Entering the Italian market for coffee

Italy represents a huge market for commercial coffee. This is mainly non-certified commercial coffee. The markets for premium and specialty coffee are still very small. This means that the main differentiator for supplying to the Italian market is based on price. Sustainability requirements are, however, becoming more important. Most of these demands come from European Union legislation.

Contents of this page

1. What requirements and certification must coffee comply with to be allowed on the Italian market?

Exporting to Italy comes with many requirements. These requirements are set by the European Union (EU), the Italian government or by companies themselves. They can be divided into:

- Mandatory requirements.

- Additional company requirements to maximise success in the market.

- Requirements for niche markets.

The mandatory requirements, additional requirements and the requirements for niche markets are described below. Most requirements are the same for all European markets. While we provide a short overview of all requirements, this section focuses more on the requirements that are specific to the Italian market. For a more extensive and generic description, read our report on requirements for the European coffee market.

Mandatory requirements

Requirements on food safety and hygiene

Any exporter must follow the European Union legal requirements applicable to coffee. These rules mainly deal with food safety. The food safety and hygiene requirements are the same for Italy as for other European Union countries. Special attention should be given to pesticides and fungi. Examples of pesticides are dichlorodiphenyltrichloroethane (DDT) and endosulfan.

You can find more information on the website of the Ministry of Agriculture, Food and Forestry and the website of the Ministry of Health. Typically, your importer will know which hygiene criteria you have to comply with and report on.

Tip:

- Use your browser (for instance Google Chrome) or an AI translation to auto-translate the information offered on Italian websites.

Quality requirements

In general, to determine the quality of coffee, green and roasted coffee undergoes a physical evaluation assessment. Roasted coffee undergoes a sensory evaluation assessment.

Evaluation Assessment of green coffee

Green coffee is first graded and classified for quality before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s heritage standards are often used as a point of reference. However, most producing countries have and use their own system for grading and classifying green coffee.

Grading and classification are usually based on the following criteria:

- Altitude and region.

- Botanical variety.

- Processing method — wet/washed, dry/natural, honey, pulped naturals.

- Screen size (Note: screen size is important to ensure uniform roasting which improves the quality of the final product).

- Number of defects or imperfections.

- Bean density.

- Cup quality.

Italian buyers will also perform a green coffee assessment. This includes a screen-size evaluation assessment, defect count and an assessment of bean colour, appearance and smell. This is followed by a moisture check and water activity analysis. Sample roasting is then performed to assess the quality and uniformity of the green coffee.

The process of quality assessment is equal for all types of beans. The exact criteria will, however, differ. This means, for example, that both high-end and low-end coffee beans are checked for bean density (mass divided by volume). For high-end coffees, a higher bean density will, however, be required.

Sensory assessment: coffee cupping

Coffee is also assessed and scored by a method called cupping. Buyers will use different protocols and standards to conduct a sensory assessment. However, the SCA recommends protocols and best practices for cupping coffee. The most widely used cupping tool is the SCA’s Coffee Taster's Flavour Wheel. The quality attributes assessed include: flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes.

The Coffee Quality Institute (CQI) and the cupping protocols of the Specialty Coffee Association (SCA) consider that coffees graded and cupped with scores below 80 are considered standard quality and not specialty. The CQI and SCA set the leading standards in the sector. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Some buyers consider 80 too low and demand a cupping score of 85 or higher. The Italian specialty coffee segment is still very small.

If you export specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, adding this information to the documentation of the coffee that you are exporting can add value. It is very important to be aware of the quality of your coffees, either through local cupping experts or by becoming a cupping expert yourself. This allows you to understand the value of your coffee when negotiating price with potential buyers.

Trade tariffs

When exporting green coffee, no trade tariffs apply. This also applies to decaffeinated green coffee. The standard duty applicable to roasted coffee imports is 7.5%. The duty for decaffeinated roasted coffee is 9%. These duties vary from country to country. They depend on whether your country has a contract with the European Union or not. Note that the importer is responsible for paying the trade tariff, not you as an exporter.

Labelling requirements

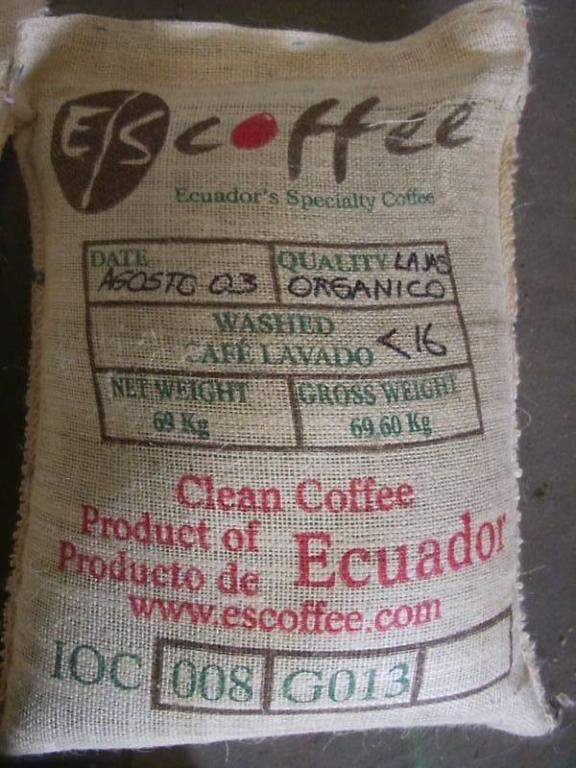

Labels of green coffee exported to Italy should be written in English and should include the following information to ensure the traceability of individual batches:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Examples of green coffee labelling

Source: Escoffee

Payment conditions

Italian payment terms do not differ from buyers in other countries. Payment is generally required within 30 or 45 days. It is crucial to look carefully at these terms. Some Italian buyers will even work with 360-day payment terms.

