The Scandinavian market potential for coffee

Norway, Sweden and Denmark are countries with a strong coffee culture. They favour high-quality and ethically sourced coffees. Of the three Scandinavian countries, Sweden offers the largest market. The Scandinavian coffee market is characterised by its high number of innovative and small-scale roasters.

Contents of this page

1. Country description

Scandinavia – consisting of Norway, Sweden and Denmark – is a region located in Northern Europe. It is known for its high coffee consumption rates and a strong focus on high-quality coffee. Finland is often considered a Scandinavian country too. It is, however, not included in this study. See our study on exporting coffee to Finland to learn more about this market.

Norway, with a population of approximately 5.4 million people, is situated in the western part of the Scandinavian Peninsula. Its economy is highly developed, focusing on natural resources such as oil, gas and minerals. The official language is Norwegian.

Sweden, the largest country in Northern Europe, has a population of around 10.5 million people. It lies in the eastern part of the Scandinavian Peninsula. The Swedish economy is diverse and export oriented. Key industries include manufacturing, services and high-tech sectors. The official language is Swedish. Sweden is also by far the largest import market among the Scandinavian countries.

Denmark, with a population of approximately 5.8 million people, is situated southwest of Sweden and south of Norway. A strong welfare system and a high standard of living characterise the Danish economy. It is known for its agricultural products, pharmaceuticals and renewable energy technologies. The official language is Danish.

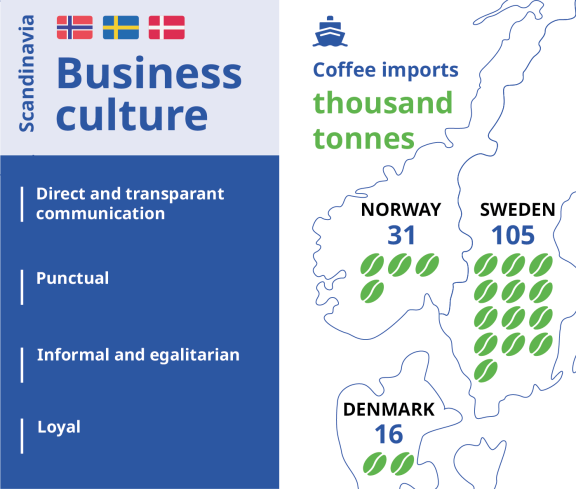

Although there are differences, the business cultures in Scandinavian countries are very similar. Scandinavians are in general considered:

- Direct and transparent in their communication. This means that your buyers will expect you to inform them as soon as possible about anything that affects them. This could be an untimely delivery or a deviation from the expected quality.

- Punctual. Scandinavians feel disrespected if you let them wait. Be on time. If you don’t manage to be on time, they expect to be notified in advance.

- Informal and egalitarian. Scandinavians prefer to be addressed by their first name. This even applies to first meetings. Norwegian business culture is a bit more formal.

- Loyal. Building relations, towards a long-lasting relationship is key. Scandinavians are loyal to their suppliers if they are satisfied.

Figure 1: Characteristics of the Scandinavian business culture and size of imports

Source: Eurostat, Open Trade Gate and various interviews. Imports in thousands of tonnes of green, non-decaffeinated coffee beans. Design by Bart Wortel.

Tips:

- Become better informed about the main European markets by reading CBI’s coffee studies. These include the German market, the Belgian market, the French market, the Swiss market and many other markets.

- Learn more about Scandinavian ports and potential trade partners there. Have a look at the websites of the Port of Oslo (Norway), the Port of Aarhus (Denmark), the Port of Gävle and the Ports of Stockholm (Sweden). The port of Gävle is the most important. It is also called the port of coffee in Sweden.

- Access the Access2Markets website to analyse the Danish and Swedish trade dynamics and to build your export strategy. Select Denmark or Sweden as a reporting country and follow developments such as the ups and downs of new and established suppliers. The data for Norway, which is not an EU member, is available on the Trade Map of the International Trade Centre.

