The European market potential for multi-certified coffee

There are many different Voluntary Sustainability Standards (VSS) available for coffee production. Producers can join multiple VSS, but this only happens for a small part of global coffee production. Coffee sales are usually only made under one VSS in Europe, with the only common exception Fairtrade or Rainforest Alliance together with Organic certification. The most interesting markets for these VSS combinations are the United Kingdom, Germany, Switzerland, France, Sweden and Italy. The market uptake of VSS-compliant coffee is slowly shifting from third-party certification schemes towards company-led schemes.

Contents of this page

1. Product description

This study looks at both green coffee production produced under multiple schemes and roasted coffee sold to consumers under multiple schemes. Coffee production can be part of multiple schemes at the same time. However, coffee is often sold under only one of these schemes. Buyers are usually only interested in buying and marketing the coffee under one VSS. The only notable exceptions are Fairtrade with Organic or Rainforest Alliance with Organic, which are labelled under both schemes on the final product.

Coffee is a prominent and visible consumer product. Because of its visibility, coffee has been a key agricultural commodity for experimenting with Voluntary Sustainability Standards (VSS) to improve production practices in the sector. Coffee certification and verification systems have become popular as a strategy to improve sustainability throughout the coffee value chain. Without robust public regulations in many coffee-producing countries, VSS have emerged as regulatory instruments to improve the sustainability aspects of coffee production.

VSS can be designed by NGOs or companies. They can include both third-party certification systems and second-party verification programmes. VSS can be different in content and scope, but they all provide guidelines for producing, selling, and purchasing coffee labelled as "sustainable", "responsible" or "ethical". These standards can be very different, including on their sustainability criteria, how they are audited, and how they are marketed.

Demand for certification is higher in the mainstream market than in the specialty market. Demand for multi-certified coffee is therefore also lower in the specialty segment.

There are sustainability schemes with certification and verification

Assurance on a VSS can be done with certification or verification. There are important differences between certification and verification. Certification has third-party verification, which means that an independent person (external body) such as an auditor checks compliance with the standard. The Global Coffee Platform (GCP) describes this as the “oversight of an external body in the assurance activities of the organisation or company that owns the scheme”. Verification programmes do not have these independent checks. For that reason, third-party certification schemes are often seen as stronger than verification programmes. See the box for more details.

Third-party schemes often include audits. A common approach is to audit the square root of the total number of farmers in the cooperative (For example 31 audits for a cooperative with 1,000 farmers). The idea is that over time, most farmers will be audited. This may not always be the case in practice due to farmers joining or leaving the group. Read our study on certified coffee for more information about certification and verification in coffee.

The differences between certification and verification according to The Coffee Guide

“Certification guarantees (through a certificate) that specific rules and regulations of voluntary standards are met in a particular environment (for example, individual producer, producer group, cooperative or even region). These producers must meet certain requirements – social, economic and/or environmental. Certification calls for independent third-party confirmation of this status, conducted by an accredited auditor. Typically, certifications must be renewed annually and are designed to protect both buyers and suppliers. Roasters buying certified coffee benefit from the guarantee provided by the certificate and by using the sustainable branding on their retail packaging. This contributes to better marketing opportunities because of a specific market demand for certified goods.”

“Verification enforces certain agreed criteria and practices but does not use a certificate to market the claim to the final consumer. Instead, company standards or internal supply chain standards rely on verification processes that are not as rigid and costly as a certification process that has to be conducted by appointed auditors. Local third-party actors such as NGOs – or even second-party actors – may be asked to verify adherence to specific criteria. The timing between repeat verifications may be significantly less onerous than an annual recertification process.”

There are many sustainability schemes available for coffee production

The market features several prominent sustainable coffee production standards.