Italian buyers pay the same prices as buyers from other European companies for the same product. They will therefore pay neither more nor less than buyers from other countries. Note, however, that Italian buyers prefer low-priced Arabicas and Robustas.

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Some specialty coffee suppliers also use other materials inside jute bags. Examples are GrainPro and Videplast. These materials have added value over traditional packaging. They preserve bean quality, prevent post-harvest loss, reduce solid waste, reduce farmer’s net carbon footprint and facilitate chemical-free storage. Note that these innovative materials are mostly used for the high-end and upper-end segments. These segments are very small in Italy. You can read more about these segments in our paragraph How is the end-to-end market segmented?

Most green coffee beans of standard quality imported into Italy are packed in container-sized bulk flexi-bags. These hold roughly 20 tonnes of green coffee beans each. The rest of the green coffee is transported in traditional 60 kg or 70 kg jute sacks. Each container holds a net volume of 17 tonnes to 19 tonnes of coffee. Although the 60kg bag is the most common, some countries use bags weighing 46kg, 50kg, 69kg or 70kg.

Other packaging for transporting coffee includes:

- Polypropylene super sacks for 1 tonne of coffee.

- Polyethylene liners for 21.6 tonnes.

- Vacuum-packed coffee.

These techniques increase efficiency and maintain and preserve quality.

Figure 2: Examples of coffee packing from left to right: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Tips:

- For the full buyer requirements, read the CBI study on buyer requirements for coffee in Europe.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009. Use the search tool to find the Codes containing information on Ochratoxin A and select your preferred language.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Find out more about delivery and payment terms for your green coffee exports by reading our study Organising your coffee exports to Europe.

Sustainability requirements

The main (mandatory) sustainability requirements are derived from the European Green Deal and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal focusses on environmental sustainability. The CSDDD aims at improving social sustainability. Both apply to EU-based companies and their supply chains.

The CSDDD will increase the requirements for traceability and human rights

Under the new CSDDD regulations, corporations must improve their sustainability performance across their global supply chains and prevent damaging effects on human rights and the environment. Businesses are required to take the following actions:

1. Integrating due diligence into their policies.

2. Identifying actual or potential adverse impacts.

3. Preventing and mitigating potential adverse impacts. Bringing actual adverse impacts to an end and minimising their effect.

4. Establishing and maintaining a complaints procedure.

5. Monitoring the effectiveness of their due diligence policy and measures.

6. Publicly communicating on due diligence.

As the directive applies to the supply chain, the directive forces your buyers to ask for proof that you act in a socially sustainable manner. The CSDDD is anticipated to come into force around 2025-2026.

The European Green Deal will create many sustainability requirements in the future

The European Green Deal (EGD) is the European Union’s (EU) response to the global climate emergency. The EGD is a package of policies that define Europe’s strategy to reach net zero emissions and become a resource-efficient economy by 2050.

One of the laws resulting from the Green Deal is the EU Deforestation Regulation (EUDR). This is undoubtedly the legislative measure exerting the most influence on the European coffee industry. This regulation became effective in June 2023. Roasters and traders have been given a timeframe of 18 months to implement the new rules (31 December 2024), with micro and small enterprises granted an additional six months. This law makes traceability and technology crucial for exports to the EU market. This will have implications for the coffee-producing industry. The EU provides an information sheet addressing frequently asked questions about this topic.

As a cooperative, you must be able to demonstrate that your coffee is not produced on deforested or degraded land. Certification can be one of the tools to help prove that your company complies with the EUDR. This may involve certification schemes with strict environmental criteria promoting sustainable farming practices. Examples are Organic and Rainforest Alliance certification.

This regulation came into force in mid-2023. Companies will have 18 months to meet the new rules. This means that they have to comply by 31 December 2024. European micro- and small enterprises have six more months to comply with the standards. Watch our webinar on meeting European sustainability requirements in the cocoa sector for more information on complying with these standards. Although the webinar is developed for the cocoa sector, the requirements are the same.

Italian public procurement must include sustainability issues

Italian governmental organisations must address sustainability in their procurement process. This includes schools, universities and military and healthcare organisations. For some products, Italian governmental organisations are only allowed to source sustainably. For coffee, however, governmental organisations only need to apply it to their criteria for additional points. Your chances of winning a tender are therefore better if you can prove that your offer adheres to a sustainability standard.

You can find more information on the Fairtrade Italy website.

Tips:

- Increase your traceability. European sustainability requirements will become ever stricter. You can only provide proof of your sustainable behaviour if you know where your coffee comes from. Depending on market interest, certification could be an interesting tool to improve this.

- If you are unsure about any requirements, consult your buyer.

- Read more about the European Green Deal.

