Analysis and Critical Control Points). It is a must for products beyond the primary production stage.

- Pesticides: Look at the EU pesticide database. You will find the highest levels of pesticide residues allowed. It includes limits for pesticide residues on cocoa beans, which helps prevent contamination in derived products.

- Food Safety Rules: Edible cocoa products must follow EU food safety rules. These rules make sure the food is safe to consume. One example is Regulation (EC) No 178/2002.

- Food Labelling Rules: Cocoa products packaged and sold to consumers need to follow EU food labelling rules, like Regulation (EU) No 1169/2011. You must give clear and accurate information about what is in the product, e.g. ingredients, allergens and nutrition facts. Also give information on any special claims. This includes certifications.

- Traceability Rules: In Europe, consumers want to know where their food comes from (Regulation (EC) No 178/2002.). Companies that work with cocoa products must keep records. They must show where the products come from and the process for making the product. This helps consumers trace the origin of the food.

- Organic Certification Rules: If cocoa products claim to be organic, they have to meet EU organic rules for how they are produced and labelled. These rules are outlined in outlined in Regulation (EC) No 834/2007 and Regulation (EC) No 889/2008.

- Microbiological contamination: This law doesn't have specific rules for cocoa products, but your semi-finished cocoa products should not contain harmful contaminants, like E. coli, salmonella, other Enterobacteriaceae, moulds or yeast. You must check this often during production. It will help you prevent large-scale losses. Take your products off the market if you discover contamination in them. Be truthful and take responsibility. For example, in June 2022 Barry Callebaut observed and reported salmonella food poisoning in their production. They shut down their biggest chocolate factory in the world, located at Wieze in Belgium, for six weeks.

- Extraction solvents: This law only applies to certain cocoa products. For instance, there is a limit on using hexane (1 mg/kg) when making cocoa butter.

- Contaminants in food: You need to be careful about mycotoxins (like ochratoxin A), polycyclic aromatic hydrocarbons (PAHs) and heavy metals (like cadmium). Cocoa from some Latin American countries can have high levels of cadmium. This can be due to factors like volcanic activity and forest fires.

- Cadmium contamination: The EU has tightened its rules on cadmium in cocoa and cocoa products. These new rules started in January 2019. Check out our study on cocoa trends to learn more about how much cadmium you can have in different cocoa products.

Quality requirements

The quality of your cocoa products is largely based on the quality of the cocoa beans you use. But the quality is also based on how you process and handle the beans. If you want to access the European market for semi-finished cocoa products, you will have to meet international quality standards. If you want to access the specialty segment for fine flavour products, the standards you have to meet are particularly high.

In Europe, buyers use various methods to check the quality and taste of cocoa beans. They might use more than one method simultaneously. The Chocolate and Cocoa Industry Quality Requirements give suggestions on how to check the quality of the cocoa beans you use.

Some other common methods and international standards are:

- ISO's Standards on classification and sampling for cocoa beans;

- The sampling and grading protocol by the Fine Cacao and Chocolate Institute (FCCI). You can contact FCCI through their website for their sampling protocol and grading form;

- The genetic evaluation of cocoa by the Heirloom Cacao Preservation. This helps identify and value cocoa and its flavour;

- The quality assessment and tasting guide by USAID, Equal Exchange and TCHO. This helps assess the quality of cocoa along the value chain.

The Cocoa of Excellence Programme (CEP) also has a special group that created the International Standards for the Assessment of Cocoa Quality and Flavour website. On this website you can find different quality standards protocols. They include instructions on how to take samples of cocoa beans for evaluation. You can find how to check their physical quality. They also give guidance on turning the beans into coarse powder, liquor and chocolate. You can also find how to test the different flavours of these products. Download these protocols to learn more about cocoa quality assessment. The CEP is run by the Alliance of Biodiversity International and CIAT.

The United Nations' Codex Alimentarius has standards for cocoa products. They give helpful guidance on how to handle and store semi-finished cocoa products and chocolate. European buyers pay attention to these factors when evaluating your product. You can find these standards in the following documents:

Labelling requirements

Labels on products should have information that is easy to understand and read. It should be visible and written in a language that the buyer can understand. The label should be in English, and should include the following details to track each batch:

- Product name according to the Codex Alimentarius definitions;

- Lot or batch code;

- Country of origin;

- Net weight in kilograms;

- Name and address of manufacturer, packer, distributor and/or importer;

- List of ingredients;

- Date of processing and packaging;

- Instructions for storage and use;

- For organic and/or Fairtrade: name/code of the inspection body and certification number.

