Entering the French market for cocoa

The French cocoa market is largely dominated by multinational corporations. However, the growth of the speciality cocoa market has created opportunities for more high-end suppliers who sell their products in niche markets. This trend allows suppliers who sell smaller volumes and higher-quality products to enter the market and encourages more personal relationships between suppliers and buyers. Producers and exporters of speciality and/or certified cocoa beans have the best opportunities to sell directly to high-end cocoa importers or chocolate makers.

Contents of this page

- What requirements and certifications must cocoa meet to be allowed on the French market?

- Through which channels can you get cocoa on the French market?

- What is the most interesting channel for you?

- What competition do you face on the French cocoa market?

- What are the prices of cocoa on the French market?

1. What requirements and certifications must cocoa meet to be allowed on the French market?

To export cocoa to France, you must comply with strict European Union (EU) requirements. For a detailed overview of these standards, read the CBI study Buyer requirements for cocoa or check the EU Trade Helpdesk for specific cocoa regulations.

Buyer requirements can be divided into three categories:

- Mandatory requirements: legal and non-legal requirements you must meet to enter the market.

- Additional requirements: standards you must meet to stay competitive.

- Niche requirements: applicable to specific niche markets.

The key requirements are given below, specified for the French market where relevant.

What are the mandatory requirements?

Legal and quality requirements

You must comply with the EU’s legal requirements for cocoa. These mainly apply to food safety and hygiene. The legal limits for food contaminants are related to this. The most common requirements concern pesticides, mycotoxins, Polycyclic-aromatic hydrocarbons (PAHs), microbiological contamination such as Salmonella, and heavy metals such as cadmium.

To access the French market, your cocoa beans must also meet your buyer’s quality standards. These are particularly high for fine-flavour cocoa beans.

You can find more details about legal and quality requirements in the CBI study Buyer requirements for cocoa in Europe.

Labelling and packaging requirements

Cocoa beans exported to France must follow the EU’s general food labelling guidelines. For organic cocoa, the label should also contain the name and code of the inspection body, as well as the certification number.

Figure 1: An example of cocoa bean labelling

Source: Chocolate Cortés

Cocoa beans are traditionally shipped in jute bags, weighing between 60 and 65 kilograms. In the mainstream market, bulk shipments of cocoa beans are the most common. This involves loading cocoa beans directly into the ship’s cargo hold or into shipping containers fitted with a flexi-bag (see Figure 2). This mega bulk method is mainly used by larger cocoa traders and processors who handle low-end and middle-range cocoa beans. The French ports of le Havre and Rouen (part of HAROPA) can receive cocoa in bulk carriers and in containers.

In the specialty cocoa segment, jute bags are still widely used. For very high-quality micro lots, vacuum-sealed GrainPro packaging is also an option.

Figure 2: Examples of packaging for cocoa: jute bag, container-sized flexi bag and GrainPro

Sources: Osu.edu, Bls.bulk.com and GrainPro

In France, chocolate must have a dry-matter cocoa content of more than 35%, of which at least 18% must be cocoa butter. Products with a lower content are not considered chocolate. The cocoa content must be shown on the packaging. This is important for exporters of chocolate products to France.

Since 2023, companies must also name the country of origin of the cocoa powder when it is packaged in France. This provides consumers with more information about the origin of the cocoa that they consume. For exporters, it is important to include the name of the country of origin on any cocoa powder shipments as well.

Due diligence requirements

Buyers in France must also comply with EU regulations. While this is often not the responsibility of the exporter, it is important to provide your buyers with the information that they need to comply.

In 2017, France became the first country to have a social and environmental due diligence law. The Duty of Vigilance law means that companies must identify risks and prevent serious harm to human rights, health and safety and the environment in their supply chain. The thresholds are high (5,000 employees for companies established in France and 10,000 employees for foreign companies operating in France).

This law contributed to the development of the Corporate Sustainability Due Diligence Directive (CSDDD). The CSDDD makes sure that companies identify and handle any negative human rights and environmental impacts of their actions. The CSDDD entered into force in 2024 and companies must start complying in 2027.

The CSDDD brings the Duty of Vigilance law more in line with international standards. The thresholds for company size are also lower, at 1000 employees and €450 million turnover worldwide for EU companies and €450 million turnover in the EU for non-EU companies. However, it still only applies to large companies and small and medium-sized enterprises (SMEs) are not included. France will adopt the Directive into national law by 26 July 2026.

Another important regulation is the EU Regulation on Deforestation-free Products (EUDR). The EUDR promotes the consumption of ‘deforestation-free’ products and aims to reduce the EU’s impact on global deforestation and forest degradation. In December 2024, the European Union postponed the implementation of the EUDR by a year, to 30 December 2025. Micro and small enterprises have an additional six months to comply.

