Entering the European market for organic coffee

Europe is a growing market for organic coffees. In 2018, most organic coffees imported by the European Union were sourced from Latin America, especially Peru and Honduras. Organic coffees are only recognised as such when all actors in the supply chain are certified and comply with the EU organic regulation. On the European market, organic coffees are found across all price segments and are mainly sold through supermarkets. Organic coffees follow similar trade flows in Europe as conventional coffees.

Contents of this page

1. What requirements must organic coffee comply with to be allowed on the European market?

Coffee exported to Europe must comply with strict European requirements. For a complete overview of these standards, refer to our study on buyer requirements for coffee. Below are the requirements that specifically apply to organic coffee.

Organic legislation and standards

Organic certification is a non-legal requirement for coffee. However, ‘organic by default’ does not exist from the perspective of European authorities and buyers. This means that organic certification entails more than ‘naturally grown’ and pesticide free. In order for a company to market coffee as ‘organic’ on the European market, it must comply with EU legislation (2018/848) on organic production and labelling – which in itself is a legal requirement. Regulation EU 1235/2008 describes the implementing rules of the EU legislation for imports of organic products from third countries.

Note that the EU organic regulation will apply some changes as of 1 January 2021; the website of IFOAM describes these changes in detail and highlights the implications for exporters. An important change, already implemented as of February 2020, is that Certificates of Inspection (COIs) must be issued by control authorities prior to the departure of a shipment (Article 13 (2) EU 2020/25). If this is not done, your product cannot be sold as organic in the EU and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

If you want to export to countries outside of the EU, check the required legislations for that country. For instance, Switzerland has its own Swiss Organic Law, and the Organic Products Regulations 2009 apply in the United Kingdom.

In addition, most European countries also have their own voluntary organic standards and labels, next to the EU organic label. Examples are Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, such as Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland), KRAV (Sweden) and Demeter (specific to biodynamic farming; the standard is not country-specific).

Note that most private standards demand additional requirements, next to those of the EU organic legislation. Therefore, always check the requirements asked for by the official website of the standard itself. For instance, click the link to check the additional requirements asked for by Naturland, in comparison to the EU organic regulation.

Before you can market your coffee as organic, an accredited certifier must audit your growing and processing facilities. Refer to this list of recognised control bodies and control authorities issued by the EU, to ensure that you always work with an accredited certifier. After being audited and receiving an organic certificate, you can use the EU organic logo on your products.

Organic labelling for green coffee

When you export green coffee as organic, it is mandatory to label the batch with the name and number of the organic control body and the certification number. Labels of green coffee should be written in English. The use of the EU organic logo is voluntary for the import of green coffee beans. Note that the use of the EU organic logo is mandatory for pre-packaged foods, such as roasted coffee.

Tips:

- For a complete overview of EU requirements, refer to our study on buyer requirements for coffee or consult the specific requirements for coffee in the EU Trade Helpdesk.

- Learn more about organic farming and European organic guidelines on the websites of the European Commission, IFOAM EU Group and the Organic Export Info website.

- Only use a certifier accredited by the EU. Otherwise, you will risk your certificate not being recognised by European buyers. Periodically, changes are made in the area of accredited inspection bodies. This is incorporated in TRACES.

- If you have any questions about issuing a Certificate of Inspection (COI) and what this means for your export, it is best to contact your inspection body. They are the first point of contact for further questions. Your client or potential client may also have information that can help you.

- Help your European client by getting your labelling right, sending documents in time and always keeping your master certificate valid. Without the correct paperwork from their suppliers, importers risk getting fined or losing their organic certification when inspected by their national control authorities.

- Try to combine audits if you have more than one certification, to save time and money. Also, investigate the possibilities for group certification with other producers and exporters in your region.

- For a full overview of certification schemes, consult the International Trade Centre Standards Map.