Third-party schemes (certification) include:

- Rainforest Alliance, merged with UTZ in 2018

- Fairtrade International

- Fair Trade Certified (Fairtrade USA)

- Organic

- 4C (the Common Code for the Coffee Community)

- Certifica Minas

There are also many smaller third-party certification programmes available, including:

- Biodynamic/Demeter

- Símbolo de Pequeños Productores (Small Producers’ Symbol)

- Smithsonian Bird Friendly

- Regenerative Organic Certified (ROC)

- World Fair Trade Organization (WFTO)

Examples of VSS created by companies include:

- AAA Program (Nespresso)

- AtSource (Ofi)

- Bloom (Neumann Kaffee Gruppe (NKG))

- C.A.F.E. Practices (Starbucks)

- IMPACT (Sucafina)

- LIFT (Mercon Coffee Group)

- Sustainability Management Services (ECOM)

- The Volcafé Way (Volcafé)

There are also independent verification programmes, such as:

- Fair for Life (Control Union)

- Enveritas

There are also examples of different schemes working together. An example is the Nescafé plan, which partners with the Rainforest Alliance.

See our study on exporting organic coffee to Europe and exporting certified coffee to Europe for more information on certification programmes.

Figure 1: drying Fairtrade Organic coffee cherrie

Source: Fairtrade

The Global Coffee Platform helps determine a baseline level for VSS

There are a lot of different schemes available for coffee. This makes it difficult to tell them apart or see how they are different. The Global Coffee Platform (GCP) is an initiative that tries to help show the similarities and differences.

The Global Coffee Platform is a multi-stakeholder membership association. Their members include coffee producers, traders, roasters and retailers, civil society, associations, governments and donors. The GCP works towards a thriving, sustainable coffee sector. It was formed in 2016.

The GCP has developed a Coffee Sustainability Reference Code. This code outlines 12 principles that describe baseline sustainability for coffee production and primary processing. The code has 5 critical practices:

- Elimination of the worst forms of child labour;

- Elimination of forced labour;

- No deforestation;

- No use of prohibited pesticides; and

- Continuous improvement.

The Coffee Sustainability Reference Code was published in 2021. It is the successor of the GCP Baseline Coffee Code. The Baseline Coffee Code was a sector-wide agreement on baseline practices of sustainability. The GCP categorises coffee sustainability schemes into third-party schemes (certification) and second-party schemes (verification). The GCP has approved several schemes by comparing them to the Baseline Coffee Code.

GCP lists the following approved third-party schemes: Rainforest Alliance, Fairtrade, Organic, 4C and Certifica Minas. The GCP also considers one company programme to be equivalent to third-party schemes: C.A.F.E. Practices (Starbucks).

Second-party schemes approved by the GCP are: Ecom’s SMS, Enveritas Gold, Enveritas Green, AAA Program (Nespresso), Ofi’s AtSource Entry Verified and AtSource Plus, LIFT by Mercon, Neumann’s NKG Bloom.

Several companies have also developed their own VSS that are not included by the GCP. This can be because they are not members of the GCP, because their VSS is new (less than a year old) or for other reasons. An example is the Sucafina responsible sourcing programme IMPACT.

There is overlap between programmes but there are also key differences

There is a lot of overlap between the different programmes, but there are also important differences. Once a producer meets the standard for one sustainability scheme, it is generally easier to meet requirements of other sustainability schemes. However, there are also a lot of differences between schemes, both in their setup and their effectiveness.

Some VSS have stricter requirements on certain topics, such as Organic, which requires full organic coffee production. This is not required for many other sustainability schemes. Training for a specific scheme might not be available in every production country. There may also not be demand for a specific scheme in some producing countries or regions.

One restriction with Fairtrade certification is that the certification is only possible for producer groups, and not for individual farmers. Farmers therefore need to join a group if they want to join the Fairtrade programme in combination with other programmes. An individual farmer would only be able to join Rainforest Alliance and Organic (and not Fairtrade). It is not common for a large individual farmer to join a producer group.