Each EU country has an authority that carries out EUDR checks. In France, there is a joint authority between the Ministry of Ecological Transition and Territorial Cohesion and the Ministry of Agriculture and Food Sovereignty. The organisation and the departments responsible for doing the checks have been announced in 2024. The French government has published a detailed description of the requirements in English and French.

Payment and delivery terms

Payment and delivery terms may be different depending on the exporting and importing countries. The EU’s website Access2Markets provides the necessary information on tariffs, taxes, requirements, trade barriers and more. On this website, you can search for the relevant taxes and tariffs for exporting cocoa from your country to France.

The relevant taxes and tariffs for cocoa beans, cocoa paste, cocoa butter and cocoa powder from the main export countries are shown in the table below.

Table 1: French taxes and tariffs for cocoa beans and cocoa products for key import countries (2024)

| Beans (1801) | Paste (1803) | Butter (1804) | Powder (1805) | |

| Ghana | 0% tariffs 5.5% VAT* | 9.6% third country duty 0% tariff preference 5.5% VAT | 7.7% third country duty 0% tariff preference 5.5% VAT | 8.0% third country duty 0% tariff preference 5.5% VAT |

| Ivory Coast | 0% tariffs 5.5% VAT | 9.6% third country duty 0% tariff preference 5.5% VAT | 7.7% third country duty 0% tariff preference 5.5% VAT | 8.0% third country duty 0% tariff preference 5.5% VAT |

| Ecuador | 0% tariffs 5.5% VAT | 9.6% third country duty 0% tariff preference 5.5% VAT | 7.7% third country duty 0% tariff preference 5.5% VAT | 8.0% third country duty 0% tariff preference 5.5% VAT |

| Cameroon | 0% tariffs 5.5% VAT | 9.6% third country duty 0% tariff preference 5.5% VAT | 7.7% third country duty 0% tariff preference 5.5% VAT | 8.0% third country duty 0% tariff preference 5.5% VAT |

| Madagascar | 0% tariffs 5.5% VAT | 9.6% third country duty 0% tariff preference 5.5% VAT | 7.7% third country duty 0% tariff preference 5.5% VAT | 8.0% third country duty 0% tariff preference 5.5% VAT |

Source: Access2Markets 2024. *VAT stands for value-added tax.

What additional requirements and certifications do buyers often have?

Buyers in France often request additional food safety guarantees. Certification organisations often include GLOBAL G.A.P. in their standards. A quality management system (QMS) like HACCP could be required for cocoa bean storage and handling. For semi-finished cocoa products, buyers may expect certificates like IFS, FSSC 22000 or BRCGS. IFS is a joint initiative of the French retail association FCD and the German retail association HDE.

What are the requirements for niche markets?

Corporate responsibility and sustainability are becoming increasingly important in the French cocoa sector. It has become essential to adopt codes of conduct or sustainability policies related to environmental and social impacts. Leading companies in the French chocolate market, such as Cémoi and Valrhona, have sustainability policies that focus on their relationship with farmers, transparency in their operations, as well as their social and environmental impact at origin.

Certification can help you access the French market

As a producer or exporter, being part of a certification programme or corporate sustainability programme can help you access the French market. The most common sustainability standards on the French market are Rainforest Alliance, Fairtrade International, SPP (Small Producers’ Symbol) and Fair for Life.

Certification standards like Rainforest Alliance are important in the mainstream chocolate market. In 2023, 95 traders, cocoa processors and chocolate manufacturers operating in France were Rainforest Alliance certified. This was an increase from 81 in 2022. Import volumes increased by 19%, from 166,000 tonnes in 2022 to 198,000 tonnes in 2023. This represented 15% of all global Rainforest Alliance cocoa sales in 2023, making France a major player in certified cocoa imports.

See the CBI study Exporting certified cocoa to Europe for more information.

Organic is popular in France

To sell cocoa as organic in the French and European market, it must comply with the regulations of the European Union for organic production and labelling. EU Organic is the minimum legislative requirement for marketing organic cocoa in the European Union. The EU passed a new regulation on organic products in 2021. The changes are analysed in BASIC’s Cost & Benefit Analysis of the EU and US Regulatory Changes for Organic Production.

Certificates of Inspection (COIs) must be issued by control authorities before the cocoa is shipped. Without a COI, your product cannot be sold as organic in the EU and will be marketed as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

There is no mandatory national organic label in France. However, there is a widely used and recognised national organic logo. This is the AB mark, which is owned by the French Ministry for Agriculture and Food.

Équitable & Bio is a combined organic and Fairtrade label from France. Products must be organic according to EU laws and comply with the FiABLE standard. The label means that the product contains at least 50% Fairtrade ingredients from one or more “biopartnerships”, including Fair For Life, Fairtrade Max Havelaar, the World Fairtrade Organization and others. An example of a “biopartner” chocolate brand is Kaoka.