2. What competition do you face on the European organic coffee market?

The organic coffee market has developed significantly in recent years and has increased in both mainstream and specialty segments. The land area production of organic coffees reached around 701 thousand hectares or 6.5% of global coffee area in 2018. About 52% of organic production was in Africa, followed by 35% in Latin America, 9.6% in Asia and 3.5% in Oceania. The main suppliers of organic coffees to the EU were Peru and Mexico, which each supplied about 30% of EU organic coffee imports in 2018.

The mainstream and specialty segments for organic coffees

In mainstream segments, organic certification is becoming an interesting entry point for mid-range products sold mainly at supermarkets. This refers to both branded and private label coffee packages of filter coffee, roasted beans or pods. Roasters also sell quite some volume of organic coffee to organic wholesalers, such as Udea in the Netherlands, Dennree in Germany and Biocoop in France.

In higher-end segments, which generally involve lower volumes and a stronger focus on quality, origin and sustainability, organic certification adds an important differential. The specialty segment has seen an increase in organic certification, especially in comparison to other certification schemes. Although organic certification does not have a direct impact on the coffee’s cupping score, it is associated with improved traceability and safety profile. In ethical segments, fair trade certification can provide a competitive advantage when combined with organic certification.

New entrants to the market may face some extra competition from coffee exporters that are already successful, especially because of their already-established long-term relationships with buyers. Entering the market as a newcomer requires you to have extensive knowledge of your product assortment, stable quality and volumes and good communication skills to start building your own new relationships with buyers.

Peru is the largest organic coffee supplier to Europe

Peru is the largest organic coffee supplier to the EU, with an estimated 31% of total EU organic imports. Peru supplied almost 40 thousand tonnes of organic coffee to the EU in 2018. Total Peruvian supplies to the EU in 2018 amounted to 1,273 thousand tonnes.

Peru ranked as the world’s second-largest organic coffee producer in 2019, only after Ethiopia. The organic coffee area in Peru reached 121 thousand hectares, which is about 29% of all coffee land in the country. The production of organic coffees is actively promoted by local government agencies and non-governmental organisations (NGOs), which is done mainly as a strategy to increase farmers’ income.

The government of Peru has prioritised the international promotion of its coffees. Key focus area of promotion are their unique origin, the sustainability of production and the high quality of coffees. Peru is regarded as the fourth-largest producer of coffees with sustainability certification, including Rainforest Alliance/UTZ and Fairtrade. Promotion is done by the Peruvian export promotion agency PromPeru. As part of the international promotion strategy, Peru recently introduced its own national coffee brand to the international market: Cafés del Peru.

Ethiopia is the world’s largest organic coffee producer

In 2019, Ethiopia was the world’s largest organic coffee producer. An estimated 161 thousand hectares were designated to organic coffee farming, reaching an organic coffee area share of 23%. The Ethiopian government highly encourages the sector to adopt more sustainable growing techniques and to focus on producing high-quality Arabicas.

Ethiopia is the largest African coffee producer and the world’s fifth largest, with production volumes reaching 470 thousand tonnes in 2018. The EU imported an estimated 5.3 thousand tonnes of organic coffee from Ethiopia. Coffee is the most important export crop for the country, with an estimated 34% of the entire export value in 2017/18. Ethiopian producers rely on the uniqueness of Ethiopia as an origin; it is considered by many as the birthplace of coffee. Ethiopia’s coffees have high potential in the specialty market.

Almost all coffee in Ethiopia is traded on the Ethiopian Commodities Exchange (ECX). However, since 2017, exporters have been allowed to sell directly to international buyers, due to recurring issues related to the lack of traceability of farm-specific or organic-certified coffees sold through ECX.

Honduras has emerged as a major organic coffee producer and exporter

Honduras is the largest coffee producer in Central America and ranks sixth in global coffee production. In 2018, production volumes reached 481 thousand tonnes. The introduction of more disease-resistant varieties in Honduras, after a severe coffee rust outbreak, resulted in increased production volumes.

