10 tips on how to do business with European cocoa buyers

Europe provides many opportunities for cocoa exporters. In this study we provide practical tips for doing business with European cocoa buyers. As the cocoa trade is a people’s business, it is important to invest in personal relationships and be aware of differences in business cultures. It is also critical to understand and meet buyer requirements and expectations. In addition, framing any unique selling point (USP) effectively is crucial to branding oneself in a highly competitive market.

Contents of this page

- Understand the business culture in the European cocoa sector

- Be professional in communicating with buyers

- Prepare well for and attend cocoa events and conferences

- Provide good-quality samples with the right information

- Follow-up, follow-up, follow-up

- Be well informed about pricing strategies and providing quotes

- Emphasise your unique selling points

- Consistency is key

- Comply with mandatory sustainability and traceability requirements

- Leverage industry support

1. Understand the business culture in the European cocoa sector

To successfully export cocoa from origin countries to the European market, it is important to understand European business culture. Proper business etiquette, punctuality and looking professional are expected. Take time to make personal connections but keep initial interactions more formal. Be aware of and sensitive to some notable differences between countries. Table 1 presents differences in the business cultures of some European countries. Overall, while Germany, France and Belgium emphasise punctuality and hierarchical structures, the UK is more flexible and values personal connections. Communication styles vary, with Germany and the Netherlands being direct, France expecting impeccable etiquette, and the UK using openness and humour. Gift-giving practices are generally conservative across all countries. Passport to Trade 2.0 provides a good overview of differences in business cultures in Europe: for example, Northern European buyers are often straightforward and will tell you what they think, whereas Southern European buyers tend to be less direct.

Table 1: Some differences in the business culture of few European countries to take note of

| Aspect | Germany | Netherlands | France | UK | Belgium |

| Punctuality | Extremely punctual and efficient in business dealings. | Punctuality in business is regarded as a virtue, although apologies for a late arrival will be accepted politely. If you are unexpectedly delayed, call ahead. | Relatively punctual. While you should strive to be punctual, you won’t be considered late if you arrive ten minutes after the scheduled time. | Punctuality is expected and appreciated in the UK, but no one really minds if you arrive a few minutes late for a one-to-one meeting, provided there is a good reason, e.g. traffic. | Punctuality in business is generally regarded as a virtue. |

| Communication style | Directness and honesty are valued, avoid excessive flattery. | Comfortable with disagreement. | Impeccable personal presentation and etiquette expected. | Generally open and straightforward Humour and understatement are commonly used. | |

| Decision-making | Relies on detailed facts/data. | Focuses on functionality. Values formal procedures but also with emphasis on long-term relationships and sustainable sourcing. | Relatively bureaucratic. Patience is required, avoid appearing overly pushy. Relationships are important but are built slowly over time. | Values input and openness. | |

| Corporate hierarchy | Respects hierarchical structure. | Values personal connections. | French business culture has a strong, vertical hierarchy. | Corporate hierarchy respected but input welcomed. | |

| Gift-giving | Gift-giving is minimal to avoid perception of bribery. | Giving or receiving anything other than the due reward for services rendered is not expected, but neutral, reasonably modest gifts can be accepted. | Modest corporate gift-giving only once relationship established. | Conservative attitude towards gift-giving. | Gift-giving is not normally an aspect of business relations in Belgium. If you decide that some sort of gesture is appropriate, make the gift a reasonably modest one and make sure it is logo-neutral. |

Source: Passport to trade 2.0

Be familiar with common terms and jargon in the cocoa sector

In communication, it is very important to know and understand certain language terms and jargon used across the entire European cocoa sector. While there is no single universal slang or vernacular language, in Table 2 we present certain industry-specific terms around cocoa quality.

Table 2: Cocoa industry-specific terms and jargon frequently used with regard to cocoa quality

| Term | Description |

| Bean count | Classifying cocoa beans based on their size. |

| Cut test | Opening up a cocoa bean by cutting it in two lengthwise to analyse the fermentation levels and quality of the bean. |

| Flat beans | A cocoa bean whose cotyledons are too thin to be cut to give a surface of the cotyledon. |

| Slaty beans | A cocoa bean whose internal surface exposed by a cut is uniformly slate grey, indicating that the bean has not been fermented. |

| Broken bean | The seed of the cocoa tree (Theobroma cacao, Linnaeus), commercially and for the purpose of the Model Ordinance; the term refers to the whole seed, which has been fermented and dried. |

| Doubles | Two cocoa beans fused together during the fermentation process that can be split apart with finger pressure. |

| Fragment | A piece of cocoa bean equal to or less than half the original bean. |

| Adulteration | Alteration of the composition of graded cocoa by any means whatsoever, so that the resulting mixture or combination is not of the grade prescribed, affects the quality of flavour injuriously, or alters the bulk weight. |

| Cluster | More than two beans joined together that usually cannot be split apart with finger pressure. |

| Foreign matter | Any substance other than cocoa beans, fragments and pieces of shell. |

| Germinated bean | A cocoa bean whose shell has been pierced, split or broken by the growth of the seed germ. |

| Smoky bean | A cocoa bean that has a smoky smell or taste or that shows signs of contamination by smoke. |

| Violets | Over-fermented cocoa beans with a purple hue. |

| Mold/Insect damage | Beans that are contaminated or have defects. |

| Waste | Debris remaining after removal of whole, double and broken cocoa beans, clusters and foreign matter; this includes cocoa bean fragments, pieces of shell, broken nibs, dust and flat beans. |

| Thoroughly dry cocoa | Cocoa that has been evenly dried throughout. The moisture content must not exceed 7.5%. |

| Off-Notes or Off-Flavours | Undesirable flavours or aromas in cocoa beans, like smoky, hammy or musty. |

| Single origin | Cocoa beans sourced from a specific geographic region or plantation. |

| Arriba nacional | A specific variety of cocoa bean grown in Ecuador. |

| Butter/Powder/Liquor | Semi-finished cocoa products. |

| Fine flavour cocoa | Cocoa beans with distinctive flavours and aromas – often associated with specific regions or plantations. |

Here are additional common terms you can encounter in the cocoa trade:

- Supply Chain Terms

- Traceability: The ability to track cocoa beans from farm to consumer, ensuring transparency and accountability.