Packaging requirements

Semi-finished cocoa products have different transportation needs. This is based on how they look and feel. There are different options for transportation, but buyers may have their own specific requirements and instructions.

- Cocoa paste and butter are usually packed in solid form in 25-kg blocks inside special cartons. These cartons are placed in bigger containers for transportation. In hot weather, cocoa butter can melt because of high temperatures. To prevent this, some importers choose to ship the butter in refrigerated compartments.

- The paste and butter can also be transported in their liquid (molten) condition. The products are then carried in heated tanks. When the liquid cocoa butter and paste are shipped, they are transported in heated stainless steel tanks.

- Cocoa powder is usually put into 25-kg bags made of many layers of paper. It can be transported without many strict rules, but does need to be stored in a dry and clean place and protected from any strange smells or water to keep it dry.

- Couverture chocolates come in various types of packaging. These include aluminium foil, composite films, paper, or plastic trays, and are transported in carton boxes. Sizes and presentations can vary based on who will use them. Chocolatiers often prefer grains/chips/drops in bags of 1, 2.5, 5 or 10 kg. These sizes/weights are easy to work with. Other industries may look for chocolate in different forms like liquids, chunks, powder or grains in containers up to 25 kg. Large slabs and blocks (up to 5 kg) go mostly to bigger industrial users. If you don't have machinery for making chips/grains, you could check if your buyer is interested in shavings instead.

Figure 1: Semi-finished cocoa products: presentation and transport

Sources: MOI International, Maretai Organics and Paris Gourmet

Tips:

- Ensure your cocoa is sourced from producers or cooperatives that meet EU sustainability requirements. Also ensure your company adheres to EU sustainability requirements in your operations, processing and export of products.

- For the full buyer requirements, read the study on buyer requirements for cocoa in Europe.

- Check the website of EUR-Lex for more detailed information about regulations for cocoa products.

- Learn more about maintaining the quality of your cocoa products during transportation on the websites of the Transportation Information Service and the Cargo Handbook.

- Learn about common problems faced by suppliers during border controls and take measures to avoid similar issues. Check the product category 'cocoa and cocoa preparations' when accessing the RASFF Portal.

- Provide complete and correct documentation for your semi-finished cocoa products. Learn how some companies compile their specification sheets – for example, Nutsinbulk, Pil plantation industries limited and Organic crops.

- Read more about delivery and payment terms for your cocoa bean exports in our study Organising your cocoa bean exports to Europe.

Additional requirements to keep up with the market

To make sure semi-finished cocoa products are safe, you need to follow HACCP rules. Some buyers might want more certificates for good quality and safety. Getting certificates from trusted sources shows you care about good quality and safety.

The rules you follow depend on who you're selling to. Big stores, companies that import ingredients for food and health, and those who make their own brands are pickier. They might want you to follow these standards:

- International Featured Standards: Food (IFS);

- British Retail Consortium Global Standards (BRC);

- Food Safety System Certification (FSSC) 22000;

- International Organization for Standardization (ISO) 22000.

Tips:

- Learn about keeping food safe. If you want to sell in Europe, you will likely need to use one of these standards. Look at the International Trade Centre Standards Map or the Global Food Safety Initiative website to understand different ways to keep food safe, hygiene rules, and certificates.

- Ask your potential customers what safety rules or labels they expect. They might want a certain way to keep food safe or a label showing it's good for the environment. Talk to them first before getting certified.

- Develop and implement your own corporate social responsibility (CSR) policy or code of conduct. This helps show customers you care about important things. It can also make you special when customers have to pick from different suppliers.

- Check how well you're taking care of the planet and people. You can use these easy online forms:

1. Amfori BSCI form to check how to treat people fairly.

2. Excel form from Sustainable Agriculture Initiative (SAI) Platform to see if your work is sustainable.

Niche requirements

To sell to special markets in the Europe, you need organic and/or Fairtrade certificates.

