Entering the European market for roasted coffee

The European roasted coffee market is highly competitive. The supply of coffee roasted at origin is still very small. This offers opportunities for large companies focusing on efficiency or small suppliers focusing on sustainability. In general, the companies that export roasted coffee are the roasting companies.

Contents of this page

All suppliers must meet strict European legislative requirements, which are stricter for roasted coffee than green coffee. However, some entry requirements only apply to certain organisations. In this study, we distinguish between two main exporter types of coffee roasted at origin: efficiency-focused roasters and the sustainability-focused roasters.

Efficiency-focused roasters

A share of the exporters of coffee roasted at origin can compete on the European market due to low price. These organisations mainly target large domestic markets, such as Brazil, Vietnam, or Colombia. These companies typically roast large volumes, which increases their efficiency. Also, these companies have lower wages than European companies, further boosting their positions as efficient producers.

Efficiency-focused roasters are usually not well-known in the European market. Therefore, many sell their coffees as private labels. This means their coffee is sold to consumers as a different brand, often a supermarket brand.

Examples of efficiency-focused roasters are:

- Trung Nguyen (Vietnam)

- 3 Curações (Brazil)

- Juan Valdez (Colombia)

Sustainability-focused roasters

Sustainability-focused roasters emphasise a more equitable value distribution. Their main message is that a large or larger value share remains in the producing country. Sustainability-focused companies are usually founded by European entrepreneurs with strong connections in a producing country. These companies target sustainability-minded buyers. Therefore, they also focus on other aspects of sustainability.

Sustainability-focused roasters are often both importers and exporters. They roast at origin and sell to retailers and businesses in the consuming country. This is possible due to their strong ties with the consuming country. Because strong ties with the consuming country are necessary, these companies mainly focus on one target country.

Examples of sustainability-focused companies are:

- Moyee Coffee (Kenya, Ethiopia, Ireland and the Netherlands)

- Guzo Coffee (Ethiopia and the Netherlands)

- Solino Coffee (Ethiopia and Germany)

This study discusses the requirements, market channels, and competition for exporting roasted coffee to Europe. In this document, the supplier types efficiency-focused roaster and sustainability-focused roaster are used to highlight significant differences between these organisation types. However, this will always simplify the complex roasted coffee market. In reality, there are many hybrids. For example, Coffee Annan sells coffee roasted at origin. Although the company has close relationships with African roasters, they do not roast their own coffee.

In addition to the efficiency-focused roasters and the sustainability-focused roasters, we found several quality-focused roasters who have made their way to the European market. Most of these companies make use of e-commerce to sell their products to European consumers. One example is Samaria from Colombia, selling specialty coffee via the website of Alternative Café. Their market shares are generally very small, and due to this fact, these companies are not specifically targeted in this study. Despite the fact that these companies are not targeted specifically, the content of this study is applicable to these companies.

1. Which requirements and certifications must roasted coffee meet to be allowed on the European market?

The coffee you export to the EU needs to comply with the EU’s strict standards. Most requirements that apply to green coffee also apply to roasted coffee. Therefore, we recommend that you read our report on What requirements coffee must meet to be allowed on the European market. Or consult the specific requirements for coffee in the EU Trade Helpdesk Access2Market. This section will highlight where the demands for roasted coffee deviate from green coffee.

The requirements in this section are divided into:

- Mandatory requirements: legal and non-legal requirements you must meet in order to enter the market;

- Additional requirements and certifications: those you need to comply with to stay relevant in the market;

- Niche requirements: applying to specific niche markets.

What are mandatory requirements?

Additional mandatory requirements for roasting include hygiene requirements. Also, the labelling of roasted coffee is different from green coffee. Finally, trade duties apply to roasted coffee for some countries.

Hygiene requirements for roasting

Food imported into the EU is subject to official food controls. These controls include regular inspections that can be carried out at import (at the border) or later on, once the food is in the EU. The control is meant to check whether the products meet the legal requirements.

All roasters must use a procedure based on HACCP principles. A HACCP plan is a critical element of the quality management systems of companies aiming to become successful suppliers to the European market. The HACC (Hazard Analysis and Critical Control Points) principles for roasted coffee focus on keeping the coffee safe and of good quality. The steps include checking for issues like contamination, setting up points in the process to control these issues, and ensuring the coffee meets safety standards at each point. Monitoring and keeping records are also important to ensure the coffee remains safe for consumption.

