Entering the European market for speciality coffee

Exporting specialty coffee to Europe comes with strict rules about quality, labels and sustainability. To succeed, exporters need to understand different market segments and how to sell their coffee. Creating a good relationship with your buyers is of key importance. You need this to establish trust and a long-term trading relationship. Many European buyers will have their own quality requirements. This creates opportunities to diversify and appeal to European importers and roasters.

Contents of this page

1. What requirements must speciality coffee comply with to be allowed on the European Market ?

You can only export coffee to countries in the European Union (EU) if you follow strict requirements. See our study on buyer requirements for coffee to get a complete overview of these standards. Or consult the specific requirements for coffee in the EU Trade Helpdesk Access2Market.

Buyer requirements can be divided into:

- Mandatory requirements: legal and non-legal requirements you must meet to enter the market;

- Additional requirements: those you need to comply with to stay relevant in the market;

- Niche requirements: applying to specific niche markets.

The highlights of the legal and non-legal requirements you must comply with are described below.

Mandatory requirements

Mandatory requirements consist of legal requirements, quality requirements, requirements for labelling and packaging, and food safety requirements.

Legal requirements

You must follow the European Union legal requirements applicable to coffee. These rules mainly refer to food safety. Food safety includes plant protection, hygiene and product traceability. Special attention should be given to specific sources of contamination, namely:

- Pesticides. Consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide. Examples of pesticides are dichlorodiphenyltrichloroethane (DDT) and endosulfan.

- Mycotoxins and mould. Consult the EU mycotoxin regulations to understand how to minimise contamination.

- Salmonella. There is a low risk of salmonella in coffee. Nevertheless, the EU food safety authorities can withdraw imported products if they suspect contamination.

In addition to food safety laws, the EU bans the import of products that drive deforestation. Undoubtedly, the legislative measure exerting the most influence on the European coffee industry is the EU Deforestation Regulation (EUDR). This regulation became effective in June 2023. Roasters and traders have been given a timeframe of 18 months to implement the new rules (31 December 2024), with micro- and small enterprises granted an additional six months. This law makes traceability and technology crucial to export to the EU market. This will have implications for the coffee-producing industry. The EU provides an information sheet addressing frequently asked questions about this topic.

Stricter regulations on social sustainability are expected to come into force in 2025-2026. The Corporate Sustainability Due Diligence Directive (CSDDD) forces European companies to account for their negative impact on human rights and the environment. A crucial element is that buyers are made responsible for their supply chain. This means that they will demand proof that you, as a supplier, maintain certain sustainability standards.

Quality requirements

Green coffee is graded and classified for quality before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s (SCA) coffee standards are the most used grading scale. While the SCA sets the leading standards, most producing countries have and use their own grading systems.

Another important institute is the Coffee Quality Institute (CQI). CQI trains people to become professional quality graders (Q Graders) and experts in post-harvest processing. Their Q grading system is considered a standard for quality assessment and reporting.

The International Trade Centre states that grading is usually based on the following criteria:

- Altitude and region;

- Botanical variety;

- Preparation – wet processed (washed), dry processed (natural), semi-washed (wet-hulled), pulped natural or honey processed;

- Bean size or screen size, sometimes also bean shape and colour;

- Number of defects or imperfections;

- Roast appearance and cup quality based on flavour, characteristics and cleanliness;

- Bean density.

Coffee beans can display primary and secondary defects. Primary defects include, for example, black beans, fermented sour beans or severe insect damage. The presence of foreign matter or dried cherries are also primary defects. These defects greatly impact the quality of the cup and need to be eliminated. Secondary effects include partial black, partial sour, parchment, floater, immature/unripe and withered.

Coffee is graded by size, called screen size. Sorting according to screen size is important to ensure that coffee batches are uniform to allow uniform roasting. This increases the quality of the end-product. Arabica coffee sizes are expressed in numbers and Robusta bean sizes are expressed in letters.