EU Organic

If you want to sell your cocoa products as organic in Europe, they must follow the rules of the European Union for organic production and labels. Getting the EU Organic label is the basic legal rule for selling organic semi-finished cocoa products in Europe. Just having organic-certified cocoa beans is not enough. The factory where they are processed also needs to be certified as organic.

Keep in mind that the new EU organic rules started on 1 January 2021. This means that producers in other countries also have to follow the same rules as those in the EU. The checks on organic production and products are now stricter, to avoid false claims.

Before you can sell your cocoa products as organic, a certified inspector must visit and review your farms and processing sites. You can check the official list of approved organisations provided by the EU to make sure you choose an authorised inspector. To get your organic certification you will need to have an inspection and review every year. This helps confirm you are following organic production rules.

Note that if you want to sell organic products in the EU, you need a special electronic certificate – a Certificate of Inspection (COI). This certificate must be given by authorised inspectors before your products leave. If you don't have this certificate, your product cannot be called organic in the EU and will be considered as a regular product. You can get these certificates using a system called TRACES, made by the European Commission.

Fair trade

Before you can sell your cocoa products as Fairtrade-certified, someone who checks these things (an accredited certifier) needs to visit where you grow and process the cocoa. In Europe, the most common fair-trade standard is called Fairtrade. It is like a promise that your business treats people fairly. FLOCERT is the group that checks whether you follow the fair-trade rules. There are also other fair trade standards like SPP (Small Producers' Symbol), Fair for Life (certified by IMO/Ecocert) and Fair Choice (certified by Control Union).

Tips:

- Look into IFOAM certifications. See questions & answers about the official controls on products from third countries intended to be placed on the EU market as organic products.

- Learn more about organic farming and organic guidelines on the European Union website and the Organic Export Info website. Find companies that specialise in organic products on the Organic-bio website.

- Try to visit trade fairs for organic products, like Biofach in Germany. Check out the fair's website for a list of exhibitors, seminars and other events.

- If you produce cocoa according to a fair trade scheme, find a specialised European buyer who is familiar with sustainable and/or fair trade products, for instance through the FLOCERT customer database.

- Try to combine audits if you have more than one certification. This will save you time and money. Also, investigate the possibilities for group certification with other producers and exporters in your region.

2. Through what channels can you get semi-finished cocoa products on the European market?

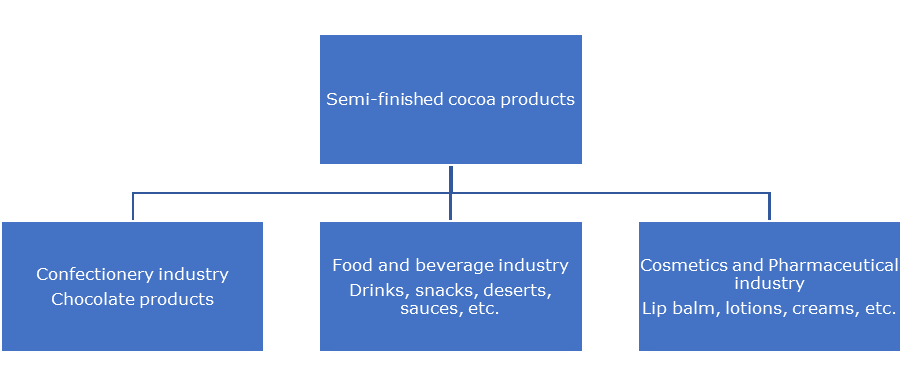

Cocoa and cocoa products are used in four different types of businesses. These are businesses that make confectionery, food, beauty products and pharmaceuticals. The beauty and pharmaceutical businesses use semi-ready cocoa products, but the sweet-treat makers might begin with cocoa beans.

Final market is divided into different segments

The different semi-finished cocoa products can be segmented by their end use:

- Cocoa paste is essential in manufacturing chocolates. It is also used in other applications, ranging from bakery goods to ice creams and beverages.

- Cocoa butter is very important in making chocolate. It helps give chocolate a smoother mouthfeel. To make sure chocolate is made the right way, rules from the European Commission say how much of other oils can be used. They allow a little bit, about 5%, of other vegetable oils. But some specialty chocolate makers in Europe use only cocoa butter and no other oils. Cocoa butter is also used in cosmetics and health products.

