The Italian market potential for coffee

Italy is Europe’s second-largest import market for green coffee. It is home to a strong coffee culture. Italians favour strong espresso-based coffees, which are usually blends using Arabica and Robusta varieties. Next to a big consumer market, Italy has a huge roasting industry. The Italian market remains traditional in certain aspects. However, business consolidation and the rising demand for single-serve coffee are trends that change the coffee landscape.

Contents of this page

1. Country description

Italy is situated in Southern Europe. With a population of around 60 million people, it is one of the most populous countries in Europe. Italy's economy is strong, ranking as the third largest in the Eurozone. The main Italian industries are manufacturing, fashion, automotive, tourism and services. The country's luxury brands and craftsmanship contribute to a robust export sector. Italy has a GDP of $34 thousand per capita. This is comparable with the EU average.

Italy shares borders with France, Switzerland, Austria and Slovenia. This makes it a crossroads between Europe and the Mediterranean. Its trading ports, including Genoa, Naples, Trieste and Venice, serve as key trade hubs. Italian is the official language, but regional dialects and minority languages also persist.

The country's coffee culture is famous worldwide. Coffee houses, also called cafés, are central social spaces. Italians take pride in the quality of their espresso and enjoy coffee in short, strong shots. The baristas in the coffee bars are skilled professionals who create a welcoming atmosphere. Italian coffee culture represents a blend of craftsmanship, social interaction and appreciation for the art of coffee preparation.

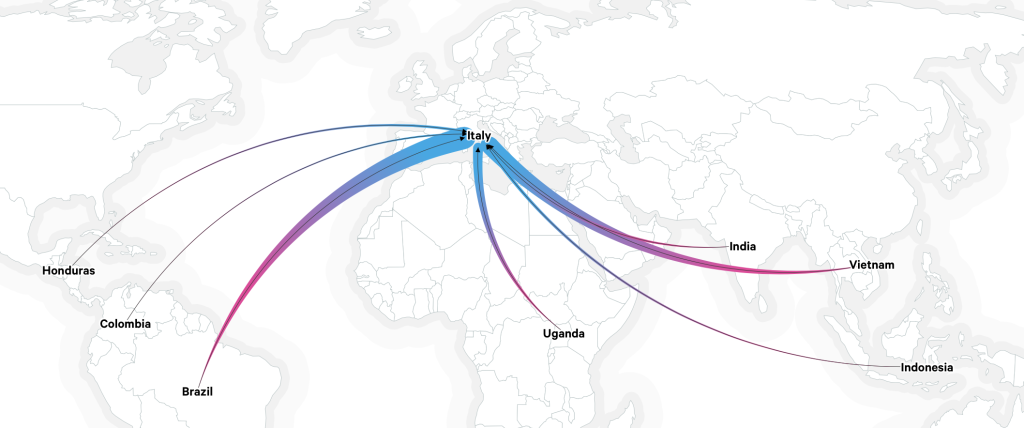

Coffee for the Italian consumption market is mainly roasted in Italy. Italy’s roasting industry needs to import large quantities. In 2022, Italy imported over 670 thousand tonnes of green coffee. This coffee was mainly imported from Brazil, Vietnam and India.

Figure 1 shows the largest green coffee trade flows to Italy. Broader arrows indicate larger trade flows.

Figure 1: Main green coffee export flows to Italy

Source: Resource trade

Tips:

- Refer to the websites of the Union Italian Food and the Italian Coffee Roaster Group to learn more about the coffee industry in Italy.

- Find a list of Italian roasters on the Coffee Insurrection website.

- Learn about the main European markets by reading the CBI country studies. These include the German market, the Belgian market, the French market, the Swiss market, and many other markets.

- Check out the websites of the Italian Port of Genoa and the Port of Trieste. On these websites you can learn about the ports themselves and potential trade partners based there.

- Activate the “Translation” function of your browser to make the studies available in your native language. Since Italians strongly favour their own language, many sources are in Italian. Read more information on how to do so in Chrome by reading the Google Support website.

2. What makes Italy an interesting market for coffee?

Italy offers one of Europe’s most interesting coffee markets. The country has a big coffee consumer market and is home to a huge roasting industry. The Italian coffee culture is famous the world over. Supplying to Italian roasters might therefore open doors to non-Italian buyers as well.