Non-compliance with European food legislation is reported by the Rapid Alert System for Food and Feed (RASFF) reports. In 2023, seven issues with roasted coffee were reported in RASFF. Six out of the seven issues identified had to do with too much ochratoxin.

Tip:

- Keep detailed records of your cleaning schedules, employee training, pest control measures, and HACCP procedures. This documentation can be crucial during inspections.

Packaging

There are specific rules for consumer packaging materials which come into contact with roasted coffee. Rules regarding this are outlined in Regulation (EC) No 1935/2004. Packaging materials used for your coffee must not endanger human health, change the composition of the coffee to an unacceptable degree or negatively impact its taste and odour. Common restricted substances include:

- Vinyl chloride monomer N-nitrosamines

- N-nitrosatable BADGE

- NOGE

- BFDGE

- Heavy metals

Labelling

European Union food labelling rules ensure that consumers receive essential information to make an informed choice when purchasing their food. The information on the label must be accurate, easy to see and understand, not misleading and hard to remove/erase. The language to be used on the label is based on your target market. The label should generally be in the country's official language where your product is sold. But multi-language labels can also be used.

The following information is required on the packaging:

- Name of the product, including its physical condition like ‘dark/medium/light roasted coffee’, ‘whole beans’ or ‘ground’.

- Ingredient list (though roasted coffee should be a single ingredient).

- Allergen information, if any.

- Date marking (best before / use by).

- Country of origin.

- Name and address of the manufacturer/packager/seller.

- Net quantity.

- Any special storage conditions and/or conditions of use.

Figure 1: An example of roasted coffee labelling for the European (Dutch-speaking) market

Source: photo by Tjalling de Boer (Molgo Research)

The label may contain the certification logo if your roasted coffee is Organic and/or Fairtrade-certified. The term ‘Organic’ and the European Union’s Organic logo can only be used for products which comply with the European regulation on organic production and labelling.

If the imported product goes directly into the retail channel, product labelling must comply with EU regulations on the provision of food information to consumers. This regulation clearly defines nutritional labelling, origin labelling, allergen labelling, and minimum font size for mandatory information.

In some countries, the government sets standards for exporting roasted coffee to the European market. For example, the Ethiopian Food and Drug Authority sets strict standards on hygiene levels for roasting coffee for export.

Tips:

- Ask your buyer to approve your concept before you print your labels.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on preventing and reducing Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009.

- Read more about quality requirements for coffee on the Coffee Quality Institute website.

- Read how to label your product in the Practical Guide to Food Labelling.

- Inform yourself of other requirements for entering the European roasted coffee market via ITC’s Coffee Guide.

- For information about payment and delivery terms, refer to our study on Organising your Coffee Export to Europe. Note that the most relevant risk for the transportation of roasted coffee by sea is the deterioration of the product’s quality. This requires well-ventilated containers with a breathable membrane, and top-quality packaging solutions for the product. Air freight is more expensive but generally shortens the transportation interval by more than 10 times and thereby lowers quality-related risks. In both cases, the use of Letters of Credit is not common.

Trade duties for roasted coffee

Tariffs may apply to roasted coffee, as is shown in table 1. To see if your country belongs to the Generalised Scheme of Preferences (GSP) or Everything But Arms (EBA), refer to the European Commission’s website. Refer to the Access2Markets webpage to see if your country has an Economic Partnership Agreement (EPA) or Free Trade Agreement (FTA) with the EU.

Most coffee-producing countries are part of a preferential group and are, therefore, eligible for reduced trade tariffs. Note that these groups may change over time. Therefore, it is essential to check the current state of your country via Access2Markets Trade Assistant.

Table 1: EU tariffs for green coffee beans and roasted coffee

| Origin | Roasted coffee | Examples |

| Countries with no specific agreement | 7.5% | |

| GSP | 2.6% | Indonesia, Nigeria |

| GSP+ | 0% | Philippines, Sri Lanka |

| EBA | 0% | Ethiopia |

| EPA / FTA | 0% | Costa Rica, Peru, Kenya |

Source: Access2Markets Trade Assistant

You need a preferential entry certificate to prove that your duties have been lifted. Sales contracts often require this certificate. If missing, the buyer can deduct the duty costs from the payment. The seller can get a refund by submitting the certificate later, but only within a certain timeframe. Sellers should check with their local chamber of commerce to find out if they need this certificate. Under the European Standard Contract for Coffee (ESCC rules), buyers may specify a country other than the destination port when importing.

