Entering the European market for multi-certified coffee

Coffee can be produced and sold under more than one Voluntary Sustainability Standard (VSS). It is easier for a coffee producer to join additional schemes once they are part of one scheme, but it also costs extra money and effort. Coffee producers therefore usually only join multiple schemes if they have confirmed buyers for all those schemes. The extra premiums or higher prices they receive for additional VSS could make it worth the extra effort, although the overall decision depends on the context. It is strongly recommended to confirm with buyers first before deciding to join multiple VSS.

Contents of this page

- What requirements and certifications must multi-certified coffee comply with to be allowed on the European market?

- Through channels can you get multi-certified coffee on the European market?

- What competition do you face on the European multi-certified coffee market?

- What are the prices for multi-certified coffee?

1. What requirements and certifications must multi-certified coffee comply with to be allowed on the European market?

Producers can comply with multiple schemes at once

There is a lot of overlap between the schemes. Some have more of an environmental focus, while others are more socially oriented. All of them include the key sustainability topics to some extent. The GCP Equivalence Mechanism includes 5 critical practices:

- Elimination of the worst forms of child labour;

- Elimination of forced labour;

- No deforestation;

- No use of prohibited pesticides; and

- Continuous improvement.

If there is a lot of overlap, it becomes easier to produce coffee under multiple VSS. However, it can also be the case that the standards are complementary.

One example of complementary standards is Fairtrade with Organic. Fairtrade is regarded as being stronger on the social topics than on the environmental topics. Organic is considered to be stronger on the environmental topics than on the social topics. This is why you regularly see the combination of Fairtrade and Organic. They complement each other well, combining the relative strengths from both programmes. For this reason, however, it may also be more difficult for producers to combine them, because it requires more work than joining only one scheme.

Producers can be supported by the certification programmes, their buyers, or local supporting organisations. Multinationals may partner with local organisations (local partners) who manage the certification for them. They help with Fairtrade or Rainforest Alliance certification and support the audit and the farmers.

Producers and exporters face different requirements when joining multiple sustainability schemes

It is important that you first determine if joining a sustainability scheme will be worth the extra effort and investment. The following points need to be considered:

- The efforts needed for compliance with the scheme. What actions do you need to take to meet the standard of the VSS? You can find the requirements on the websites of the schemes, or you can contact the owner of the scheme.

- The audit cost (if audits are required). Can an auditor do the audit for both schemes at once? Does the auditor have to travel far to get there, or are there auditors located close by? You often pay auditors per day, so less travel time means lower costs.

- The premiums for the VSS. The premiums will differ between programmes and can be mandatory or voluntary. If the coffee is sold under multiple VSS at once, then the producer will also receive multiple premiums. However, this only usually happens for Fairtrade with Organic and Rainforest Alliance with Organic. For Fairtrade, producers receive an additional price incentive on top of the Fairtrade premium. For Rainforest Alliance the organic premium is negotiable.

- The location of the farms. How spread out are the farmers that need to be audited? The more spread out they are, the costlier it could be to audit the farms. In some regions it will be easier than in others.

- The license costs, membership fees or other fees for joining a scheme. For example, FLO and Fairtrade International require a fee for both. Fair Trade USA also requires a fee.

- The type of customer. Does your buyer have a commitment for multiple years? How big is the volume that they want? Do you already have a relationship with the buyer? For example: a roaster asks a cooperative to sell them Rainforest Alliance coffee. The cooperative produces 10 containers, but the roaster only wants 3 containers. If no one else is asking for Rainforest Alliance coffee, it may not be worth the extra costs.

- Whether to certify the whole or only part of the cooperative. For example, a cooperative can choose to certify only one of the base groups if the production of the base group is enough to meet the demand of the buyer.

- Exchange rate fluctuations. What are the currencies in the contracts? The contract could change in value if the exchange rate rises or falls.

The market drives multi-scheme certification and verification

The cooperative or coffee producer decides which VSS to join. The decision, however, is almost entirely driven by market demand.

The demand of a roaster for multiple VSS is influenced by the following factors:

- Tool to improve sustainability levels. Companies can use a VSS to improve the sustainability levels of the coffee that they source. The combination of Rainforest Alliance and Fairtrade with Organic is used to increase coverage across the social, economic and environmental sides of sustainability.

