The European market potential for speciality cocoa

There is significant growth in the demand for specialty chocolate in Europe. Specialty chocolate offers unique flavour experiences, healthier snacking and tells a story. The trend is part of the general demand for certified chocolate, which is also growing.

Specialty cocoa, often referred to as the premium market, lacks a definition by the sector. It also lacks specific industry statistics. Specialty cocoa can be recognised by the use of particular cocoa varieties, post-harvest practices, countries of origin and taste and aroma profiles.

Contents of this page

1. Product description

The global cocoa trade recognises two main markets for cocoa beans: the commodity market and the specialty market. Fine flavour cocoa is part of the specialty market.

The commodity market mainly offers bulk cocoa and covers over 85% of the entire market. Bulk cocoa is of standard quality and traded in high volumes. It follows international prices set in the London and New York futures markets. Over the past two decades, sustainability certification, mostly Rainforest Alliance, has been increasingly used as a requirement. These certifications are promoted by sustainability policies and programmes by large chocolate manufacturers and European retailers.

The overall specialty market, often referred to as premium cocoa, makes up less than 15% of the market. Cocoa beans are of a higher quality, but volumes are quite low. Specialty cocoa sells for higher prices because of characteristics such as particular tastes and aromas. Their uniqueness and the low availability also drive up prices. This is certainly the case with fine flavour cocoa, a sub-category of specialty cocoa.

There is not a generally accepted definition of specialty cocoa. Specialty cocoa can be recognised by the use of particular cocoa varieties, post-harvest practices, countries of origin, and taste and aroma profiles. In 2018, the International Cocoa Organisation (ICCO) formulated a definition of Fine or Flavour cocoa. This differentiates fine cocoa and flavour cocoa. However, this study refers to fine flavour cocoa.

Both definitions share a focus on genetic diversity as well as taste and aroma. The difference is that:

- Fine cocoa offers complex flavours representative of the place it was produced (‘terroir’);

- Flavour cocoa offers flavour characteristics important for blends.

ICCO identifies the countries that produce fine flavour cocoa based on price premiums. In 2022, it made a revised list of Fine Flavour cocoa exporting countries. Countries that produce fine flavour cocoa account for about 6% of the global production.

Figure 1: Countries that produce fine flavour cocoa

Source: ICCO

There is also no full methodology for assessing high quality cocoa for buyers and consumers. This methodology does exist in the coffee sector, with the Specialty Coffee Association’s cupping protocol for assessing the quality of the coffee. The protocol is based on a 100-point scale, where a coffee variety is considered a specialty variety when it scores 80+ points. However, no full methodology has been developed for cocoa.

Specialty cocoa is often associated with single-origin chocolates. This is because chocolate made entirely from cocoa produced in one origin country invites consumers to get to know the flavour profile. Chocolate manufacturers and consumers can trace the cocoa to the origin country. Traceability and its storytelling ability add value to the final product for consumers.

Specialty cocoa is often organic certified. The organic certification limits agrochemical and ensures traceability, which are important aspects for buyers. Organically-produced cocoa can also improve the taste of the cocoa compared to non-organic cocoa. This is often seen with fine flavour cocoa used in craft chocolate manufacturing, like the small-scale bean-to-bar model. Conceptually, specialty cocoa can be used by chocolate manufacturers of any size and scope. Speciality cocoa uses higher quality beans than bulk cocoa. This includes blends. Cocoa does not need to be certified or organic in order to be considered specialty cocoa. Both specialty and fine flavour cocoa belong to a niche market that is growing in popularity.

The main varieties of the cacao plant are Forastero, Criollo and Trinitario. Fine flavour cocoa is mainly produced from Criollo or Trinitario and bulk cocoa usually comes from Forastero trees. Nacional is a specialty cocoa variety from Ecuador.

- Criollo, which is the original cocoa tree, is mainly grown in Central America, northern South America, the Caribbean and Sri Lanka. Criollo makes up around 5% of global cocoa production. The beans have a delicate and sweet flavour. In some countries of origin, nutty notes are found. Criollo is often mixed with other varieties when making chocolate, given that it is scarce and expensive. Well-known varieties are Chuao, Porcelana, Ocumare and Mayan Red.