Coffee is graded according to its cupping profile. Aroma, flavour, aftertaste, balance, acidity, sweetness, uniformity and cleanliness are all important factors. These elements determine the grading of the coffee. According to SCA, specialty coffee is coffee graded between 80 and 100 points.

If you export specialty coffee, it is important for buyers to know the cupping score of your coffee. The cupping score is relevant information to document when exporting your coffee. The score can also provide feedback to the producers. This allows everyone in the supply chain to know the coffee’s quality. Cupping evaluations are done by professionals, called Q Graders. You can also become a Q Grader yourself.

Figure 1: Future Q Grader receives a coffee cupping grading training in Rwanda

Source: Ethos Agriculture

Labelling requirements

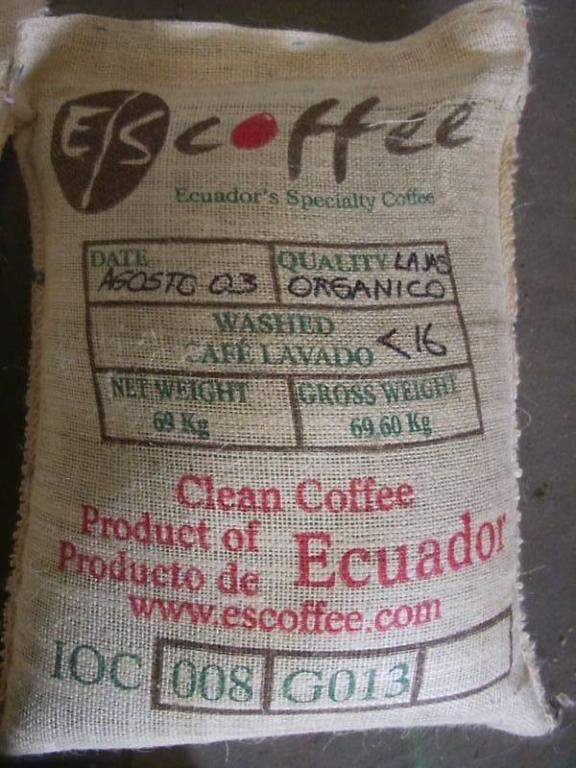

Labels of green coffee exported to Europe should be written in English. It should also include the following information to ensure traceability of individual batches:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 2: Example of green coffee labelling

Source: Escoffee

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Materials such as GrainPro or Videplast are used to pack specialty coffee inside the jute bags. Transporting green coffee in high-barrier packaging helps retain rich flavours and prevents water exchange. Specialty coffee can also be shipped in vacuum packaging. This is usually only done with coffees from micro or nano lots because of the high packaging costs.

Figure 3: Examples of coffee packing from left to right: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Additional food safety requirements

Expect buyers in Europe to request extra food safety guarantees from you. These usually cover production and handling processes. Examples include:

- Implementation of good agricultural practices (GAP). The main standard for good agricultural practices is GLOBALG.A.P.. This is a voluntary standard for certification. It shows that products are traceable and safe. Certification organisations often incorporate GAP in their standards. An example of such a certification organisation is Rainforest Alliance.

- Implementation of regular checking of residue levels. Ochratoxin A (OTA), polyaromatic hydrocarbons (PAHs) and glyphosate contamination should be prevented and monitored. It is recommended to get certificates that show periodical analysis of the coffee. This includes that periodical checks should be conducted. This is preferably done from an EU-accredited laboratory, such as eurofins or TÜV SÜD.

- Implementation of a quality management system (QMS): A system based on Hazard Analysis and Critical Control Points (HACCP) is increasingly required by buyers. It is a minimum standard for green coffee production, storage and handling. The implementation of checking residue levels would be part of this system.

- For roasted coffee, HACCP is the minimum standard that an exporter must comply with. It is preferably complemented by a global food safety initiative (GFSi). Examples are: BRC Global Standard Food Safety, FSSC 22000, IFS Food or SQF.

- Ensure a high traceability. For many European specialty coffee buyers, this is crucial. European consumers want to know where their coffee comes from.