- Bean-to-bar: Chocolate production process that involves sourcing cocoa beans directly from growers and overseeing all stages of production.

- Direct trade: A business model where cocoa buyers purchase directly from farmers, often emphasising fair prices and long-term relationships.

- Bulk cocoa: Large quantities of cocoa beans being traded.

- Market Trends and Demand

- Craft chocolate: Artisanal chocolate made in small batches, focusing on quality ingredients and unique flavours.

- Single-origin chocolate: Chocolate made from cocoa beans sourced from a specific region or plantation, highlighting terroir and flavour diversity.

- Logistics and Shipping Terms

- FOB (free on board): This term means that the seller is responsible for the products until they are placed aboard the vessel for shipment. After that, the buyer takes responsibility.

- CIF (cost, insurance and freight): A pricing word that includes the cost of the goods, insurance and freight charges up to the final port. These charges are the seller’s responsibility until the items arrive at the destination port.

- Certificates of provenance: They certify the provenance of the goods, namely cocoa beans. They may be required by tariff rates and guarantee adherence to trade agreements by customs authorities.

- Phytosanitary certificate: This document certifies that the exported cocoa beans meet the phytosanitary standards of the nation of import by being free of pests and illnesses.

The International Chamber of Commerce (ICC) publishes Incoterms, which are standardised words used in international trade. EXW (Ex Works), FCA (Free Carrier) and DDP (delivered duty paid) are also examples of frequently used Incoterms that outline the obligations of the buyer and seller in a transaction.

The language and terminology can vary based on the specific European country or company, or an individual’s background. But in general, cocoa traders and processors use this specialised vocabulary to efficiently communicate about bean quality, sourcing and logistics. Use of acronyms like ICCO (International Cocoa Organization) and HACCP (Food Safety Certification) is likewise common jargon in the cocoa sector.

Tips:

- Learn more about chocolate terminology. The Fine Chocolate Industry Association has also launched the Fine Chocolate Glossary, which serves as a comprehensive resource to address a prevalent challenge faced by those involved in the cocoa and chocolate industry, as well as individuals embarking on a journey to learn about these domains. This challenge arises from the fact that terminology related to fine chocolate may hold different meanings or interpretations amongst various stakeholders. The Glossary aims to bridge this gap by providing clear and consistent definitions for key terms, facilitating effective communication and shared understanding within the cocoa and chocolate community.

- Check out the Lindt & Sprüngli Farming Program, which also provides a glossary of terminologies on everything you want to know from cocoa farming to finished cocoa products.

Be cautious about giving gifts

Gift-giving practices in business relationships can vary significantly across cultures, and it is essential to approach this aspect with caution when engaging with European buyers, particularly during the initial stages of establishing a professional relationship.

Once a solid business relationship has been developed and a foundation of trust has been built, small regional gifts or items representative of your company’s origin or culture can be appropriate gestures to strengthen ties and demonstrate appreciation. These gifts should be modest in value and presented in a professional manner, without any expectation of reciprocation or favouritism.

When presenting any gift, you must provide context and explain the cultural significance or regional connection behind the item. This adds value and meaning to the gesture, showcasing your appreciation for the business relationship and your desire to share a piece of your origin with your European partners.

Tips:

- Read more about the business etiquette of EU countries.

- Refer to CBI’s tips on organising cocoa exports to Europe to learn more terminology about logistics and contracting in cocoa.

- Be mindful of the gift policies and cultural sensitivities of the European company or individual you’re engaging with. If there is any uncertainty or potential for misinterpretation, better to be safe than sorry: refrain from gift-giving until a deeper understanding of the appropriate protocols has been established.

- Learn about unethical gifting with the corporate sector in some European countries.

2. Be professional in communicating with buyers

In general, Europe is characterised by more direct communication styles compared to many cocoa-producing regions. It is therefore important to be aware of cultural protocols, such as formality in greetings and the role of hierarchies in business dealings.

When approaching a potential European cocoa buyer or partner for the first time, you should adopt a formal and professional communication style. The cocoa trade in Europe tends to be relationship-driven, but initial interactions should be respectful and follow established business norms.

Ideally, the first contact with a buyer is in person, such as meeting in origin, at a trade show like the Amsterdam Cocoa Week - CHOCOA, ISM Cologne, World Cocoa Conference, CHOCOTEC or the Salon du Chocolat conference. These settings provide a great opportunity to establish a strong initial connection, discuss products in detail, and demonstrate commitment to quality and partnership.

Alternatively, you can also begin with an introductory email: start your outreach with proper due diligence, knowing what a buyer is looking for. Are they looking for specialty cocoa or single origin, or working more in the bulk markets? Knowing your customer is the starting point of any conversation. In the email, introduce yourself; your company; your cocoa offerings, such as varieties and certifications (e.g. Fairtrade, Organic, Rainforest Alliance); and your production and processing capabilities. Describe how your products create value for the buyer considering what they are looking for. Highlight your USPs such as exceptional quality, distinct flavour profiles, or sustainable production practices.

After providing the initial introduction, politely request an introductory call or video meeting to discuss potential partnerships in more detail. An initial call or meeting should focus on understanding your client. In this meeting, explore how you can be of service to your potential client. Also, propose attending major cocoa conferences or events, where you can arrange in-person meetings with European buyers. Be prepared to discuss your company’s capabilities, quality control measures, certifications, and commitment to sustainability and compliance.