- Trinitario is mainly grown in Central and South America, the Caribbean and Asia. The beans are a hybrid of the Criollo and Forastero trees. This variety represents around 10–15% of the global cocoa production. The beans have a floral, fruity flavour. Well-known varieties are Carenero, Rio Caribe and Sur del Lago. There are exceptions to this classification. For example, Cameroonian cocoa beans produced from Trinitario trees are classified as bulk cocoa.

- Nacional (a Forastero sub-species) is grown in Ecuador and produces a specialty cocoa. It is considered to be a Forastero type tree but is sometimes also categorised as a separate variety. It was thought that this variety was lost in 1919 but it was rediscovered in 2011.

Figure 2: Nacional, Criollo and Trinitario cocoa fruits

Source: design by Bart Wortel

This document focuses on cocoa beans (whole or broken, raw or roasted), which corresponds with HS code 1801. Harmonised System (HS) codes are used to classify products and to calculate international trade statistics, such as imports and exports. Note that there is not a dedicated HS code for specialty cocoa, which limits specific data.

2. What makes Europe an interesting market for speciality cocoa?

There is significant growth in consumer demand for specialty chocolate in Europe. Specialty chocolate offers unique flavour experiences. It is considered a healthy food and tells a story of the origin country. This trend is part of the long-term growing consumer demand of certified chocolate. The market for specialty cocoa has grown twice as fast as the market for bulk chocolate products. It is expected to keep growing at a faster rate.

Demand continues to grow in Europe

The global premium chocolate market accounts for less than 10% of the global chocolate market. It has an estimated value of 30.9 billion USD. However, premium chocolate is a fast growing segment. It is expected to continue to grow in the short-term (46.1 billion USD in 2028). The European market for premium chocolate is greater than one-fifth of the total chocolate market and is expected to grow by an annual average of 8.7% between 2023 and 2028.

A sign of the growing demand for specialty cocoa is the growth of single-origin chocolates. Single-origin chocolates typically meet more consumer preferences. They offer unique flavour experiences, are a healthy food and tell a story of the origin country. In 2022, the number of single-origin products launched globally increased by 25%. Examples of single origin chocolate products are Blanxart (Spain) , Original Beans (the Netherlands) , Domori (Italy), Mi Joya (Belgium) and Fjåk Chocolate.

Consumers are increasingly interested in premium and healthier chocolate products

After the COVID-19 pandemic and related supply chain disruptions, a key trend has been a new focus on premium chocolate products. Premium chocolate often has a higher price and a better taste and quality. These products can be combined with other ingredients. Many companies are selling premium chocolates to attract consumers who are influenced by price, packaging, ingredients, exclusivity and the country of origin.

Premium chocolate can be sold both in the middle-range segment and the high-end segment. Consumers in the middle-range segment are increasingly looking for unique flavour experiences. This is both through cocoa from new origin countries and the inclusion of complimentary ingredients like fruits, spices and nuts. Some consumers are interested in health and want to consume less sugar.

High-end consumers also look for health benefits. An example is antioxidants in high-quality cocoa.

This segment is where direct trade with craft manufacturers plays an important role. Specialty cocoa producers and exporters can ensure the quality of fine flavour cocoa to buyers through direct relationships. They tell consumers where the cocoa comes from and how it is produced.

Studies have shown that consumers are willing to pay more for premium food when these products are of higher quality or sustainable. Barry Callebaut, the world’s largest manufacturer of industrial chocolate, says that 55% of consumers will pay more for improved flavours and textures.

Tips:

- Check the Fine Cacao and Chocolate Institute (FCCI) resource library for more information about the history, production and market of fine flavour cocoa.

- Find out if your cocoa could win industry awards, such as the International Cocoa Awards (Cocoa of Excellence).

- Have a look at our study on exporting certified cocoa to Europe for more information about certifications on the European cocoa market.