Producing under more than one VSS is not the same as selling under more than one VSS

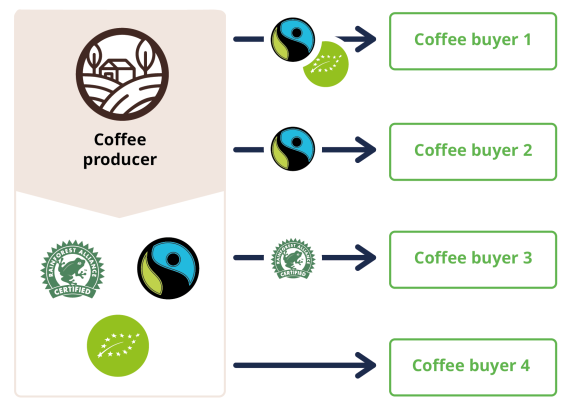

Producers that are part of multiple schemes usually do not sell their coffee under multiple schemes to one buyer. If a producer is part of multiple schemes, then the producer must choose the scheme when the coffee is first sold. The decision is made at the beginning of the supply chain. The coffee then travels through the supply chain under that scheme (or multiple schemes).

There are many coffee producers (or producer groups) that produce their coffee according to the standards of multiple schemes. These producers can sell their coffee under different schemes to different markets. For example, a producer that is Fairtrade and Rainforest Alliance-certified can sell Fairtrade-certified coffee to one buyer and Rainforest Alliance certified coffee to another buyer. But it is very rare that one container of coffee is sold by a coffee producer under more than one scheme at the same time. The only common exception is Rainforest Alliance or Fairtrade in combination with Organic.

There can be many reasons why coffee is usually sold under only one VSS. Coffee traders or roasters may prefer to buy or sell coffee under their own VSS. Coffee sales under these schemes are not commonly combined with third-party schemes.

If a roaster buys coffee that is third-party certified, they prefer to market the coffee under one label or seal (with Fairtrade or Rainforest Alliance with Organic as the only common exception). This is a clearer message for consumers and avoids having to pay double premiums.

In Figure 1, this dynamic is visualised: the coffee producer is certified for Rainforest Alliance, Fairtrade and Organic. The producer sells Fairtrade Organic to buyer 1, Fairtrade to buyer 2, and Rainforest Alliance to buyer 3. It is highly unlikely that a buyer is willing to buy coffee as both Fairtrade and Rainforest Alliance-certified. The producer may also sell part of the coffee as “conventional” (buyer 4).

Figure 2: Schematic representation of coffee production and sales under multiple VSS

Source: Long Run Sustainability, design by Bart Wortel

Tips:

- Read the reports exporting organic coffee to Europe and exporting certified coffee to Europe for more information about certification and organic coffee. Check the Rainforest Alliance and Fairtrade websites for more information about their certification programmes.

- Check the Global Coffee Platform website and the Coffee Sustainability Reference Code for more information about company VSS.

2. What makes Europe an interesting market for multi-certified coffee?

Multi-certified coffee represents a very small part of the coffee market. Coffee can be produced under multiple schemes, but it is usually not sold under multiple schemes. The only common combinations are Fairtrade with Organic and Rainforest with Organic. 18% of Rainforest Alliance coffee production was also Organic-certified. More than half of the Fairtrade coffee on the market is also sold as organic-certified.

Multi-scheme coffee production only represents a small part of global coffee production

In 2020-22, 55% of global coffee production was produced under a VSS (not adjusted for multi-certification). However, in 2021 less than 26% of coffee production was also purchased as standard-compliant coffee by the industry. This means that the other 74% of the coffee produced under a VSS was sold as conventional coffee. For example, a Fairtrade cooperative produces 8 containers, and is only able to sell 2 with the Fairtrade premium. The other 6 are sold as conventional coffee.

Only part of the coffee purchased as standard-compliant is bought under 2 or more schemes. The GCP reports that for 8 of their members, 16% of the VSS coffee in 2022 was reported against 2 or more VSS, including company programmes. This represents 8.9% of the total coffee purchases of these members (both VSS-compliant and conventional coffee).

It is difficult to estimate how much multi-VSS coffee is sold in Europe. These 8 companies buy 36.3 million bags of coffee, which is less than a quarter of global production. These companies also might not be representative of the global or European coffee industry. They are more transparent and buy more certified than the global average. However, if the global share would be the same as it is for these 8 companies (16% of VSS sales), then 4% of the coffee sold globally would be part of multiple VSS (16% of 26% sold as certified). This is based on a rough estimate, the actual global share could be very different.