You can phrase your request as follows:

“I would be delighted to arrange an introductory call or video meeting to discuss a potential partnership and answer any questions you may have about our cocoa offerings. Additionally, we plan to attend [Event Name, e.g. World Cocoa Conference] in [Date/Location], where I would welcome the opportunity to meet with you in person, share our cocoa samples, and explore how we can collaborate to meet your specific requirements.”

In building this relationship, demonstrate knowledge and control of your value chain, and answer emails and phone calls promptly.

One important thing to also note is that direct trade cocoa is becoming a growing trend within Europe, particularly in the specialty segment. This means building personal relationships with buyers can enhance direct trade of your cocoa. You can invite potential buyers for a visit to your producing region and offer them samples of micro lots. If an in-person visit is not possible, you can ask for a video conference call or virtual tour, where you can show them what you have to offer that meets what they’re looking for.

Figure 1: Example of a virtual tour offered by Maui Ku’ia Estate (Hawaii)

Source: Maui Ku’ia Estate Chocolate

At all meetings, maintain a professional yet warm tone in all communications. Promptly respond to inquiries and requests from potential buyers. Consistently emphasise your commitment to quality, sustainability and compliance with relevant European standards and regulations. This approach demonstrates reliability and builds trust, which is crucial for establishing long-term partnerships in the European cocoa market.

Avoid common misconceptions that hinder exporters within the cocoa sector

European cocoa buyers look for your values and adherence to quality, sustainability and business regulation in your own country. See our tips on going green, social responsibility and buyer requirements in the cocoa sector to learn more about how to meet the demand for these values. It is important to know this and comply with mandatory requirements, including the Regulation On deforestation-free products (EUDR), Corporate Sustainability Due Diligence Directive (CS3D) and food safety requirements for your cocoa export business. We provide more information about these in tip #9. However, many exporters have some misconceptions that can hinder their cocoa export business.

To gain a competitive edge, here are some common misconceptions to avoid:

- Assuming price is the primary factor. Price is not the primary factor driving purchasing decisions, especially in the premium and specialty cocoa segments. European buyers are willing to pay a premium for cocoa that meets their stringent quality standards, showcases unique flavour profiles, and aligns with their sustainability and ethical sourcing principles. While price is still a consideration, it is often secondary to quality when supplying specialty cocoa. Sustainability and the overall value proposition offered by the supplier are also key.

- Underestimating documentation requirements. Proper documentation of business certificates and on sourcing, quality control measures, certifications, and compliance with labour and environmental standards in your own country is expected from suppliers – not just verbal claims or assurances. European buyers require detailed product specifications, certifications (e.g. Fairtrade, Rainforest Alliance, Organic), traceability records and documentation demonstrating compliance with relevant regulations and standards. Transparent and well-documented supply chains are highly valued.

- Expecting quick results. Building trust and demonstrating reliability through consistent performance over an extended period is crucial for establishing successful long-term partnerships in the European cocoa market. Quick wins or one-off transactions are less valued than developing relationships based on consistently delivering high-quality products and services. European buyers often prioritise suppliers who have proven themselves reliable over time, as they value the stability and predictability of such partnerships.

- Overlooking cultural differences. Failure to adapt to the formal business cultures and communication styles prevalent in European markets can hinder the development of successful partnerships. Understanding and respecting these cultural differences is crucial for building strong relationships and fostering trust with European partners.

- Ignoring sustainability trends. Sustainability trends such as transparency, environmental responsibility and fair labour practices are becoming increasingly important for European buyers and consumers alike. European buyers are actively seeking suppliers who can demonstrate their commitment to sustainable and ethical practices throughout their supply chains. Certifications, third-party audits and comprehensive reporting on sustainability initiatives are often expected or preferred.

- Assuming that the superior quality of your cocoa would be immediately recognised and valued by European buyers. For example, Greenplanet, a cocoa exporter from Venezuela, had an unsuccessful first encounter with European buyers in Lisbon. Despite offering several containers of fine aroma Criollo cocoa, fermented to 90%, the buyer was only interested in regular, low-cost cocoa. This experience taught them a valuable lesson: they had mistakenly believed that all European cocoa buyers would be interested in and willing to pay a premium for high-quality, fine aroma cocoa like Criollo.

In reality, different European buyers have different needs and priorities. Some may be more focused on securing a reliable supply of regular, commercial-grade cocoa at the lowest possible cost, rather than seeking out premium, specialty cocoa varieties. It is important to keep an open communication with potential buyers. This will help identify buyers who specifically value and are willing to pay a premium for high-quality, fine aroma cocoa, as well as ensure alignment between your product and the buyer’s requirements

Tips:

- Visit the Harvard Business Review webpage for more tips for writing professional emails.

- Read this Journal of Agriculture and Food Research article to learn about the what, how, and why of cacao sourcing. The study provides a first step towards understanding the potential impact of transparency by investigating how craft chocolate makers define the concept.

- Read Silva’s Ultimate Sourcing Guide. This comprehensive guide will provide you with valuable insights into the processes and rationale behind Silva’s sourcing of some of the world’s finest cocoa beans. This will help you understand how cocoa buyers approach the sourcing process, and you will be better equipped to meet buyers’ demands holistically.

- Always be transparent and honest. The cocoa market is small, so negative experiences with suppliers travel fast. Be clear and open about your own track record, your supply capacities and your cocoa varieties.

- It is recommended to proactively and periodically obtain certificates of analysis for the cocoa beans you produce and export, preferably from an EU-accredited laboratory like Eurofins or Tüv.