- Marketing tool. Companies can use a VSS to promote the sustainability levels of the coffee. Organic in combination with a certification scheme can be attractive to buyers looking for socially and environmentally responsible coffee.

- Meet minimum requirements. A VSS can be an easy and cheap way to meet key core criteria (the topics that the company cares about the most). If this is the main reason for roasters to buy coffee under a VSS, it is likely that more than one VSS is not necessary. Check the GCP reports for examples of roasters that buy coffee only through one company scheme and read our study on certified coffee for more details about the requirements.

- Risk mitigation. A VSS can help companies reduce their exposure to risks such as negative media reports or scandals. One VSS may also be sufficient here, unless the roaster wants to use complementary schemes as described above.

- Market segments. Companies use different VSS to market specific brands. For example, some roasters will buy Fairtrade Organic coffee for their sustainability-focused brand and conventional coffee for their mainstream brand.

Large, risk-aware companies tend to be more ‘hands-on’ by implementing their own sustainability strategies. Smaller consumer-facing companies and producers can be more ‘hands-off’ by using external VSS.

Tips:

- Carefully consider whether the efforts of joining multiple VSS are worth it. Consider asking buyers for multi-year commitments, to make sure that you are rewarded for your efforts for multiple years.

- Read our study on Exporting certified coffee to Europe for more information on how to become certified.

- The Standards Map helps companies choose the right voluntary sustainable standard with which to certify their goods or services.

2. Through channels can you get multi-certified coffee on the European market?

How is the end-market segmented?

Coffee that is produced under multiple VSS is not necessarily sold under multiple (or any) VSS. In the end, the company will decide which certification fits a certain consumer profile and market it accordingly. For the end-market segments, this study will only look at coffee sold under multiple VSS. You can read more about the market segments for coffee in the CBI study What is the demand for coffee on the European market? and demand for certified coffee in the study Exporting certified coffee to Europe.

Rainforest Alliance, Fairtrade and Organic

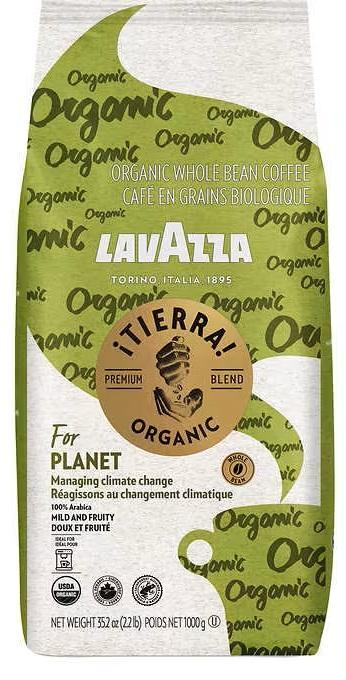

Rainforest Alliance and Fairtrade with Organic is the only VSS combination to be sold to European consumers in significant volumes. Examples include Lavazza’s Tierra that is Rainforest Alliance Organic certified, Keurig Dr. Pepper’s Fairtrade Organic Ekocups, Julius Meinl’s Organic Fairtrade coffees, and Nescafé’s Gold Organic Fair Trade.

Figure 1: Lavazza Tierra Rainforest Alliance Organic certified coffee

Source: Lavazza

Specialty coffee

Single- or multi-certification is less common in specialty coffee than in commercial coffee. The quality becomes relatively more important, with the result that certificates are less valuable. Specialty coffee can still be sold as Fairtrade Organic, but it is more interesting for producers of commercial coffee to become multi-certified than for specialty coffee producers. Certification becomes relatively more valuable when quality is not the most important factor. Some specialty coffee producers will sell small volumes of high-end coffee without certification, even if they are certified. This is because the price they can get for the quality is higher than the certification premiums they would receive.

Trader programmes

A trader programme combination with Fairtrade or Rainforest Alliance is very rare. Fairtrade and Rainforest Alliance certification are not part of the trader programmes Atsource (Ofi), SMS (Ecom), LIFT (Mercon), Bloom (NKG), IMPACT (Sucafina)or The Volcafé Way (Volcafé). If coffee is sold under a trader programme, the final roasted product is not labelled under that programme. It is therefore rare for this coffee to be sold to a roaster under the trader programme and another scheme. A trader programme is not combined with another trader programme, according to the GCP.