Because the European roasted coffee market is very competitive, exporting roasted coffee into Europe will be very hard if your country is subjected to trade duties.

What additional requirements and certifications do buyers often have/need?

The additional requirements are those that give you a competitive advantage. They depend on the type of exporter.

Additional requirements for efficiency-focused roasters

The main requirements for efficiency-focused roasters (see introduction) are price, consistent quality, and quantity. The quality needs to be average. Other requirements depend on your buyer’s preferred customer taste profile. Countries like Italy and Spain typically request blends containing a high percentage of Robustas. Certification is less important. Scandinavian countries have a higher demand for Arabicas and certified coffees. Many efficiency-focused roasters certify part of their production to serve different clients but remain efficient.

Large roasters that focus on costs mainly sell their products as private labels. Many buyers have specific requirements concerning packaging. When focusing on efficiency, you must ensure that certified coffee is not sold as regular coffee.

Additional requirements for sustainability-focused roasters

Sustainability-focused roasters (see introduction) must address all aspects of sustainability. Their unique selling point is a more equitable distribution of the value chain. However, their clients will also expect a high emphasis on other aspects of sustainability.

Coffee from sustainability-focused roasters does not require certification. Their certification standards are higher than required by most certification schemes. These companies, for example, focus on sourcing from the lowest-income countries, fair payment to farmers, etc. Certification could help you if you focus on the supermarket segment, especially in Scandinavian countries. Also, it can help as a management tool to improve your business.

The packaging of sustainable producers typically includes a lot of storytelling. It emphasises the equitable (fair) distribution across the value chain. Secondly, it is recommended that you create a sympathetic, personal profile of the producer. Consumers buy this coffee because they empathise with the producer. You can add much value by showing who profits from their purchase.

Example of sustainability-focused storytelling, from Moyee’s website:

The problem with coffee is that 90% of what coffee is worth, goes to a handful of large multinationals, which we call Big Coffee; labels we all know. This means that only 10% of the value of coffee stays within the country of origin. That leaves the farmer with no options for development or margin! With us this is 50%, because we roast and package in the country of origin and in doing so we redistribute the coffee chain toward an equal partnership.

Quality requirements for sustainability-focused roasters

Quality, especially freshness, can be a bottleneck. This mainly applies to sustainability-focused roasters. European consumers don’t pay extra for ‘just sustainability’. Most consumers expect higher quality when paying extra for a product.

Roasted coffee quality is often associated with its freshness after roasting. This is one of the most important quality aspects of coffee roasted at origin and requires working with small batches and just-in-time production and shipment. Next, packaging is essential. The two methods most commonly used to preserve freshness are vacuum sealing and nitrogen flushing. Another crucial element in safeguarding the freshness of roasted coffee is one-way valve packaging. This allows the air out and not back in.

Figure 2: Valve packaging of Guzo coffee (roasted in Ethiopia)

Source: photo by Tjalling de Boer (Molgo Research)

Tips:

- Read CBI’s studies on How to go green and How to become socially responsible. These studies provide many ideas on how to improve your sustainability requirements.

- Carefully plan your production. This is one of the critical characteristics of a successful roaster. Shipping batches that are too small leads to inefficient roasting and transport, while shipping batches that are too large leads to lower quality or waste.

- Adjust your communication to the European consumer market. If you target a specific country, adjusting your packaging to the targeted European country is best. Also, ensure your website is readable in the language of a particular European country.

What are the requirements for niche markets?

Certain niche markets have additional requirements. The most common niche markets are the specialty coffee niche market, the certified coffee niche market, and the market for coffee pods. This section only describes the requirements for coffee pods. The requirements for other niche markets are described in the CBI studies on Exporting certified coffee, Exporting multi-certified coffee, Exporting organic coffee and Exporting specialty coffee.

Biodegradable capsules must break down within six months

Sustainability-focused roasters, should consider producing compostable cups when entering the capsule market. Compostable capsules are the most sustainable single-serve coffee units. Compostable coffee pods must comply with the European EN 13432 industrial composting standards. To comply, coffee capsules must break down within a maximum of six months. Most sustainability-focused roasters, however, do not produce cups, but stick to ground coffee or whole beans when exporting roasted coffee.