- Coffee stocks: Green coffee fades and loses some of its desired characteristics if stored for long periods. “Just in time” techniques that reduce inventory and financial costs are favoured by the main roasters. Controlling available raw material inventories at destination markets and simplifying procurement logistics are just part of the services that large roasters now require through “Vendor Managed Inventory” (VMI) procurement systems.

Tips:

- Stay in close contact with the roasters that work with your product. Make clear that you want to improve its quality. By doing so, you give your buyer more influence over the quality of the coffee. This may strengthen your relationship, leading to longer-term contracts.

- Read the CBI study on buyer requirements for coffee in Europe for the full buyer requirements. Or read more about quality requirements for coffee on the website of the Coffee Quality Institute.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009. Use the search tool to find the Codes containing information on Ochratoxin A and select your preferred language.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Find out more about delivery and payment terms for your green coffee exports by reading our study Organising your coffee exports to Europe.

Additional requirements

Additional requirements consist of sustainability requirements and price.

Additional sustainability requirements

European traders and small-scale roasters in the specialty segment work with ethical and sustainable sourcing. Direct contact with producers, transparency, and promoting sustainable practices are important values to them. Examples of importers that have high Corporate Social Responsibility (CSR) standards include: Dutch companies Trabocca and This Side Up Coffees; Belgian company Ethiquable; German companies GEPA and El Puente. These importing companies work on projects with coffee-producing cooperatives in the countries of origin.

Certification standards such as Rainforest Alliance, Fair for Life and Fairtrade have gained importance in the mainstream coffee market. They are usually part of the sustainability strategy of traders, roasters and retailers. Large European importers such as the Neumann Kaffee Gruppe and List + Beisler (Germany) handle a wide range of coffees of various origins and certifications.

Communication with your buyers is key to building a long-term relationship. Specialty coffee suppliers are often moderate-sized enterprises that may benefit from improved management practices. European buyers value effective communication with producers and appreciate a prompt response to phone calls and emails.

Excellent communication about deliveries is key. If you cannot meet all delivery requirements, informing your buyers on time is crucial. This offers them the opportunity to respond and take measures. An example is ordering more volume via another buyer. While that may not sound all too great, the consequences of no communication are worse. Insufficient or late communication are often the main reason for shifting to other suppliers. European communication standards are generally a lot higher than you expect.

Price

On the specialty coffee market, quality is most important. However, the Free on Board price is becoming increasingly important to European buyers. The Free on Board price is the point in the supply chain when a buyer becomes responsible for the goods being transported. The increased attention to price is caused by high (European) inflation. Moreover, the lower the quality (cupping score), the greater the importance attached to your pricing.

Coffee sold for in-shop consumption includes costs such as wages, leases and ingredients other than coffee. Similarly, coffee costs for foodservice consumption often involves services such as providing coffee brewing machines or other products and services. In the out-of-home environment, coffee costs play a less significant role in the overall cost structure. Instead, the quality and sophistication of the consumer experience become more crucial components of the overall offering.

Tips:

- Refer to the International Trade Centre (ITC) Standards Map or to the Global Food Safety Initiative (GFSi) website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Find out which standards or certifications potential buyers in your target segment prefer. Buyers may have preferences for a certain food safety management system.

- See our study on how to become more socially responsible in the coffee market for more information about how to work on your sustainability.

Niche requirements

The European market has special requirements for organic coffee and direct trade.

Organic certification

The demand for certified organic coffee is growing in Europe. This offers opportunities for exporters to European countries. To market your coffee as organic in Europe, it must follow the regulations of the European Union (EU) for organic production and labelling. Getting the EU Organic label is the minimum legislative requirement to market your coffee as organic in the EU.

The EU broadened the scope of the regulations surrounding organic certification in 2022. The IFOAM Organics Europe website describes these changes and their implications for exporters. A Certificate of Inspection (COI) must be issued to sell your product with an organic label. Control authorities issue this certificate before shipment. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES). TRACES ensures that the products exported to or through the EU are safe and traceable to its source.