Consumers associate organic with high quality and healthier products

Organic farming practices do not allow growers to use genetically-modified varieties or agrochemical pesticides and fertilisers. The aim is to conserve the health of people and local ecosystems. These strict limits ensure low residue levels. This is appreciated by consumers and can make up for quality factors.

Organic cocoa is separated from conventional cocoa. Traceability systems follow the organic cocoa along the value chain and identify the producers behind the cocoa beans. An independent assurance body conducts audits to certify the cocoa beans or other products as organic. The standards for auditing are defined by public authorities, such as the European Union.

In 2022, the organic chocolate market valued $0.55 billion. Europe and the United States represent a large part of the organic chocolate market. Europe accounts for 44% of global organic food sales. The outlook is positive. The segment in Europe is expected to grow by 8.6% annually between 2023 and 2030.

Specialty beans gain more share of imports after COVID-19 disruptions

It is difficult to measure the volume of specialty cocoa that is imported by Europe. This is because specific import data is not publicly available. You can check how many cocoa beans are imported by key European countries from the ICCO website. This offers a rough idea of the fine flavour imports.

The Netherlands, the world’s largest cocoa importer, imported over 11,000 metric tonnes of cocoa from the Dominican Republic in 2021. Although this represented 2% of imports, it was a 20% increase from 2019. Germany’s and Italy’s cocoa imports from Ecuador accounted for 2% (Germany) and 12% (Italy) of cocoa imports in 2021. Both import countries also saw more specialised traders and craft manufacturers. This is another sign of growth in specialty cocoa. Cocoa imports have fluctuated after the pandemic but specialty cocoa is becoming more popular.

Tip:

- See the CBI cocoa country studies for the Netherlands, Germany and Italy for more information.

3. Which European countries offer most opportunities for speciality cocoa?

In Europe, the growing demand for specialty chocolate comes from the traditional consuming and manufacturing countries. Examples are Belgium, France, Germany, Italy, Spain, Switzerland and the Netherlands. Consumption in this segment is driven by higher incomes, consumer preferences for health and premium products and accessibility. At the same time, mainstream chocolate companies have been investing in premium product lines. Retailers also have been successful with higher-end private label products. Specialty chocolates are now increasingly accessible to all types of consumers, at different price levels.

France is a large and growing market for specialty chocolate

France is among the largest specialty markets in Europe. The French specialty chocolate market is expected to grow at a rate of 7.9% annually between 2023 and 2028. French consumers value craftsmanship and premium chocolate, for example with a high cocoa content. Dark chocolate represents about 30% of the French chocolate consumption. In the rest of Europe, this is 5% on average.

The focus on origin has become very important in the French high-end chocolate market. Most high-end brands offer a line of single-origin chocolates. The French fairtrade organisations Alter Eco and Éthiquable are good examples of organisations that reference the origin country on packages and show the co-operatives they work with on their websites. Specialty chocolate makers such as Bonnat Chocolatier and Chocolaterie A. Morin are other examples of organisations that develop direct trade relationships with their suppliers in producing countries. Paris is home to more than 300 premium chocolate shops. This includes La Maison du Chocolat, Cluizel Paris, Jean-Paul Hévin and La Maison Pralus.

France ranks as the third largest cocoa bean importer in Europe. In 2021, imports reached over 161,000 metric tonnes, of which 4% was sourced directly from fine flavour cocoa-producing countries.

France sources from a wide range of origin countries. This includes fine flavour cocoa-producing countries like Grenada, Belize and Guatemala. This is because of consumer preferences for dark chocolate and unique origins.

Switzerland has the highest chocolate consumption per capita globally

In 2021, the Swiss population consumed 11 kilogrammes of chocolate per capita. This is after having recovered from a brief drop due to the COVID-19 pandemic. The chocolate consumption grew 4% compared to pre-pandemic levels. The Swiss are able to enjoy eating this much chocolate because of the higher incomes. Other reasons for consuming this much chocolate are a preference for premium products and being close to a large number of manufacturers. There is an increasing number of bean-to-bar chocolate makers that use specialty cocoa. Examples are:

Over a third of all Swiss imports is sourced from countries that export a high share of fine flavour cocoa. In 2021, total Swiss cocoa bean imports reached 52,410 metric tonnes. Imports have grown over 20% since 2015. The main supplier of fine flavour cocoa is Ecuador, with a volume of 12,500 metric tonnes in 2021. The Dominican Republic and Peru were also key suppliers, with 8% and 4% shares respectively. One notable African example is Madagascar. Madagascar exported over 1,500 metric tonnes to Switzerland, which is 3% total Swiss imports.