Roaster programmes

A roaster programme combination with Fairtrade or Rainforest Alliance is possible but very rare. For example, Nescafé sells some coffee that is also Rainforest Alliance certified.

Table 1: VSS combinations available in the European market

| Rainforest Alliance | Fairtrade | Organic | Other certification | Other VSS | Trader programme | Roaster programme | |

| Rainforest Alliance | |||||||

| Fairtrade | Very rare | ||||||

| Organic | Some products | Many products | |||||

| Other certification | Very rare | Very rare | Some products | ||||

| Other VSS | Very rare | Very rare | Some products | Very rare | |||

| Trader programme | Very rare | Very rare | Some products | No | Very rare | ||

| Roaster programme | Very rare | Very rare | Some products | No | Very rare | No |

Source: Long Run Sustainability

Consumers can buy Fairtrade or Rainforest Alliance Organic certified coffee in many locations. The most common places are:

- Products sold in supermarkets under their own brand or private label.

- Niche products targeted at sustainability-minded consumers, sold in supermarkets or online.

- Cafés with a large sustainability focus.

These segments all sell multi-certified coffee.

Tips:

- Before joining one or more sustainability schemes, it is important to confirm with your buyer that they will buy your coffee under that sustainability scheme.

- When deciding to join a sustainability scheme, make a detailed cost-benefit calculation. Make sure that you know how much it will cost to join the sustainability scheme and how much effort is needed. Only join the (extra) scheme if the higher price you receive for the coffee is worth the extra costs that you make.

- When you search for buyers, look for buyers that sell to supermarkets, niche brands and cafés. Each category will have different expectations when it comes to price and volume. A supermarket may expect Fairtrade Organic coffee at a lower price and at larger volumes. More niche roasters may expect higher quality in addition to Fairtrade Organic coffee and may be more willing to pay a higher price for the product. The volumes could, however, be lower.

- Ask your buyers for multi-year contracts that include volume commitments and premium commitments. It takes effort to join a sustainability scheme, and these costs diminish over time (if you are part of the scheme for multiple years). Long-term commitments are therefore a good way to minimise the risk that you fail to get a return on your investment.

Through what channels does multi-certified coffee end up on the end-market?

Figure 2: Fairtrade Organic coffee bag in a warehouse

Source: Café Imports

The channel via which your coffee reaches the end-market depends on which VSS you are part of. The different programmes have different channels.

Fairtrade is usually bought for specific buyers. However, some traders may buy Fairtrade Organic coffee if they don’t have a buyer for the coffee yet. This coffee is bought for the spot inventory list. In other words, the trader buys it because they think they can sell it to a roaster later. This is most common for Fairtrade Organic from a specific origin. The traders can offer the coffee as Fairtrade, Fairtrade Organic, Organic only, or without a scheme. This is what smaller specialty buyers may want.

Traders can speculate on Fairtrade Organic because the price difference may not be that big for Fairtrade Organic compared to buying as just 1 of the 2 schemes. The trader therefore may as well buy as both, and then see what the market is like later. It gives them more options. If they find a buyer that wants coffee from that country, or Fairtrade coffee, or organic coffee, or a combination of these, the trader has coffee available to sell to them. In some cases, the trader already has buyers in mind, but the sale has not been made yet. This speculation is most common with Fairtrade Organic, because that demand is highest. It is less common for traders to buy Rainforest Alliance Organic coffee without a specific client.

The sustainability programmes AAA Program (Nespresso) and C.A.F.E. Practices (Starbucks) are bought specifically for that specific brand. They can be bought by various traders, but AAA coffee is sold to Nespresso as AAA, and C.A.F.E. Practices coffee is sold to Starbucks as C.A.F.E. Practices. This is also shown in the table below.

Sales under sustainability schemes are most often sold through the channels in the table below. You can read the CBI report Entering the European market for certified coffee for more information on the European market for certified coffee.

