Entering the Scandinavian market for coffee

Scandinavian buyers favour high-quality and ethically sourced coffee. This creates a great market for premium and specialty Arabicas. You must adhere to EU legislation, and most large buyers will also require certification. They import their coffee via large international traders, requiring large volumes. Smaller roasters mostly work with a local trade agent. Their volumes are lower and offer more possibilities for direct trade.

Contents of this page

1. What requirements and certification must coffee comply with to be allowed on the Scandinavian market?

Exporting to Scandinavia comes with many requirements. These requirements are set by the European Union (EU), the Norwegian, Swedish or Danish governments, or by companies themselves. These requirements can be divided into:

- Mandatory requirements.

- Company requirements to maximise success in the market.

- Requirements for niche markets.

The mandatory requirements, additional company requirements and the requirements for niche markets are described below. Most requirements are similar for all European markets. This section provides a short overview of all requirements. Subsequently, it goes deeper into the requirements that are specific to the Scandinavian market. Read our report on requirements for the European coffee market for a more extensive description of these requirements.

Whereas Sweden and Denmark are part of the European Union (EU), Norway is not. However, Norway participates in the European Economic Area (EEA), which extends the European Union’s single market to non-EU countries in the European Free Trade Association (EFTA). The EFTA countries include Iceland, Liechtenstein and Norway. In practice, this means that Norway’s food laws equal the European Union rules. Hence, EU legislation can be taken as a basis for all three countries.

Mandatory requirements

It is important to comply with the overarching regulations established by the European Union for food products. These regulations set the quality and safety standards. Some notable examples include:

- The General Food Law;

- Regulation 1881/2006 focusing on the maximum permissible levels of contaminants in food.

- Regulation 396/2005 specifying thresholds for pesticide residues.

- Regulation 2073/2005 outlining microbiological criteria for food products.

Requirements on food safety and hygiene

Exporters must follow the European Union legal requirements applicable to coffee. These rules mainly deal with food safety. The food safety and hygiene requirements are the same as for other European Union countries. Special attention should be given to pesticides. Some pesticides are banned and could lead to a rejection of your coffee if detected. Examples of pesticides are dichlorodiphenyltrichloroethane (DDT) and endosulfan. For approved pesticides, there are also maximum residue limits.

Your importer will typically know which hygiene criteria you must comply with and report on.

Quality requirements

In general, to determine the quality of coffee, green and roasted coffee undergoes a physical evaluation assessment. Roasted coffee undergoes a sensory evaluation assessment.

Evaluation Assessment of green coffee

Green coffee is first graded and classified for quality before export. There is no universal grading and classification system for specialty coffee. The Specialty Coffee Association’s heritage standards are often used as a point of reference. However, most producing countries have and use their own grading and classification of green coffee.

Grading and classification are usually based on the following criteria:

- Altitude and region.

- Botanical variety.

- Processing method — wet/washed, dry/natural, honey, pulped naturals.

- Screen size (Note: screen size is important to ensure uniform roasting which improves the quality of the final product).

- Number of defects or imperfections.

- Bean density.

- Cup quality.

Scandinavian buyers will also perform a green coffee assessment. This includes a screen-size evaluation assessment and defect count, as well as a bean colour, appearance and smell assessment. This is followed by a moisture check and water activity analysis. Sample roasting is then performed to assess the quality and uniformity of the green coffee.

The process of quality assessment is equal for all types of beans. The exact criteria, however, will differ. This means, for example, that both high-end and low-end coffee beans are checked for bean density (mass divided by volume). However, for high-end coffees, a higher bean density will be required.

Sensory assessment: coffee cupping

Coffee is also assessed and scored by a method called cupping. Buyers will use different protocols and standards to conduct a sensory assessment. However, the SCA recommends protocols and best practices for cupping coffee. The most widely used cupping tool is the SCA’s Coffee Taster's Flavour Wheel. Some of the quality attributes assessed are flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes.