- Cocoa powder is an important product for the food industry. It is a by-product of cocoa processing. It is widely used in food products such as dairy, bakery goods and instant beverages. Cocoa powder is also sold directly to consumers for use in chocolate drinks and other recipes.

- Couvertures are important for making chocolate. Big and small chocolate makers use them to make chocolate. They are also used by other sweet foods makers, chefs and baking afficionados to make e.g. cookies, breakfast treats and bakery items.

Figure 2: Main trade channels for semi-finished cocoa products on the European market

Tips:

- Refer to our study on trends in the cocoa sector. You can learn more about developments within different market segments.

- Visit the CAOBISCO website to learn about how cocoa is used in the food and chocolate industries. CAOBISCO is the Association of Chocolate, Biscuit and Confectionery Industries of Europe. The food and confectionery industries will be most interesting for semi-finished cocoa products since they are the largest.

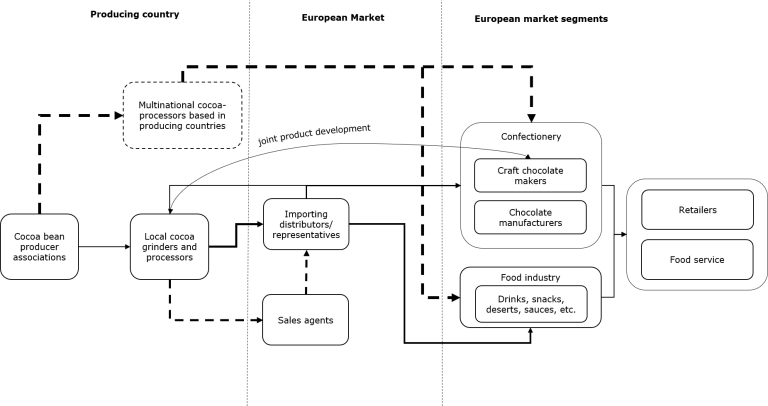

Cocoa reaches the final market through various distribution channels

As an exporter of cocoa products, you can use different channels to bring your products to the European market. This depends on the quality of your cocoa products and your supply capacities. The figure below shows the most important channels for cocoa products in Europe:

Figure 3: Main trade channels for semi-finished cocoa products on the European market

Source: ProFound

Large multinational cocoa processors are not a good fit for independent processors

Cocoa processors turn cocoa beans into cocoa paste, cocoa butter and cocoa powder. They supply these products to the chocolate, food, cosmetics and pharmaceutical industries in Europe. A lot of semi-finished cocoa products are brought into Europe by big processors. These companies – e.g. Cargill, Olam, Ecom, Barry Callebaut – have their own processing facilities in cocoa-producing countries.

These big companies will not be a good point of entry if you are an independent processor. If you process fine flavour cocoa it is better to find other ways into the market. Markets that have a stronger emphasis on quality and build long-term partnerships are suitable for you.

Importers are suitable contacts to target the food industry

Importers are your best way to connect with the European food industry. Usually, you will not deal with food processors directly. This path is good if you are selling semi-finished cocoa products from regular good-quality beans, but might not be the best fit if you have high-value or extra-quality beans.

Importers are very important in the European food industry. They connect suppliers to buyers of semi-finished products. They usually deal with lots of different products from different places – so they also deal with different types of cocoa products, like cocoa powder, cocoa butter, and more. They can help you supply semi-finished cocoa products to different food makers and cosmetics companies.

It is a good idea to find importers that focus on cocoa or specific cocoa markets like organic products. They may have more experience on the sector's requirements, which could help you streamline your sourcing process, ensure product quality, and gain access to valuable market information. Many companies that trade ingredients are in the Netherlands and Germany. They buy products for their country and for other places in Europe too.

Companies that import cocoa products in Europe and specialise in cocoa products include Daarnhouwer, Gaia Cacao, Campo Lindo and Huyser Möller (Netherlands), Albrecht & Dill Trading (Germany), Panamir (Estonia) and Henley Bridge (UK). Companies specialised in the purchase and distribution of organic-certified products, including cocoa derivatives, include CARE Naturkost, Naturkost Übelhör (Germany), DO-IT, Rhumveld Winter & Konijn and Tradin Organic (Netherlands).