2. What makes Scandinavia an interesting market for coffee?

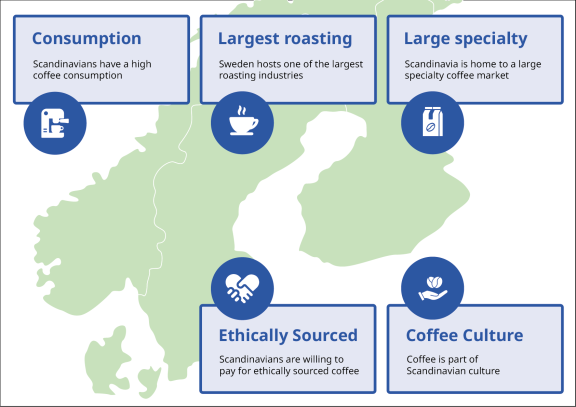

Scandinavian countries are among the highest per capita coffee-consuming countries. Because Scandinavian countries have small populations, import volumes are relatively low compared to other European countries. However, Scandinavian consumers prefer high-quality Arabicas and have the means to pay for them.

Figure 2: Characteristics of the Scandinavian coffee market

Source: diverse. Design by Bart Wortel

Scandinavian consumption levels are among the highest in Europe

Norway, Sweden and Denmark all have a coffee consumption level that lies well above the European average. With 9.9 kg of coffee consumed per capita, Sweden ranks third in terms of coffee consumption among European countries. Numbers 1 and 2 are Luxembourg and Finland. Norway ranks fifth, with 8.6 kg consumption per capita. Denmark ranks number 8, with an average consumption of 6.6 kg per capita. The average daily coffee consumption of Sweden (3.2 cups of coffee per day), Norway and Denmark (both 3.1 cups of coffee per day) is only slightly less than the Finnish consumption (3.5 cups of coffee per day).

Coffee is part of Scandinavian culture

Scandinavians love their coffee. Coffee breaks are common at work and at home and are an essential part of daily life. Scandinavians often take multiple coffee breaks during the day. They drink coffee not only at home but also at work and during social gatherings. Coffee consumption in Scandinavia is casual and social. It's common for people to meet up at cafes for a cup of coffee and a chat. Coffee gatherings are a way to catch up with friends, family or colleagues.

In Sweden, there is a tradition called “fika”. This social event is where people gather to enjoy coffee, often with sweet pastries or cakes. Fika is an important part of Swedish culture, encouraging socialising and relaxation. It is a moment to slow down from daily busy life. It is also a moment to enjoy with others.

Scandinavians prefer their coffee to be strong and robust. In Denmark, Sweden and Norway, coffee is predominantly consumed black. This means without milk and sugar. The quality of the actual coffee is therefore very important in these markets. Filtered coffee is particularly popular.

Ground coffee is the most frequently sold type in Sweden. It accounts for 77% of total coffee sales. It is followed by instant coffee, accounting for 12%. Capsules represent about 5% of the market, while whole beans and other forms of coffee each account for 3%. The whole-bean share is not large but is growing. This growth is driven by the availability of good coffee machines for the consumption market.

Scandinavian imports are low in quantity but high in quality

Scandinavian countries are not the largest importers of green coffee. Sweden imported 105 thousand tonnes in 2022. It ranks 10th in the list of largest European importing countries. Norway ranks 14th and imported 31 thousand tonnes in 2022. Denmark ranks 19th and imported 16 thousand tonnes. In comparison: Germany, Europe's largest importer, imported 1.15 million tonnes of green non-decaffeinated coffee.

Source: Eurostat and Trade Map

Exports from producing countries to Sweden have reduced by 10% since 2020. This was caused by a significant transformation in shipping operations due to COVID-19. An increased demand for efficiency has given large European ports an upper hand. Most Scandinavian green coffee traders are located near these ports. Another reason is the increase in the market price in the last two years.

Scandinavians are willing to pay for good coffee. The region predominantly imports Arabica beans. The share of lower-quality Robusta imports is small compared to other European markets. Scandinavians are also willing to pay for ethically sourced coffee. The amount of certified coffee is among the highest in Europe. You can read more about this in our section Which products offer the most opportunities for the Scandinavian market?