It is not common for a coffee producer to be part of multiple company programmes. This is partly because the company will often invest in the farmer group as part of the programme. The company does not want other companies to benefit from these investments. The farmer groups are free to decide which programmes they are part of, but the company may give incentives not to join other programmes. With training and access to inputs and finance, they try to support farmer cooperatives to join a specific VSS.

Fairtrade, Organic and Rainforest Alliance (merged with UTZ) are the most common combinations

Most schemes do not report on multi-certification. Data is only provided by UTZ/Rainforest Alliance, Fairtrade and the Global Coffee Platform. The most common combination reported by these organisations is Fairtrade, Organic and Rainforest Alliance (merged with UTZ).

Rainforest Alliance and UTZ merged in 2018. However, UTZ-certified coffee was still available for several years after that, during the roll-out of the 2020 Rainforest Alliance certification programme and the transition for supply chain actors. UTZ-certified coffee was still produced and sold as UTZ-certified until 2022. The majority of coffee farm certificate holders have now transitioned, so UTZ coffee will no longer be available. But since UTZ coffee was still produced and traded until 2022, we will also include UTZ data in the analysis for this study.

Multi-certified production reported by UTZ

In 2020 and 2021, the combination with Organic was the most common for UTZ-certified producers (excluding the UTZ/Rainforest Alliance combination). In 2021, 25% of UTZ-certified coffee producers were also Organic-certified.

UTZ reports the production of coffee that is multi-certified. UTZ does not report multi-certified sales. It is not known how much coffee is sold as UTZ together with Organic certification. It is unlikely that coffee was sold under both UTZ and Fairtrade certification. With the transition to the new Rainforest Alliance standard completed, UTZ-certified coffee is no longer produced. Rainforest Alliance did not publish multi-certification data for 2022, after the transition had been completed.

UTZ coffee production was 44% of global coffee production in 2021.

Source: UTZ

Multi-certified production reported by Rainforest Alliance

In 2021, 18% of Rainforest Alliance coffee was also Organic-certified and 16% was Fairtrade-certified. These proportions were a large increase compared to the previous year (6% Organic and 7% Fairtrade).

Rainforest Alliance reports the production of coffee that is multi-certified. Rainforest Alliance does not report multi-certified sales. It is not known how much coffee is sold as Organic and Rainforest Alliance. It is unlikely that coffee was sold under both Rainforest Alliance and Fairtrade certification. With the transition to the new Rainforest Alliance standard completed, multi-certification data is no longer published.

Rainforest Alliance coffee production was 30% of global coffee production in 2021.

Source: Rainforest Alliance

Multi-certified sales as reported by the Global Coffee Platform

The Global Coffee Platform reports VSS combinations purchased by 8 GPS members. These are certified sales, compared to the certified production that is reported by Rainforest Alliance and UTZ. 15.6% of these coffee purchases in 2022 were under more than one VSS. Organic certification was not part of the analysis by the GCP.

- 4C, Fairtrade and RA/UTZ (7% of VSS purchases), purchased from Vietnam, Indonesia and Uganda.

- 4C and RA/UTZ (6% of VSS purchases), purchased from Brazil, Colombia, Peru and Honduras.

- Fairtrade and RA/UTZ (3% of VSS purchases), purchased from Colombia, Peru, Guatemala and India.

Source: Global Coffee Platform

The share of multi-certified coffee has steadily increased from 2019 to 2022. The biggest jump was seen between 2021 and 2022, when the share of multi-VSS coffee bought by these 8 GCP members increased from 8.9% to 15.6%.

It is not clear which of the 8 companies are responsible for this increase. GCP does not report VSS combinations per company. Part of the explanation for the increase could be that the same 8 companies did not report in both years. Straus only reported in 2021, and Julius Meinl only reported in 2022. Strauss purchased 1% of their coffee under a VSS in 2021, while Julius Meinl purchased 22% of their coffee under a VSS in 2022. This helps explain only part of the increase. The remainder could be due to increased demand for multi-VSS coffee.

