The Swiss market potential for coffee

Switzerland has a diverse and thriving coffee sector, home to many large and small-scale companies. It is Europe’s sixth-largest green coffee importer and Europe’s third-largest roasted coffee exporter. All large importing and roasting multinationals have trading offices in the country. Switzerland imports coffee directly from several producing countries, making it a very interesting destination market for coffee exporters. The Swiss market itself is characterised by a high interest in sustainable coffees and increasingly also in higher-quality coffees.

Contents of this page

1. Product description

Harmonised System (HS) codes are used to classify products and to calculate international trade statistics, such as imports and exports. The focus of this study is green coffee beans, classified under HS code 090111 (coffee, not roasted, not decaffeinated). The available data do not distinguish between bulk, high-quality or specialty coffees. Coffee in Europe is mainly consumed as a beverage with multiple preparations. However, its extract is also used in the production of coffee-flavoured products like pastries and liqueur.

Approximately 124 coffee species exist in the wild, of which only a few are commercially relevant. The two most important species on the market are:

- Coffea Arabica (Arabica): Referred to as a highland coffee, because it grows best at altitudes between 600 and 2,000 metres, Arabica is the most dominant species in the coffee market, representing about 75% of global coffee production. Each coffee tree yields an average of two to four kilos of cherries. Arabica beans are fairly flat and elongated. Arabica coffee beans have a smoother, more aromatic and more flavourful taste compared to Robusta. Arabica beans have a caffeine content of approximately 1.5%. Due to its characteristics, Arabica beans make up the largest share of specialty coffees in Europe.

The main sub-varieties of Arabica are the Yemen accession, which is subdivided into the Typica and Bourbon coffee lineages, and the Ethiopia/Sudan accession. Examples of the Ethiopian and Sudanese cultivars are Geisha, Java, Sudan Rume and Tafari Kela.

Examples of Typica cultivars are the Hawaiian Kona, Jamaican Blue Mountain, SL14 and Maragogipe. Examples of the Bourbon cultivars that are grown mostly in Latin America are Caturra, Villa Sarchi and Pacas. Examples of Bourbon cultivars grown in East Africa are Jackson, K7, SL28 and SL34.

- Coffea Canephora (Robusta): Robusta coffee can be considered a lowland coffee, as it grows best at altitudes below 600 metres. Robusta accounts for around 20% of global coffee production. Its beans have a caffeine content of approximately 2.7%. Robusta is less susceptible to pests and diseases than Arabica. Its beans are smaller and rounder than Arabica beans. When roasted, Robusta beans generally have a stronger and harsher taste than Arabica, which is often described as bitter. Robusta beans are often used in coffee blends and in instant coffee production.

Examples of crossbreeds of the Arabica and Robusta species are Catimor, Castillo (the most commonly grown coffee plant in Colombia), IHCAFE90, Ruiru 11, Sarchimor and Obatá.

2. What makes Switzerland an interesting market for coffee?

The enormous coffee roasting industry in Switzerland demands high volumes of green coffee. Switzerland is Europe’s sixth-largest green coffee importer, importing from several coffee-producing countries. Switzerland is Europe’s third-largest roasted coffee exporter. In terms of export value, Switzerland has ranked as number one for many years.

Switzerland is the sixth-largest green coffee importer of Europe

In 2021, Switzerland ranked as Europe’s sixth-largest green coffee importer. According to data from Eurostat, Swiss green coffee imports amounted to 192 thousand tonnes that year, corresponding to 5.3% of all European green coffee imports. In 2021, 99% of Swiss green coffee imports were sourced directly from producing countries. The main suppliers were Brazil, Colombia and Vietnam. Swiss imports grew at an annual average rate of 7.1% between 2017 and 2021.

Coffee imports mainly enter the country through the Rhine River via the port of Basel and its sub-ports Kleinhüningen, Birsfelden and Auhafen Muttenz. The world’s largest green coffee importers all have trading offices in Switzerland, being: ECOM, Louis Dreyfus Company, Olam Food Ingredients (ofi), ED&F Man and Bernhard Rothfos Intercafé (part of Nuemann Kaffee Gruppe).