The Coffee Quality Institute and the cupping protocols of the Specialty Coffee Association set the standards in the global specialty coffee industry. They consider that coffees graded and cupped with scores below 80 are considered standard quality and not specialty. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Some buyers consider 80 too low and demand a cupping score of 85 or higher.

If you export specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, adding this information to the documentation of the coffee that you are exporting can add value. It is very important to be aware of the quality of your coffees, either through local cupping experts or by becoming a cupping expert yourself. This allows you to understand the value of your coffee when negotiating price with potential buyers.

Although Scandinavians have a relatively large specialty segment, most coffee is considered commercial coffee, and is not graded by a cupping score. The latter only applies to specialty coffee and some premium coffees.

Trade tariffs

When exporting green coffee, no trade tariffs apply. This also applies to decaffeinated green coffee. The standard duty applicable to roasted coffee imports is 7.5%. The duty for decaffeinated roasted coffee is 9%. These duties vary from country to country. They depend on whether your country has a contract with the European Union or not. Note that the importer is responsible for paying the trade tariff, not you as an exporter.

You can find the trade tariff for your country via the TARIC Consultation website or Access2Markets, both provided by the European Commission. Use the HS codes 090121 to find roasted decaffeinated coffee and 090122 for roasted caffeinated coffee.

Labelling requirements

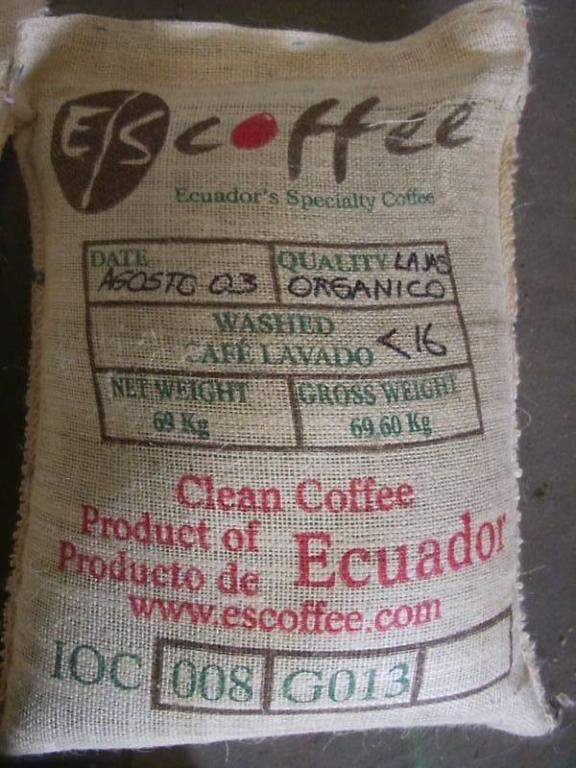

Labels of green coffee exported to Scandinavian countries should be written in English and should include the following information to ensure traceability of individual batches:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Examples of green coffee labelling

Source: Escoffee

Payment conditions

Payment terms differ from buyer to buyer. Payment is generally required within 30 or 45 days. However, this can be much longer. European buyers can extend their payment up to 360 days. The longest payment term by Scandinavian buyers we noticed in our interviews was 180 days.

Scandinavian buyers pay the same prices as buyers from other European companies for the same product. Note however that Scandinavians mostly buy certified products. A large share is also of high quality. This means that the average price Scandinavians pay is higher than the European average.

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Some specialty coffee suppliers also use other materials inside jute bags. Examples are GrainPro and Videplast. These materials have added value over traditional packaging. They preserve bean quality, prevent post-harvest loss, reduce solid waste, reduce farmer’s net carbon footprint, and facilitate chemical-free storage. Note that these innovative materials are mostly used for the high-end and upper-end segment. You can read more about these segments in our paragraph How is the end-to-end market segmented?

Other packaging used in transporting coffee includes polypropylene super sacks for 1 tonne of coffee, polyethylene liners for 21.6 tonnes and vacuum-packed coffee. These techniques increase efficiency and maintain and preserve quality.