Honduras was the second-largest supplier of organic coffees to the EU in 2018, with over 39 thousand tonnes or 31% of organic coffee imports. In 2018, about 24 thousand hectares were dedicated to organic coffee farming in Honduras, approximately 4.7% of the total Honduran coffee area. This relatively low share underlines the existing growth potential of Honduras as an organic producer.

The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees, either through certification or by actively improving coffee quality. Honduran exports of specialty organic coffees increased by 30% between 2016 and 2017 because of these efforts. An estimated 28% of total Honduran coffee exports consist of sustainably produced coffee.

Mexico: a well-known origin for organic coffees

Mexico is the world’s tenth-largest coffee producer, with production volumes reaching 158 thousand tonnes in 2018. Mexico has for years been one of the major organic coffee producers. In 2018, an estimated 44 thousand hectares were dedicated to organic coffee farming, 6.9% of Mexico’s total coffee area. An estimated 7-8% of Mexican coffee farmers cultivate organic coffee.

In 2018, Mexico supplied an estimated 9.2 thousand tonnes of organic coffee to the EU. Almost all coffee exported was Arabica, given that approximately 96% of coffee produced in Mexico is of that variety. However, the 4% share of Robusta is expected to increase in the future, as the Mexican government aims to increase Robusta production. The specialty coffee market shows increasing interest in high-quality Robusta varieties. The current limited supply of high-quality Robusta coffees may offer interesting opportunities for Mexican exporters which are able to provide a constant supply of fine Robusta coffees, especially if they are also certified as organic.

The outbreak of coffee rust has severely affected the coffee production in Mexico, mainly of organic coffees. As such, the government has promoted several state initiatives to support coffee tree renewal, the introduction of pest-resistant varieties and training, as well as value-added initiatives such as the production of certified coffees, among which organic.

Uganda has potential as organic coffee producer

Uganda is the world’s eighth-largest coffee producer, with production volumes reaching 255 thousand tonnes in 2019. Total Ugandan exports to Europe reached 147 thousand tonnes in 2019. Uganda mainly exports Robusta coffees, although it also produces and exports Arabica. Coffee is the most important agricultural commodity by value for Uganda.

An estimated 66 thousand hectares are certified as organic coffee land, amounting to about 17% of the total organic coffee area in the country. The National Coffee Policy has been implemented for about five years now, which promotes sustainable production systems in the country, favouring organic coffee production. In 2018, about 20% of coffee produced in the country was certified according to sustainability standards.

Coffee in Uganda is mainly grown by smallholder farmers, who are organised as farmers’ cooperatives and associations under NUCAFE, the national umbrella coffee farmers’ organisation. The Uganda Coffee Development Authority (UCDA) helps to promote and guide the development of the Ugandan coffee industry through quality assurance, research and improved marketing techniques.

Brazil and Colombia: large producing countries with interesting offer of specialty organic coffees

Brazil is the world’s largest coffee producer, with production volumes reaching 3,558 thousand tonnes in 2019. Colombia ranks as the third largest, with a production volume of 828 thousand tonnes in 2019. In 2019, Europe imported around 1,024 thousand tonnes of green coffee from Brazil and 206 thousand tonnes from Colombia.

Neither in Brazil nor in Colombia does the production of organic coffee reach scale. In 2018, only an estimated 10 thousand hectares in Colombia were certified as organic coffee land. This amounts to 1.3% of the total coffee area in the country. In Brazil, only 689 hectares were officially recognised as organic, which is very small given the near 2.4 million hectares dedicated to coffee production in the country.

There are, however, initiatives to boost organic production in Brazil. For instance, the Brazilian Organic Coffee association aims to boost organic and sustainable coffee production, and the state government of Minas Gerais has offered technical assistance to facilitate the transition to organic production, with a strong focus on maintaining the high quality of the produced coffees.