- Read more in our CBI coffee studies about tips to go green or about tips to become socially responsible.

Additional company requirements

Corporate responsibility and sustainability are gaining more attention and importance in the Italian coffee sector. Many Italian coffee companies have their own sustainability requirements. These can be derived from their sustainability goals and will change their procurement demands over time.

- For example, Lavazza launched the "Roadmap to Zero" initiative. It aims to achieve zero carbon impact for the entire group by 2030. This initiative began in 2020-2021 with an investment of around €50 million.

- Segafredo Zanetti aims to make their packaging 100% recyclable. One of their subsidiaries, Meira, wants to achieve carbon neutrality by 2030. It also aims to produce with an 80% recycling rate.

- In 2019, Illy became the first Italian coffee company to obtain B Corp certification. This certification is awarded to organisations that meet the highest standards of social and environmental performance. This includes optimising their impact on employees, communities and the environment. It also ensures animal welfare and high-quality standards for ingredients used in products.

Supplying more sustainable coffee can offer you better access to the Italian market. If not now, it prepares you for future demands by Italian buyers.

Tips:

- Refer to the International Trade Centre (ITC) Standards Map or the Global Food Safety Initiative (GFSi) website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Draft a written plan for your food safety controls. Review and update your plan whenever change occurs in your business operations, or at least every other year.

- Find out which standards or certifications potential buyers prefer in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label. This depends on their end-clients and distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this Excel form by the Sustainable Agriculture Initiative (SAI) Platform to assess your farm’s sustainability performance.

Certification is not a main requirement for many Italian buyers. This varies, however, depending on the market channel. Most certified coffee is sold via supermarkets. Most Italian coffee houses mainly focus on price. This is driven by Italian culture. According to Italians, coffee should be cheap. The unwritten rule is that an espresso shouldn’t cost more than €1 in a café. This impacts the possibility of buying certified coffee, which is generally more expensive. The market share of certified coffee in the out-of-home market is therefore very low, even though the demand has been rising in recent years. This is partly driven by increased exports and higher incomes in Northern Italy.

There are some exceptions to this rule. Some international coffee chains in Italy have much higher prices. The main example here is Starbucks. After many international coffee chains failed to establish themselves in Italy, Starbucks finally succeeded. Although price is still a big issue, many Italians appreciate Starbucks. A factor contributing to their success is their diverse offering and Italian atmosphere. Starbucks has its own verification scheme called C.A.F.E. Practices. Since most C.A.F.E. Practices-certified coffee is sold as such, it may be rewarding to become C.A.F.E. Practices-certified and supply to Starbucks. You can find more information on their requirements on the Starbucks website.

The northern part of Italy is richer than the southern part. Consumers in the North therefore have more money to spend on certified coffee. Certified coffee is, however, still an exception in northern independent cafés. Some examples include:

- Alps-coffee is a Fairtrade-certified roaster. They mostly focus on the Italian out-of-home market, but also export to Austria and Germany.

- Costadoro, based in Turin, roasts Fairtrade-certified coffee. They have a few stores for consumers but also supply other cafés in the region. The company exports some of its products to Monaco and France.

Common certifications preferred within the Italian niche coffee market include:

- Organic: To market your coffee as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Regulation (EC) 2018/848 sets down rules on organic production and labelling. Regulation (EC) 1235/2008 describes the implementing rules of EU legislation for imports of organic products from third countries.

- Rainforest Alliance: Rainforest Alliance is most in demand among Italian buyers, especially in retail.

- The combination of Fairtrade and Organic is the only common form of multi-certification. According to Fairtrade, 65% of all Italian Fairtrade coffee is also sold as Organic. This share is higher for Arabicas (67%) than for Robustas (54%).

Requirements for organic coffee

Exporting organic coffee comes with extra requirements. To market your coffee as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Regulation (EC) 2018/848 sets down organic production and labelling rules. Regulation (EC) 1235/2008 describes the implementing rules of the EU legislation for imports of organic products from third countries.

Organic coffee is checked at the EU border. To import organic coffee to the European Union, the delivery needs to include an electronic certificate of inspection (e-COI). The certificate should be set up in the Trade Control and Expert System (TRACES). It must be signed by a control authority in your country before the shipment leaves the country.

Requirements for high-end specialty coffee

The high-end specialty coffee segment is characterised by:

- High cupping scores (usually 84+ or sometimes 80+).

- Innovative processes (such as natural and honey-processing).

- Direct trade relations.

- High transparency and traceability from source to consumer.

This means that these coffee buyers may ask for requirements beyond certification.

Besides high quality, these buyers are interested in stories about the product's origin. Examples include details of your coffee farm, the coffee growers, how and where you grow your coffee, and your processing facilities. This means that you should know the specifics of your coffee, from soil management to cup, from variety to processing, from external suppliers to farmers, and you must be willing to share these honestly. Other than that, direct trade can result in more frequent coffee farm visits and product assessments by your buyers, as well as long-term business relationships.

Find an example of how storytelling is used in the Italian specialty coffee market on the Nero Scuro website.

Tips:

- Learn more about organic farming and European organic guidelines on the European Commission website and the OrganicExportInfo website. Also, familiarise yourself with the range of organisations and initiatives that can offer technical support to help you convert to organic farming. Start your search by learning about the organic movement in your own country and inquire about support programmes or existing initiatives. Refer to the database of affiliates of IFOAM Organics Europe to search for organic organisations in your country.