Figure 2: The Italian coffee market

Source: Diverse, design by Bart Wortel

Italy is Europe’s second-largest importer of green coffee

Italy is the second-largest importer of green coffee beans in Europe, surpassed only by Germany. For the market statistics of other European countries, read our study on the demand for coffee on the European market.

In 2022, Italian green coffee bean imports reached a volume of 672 thousand tonnes. Italian imports increased at an average annual rate of 2.1% between 2018 and 2022. 2020 showed a dip, caused by the corona pandemic. However, since 2020, Italian coffee imports have shown the largest growth in Europe. Over 96% (648 thousand tonnes) of Italian imports are sourced directly from coffee-producing countries.

Source: Eurostat

Most green coffee is sourced from Brazil, Vietnam and Uganda

The main suppliers of green coffee to Italy in 2022 were Brazil (200 thousand tonnes), followed by Vietnam (150 thousand tonnes) and Uganda (110 thousand tonnes). To see the export from your country to Italy, hover your mouse cursor or pointer over the countries in blue in figure 4.

Source: based on Eurostat data

Tip:

- Read more about competing coffee-producing countries in our study on entering the Italian market for coffee.

The forecast for the Italian coffee market is positive

Italian import volumes are expected to remain relatively stable in the coming years. In terms of market value, the market is expected to rise by around 3% annually between 2023 and 2028. This increase is driven by various trends, which include more demand for higher quality beans and a greater interest in coffee pods and capsules. These trends are also driven by the increased incomes and higher number of one-person households. You can read more about this in the section on trends.

Italy has Europe’s largest roasted coffee production

Italy has the largest coffee-roasting industry in Europe. With 616 thousand tonnes, it accounts for 32% of all coffee roasted in Europe in 2020. Europe’s number 2 is Germany, which produced 571 thousand tonnes of roasted coffee. France is third, with 149 thousand tonnes. Almost all of Italy’s green coffee imports remain in the country and are used by the powerful Italian coffee-roasting industry.

Italy is home to hundreds of small-scale roasters. Many of these roasters are family-owned businesses, which also operate internationally. These small-scale roasters mainly serve local cafés. Therefore, what kind of coffee you drink in a café depends considerably on the region. Most cafés in one particular region will buy from the same roaster.

Roasting techniques in Italy vary, but one common method is a slow, traditional roasting process. This approach allows the beans to develop their flavours fully, resulting in a rich and robust taste profile. The largest share of this Italian roasted coffee is sold domestically, representing a value of €2.8 billion. A very large share, however, valued at €2.2 billion, is exported to other countries. Italian coffee exports grew by 12% in 2021, and 7% in 2022. Exports are therefore currently the main driver behind the growth of the Italian roasting industry. According to Beverfood, 94% of Italian coffee exports are roasted coffee.

Italy is home to some of the world’s largest coffee companies

Large Italian roasters export substantial amounts of Italian coffee blends to destinations all over Europe and the United States. About 60% of the roasted coffee is consumed domestically. The other 40% is exported. Most exports go to other European countries, followed by the United States, Australia and Canada.

This means Italy has a high demand for green coffee from producers and exporters worldwide. The top five companies in the sector account for more than half of the total market. According to Beverfood, the five largest companies are Lavazza, Illy, Nestlé Italia, Nespresso Italia (a Swiss company active in Italy) and Caffe Borbone. Segafredo Zanetti, part of Massimo Zanetti, is another very large Italian roaster. It has a highly international focus.

Out of these companies, Lavazza, is Italy’s largest company. It employs over 4,000 employees worldwide, has 9 production facilities in 6 countries. It exports to over 140 countries. The company’s revenue equalled €2.7 billion in 2022. 70% of its revenue is generated outside of Italy. In 2021, Lavazza launched the Lavazza A Modo Mio Voicy. This coffee machine integrates voice commands with the Amazon Alexa service. This showcases the company’s innovativeness.

Segafredo Zanetti offers a diverse range of beverages, with coffee being one of its main products worldwide, along with tea, cocoa and various spices. In 2020, Segafredo Zanetti introduced a series of products called "Segafredo Storia", which includes a 100% Arabica single-origin coffee traceable through blockchain technology. Consumers can scan a QR code on the packaging to access the entire history of the coffee beans, mapping their journey from plantation to cup using a dedicated platform that enables traceability at every step.

With a revenue of about 500 million euros, IllyCaffè is the third-largest coffee company in Italy. The company has over 1,300 employees. The company has a strong focus on sustainability and development. In 1990, Illy founded the University of Coffee.