The specialty organic coffees from Brazil are highly valued in Europe. The cooperative COOPFAM from Minas Gerais, for instance, has seen the European demand for their specialty and organic coffees grow. Fazendas Klem is another example of a successful exporter of high-quality organic coffees to the European market.

The same holds true for Colombia; its high-quality organic coffees are much appreciated on the European market. Although total organic production is just a small share of total coffee production, and although the national Colombian Coffee Growers Federation (FNC) does not actively support farmers who are willing to transition to organic farming, there are initiatives to boost organic production in the country. For instance, the project ‘organic coffee for peace’ aims to increase the organic coffee growing area in Cauca, and there are also cooperatives that support the transition to organic production, like AMUCC.

In addition to specialty organic coffee, Colombia is also a large supplier of specialty coffees that are both Fairtrade and organic certified. An estimated 23% of Fairtrade coffee sales were also organic certified, amounting to 7.2 thousand tonnes of coffee in 2018. To put this in perspective, Peru, Honduras and Mexico registered higher sales of Fairtrade and organic certified coffees in 2018, with approximately 39 thousand tonnes, 25 thousand tonnes and 11 thousand tonnes respectively. This double certification is increasingly popular on the market, providing interesting opportunities for exporters.

Learn from your potential competitors

To be successful as an exporter, it is important to learn from your potential competitors. Focus on their marketing strategies, the product characteristics they highlight and how they use organic certification as a value addition approach. Successful companies that export organic coffee to the European market and from which you can learn include Ibrahim Hussien (Ethiopia), Cenfrocafe (Peru), RainForest Trading (Peru), Mayorga Organics (Honduras), Café Orgánico Marcala (Honduras), Kawa Kabuya (DR Congo) and Rwashoscco (Rwanda).

Learn how to promote your portfolio of certifications and sustainability practices from these companies. Give detailed information about your coffee growing region (origin) and the varieties, qualities, processing techniques and organic or other certifications of the coffee you offer. You can also share information about the history of your organisation, your coffee growing farm(s) and the passion and dedication of the people working there. These are all elements that make your company unique.

Tips:

- If you are new to organic coffee, get price quotations from different control bodies in your region and negotiate with these (private) companies to get the best deal.

- If you are new to organic coffee, make calculations to see if (or when) organic certification is something for you: you should weigh your certification against realistic (future) demand from (potential) clients. Also, take into account the volume you can produce. Typically, exporting only one full container load (FCL) of coffee will only barely cover the organic certification costs of a small cooperative.

- If you have considerable volume, for instance around or more than 10 containers, consider adding Fairtrade certification to your organic certification. Fairtrade-Organic certification will increase your options of selling more of your coffee with the organic premium. Again, do all the necessary cost-benefit calculations and check for potential customers before deciding upon this.

- Develop long-term partnerships with your buyer. This implies that you must always comply with buyer requirements and keep your promises. This will provide you with a competitive advantage, more knowledge and stability on the European market.

- Actively promote your company on your website and at trade fairs. Cup quality competitions also provide good opportunities to share your coffee with a wider audience (examples: Cup of Excellence or check this list of competitions and awards provided by the Specialty Coffee Association (SCA).

- Promote the sustainable and ethical aspects of your company and support these claims with certification. Examples of coffee exporting companies that provide information on their sustainable practices and certifications include Café Orgánico Marcala (Honduras), Maya Vinic (Mexico), Bench Maji Coffee (Ethiopia), Sumatera Arabika Gayo (Indonesia), ACODIHUE (Guatemala), Nyamurinda Coffee (Rwanda) and Café Mesa de los Santos (Colombia).

- See our study on doing business with European coffee buyers for more tips on marketing and promoting coffee.

3. Through what channels can you get organic coffee on the European market?

As an exporter, you can use different channels to bring your organic coffee to the European market, depending on the quality of your coffee and your supplying capacity. Suppliers in producing countries mainly enter the European market through an importer or large roaster that has organic product lines, but there has been an increase in direct trade between coffee roasters and producers.