Another good sign for specialty cocoa producers is the presence of several fairtrade and organic companies in Switzerland. Some examples include chocolate makers such as:

It also includes specialised traders such as:

Pronatec opened an organic processing facility, which indicates confidence that the segment will grow. This is mainly due to private label consumption.

Germany’s large chocolate market likes organic and lately more premium products

Germany is the largest European chocolate market and is expected to reach a market value of $9.16 billion in 2023. This figure is roughly twice the size of France’s chocolate market, the second largest in Europe. Germans consume about 9 kilogrammes of chocolate per capita. This is the second highest in Europe.

The market’s big size and consumer preferences toward more premium chocolate make it an important opportunity for specialty cocoa suppliers. Certified chocolate sales have steadily grown in Germany over the past decade. For instance, Fairtrade chocolate saw an 11.62% annual growth rate (CAGR) between 2011 and 2021. Germany continues to be Europe’s largest organic food market, reaching nearly €16 billion in market value 2022. This includes organic chocolate.

Germany is Europe’s second largest importer of cocoa beans, reaching 445,000 metric tonnes in 2021. It is a top destination for fine flavour cocoa-exporting countries such as Peru and the Dominican Republic. Consumer preferences for organic chocolate at all price levels play a role in this development.

The Netherlands’ dominance in the global cocoa trade extends to specialty cocoa

The Netherlands is the world’s largest cocoa bean importer, with 713,532 metric tonnes in 2021. The COVID-19 pandemic has affected total imports and the share of fine flavour. For instance, the Netherlands’ imports from top fine flavour cocoa-exporters Ecuador, Peru and the Dominican Republic fell from 7.7% in 2019 to 3.4% in 2021. The biggest decrease was Ecuador (from 35,232 to 11,536 metric tonnes). But, volumes have rebounded to 16,850 metric tonnes in 2022.

Several specialised traders are present in the Netherlands. Examples are Daarnhouwer, Cocoanect, Tradin Organic and Dietz Cacao Trading. Examples of craft manufacturers include:

- Lovechock

- Heinde & Verre

- The Chocolate Explorers

- The Chocolate Makers

Belgium’s important role in chocolate manufacturing also covers specialty cocoa

Belgium is Europe’s second largest chocolate exporter, after Germany. Its exports valued $3 billion in 2022. The country has created ‘Belgian chocolate’ as a geographical sign to protect the image and authenticity of products on the consumer market. It is mainly known as a key manufacturer of bulk chocolate for brands and retail private labels.

Belgium is home to leading global producers Barry Callebaut, Cargill and Puratos. But, there are several smaller chocolate makers in Belgium that use specialty cocoa. Examples are:

- Benoit Nihant Chocolatier

- Montserrat

- Chocolatoa

- Darcis

- Frederic Blondeel

- Mi Joya

- The Chocolate Line

- Van Dender

- Patisserie Zuut

Some examples of specialty chocolate retail shops include:

There are several specialised traders in specialty cocoa in Belgium. Examples are Le Cercle du Cacao and Silva, both of which source fairtrade and certified cocoa beans from various origin countries. In 2021, the total cocoa bean imports reached 336,000 metric tonnes. The Dominican Republic continues to be a leading fine flavour supplier, at 4,526 metric tonnes or 1.3% of total imports. Notably, Belgium imports a relatively large share from Papua New Guinea. This accounts for an estimated 70% of EU imports from this origin country.

Italy’s role in chocolate manufacturing is notable for its share of specialty cocoa

Italy is an important chocolate producer in Europe with exports valuing $2.3 billion in 2021.