Examples of large coffee importing and roasting companies in Scandinavia include Friele, Joh. Johannson Kaffe (Norway), Arvid Nordquist (Sweden) and BKI (Denmark). Examples of specialised importers include Collaborative Coffee Source and Nordic Approach (Norway), which sell high-quality green coffee to roasters worldwide. They store their coffees in warehouses in Belgium and the United Kingdom.

Sweden offers a large roasting industry

Swedish companies roasted 88,000 tonnes of coffee in 2020. This accounts for 5% of all coffee roasted in the European Union. Sweden is the sixth largest roasting country in Europe. In comparison, Spain, Europe’s number 5 producer, roasted 128,000 tonnes. The Swedish roasting industry is much larger than the Danish and Norwegian ones. The Norwegian and Danish sectors host many small-scale roasters. These could be very interesting to your company. They do not, however, have larger roasters like in Sweden.

Four big coffee roasters dominate the Swedish coffee market. Together, they share about 84% of the total Swedish coffee market. They are:

- Gëvalia is situated in Gävle and has about a 40% market share of the Swedish market.

- Löfbergs is situated in Karlstad and has about a 15% market share of the Swedish market. It imports its green coffee via Gothenburg.

- Zoégas is situated in Helsingborg and has about a 20% market share of the Swedish market.

- Arvid Nordquist is situated in Stockholm and has about a 9% market share of the Swedish market. It imports its coffee via the port of Gävle.

The dominant roastery differs per region. In some regions, different local roasteries are the leading brand in those specific areas. Next to these large roasters, there are 6 small roasters, which have about 10% market share. The last 6% is shared by about 80-100 micro roasters. This number is growing.

With the demand for specialty coffee rising, international coffee companies show a large interest in the Scandinavian sector. This also applies to Sweden’s larger roasters. For instance, Gëvalia has been acquired by JDE, while Zoegas is now a part of Nestlé.

The Scandinavian coffee market is expected to remain stable

Based on several sources, we expect the Scandinavian coffee market to remain stable in the coming years. Some sources indicate a very slight decline, while others mention an increase below 1%.

The Scandinavian coffee market is saturated. This means that (almost) all Scandinavians have the means to buy coffee. Scandinavian coffee consumption is among the highest in Europe. However, because of health issues, many consumers are lowering their consumption. At the same time, we expect ethical sourcing, certification and the demand for high-end coffee to rise further. This will foster the coffee market value.

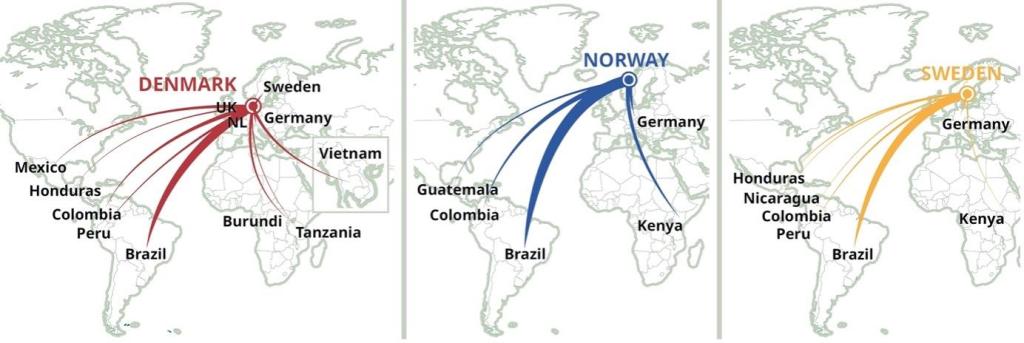

Brazil, Peru and Colombia are the most important suppliers

Most green coffee sourced by Scandinavian countries comes from Brazil (57 thousand tonnes), Peru (15 thousand tonnes) and Colombia (14 thousand tonnes). Germany (9 thousand tonnes), Honduras (9 thousand tonnes) and the Netherlands (6 thousand tonnes) are the next largest. Note that Germany and the Netherlands do not produce coffee. Export flows from these countries therefore represent re-exports.

Note that Vietnam ranks only 11th. Vietnam is the world's second-largest coffee producer. It is also Europe’s second-largest supplier. Vietnam mostly produces Robustas. These are low in demand among Scandinavian countries.