Capsules must fit in European coffee machines

The market for coffee pods is dominated by a few large players. Nespresso (Nestlé) is the largest brand. Other important brands are Dolce Gusto (also Nestlé, but not compatible with the Nespresso machine) and JDE Peet’s. To serve the largest market, ensure your capsules are a good fit for the dominant brand in the target country.

Most roasters outsource the encapsulating of ground coffee. They work with a capsule partner. AFPAK is a company that has helped over 300 companies encapsulate their coffee.

2. Through which channels can you get roasted coffee onto the European market?

There are many channels and segments that exporters of roasted coffee can target to enter the European market. The market channel which is best for you depends on your situation. There is a main distinction between efficiency-focused roasters and sustainability-focused roasters.

How is the end-market segmented?

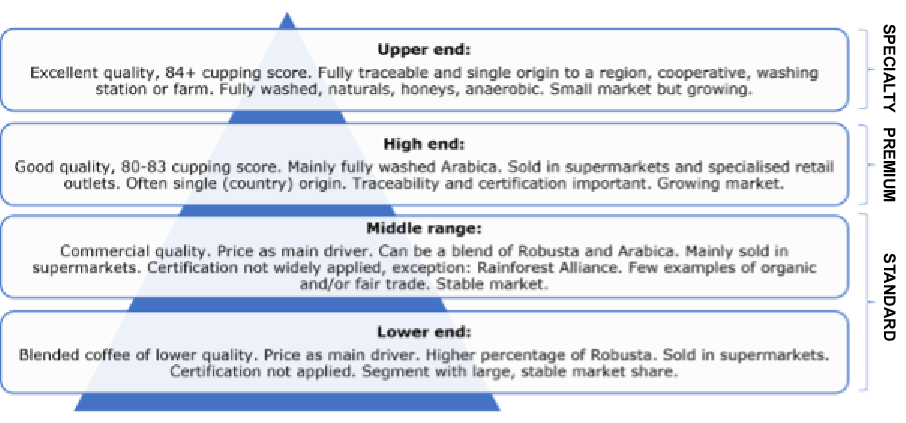

The end market for roasted coffee can be divided into four segments: the lower end, middle end, high end and upper end.

Figure 3: Segmentation of the end market

Source: Profound, adjusted by Bart Wortel

Efficiency-focused roasters mainly focus on the lower end but may also provide some coffee in the middle range. They focus on cost, not quality or sustainability.

Sustainability-focused roasters focus on the high end. Because their coffee is more expensive than usual, their clients will also demand above-average quality. Their coffee will not be the upper end (84+ cupping score) either because this requires a very high freshness, further increasing logistical difficulties.

Next to a segmentation based on quality, two different market segments may be interesting for roasters at origin. These are food tourists and diaspora communities. Attracting food tourists is only interesting if you are located in an area that attracts many tourists. Diaspora communities are important if many people from your home country have moved to other areas in the world.

Targeting food tourists can boost direct sales

Some farmers or roasters also target food tourists. Food tourists travel for a taste of place to get a sense of place. Food tourism can offer extra income by selling activities such as visits to farms or roasters, but it can also directly boost coffee sales to European consumers.

Food tourism is very popular. Europeans are increasingly interested in where their food comes from. Additionally, European travellers are looking for unique and enriching experiences. Coffee tourism can be a way of engaging with the local community and learning how coffee is produced. Coffee tourism can be especially interesting to the growing specialty coffee community. However, the production of coffee is interesting to a larger community since most Europeans consume coffee.

There are many options for coffee tourism to attract travellers. Some examples are:

- Take part in food festivals;

- Take part in food trails/coffee trails;

- Offer workshops;

- Offer producer visits.

To start, it is often good to contact a local travel agent. The Colombian company Juan Ballena, for example, offers all kinds of trips around Cartagena. This includes a private coffee roasting and tasting trip. Local travel agents can either sell their activities to independent travellers directly, or to European tour operators. European tour operators include these activities in their holidays. For example, the Dutch tour operator Intrepid offers a trip to Colombia, combining culture, nature, and a visit to a coffee plantation with learning about the roasting process.

Examples of coffee companies offering coffee tourism are:

- Hacienda Doka in Costa Rica.

- Beaver Creek coffee in South Africa.

- Co Colombia in Colombia.

Tip:

- Read the CBI study on Food tourism to learn how to target food tourism. This may be a good way to diversify your income, especially if your region hosts many travellers.