Selling to chocolate makers requires uniqueness and trust-building

Large chocolate manufacturers in the European market who do not have their own cocoa-processing departments will source their semi-finished products from other large players like Barry Callebaut or Cargill.

Smaller European chocolate makers may be a more interesting entry point. Such companies are increasingly searching for personalised products. They are also looking for closer contacts with cocoa producers and exporters in the countries of origin. This development has led to an increase in direct trade of cocoa beans. Direct trade in semi-finished cocoa products remains much less common.

Chocolate makers can buy semi-finished cocoa products directly from the countries where the cocoa is grown. But there are specific reasons for this. They might work together with their suppliers to create unique types of chocolate or recipes. This is called joint product development. This kind of direct trade usually happens when there are strong and trustworthy relationships. Some organisations in cocoa-producing countries that already do this kind of trade:

i. EcoKakao and AgroExport Carmita (Ecuador)

ii. Norandino (Peru)

iii. El Ceibo (Bolivia)

iv. Grupo Conacado and Rizek Cacao (Dominican Republic)

v. Twin Track Cocoa Products (India)

Also, specialty chocolate makers seek exceptional cocoa products with outstanding flavours and impeccable sourcing credentials. They have strict criteria, including processing methods, roasting techniques and organic certification. Collaboration becomes possible if these makers are confident that the end product aligns with their exacting standards. They are deeply invested in understanding the cocoa's unique story, often visiting its origins, engaging with local producers, and exchanging insights to create the perfect chocolate.

Having a European representative can increase your competitiveness

In some cocoa-making countries, there are processors who use help from people in Europe to sell their products. These helpers can be part of the same company but live in Europe. They can also be separate agents or sellers based in Europe. For example, Belgian-based Luker Chocolate Europe helps the Colombian Casa Luker chocolate company, and Dutch-based Cocoa Supply Company helps the Ecuadorian company Cocoa Supply.

When you have someone in Europe to help, it makes things easier. This helper can take care of advertising, selling, sending out products, and helping customers after they buy. It's even better if this helper has a place to store the products. Having someone in Europe can also help with planning when to make the products based on how much people want to buy. For buyers, like food makers or chocolate companies, it's better to buy products that are already stored in Europe. This way, there is less paperwork and less chance of problems.

Tips:

- Attend trade fairs in Europe where you can meet people who might want to buy your cocoa products. These events are like big parties where many buyers and sellers gather. For example, there's a big trade fair called Salon du Chocolat in Paris, France. There is another one called Chocoa in Amsterdam, the Netherlands. Consider going to food events like the ISM fair in Cologne, Germany, or PLMA's World of Private Label in Amsterdam, the Netherlands. These events can help you learn more about what European buyers like and want. When you know this, you can make sure your products match what they're looking for.

- Link up with local cocoa processors if you are a cocoa producer or cooperative. Such local cocoa processors include Bakau and Quillacao in Peru, and Nichecocoa and Chocomac Ghana Limited in Ghana. Cooperate with buyers that are interested in semi-finished cocoa products from places of origin.

- Look into collaborations in your country that can boost your marketing and advertising, for example sector initiatives like the Meso-American Association of Fine Cacao and Chocolate (AMACACAO) (Central America) and trade promotion agencies like PROMPERU or PROCOLOMBIA.

3. What competition do you face on the European market for semi-finished cocoa products?

The competition is strong in the market for regular semi-finished cocoa products. Multinational companies dominate this area with low prices and large amounts. Small and medium-sized businesses find it hard to compete. But in the specialty cocoa segment, competition is different: quality, relationships and sustainability matter more.

The European chocolate industry is your entry point and your main competitor

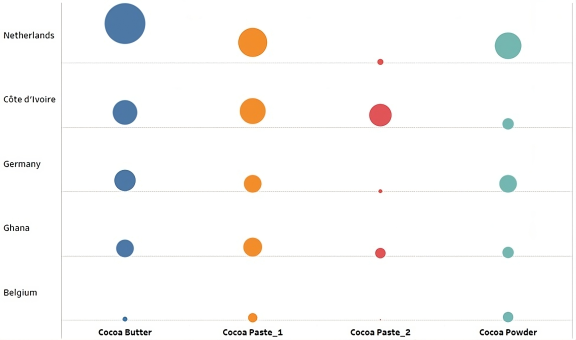

The Netherlands and Germany make the most semi-finished products. They have big groups of businesses that trade and process cocoa. While these countries serve as entry points for exporting semi-finished cocoa products, they also pose strong competition in the industry. This is because of the volumes of beans they import (Figure 4) to feed their large grinding industries (Figure 5). Also, many chocolate makers in Europe prefer purchasing semi-finished products that have been processed in Europe.