3. Prepare well for and attend cocoa events and conferences

Attending cocoa events and conferences is an essential strategy for you to enhance your network, stay updated with industry advancements, and uncover new business partners and potential buyers. These events are crucial for learning and professional development. They provide a platform to build and maintain connections with industry peers and like-minded individuals. Moreover, conferences offer excellent venues to showcase your organisation and ideas, and work with others.

As the saying goes, ‘success is where preparation and opportunity meet’. This is particularly true when aiming to connect with potential buyers interested in your cocoa. Effective preparation involves thorough research and planning: define your objectives, outline what you want to achieve during the conference, identify attendees, and select sessions that align with your goals.

Just as athletes practice for competitions, you should treat the conference as your game time. Structure your attendance by creating a strategic plan. Review the conference website, examine (or request) the attendee list, and highlight individuals you wish to meet. Research the speakers and sessions to identify presentations most relevant to your business objectives. Schedule and prepare for meetings with key stakeholders in advance. During the bustling conference everyone is busy, making it challenging to catch people. However, being prepared helps you deliver your message efficiently, even with limited time or opportunities to speak with your targets.

Whether it is a virtual or in-person meeting;

- Engage with attendees before the event: Use social media and the event’s hashtag to create buzz and engage with potential attendees. If you plan to have a booth to showcase your cocoa offerings, send personalised invitations to key contacts to ensure they visit your booth.

- Bring essential materials such as samples of your cocoa varieties, properly packaged for evaluation. Include key cocoa data and your contact information on the label attached. A comprehensive documentation should include:

- Detailed product specifications (variety, origin, processing methods, quality scores, etc.).

- Certifications (e.g. Fairtrade, Organic, Rainforest Alliance).

- Traceability records and supply chain information.

- Compliance documentation (e.g. food safety, labour standards).

- Promotional materials or visual aids highlighting your capabilities, quality control measures, sustainability initiatives and unique value propositions. Ensure your promotional materials are updated and fit the objectives of your attendance. Prepare leaflets or a digital presentation of your organisation, including key data on your business, services and contact information.

- Create an attractive booth: Ensure your booth is visually appealing and professional. Avoid worn-out displays and invest in high-quality materials that reflect your brand’s image. Offer something unique to draw attention, such as a fun contest or a visually striking video presentation about your brand.

- Leverage testimonials and branding: Highlight testimonials from well-known brands and feature their logos prominently to create buzz and lend credibility to your cocoa offerings. Use these endorsements in your marketing materials to attract more visitors.

- Prepare your team: If you attend with your team members, be sure that you have a knowledgeable and friendly team that can engage with attendees and effectively represent your brand.

- Follow up: After the event, follow up with the contacts you made. Send personalised emails referencing your interactions at the event to keep the conversation going and turn leads into business opportunities.

Tips:

- Ensure you have no other work requirements. Plan yourself free. Don’t get distracted; it is expensive to attend and important to completely immerse yourself.

- Let people know you will be attending via your social media platforms and network; they might want to link up with you in advance.

- Prepare and plan at least three meetings before the conference; be specific on what you want to achieve.

- Prepare and bring a conference survival pack, including pens, a notebook, chargers, business cards and snacks – let nothing jeopardise effective conference attendance.

4. Provide good-quality samples with the right information

Offer to send interested buyers a sample of your product. This sample should represent the overall quality of your cocoa (known as representative samples). Your potential buyers will assess both the physical and sensory quality of your cocoa. If a buyer is interested in receiving a sample, agree on what kind of sample and the delivery date. Also, make agreements on quantities, packaging (example: it is quite common to send the samples in a simple plastic bag or Ziplock), labelling and accompanying documentation.

Regarding the documentation, samples are often sent together with a fact sheet providing information such as variety, altitude, soils, average rainfall, location, annual production by grade of cocoa, harvest season, harvest and post-harvest practices, warehousing, distance to port and shipping options. Samples include a label containing basic information, such as weight, moisture and ferment percentages, dates of collection, drying and entry into the warehouse, as shown in Table 3.

It is important to know your product offering and the characteristics of your sample. Greenplanet, a cocoa exporter from Venezuela, successfully maintains strong relationships with cocoa buyers, particularly in the bean-to-bar market, by investing in a portable laboratory where they conduct physical and chemical examinations of the cocoa in video conference calls with potential buyers. Following these live evaluations, they provide buyers with detailed technical data sheets and laboratory test results (see Table 3). They follow up by sending cocoa samples directly to buyers, allowing them to cross-check the phytosanitary information and quality claims. This approach, which combines virtual evaluations, detailed documentation and physical samples, has enabled Greenplanet to build trust and credibility with cocoa buyers in the competitive bean-to-bar market.

Table 3: Sample datasheet of Greenplanet

| Section | Attribute | Details |

| I. GENERAL CHARACTERISTICS | Product | Lake Maracaibo South (Sur del Lago de Maracaibo) cocoa beans |

| Botanical Name | Theobroma cacao, Creole, foreign and Trinidadian hybrid | |

| Plantation | 12 Ha. Traditional cultivation, hand-assisted, non-invasive chemical | |

| Location | Quebrada Blanca Sector, Top and Middle zones, Pan-American Highway | |

| Coordinates and Altitude above sea level | 8º42´32.84” N, 71º33´43.99” W, 130 mamsl | |

| Product Name | Cacao F1 beans fermented and dried in oak boxes | |

| Product description | Cocoa fermented in oak boxes with a 90% degree of fermentation, 0% defects | |

| Product | Cacao F1 beans fermented and dried in oak boxes | |

| II. PHYSICAL-CHEMICAL CHARACTERISTICS | Average size of the bean | Average length (Lp) = 2.5 cm |

| Average mass of the bean | Average mass (mp) = 2.5 g | |

| Detection of heavy metals (Cd) | 0.369 mg/kg (EU Max: 0.80 mg/kg) | |

| Microbiological Parameters | Absence of E. coli, Listeria monocytogenes, Salmonella, Enterobacteria, Staphylococci | |