Targeting diaspora communities

Targeting communities that originate from your producing country could provide opportunities. Europe is home to many immigrants, many of whom have strong ties to their home countries. They identify themselves with their country of origin. Many also favour products from their home country. Most of these diasporas are targeted via supermarkets or websites that focus on these groups.

There are many examples of roasters at origin targeting the European diaspora market:

- Torrecafe Aguila Roja & Cia originates from Colombia. It focuses on Colombian customers. However, the company also sells their products via Tu Tienda Latina, targeting the Colombian community in Spain.

- Latincor, a supermarket in Barcelona (Spain) sells Juan Valdez coffee to the Latin American community there.

- Trung Nguyen, a Vietnamese coffee brand, sells its coffee to the European market via websites such as Asianfoodlovers, Nguyenorientalfoods, Orientalwebshop, and other web shops.

Through which channels does a product end up on the end market?

In most cases, roasters in the country of origin supply supermarkets, companies, or consumers in the consumer country.

Figure 4: market channels for coffee roasted in producing countries

Source: Molgo Research, adjusted by Bart Wortel

Compared to green coffee, the market chain for roasted coffee has fewer players. Therefore, the market for coffee roasted at origin uses direct or more direct trade. Direct trade is sometimes assured because the roaster is also the importer. Moyee and Guzo for example are roasters, exporters and importers, and sell directly to supermarkets, companies and consumers. Other companies sell directly via online marketplaces.

Is direct trade beneficial?

Direct trade reduces money otherwise spent on ‘middlemen’, traders, shippers, distributers, etc. The idea is that this increases the income of the exporter. However, direct trade not always reduces costs. It may also increase costs. For example, if your company supplies European supermarkets directly, you must cover transport, warehousing, insurance, marketing, and sales. It is questionable whether or not you could do this better or cheaper than companies that specialise in a specific step in the value chain.

What is the most interesting channel for you?

The best market channel is the channel that best aligns with your company, and the investment you are willing to make. Table 2 shows a non-exhaustive overview of market channels connected with the organisation type, situation, and required investments.

Table 2: Connecting market channels to organisation types

| Market channel | Organisation type or situation | Required investments |

| Supermarkets | Mid-sized roasters or larger. Supermarkets are mostly chains requiring a minimum volume. | High. It requires long-term branding and sales to sell your coffee via supermarkets. |

| European businesses (offices) | All | High. It requires long-term branding and sales to sell your coffee to European companies. |

| E-commerce | All | Low investments, but also low return. |

Supermarkets

Supermarkets offer a huge sales channel. According to Beverfood, 44% of the coffee in the Italian market is sold via supermarkets. In most other European countries, this is even over 50%. This means that sales volumes can be very high. However, the sales margins via supermarkets are generally low.

The largest European supermarkets are:

- Schwarz Group (Germany), owning Lidl and Kaufland

- Aldi (Germany)

- Rewe Group (Germany)

- Edeka (Germany)

- Tesco (United Kingdom)

- Carrefour (France)

- E. Leclerc (France)

- Les Mousquetaires (known for the brand Intermarché in France)

- Sainsbury’s (United Kingdom)

- Auchan (France)

Most companies selling via supermarkets are large roasters. An example is the Colombian roaster Juan Valdez, selling coffee via the Dutch supermarket chain Jumbo. An example of a medium-sized company is African Coffee Roasters in Kenya. The company focuses on supplying European supermarkets.

Moyee is an example of a sustainability-focused roaster. Its main promise is that 50% of the value remains in the country of origin. This company sells most of its coffee via the supermarket chain Albert Heijn to maximise its reach.

Tip:

- Read this article in the Perfect Daily Grind about how you should price coffee for supermarkets.

Targeting European businesses can be a good way to properly tell your unique story

Europeans had to work from home during COVID-19. As of 2022, many offices have reopened for employees who choose to work in the office full-time or part-time.

The Dutch company Guzo roasts in Ethiopia, exports to the Netherlands, and sells primarily to businesses. This allows them to explain their story properly during company visits. Guzo is a sustainability-focused roaster. The company emphasises that buying coffee that is roasted at origin leads to a more equitable supply chain.

E-commerce is mainly done via online marketplaces

E-commerce can be a very interesting market channel for selling coffee. This channel has become especially important during the COVID-19 pandemic, when physical shops were closed. Some companies use their own websites to sell roasted coffee directly to consumers, while other companies use online marketplaces.