- Find importers that specialise in organic products on the website Organic-bio.

- Try to visit trade fairs for organic products, such as Anuga in Italy. Check out their website for a list of exhibitors, seminars and other events at this trade fair.

- Use this cost calculator to estimate what costs would be involved for your organisation to become Fairtrade-certified. Also, ask for quotations from different certifiers before you decide which one you want to work with. Ask for timelines and an estimate of how many days would be charged. Always discuss potential certification with your buyers before you make any investment or decision.

- Try to combine audits in case you have more than one certification to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

2. Through what channels can you get coffee on the Italian market?

Most coffee in Italy is sold via supermarkets. Cafés however are still accountable for a large market share, especially in comparison to Northern and Western European countries. Most coffee flows via a diversity of value chain actors to the consumer. Due to the rise of ecommerce and marketplaces, the supply chain has become shorter in some cases.

How is the end-to-end market segmented?

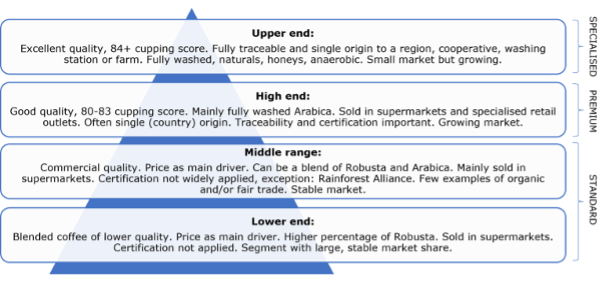

The Italian end-market for coffee can be divided into four segments: the lower end, middle end, high end and upper end.

Figure 3: Coffee end-market segmentation

Source: Profound

The lower end and middle end markets are by far the largest in Italy. These segments are very large compared to other European countries. Especially in the out-of-home market, price is vital. This is largely determined by culture. The Italian market also offers limited possibilities for sustainability. Normally, this comes at a higher price.

The lower end is growing

The market share of retail discounters is growing. In 2016, they accounted for 18.3 million kilograms sold in Italy. This was 7.3% of all roasted coffee consumed. In 2020, the retail discount share, with 22.2 million kilograms, equalled 10.2%. Note that E-commerce, coffee consumed in the office and HoReCa (hotels, restaurants and catering) are not taken into account here.

The middle end market is declining

The large-scale retail coffee trade, excluding discounters, equalled 105 million kilograms in 2016, and 101.4 million kilograms in 2020. Note that E-commerce, coffee consumed at the office and HoReCa (hotels, restaurants and catering) are not taken into account here.

The premium market is growing

There were particularly positive trends for some premium types such as Decaffeinated Coffee (+13.7% growth in 2020), 100% Arabica Coffee (+17.3% growth in 2020) and Single-Origin Coffee (+35.1% growth in 2020). The only exception among higher-value products is the Organic segment, which grew to a lesser extent compared to non-organic alternatives.

The upper end is very small, but promising

There are no numbers available about the specialty coffee at-home market. Italy only hosted 79 specialty coffee cafés, out of over 50 thousand cafés. This is less than 0.2% of all cafés. You can find more information in our study on the Italian market potential for coffee.

Through what channels does coffee end up on the end-market?

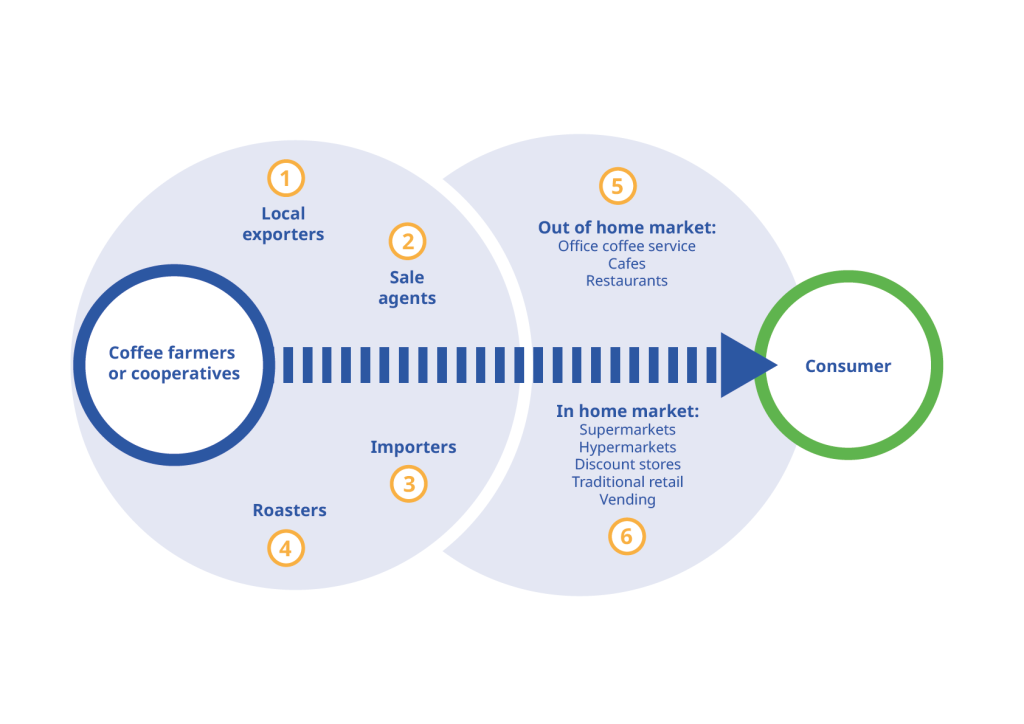

The Italian supply chain consists of many actors. These actors are mentioned in figure 4. Most coffee flows through all actors of the chain. Options to penetrate the Italian market more directly are, however, emerging.