Table 2: VSS type, main buyers and type of purchase

| VSS type | Organisation name | Main buyers | Type of purchase |

| Large third-party certification programme | Rainforest Alliance (UTZ) Fairtrade Fair Trade USA Organic 4C Certifica Minas | Available for all roasters. Main buyers are large volume roasters and retailers. | Most often for specific buyers. Some spot-buying– traders can buy coffee as certified without having a confirmed buyer for the coffee. |

| Smaller third-party certification programmes | Biodynamic/Demeter Símbolo de Pequeños Productores (Small Producers’ Symbol) SMBC Bird Friendly Fair Choice Regenerative Organic Certified (ROC) World Fair Trade Organisation (WFTO) | Almost exclusively for specific buyers. The programmes are small and demand is very specific. | |

| Other verification programmes | Enveritas Fair for Life (Control Union) | Almost exclusively for specific buyers. | |

| Trader programmes | ECOM Agroindustrial’s Sustainability Management Services (SMS) Ofi’s AtSource Entry Verified and AtSource Plus Mercon Coffee Group: LIFT Neumann Kaffee Gruppe (NKG): Bloom Sucafina: IMPACT Volcafé: the Volcafé Way | The coffee is only bought by the trader that owns the scheme. The coffee can be sold to any roaster, although not necessarily under that scheme. | |

| Roaster programmes | AAA Program (Nespresso) C.A.F.E. Practices (Starbucks) | The coffee can be bought by many traders. The coffee is only sold on to the roaster that owns the scheme (Nespresso or Starbucks). | Producers only join the programme if they have a commitment from the roaster. Services are often provided in-country. The roaster often funds the whole implementation system. |

Source: Long Run Sustainability

3. What competition do you face on the European multi-certified coffee market?

This report focuses only on coffee that is produced under multiple VSS and coffee that is sold under multiple VSS. Read the CBI report What is the demand for coffee on the European market for more information about overall production and demand. There is little information available about multi-certification at country level. This chapter will therefore highlight the key insights from the CGP reports. These numbers are based on the data from 8 GCP members, and not the entire production and sales of the country.

Which countries are you competing with?

Figure 3: A Rainforest Alliance certified coffee farm in Colombia

Source: The Rainforest Alliance

Vietnam has the largest volume of multi-scheme coffee sales

According to the Global Coffee Platform, Vietnam had the largest volume of coffee to be sold under 2 or more VSS in 2021 among reporting GCP members. The combination in Vietnam is 4C with Rainforest Alliance/UTZ for 95,000 tonnes. This represents 23% of the total VSS sales. Total coffee production in Vietnam was 1.74 million tonnes in 2020.

Brazil has the second-largest volume of multi-scheme coffee sales

Brazil has the second largest volume of coffee sold under multiple VSS among reporting GCP members. The combination in Brazil is 4C, Fairtrade and Rainforest Alliance/UTZ for 35,000 tonnes. This volume represents about 10% of the total VSS sales. Total coffee production in Brazil was 4.14 million tonnes in 2020.

Brazil has more intensive agriculture, and therefore less organic production. There are some producers of organic coffee, but this is not available in the volumes that other countries may be producing. This may help explain the low percentage available under multiple VSS.

India has the highest percentage of multi-scheme coffee sales

India has the highest percentage of producers selling coffee under 2 or more VSS at 49% among reporting GCP members. The combination in India is Fairtrade with Rainforest Alliance/UTZ for 14,000 tonnes. Total coffee production in India was 342,000 tonnes in 2020.

Peru has the second-highest percentage of multi-scheme coffee sales

Peru has the second-highest percentage of production that is sold under multiple VSS among reporting GCP members, with 30% of VSS sales. The combination in Peru is Fairtrade with Rainforest Alliance/UTZ for 10,000 tonnes. Total coffee production in Peru was 228,000 tonnes in 2020.

Honduras has the third-largest volume of multi-scheme coffee sales

Honduras has the third-highest percentage of overall sales that are part of multiple VSS among reporting GCP members. This is the case for 25% of VSS coffee sales. The combination in Honduras is 4C, Fairtrade and Rainforest Alliance/UTZ for 18,000 tonnes. Total coffee production in Honduras was 366,000 tonnes in 2021.

Source: Global Coffee Platform

Which companies are you competing with?

To be successful as an exporter, it is important to learn from your potential competitors. Focus on their marketing strategies, the product characteristics they highlight, the VSS they offer, and their value addition approaches. Many exporters that offer certified coffee are also able to offer multi-certified coffee.