If you want to export to countries outside the EU, check the requirements from that country. For example, Switzerland has its own Swiss Organic Law. The United Kingdom has Organic Products Regulations 2009.

Next to the EU standards, most company and third party certification schemes have additional requirements to be adhered to. It is important to check the requirements asked for on the standard’s website. For instance, this Naturland handout compares the additional requirements set by Naturland with the EU Organic regulation.

A certifier must audit your growing and processing facilities to issue organic certification. The EU provides a list of recognised control bodies and authorities. This ensures that you always work together with an accredited certifier. After auditing and receiving Organic certification, your products can use the EU Organic logo.

Direct trade

The specialty coffee segment is characterised by direct trade, high transparency and traceability. Buyers of specialty coffees often have more requirements than just certification. For example, they will visit your coffee farm, test your product, and want frequent contact. Buyers value a close relationship because they care about the coffee's origin.

Keep in mind that supply chain transparency is important in the specialty segment. Transparency ensures that the coffee is produced ethically and sustainably. It also provides information to the consumer to make an informed decision.

This means that you should know the specifics of your coffee and be willing to share it honestly. Frequent phone calls, meetings or email exchanges with your buyer are often important. This makes sure everyone is informed about updates.

Another way to ensure traceability is through blockchain solutions. For example, Farmer Connect allows all actors in the supply chain to record and access information via the platform.

Establishing a clear and direct link between yourself, the buyer and the consumer is important.

Tips:

- Ensure your samples are of high quality. Based on samples, traders might become interested in your coffee. Most specialty coffee buyers start with ordering small lots.

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding European coffee buyers. In addition, read the Specialty Coffee Transaction Guide for more information on how to do business.

- Attend trade fairs to meet potential European buyers. Interesting trade fairs include SCA’s World of Coffee and Biofach (organic). Producer & Roaster Forum is another interesting fair that aims to connect producers and roasters. You can meet with local roasters during the African Fine Coffees Association (AFCA) conference. There are also coffee festivals for consumers in most large European cities. These cities include Berlin, London, Amsterdam, Milan, Warsaw and Paris. These events can give insights into the preferences of European buyers and consumers.

- Contact industry associations to find potential buyers in Europe. Examples are the Specialty Coffee Association and the Coffee Roasters Guild.

- Read our study on how to go digital in the coffee sector to find useful traceability tools, platforms to optimise sales and monitoring applications.

- Invest in long-term relationships. Whether you are working through importers or roasters, you must establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance. Read our study on how to do business with European coffee buyers. The article provides insights into what your European coffee buyer values in the trading process.

2. Through what channels can you get speciality coffee on the European market?

Specialty coffee is sold in the high end or the upper end market. It flows into the European market via specialised buyers and mainstream traders. However, the specialty coffee market offers opportunities for direct trade. This often leads to higher margins.

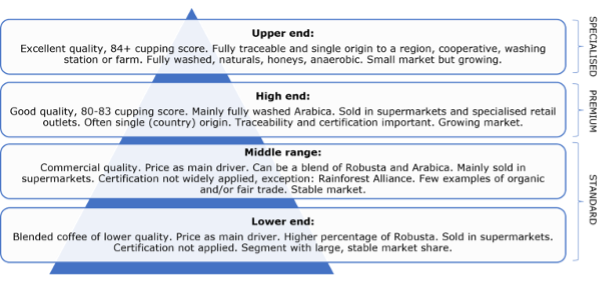

How is the end market segmented?

Specialty coffee beans belong to the high and upper-end segments. Figure 4 shows the general segmentation of the coffee end market.

Figure 4: Coffee end market segmentation

Source: Profound

High end: High-end coffees mainly refer to coffees with a cupping score of 80-85. These coffees are often single origin and have a special story. The popularity of blended coffee in the specialty segment is, however, growing. The production of high-end specialty coffee is estimated at 10% of the total coffee volume.

Sustainability certifications are more uncommon in this segment. This is because sustainability practices are often commonplace among buyers. However, the high and upper-end segments see a growth in organic-certified coffees.