Figure 4: The Italian coffee supply chain

Source: various, design by Bart Wortel

Supermarkets are the main distribution channel. Supermarkets are followed by ‘traditional retail, coffee stores and sales online’.

Source: Beverfood, 2022

Note that sales via ‘HoReCa and catering’ and ‘vending and office coffee service (OCS)’ has seen a huge decline in 2020 due to the COVID-19 pandemic. Both channels have partly recovered in 2021.

Importers have large roles in the supply chain

Importers play a vital role in the coffee market. They function as supply chain managers. They maintain wide portfolios from various origins, pre-finance operations, perform quality control, manage price fluctuations and establish contact between producers and end-buyers such as roasters. In most cases, importers have long-standing relationships with their suppliers and customers.

Green coffee beans mainly enter Italy via the Port of Genoa and the Port of Trieste. Most green coffee traders in Italy are located near these ports. In general, importers either sell the green beans to roasting companies in Italy or re-export them to other European buyers.

Large-scale importers usually have minimum quantity requirements. This starts at around ten containers. These cover a wide range of qualities, varieties and certifications. At the same time, they provide strong support in logistics, marketing and financial operations. Examples of large importers in Italy include Garbin Coffee Trade, Interkom and Alkaff.

Specialised importers are able to buy small volumes of high-quality coffee and single-origin coffees. Examples of small and large specialised importers in Italy include:

- Best Coffee S.L.R.: in addition to conventional coffee, they focus on certified and specialty coffees.

- Sandalj Trading Company, specialty coffee, focus on traceability.

- Altromercato, fair trade coffee.

Agents that act as intermediaries between you, coffee importers and roasters are not very common in Italy. In other European countries, such as Germany and the United Kingdom, sales agents are more common. An agent usually has the knowledge to evaluate and select interesting buyers for you.

Large roasters and private labels

Most large roasters buy their coffee beans via large international traders, such as Neumann Kaffee Gruppe (NKG), or they buy it directly from exporters at origin. Large roasters normally only buy large volumes. For commodity coffee, this starts from about 10 containers. For specialty coffee, this can be one container per year. Note that these are just indications and will differ per buyer. Exceptions are also sometimes made. This can be because of personal relations, or because your quality is very high.

Roasters usually perform analyses and cup testing to check the roast's evenness and identify any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Large roasters usually blend different qualities of green coffees to maintain constant levels of quality. The final product is distributed to retailers and the food service industry.

Roasters can operate under their own brands or under their own private label. Examples of large roasters operating under their own brands in Italy include: Lavazza, Kimbo, Illycaffè and Hausbrandt. Examples of Italian private label coffee roasters are: Co.ind, Gruppo Gimoka and Daroma.

Most small roasters buy from local traders

Most small roasters buy from a local (Italian) importer or trade agent. Small roasters normally want to do business in Italian with a trader they know. These local traders take care of logistics, documentation and pre-financing. Therefore, many small roasters continue to buy via local importers.

Although this market is still small, a growing number of small roasters import green coffee directly from origin. These small roasters are often specialised in certain high-quality blends and single origins. Examples of small roasters in Italy directly importing coffee include: Gardelli Specialty Coffees, D612 Coffee Roasters and Caffè Malatesta.

Supermarkets are the main sales channel

Supermarkets mainly sell standard-quality coffee products, comprising the lower-end and middle-range segments. These segments also include a wide range of retailers’ own private label coffee products. These products are popular as they offer the same characteristics as branded products but are usually more affordable. Table x provides an overview of the largest supermarket chains in Italy.

Table 1: Largest Italian supermarket chains

| Supermarket | Number of stores | Revenue |

| Conad | 3,332 | €18.45 billion in 2022 |

| Gruppo Selex | 3,190 | €16.7 billion in 2022 |

| Coop Italia | >1,100 | €14.3 billion in 2021 |

| Gruppo Végé | 3,836 | €11.95 billion in 2021 |

| Esselunga | 168 | €8.5 billion in 2021 |

| Crai | 3,700 | €6.25 billion (estimated for 2020) |

| Eurospin | >1,200 | €6.2 billion (estimated for 2020) |

| Lidl Italia | >650 | €5.5 billion in 2021 |

| Carrefour | >1,500 | €4.17 billion |

| Despar | 1,374 | €3.99 billion in 2021 |

Main source: European Supermarket Magazine

The coffee chain is changing

The Italian coffee market chain is slowly changing. Italian coffee consumers are becoming more knowledgeable about coffee sustainability issues and quality. Some want to try different flavours. Some buy their coffee online, sometimes directly from roasters. Online coffee sales by consumers saw a 50% increase in 2020.