One segment to look at is international exporters. Many international exporters have a local office in producing countries. Examples include Sucafina, Ecom, Neumann Kaffee Gruppe (NKG) which also owns a multi-certified coffee producer, Louis Dreyfus Company (LDC), Ofi which also reports certified volumes sold (but not multi-VSS), and Volcafe which also lists certifications per country. These international traders all buy and sell certified coffees.

It is useful to look at international exporters that focus more on sustainability. These may have a larger share of their coffee available under multiple VSS. One example is Sustainable Harvest, which also lists the multi-certified coffee available in their warehouses. There are also many local exporters that export multi-certified coffee. Our country studies list many interesting local exporters.

Learn from these companies how to promote your portfolio of coffee produced under multiple VSS. Give detailed information about your coffee growing region (origin), the varieties, qualities, processing techniques and certifications of the coffee you offer. You can also talk about the history of your organisation, your coffee growing farm(s), and about the passion and dedication of the people working there. These are all elements that make your company unique.

Tips:

- Find potential business partners in Europe by checking the lists of Fairtrade-certified operators, Rainforest Alliance supply chain actors and organic-certified companies.

- Read our study on 10 tips for finding European coffee buyers and 10 tips for organising your coffee export to Europe.

- Our country studies list many local exporters. Review these for your country to determine your competitors.

Which products are you competing with?

Coffee produced under multiple VSS is attractive for companies that want a strong sustainability message that covers the social, environmental and economic side. This message needs to be stronger than the message of one VSS on its own. Marketing the product under multiple schemes makes the product more attractive for consumers that care about sustainability.

A key competitor for multi-VSS coffee is coffee that can be marketed with a strong sustainability story without the need for multiple VSS. This includes specialty coffee and direct trade coffee. For these segments, the origin story makes the coffee attractive for coffee drinkers that care about sustainability. They may not need sustainability schemes to tell their story. The only exception is organic, but this would not be bought in combination with another scheme.

Some consumers that care about sustainability are also happy if the coffee is only part of one VSS. This includes certification programmes and company programmes (verification programmes). It is important to explain that coffee that is covered by multiple VSS is more sustainable than coffee sold under one VSS.

In the end, the most important factor is that there are buyers for multi-VSS coffee. It is most important to confirm with your buyers before you start producing and marketing your coffee under multiple VSS.

4. What are the prices for multi-certified coffee?

The key parts of the price to consider for multi-certified coffee are the base price, country differential, premiums and quality differentials.

Table 3: the key parts of the price for sales of multi-certified coffee

| Type | Details |

| Base price (New York) | See ICO. Example: The ICO Composite Indicator Price (I-CIP) decreased by 2.4% from May to June 2023, averaging 171.25 US cents/lb for June. |

| Country differential | See understanding physical coffee prices. |

| Premiums | VSS have different voluntary or mandatory premiums. |

| Quality differentials | Coffees that score high on the Specialty Coffee Association (SCA) quality scale. This may result in extra price differentials. |

| Total | The total results in the final price for the coffee. |

Source: ICO, SCA, Coffee Trading Academy

The following factors are relevant when determining price, according to The Coffee Guide:

- There is value in rarity;

- Higher quality means higher prices;

- Production costs hike up the final prices;

- The cost of doing business influences prices;

- There is usually more than one end-buyer, which drives prices up;

- The issue of how much of the farmer’s coffee is ultimately sold at a given export price.

Premiums for coffee sold under multiple VSS

In March 2023, Fairtrade raised the Fairtrade Minimum Price for coffee. The minimum price for washed Arabica was increased from USD 1.40 to USD 1.80 per pound. The minimum price for natural Robusta was increased from USD 1.01 to USD 1.20 per pound. Buyers pay the Fairtrade Minimum Price or the market price, whichever is higher. See our study on certified coffee for more details.

Organic coffee is typically more expensive than conventionally grown coffee, due to the higher costs associated with organic farming practices. Fairtrade Organic producers receive an additional price incentive on top of the Fairtrade premium. This helps farmers manage their risk in an unstable market, gives farmers more during rising inflation, and helps farmers invest to adapt to climate change.

The premiums for other combinations are not publicly available.

Long Run Sustainability, Molgo Research, and Ethos Agriculture carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research