Source: Global Coffee Platform

Multi-certified sales as reported by Fairtrade International

Fairtrade International reported that 66% of Fairtrade green coffee sales were also certified Organic in 2020. This represented 149,000 tonnes of green coffee sales. “More than half” of Fairtrade coffee beans sold in 2021 were also organic-certified. Fairtrade did not report a percentage for 2021, but this shows a decline in multi-certified sales.

Fairtrade coffee sales were 8% of global coffee consumption in 2021. This would mean that over 4% of global coffee sales are Fairtrade Organic.

Fairtrade Organic producers receive an additional price incentive on top of the Fairtrade premium. This also helps stimulate the sale of coffee under both schemes at the same time.

Coffee is not commonly sold under multiple VSS

Fairtrade with Organic is the most common combination of VSS on the market. Coffee is also sold as Rainforest Alliance with Organic, but this is not as common as Fairtrade with Organic. Other combinations are rare. The GCP reported zero coffee purchases under both a company programme and a third-party scheme. Expert interviews also confirmed that coffee is not sold with this combination.

It is difficult to predict whether sales of coffee under multiple VSS will continue to increase. It is expected that the increases will continue to develop in parallel with single-VSS coffee. Read the study exporting certified coffee to Europe for more details about the expected developments.

Tips:

- Different buyers will have different demands for VSS. Before joining one or more VSS, it is important to confirm with buyers that they will buy the coffee under that scheme. Read the CBI study on Entering the European market for multi-certified coffee for more information about the importance of confirming buyers before joining a VSS.

- Consider that it is very unlikely that buyers will want to buy coffee under multiple VSS at once. The only notable exception is Fairtrade Organic, and Rainforest Alliance Organic to a lesser degree.

3. Which European countries offer most opportunities for multi-certified coffee?

In this chapter, we will only look at markets for multi-certified coffee. You can read more about the European market for coffee sold under one sustainability scheme in the CBI report The European Market for Certified Coffee. From a sales and export perspective, the most interesting segment for coffee sold under multiple VSS is Fairtrade and Organic. There is also some demand for Rainforest Alliance and Organic. Other combinations of VSS are rarely sold together.

This study will focus on the United Kingdom (UK), Germany, Switzerland, France, Sweden and Italy.

The United Kingdom

The United Kingdom is the largest market for Fairtrade Organic coffee. There are several retailers that sell Fairtrade Organic under their own private label brand. For example, Waitrose sells Fairtrade Organic coffee under its own Waitrose brand. Tesco sells Fairtrade Organic coffee under the brand Café Direct. Sainsbury’s sells Fairtrade Organic coffee under the brand SO. A list of specialty roasters that sell Fairtrade Organic coffee can be found on the Fairtrade website.

Germany

Germany also has an interesting market for Fairtrade Organic coffee. 24,057 MT of German coffee consumption was Fairtrade-certified in 2022. This corresponds to about 5% of total coffee consumption. Of this 5%, about 72% was also organic-certified according to Statista. This percentage has been quite stable since 2011 (fluctuating between 68% and 78%). This means that approximately 4% of all coffee sales in Germany were Fairtrade Organic-certified.

The largest German retailers sell Fairtrade Organic coffee as part of their own-branded range (private label). Aldi sells Fairtrade Organic coffee under its own brand Simply Nature. Lidl sells Fairtrade Organic coffee under its own brand Café del Mundo. REWE also sells Fairtrade Organic coffee.

An example of Rainforest Alliance Organic coffee in Germany is Röstfein’s Rondo Bio.

Switzerland

An estimated 4% of coffee sold in Switzerland was Fairtrade Organic certified (30% of the 12% Fairtrade market share). Examples of both organic and Fairtrade-certified coffees on the Swiss market include Beararella and La Semeuse. The Swiss retailer Coop sells Fairtrade Organic coffee under the brand Naturaplan. Coop has also set targets for sales of organic products (however not in combination with other VSS). MIGROS sells Fairtrade Organic coffee under its own brand MIGROS Bio.