Marketplaces are also sometimes used. Marketplaces are platforms that connect actors in the chain, mainly connecting farmers to roasters directly. Using marketplaces allows farmers or cooperatives to cut out parts of the chain. This may allow you to get better prices for your products. Some of these marketplaces are:

We didn’t find any Italian marketplaces that connect farmers to roasters, but the companies mentioned work globally.

Some farmers and cooperatives have direct relations with roasters. This gives roasters a better feeling for where their product comes from, and it offers you opportunities to understand your client better. In some cases, roasters also take steps to shorten the supply chain length. Illy Caffè for instance, is one of Italy’s largest coffee companies and works directly with farmers.

Direct trade with the Italian market, or trade via marketplaces with the Italian market, is still very small. Almost all coffee enters the Italian market via large international traders.

What is the most interesting market channel for you?

The market channel that is most interesting to you depends on many factors. Primarily, it depends on your unique selling points. This means you need to know your product.

To sell your coffee to Italian buyers, your first step is to know its specific characteristics and what sets it apart from the competition. Think about the origin of your coffee and its unique flavour notes. Consider factors such as your coffee beans’ genetic profile, agroecological context, post-harvest practices, quality, and impact on communities and nature. Storytelling and traceability are also important. By telling the right story, you can connect consumers to the coffee’s origin and make coffee consumption a more complete experience.

The second step is to know your (potential) customers. To successfully sell your coffee to European buyers, it is important to understand their preferences and consumption patterns. Explore specific coffee requirements such as quality and sustainability with your buyers. Look for buyers who are willing to build long-term relationships. This can either be done directly or through an importer. You can increase your chances of success by analysing market information and identifying key buyers.

If you are an exporter of green mainstream coffee beans and you can offer high volumes (10 containers or more), you should investigate entering the Italian market through large importing companies. These companies usually have agents or representative offices in producing countries. This can be your first point of contact.

Specialised traders can be interesting if you have evidence of high cupping scores of at least 80 or higher. Many specialised importers prefer to work directly with producers or cooperatives.

Supplying to small roasters is interesting if you have:

- high-quality coffees

- micro lots

- sustainability certification

- or are willing to engage in long-term partnerships.

As the coffee market changes, exploring multiple market channels is key.

Tips:

- Explore selling to Italian roasters directly.

- Address small-scale Italian roasters in Italian. Italian roasters are used to doing business in Italian with Italian importers. They are more likely to respond when addressed in their own language.

- Export via marketplaces, such as Algrano, Beyco, Raw Material and Transparent Trade Coffee. Via these platforms, you can sell directly to Italian roasters. Try to reduce the length of the chain. If you have very high-quality coffees and are working through an importer, you could explore direct trade possibilities and connect with specialised roasters. If you are a farmer that has the financial means and technical know-how to organise export activities, you can offer your coffee directly to specialised coffee importers and small coffee roasters.

3. What competition do you face on the Italian coffee market?

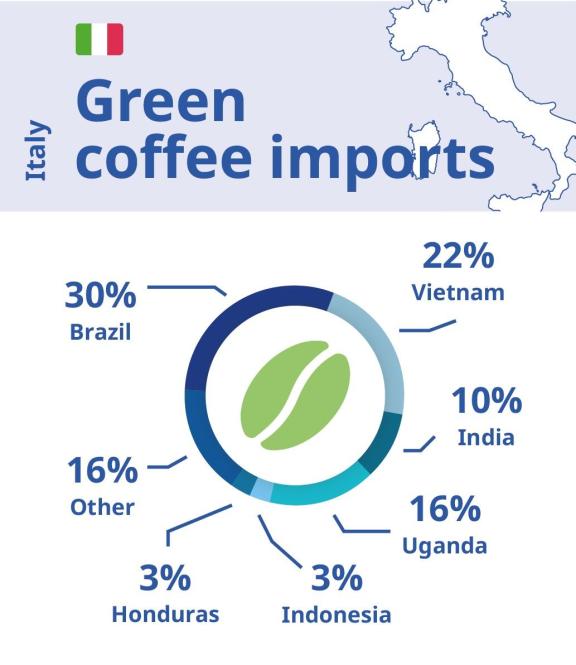

The competition on the Italian coffee market is fierce. Your main competitors depend on the product you supply. Vietnam, Uganda, Indonesia and Southern India are Italy’s main Robusta suppliers. Brazil, Northern India and Honduras have a higher focus on Arabica. Italy sources high quantities of both varieties. These are blended to make espressos. Compared to other European markets, Italy imports high amounts of Robusta.

Figure 6 gives an overview of how much coffee is sourced from the top 6 supplying countries.

Figure 6: Relative import values of Italy’s top 6 exporters in 2022

Source: data from Eurostat, design by Bart Wortel

If you want to know how much Italy sources from your country, read our study on the Italian market potential for coffee.

Brazil is Italy’s main green coffee supplier

Brazil is the world’s largest coffee producer and exporter, producing both Arabica (around 70%) and Robusta (around 30%), although almost 80% of exports consist of Arabica. Brazil is also Italy’s largest supplier. Brazilian exports to Italy reached 200 thousand tonnes in 2022. It registered an average yearly increase of 3.3% since 2018.