Source: Amonarmah consults; data from EUROSTAT

Source: Amonarmah consults; data from ICCO

The Netherlands houses large cocoa processors like Cargill, Ecom/Dutch Cocoa and Olam. Germany also houses large cocoa grinders like Barry Callebaut and Cargill. Other major grinding competitors on the European market are Natra, INDCRESA and Nederland SA (Spain), Cémoi (France), August Storck, Confiserie Coppeneur et Compagnon, Ludwig Weinrich and Schokinag (Germany), and ICAM, Ferrero and Elah Dufour (Italy).

These large multinational companies in Europe will also be your main competitors for sourcing beans when you process cocoa at origin. The competition is even more direct when they also have cocoa-grinding facilities in the origin country where you operate. For instance, Olam and Mondelēz have joined forces to build a high-tech sustainable cacao farm in Indonesia.

Figure 6: Top 6 exporters of semi-finished cocoa products, 2022

Source: Amonarmah consults; data from EUROSTAT

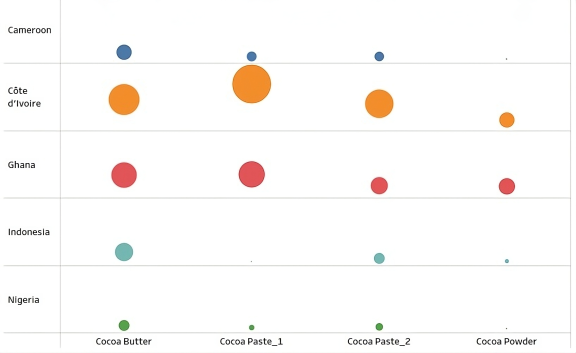

Côte d'Ivoire and Ghana dominate the market for semi-finished products from cocoa-producing countries

In 2022, about 38% of all semi-finished cocoa products were imported from cocoa-producing countries. Of these products, defatted cocoa paste had the highest share (90%) of import from producing countries, followed by not defatted cocoa paste (39%). Combining both makes cocoa paste the product with most the import from producing countries. Côte d'Ivoire and Ghana were the main cocoa-producing suppliers of bulk cocoa paste to the European market.

Source: Amonarmah consults; data from EUROSTAT

They were also the main cocoa-producing suppliers of cocoa butter and cocoa powder to the European market. The processing in these countries takes place primarily through multinationals or European companies located in those countries, such as Barry Callebaut, Cargill, Olam and ECOM. Hence being an independent local processor means that you will have to compete with European companies based in Europe which are also active in producing countries.

Local cocoa processors active in the two countries include Susco, ICC, Foragri, Ivcao, Condicaf and SAF-Cacao (Côte d'Ivoire) and the Cocoa Processing Company, Niche Cocoa, Plot Group and Afrotropic Cocoa Processing Company (Ghana).

Indonesia is another large supplier of bulk cocoa products to the European market, especially cocoa butter and defatted cocoa paste. The same large multinationals as mentioned before are also behind Indonesia's strong position in cocoa processing. Indonesia has a lot of potential, also for export of semi-finished products. It has 11 factories that process these products, which can handle 739,250 tons every year.

Figure 8: Top producing country exporters of semi-finished cocoa products, 2022

Note: Cocoa paste_1 is not defatted cocoa paste, and Cocoa paste_2 is wholly or partly defatted cocoa paste

Source: Amonarmah consults; data from EUROSTAT

Rising demand for cocoa butter alternatives

In the chocolate and confectionary industry, some producers think about using different fats and oils instead of or along with cocoa butter. This can change how the final treat feels and tastes, and it can be cheaper too. These other options to cocoa butter are called cocoa butter alternatives, or CBAs.

The cocoa butter alternatives market is expected to keep growing about 5.5% every year until 2030 – probably even more so because cocoa beans' prices have been increasing lately. The supply of cocoa beans is also decreasing. Another factor that might affect this is a new rule from the EU, the European Union Deforestation Regulation (EUDR), which was mentioned earlier. This could popularise the use of different butters.