Other large coffee roasters based in Italy are:

- Kimbo

- Caffitaly

- Casa del Caffè Vergnano

- Pellini Caffè

- Coind

- Jacobs Douwe Egberts Italia

- Hausbrandt Trieste

- Caffè Trombetta

- Covim

- Caffè Carraro

- Ekaf Cellini

- Essse Caffè

- Procaffè

- Lollo Caffè

- Quarta Caffè

- Caffè Diemme

Tip:

- Visit the Access2Markets website to analyse European and Italian trade dynamics and to build your export strategy. By selecting Italy as your reporting country, you will be able to follow developments such as the emergence of new suppliers and the decline of established ones.

Italy hosts a large consumer market

Italy has a relatively large consumer market. Italy is the third most coffee-consuming country in Europe. It is responsible for 11% of European coffee consumption, after Germany (26%) and France (12%). In 2022, the Italians consumed 237 million kilograms of coffee. Globally, Italy has the seventh largest consumer market. Since 2020, the Italian consumer market value has remained relatively stable. The value of the retail consumer market was €2.34 billion in 2020.

In 2022, it increased to €2.48 billion but declined in volume. 2014 was the peak year, with 392.9 million kilograms green coffee equivalent consumed. This decreased slowly over the years to 301.2 million kilograms in 2020. The market volume recovered a bit in 2021, with consumption rising to 313.9 million kilograms.

Italians favour espresso-based coffee. The most common coffee consumed is espresso without milk (around 67% at home and 73% out-of-home). They value full-bodied and intense coffee, often achieved through medium to dark roasts. Coffee is an integral part of Italian culture, with the average person consuming 3.4 kilograms of coffee a year. Italy hosts almost 150 thousand coffee bars. Most coffee is consumed in the regions Lombardy, Lazio and Campania. These are also the regions with the largest numbers of citizens.

In supermarkets, most of the volume is controlled by major national leaders. Lavazza is the largest player. Based on interviews, it accounts for over one-third of the market. The catering industry (including cafés and restaurants) is, however, much more fragmented. Most restaurants and cafés source their coffee from the local small roaster.

Italy has a strong coffee culture

Italians value their coffee and have a strong opinion on how coffee should be prepared. Italians prefer using freshly roasted coffee beans and insist on grinding them right before preparing the espresso. They also favour the use of traditional espresso machines, which allow for precise control over the brewing process.

Cafés, or "bars" as they are commonly called in Italy, play a central role in coffee culture. They are vibrant gathering places, serving as meeting points for friends, colleagues and locals. Italians often enjoy multiple cups of coffee throughout the day, with a morning coffee, a mid-morning coffee break (known as "pausa") and an afternoon pick-me-up espresso. Italians prefer milk-based coffee drinks like cappuccinos and lattes after breakfast. These are considered more appropriate for the morning.

Italians believe that coffee needs to be cheap. In most Italian cafés, an espresso costs around €1. Due to inflation, many cafés were forced to increase their prices to over €1. In Western Europe, consumers easily pay €2-3. You can read more about the effects of these low prices in our study on entering the Italian market for coffee.

The strong Italian coffee culture is also an inspiration for many Western coffee companies. Coffee companies want to be connected to Italian culture by emphasising the traditions, skills and love associated with the Italian coffee culture. They decorate their cafés and packages in an Italian style and show the idea of Italian cafés as places where people enjoy coffee and talk.

Figure 5: Italy is famous for its espresso culture

Source: Photo by Krists Luhaers on Unsplash

Tips:

- Learn about the Italian coffee culture if you want to tap into the Italian market.

- Explore the Milan Coffee Festival and programme to learn about Italian coffee culture.

3. Which products offer the most opportunities for the Italian market?

The Italian market is huge and offers many opportunities. A few products offer the most opportunities for the Italian market based on the market structure:

- The current Italian market has an enormous demand for average-quality Arabicas and Robustas.

- The single-serve coffee market is very large and offers opportunities to add value in the producing country.

- The specialty coffee market is small, but investing in market access now may offer future rewards.

- The Italian market for certified products is small but will grow when European regulations become stricter.

To enter the Italian market, knowing your product is important. Specialty, premium and certified coffees offer the best margins. However, producing certified, premium or certified coffee is not possible for all producers. It depends on the location of your farm, the soil, altitude, knowledge and skills, as well as market access. Therefore, offer the product that best fits your company.