The market for organic products in Europe is quite developed and has shown continuous growth. The sales of organic coffee have benefited from this growth in Europe. The retail marketing channels differ from country to country, yet general retailers are gaining ground everywhere.

How is the end market segmented?

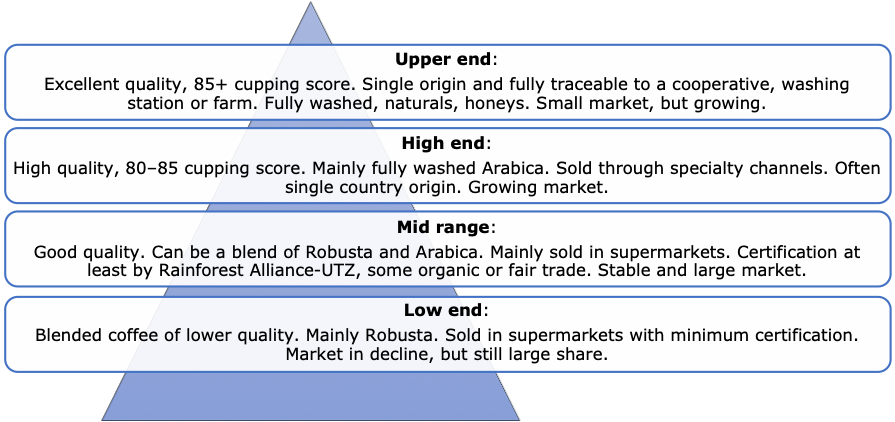

Organic coffee beans belong to the middle-range and high-end segments. The figure below shows the general segmentation of the coffee end market.

Figure 1: Coffee end market segmentation by quality

Mid range: mid-range coffees are commercial coffees with a good and consistent quality profile, such as quality espresso. This segment typically consists of blends with a higher proportion of Arabica compared to the low-end segment. The mid-range segment represents a stable coffee market, in which sustainability certifications are important, including organic.

Mid-range coffees are often sold in supermarkets and by the food service industry. The market share of private labels in Europe continues to grow, with Spain (51%), Switzerland (49%) and Germany (45%) taking the lead. Retailers increasingly develop their own private label products with organic certification, which are offered at more accessible prices that appeal to consumers of all profiles.

Europe also has a large segment of organic food retail shops, both independent shops and chains. Examples of leading organic retail chains in Europe include Denn’s Biomarkt (250 shops in Germany in 2018), Alnatura Super Natur Market (133 shops in Germany), Biocoop (572 shops in France), La Vie Claire (353 shops in France), Ekoplaza (75 shops in the Netherlands), Veritas (50 shops in Spain), Bioshop (17 shops in Belgium) and Natura Si (262 shops in Italy).

Examples of products and prices in the mid-range segment, based on Dutch retail prices in 2020, include:

| Product | Retail price (€/kg) | |

| Mid range | Perla (organic + UTZ, espresso coffee beans #8, 500 g package) | 14.18 |

| Destination (organic, Arabica coffee beans, 1 kg package) | 14.99 | |

| Australian (organic + UTZ, slow roasted coffee beans, 500 g package) | 15.98 | |

| Café Intención (organic + Fairtrade, coffee beans, 500 g package) | 15.98 | |

| Fairtrade Original (organic + Fairtrade, single origin, 500 g package) | 17.78 | |

| Simon Lévelt (organic, espresso medium roast, 500 g package) | 17.98 |

High and upper ends: high-quality coffee mainly consists of washed Arabicas. These coffees are often single origin and coffees with a special story. The upper end of this segment consists of specialty coffees of excellent quality, often from micro or nano lots that go through innovative processing such as naturals and honeys. These are mainly fully traceable and single-origin Arabica beans with a cupping score of 85 and above. The high and upper-end segments are a growing market but remain very small.