Examples of coffees in the high-end market segment include (based on European retail prices in 2023):

| Product | Retail price (€/kg) | |

| High end | Washed coffee beans from Tanzania, roasted by District Five Coffee Roasters (Germany) | 35.10 |

| Washed coffee beans from Ethiopia, roasted by Parlor Coffee Roasters (Belgium) | 40.00 | |

| Decaffeinated coffee from Colombia, roasted by Alchemy (United Kingdom) | 37.00 | |

| Arabica blend from Brazil and India, roasted by Java Coffee (Poland) | 29.51 |

Upper end: The upper end of the specialty segment consists of excellent quality coffees. These are often from micro or nano lots that use innovative processing. The coffees are usually Arabica beans and have a cupping score of at least 85. The beans are traceable and single origin. Long-term contracts between suppliers and buyers and high prices are common.

The direct involvement of buyers makes sustainability certification uncommon. Buyers of upper-end coffee undertake projects with suppliers for the local community. The production of upper-end specialty coffee is around4% of the world’s total coffee volume.

Examples of coffees in the upper-end market segment include (based on European retail prices in 2023):

| Upper end | Product | Retail price (€/kg) |

| Coffee beans from Vietnam, roasted by Back to Black (Netherlands) | 50,85 | |

| Coffee beans from Burundi, roasted by Muttley & Jack’s Coffee Roaster’s (Sweden) | 37,00 |

Sales channels: Specialty coffee is often sold by roasters or coffee houses. These can either be physical or online shops. Most physical retailers also sell their coffee offering online through their web shop. There are also shops that only sell their products online, such as Roast Market (Germany) and Specialty Coffee (Netherlands).

European Coffee Trip lists examples of European specialty roasters and cafés. To find examples of European specialty roasters and cafés, refer to the city guides on the European Coffee Trip website.

Value distribution: End-market prices for coffee vary according to which segment of the market is targeted. Green coffee export prices typically amount to only 5% to 25% of the end-market prices.

The New York market prices for Arabica coffees can be used as reference points. But the price will also depend on a lot of other aspects. These include the quality of the coffee, the lot size and the buyer-seller relationship. The share of the coffee price is usually much higher than in the specialty segment. Approximately 10% of the added value of sold coffee goes to farmers. In some cases, this can be higher. The Dutch trader This Side Up, for instance, offers an average farmgate price of €4.25.

The SCA provides an example of how exporters should look into their value chain, in terms of different costs and margins. Also, refer to the Specialty Coffee Transaction Guide to get an idea of current market prices for specialty coffee. This guide shows the mean contract and pricing information based on the coffee's quality, volume and origin.

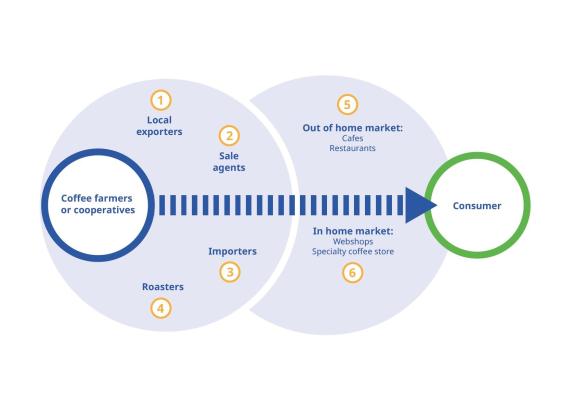

3. Through what channels does specialty coffee reach the end market?

The market for specialty coffee is relatively small and highly specialised. In general, the specialty value chain is transparent and shorter than the commodity value chain. Farmers often sell their specialty coffee directly to specialised importers or small-scale roasters. This increases efficiency and distributes prices more fairly.