Most cooperatives and exporters do not offer one quality consistently. Some might experiment with different processing techniques. This means that you may market a diversity of products.

Efficient production of large volumes offers opportunities

Driven by its strong culture, Italian consumers prefer cheaply priced espresso-based coffees. Italian traders mostly import Arabicas and Robustas for a low price. You can only compete in this market if you can produce efficiently. This requires economies of scale. Italian importers and roasters can offer a stable market for commercial – not premium or specialty – coffee.

The Italian commercial coffee market requires efficient production

Since coffee prices in this segment are generally low, it means you need to produce efficiently. Otherwise, farmers cannot earn a living income.

Brazil is the only country where farmers can generate a living income based on coffee production. It is, however, neither possible nor desirable for most countries to copy the Brazilian coffee sector. Firstly, Brazil can produce cheaply by using plucking machines. This is only possible if your land is suitable for mechanised farming. The relatively flat land and large farms in Brazil are ideal for mechanised harvesting. In your country, this can be very different.

The Brazilian coffee industry is also unsustainable. Pesticides are widely used there, leading to the contamination of groundwater and ecosystems. This is dangerous to humans and animals. Brazilian coffee farms also mostly use the sun-grown method. This means that they are monocultures, which are disastrous for biodiversity.

Tips:

- Learn from local peers. Instead of looking at Brazil as an example, look for other producers and exporters that have similar conditions. Try to learn from each other.

- Develop a process map of your operations and identify opportunities to improve efficiency. Focus on efficiency in the long run. Reducing your costs or increasing production is something that takes many years. It therefore remains important to not only focus on the short term. For example, cutting trees to reduce shade or not renewing your old trees may be more costly in the long run.

- Create economies of scale. Large-scale production is cheaper than small-scale production. One reason for this is that you have more money to buy tools. Another reason is that large-scale processing is cheaper. You must collaborate with other producers and exporters to increase economies of scale.

- Invest in proper management without certification if you focus on the lower end of the market. Getting certified comes with extra costs, mainly due to auditing. However, applying (some of the) measures fosters the management of your business.

The Italian single-serve coffee market represents more than 50% of the Italian retail market value

Despite their fondness for traditional espresso, the Italian market for single-serve coffee is growing fast. There are two ways to profit from this big market.

- The first way is to sell commercial green coffee. European buyers can use this coffee to produce their single-serve coffee. This requires efficient production and logistics to remain profitable. See the previous paragraph for more information on this.

- The second way is to produce single-serve coffee in your own country. This adds value to the product and increases margins. Exporting single-serve coffee comes with different requirements. You can read more on this in our study on requirements for the European coffee market.

The single-serve market mainly consists of pods and capsules, although sometimes both are called ‘pods’. Coffee pods are paper-based and contain 7 grams of coffee. Coffee pods are sometimes also referred to as soft pods or pads. The packaging has a low environmental impact. Coffee capsules contain 5 grams of coffee. Capsules are sometimes also called hard pods. The packaging usually contains aluminium or plastic and is not sustainable. The terminology is not very strict. Sometimes, pods also refer to both capsules and (soft) pods.

The Italians have a high demand for high-quality single-serve coffee

In volume, the Italian single-serve market is about 15% of the total market. This is just below the European average of 16%. Regarding retail value, however, the coffee single-serve market was 56% of the total market in 2022. This is far above the European average of 39%. In Italy, 31% of consumers prefer making coffee by using capsules. This is relatively high compared to the French (28%), Spanish (27%) and German market (8%). In 2019, the Italian capsule market accounted for a 30.5% share of the Italian single-serve market.

Several trends can explain the high demand for single-serve coffee. In recent years, there has been a sharp rise in single-person households in Italy. Young Italian professionals also have a higher disposable income than in the past. As a result, they are eager to spend on high-quality products. This includes high-quality single-serve coffees.

Ground coffee and single-serve coffee are both mostly sold in supermarkets. However, the single-serve market is fostered by e-commerce. The e-commerce market has shown annual double-digit growth. In 2019, the increase was almost 150% compared to 2018.

Table 1 provides an insight into the growth of the Italian capsule market.