Sustainability practices are often commonplace among buyers in the high and upper-end segments. Long-term contracts between suppliers and buyers characterise these segments, as do higher prices. Also, buyer and supplier usually agree on projects for communities and distribution of money to farmers, a common characteristic of certifications aimed at social impact. As such, certification is not commonplace in these segments, although organic certification is an exception to this. The primary focus of organic certification is consumer safety and environmental accountability. Organic farming and certification is regulated by legislation, and it addresses aspects which are complementary to high quality, such as the prohibition of synthetic inputs.

Coffees from this segment are mainly sold directly by specialty roasters, at their physical and web shops as well as at coffee events. Examples of coffee festivals are those held in Berlin, London, Amsterdam, Milan, Warsaw, Barcelona and Paris. To find examples of European specialty roasters and cafés, refer to the city guides on the European Coffee Trip website. There are also several coffee web shops in Europe, where you can find high and upper-end coffees, including Roast Market (Germany) and Specialty Coffee (Netherlands).

Examples of organic coffees in the high and upper-end market segments include:

| Product | Retail price (€/kg) | |

| High and upper end | Organic, washed Caturra/Catuaí/Typica, from Daniel Quispe Mamani, Bolivia, roasted by Mokxa (France), 250 g package | 34.00 |

| Organic, washed Kurume/Welicho (Heirloom), from Suke Quto, Guji, Ethiopia, roasted by Bocca (the Netherlands) 250 g package | 35.00 | |

| Organic, washed Caturra/Bourbon, from Cajanarca, Peru, roasted by Beanberry Coffee Company (United Kingdom), 250 g package | 49.80 | |

| Organic, washed mixed Heirloom, from Nano Challa Cooperative, Gera, Ethiopia, roasted by The Barn (Germany), 250 g package | 60.00 |

Value distribution: as the above shows, end-market prices for coffee vary depending on which segment of the market is targeted. Note that trade prices and retail prices behave independently and are not directly linked. However, typically, export prices of green coffee only account for 5% to 25% of the end-market prices, depending on the coffee quality, the size of the lot and the supplier’s relationship with the buyer.

Organic certification offers a premium to producers and exporters. Those premiums may differ per country, producer and buyer due to various aspects, such as quality and negotiation power. Organic coffee usually commands a premium of about 15-20% over the baseline prices paid for conventional green coffee. If you handle Fairtrade and organic-certified coffee, buyers pay the Fairtrade Minimum Price, and on top of that a Fairtrade premium and a fixed organic differential.

Prices for specialty coffees will also command differentials, although prices may have a reference on the international London and New York market prices. In the specialty segment, the shares of added value for farmers tend to be much higher than in the conventional coffee market (see the figure below), where approximately 10% of the added value of sold coffee goes to farmers.

Tips:

- Learn more about the difference between retail prices for organic coffees of standard quality and those in the specialty segment. For organic coffee prices in the middle-range segment, check the websites of European supermarkets such as Carrefour (France), Albert Heijn (the Netherlands) or REWE (Germany). Compare their product assortment and price levels with specialised roasters, such as the ones listed here on the website of Specialty Coffee (the Netherlands).

- Price premiums for organic coffee may range widely, depending on quality. If you move towards organic coffee production, make a thorough cost calculation with and without the certification expense, using various scenarios with different volumes of organic coffee sales to calculate the possible extra profit.

- Refer to our study on trends in the coffee market to learn more about developments within different market segments.

- Check the website of the Specialty Coffee Association (SCA) to learn more about the high-end coffee segment, market trends and main players.

Through what channels does organic coffee reach the end market?