EU rules on using different butters and oils instead of cocoa butter also provide a chance for CBAs to do well. The Cocoa and Chocolate Products Directive (Directive 2000/36/EC) is the rule for these butters. It does not say anything about the minimum quantity of CBAs you can use instead of cocoa butter, but does say you can use up to 5% of other fats that aren't cocoa butter.

One of the main competitors in this area is butter that comes from palm trees. This kind of butter is used a lot in making chocolate. It is good because it can be used in many ways, it's cheaper, and it's better for the environment. People working in the palm oil industry have also made big changes to stop cutting down forests. In 2021, most of the palm oil that came to the EU (about 93%) was certified as sustainable and good for the environment. This is important because people are starting to care more about how food is made and where it comes from.

Tips:

- To increase your chances of selling your products to other countries, highlight what makes you special. It's tough to be just like the cocoa companies in Europe, so make yourself stand out. For instance, you could make cocoa products from really good beans in small amounts. Work directly with chocolate makers to create unique chocolates together and make special products like couverture. Do things that help the communities where you get your cocoa.

- Consider teaming up with other cocoa companies in your area if your business isn't very big or you don't have a lot of cocoa. By working together, you can make high-quality cocoa products from your region and become a better and more competitive choice for selling to Europe.

- Build strong, lasting relationships with the people who buy your cocoa. This means you need to always meet their standards for your products and quality, and do what you say you'll do. This will give you an edge over others and help you learn more and stay steady in the European market.

- Visit the websites of the European Cocoa Association and the International Cocoa Organisation to learn more about worldwide production and grinding.

4. What are the prices for semi-finished cocoa products on the European market?

With the exception of cocoa butter, the price of semi-finished cocoa products experienced annual increases in 2018-2022 (Figure 9). Further price increases are expected in the coming years due to the rising cost of cocoa beans.

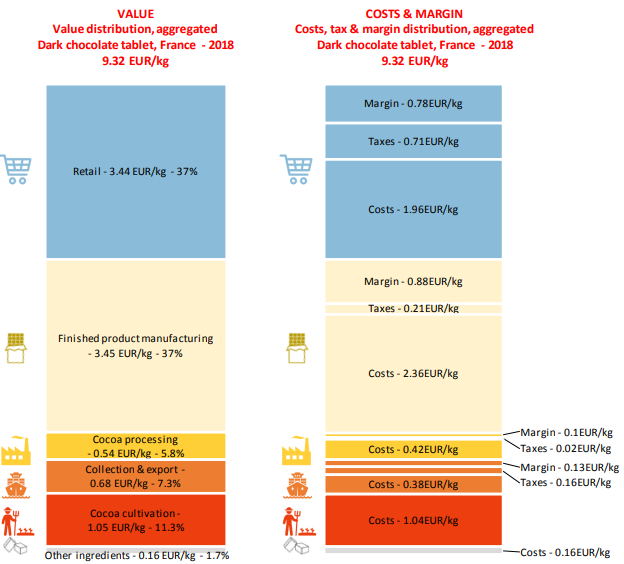

While cocoa bean prices continue to soar, chocolate prices also keep rising globally. Europe has already experienced a 13% increase in chocolate prices since 2021 and this is expected to continue in the coming years. Within the cocoa supply chain, chocolate makers and retail stores benefit the most. They can get about 80% of the total profit of the industry, or even more depending on the type of cocoa and chocolate product – that is, if we consider the profit share for 1kg dark chocolate (Figures 10 and 11). Semi-finished cocoa processors can also get 3.7% to nearly 6% depending on the type of cocoa – conventional or certified as organic, Rainforest Alliance or Fairtrade (Figures 10 and 11).

Source: Amonarmah Consults; data from EUROSTAT

Note: Data was based on the import quantities and euro values of these inward flows. The ratio of the euro value to the imported volumes gave the euro unit value.

Figure 10: Distribution of value, costs and margins of plain dark chocolate bars

Figure 11: Distribution of value for certified 'Premium' plain dark chocolate tablets

Source: FAO & BASIC, 2020

Amonarmah Consults, Molgo Research, and Long Run Sustainability carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research