Table 1: Growth of the coffee single-serve market in 2019 and 2020

| 2019 (€ million) | 2020 (€ million) | 2020/2019 percent change | |

| Production + import | 1,331 | 1,430 | 7.4 |

| Export | 334 | 338 | 1.2 |

| Domestic market | 997 | 1,092 | 6.3 |

Source: Monitora Italia

Convenience is the main driver for buying single-serve coffee. Another driver of the growing demand was the COVID-19 pandemic. Restrictions forced consumers to drink their coffee at home. In 2021, the Italian coffee capsule consumption was 22% higher than in 2017. Another reason for drinking single-serve coffee is the easy switch between flavours and cup quality. About 1.4 million Italians buy coffee pods and capsules.

Nespresso, owned by the Swiss company Nestlé, has a 30% market share of the Italian capsule market. Large Italian players are A Modo Mio (owned by Lavazza), Illy Iperespresso (owned by Illy), Kimbo, Segafredo and Vergnano.

Producing countries show potential to tap into this market

Most single-serve coffee for the Italian market is produced in Italy. There are, however, some examples of other producing countries.

- Moyee Coffee offers one great example. Their green coffee is grown in Uganda and Congo and roasted in Kenya. Coffee is packaged in fully biodegradable pods made of corn. Capsules are sold directly to consumers. In their communication, Moyee emphasises the African heritage of their coffee.

- Pilão is a Brazilian roaster. It offers all kinds of coffee. Pilão mostly produces for the domestic Brazilian market. Its single-serve options include capsules and pods.

- Hermanos Coffee Roasters in Colombia offers fully compostable coffee capsules.

- Aroma Group is a company from Thailand that produces coffee capsules but also supplies a very large range of other products.

The single-serve market offers some options for sustainable production

In general, coffee capsules are very unsustainable. The reason is that using capsules creates a lot of waste, which is hard to recycle. Europeans are increasingly demanding more sustainable coffee capsules. A questionnaire among Italian consumers shows Italians are more willing to buy more sustainable pods and capsules. This is especially true for environmentally sustainable pods.

There are initiatives for producing more sustainable capsules. For example, biodegradable or vegetable fibre-based capsules. This market is, however, still very small. Some of these initiatives by Italian brands include:

- Vergnano introduced compostable capsules certified "OK COMPOST". These can be disposed in organic waste bins without separating the wrapper from the coffee.

- Lavazza launched compostable capsules made with "Mater-Bi bioplastics". These can be collected with organic waste.

- Illy implemented reverse vending machines for capsule disposal. It is also developing machines to separate plastic from coffee.

The Italian specialty market offers long-term opportunities for early investors

Like other Mediterranean markets, the Italian specialty coffee market is still small. But this also means that competition is still low. When the specialty coffee market is growing, suppliers which already gained ground may profit.

In 2021, Italy only had 79 specialty coffee cafés, out of over 50 thousand cafés. This is less than 0.2% of all cafés. Another indication of the small size of the Italian specialty coffee market, is that only 1.1% of all coffee sold in Italian supermarkets was 100% Arabica.

The Italian demand for specialty coffee is, however, expected to rise in the near future, following Western European countries. This predicted increase is partly driven by large roasters launching their own specialty coffee brands. An example is Lavazza, which founded a specialty brand called 1895. Examples of specialty coffee roasters in Italy include Nero Scuro, Pierre Cafè and Cafezal Specialty Coffee.

An example of a specialty coffee retailer is Garage Coffee Bros. It offers high-quality coffees with different processing methods, such as aerobic and anaerobic coffees. Another example is Cafezal, a specialty roaster offering both specialty coffee beans and capsules. The country also hosts the annual coffee Milan Coffee Festival.

For more information, we refer to our study on the European specialty coffee market.

Certification offers opportunities for the near future

The demand for certified coffee is still relatively low in Italy. It is, however, becoming more common, especially in supermarkets. This applies particularly to Rainforest Alliance. The sales of Fairtrade-certified products are also increasing.

The expectation is that the demand for certified products will increase. Firstly, this is because the consumer perspective is changing, with Italian buyers increasingly valuing sustainability. You can read more on this in the section Italian Generation Z is driving change. Secondly, European regulation is getting ever stricter. Certification and verification are means of proving that you adhere to certain sustainability standards. You can read more about certified coffee in our tips to become more socially responsible, tips to go green and our report on certified coffee.