Figure 2: Examples of coffee packing from left to right: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Tips:

- Investigate trade requirements when exporting to Sweden. An excellent tool to do so is ‘The Road to Export’. It is a step-by-step approach to start exporting. The National Trade Board of Sweden initiated this.

- Read the CBI study on buyer requirements for coffee in Europe for the full buyer requirements. Or read more about quality requirements for coffee on the website of the Coffee Quality Institute.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009. Use the search tool to find the Codes containing information on Ochratoxin A and select your preferred language.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Find out more about delivery and payment terms for your green coffee exports by reading our study Organising your coffee exports to Europe.

Sustainability requirements

The main (mandatory) sustainability requirements are derived from the European Green Deal and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal focusses on environmental sustainability. The CSDDD aims at improving social sustainability. Both apply to EU-based companies and their supply chains.

The CSDDD will increase the requirements for traceability and human rights

Under the new CSDDD regulations, corporations must improve their sustainability performance across their global supply chains and prevent damaging effects on human rights and the environment. Businesses are required to take the following actions:

1. Integrating due diligence into their policies.

2. Identifying actual or potential adverse impacts.

3. Preventing and mitigating potential adverse impacts. Bringing actual adverse impacts to an end and minimising their effect.

4. Establishing and maintaining a complaints procedure.

5. Monitoring the effectiveness of their due diligence policy and measures.

6. Publicly communicating on due diligence.

As the directive applies to the supply chain, it forces your buyers to ask for proof that you act in a socially sustainable manner. The CSDDD is anticipated to come into force around 2025-2026.

Norway already enforced due diligence regulation

Norway already has due diligence legislation in place. This law, the Transparency Act (öppenhetslagen), came into force in July 2022. Just like the CSDDD, it is based on the OECD due diligence guidelines. It applies to companies that meet two out of three criteria:

- Sales revenue of NOK 70 million (€6.1 million)

- Total assets of NOK 35 million (€3 million)

- 50 or more employees

The European Green Deal will create many sustainability requirements in the future

The European Green Deal (EGD) is the European Union’s (EU) response to the global climate emergency. The EGD is a package of policies that define Europe’s strategy to reach net zero emissions and become a resource-efficient economy by 2050.

One of the laws resulting from the Green Deal is the EU Deforestation Regulation (EUDR). This is undoubtedly the legislative measure exerting the most influence on the European coffee industry. This regulation became effective in June 2023. Roasters and traders have been given a timeframe of 18 months to implement the new rules (31 December 2024), with micro- and small enterprises granted an additional six months. This law makes traceability and technology crucial to export to the EU market. This will have implications for the coffee-producing industry. The EU provides an information sheet addressing frequently asked questions about this topic.

As a cooperative, you must be able to demonstrate that your coffee is not produced on deforested or degraded land. Certification can be one of the tools to help prove that your company complies with the EUDR. This may involve certification schemes with strict environmental criteria promoting sustainable farming practices. Examples are Organic and Rainforest Alliance certification.

This regulation came into force in mid-2023. Companies will have 18 months to meet the new rules. This means that they have to comply by 31 December 2024. European micro- and small enterprises have six more months to comply with the standards. Watch our webinar on meeting European sustainability requirements in the cocoa sector for more information on complying with these standards. Although the webinar is developed for the cocoa sector, the requirements are the same.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative (GFSi) website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Draft a written plan for your food safety controls. Review and update your plan whenever change occurs in your business operations, or at least every other year.

- Find out which standards or certifications potential buyers prefer in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label. This depends on their end-clients and distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this Excel form by the Sustainable Agriculture Initiative (SAI) Platform to assess your farm’s sustainability performance.

Additional company requirements

Most large roasters require certification. Arvid Nordquist, Löfbergs, Zoégas and Joh. Johannson Kaffe all buy 100% certified coffee. Note that this differs greatly from roasters in many other European countries, where certification is less prominent. Gëvalia is the only large Swedish roaster that does not require certification. Based on our research, the estimation is that about 90% of all coffee sold in Scandinavian supermarkets is certified.