Before you can market your cocoa beans as certified, an accredited certifier must audit your growing and processing facilities. Examples of accredited certifiers are Control Union, Ecocert, FLOCERT (for Fairtrade International), ProCert and SGS.

Supplier may ask for compliance with their Code of Conduct

Many cocoa suppliers and chocolate manufacturers have a Supplier Code of Conduct. Examples for French companies include the Cémoi Code of Conduct, the Sucden Code of Conduct and Touton PACT standard for cocoa suppliers. These supplier codes include different topics. They can involve human rights and environmental protection. Make sure that you comply with the right Supplier Code of Conduct to get access to the French market through these manufacturers.

Tips:

- See the CBI studies Tips on how to become EUDR compliant in cocoa and Tips on how to become more socially responsible in the cocoa sector for more details about laws and regulations. For the detailed buyer requirements, read the CBI study Buyer requirements for cocoa in Europe.

- Take a look at the EU’s website Access2Markets. This website provides all the trade information you need to know, including tariffs, taxes, procedures, requirements, rules of origin, export measures, statistics, trade barriers and more. Enter the product code (e.g. 180100 for cocoa beans), origin country and destination country to search for the relevant details for your country.

- Visit the EUR-Lex website for detailed information about the regulations concerning cocoa products.

- Consider combining audits if you have more than one certification. This can save time and money. Also, explore the possibilities for group certification with other producers and exporters in your region.

- Find out which standards or certifications potential buyers prefer. Buyers may prefer a certain food safety management system or sustainability label, depending on their end clients and/or distribution channels.

2. Through which channels can you get cocoa on the French market?

Cocoa and cocoa products are used for processing in four different industries: confectionery, food, cosmetics and pharmaceutical. This study focuses only on the confectionery industry, as this is the main segment for cocoa. This industry mainly processes cocoa liquor and butter into chocolate products, such as bars, candy bars and bonbons.

How is the end-market segmented?

The confectionery industry can be segmented according to the quality of the end products. For cocoa beans, the end products mainly consist of candy bars and chocolate bars. In France, chocolate bars accounted for over 36% of total chocolate sales volumes in 2021. The chocolate confectionery market in France was valued at €3.3 billion in 2021, with sales volumes reaching 348,000 tonnes.

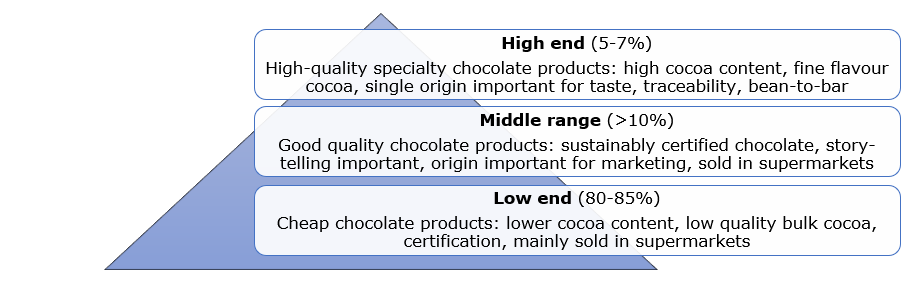

Figure 3: Segmentation of the chocolate market based on quality

Source: ProFound – Advisers In Development

Low end: the low-end segment offers chocolate products with lower cocoa content at lower prices. These products are typically produced by large chocolate manufacturers, using bulk cocoa primarily sourced from West Africa (Forastero variety). Bulk cocoa is known for its high production volumes, low value and standard quality. Rainforest Alliance is often used to certify low-end products.

Low-end chocolate products are usually mass-market products of big brands and lower-quality private label products from supermarkets. Almost 70% of all chocolate is sold through supermarkets. In 2024, private label brands held a 34% market share in French supermarkets. The largest retailers in France are:

- E. Leclerc (24% market share in 2024)

- Carrefour (20%)

- Les Mousquetaires (17%)

- Groupement U (12%)

- Auchan Retail (9%)

- Lidl (8%)

- Casino (3%)

Some examples of low-end brands in French supermarkets are shown below, including the consumer price.

Table 2: Examples of low-end brands in French supermarkets

| Product | Retail price (€) | Price (€/kg) | |

| Lower end | Carrefour CLASSIC dark chocolate extra (3 tablets of 100 grams each) | 2.45 | 8.17 |

| Carrefour CLASSIC milk chocolate extra (3 tablets of 100 grams each) | 2.89 | 9.63 | |

| Poulain (extra dark chocolate, 200 grams) | 1.95 | 9.75 |

Source: Carrefour retail prices 2024

Middle range: the middle-range segment includes chocolate products of good quality, which are commonly certified. Storytelling and the origin of the cocoa beans are important in this segment, mainly for marketing purposes.