Italian consumers greatly value premium chocolates with a high cocoa content with dark chocolate. This makes up over 40% of all chocolate consumption. For this preference, single origin chocolates are gaining popularity in Italy as they tend to have a higher cocoa content. Some Italian brands that offer single origin lines include;

Of Italy’s total imports, Ecuador accounted for 12% in 2021. Notably, Italy’s fine flavour imports count Uganda an emerging supplier of fine flavour cocoa.

Tips:

- Take a look at the website of Bean-to-bar.be to find examples of bean-to-bar makers active in this niche market in Europe.

- Refer to our country studies to read more about the specialty markets and cocoa opportunities. We have studies on Belgium, France, Germany, Italy, Spain, Switzerland and the Netherlands.

- See this map on the Fine Cacao and Chocolate Institute website to find companies active in the specialty cocoa market.

4. Which trends offer opportunities on the European speciality cocoa market?

Several trends in the specialty segment follow long-term trends seen in the European cocoa market. Most importantly, there has been considerable growth in certified chocolates and storytelling on where the cocoa comes from and how it is produced. There has also been a gradual rise in online sales. However, specialty cocoa greatly builds on these trends. What is different is that specialty cocoa has a strong focus on quality in terms of taste and aromas as well as health benefits. This has also led to a sharp increase in the number of craft chocolate made by small-scale manufacturers (like bean-to-bar).

Single origin chocolate is increasingly an important premium product

Consumers want higher quality chocolate products. Chocolate companies are increasingly able to meet this interest in single origin chocolate. This is often mentioned on the chocolate bar itself. Chocolate made entirely from cocoa produced in one origin country invites consumers to get to know the flavour profile of an origin. Sales are expected to grow.

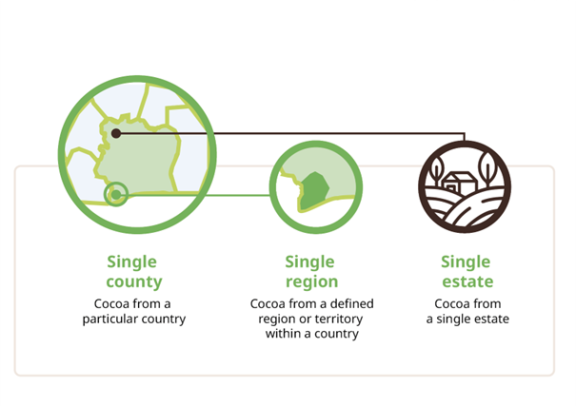

‘Single origin’ refers to cocoa beans that come from one particular country, region or estate. Examples are Valrhona and Ritter Sport. The producing country behind a single origin chocolate is often a fine flavour country. The cocoa can also be unique and scarce on the market. The chocolate manufacturer is able to trace the specialty cocoa to where it is produced. This greater control over the value chain helps the brand ensure the higher quality that consumers want for health or taste reasons. The better insight into the farming of specialty cocoa also allows the brand (and retailers) to tell more interesting stories about producers and their communities. This storytelling builds further on what consumers of certified chocolate are used to.

Figure 3 : Variations of single-origin cocoa

Source: Bart Wortel Design

Tips:

- Identify and communicate your unique selling points as a supplier of specialty cocoa beans. Think about factors that distinguish you from your competitors, and then base your marketing story on them. For example, they could be related to the origin of your cocoa beans, the agroclimatic characteristics of the producing region, the culture of the producing communities, the unique quality of your product or your post-harvest techniques, or a combination of these aspects. One example of a company successfully talking about key characteristics is Xoco Gourmet (Honduras).

- Find out if your cocoa could win industry awards. One example is the International Cocoa Awards (Cocoa of Excellence). The cocoa awards recognise flavour, quality and diversity of different origins. This can be an interesting way to stand out on the European market for fine flavour cocoa.

Consumers are increasingly health conscious and more interested in premium chocolate

The positive outlook for the EU specialty chocolate market is partly driven by consumers’ increasingly healthy lifestyles. Cocoa is known to be a good source of antioxidants and its ability to lower risk of cardiovascular diseases. Dark chocolate is a good sign of the healthy living trend. This is because it includes more cocoa and less sugar. In 2022, Europe accounted for over 48% of the global dark chocolate market. It is expected to grow (2.8% CAGR) between 2023 and 2028. This is slower than other key markets like the United States.