The certification demands of Scandinavian roasters depend very much on size. Medium roasters generally all require certification. Larger roasters dominate the Scandinavian market. This especially applies to Sweden. The four largest roasters share about 84% of the total Swedish coffee market.

The main certificates are Rainforest Alliance, Fairtrade and Organic. Most large roasters don’t have a single-label strategy. Instead, they will buy a combination of coffees with different certificates.

Organic

Exporting organic coffee comes with extra requirements. To market your coffee as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Regulation (EC) 2018/848 sets down organic production and labelling rules. Regulation (EC) 1235/2008 describes the implementing rules of the EU legislation for imports of organic products from third countries.

Organic coffee is checked at the EU border. To import organic coffee to the European Union, the delivery needs to include an electronic certificate of inspection (e-COI). The certificate should be set up in the Trade Control and Expert System (TRACES). It must be signed by a control authority in your country before the shipment leaves the country.

Niche requirements

Many small-scale roasters and specialty roasters consider certification a tool for the larger companies. These small-scale companies have their own requirements and ways of checking whether you meet them.

Small roasters are more interested in personal relations

For most small-scale roasters, certification is of less importance. This does not mean that their demands are lower. In general, personal relations with their suppliers are more important than certification. Producing in a (more) sustainable way is still very relevant, but small-scale roasters verify this by different means. If you supply directly to Scandinavian roasters, they might want to visit your farms to investigate and better understand the situation. Most will ask you questions about your production processes and post-harvest procedures. They will also test your beans. These buyers are interested in your stories of origin. This implies that you should know the specifics of your coffee and be willing to honestly share this.

The exact requirements differ per roaster. Some small-scale roasters still value certifications highly. This especially applies to organic. You can read more about small-scale roasters in our study on the Scandinavian market potential for coffee.

Specialty roasters emphasise quality

The specialty coffee segment is characterised by high cupping scores (sometimes 80+, usually 84+), innovative processes (such as natural and honey-processing), direct trade relations, and high transparency and traceability from farm to consumer. This means that buyers of these coffees ask for requirements that go beyond certification.

Besides high quality, these buyers are interested in stories about the origin of the product, such as your coffee farm, the coffee growers and your processing facilities. This means that exporters should know the specifics of their coffee, from soil management to cup, from variety to processing, from external suppliers to farmers, and you must be willing to share these stories honestly. Other than that, direct trade can result in more frequent coffee farm visits and product assessments by your buyers, as well as long-term business relationships.

Scandinavia is home to many small and micro roasters in this segment. Many of these source via a Scandinavian trade agent, although some will also source directly from origin. These companies are mostly not interested in certification. Their focus is fully on quality and differentiation. Despite their lack of interest in certification, many of these roasters highly value sustainability. This often goes beyond the level of certification. They will verify sustainability by observing your production and asking questions on sustainability issues.

Producing more sustainable coffee and developing your sustainability narrative offers you better access to the Scandinavian market. If some things are not required now, it still prepares you for future demands by Scandinavian buyers. Read our tips on how to become socially responsible and our tips on how to go green for information on how to become more sustainable in the coffee sector.

Tips:

- Learn more about organic farming and European organic guidelines on the European Commission website and the OrganicExportInfo website. In addition, familiarise yourself with the range of organisations and initiatives that can offer technical support to help you convert to organic farming. Start your search by learning about the organic movement in your own country and inquire about support programmes or existing initiatives. Refer to the database of affiliates of IFOAM Organics Europe to search for organic organisations in your country.

- Find importers that specialise in organic products on the website Organic-bio.

- Use this cost calculator to estimate what costs would be involved for your organisation to become Fairtrade-certified. Also, ask for quotations from different certifiers before you decide which one you want to work with. Ask for timelines and an estimate of how many days would be charged. Always discuss potential certification with your buyers before you make any investment or decision.

- Try to combine audits in case you have more than one certification to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Increase your traceability and/or become certified. European sustainability requirements will become ever stricter. You can only provide proof of your sustainable behaviour if you know where your coffee comes from.