Middle-range products are mainly sold through supermarkets. They are typically positioned in the high-quality category. Supermarkets also increasingly offer their own premium private label chocolate products. An example in France is the premium chocolate line from Carrefour Selection. These products have similar quality and characteristics as branded products but are usually sold at lower prices.

The table below gives some examples of middle-range chocolate brands and their retail prices (based on Carrefour retail prices in 2024):

Table 3: Examples of middle-range brands in French supermarkets

| Product | Retail price (€) | Price (€/kg) | |

| Middle range | Carrefour Selection (dark chocolate, Tanzania, 85%, 80 grams) | 1.09 | 13.62 |

| Alter Eco (organic, fair trade chocolate, Peru, 75%, 100 grams) | 2.55 | 25.50 | |

| Ethiquable (organic, fair trade chocolate, Ivory Coast, 74%, 100 grams) | 2.79 | 27.90 | |

| Le Petit Carré (dark chocolate, Tanzania, 75%, 90 grams) | 3.95 | 43.89 |

Source: Carrefour retail prices 2024

High end: smaller, more specialised chocolate makers produce high-end chocolate products, mainly using fine flavour cocoa (usually Criollo and Trinitario varieties). These products are characterised by a high cocoa content. Single-origin cocoa beans are important and are valued for their taste, traceability and the story of the cocoa. Bean-to-bar is one of the categories of the high-end chocolate market, with French brands such as Bernachon and François Pralus.

High-end products are mainly sold at chocolate events and in specialty shops. In France, well-known speciality shops include Choco Latitudes, La Balade Gourmande and Kosak Chocolat. There are many French high-end chocolate makers. The website of the Fine Cacao and Chocolate Institute has a good list with examples of chocolate makers working with high-quality cocoa. Some examples and an indication of consumer prices for high-end chocolate products are given below (based on data from their websites):

Table 4: Examples of high-end brands on the French market

| Product | Retail price (€) | Price (€/kg) | |

| High end | A. Morin (dark chocolate, Nicaragua, 70%, 100 grams) | 7.50 | 75.00 |

| Bouga Cacao (dark chocolate, Ecuador, 70%, 70 grams) | 3.85 | 55.00 | |

| Chocolat Bonnat (dark chocolate, Mexico, 75%, 100 grams) | 11.50 | 115.00 |

Source: company websites 2024

Tips:

- Learn more about the promotion of standard-quality and speciality chocolate by mainstream French supermarkets such as Carrefour. Compare their product assortment and price levels with specialised stores such as Natureva Store.

- Refer to the CBI study Trends in the cocoa sector to learn more about developments across various market segments.

- Monitor end-consumer prices of chocolate to get an idea of price ranges. Good sources for price information are the websites of supermarket chains and chocolate specialty stores.

Through which channels does cocoa end up on the end-market?