Swiss roasted coffee exports in Europe: third-largest in volume, highest in value

In 2021, only 1.1% of Swiss green coffee imports were re-exported, amounting to 2.0 thousand tonnes. The main destinations for Swiss re-exports were Germany, Belgium and the Netherlands. The fact that only a small volume is re-exported suggests that most of the green coffee stays in the country and is processed domestically. This, in turn, indicates the size and importance of the Swiss coffee roasting industry.

Switzerland is the third-largest roasted coffee exporter in Europe, after Italy and Germany. According to data from Eurostat, Switzerland exported 107 thousand tonnes of roasted coffee in 2021, accounting for 9.6% of total European exports. The main destination markets for Swiss roasted coffee in 2021 were France (18% of total exports), the United States of America (12%), Spain (11%) and Germany (9%).

When it comes to the export value of roasted coffee, Switzerland accounts for the highest export value among all European countries, at €304 million. Almost 31% of Europe’s roasted coffee export value is accounted for by Switzerland, followed by Italy with 17% and Germany with 15%. The high value of Swiss roasted coffee is strongly related to Nespresso capsules. Coffee for these single-serve capsules are all manufactured in one of three Nestlé factories based in Switzerland, and then exported to over 80 countries worldwide.

Regarding consumption, over 1,074 thousand 60 kg bags (approx. 64 thousand tonnes) of green coffee were consumed domestically in 2021. Between 2017 and 2021 Swiss consumption increased with a year-to-year growth of 2.0%.

Swiss green coffee imports come from a wide range of supplying countries

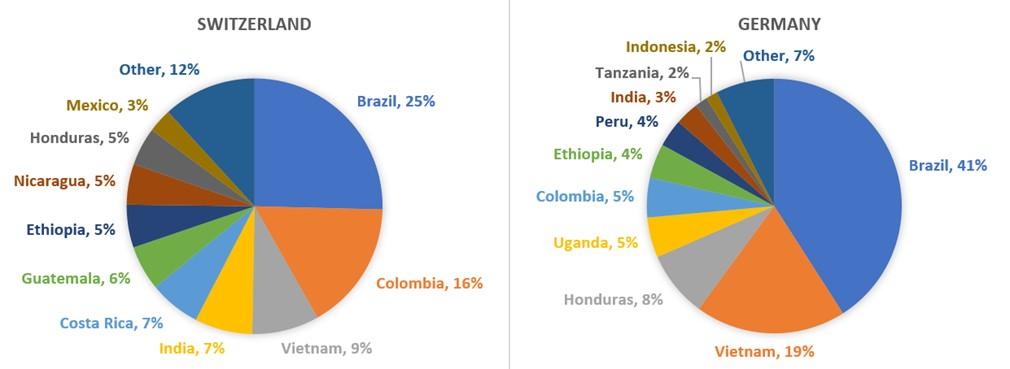

Few countries in Europe source such large volumes from such a diverse range of coffee origins as Switzerland. Often, the bulk of coffee imported by European countries is supplied by just a few supplying countries. For instance, Germany and Italy both sourced 68% of its direct coffee imports from three countries only, about 65% of the United Kingdom’s import was supplied by three countries only, for Spain this percentage amounted to 70% and for Belgium to 61%. The three largest coffee-exporting countries to Switzerland supplied just 50% of Swiss coffee imports.

As shown in Figure 2, Switzerland stands out among other European countries because of its imports from a wide variety of coffee producing countries. Vietnam and Brazil are the largest supplying countries to all European countries mentioned, except to Switzerland. The country imports most green coffee from Brazil and Colombia. Moreover, seven of Switzerland’s ten largest suppliers are Latin American countries. This evidences that Switzerland maintains important trade relations with Latin America, which increased by 8.4% in 2021 according to SECO’s Economics Relations Report.

The wide range of producing countries supplying coffee to Switzerland provides opportunities for coffee exporters. It shows that Switzerland is an interesting market for suppliers of different sizes and profiles. Read more about supplying countries to the Swiss coffee market in our Market Entry study.

Figure 2: Ten largest coffee-supplying countries for the Swiss and German market, 2021

Tips:

- Activate the “Translation” function of your browser to make the studies available in your native language.