2. Through what channels can you get coffee on the Scandinavian market?

The Scandinavian high-end and upper-end markets are relatively large. They show much potential for suppliers offering high-quality green coffee. You can supply the Scandinavian market via different trade channels. These mainly depend on the volumes you offer, certification and quality.

How is the end-to-end market segmented? How is the end-to-end market segmented?

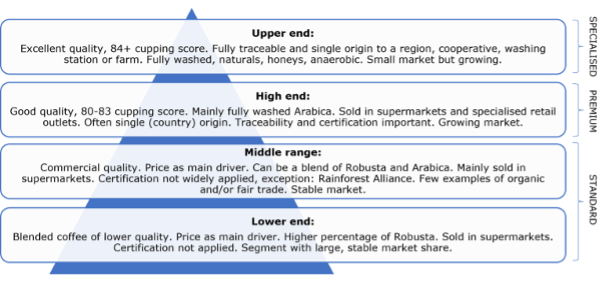

The Scandinavian end-market for coffee can be divided into four segments: the lower end, middle range, high end and upper end.

Figure 3: Coffee end-market segmentation

Source: Profound

As in all European countries, all coffee segments can be found in the Scandinavian market. The lower end market is, however, relatively small in Scandinavia. Most large roasters focus on 100% Arabica coffee. For example, Gëvalia, although not offering certified, offers only Arabicas in their webshop.

The middle range offers the largest segment. There is, however, also a relatively large high end and upper end market. Many large roasters also offer premium and specialty coffees.

Through what channels does coffee end up on the end market?

The market channels differ among roasters. In general, larger roasters source their green coffee from different channels than small roasters.

Large roasters source from trading companies or producing country suppliers

Large roasters mainly buy their green coffee beans from coffee trading companies or directly from producing country suppliers. Examples of large Scandinavian roasters are Arvid Nordquist, Gëvalia, Löfbergs and Zoégas.

Some examples of large coffee trading companies that supply to the Scandinavian market are:

- Neumann Kaffee Gruppe (NKG), based in Germany.

- Louis Dreyfus Company (LDC), based in Switzerland.

- ECOM Agroindustrial (ECOM), based in Switzerland.

- Covoya (previously Olam), based in Singapore.

- ED&F Man VOLCAFE, based in the United Kingdom.

According to the Coffee Barometer 2020, the top-5 largest traders are responsible for 50% of the global trade. These same companies are also responsible for supplying the Scandinavian market. These trading companies are not specialised. They source from all over the world and buy all quality ranges.

The companies above are among the largest traders worldwide. Nordic Approach and Tropiq are examples of smaller trading companies based in Norway. In 2023, Neumann Kaffee Gruppe (the world’s largest coffee trader) acquired a majority of the shares of Nordic Approach and Tropic.

Small roasters source via coffee agents

Most smaller roasters often buy green coffee beans through coffee agents. These agents have contacts with one or several trading companies in Europe. For these types of roasters, this channel provides them with several advantages:

• They can buy smaller quantities of green coffee.

• They do not have to worry about the quality requirements. They rely on their trade agent or trading company.

• They have shorter delivery times (mostly 1-7 days). Trading companies usually have sufficient supply in stock.

Because these trade agents supply smaller roasters, they are more interested in small volumes of higher quality.

Tips:

- Make sure you can supply sufficient volume, over time and of consistent quality, when approaching the larger roasters. They normally buy at least one container (21 tonnes) on the first purchase and scale up from that point.

- Choose your Scandinavian trade agents with care. Your supply becomes less interesting if you also distribute via another agent. Most trade agents want their offerings to be unique.

- Contact small or micro roasters directly. Try to visit them during a business trip in Scandinavia. For most small and micro roasters, personal relations are crucial. You can also visit trade fairs. Most roasters will visit the World of Coffee trade fair. This is organised every year in a different location. In 2024, it will be organised in Copenhagen (Denmark).

- Profile your ideal business partner. Only reach out to buyers that fit your company. This will save you time and money. For example, large roasters will only be interesting if you can deliver high volumes of certified coffee with consistent quality.