| Form of Presentation | Dry whole grains with husk, unroasted, clean | |

| Humidity | +/- 7% | |

| pH | 5-5.4 | |

| Ultraviolet bath (UV) | Submitted to 6 sessions of 60 min | |

| Fats | 48.5-54.6% | |

| Sugars | Fructose: 4.77-11.72 mg/mg, Glucose: 1.79-3.87 mg/mg | |

| Polyphenols | Total polyphenols: 30.20-65.70 mg gallic acid/mg | |

| Fats | 48.5-54.6% | |

| III. PRESENTATION | Presentation | Identified 60 kg jute sacks (net weight) |

| Contents | Fine Fermented Aroma Cacao. COVENIN 442: 1995 | |

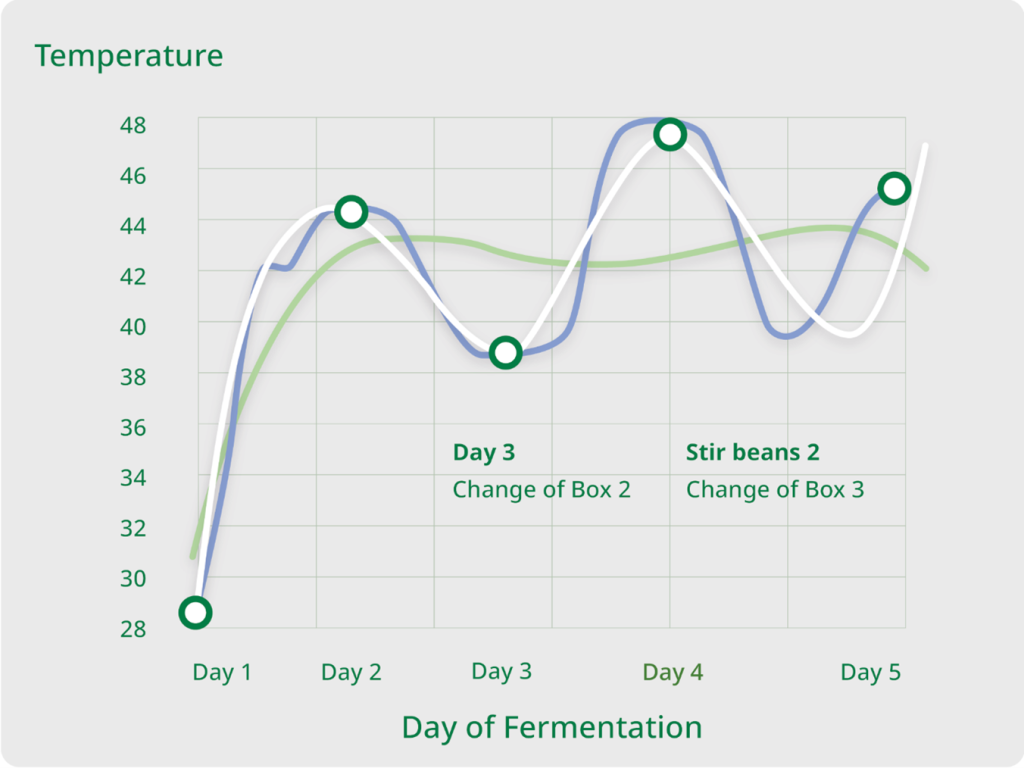

| IV. FERMENTATION CURVE | Fermentation curve details (see example in Figure 2) | Temperature monitored for 5 days, chemical processes described |

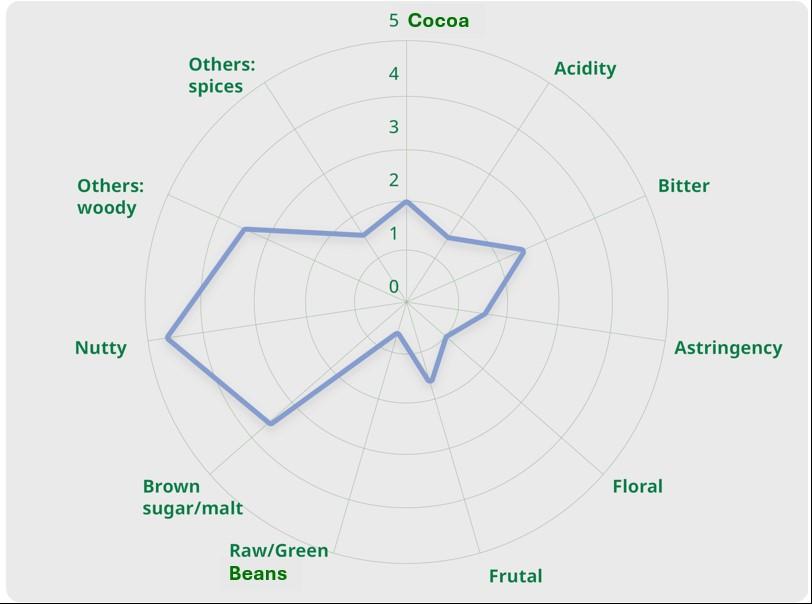

| V. SENSORY ANALYSIS | Sensory analysis details (see example in Figure 3) | Nutty and malt flavours prevalent, genetic dominance influences flavour |

Source: the Greenplanet Team

Figure 2: Example of fermentation curve

Source: the Greenplanet Team

Figure 3: Example of sensory analysis curve

Source: Jose Fuentes Bolivar of the Greenplanet Team

As a general rule, you should offer samples of about 1 kg. With this amount, interested buyers will have enough beans to conduct tests. Also, keep a 1-kg sample for yourself and document well which sample you send to which company. This is important to ensure consistency in testing and to track which beans were sent to each buyer for accurate follow-up and quality control.