In 2022, only 759.324 kilograms (0.32% of the total market) were sold Fairtrade certified. In comparison, 5% of all coffee sold in the Netherlands was Fairtrade certified. Most Fairtrade-certified coffee is sold via supermarkets. Coop/Ipercoop sells most Fairtrade coffee. This is followed by Conad, Lidl, Esselunga, Carrefour and Despar. According to research by Nielsen, Fairtrade has a good reputation among Italian consumers.

Certification standards are usually part of the sustainability strategy of traders, roasters and retailers. With European due diligence regulations becoming stronger, the expectation is that the demand for certified coffee will rise in the future. Besides third-party certification schemes, an increasing number of traders, roasters and retailers will work with their own verification schemes.

- Massimo Zanetti has a €1.2 billion revenue in 2021. The company works with a range of certifications. These include Organic, Rainforest Alliance-UTZ and Fairtrade. 16% of their coffee has one or more of these certifications.

- Lavazza is the largest Italian coffee company, with a €2.7 billion revenue in 2022. The company works with a diversity of coffee certifications. These are Rainforest Alliance, TUV Austria Product Certification, Organic, Hand-picked coffee certification, Well-Health Safety certification and LEED certification. Out of their total coffee production, 5% is certified.

- Illy caffè is B Corp certified and had a revenue of €438 million in 2021. The company has its own verification programme.

- Kimbo sources a lot of Fairtrade coffee. It is one of the top buyers of Fairtrade coffee in Italy, although it mostly sells abroad. Foreign sales are mostly destined to the Netherlands, France and the United Kingdom.

- Coop, a large retailer, sells roasted coffee products which are certified by the main certification standards, such as Fairtrade. It sells relatively large volumes of certified coffee in Italy.

- iN’s mercato is a large discount retailer, with about 550 shops in Italy. The company has increased its share of Fairtrade in recent years.

- Alce Nero is one of the leading Italian brands in the organic sector.

The demand for organic coffee in Italy was about 1.2 million kilograms in 2020. This equals 0.5% of the total market volume. It is, however, a growing market. Sales grew by 500% in the last 5 years.

Globally, the main origins of Organic coffee are Honduras and Peru. The share of organic coffee sold is expected to grow further in the near future, however not at the same pace as it did in the last 5 years. The increase is mainly driven by Generation Z Italians (born 1995-2010), who are more environmentally conscious.

Tips:

- Look for potential buyers online if you supply certified coffee. For instance, you can find Italian importers of Fairtrade-certified coffee on the Fairtrade Italy website. Select Importatori (importers) and caffè (coffee) on the webpage to get a list of potential buyers.

- Invest in cupping facilities: a lab and skilled Q-graders. By better understanding the quality and value of your own product, you learn the language of the buyer and are better positioned to negotiate the right price. You can find specialty cafés and roasters on the Specialty Coffee Italy website.

- See the website of the Italian Specialty Coffee Association (SCA) for more information about the specialty coffee industry in Italy.

- Want to get specialty coffee on the Italian market? Try to establish direct trade relationships with small traders and roasters. Meet them at trade shows such as the Milan Coffee Festival.

- Find potential organic business partners in Italy by checking this list of Italian organic coffee importers.

4. Which trends offer opportunities or pose threats on the Italian coffee market?

Due to its strong tradition, changes in the Italian coffee market take longer to occur. This does not mean, however, that the Italian market is not changing. Two trends apply particularly more than other trends to the Italian market. These are consolidation in the Italian coffee market and shifting demands by Generation Z.

Large Italian coffee companies take over smaller players and invest internationally

Large Italian companies take over smaller companies. This results in a market with fewer players, which are more powerful.

Big companies such as Melitta Group and Coca Cola HBC are buying large parts of Italian coffee companies like Corsino Corsini and Caffè Vergnano. This is because Italian brands are very popular with European consumers. These acquisitions happen for both small and larger companies.

Illy caffè sold part of itself to Rhone Capital to grow and sell more coffee in the United States. It also entered into a partnership with JDE, outsourcing the production of aluminium coffee capsules.

Lavazza is familiar with international takeovers. It took over the French companies Carte Noire and ESP (acquired in 2016 and 2017 respectively), Danish Merrild (2015), Canadian Kicking Horse Coffee (2017), Italian Nims (2017) and Australian company Blue Pod Coffee Co. (2018) and MaxiCoffee (2023).

The effects of this consolidation on you as a supplier will depend on the situation.

- In some cases, consolidation leads to lower prices, and higher minimum volumes. This may bring difficulties for smaller suppliers.