Figure 5: The specialty coffee supply chain

Source: diverse. Design by Bart Wortel

Importers are the main buyers

Importers play a vital role in the coffee market. They function as supply chain managers and maintain extensive portfolios with various origins. They also provide pre-finance operations, perform quality control and manage price fluctuations. Importers also establish contact between producers and buyers such as roasters. Importers usually have long-standing relationships with their suppliers and customers.

Specialised importers can buy small volumes of high-quality or single-origin coffees. Examples of small and large specialised importers in Europe are Cafe Imports Europe, Rehm & Co and Touton Specialties Coffee (Germany), Trabocca, The Coffee Quest, This Side Up Coffees and Daarnhouwer (Netherlands), Belco (France), Sucafina Specialty (Belgium), Falcon Coffees (United Kingdom) and Imperator (Italy).

Small roasters offer a great opportunity for direct trade

Small roasters often source green coffee from importers. Importers take care of logistics, quality control and pre-financing. This relieves small-scale roasters of many tasks. Importers can also guarantee traceability – an important aspect when roasters pass on the backstory to customers.

The number of small roasters importing from origin is growing. Small roasters often specialise in high-quality blends and single origins. They usually perform cup tests to check the evenness of the roast. This also helps them spot defects that can occur post-harvest. Post-harvest defects can happen during fermentation, drying and storage. Small roasters trading directly with producers are generally less interested in certification. Instead, they have their own ways of assessing sustainability and quality.

Examples of small roasters directly sourcing coffee from producing countries include Flying Roasters and Röstfrisch (Germany), OR coffee (Belgium), Gardelli Specialty Coffees (Italy), Johan & Nyström (Sweden), Lippe (Norway), Coffee Collective (Denmark) and Yellow Bourbon Coffee Roasters (United Kingdom).

What is the most interesting market channel for you?

Specialised traders can be interesting if you have evidence of high cupping scores of at least 80. Some buyers may require scores above 85 and single-origin coffees. Many specialised importers prefer to work directly with producers or co-operatives.

Targeting small roasters directly is recommended for producers and exporters dealing with high-quality beans from micro or nano lots. Entering into a contract with these small roasters or exporters is usually the start of a long-term partnership. In this case, it is important to have the financial means and technical know-how to organise exports.

4. What competition do you face on the specialty coffee market?

The specialty segment focuses on quality, origin, sustainability and long-term direct trade relations. Annual competitions identify the highest quality coffees produced worldwide. The producing country's government policies influencing the coffee sector are important to consider. These policies can have an impact on the opportunities and development of the sector.

Data on exporting numbers in the specialty coffee segment are lacking. However, some countries are famous for specialty coffee and their large contribution to the European market. This section describes the six countries that are known for their specialty coffee culture.

Brazil is the world’s largest coffee supplier

Brazil is the world’s largest coffee producer and a prominent specialty supplier. It is also the world’s largest coffee producer and Europe’s largest supplier. Brazilian exports to Europe exceeded 1 million tonnes in 2022. Brazil produces both Arabica (70%) and Robusta (30%).

Brazilian coffee is most commonly known for its low acidity, smooth feel and sweet taste. Cupping experts usually find hints of caramel, chocolate or nutty flavours. However, the taste profile depends on various factors such as coffee varieties. Mundo Novo, Bourbon, Catuaí and Acaiá are the most common coffee varieties. Brazil is well-known for dry processing its coffee due to the climate’s dry seasons.

Almost 73% of Brazilian coffee is harvested partially with machines. The Brazilian landscape allows machines to harvest more easily, making the process more efficient. Mechanised harvest is usually not suitable for specialty coffee. For specialty coffee, it is crucial to only pick ripe berries. Plucking machines are usually not suitable for distinguishing between ripe and unripe berries.

Nevertheless, Brazil’s reputation when it comes to specialty coffee has grown rapidly in recent years. This is in part thanks to the Brazil Specialty Coffee Association (BSCA), which aims to elevate the quality standards and enhance the value of Brazilian coffees. An example of a successful exporter of specialty coffees in Brazil is Bourbon Specialty Coffees.