Figure 4: Main green coffee export flows to Scandinavian countries

Source: maps extracted from Resource Trade, redesigned by Bart Wortel

Tips:

- Read more about competing coffee-producing countries in our study on entering the Scandinavian market for coffee.

- Ensure you can promise sufficient coffee for at least two years. Scandinavian buyers want to build up long-term relationships.

- Find a list of Swedish coffee roasters;on the Kaffe Journalen website. Use your browser (for instance, Google Chrome) or an AI translation tool to auto-translate the information.

3. Which products offer the most opportunities for the Scandinavian market?

Quality and ethical sourcing are key characteristics of Scandinavia. Norway, Sweden and Denmark have a preference for specialty coffee. Rainforest Alliance-UTZ, Organic and Fairtrade-certified coffees are particularly interesting to consumers in this region. About 90% of all coffee sold in retail is certified.

Compared to many other countries, the Scandinavian market for coffee pods is not among the most interesting. The market for coffee pods is relatively small in Scandinavian countries. These represent only 8% and 9% of the total retail value for Denmark and Sweden, respectively. This is far below the European average of 39%. This is partly because coffee pods are considered unsustainable.

Scandinavia offers a large market for certified coffee

Scandinavia offers a large market for certified coffee. Their high demand for certification differs greatly from other European countries. For Italian roasters, for example, certification is less important. The main certificates are Rainforest Alliance, Fairtrade and Organic.

Fairtrade

Fairtrade had a market share of 11.3% of the total Swedish coffee market in 2018. In Denmark, the total volume of Fairtrade coffee sales was 1,730 tonnes. This equals 8.3% of the total coffee sales in Denmark. Most of this coffee was also Organic certified. 7.3% of all coffee sales in 2022 was Fairtrade and Organic certified.

Organic

Scandinavia has a high demand for Organic coffee. Löfbergs is one of the world’s largest importers of Organic coffee. Most Organic coffee is also Fairtrade certified. Key reasons for Scandinavian consumers to drink organic coffee are:

- Scandinavians like organic coffee because it is grown without harmful chemicals. Scandinavians are generally very environmentally aware.

- Scandinavians want to be healthy. They think organic coffee is better because it is grown without synthetic pesticides or fertilisers.

- Scandinavians believe organic coffee tastes better because it is grown using practices that make the beans more flavourful. They associate organic with higher quality.

Rainforest Alliance

Of all schemes, Rainforest Alliance is most in demand among Scandinavian buyers, especially in retail. Based on our research, the estimation is that around 75% of all coffee sold in supermarkets is Rainforest/UTZ certified. Most coffee is sold via supermarkets.

Multi-certification

The combination Fairtrade and Organic is the only common form of multi-certification.

In addition to the international certifications, Scandinavian roasters might want to add local certificates. These certificates are added after importing the coffee. One example is KRAV. It is used for food without artificial chemicals and pesticides.

Scandinavian markets value specialty coffee

Scandinavians have a strong preference for specialty coffee. They value high-quality and distinctive flavours. The influence of innovative Scandinavian roasters on the global specialty coffee scene is significant. Scandinavian roasters were pioneers in working with very light-roasted coffee. They set global standards for coffee quality through the Specialty Coffee Association (SCA). The SCA originated in Norway.

The love for specialty coffee is particularly prominent in Sweden. Light roasting is a preferred method. It optimally brings out the unique aromas and flavours of coffee. This contributes to the growth of small new coffee roasters in Sweden.

Since 2010, Scandinavian countries have witnessed remarkable growth in coffee shops. Norway even established the prestigious World Barista Championship.

A large share of the Scandinavian specialty coffee is roasted by small and micro roasters. These roasters cater to niche markets. They follow the principles of direct trade, transparency and high-quality products. An example of a specialty coffee roaster is Caravela. This company sources specialty coffee from various countries in Latin America. It focuses on building long-term relationships with smallholder farmers and serving the Scandinavian market with top-notch coffee varieties.

The growing demand for specialty coffee is driven by consumers' increasing interest in coffee preparation methods and how and where coffee is grown. This growing interest provides opportunities for exporters of high-quality coffees. This means that suppliers should know who produces their coffee and how it is produced.