- Consolidation may lead to more competition among current suppliers. In general, larger buyers have a need for larger suppliers. This offers the opportunity to take over sales from a competitor. It may also pose the thread of being outperformed by competition. Furthermore, the more powerful a roaster is, the higher the price it may be willing to pay.

- Consolidation among small-scale roasters will increase substantial economies of scale. It is unclear what the effects are on suppliers.

- In some cases, consolidation leads to a reduction of the number of chains. It is unclear what the effects are on suppliers.

- Consolidation may lead to less sustainable sourcing. Some small roasters buy from small traders that source more sustainably. If a small roaster is taken over by a large roaster, the small roaster’s sourcing process may be replaced by the sourcing process of the larger roaster to reduce costs. Consolidation also reduces the number of potential buyers, and therefore reduces the exporters’ room for negotiation.

Italian Generation Z is driving change

Generation Z, born between 1995 and 2010, is a demographic cohort. It has grown up in a world characterised by rapid technological advancements and significant societal changes. In Italy, Generation Z shares some global characteristics with their counterparts in other countries. They are also being influenced by the unique cultural and social dynamics of the country. As Italians belonging to Generation Z become adults, their spending power increases, and so does their influence on the consumer market.

Italian Generation Z is technologically fluent, having grown up with smartphones, social media and the internet as integral parts of their lives. They are often considered more socially aware and environmentally conscious compared to previous generations. This generation values individuality, diversity and inclusivity. They tend to have a strong entrepreneurial spirit. They see creative and unconventional career paths. Italian Gen Z is also known for valuing experiences over material possessions. This leads to an emphasis on travel, exploration and trying new things.

Figure 6: The Italian Generation Z is driving change

Source: Bart Wortel

The impact of Generation Z on the Italian coffee market is notable. It reflects their distinct preferences and habits.

Online Coffee Sales

Generation Z's comfort with technology and online shopping has driven an increase in the demand for coffee sold online. They appreciate the convenience of browsing and purchasing coffee from the comfort of their homes. They often seek out unique or specialty blends that might not be readily available in local stores. According to an assessment by IRI, coffee sales in the online channel were around €19.5 million in 2018, increased by 50% in 2019 to €29.3 million, and in the first months of 2020, they further grew by 84%.

Single-serve coffee

The convenience-oriented nature of Generation Z has contributed to the popularity of single-serve coffee. These products align with their fast-paced lifestyles. It offers quick and mess-free coffee options. This trend also raises concerns, however, about environmental sustainability due to the waste generated by single-use pods.

Specialty Coffee

Generation Z's inclination towards unique experiences has fuelled a growing interest in specialty coffee. They are more likely to explore different flavours, brewing methods and origins of coffee beans. This has led to an increased demand for high-quality, artisanal coffee that offers a richer and more diverse taste profile.

Sustainability and Organic Coffee

Generation Z's strong environmental consciousness has translated into a preference for sustainable and organic products, including coffee. They are more likely to support brands that prioritise ethical sourcing, fair trade practices and environmentally friendly packaging. This has prompted coffee producers and retailers to focus on offering coffee that meets these criteria, appealing to the values of this generation.

Social Impact and Transparency

Italian Generation Z is interested in the story behind their products. They value transparency and authenticity from brands, wanting to know the ethical and social impact of their coffee choices. This has pushed coffee companies to communicate their sourcing practices and community initiatives more openly.

Next to these trends, there are shifts occurring on a product level. These shifts have been integrated in the section Which products offer the most opportunities for the Italian market? Options for direct trade to the Italian market are also increasing. Direct(er) trade may lead to better margins. In comparison to many other European countries, however, volumes exported directly to Italian roasters are still very small. You can read more about these changes in our study on Entering the Italian market for coffee.

All trends described in our study on trends in the European coffee market also apply to the Italian market.

Tips:

- Tailor to the Generation Z market. This market is expected to increase in size. Make sure to use storytelling to focus on the sustainability aspect and the connection with the local region and farmers.

- Read more about consolidation on the Italian market on the Beverfood website. The IRi website also includes much information about the Italian coffee market. However, they offer it only in Italian. Use your browser (for instance Google Chrome), or an AI translation, to autotranslate the information.

- See our study on finding European coffee for more information on different approaches to the coffee market.

- Read our study on trends in the coffee market to learn more about how the European coffee market is changing.

Molgo Research carried out this study in partnership with Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research