What is the most interesting market channel for you?

Your most important market channel depends considerably on your product and business. Table x shows an insight into market channels that might suit your situation. Note that it is not possible to describe the ideal market channel for all situations. In most cases, a basket approach would be recommended, ensuring you can sell your different quality segments and you are not depending on one buyer.

Table 1: Most interesting market channel per business situation

| Situation | Most interesting market channel | Reason |

| You produce small volumes of coffee of standard quality | Via an exporter that supplies to the Scandinavian market, or any other market | Although a supplier takes part of the margin, it offers economies of scale |

| You produce large volumes of certified coffee of standard quality | Directly to a European importer or a large Scandinavian roaster. These could be Arvid Nordquist, Löfbergs, Zoégas or Joh. Johannson Kaffe | You can cut out part of the chain. These roasters all buy certified coffee. This requires you to build a relationship directly with the buyer and understand all their importing requirements |

| You produce large volumes of non-certified coffee of standard quality | Try to sell to Gëvalia directly, or through one of their suppliers | Gëvalia is the main Scandinavian buyer of uncertified coffee |

| You supply low volumes of premium or specialty coffee | Sell to Scandinavian trade agents or small roasters directly. Focus on storytelling and personal connections | High sales efforts could lead to good prices and long-term relations |

| You produce high volumes of good quality coffee | Build your presence and reputation in Scandinavia via tradeshows or by inviting (small and large) roasters to your farms | Roasters and retailers purchasing high end volume prefer exclusive business agreements, be selective yourself |

Source: diverse

3. What competition do you face on the Scandinavian market?

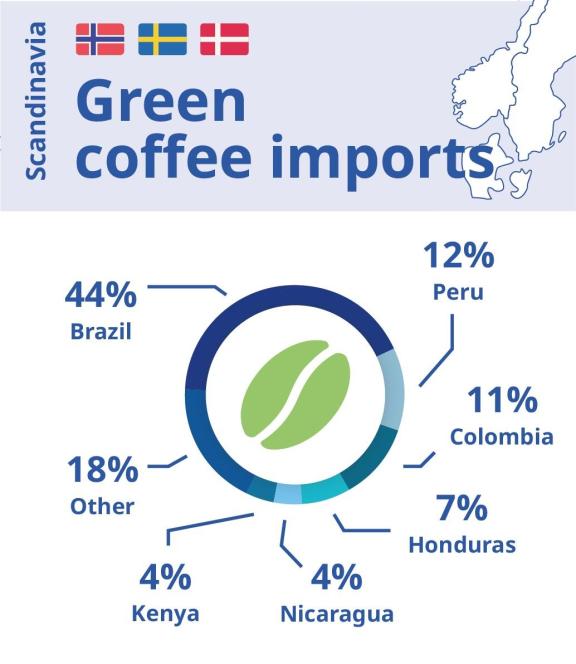

In the Scandinavian market, you face most competition from the Arabica-producing countries and Arabica-exporting companies. Brazil, Peru, Colombia, Honduras, Nicaragua and Kenya are the six most important suppliers.

Figure 4 gives an overview of how much coffee is sourced from the top-6 supplying countries.

Figure 4: relative import values of Scandinavia’s top-6 suppliers in 2022

Source: Eurostat, design by Bart Wortel

Brazil is Scandinavia’s main green coffee supplier

Brazil is the world’s largest coffee producer and exporter, producing both Arabica (around 70%) and Robusta (around 30%), although almost 80% of exports consist of Arabica.

Brazil’s coffee-producing areas are relatively flat. This has intensified the use of mechanical pickers. The use of mechanical pickers has reduced labour costs in Brazil’s coffee production. It has also led to lower average quality, as machines do not distinguish between ripe and unripe cherries.

Brazil mainly produces natural and pulped natural coffees. Low-grade Brazilian Arabica is mostly used in blends.

Despite the lower coffee prices, Brazilian coffee farmers are relatively successful. Factors contributing to their success are:

- The scale at which they operate.

- Mechanised cherry picking.

- An efficient infrastructure.