Brazil’s coffee-producing areas are relatively flat. This has intensified the use of mechanical pickers. The use of mechanical pickers has reduced labour costs in Brazil’s coffee production. It has also led to average lower quality, as machines do not distinguish between ripe and unripe cherries.

Brazil mainly produces natural and pulped natural coffees. Low-grade Brazilian Arabica is mostly used in blends. This is in high demand among Italian roasters, who focus mainly on price.

Despite the lower coffee prices, Brazilian coffee farmers are relatively successful. Factors contributing to their success are:

- the scale at which they operate.

- mechanised cherry picking.

- an efficient infrastructure.

- a good climate (although climate change drastically impacts several key producing regions in the country).

Brazil is the only large producing country where the average farmer is able to generate a living income based on coffee farming.

Although Brazil is known mainly for exporting large volumes of standard quality, the country also has a strong reputation as a producer of specialty coffees. The sector receives considerable institutional support through the Brazil Specialty Coffee Association (BSCA). The association aims to elevate the quality standards and enhance value in the production and marketing of Brazilian coffees.

Examples of exporters of specialty coffees in Brazil are Burgeon and Bourbon Specialty Coffees.

Table 2: Competitive country profile of Brazil

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Vietnam is the second-largest coffee supplier to Italy

Vietnam is the world’s second-largest coffee producer and the biggest Robusta producer. Over 96% of Vietnamese coffee production consisted of Robusta coffees in 2021. Vietnam’s coffee production is strongly focused on creating large volumes of standard quality coffees.

Vietnam’s total coffee exports to Italy reached approximately 150 thousand tonnes in 2022. Vietnamese exports to Italy increased by 3.7% per year on average between 2018 and 2022.

Examples of large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and Mascopex.

Table 3: Competitive country profile of Vietnam

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Main source: Standard Insights

Uganda’s coffee exports to Italy have grown rapidly

Another major coffee supplier to Italy is Uganda. In 2022, Italy imported 110 thousand tonnes from Uganda. Between 2018 and 2022, green coffee imports from Uganda registered an 18% annual growth percentage.

Coffee in Uganda is mainly grown by smallholder farmers, who are organised as part of NUCAFE, the national umbrella organisation of coffee farmers. NUCAFE represents more than 213 farmer cooperatives and associations as NUCAFE members. Approximately 80% of total Ugandan production is Robusta. Uganda is one of the countries with the largest organic coffee production areas worldwide (66 thousand hectares in 2018).

The Uganda Coffee Development Authority (UCDA) helps to promote and guide the development of the Ugandan coffee industry. They do so through quality assurance, research and improved marketing techniques. UCDA works towards achieving the Presidential directive of 20 million 60kg bags of coffee by 2030. UCDA has also encouraged the production and marketing of high-quality Arabica coffees. In addition, private companies have also invested in Uganda, focusing on sustainable production approaches.

The fact that Uganda is the only African country where green coffee is available throughout the year gives the country a strong competitive advantage. Disruptions in weather and participation patterns due to climate change are, however, leading to increased supply chain difficulties. Examples of Ugandan exporters are ACPCU and Great Lakes Coffee.

Table 4: Competitive country profile of Uganda

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: Ethos Agriculture

For India, Italy is the number 1 export market

Italy is the largest importer of Indian coffee worldwide. India’s total coffee exports to Italy reached approximately 64 thousand tonnes in 2022. On average, Indian exports to Italy decreased by 5.5% per year between 2018 and 2022.

Indian Robusta is often preferred for Italian blends thanks to its good blending quality. Much of India’s exports consists of washed Robusta from Kerala, the Monsoon Malabar, a high-quality Robusta. This coffee is exposed to the salty sea air during the monsoon season, which gives it a specific taste. The coffee sector in India is promoted by the Coffee Board of India.

Most of India’s coffee is produced in the South. Around 70% of the coffee is produced in the Karnataka state, where Robusta coffees (around 70%) are mostly grown. India is a large exporter of instant coffee, which contributes to almost one-third of India’s coffee exports.

Table 5: Competitive country profile of India

| Strengths | Weaknesses |

|

|

Source: diverse

Indonesia is the world’s second-largest Robusta exporter

Indonesia produces several types of coffee in different regions. These include Sumatran, Java, Sulawesi and Bali coffee. In 2022, Italy imported 23 thousand tonnes from Indonesia. Indonesian exports to Italy decreased by 5.4% per year on average between 2018 and 2022.

About 90% of Indonesian exports are Robusta, making Indonesia the world’s second-largest exporter of Robusta, only after Vietnam. Domestic consumption is growing rapidly. Indonesia therefore only exports an estimated 46% of its green coffee production. An estimated 20% of Indonesia’s coffee exports are certified or verified as sustainably produced. Indonesia is one of the countries with the largest organic coffee production areas worldwide, with 60 thousand hectares in 2018.

Table 6: Competitive country profile of Indonesia

| Strengths | Weaknesses |

|

|

Source: diverse

Honduras is the largest Central American coffee supplier to Italy

Honduras supplied 18 thousand tonnes to Italy in 2022. Honduran coffee exports to Italy decreased by 7.8% per year on average between 2018 and 2022. The fall in exports may be related to decreasing yields, price and lower production output in the country.

The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees. It did so either through certification or by actively improving quality. The country has grouped coffee production and quality specifications into six regions with different microclimates and soil composition.