More concern for health in society has also led to increased demand for organic specialty cocoa. EU consumers tend to associate organic farming with quality and health. This is because of its limits on agrochemical use and the ability to trace cocoa to farms. In 2022, Europe was expected to make up two-fifths of growth in organic chocolate globally. Germany sits at the top of the list with France in second place due to their chocolate industries and consumer preferences. Examples of German premium organic chocolate brands are Vivani and Belyzium. In France, the organic market has become mainstream as can be seen by the launch of organic chocolate tablets by the popular brand Côte d’Or.

German consumers are not only more concerned about health; they are also more interested in more premium versions of traditional chocolate products during the holiday seasons. In 2021, the German chocolate industry produced around 239 million chocolate Easter bunnies and 103 million chocolate Santa Clauses for the domestic market. These products are increasingly being made with specialty cocoa from various sources. Examples of certification and health/diet preferences include Fairtrade, Organic, and vegan and gluten-free ingredients.

Tips:

- Improve the quality of your cocoa beans to cater to the specialty segment. Refer to industry guidelines, such as Cocoa Beans: A Guide to Chocolate & Cocoa Industry Quality Requirements. You can learn more about the factors determining the quality of cocoa beans, and how to address them.

- Learn more about organic farming and organic guidelines on the European Union website and the OrganicExportInfo website.

Craft manufacturers still on the rise and increasingly compete with larger companies

The chocolate business has seen the number of craft manufacturers explode. Many produce bean-to-bar chocolate, where the chocolate is made from scratch with control over the whole process, from bean to bar. Driven mainly by quality, bean-to-bar chocolate makers have greater control over the value chain. They do so to help ensure the higher quality that their customers expect. This can either be in taste, aroma, or uniqueness.

This process is also called direct trade. The more direct relationship with specialty cocoa producers allows the small-scale brand to tell a more interesting story of origin. It allows them to differentiate themselves in a competitive market. In some cases, these companies are located in producing countries. They can be known as tree-to-bar companies.

The craft trend is expected to remain niche due to the challenges small-scale companies face. Examples of these challenges are high transportation costs (e.g. cold storage) and management capacity.

A few examples of European bean-to-bar brands are the companies on this partial list published on bean-to-bar.be Some tree-to-bar chocolate makers include:

- Marou Chocolate (Vietnam)

- Paccarí (Ecuador)

- Cacaosuyo (Peru)

Some chocolate makers that focus on the flavour diversity in cocoa are:

Large, established chocolate manufacturers are noticing this opportunity. Well-known companies like Mondelez and Nestle are increasingly buying or creating single origin or craft chocolate products. These are products that have a similar artisanal appeal to consumers compared to small, boutique bean to bar chocolate brands.