- A good climate (although climate change drastically impacts several key producing regions in the country).

Brazil is the only large producing country where the average farmer is able to generate a living income based on coffee farming.

Although Brazil is known mainly for exporting large volumes of standard quality, the country also has a strong reputation as a producer of specialty coffees. The sector receives considerable institutional support through the Brazil Specialty Coffee Association (BSCA). The association aims to elevate quality standards and enhance value in the production and marketing of Brazilian coffees.

Examples of exporters of specialty coffees in Brazil are Burgeon and Bourbon Specialty Coffees.

Table 2: Competitive country profile of Brazil

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Peru is the global leader in specialty coffee production

According to UNDP, Coffee is one of Peru’s main agricultural products. It accounts for around 25% of their agricultural income. As much as 40% of their farmland is destined for coffee production. In the highlands, this figure rises to 70%. Peruvian exporters are especially important in the specialty market segment. Peru counts as the global leader in specialty coffee production. An example of a Peruvian specialty exporter is RainForest Trading.

Next to specialty coffee, Peru also has a dominant position as a supplier of organic coffee. It is the second-largest organic coffee exporting country. It owns 90 thousand hectares dedicated to growing organic coffee.

The flavour profile of Peruvian coffees is usually nutty, chocolaty and mildly citrusy. The country’s varieties include Catimor, Pache, Bourbon, Typica and a small amount of Pacamara. Their main processing method is wet processing.

Peruvian coffee is known for its consistent quality and sustainable production. It is one of the leading countries trading with Fairtrade-certified coffee and 75% of the coffee industry is owned by smallholders. Peru introduced a national coffee brand, Cafés del Peru, to the international market in 2018.

Table 3: Competitive country profile of Peru

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Colombia is a strong brand of high-quality coffee

Colombia is the world’s largest producer of washed Arabica. It has a strong national coffee industry with high technological development. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee. The country has an established image and brand for high-quality coffees. Colombian coffee is known for its chocolate, nuts, herbs, fruit and citrus notes. Its main processing technique is washed processing. The country’s most well-known coffee varieties include Typica, Bourbon, Caturra and Castillo.

The Café de Colombia is a protected trademark. It is registered in eAmbrosia. This is the register for protected trademarks in Europe. A registration in eAmbrosia is unique among coffee-producing countries, and it protects the rights of more than 550,000 small-holder families in the country.

The Colombian coffee industry is developing quickly. Coffee companies are increasingly involved in capacity building and product quality. Colombian producers can follow coffee quality and tasting programmes to get certified. The Coffee Quality Institute (CQI) has a strong presence in Colombia. It provides courses in partnership with the National Institute of Professional Training SENA. The country’s coffee has ongoing success in competitions, such as the World Barista Championships.

Table 4: Competitive country profile of Colombia

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Honduras is the largest Central American coffee supplier to Scandinavia

The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees. It did so either through certification or by actively improving quality. The country has grouped coffee production and quality specifications into six regions with different microclimates and soil composition.

In addition to its growing reputation as a high-quality coffee supplier, a relatively large share of Honduras's coffee is organic. According to FiBL & IFOAM The World of Organic Agriculture 2022, about 24,000 hectares were dedicated to organic coffee farming in Honduras. This is approximately 5.7% of the total planted coffee area in the country. Honduras is one of the largest organic coffee suppliers of Europe. In 2021, exports of specialty and certified coffee amounted to 54% of total exports. Note that Scandinavia is a large importer of specialty coffee.

Examples of successful exporters in Honduras are Asoprosan, Cafico, Capiro Coffee Export and Aruco.

Table 5: Competitive country profile of Honduras

| Strengths | Weaknesses |

|

|

Source: diverse

Nicaragua, great coffee but limited branding

Coffee is very important for the Nicaraguan economy. It employs about 15% of its workforce, and over 50% of all people work in agriculture. Nicaraguan coffees are famous for their vibrant and tangy acidity, silky texture, and floral, citrus or chocolate notes. The taste characteristics that are commonly present in this country can, however, vary. This depends on the distinct microclimate of each region. Nicaragua is steadily building a positive image as a producer of high quality, specialty coffee with an emphasis on sustainability and ethical practices.