Brazil is one of the countries that hosts the annual Cup of Excellence competition. The aim of the competition is to identify the highest quality coffees produced. Those coffees that receive rewards are sold in global online auctions at premium prices. The competition is organised by the Alliance for Coffee Excellence. Other countries that host the competition are Burundi, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Indonesia, Nicaragua, Mexico, Rwanda and Peru.

Bourbon Specialty Coffees is a Brazilian producer that focuses on sustainable farming practices. The company particularly values a direct relationship with farmers. This commitment to quality and sustainability has helped it become a reputable exporter. It invests in research and development relating to varieties, picking and processing. This enables it to discover how it can improve performance.

Ethiopia is one of the world’s leading organic coffee producers

Ethiopia is Europe’s ninth-largest coffee supplier with 92 thousand tonnes in 2022. It is one of the world’s leading organic coffee producers, with 95% of produced coffee being organic. The main reason for this is a lack of money. Most farmers do not have the money to invest in more sophisticated agricultural techniques. This also results in very low production levels.

Ethiopian coffee is mostly known for its fruity and floral flavour profile. Their most common ways of processing are sun-drying or wet-washing techniques. The most common varieties include Longberry, Shortberry and Mocha.

Ethiopia is often seen as the birthplace of coffee. This is because many coffee varieties can be traced back to Ethiopian forest grounds. Climate change experts have found that climate fluctuations in Ethiopia are likely to occur more often. This will decrease the land available for the production of specialty coffee. The Ethiopian government encourages the sector to adopt more sustainable growing techniques and to produce.

Ethiopian coffee is known for its taste, quality and origin. The Ethiopian coffee market is highly fragmented and competitive. Many consider the country to be the birthplace of coffee. Ethiopia’s coffees have high potential in the specialty market. Their economy benefits a lot from their coffee exports. That is why the country's government prioritises policies that safeguard social, economic and environmental sustainability.

Ethiopia is expected to host the Cup of Excellence competition in 2024. The competition has resulted in some of the highest prices paid for green coffee globally. This sets their specialty coffee apart on the global market.

Bette Buna in Ethiopia is an example of a producer and exporter that invests in the local community. The company does this by creating job opportunities for young adults and giving financial training courses to its employees. It also has four coffee breeding nurseries to be able to provide resilient coffee varieties that increase quality. Moyee Ethiopia focuses on providing single-origin coffee, but also offers two specialty blends. The company is committed to the FairChain principles that foster partnerships along the value chain. Moyee roasts its coffee in Kenya to retain value at origin. One of the goals of using FairChain is to impact local communities positively.

Colombia has a strong country brand

Colombian coffee exports to Europe reached 124 thousand tonnes in 2022. Colombia is the world’s largest producer of washed Arabica. It has a strong national coffee industry with high technological development. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee. The country has an established image and brand for high-quality coffees. Colombian coffee is known for its chocolate, nuts, herbs, fruit and citrus notes. Its main processing technique is washed processing. The country’s most well-known coffee varieties include Typica, Bourbon, Caturra and Castillo.

The Café de Colombia is a protected trademark. It is registered in eAmbrosia. This is the register for protected trademarks in Europe. A registration in eAmbrosia is unique among coffee-producing countries, and it protects the rights of more than 550,000 smallholder families in the country.

The Colombian coffee industry is developing fast. Coffee companies are constantly increasing their capacity building and product quality. Colombian producers can follow coffee quality and tasting programmes to get certified. The Coffee Quality Institute (CQI) has a strong presence in Colombia. It provides courses in partnership with the national institute of professional training SENA. The country’s coffee has ongoing success in competitions such as the World Barista Championships.

La Meseta in Colombia is a Fairtrade and Organic certified producer and exporter of specialty coffee. Its export market share in Colombia is 10%. The company focuses on sustainable agriculture, including shade-grown coffee, organic farming methods and eco-friendly processing techniques.

Guatemala hosts many smallholder farmers

Guatemala is one of the largest producers in Central America. It exported more than 31 thousand tonnes of coffee to the EU in 2022. High altitudes and good weather conditions give Guatemalan coffees a good reputation.