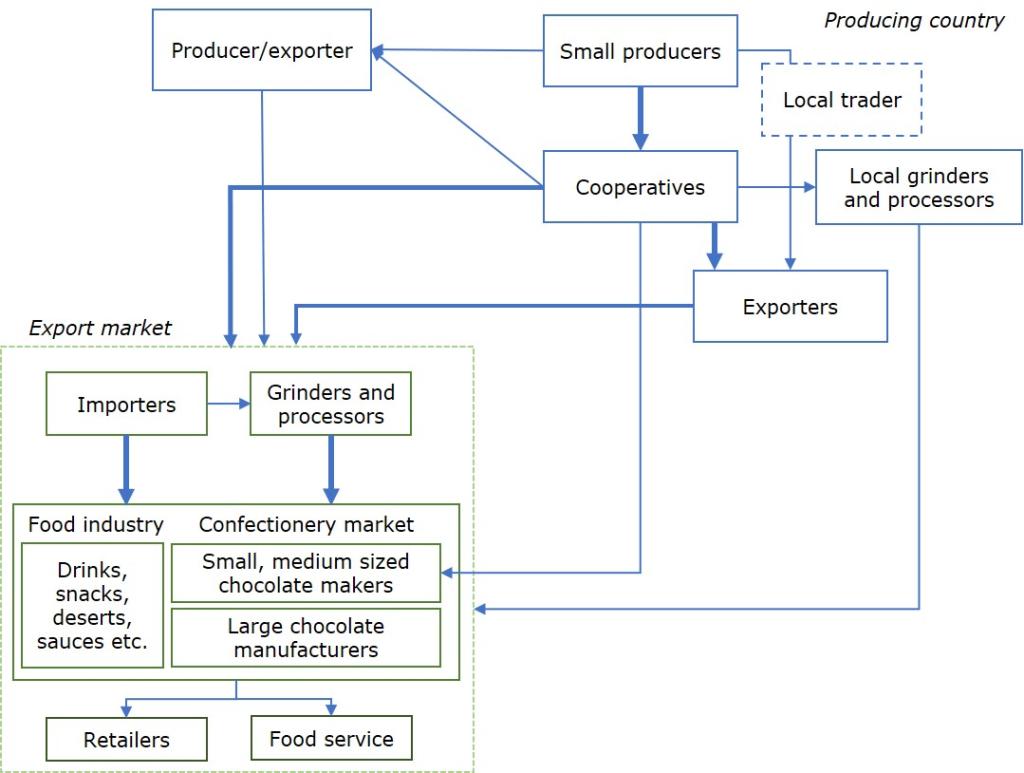

As an exporter, you can use different channels to bring your cocoa to the French market, depending on the quality and quantity of your supply.

The European market is moving towards shorter supply chains. This means retailers and cocoa-processing companies are increasingly sourcing their cocoa beans directly from producers. The figure below shows you the most important channels for cocoa beans in France.

Figure 4: The main channels for export of cocoa to France

Source: ProFound – Advisers In Development

Cocoa bean processors/grinders import large volumes

Large processors/grinders source their cocoa beans directly from producing countries. They process the raw material into cocoa mass, cocoa butter and/or cocoa powder. They then distribute these products to the confectionery, food, cosmetics and pharmaceutical industries in Europe. Some cocoa processors also make final products for the retail or food service sector.

Examples of cocoa bean processors and grinders in France are Barry Callebaut and Cargill. Barry Callebaut processes 115,000 tonnes of chocolate per year at the Meulan-Hardricourt factory. Cargill processes 40,000 tonnes of beans per year in a factory near the port of Rouen. Chocolate manufacturers Cémoi, Ferrero, Lindt & Sprüngli, Mars, Mondelēz and Nestlé also have processing facilities in France.

Importers work with exporters

Importers of bulk cocoa beans normally handle large quantities and maintain direct relationships with exporters in producing countries. In most cases, importers have long-standing partnerships with their suppliers. Importers either sell the cocoa beans to companies in France or re-export them to other European buyers. However, most cocoa beans remain in France for further processing.

Examples of large cocoa bean and derivative importers that are active in France include RockWinds, Sucden, Trading & Services SAS and Touton. Touton also has processing facilities in Ghana. Barry Callebaut, Cargill and Cémoi also import cocoa beans directly.

Importers in the specialty segment usually handle smaller quantities and often work directly with producers and producer cooperatives. Examples of specialty trading companies in France focused on specific organic and/or fair trade markets are Éthiquable, Alter Eco, Kaoka and Artisans du Monde. These companies work with cooperatives in producing countries and sell chocolate products under their own label in France and Europe.

Specialised importers could also be interested in value-added cocoa products processed in the country of origin or even in finished products like chocolate. For more information, see the CBI studies Exporting semi-finished cocoa products to Europe and Exporting chocolate to Europe.

Large (private label) chocolate manufacturers work with preferred suppliers

The largest industrial chocolate manufacturer worldwide is Barry Callebaut, which also has production and grinding facilities in France. Ferrero is the market leader for chocolate products in France. Other large chocolate manufacturers are Mars, Mondelez, Nestlé, Lindt & Sprüngli, Cémoi and Valrhona.

Private label manufacturers also offer opportunities for cocoa exporters. Private labels are becoming more popular across Europe. The market share of private labels in France is about 31% of the entire market. Examples of chocolate manufacturers that also produce for the private label market in France are Cémoi, Chocolaterie de Bourgogne and Chocmod. Selling to these companies is interesting if you have large volumes of cocoa beans of a standard quality.

For exporters, it is important to know that these brands work with preferred suppliers. Important factors are stable and reliable quality and supply. It could be difficult for SME exporters to enter the French market through these multinational brands without a preferred supplier. It is helpful to sell your products via these preferred suppliers.

Small chocolate makers have direct relationships

Especially in the specialty and fine flavour segment, cocoa beans are increasingly traded directly from farmers (or farmers’ associations and cooperatives) to chocolate makers. Although direct trade is growing, it still represents a very small share of the overall cocoa market. Not all chocolate makers can sustain direct trade and all the responsibilities that are usually outsourced to traders, such as logistics, documentation and pre-financing.

Direct trade can also be facilitated by an importer, who acts as a service provider and contact point in the transactions between the producer and the chocolate maker. Importers can ensure traceability and communicate the story of the cocoa beans accurately along the chain.

The French chocolate sector includes nearly 100 SMEs and around 400 artisan chocolatiers and confectioners. Many of these have joined the Confederation of Chocolate and Confectioners of France. Examples of specialised chocolate makers include Michel Cluizel, Grain de Sail and Le Cacaotier.