Nicaragua produces mainly Arabica. Robusta production has, however, been increasing in recent years.

Table 6: Competitive country profile of Nicaragua

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Kenya has its own auction and grading system

Kenya’s grading system makes it easy to source high-quality coffee. Kenya’s coffee industry is organised around coffee auctions by the Nairobi Coffee Exchange. This is a not-for-profit organisation that is government-owned. At the auction, lots with higher quality coffee are sold for higher prices. This system benefits the international market prices for Kenyan coffee but limits the opportunity for Kenyan producers to trade with international actors directly. Kenya’s Coffee Producers Association (KCPA) represents almost 350 thousand coffee producing households to empower them to address issues related to production, processing and marketing.

Kenya’s coffee is rated high for vibrant and crisp citrus, pepper and blackberry flavours. The washed processing technique is the most common processing method in Kenya.

Table 7: Competitive country profile of Kenya

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them too.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee-growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story, such as the auctions organised by the Cup of Excellence.

- Work with other coffee producers and exporters in your region if your company size or product volume is too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive in the Scandinavian market.

- Develop long-term partnerships with your buyers. This includes always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability in the Scandinavian market. See our tips on doing business with European coffee buyers for more information.

4. What are the prices for coffee on the Scandinavian market?

Compared to other European countries, Scandinavian countries are willing to pay more for their coffee. However, their coffee also needs to be of higher quality.

The Swedish average price for one kilo of brewed coffee is around €5.50 (based on numbers from 2018 but adjusted for general inflation). This will depend considerably on the segment, however. Specialty coffee in Scandinavian cafés can easily exceed €10 per cup.

What is the price breakdown of the supply chain?

Green coffee export prices typically amount to only 5% to 25% of the end-retail prices. However, this depends on many variables. Some examples are coffee quality, the size of the lot, certification, the distribution channel and the supplier’s relationship with the buyer.

Figure 5 shows the value distribution of wholesale coffee. Roasters end up taking more than 80% of the wholesale coffee price. A coffee farmer receives about 10%.

Source: Profound, 2020

Your share as a producer or exporter can be a lot higher than mentioned in figure 5. If you export specialty or premium coffee, the Scandinavian market offers opportunities for direct(er) trade. This usually offers better margins. You could export to Scandinavian roasters directly, or via a specialised trader. An example of a Dutch specialty importer exporting to Scandinavia is This Side Up. It publishes the price breakdown on its website.

What is the forecast for Scandinavian coffee prices?

Scandinavian coffee prices follow the global market prices. We expect that in the next few years, coffee prices will rise. According to Statista Market Insights, the global roasted coffee price is expected to rise by approximately one third between now and 2028.

The first factor that will drive up prices is reduced production due to climate change and weather conditions. Globally, the earth’s temperature is rising, and weather conditions are becoming more extreme. Based on research, Robusta production is expected to be reduced by 14% per degree Celsius of global warming. The impact on Arabica production will be even larger. In addition, El Niño will probably reduce global coffee production by another 10% in the coming years. For more information on what El Niño is and how it may impact your production, read this article by CNBC.

Secondly, global demand is expected to increase. Although the European market is saturated, the demand in upcoming economies is expected to grow.

Although consumer prices are expected to rise, it remains unclear to what extent exporters will profit from this. As Figure 5 shows, the revenues are unevenly distributed in the chain and increasing retail prices do not directly impact farm gate prices. Because large roasters have the largest buying power in the chain, they also make the most money.

Tip:

- Explore how El Niño and climate change will impact your production region and how you can mitigate risks with others. This includes, for instance, planting varieties that are more resilient to changing weather conditions.

Read our studies on how you can produce in a greener and more socially responsible manner. European sustainability requirements will become ever stricter. You can also watch our online webinar on meeting sustainability requirements on the European coffee market.

Molgo Research carried out this study in partnership with Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research