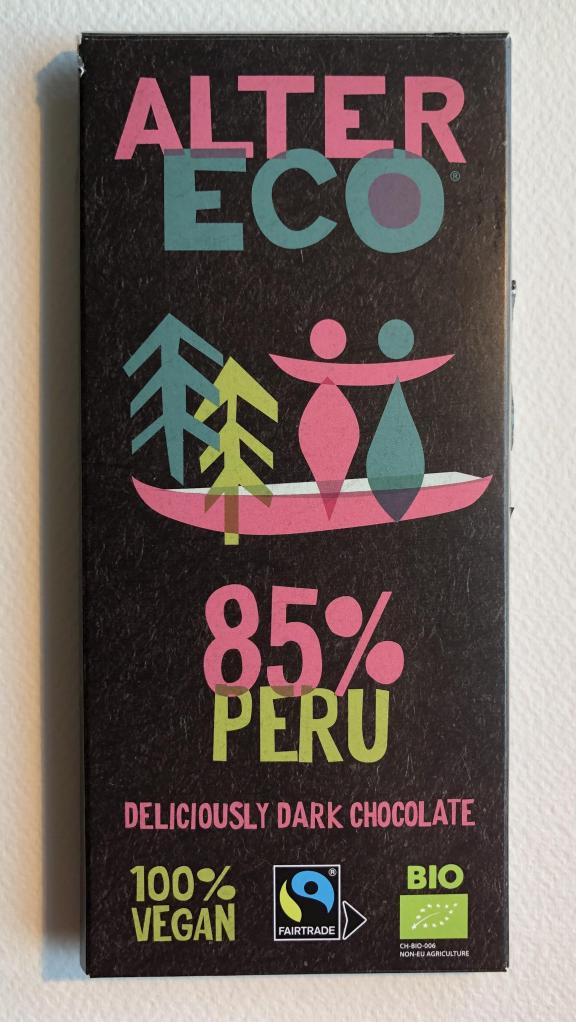

Figure 4: Example of a single origin chocolate bar from Alter Eco

Source: Long Run Sustainability

Tips:

- Check the website Flavors of Cacao to read about all the factors that contribute to the final flavour of chocolate.

- Improve your understanding of the effect of fermentation on your cocoa beans by reading this article by Perfect Daily Grind.

- Discuss the possibility of developing limited and special editions for high-end cocoa, produced in small quantities or micro-lots, with your buyer. Make sure you understand their requirements and the kind of samples they require. Requirements can relate to quantities, packaging, labelling, and documentation.

- Explore the possibility of adding value to your product. Do so by designating the origins of different types of cocoa that are specific to your area. This will make your product more attractive for specialised buyers. Also, explore the possibility of obtaining legally protected geographical indications for these varieties. This can be an important element in your storytelling.

- See examples of producers already experimenting with different cocoa flavour profiles, such as Ingemann (Nicaragua) and Zorzal Cacao (Dominican Republic).

Online sales are a promising channel for specialty cocoa

Globally, the online channel for chocolate is expected to see the most growth (10.3%) between 2022 and 2030. The online sales trend has been driven by the COVID-19 pandemic and the public’s need for safety and convenience. Increasingly in Europe, the combination of online promotions with more premiumisation of chocolate products has led to success now and in the future. Online is an interesting sales channel for craft manufacturers. It allows you to:

- reduce costs by not having a physical retail shop;

- market directly to the right customers;

- better tell the story of origin and the craft manufacturing process.

Online craft chocolate shops in Europe include:

- Kakaw (Sweden)

- Club del Chocolate (Spain)

- Schokov (Austria)

- Cocoa Runners (United Kingdom)

- Feine Schokolade (Germany)

- ClearChox (the Netherlands)

Increasing demand for specialty cocoa benefits sustainability in the sector

There is increasing attention being paid to sustainability issues in the cocoa supply chains. Key sustainability issues in cocoa are social issues – such as low farmer income, child labor and gender equality – and environmental issues – such as deforestation and climate change. See the CBI studies on Tips to go green and Tips to become socially responsible for more details.

There is increasing demand for more sustainable chocolate products. The specialty cocoa sector is well positioned to benefit from this trend. Sustainability is usually one of the key aspects that is highlighted when specialty chocolate products are sold.

One advantage is a higher level of traceability for specialty cocoa compared to bulk cocoa. This is because specialty cocoa is less commonly mixed in the supply chain. This means that buyers know better where their cocoa comes from and talk about it to the people that buy the chocolate. Specialty cocoa helps with storytelling and highlighting the unique aspects of the cocoa.

Another advantage for the specialty cocoa sector is the higher price of specialty cocoa compared to bulk cocoa. Producers often receive higher prices for their cocoa. This helps them earn more for their product and potentially earn a living income through cocoa. Higher incomes can help decrease child labour, since the extra money can help with hiring external labour. The higher price can also help reduce deforestation rates, since it is less necessary to cut down forests to expand cocoa farms.

These benefits are often also part of the marketing and storytelling of the chocolate. Many specialty chocolate companies use the advantage of higher traceability, quality and uniqueness to tell a story about the sustainability aspects of their chocolate products.

Molgo Research carried out this study in partnership with Long Run Sustainability, Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research