Intermediaries/agents can be helpful

Agents act as intermediaries between cocoa exporters, cocoa importers and chocolate makers. Some agents are independent, while others are contracted to procure cocoa beans on behalf of a company. An agent has the knowledge to evaluate and select interesting buyers for you. An example of an agent in France is Commodities Connexion.

If you have limited experience exporting to European countries, agents can play an important role. Agents are especially helpful if you have small volumes of non-specialty cocoa or if you lack the financial and logistical resources to trade cocoa. Working with an agent is also useful if you need a trusted and reputable partner within the cocoa sector. Intermediaries usually charge a commission for their services.

Tips:

- It is important to know the strengths and weaknesses of your business. This can help you find buyers in France. Make sure that you know the quality and profile of your cocoa, the available supply, delivery terms, sustainability aspects and compliance data. For more tips on finding the right buyer for you, see the CBI study Tips to find buyers on the European cocoa market.

- If you produce cocoa according to a certification scheme, find a specialised French buyer who is familiar with certified products. Search the FLOCERT customer database and the Rainforest Alliance database for member companies in France. Find French importers that specialise in organic products through the Organic-bio website. Use the filters to select “chocolate” and “France”. The Commerce Équitable France website has more information on certification in France.

- Attend trade fairs in Europe to meet potential buyers. Interesting trade fairs include Salon du Chocolat (France), Chocoa (Netherlands) and Biofach (Germany, for organic products). Participating in these events can give you more insight into the preferences of French buyers, for example on origin, flavour and sustainability certification. By understanding the market better, you can better match your product with buyer demands and requirements.

3. What is the most interesting channel for you?

The most interesting channels for exporters are the large cocoa bean processors and grinders, importers and small chocolate makers.

Cocoa bean processors/grinders

If you are an exporter of large volumes of bulk cocoa beans, your main trading partners will probably be cocoa grinders and/or processors. These companies buy high volumes of standard quality cocoa and usually have cocoa-buying stations in producing countries. This allows you to sell your cocoa beans directly to them.

Importers

If you are an exporter of large high volumes of bulk cocoa beans from producers or cooperatives, large importing companies can be a good way to enter the French market. If you are selling bulk cocoa, check with your buyer about their demand for certified cocoa. Many specialised importers prefer working directly with producers and/or cooperatives rather than going through intermediaries.

The best option for farmers or farmers’ cooperatives who produce specialty or certified cocoa is to sell cocoa beans directly to specialised cocoa importers. If you are an exporter who sells high-quality cocoa beans to an importer, it could be interesting to try linking up directly with high-end chocolate makers. This is an interesting option for exporters that have the financial capacity and expertise to access the market directly.

Small chocolate makers

Targeting specialty chocolate makers directly is recommended for producers and exporters that deal with specialty cocoa beans. This approach requires financial resources and expertise to organise export logistics.

Tips:

- Check the websites of industry network organisations to find buyers in France. The Syndicat du Chocolat is a member organisation including nearly 60 cocoa and chocolate companies, representing 85% of the sector. See their members page to learn more about which companies are active in France. The Confederation of Chocolate and Confectioners of France is an organisation of chocolate artisans with members across France.

- Build long-term relationships. Whether you are working with an importer or directly with a chocolate maker, it is important to establish a strategic and sustainable relationship with them. This will help you manage market risks, improve the quality of your product and reach a fair quality/price balance. For more guidance, read the CBI study Doing business with European cocoa buyers.

4. What competition do you face on the French cocoa market?

Most French cocoa bean imports come from the Ivory Coast and Ghana. They represent 89% of all imports from producing countries. France also imports bulk cocoa from Cameroon. Sources of key fine-flavour cocoa and organic cocoa are Ecuador and Madagascar.

Which countries and companies are you competing with?

There is a lot of competition in the bulk cocoa market, with low added value. This segment is dominated by suppliers and cooperatives that can deliver large quantities at competitive prices. It is difficult for small and medium-sized companies to compete in this segment. Rivalry is less intense in the specialty cocoa market. This segment has a stronger focus on quality, taste and sustainability.

French cocoa processors depend on West African supplies. In 2023, France imported 34,000 tonnes from the Ivory Coast and 40,000 tonnes from Ghana. This represented 89% of all bean imports from producing countries. Other import countries to France with at least 1,000 tonnes were Ecuador, Cameroon and Madagascar. No other country exported more than 1,000 tonnes of beans to France in 2023.

Source: Eurostat, 2024

France also imports cocoa paste and cocoa butter from producing countries. France imported 31% of its cocoa paste and 33% of its cocoa butter from producing countries in 2023. The main origins for cocoa paste were the Ivory Coast (82% of imports from producing countries), Cameroon (11%) and Ghana (6%). For cocoa butter, the top three origins were the Ivory Coast (39%), Cameroon (22%) and Ghana (21%). Only 4% of cocoa powder imports came from producing countries (almost entirely from Malaysia).