When suppliers and buyers enter into direct trade relations, it is usually upon approval of a pre-shipment sample. Buyers tend to include the right of refusal on delivery (with the ‘replace clause’), meaning that a new pre-shipment sample has to be offered in place of the rejected one.

Tips:

- Always be honest and transparent about your samples and the quality of your cocoa. If you cannot match any particular aspect of the sample quality, tell the interested buyer as soon as possible.

- If you have lot sizes exceeding 1 tonne of cocoa, read the International Standards for the Assessment of Cocoa Quality and Flavour (ISCQF) and the Guide for the Assessment of Cacao Quality and Flavour.

- Send samples with a reliable courier by registered mail to ensure that your samples arrive in time and in good shape. This is relatively expensive, so make sure to budget for these necessary costs.

- Cooperatives and exporters who do have facilities to test samples should collaborate with local research institutions with quality testing facilities to help test samples and supply the necessary sample quality data to provide to potential cocoa bean buyers.

5. Follow-up, follow-up, follow-up

Following up is a crucial element for any business. It helps you strengthen your relationship with a potential buyer and may provide you with successful sales opportunities. Good communication and follow-up gives you a competitive advantage, as it shows you are a professional and reliable client to work with.

Tips:

- After a visit to a buyer’s office or a meeting at the trade fair, email the client to thank them for their time, adding some points of your conversation with the importer.

- After a shipment is received, provide after-sales service by asking if the product arrived in order and if there have been any responses from the importer’s clients regarding your product.

- Inform your current or potential clients of any newsworthy fact regarding your operations, whether it is new machinery, new staff, a General Assembly, or certification changes.

- Ask about the cupping results of your sample. If you do not get an answer, continue to ask for it until the buyer cups it and gives you a response. It is okay to insist in a polite way on feedback about your cocoa.

6. Be well informed about pricing strategies and providing quotes

Cocoa is a globally-traded commodity, and its prices are determined by supply-and-demand factors in these markets. As a cocoa farmer cooperative or cocoa exporter, it is crucial to keep a close eye on both the London and New York futures markets on the International Cocoa Organization’s ICCO website.

By keeping track of both these futures markets you can gain insights into the global cocoa price trends, which can help you hedge against price risks. It can also help you improve your selling strategies. If you are a farmer cooperative, it is critical to monitor market trends, such as changes in supply and demand, weather conditions and geopolitical factors. This knowledge can assist you in anticipating price fluctuations and making informed decisions about your production and marketing strategies accordingly.

Meanwhile, to set a selling price effectively, understanding your production costs is paramount. By calculating these costs and considering the desired margin, you empower yourself to make informed business choices regarding quantities, timing, and pricing strategies. It also helps you provide detailed information in your quotations. This cost, profit and selling price calculator from the Cyprus Agricultural Research Institute is a good tool to help you calculate your production costs.

The base price should typically include costs related to production, processing, packaging and transportation to the EU port. When preparing a quotation for exporting cocoa beans or semi-finished cocoa products to the EU, ensure clarity and transparency. Here are some tips to consider:

- Product descriptions: Use clear and concise descriptions of your cocoa products, highlighting their quality, origin, and any certifications they may have. Attachments such as product specifications or quality certificates can provide additional information.

- Price structure: While both gross and net prices are used in the cocoa industry, providing net prices (excluding taxes and other charges) may simplify the quotation process. Consider offering price scales per quantity to incentivise larger purchases, with discounts applied accordingly.

- Included in the price: Specify what is included in the quoted price, such as product packaging, shipping costs, and any applicable taxes or duties. Clearly outline any additional charges or fees the buyer may incur.

Table 4: An example of information to include in your quotation

| Company name | XXX Cocoa cooperative |

| Contact | XXX |

| Grade and variety of cocoa beans | Grade 1, Forastero |

| Quotation date | 1 June 2024 |

| Quotation valid until | 31 July 2024 |

| Quality |

|

| Origin | Venezuela |

| Price | US$ 4,500 per tonne |

| Terms | FOB (Puerto Cabello) |

| Weight | 200 jute bags / Net weight: 12,500 kg / Gross weight: 12,700 kg |

| Certifications | EU Organic, certified by ECOCERT (Attach a copy of valid certification) |

| Packaging | Jute bags of 60 kg net weight |

| Terms of payment | Net cash by SWIFT or TELEX transfer against documents |

| Delivery | Shipment May 2023 |

| Expiry date of the offer | This quotation is valid for 60 days |

Source: Amonarmah Consults

Specialty cocoa usually fetches higher prices than bulk cocoa, as chocolate makers are willing to pay a premium for good quality and a unique product. For specialty cocoa, the premiums paid can go as high as €500 to €5,000 per tonne (above the London or New York stock market values). Generally, prices are determined in relation to the quality, uniqueness, scarcity and origin of the particular cocoa.

Margins in the cocoa sector can vary based on factors such as product quality, market demand and negotiation strategies. For instance, higher-quality cocoa commands better prices, allowing for more favourable margins. Also, when demand is strong, margins can improve due to higher selling prices. Effective negotiation skills can impact the final margin achieved.

Tips:

- If you export large quantities, consider hedging against falling prices to protect yourself from risks due to market price fluctuations. Hedging is a trading operation that allows a trader to turn a less acceptable risk into a more acceptable one. Learn about the cocoa supply chain and financial hedging.

- Learn about critical operating costs to consider if you process cocoa beans into semi-finished cocoa products before you export.

- Learn more about how to best organise your cocoa bean export to Europe by reading CBI’s study on tips for organising your cocoa export to Europe.

- Do not default on a contract in order to deliver the goods to a different buyer offering a better price. This can have a significant impact on your reputation as an exporter in the market and will jeopardise future business opportunities. Always meet contractual and financial requirements as agreed upon with your buyer.