France

In 2017, 745 coffee products were certified Fairtrade in France, of which 532 are also certified as organic. This means that a large share of the Fairtrade coffee market in France is dual-certified Fairtrade and Organic. Examples are Clipper Tea coffees, Malongo and Mister Bean. Starbucks also sells some Fairtrade Organic coffee.

Sweden

Sweden also has a market that could be interesting for Fairtrade Organic coffee. One study in Sweden found 22 Fairtrade Organic coffees among 188 coffees in Swedish grocery shops. This is around 12% of coffee products. The Swedish company IKEA sells Rainforest Alliance Organic coffee in stores across Europe.

Italy

In Italy, 60% of the Italian Fairtrade coffee was also organic in 2022. This breaks down to 67% Fairtrade Organic for Arabica coffees and 54% for Robusta coffees. Lavazza is Italy’s largest roaster and sells a Rainforest Alliance Organic brand called Tierra across Europe.

Tips:

- Inform yourself about the main European markets for multi-VSS coffee by reading our studies. These include the German market, the Belgian market, the French market, the Italian market, the Swiss market, and many other markets.

- Use a translate tool to translate websites to your native language, for example Google Translate.

4. Which trends offer opportunities or pose threats on the European multi-certified coffee market?

The market uptake of independent VSS is stagnating

The market uptake of coffee that is part of an independent VSS is stagnating. In the 2022 The State of Sustainable Markets report, a reduction of 5.6% in the global certified area for coffee was found in 2019-2020 (for 4C, Fairtrade International, organic, Rainforest Alliance and UTZ). The total certified area has been decreasing for many years, with a total decrease of 39% from 2016 to 2020. The decrease is mainly due to more rigorous certification procedures by the 4C standard.

Certification programmes are setting their standards higher, which makes it more difficult for coffee producers to join them. Rainforest Alliance producers have seen additional challenges due to the complexity involved in transitioning to a more ambitious standard. In 2023, Fairtrade raised their minimum price for coffee by 19% for Fairtrade-certified Robusta and by 29% for Arabica. These developments may make it more difficult for producers to join multiple certification schemes in the coming years. It is expected that the demand for coffee sold under multiple VSS will grow or decline along with demand for single VSS coffee.

On the other end of the supply chain, consumers have certification and seal fatigue. In June 2023, the Standards Map shows 79 different standards for coffee. 52 of these standards have “independent third-party verification”. It can be even more confusing if there are 2 or more seals on a pack of coffee, especially if the seals are not commonly known. This is another reason why coffee is rarely marketed under multiple VSS, except for combinations with Organic.

The combination of these factors could mean a stagnating market for multi-scheme coffee as well.

Market interest is shifting from certification programmes to company programmes

The market for certified coffee is under pressure. However, demand for more sustainable coffee keeps growing. This gives more opportunities for company programmes, which are likely to continue growing in the coming years.

Below you can see one example of a trader creating their own programme to respond to this trend.

“Many roasters are very committed to existing standards and Sucafina will continue to promote these in our supply chains. However, many existing certifications have become costly, bureaucratically heavy, and difficult to implement and sustain. As some farmers opt to drop these certifications, there is less certified coffee in supply. There need to be supplementary solutions for roasters who want to source responsibly and for farmers who share the same outlook. The aim of IMPACT is not to displace existing standards but to serve needs in the face of overwhelming and growing demand for responsibly sourced coffee.”

Source: Sucafina

It is uncommon for coffee to be sold under a company-led VSS in combination with a certification programme. This trend would therefore cause a decline in coffee sold under multiple VSS.

Tips:

- Before joining a VSS, study the current trend for that VSS. Talk to your buyer about a multi-year commitment for purchasing coffee under that specific VSS.

- Organic certification is more commonly combined with other certification programmes. Confirm interest from your buyers before adding certifications.

Long Run Sustainability, Molgo Research, and Ethos Agriculture carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research