Imports of cocoa butter from producing countries has increased by 4% per year, from 55,000 tonnes to 61,000 tonnes. Cocoa paste imports have stayed relatively stable, decreasing from 54,000 tonnes in 2019 to 53,000 tonnes in 2023.

Source: Eurostat, 2024

This study will look at Ghana, the Ivory Coast, Ecuador, Cameroon and Madagascar as the most important source for cocoa beans, and Malaysia as a large source for cocoa derivatives.

Ivory Coast has been the largest supplier historically

The Ivory Coast has historically been the largest supplier of cocoa beans to France. After imports from the Ivory Coast increased every year between 2019 and 2022, they decreased significantly from 56,000 tonnes in 2022 to 34,000 tonnes in 2023. This decrease was largely due to a decrease in production in the Ivory Coast. With low production expected for the 2024-2025 harvest as well, imports from the Ivory Coast are expected to remain lower in the short-term.

France is an important export market for cocoa paste and cocoa butter from the Ivory Coast. 18% of the Ivory Coast’s cocoa paste and cocoa butter exports are shipped to France, compared to only 4% of its cocoa bean exports.

The Ivory Coast has well-established cocoa supply chains. The export market in producing countries is dominated by multinationals. In the Ivory Coast, 10 companies handle two-thirds of all exports, including the local exporter S3C. Multinational processing companies such as Olam and Cargill have a strong presence. They are closely linked to small cocoa producers and cooperatives.

The presence of these multinationals has been a driving force behind the growing cocoa-grinding industry. The Ivory Coast was the world’s largest cocoa grinder in 2022-2023, with 793,000 tonnes, representing 16% of global grindings. Between 2019-2020 and 2023-2024, the Ivory Coast grinding volume grew by 1% per year. By increasing grinding at the origin, cocoa-producing countries aim to add value to their exports and protect their economies from the volatility of the global cocoa market. Nevertheless, most grinders at origin are owned by multinationals such as Cargill, Olam and Barry Callebaut. For exporters, this means that these companies are the main competitors and buyers of your cocoa.

A significant portion of cocoa produced in the Ivory Coast is Rainforest Alliance or Fairtrade certified. This is a common market entry requirement for large manufacturers and retailers operating in mainstream markets. In 2023, the Ivory Coast produced 1,526,000 tonnes of Rainforest Alliance certified cocoa, representing 68% of the country’s total output of 2,241,000 tonnes in 2022-2023. The Ivory Coast is also the largest origin for Fairtrade cocoa. About 505,000 tonnes of the Ivory Coast’s cocoa production was Fairtrade certified in 2022.

Despite these voluntary certification efforts, there are widespread sustainability issues in the cocoa sector. For instance, cocoa farming has been identified as a main driver of deforestation, which contributes to climate change and a loss of biodiversity. To address this, industry players, donors and the governments of Ghana and the Ivory Coast launched the Cocoa and Forests Initiative. In addition, child labour in both countries is still a big problem, with an estimated 1.5 million children still working in the cocoa fields of Ghana and the Ivory Coast.

To tackle farmer poverty, the governments of Ghana and the Ivory Coast implemented a fixed ‘Living Income Differential’ (LID) of US $400 per tonne on all their cocoa sales, applicable from the 2020/21 crop.

Ghana passed Ivory Coast as the largest bean supplier in 2023

Imports from Ghana have stayed relatively stable and, on average, increased by less than 1% per year since 2019. However, production is expected to decline significantly in 2023-2025. This will likely also impact French imports of cocoa beans from Ghana. There could be a decline in imports in 2024.

Exports are dominated by multinational companies such as Cargill, Barry Callebaut, Touton and Olam. The fourth-largest exporting company is Niche Cocoa, which is a Ghanese exporter. Barry Callebaut and Cargill were the largest exporters to France in 2019.

France is an important export market for cocoa paste and cocoa butter from Ghana. France is the destination for 6% of Ghana’s cocoa paste exports and 25% of its cocoa butter exports.

Ghana’s cocoa grinding industry processed an estimated 250,000 tonnes in 2022-2023, which was around 5% of global cocoa grindings. Ghana’s grinding volume then decreased by 10% per year, mainly due to an estimated 70,000 tonne decrease from 2022-2023 to 2023-2024.

Cameroon plays a much smaller role in French imports

Cameroon supplied about 1,700 tonnes of cocoa beans directly to France in 2023. This represents about 2% of total cocoa bean imports by France. Exports decreased by 3% between 2019 and 2023.

Cargill and Olam export 84% of all cocoa beans, and Barry Callebaut represents 89% of all cocoa processing. An example of a local company in Cameroon is Nealiko.