7. Emphasise your unique selling points

The best way to attract a buyer’s attention is by setting yourself apart from your competition. To do so, you need to define your differentiating factor, your unique selling point. When you have found your USP, actively promote it. Storytelling is very important, as both buyers and consumers love the story behind a product.

One aspect that plays a big role in the cocoa sector is origin. It is therefore a good idea to invest in online marketing to share the story of the origin of your cocoa beans. For example, build a website or create an Instagram account where you tell your buyers all about the uniqueness of your cocoa varieties, the history of your farm and the terroir (soil) where your farm is situated. Give your story a face by providing good-quality photos of the farmers, their families (ask for authorisation!) and the plantations.

Ingemann (Nicaragua) is a good example of a cocoa company that communicates this message well. Its website includes information about all aspects of production, cocoa varieties and producing communities. Also check out the websites of Kokoa Kamili (Tanzania), Xoco Gourmet (Honduras) and Balmed (Sierra Leone).

Cocoa traders and chocolate makers will also use your stories in their own communication, for instance to help market their products to consumers. It is increasingly important for them to sell their chocolates to consumers as an experience.

A compelling storytelling can be a powerful tool for you to effectively communicate your USPs to European buyers. Here are some strategies to leverage compelling storytelling:

- Sustainability Journey:

- Share the journey of your cooperative’s or farm’s transition to sustainable practices, highlighting the overcome challenges and the positive impact on the environment and local communities.

- Showcase specific initiatives, such as reforestation efforts, water conservation measures, or the adoption of renewable energy sources.

- Highlight the social impact of your sustainability efforts, such as improved livelihoods for smallholder farmers, gender equality programmes and community development projects.

2. Quality Obsession:

- Tell the story of the meticulous care and attention to detail that goes into every step of the production process, from cherry selection to processing and cupping.

- Describe the unique microclimate, terroir and soil characteristics that contribute to the distinctive flavour profile of your cocoa.

- Share anecdotes or interviews with experienced farmers or cocoa experts who have dedicated their lives to perfecting the art of cocoa cultivation and processing.

3. Cultural Heritage and Traditions:

- Delve into the rich history and traditions behind your cocoa’s origins, showcasing the ancestral knowledge and practices that have been passed down through generations.

- Highlight the unique indigenous varieties or heirloom cultivars that you grow and their significance in preserving biodiversity and cultural heritage.

- Share stories of the local communities involved in cocoa production, their customs, and the deep-rooted connection between cocoa and their way of life.

4. Personal Narratives:

- Introduce the faces behind your cocoa, sharing the personal stories and motivations of individual farmers, cooperative members, or family members involved in the business.

- Highlight the challenges they have overcome, their passion for cocoa, and their commitment to producing exceptional quality while preserving their traditions.

- Feature interviews or quotes from these individuals, allowing their authentic voices to resonate with buyers seeking a deeper connection to the source of their cocoa.

Giving regular updates about your cocoa farm and/or cocoa products on social media also serves to strengthen your position. You could use X, Facebook, LinkedIn, YouTube or Instagram to share your story. Note that you can also connect your social media pages to your own website. Buyers use these online platforms regularly, as do consumers.

Tips:

- Investigate whether you qualify for industry awards like the International Cocoa Awards (Cacao of Excellence). This can be an interesting way to brand yourself on the European market for specialty cocoa.

- Websites can be simple but need to be accurate, relevant and up-to-date. Always include company information, product data and contact details.

- Read The Ultimate Guide to Marketing Your Rainforest Alliance Certified Product to learn how to communicate your sustainability story.

- Utilise social media platforms and a dedicated website to disseminate your message effectively. You can also bring your story to life and make short videos to display your efforts. Enhance visibility by participating in trade fairs and events, showcasing your sustainability initiatives.

8. Consistency is key

European buyers are looking for suppliers who can provide a continuous supply of high-quality cocoa in steady volumes. This means you need to ensure that you can meet the quality (and volume) requirements your buyer is asking for. Remember to only make promises you can fulfil.

Regularly inform your buyers on the status of their orders, as well as your expected volume availability. If you have any problems meeting certain quality requirements or volumes, discuss this with your buyers in advance. Do not wait until the last minute to share bad news. Give yourself and your buyer enough time to work out a suitable solution.

When considering the quality of your cocoa beans, map all your processes linked to your pre-harvest, harvest, post-harvest, processing and storage methods. Also consider specific agro-climatic conditions around the cocoa production area. Producing high-quality cocoa beans requires good trees (genetics), good agricultural practices, harvesting the right beans at the right time, dedicated fermenting and drying, good storage and adequate transportation.

When it comes to post-harvest handling specifically, European chocolate manufacturers and chocolate makers are looking for suppliers that can guarantee good-quality fermentation and drying protocols. Some European chocolate companies are experimenting with these techniques themselves, and may be willing to involve you in this part of product development. Communicating that you are open to change and willing to invest time in additional processing to meet their specific requirements can give you a competitive advantage.

Tips:

- For more information about quality requirements and standards, see the CBI study on European buyer requirements in the cocoa sector.

- Refer to industry guidelines such as Cocoa Beans: A Guide to Chocolate & Cocoa Industry Quality Requirements to learn more about the factors determining the quality of cocoa beans and how to address them.

- Consider inviting buyers to visit your farm, and discuss trying out new post-harvest techniques. Work together to test the fermentation process, drying techniques and other types of processing.

9. Comply with mandatory sustainability and traceability requirements

In recent years, European buyers have increasingly enhanced their sustainability requirements. They expect you to have food quality and safety management systems implemented to demonstrate your ability to control potential food safety risks. This ensures that your cocoa is safe for human consumption. If you are unable to comply with these sustainability requirements, it will be very difficult for you to access the European cocoa market.