Tips:

- Read our studies on exporting specialty coffee to Europe. These studies will provide much more information on opportunities in these markets.

- Focus on quality, consistency and traceability in the specialty coffee market. These are key to most Scandinavian specialty coffee buyers.

Norway and Denmark source more coffee roasted at origin

Selling ground (roasted) coffee directly to Norwegian and Danish traders, coffee houses, cafés or even consumers brings opportunities.

Exporting ground coffee allows you to add value to your country’s product. If combined with good storytelling, many Scandinavian consumers will like the coffee that is roasted in your country. Most roasted coffee sold in Scandinavia is ground coffee.

Norway offers most opportunities for roasted coffee exports, followed by Denmark.

Source: Eurostat and Trade Map

The Norwegians source 81% of all coffee roasted in producing countries from Brazil. Colombia, Costa Rica (6%) and Peru (2%) are other suppliers. The import volume of coffee from producing countries has grown by 25% since 2018. The Danes source almost all coffee that is roasted in producing countries from Kenya. Their import volume from Kenya has grown by 243% since 2018. Note that their volumes are still relatively small. Although we did not find information on this, it is likely that only a few companies are responsible for these imports.

If you export roasted coffee to Scandinavia, your buyer must pay import tariffs. You can read more about this and other requirements in our study on entering the Scandinavian market for coffee.

4. Which trends offer opportunities or pose threats on the Scandinavian coffee market?

Two trends stand out for the Scandinavian market. Firstly, quality becomes more important in the at-home market. Secondly, the number of micro roasters is increasing. Both trends offer opportunities for premium and specialty coffee producers and exporters.

More focus on high quality in the at-home market

Many Scandinavians want to drink good coffee at home. This new trend means that they are choosing quality over convenience. Consumers are getting into making their own coffee, using special beans and equipment. They are paying attention to the details of brewing.

Not just any coffee will do. There is a preference for specialty blends. And it is not just about taste. Consumers want to make sure that the coffee they drink is sourced responsibly. This means that coffee suppliers need to get beans that are grown and harvested in a way that is good for the environment and the people involved.

This trend offers possibilities for exporters to supply premium and specialty coffee to roasters who focus on the at-home market. An example of such a roaster is Drop Coffee in Stockholm. This roaster is very transparent about its suppliers. At the same time, it focuses on consumers who want to make good coffee at home. They provide coffee, but also equipment, books and a brew guide, with information on how to craft the best coffee at home.

The number of micro roasters is increasing

The number of roasters in Scandinavian countries is increasing, particularly the number of micro roasteries. Many of these roasters distribute their coffee to (local) cafes but also have their own coffee shop. Sweden is home to around 80-100 micro roasters.

Many of these micro roasters started out of a passion for coffee. In many cases, hobbies have evolved into a profession. Due to their high intrinsic motivation, these micro roasters are eager to learn. The many highly motivated roasters have fostered an innovative and vivid learning culture. The micro roasters are mostly active in the specialty and premium market segment. An example of such a company is La Cabra. La Cabra is based in Denmark. It has a high focus on innovative tastes.

Besides tastes, the micro roasters also focus closely on sustainability and traceability. Note that most roasters do not check sustainability based on certification. Instead, they have their own means of verification. You can read more about these requirements in our study on entering the Scandinavian coffee market.

Many of these micro roasters will be highly motivated to explore how to improve their products with their suppliers. This means exporters of high-quality coffee can engage with these buyers in product innovation. By doing so, you can learn more about your own product. Another advantage is that this will probably lead to a long-term relationship with your buyer(s).

In addition to the two main trends described above, there is an increasing demand for specialty coffee and certified coffee. You can read more about these trends in our section Which products offer the most opportunities for the Scandinavian market? Additionally, the Scandinavian market follows the same trends as other European countries. These trends are described in our report on trends in the European coffee market.

Tips:

- Engage with your buyers in product optimisation. Visit your buyers and show interest in the end-product. Be open and transparent about your farming and processing techniques. Ask your buyers how to improve your product.

- Read more about the trends in our study on trends that offer opportunities or risks in the European coffee market.

Molgo Research carried out this study in partnership with Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research