Production volumes in Cameroon grew by 1% per year between 2018-2019 and 2022-2023. The Cameroonian government and cocoa producer associations have launched programmes to improve nationwide post-harvest techniques to improve cocoa quality. Cameroon is recognised as a fine flavour origin by the ICCO, but the percentage of fine flavour production has not been determined.

About 130,000 of the 290,000 tonnes produced in Cameroon were Rainforest Alliance certified in 2023.

Ecuador is the main cocoa supplier from Latin America

Latin America plays a significant role in French imports of cocoa beans, but in much smaller volumes when compared to West Africa. Latin American countries are known for their high shares of fine flavour cocoa in total production, as well as for the production of organic cocoa. In 2021, about 38% of the total organic cocoa area was in Latin America.

Ecuador is the largest supplier from Latin America, with 3,000 tonnes in 2023. Exports have remained stable between 2019 and 2023, at around 2,900 to 3,100 per year. Ecuador was the world’s third-largest cocoa producer in 2023-2024. As much as 75% of Ecuador’s cocoa exports can be considered fine flavour, which makes it the world’s largest fine flavour cocoa producer. Ecuador strongly promotes the origin of its cocoa beans. This is important, as chocolate products with cocoa origin claims attract a 51% higher retail price and are more attractive in online retail.

Ecuador has been affected heavily by the European Union regulation limiting cadmium levels in cocoa products. Cadmium contamination is high in some cocoa-growing regions in Ecuador, which has already led buyers to source from alternative origins.

An example of an exporter in Ecuador is EXPOAGMARSA. It exports cocoa beans, cocoa butter, cocoa powder and other cocoa products.

Madagascar is an important direct cocoa supplier to France

Madagascar is the fifth-largest cocoa bean exporter to France. Madagascar exported about 1,150 tonnes of cocoa beans to France in 2023. This volume decreased by 8% per year between 2019 and 2023. In 2023, Madagascar accounted for less than 1% of total French imports, so the volumes are small compared to the top two exporting countries.

However, this is also because Madagascar is a small cocoa origin country. In 2022-2023, Madagascar produced 20,000 tonnes of cocoa. France is an important buyer of cocoa from Madagascar. France is the third largest European export country for Madagascar, after the Netherlands and Belgium.

Source: Eurostat and Trademap, 2024

A large share of these exports is likely fine flavour and/or organic cocoa. According to ICCO, 100% of cocoa exports from Madagascar can be classified as fine flavour cocoa. About 47% of the cocoa bean harvesting area in Madagascar was organic certified in 2021, covering 5,800 hectares. This is not a large area compared to other African countries. Sierra Leone, the Democratic Republic of Congo, Ghana, Tanzania, Uganda and Sâo Tomé and Principe have a larger area of organic-certified cocoa.

Malaysia is a key supplier of cocoa butter and powder

Malaysia is a key supplier of cocoa butter and cocoa powder. In 2023, France imported 7,400 tonnes of cocoa butter and 1,400 tonnes of cocoa powder from Malaysia. For cocoa powder, this represents 90% of all France’s cocoa powder imports from producing countries.

However, most of the cocoa beans for these products were not harvested in Malaysia, but imported from other countries. In 2023, Malaysia produced 270 tonnes of cocoa beans, while importing 533,000 tonnes of cocoa beans. Malaysia is an important hub for the cocoa trade and for cocoa processing. Malaysia imports cocoa mainly from the Ivory Coast, Ecuador, Ghana, Nigeria and Indonesia. Almost all cocoa beans are processed before they are exported. Key exporters are Guan Chong Cocoa and JB Cocoa. Malaysia is therefore a key competitor for exporters of cocoa butter and cocoa powder.

Tips:

- Identify your competitors. Actively promote your company on your website and at trade fairs. Read the CBI study How to do business with European cocoa buyers to find more tips on how to market your cocoa.

- Explore support programmes to improve your crop and crop productivity. Refer to your national Ministry of Agriculture and other local programmes. Also, check if there are local support programmes in your region managed by the Food and Agriculture Organization (FAO), the International Finance Corporation (IFC), the World Agroforestry Centre (ICRAF) or other organisations. The France Development Agency has also provided funding for cocoa projects.

5. What are the prices of cocoa on the French market?

Prices depend on several factors, including the supply chain and specific characteristics of the cocoa. Certification, such as organic or Fairtrade certification, can also influence the pricing. The price of cocoa on the French market is not publicly available.

Trade and retail prices are not directly linked. On average, farmers receive only about 7% of the added value from cocoa sales. In general, cocoa bean export prices and the share kept by cocoa producers depend on the cocoa bean quality, the size of the lot and the supplier’s relationship with the buyer. The largest profits typically go to chocolate manufacturers and retailers.

Source: Le BASIC

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research