Selling coffees via your websites mainly works if you are (strongly) present in the consuming country. For example, Moyee roasts in Kenya and Ethiopia, but European consumers can buy directly from their website.

Online marketplaces are often used by companies roasting at origin. There are many examples of online marketplaces. The Vietnamese Trung Nguyen supplies the European market via online marketplaces, such as Crema Shop.

Some of these marketplaces focus on coffee that is roasted at origin. For example:

- Coffee Annan is a German and Swiss importer, and sells coffees roasted at origin. The company is sustainability focused. It emphasises a more equitable distribution of the value across the chain. When buying coffee, the company focuses on female empowerment, biodiversity and sustaining tribal regions.

- The German website Roasted at Origin allows multiple brands to sell their coffees, as long as they are roasted at origin. Most of these companies have a website, where customers can purchase their coffees directly. Generally, this accounts for only a small part of their revenue.

- The French website Alternative Café offers only coffees that are roasted at origin. It emphasises that it is fairer to consume coffee roasted at origin and targets the upper-end market.

The e-commerce market is expected to grow in the near future.

Tips:

- Carefully determine your focus. Transporting, marketing or selling your products may seem rewarding. A stronger focus, however, is often more rewarding.

- Participate in award shows to increase your market visibility and test your products in the market. Some events to consider are the AVPA International Contest: Coffees Roasted at Origin and the Great Taste Awards.

- Attend coffee festivals throughout Europe. Examples are the coffee festivals in Berlin, London, Amsterdam, Milan, Warsaw and Paris. These are business-to-consumer events and can provide additional insight into European consumers' preferences for origin, flavour and sustainability certification.

- Invest in long-term relationships with a representative in Europe. This will help you become more competitive, manage market risks, improve the quality of your product and reach a fair quality/price balance. Read CBI’s study on Doing business with European coffee buyers for more tips.

- See CBI’s study on Finding buyers on the European coffee market for more tips on finding the right buyer.

3. What competition do you face on the European roasted coffee market?

The European roasted coffee market is highly competitive. The roasting industry is mature and technology-intensive. It has many players of all sizes, serving all segments of the market. This makes it essential to set yourself apart from the competition.

Which countries are you competing with?

Brazil, Kenya, Colombia, Vietnam, and Ethiopia are the five producing countries exporting the most roasted coffee into Europe. Figure 5 shows how much roasted coffee was exported from producing countries to Europe. Hover your mouse above your country to see the number of tonnes exported to Europe.

Source: Eurostat and ITC Trade Map

From the top 5 producing countries exporting the most roasted coffee to Europe, Vietnam is not taken into consideration. Vietnam has fewer opportunities for small- and medium-sized enterprises (SMEs) and sustainable trade. The country has a high focus on large-scale production, whereas Ethiopia is home to some sustainability-focused companies.

Brazil is Europe’s largest producing country supplier of roasted coffee

Eurostat data shows Brazil exported 1,886 tonnes of roasted coffee to Europe in 2023. This is very similar to the exports in 2019. Roasted coffee exports fluctuate due to varying production and domestic consumption. In 2023, Brazil mainly exported its roasted coffee to Norway (1,544 tonnes), the United Kingdom (198 tonnes), France (63 tonnes), and Portugal (35 tonnes).

Brazil is the world’s largest coffee producer, growing both Arabica and Robusta varieties. Brazil is mainly known for exporting large volumes of standard-quality coffee. However, it is also gaining a reputation as a producer of specialty coffees. There is also an emerging micro-roasting revolution happening in the country. These micro-roasters serve the increased domestic consumption of specialty coffees.

Brazilian roasters have a competitive advantage in terms of raw material availability. However, to enter the European Union, they must pay a general import tariff of 7.5% on roasted coffees.

Some well-known roasters in Brazil which export coffee to Europe are Moema and Cereja Coffee.

The future of roasted coffee from Brazil is hard to predict. Climate change will have a severe negative impact on Brazilian coffee production in the next decades. The Brazilian export levels are highly influenced by the country’s own consumption. Therefore, green coffee exports volumes are expected to decline in the coming decades. It remains unclear how this will affect the position of Brazilian roasters.