For example, the European Green Deal (EGD) aims to make Europe climate-neutral by 2050, impacting trade and imports by enforcing stricter sustainability standards, particularly for export companies from developing countries. One focus area is the Farm to Fork Strategy.

Additionally, the EGD includes the Biodiversity Strategy for 2030, with measures like the EUDR. The EUDR also restricts importation of cocoa products from lands acquired forcibly from local and/or indigenous communities, or whose cultivation involves labour and human rights abuses. Importers who fail to comply with EUDR could face fines of up to 4% of their net profit in any EU member state.

There is also a social and economic sustainability strategy, the Corporate Sustainability Due Diligence Directive (CS3D), which has recently been approved by the European Council. The CS3D is compulsory for all companies in the EU and companies outside Europe that sell products or services in EU countries. It tackles mainly the social and economic concerns of sustainability. Companies must take steps to find and prevent any harmful impacts their business and supply chains may have on people and the environment.

These requirements aim to make cooperatives or exporters and buyers themselves more responsible in ensuring the provision of traceable cocoa to chocolate consumers. As such, if you manage a farm or belong to an association or cooperative of smallholdings, it is very important to show the degree of control that you have over the production. Implementing a traceability system in your supply chain will give you a competitive advantage in the EU market and build trustworthy relationships with European buyers. Be transparent and protect the origin of your cocoa bean supplies. This means you will have to keep batches separate along the chain and document their identity by developing an identity preservation (IP) system.

Buyers also value certification for social and ecological sustainability. The main certification schemes in the cocoa sector are Rainforest Alliance, Fairtrade and Organic. Be sure to check your potential buyer’s website to find out what their expectations are, and talk to them directly about this – especially if you have questions about how to comply with requirements. Many larger European companies publish their own sustainability claims and policies on their websites. This is a good indicator of what you can expect. For example, Mondelēz has set its own standard for cocoa called Cocoa Life.

Tips:

- Find more about mandatory and traceability requirements and the actions needed to enable adherence by reading CBI’s study What requirements must cocoa meet to be allowed on the European market?.

- For more information about certification standards on sustainability and/or social responsibility and their importance in various European countries, check CBI’s fact sheet about exporting certified cocoa to Europe.

- Refer to the ISO Standards for sustainable and traceable cocoa to learn more about traceability standards.

- Refer to CBI’s tips on going digital in the cocoa sector to learn more about how digitalisation can enable you to implement a traceability system for your business.

10. Leverage industry support

There are several government agencies and non-governmental organisations (NGOs) that offer valuable support and resources to facilitate export growth of your cocoa business. These bodies provide assistance in areas such as market intelligence, trade promotion, capacity-building and access to finance. They aim at supporting exporters from developing countries successfully navigate the European market and adhere to its requirements for sustainable and ethical trade practices. Working and being part of such initiatives and entities can help you gain access to training, investments and other resources.

Being familiar with them, utilising their resources (e.g. information on their websites), attending their webinars or contacting them directly with your questions can enhance your chances of doing business with European buyers. Knowledge gains from their resources can help you ensure compliance with environmental and social standards, which are increasingly important criteria for European buyers.

For instance, CBI (Centre for the Promotion of Imports from developing countries) is known for providing export coaching programmes and market intelligence, and promoting sustainable trade between developing countries and Europe.

Other important agencies and NGOs for the cocoa sector:

- Swiss Import Promotion Programme (SIPPO), Switzerland: SIPPO focuses on promoting sustainable trade and economic development in developing countries. They offer training, coaching and consultancy services to help businesses comply with European standards, improve production processes and access new markets.

- Import Promotion Desk (IPD), Germany: The IPD is a joint initiative of the German Federal Ministry for Economic Cooperation and Development (BMZ) and the Federation of German Wholesale, Foreign Trade and Services (BGA). They offer training and coaching programmes to help businesses from developing countries meet European market requirements and access distribution channels.

- International Trade Centre (ITC), Switzerland: The ITC is a joint agency of the World Trade Organization and the United Nations, focusing on promoting sustainable economic development and trade in developing countries. They offer a range of services, including market analysis, trade facilitation and capacity-building.

- Open Trade Gate Sweden (OTGS), Sweden, officially known as Kommerskollegium: OTGS is a Swedish government agency that supports sustainable trade and economic development in developing countries. They offer training programmes, market intelligence and networking opportunities to help businesses access the European market.

- Africrops!, Uganda: Africrops! is an NGO that works to improve the livelihoods of smallholder farmers in Africa, including cocoa producers. They offer training, technical assistance and access to certification programmes to help farmers improve their production practices, meet international standards and access premium markets.

- Solidaridad: An international NGO that works towards sustainable supply chains, including cocoa, through certification, training and capacity-building programmes.

- Fairtrade International: A leading organisation that promotes fair trade practices and provides certification for cocoa and other agricultural products.

- Rainforest Alliance: A non-profit organisation that certifies sustainable agricultural practices, including cocoa production, and provides training and support to farmers.

Tips:

- Leverage the expertise of government agencies and NGOs to gain market insights, access training opportunities and establish connections with potential buyers.

- Participate in trade fairs, exhibitions and buyer-seller meetings organised by these agencies to showcase your products and network with European buyers.

- Seek assistance in obtaining relevant certifications, such as Fairtrade, Organic or Rainforest Alliance, as these certifications are highly valued by European buyers.

- Utilise the market intelligence and export coaching services provided by these agencies to develop effective marketing strategies and improve your export readiness.

To conclude, refer to CBI’s studies on tips for finding European cocoa buyers and tips for organising your cocoa export to Europe. These studies provide detailed information to clearly define your product offer and preferred target market, and give you strategies to find buyers and properly export your coffee to buyers in the European market.

Amonarmah Consults conducted this study in partnership with Molgo Research and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research