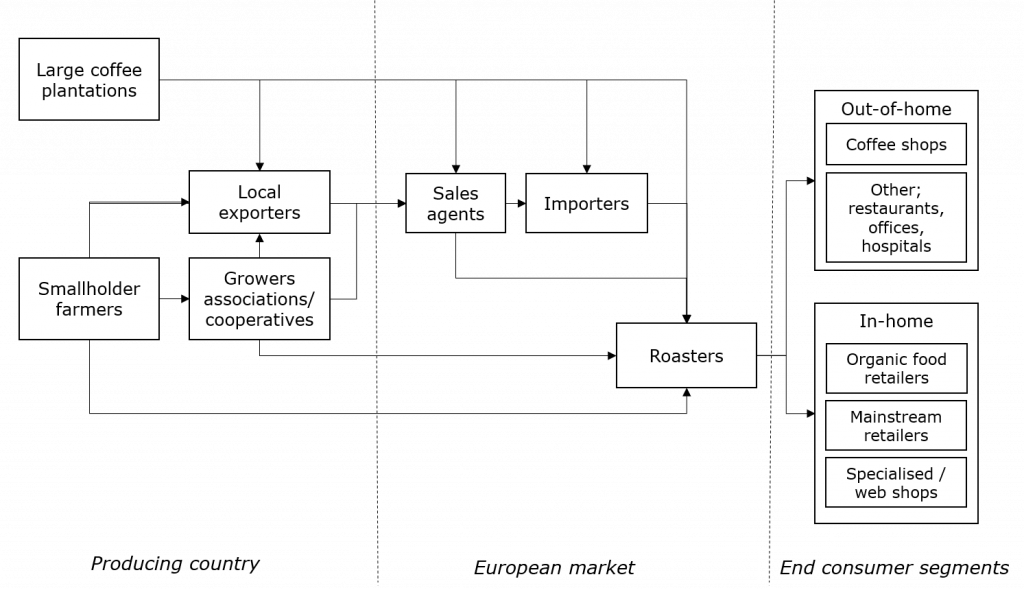

As an exporter, you can use different channels to bring your organic coffee to the European market, depending on the quality of your coffee and your supplying capacity. Note that, for coffee to be imported as organic, all operators in the product chain must be certified and acting in conformity with the organic standard (Chain of Custody).

In general, organic coffee is imported through similar market channels as conventional coffee. The figure below shows the most important market entry channels for green coffee into Europe. Bear in mind that shortened supply chains are a general trend in Europe. This means that retailers and coffee roasting companies are increasingly sourcing their green coffee directly from origin.

Figure 3: Market channels for green coffee in Europe

Importers

Importers play a vital role in the coffee market, functioning as supply chain managers. Importers pre-finance operations, provide strong support with logistics, perform quality control, manage price fluctuations, give marketing support and establish contact between producers and end buyers, such as roasters. In most cases, importers have long-standing relationships with their suppliers and customers.

Importers maintain wide portfolios from various origins. Large-scale importers usually have minimum quantity requirements of a few containers, covering a wide range of qualities, varieties and certifications, among them organic. Examples of large-scale importers in Europe dealing with organic coffees are Neumann Kaffee Gruppe, Louis Dreyfus Company and Olam Group.

Specialised importers usually buy smaller volumes of high-quality and single-origin coffees. There are quite a number of specialised importers active on the European market, which focus on the import of fine specialty coffee and also manage organic coffees. Examples include Mercanta The Coffee Hunters and DR Wakefield (United Kingdom), Touton Specialties Coffee and Rehm & Co (Germany), Nordic Approach (Norway), 32Cup (Belgium), Trabocca and This Side Up (the Netherlands).

There are also specialised importers focused on organic products, such as Alter Eco (France; besides organic, they also focus on Fairtrade), Simon Lévelt (the Netherlands), Gepa and Rapunzel (Germany).

For whom is this an interesting entry channel? The most interesting channel for you will depend on the quality of your coffee and your supply capacity in terms of volume. If you are an exporter of green coffee beans and you can offer high volumes (10 containers or more), you should look into entering the European market through large importing companies. These companies usually have agents or representative offices in producing countries, which can be your first point of contact.