The coffees’ flavour profiles are usually described as chocolaty, sweet, fruity or nutty. The country’s most common varieties include Typica, Caturra, Bourbon, Catuai, Pache and Maragogipe. Guatemalan coffee is most often processed using washing techniques.

Specialty coffee is often produced by smallholder farmers. This is also the case for Guatemala. 96% of coffee in Guatemala is grown by smallholders with less than 3 hectares.

The country’s coffee association Asosiación Nacional del Café represents 125 thousand coffee-growing families. It also invests in research to improve production and processing methods.

Finca El Injerto in Guatemala is known for its award-winning coffee. The company has won the Cup of Excellence competition multiple times. Its success is attributed to high-altitude coffee cultivation and a commitment to sustainable farming practices. It is active in a reforestation project and is also one of the first coffee farms in Guatemala to become carbon neutral. Another carbon-neutral Guatemalan coffee producer is Finca Los Tarrales. Finca Los Tarrales produces coffee with a unique terroir influenced by volcanic minerals. The nature reserve, where the coffee is produced, extends over more than 1000 hectares. This provides many people with jobs and protects the local environment.

Kenya’s coffee exchange offers better prices for farmers

Kenya exported a little over 20 thousand tonnes of green coffee to the EU in 2022.

Kenya’s grading system makes it easy to source high-quality coffee. Kenya’s coffee industry is organised around coffee auctions by the Nairobi Coffee Exchange (NCE). This is a government-owned, not-for-profit organisation. At the auction, lots with higher quality coffee are sold for higher prices. This system benefits the international market prices for Kenyan coffee but limits the opportunity for Kenyan producers to trade with international actors directly. Kenya’s Coffee Producers Association (KCPA) represents almost 350 thousand coffee producing households to empower them to address issues related to production, processing and marketing.

Kenya’s coffee is rated high for vibrant and crisp citrus, pepper and blackberry flavours. The washed processing technique is the most common processing method in Kenya.

Gikanda Coffee in Kenya is Rainforest Alliance, Organic and Fairtrade certified. The company experiments with different coffee processing methods. For example, it has experience with anaerobic fermentation and controlled drying processes. The cooperative invests in the community’s access to healthcare and education. And it also ensures proper infrastructure in the region. Othaya Coffee is another example of a Kenyan coffee producer with Fairtrade certification. Othaya Coffee gives a sustainable income to around 1100 small-scale farmers.

Peru is a large exporter of certified coffee

Peru is Europe’s seventh-largest coffee supplier. It exported 147 thousand tonnes of green decaffeinated coffee in 2022. It is the second-largest organic coffee exporting country. It owns 90 thousand hectares dedicated to growing organic coffee.

Peru especially promotes its unique origin and high-quality coffees. The flavour profile of Peruvian coffees is usually nutty, chocolaty and mildly citrusy. The country’s varieties include Catimor, Pache, Bourbon, Typica, and a small amount of Pacamara, and their main processing method is wet processing.

Peruvian coffee is known for its consistent quality and sustainable production. It is one of the leading countries trading with Fairtrade-certified coffee, and 75% of the coffee industry is owned by smallholders. Peru introduced a national coffee brand, Cafés del Peru, to the international market in 2018.

Ecoforest Cooperativa produces organic specialty coffee in Peru. It uses either the drying or washed processing methods. It is both Fairtrade and Organic certified. Its certifications and micro lots have helped it reach 351 business partners. Coinca is an example of a small-scale Peruvian coffee exporter. It trades both commodity and specialty coffee. Its main European buyers are from Germany.

Tips:

- Identify and promote your unique selling points. Give detailed information about your coffee growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee-growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and during trade fairs. Flavour quality competitions also provide good opportunities to share your story.

- Consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Develop long-term partnerships with your buyers, including by always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability in the European market. Read Trabocca’s article on understanding your coffee contract. This is important, as coffee contracts contain the agreements you have with your buyer.

Molgo Research carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research