In addition to its growing reputation as a high-quality coffee supplier, a relatively large share of Honduras's coffee is organic. According to FiBL & IFOAM The World of Organic Agriculture 2022, about 24,000 hectares were dedicated to organic coffee farming in Honduras. This is approximately 5.7% of the total planted coffee area in the country. Honduras is one of the largest organic coffee suppliers of Europe. In 2021, exports of specialty and certified coffee amounted to 54% of total exports. Note that Italy is not a large importer of specialty coffee. Italy is therefore not the main market for exporting large quantities of specialty coffee.

Examples of successful exporters in Honduras are Asoprosan, Cafico, Capiro Coffee Export and Aruco.

Table 7: Competitive country profile of Honduras

| Strengths | Weaknesses |

|

|

Source: diverse

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them too.

- Look into the marketing strategies of your competitors, the product characteristics they highlight and their approaches to adding value. Many successful companies, from whom you could learn, already export to the Italian market. Some examples include ACPCU (Uganda), O’Coffee (Brazil) and La Meseta (Colombia).

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee-growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story, such as the auctions organised by the Cup of Excellence.

- Are you interested in exporting high-quality coffee? Learn more about grading protocols and best practices on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if your company size or product volume is too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive in the Italian market.

- Develop long-term partnerships with your buyers. This includes always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability in the Italian market. See our tips on doing business with European coffee buyers for more information.

4. What are the prices for coffee on the Italian market?

The exact price breakdown depends on many factors and varies per product segment. Roasters and retailers take the largest share of the pie in almost all situations. The forecast is that coffee prices will rise. It remains unclear to what extent you can profit from these higher prices.

What are the prices on the end-market?

The prices on the Italian end-market differ per product type, per market channel, per segment and region.

In food retail (including discount shops), the average price for roasted coffee was €12.10 per kilogram. Consumers paid the highest average price per kilogram for single-serve coffee (€31.30). This was followed by instant coffee (€20.20), regular ground coffee and whole coffee beans (both €7.90).

The prices for coffee in cafés differ per city. In general, prices are a lot higher in the richer North, compared to the poorer South. Average prices for espresso (the most consumed coffee) are highest in cities such as Trento (€1.25), Bolzano (€1.24), Cuneo (€1.24) and Venice (€1.20). Average prices for espresso are lowest in cities such as Reggio Calabria (€0.92), Naples (€0.90) and Messina (€0.89). Note that these prices do not affect the Free Onboard prices or Farmgate prices. Cafés take most of these margin differences.

Note that the prices in Italian cafés are far below the European average. Coffees sold via coffee chains, such as Starbucks, can be a lot higher.

What is the price breakdown of the supply chain?

Green coffee export prices typically amount to only 5% to 25% of the end retail prices. However, this depends on many variables. Some examples are coffee quality, the size of the lot, certification, the distribution channel and the supplier’s relationship with the buyer.

Figure 7 shows the value distribution of wholesale coffee. Roasters end up taking more than 80% of the wholesale coffee price. A coffee farmer receives about 10%.

Figure 7: Wholesale coffee value distribution per actor

Source: Profound, 2020

Although roasters generally get most money from the value chain, for specialty coffee these margins could be very different. This especially applies to exporters who manage to sell their coffee via marketplaces. Algrano is a marketplace supplying the Italian market, and offers an example of a price breakdown on their website. You can read more about this in The coffee chain is changing. Note however, that most volumes enter the Italian market via large international traders, for low prices.

What is the forecast for Italian coffee prices?

Italian coffee prices follow the global market prices. Our expectation is that in the next few years, coffee prices will rise. According to Statista Market Insights, the global roasted coffee price is expected to rise by approximately one third between now and 2028.

The first factor that will drive up prices is reduced production due to climate change and weather conditions. Globally, the earth’s temperature is rising, and weather conditions are becoming more extreme. Based on research, Robusta production is expected to be reduced by 14% per degree Celsius of global warming. The impact on Arabica production will be even larger. In addition, El Niño will probably reduce global coffee production by another 10% in the coming years. For more information on what El Niño is and how it may impact your production, read this article by CNBC.

Secondly, global demand is expected to increase. Although the European market is saturated, the demand in upcoming economies is expected to grow.

Thirdly, the average price for roasted coffee is expected to increase because Italian consumers have higher demands. Italian consumers are becoming increasingly aware of sustainability aspects. The market for single-serve coffee is also growing, which drives up the prices. Lastly, more consumers are becoming knowledgeable about their coffee and choose premium and specialty coffee. This also boosts the average price.

Although consumer prices are expected to rise, it remains unclear to what extent exporters will profit from this. As Figure 7 shows, the revenues are unevenly distributed in the chain and increasing retail prices do not directly impact farm gate prices. Because large roasters have the most buying power in the chain, they also make the most money.

Tips:

- Explore how El Niño and climate change will impact your production region and how you can mitigate risks with others. This includes, for instance, planting varieties that are more resilient to changing weather conditions.

- Explore how you can produce in a greener and more socially responsibly manner. European sustainability requirements will become ever stricter. You can also watch our online webinar on meeting sustainability requirements on the European coffee market.

Molgo Research carried out this study in partnership with Long Run Sustainability, Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research