Kenya is Europe’s second largest producing country supplier of roasted coffee

Eurostat data shows that in 2023, Europe imported 1,165 tonnes of roasted coffee from Kenya. This represents a 33% annual growth since 2019, when imports from Kenya amounted to 506 tonnes. In 2023, Kenya mainly exported its roasted coffee to Denmark (930 tonnes), the Netherlands (143 tonnes), and Finland (84 tonnes).

The Government of Kenya has developed multiple policies aimed at increasing productivity and quality in the national coffee sector. Kenya’s improvement in quality level is often associated with a government-run system that rewards farmers for producing better quality coffee. In 2020, the Government of Kenya announced a coffee revitalisation programme, most of whose funds were allocated to improve coffee processing. In early 2022, Kenya and the EU signed an economic partnership agreement. This resulted in 0% import tariffs on roasted coffees from Kenya.

African Coffee Roasters is one of Kenya's most successful exporters of roasted coffee. It was created as an initiative of Coop Denmark in 2015 and started commercial production in 2016. This company roasts and packages coffee in Kenya and ships it out directly, mainly to supermarkets in Denmark. The company offers certified and organic coffee.

Kenya’s roasting industry is growing. This is accelerated by a growing domestic market. However, Kenya’s crop production has declined in the past decades, and climate change is likely to accelerate this process. This makes the future of Kenyan roasted coffee exports highly uncertain.

Colombia is well-known for its high-quality coffees

Eurostat data shows Europe imported 394 tonnes of roasted coffee from Colombia in 2023. This represents a large yearly growth of 7.5% since 2019, when roasted coffee imports from Colombia amounted to 304 tonnes. Due to a trade agreement with the EU, imports from Colombia are not subject to import duties. In 2023, Colombia mainly exported its roasted coffee to Spain (1,159 tonnes), Iceland (660 tonnes), the United Kingdom (610 tonnes), and Norway (570 tonnes).

Colombia has an established reputation for high-quality coffees. As of 2006, Colombia has obtained the designation of protected geographical indication (PGI) in Europe for the Café de Colombia trademark. Colombia is also the second-largest producer of Rainforest Alliance-certified coffees and the largest producer of Fairtrade-certified coffees.

The Colombian Coffee Growers Federation (FNC) sets the administrative and quality norms for roasters and brands who want to trade roasted coffee and/or use the Café de Colombia logo. Procolombia’s work has also been influential in promoting roasted and specialty coffees.

Promotora de Café Colombia SA is one of the most important roasters in the country. It belongs to FNC and manages the well-known brand Juan Valdez. This brand has developed different premium product lines, including single-origin coffees, organic-certified products, and premium selection coffees. Juan Valdez is widely for sale in Europe. A large exporter of roasted coffee from Colombia is Colcafé, which specialises in private-label roasting. The company has a wide portfolio of qualities, certifications and food safety standards.

The future of Colombia’s coffee production is highly uncertain. The expectation is that 60% of Colombia’s production lands will be affected by climate change. Some areas have already seen a 35% drop in production.

Ethiopia’s roasted coffee exports have grown significantly

Eurostat data shows Europe imported 328 tonnes of roasted coffee from Ethiopia in 2023. This represents a large yearly growth of 28% since 2019, when roasted coffee imports from Colombia amounted to 155 tonnes. In 2023, Ethiopia mainly exported its roasted coffee to Germany (139 tonnes), and the Netherlands (99 tonnes).

Ethiopia is a notable producer of specialty coffee within Europe. The country produces both Arabica and Robusta varieties. Ethiopian exporters have benefited from the European Union’s Generalised System of Preferences as this system allows roasted and processed coffee to enter the EU market without paying an import tariff.

Two examples of Ethiopian companies that export coffee roasted at origin to Europe are Moyee and Solino Coffee. Solino, based in Germany, also processes the coffee entirely in the country of origin. They pay above-average wages and are acknowledged as a Fairtrade Plus brand. Other examples of Ethiopian roasted coffee exporters are Tarara Coffee, Garden of Coffee and Tomoca Coffee.

Though the future of the other coffee producing countries roasted coffee exports is uncertain, the exports from Ethiopia are even more uncertain. Besides climate change, there are multiple factors influencing Ethiopian coffee production. The civil war is threatening the local economy and forcing farmers to abandon their farms. The quality of the production has declined in 2023, and the Ethiopian government is regulating the industry.

Tip:

- Read more about what is going on in the Ethiopian coffee market.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research