Specialised traders can be interesting if you have evidence of high cupping scores of at least 80 or higher, although some buyers may require scores higher than 85. Specialised traders may have a special interest in single-origin coffees as well as coffees with sustainability certification, such as organic or fair trade. Keep in mind that many specialised importers prefer to work directly with producers or cooperatives, and not through middlemen.

Large roasters and private labels

Most large roasters buy their own coffee beans at the country of origin, although they might also source through importers. Roasters usually perform an analysis and cup testing to check the evenness of the roast and to identify any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Large roasters usually blend different qualities of green coffees to safeguard quality consistency. The final product is distributed to retailers and the food service industry.

Roasters can operate under their own brands or private labels. Most roasters manage organic coffees. Examples of large-scale roasters active on the European market include Jacobs Douwe Egberts, Nestlé and Lavazza. Examples of private label roasters include Lincoln & York (United Kingdom) and Beyers (Belgium).

Examples of medium-sized roasters focused on specialty coffees in Europe are Taylors of Harrogate and Union Hand-Roasted Coffee (United Kingdom) and Arvid Nordquist and Löfbergs (Sweden).

For whom is this an interesting entry channel? Supplying to large-scale roasters is only interesting if you are able to supply large volumes at a consistent quality. Supplying to medium-sized roasters which focus on specialty coffees is interesting if you have steady volumes of higher-quality coffees and if you are willing to engage in long-term partnerships.

Small-scale roasters

There is also a growing number of small-scale roasters that import green coffee directly from origin. However, many small-scale roasters continue to buy their coffee via importers, because not everyone can take on the additional responsibilities necessary to import directly from source. Importers help roasters with financial services, quality control and logistics. Small-scale roasters mostly maintain a direct connection with their producers. Small roasters are often specialised in single origins and the finest specialty coffees. Many of them deal with organic-certified coffees as well.

Examples of small-scale roasters in Europe that import coffee directly from origin include Cafédirect (United Kingdom), Coffee Collective (Denmark) and Flying Roasters (Germany). There are many more artisanal coffee roasters in Europe; for more examples, refer to this list of roasters by Good at Coffee and the website of the European Coffee Trip.

For whom is this an interesting entry channel? Supplying to small roasters is interesting for producers and exporters that have high-quality coffees, micro lots and sustainability certification and are willing to engage in long-term partnerships. If you have very high-quality coffees and are currently working through an importer, for example, it would be interesting to explore direct trade possibilities to see whether you could connect directly with roasters. This requires you to have the financial means and technical know-how to organise export activities.

Intermediaries/agents

Agents act as intermediaries between you, coffee importers and roasters. They are actors with vast market knowledge and can help you assess and select interesting buyers. Some agents are independent, while others are hired to make purchases on behalf of a company. Examples of agents in Europe include Eugen Atté and Euroca (Germany) and Marex Spectron and Coffee AG (the United Kingdom). Before engaging with agents, make sure they have organic licenses which enable them to deal with organic coffees.

For whom is this an interesting entry channel? If you have limited experience exporting to European countries, agents can play a very important role. Agents are also interesting if you have limited quantities of coffee or if you lack the financial and logistical resources to carry out trade activities. Working with an agent is also useful if you need a trusted and reputable partner within the coffee sector. Be prepared to pay an extra commission for their work.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and organic certification. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Find importers that specialise in organic products on the website Organic-bio.

- Check the website of Organic Market Info to find a list of several distributors of organic food in Europe.

- Try to visit trade fairs for organic products, like Biofach (Germany), Natural & Organic Products (United Kingdom) and Nordic Organic Food Fair (Nordic region). Check out their websites for lists of exhibitors, seminars and other events at these trade fairs. Other interesting trade fairs in Europe include SCA’s World of Coffee (every year in a different European city) and COTECA (every other year in Germany).

- Invest in long-term relationships. Whether you are working through importers or roasters, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on how to do business with European buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research