- Access ITC Trade Map to analyse Swiss trade dynamics yourself and to determine your export strategy. By selecting a specific country as your reporting country, you will be able to follow developments such as trade flows with established suppliers, the emergence of new suppliers and changing patterns in direct and indirect imports.

- See the website of the Swiss Roaster Guild, the Swiss association for the promotion of coffee consumption and the Swiss Coffee Trade Association for more information about the coffee industry in Switzerland, and to find potential buyers.

- See our study of trade statistics for coffee for more detailed information about the European trade in green coffee beans.

3. Which trends offer opportunities or pose threats on the Swiss coffee market?

Swiss consumers are increasingly interested in specialty coffees, shown by a growing number of specialty roasters and coffee shops in the country. Still, most coffee is purchased in supermarkets. Retailers in Switzerland are driving forces for the increasing share of certified coffees in the market.

Growing demand for high-quality coffees in Switzerland

Despite being one of the world’s largest roasted coffee exporters, Switzerland is also home to a thriving domestic coffee market. In 2020, per capita coffee consumption amounted to approximately 7.9 kg per year. Domestic demand for mainstream quality coffees have stagnated, while that for high-quality coffees has grown.

There is a growing number of specialty roasters on the Swiss market to cater for this demand. Examples of specialty roasters in Switzerland include Vertical Coffee, Mame Coffee and Drip Roasters. Coffee Avenue is a web shop showcasing a large number of Swiss specialty coffee roasters and their coffees.

The number of specialty coffee shops has also increased on the Swiss market. Examples of these shops are: The Coffee Project, Just Coffee and 169 West.

To further boost the specialty segment and promote conscious coffee consumption, the Specialty Coffee Association Switzerland (SCAS) organises specific coffee events, seminars and courses. The Swiss Coffee Festival is an example of such an event and is especially aimed at Swiss-German speakers. The Swiss Coffee Connection is the main event for the French-speaking Swiss. There are also several private coffee academies, authorised by SCAS, to promote knowledge about specialty coffees, like Academie du Café.

Popularity for specialty coffees is leading the coffee industry to adopt high-quality standards and seek unique coffees that offer distinct flavours. Specialty coffee exporters may find interesting opportunities in this segment of the Swiss market.

Swiss organic and fair trade market highly valued

In 2020, fair trade retail sales in Switzerland amounted to €892 million. The consumption of fair trade products grew by 5.5% between 2019 and 2020, and reached a new high of €103 per capita spending in 2020.

According to statistics from the Research Institute of Organic Agriculture,, Swiss organic per capita consumption of agri-food products reached €418 in 2020 – the highest amount spent on organic in the world. Swiss organic retail sales amounted to €3.6 billion in 2020, which represented an increase of 19% compared to the sales value in 2019. Organic sales in Switzerland represented 11% of total retail sales.

Swiss Fair Trade is the industry association of fair trade organisations in Switzerland. Among its members are several coffee actors, including coffee roaster Original Foods, distributor Rüegg's and importer Yocafé.ch. The retailer claro fair trade, with more than 100 shops across Switzerland and a diverse offer of coffee products, is also a member, just like Fairtrade Max Havelaar Switzerland.

The sales of Fairtrade-certified roasted coffee increased steeply in Switzerland, at an average annual growth rate of 15% between 2015 and 2019. Total Fairtrade-certified roasted coffee sales amounted to 7.6 thousand tonnes in 2019, good for 12% of total roasted coffee sales in Switzerland. An estimated 30% of the Fairtrade-certified coffee was also organic certified. Examples of both organic and Fairtrade-certified coffees on the Swiss market include Beararella and La Semeuse.

Fair for Life is another fair trade standard, launched in Switzerland in 2006. Examples of coffee actors holding this label are Swiss roasters Blaser Café and Original Foods.

Swiss retailers push sustainability to mainstream markets

Sustainability is an increasingly important theme on the Swiss coffee market. Several activities are undertaken to increase sustainability in the coffee sector, such as the launching of a new program to work with the Swiss coffee sector on addressing human rights due diligence through closing living income gaps. This program will be a joint effort of the CI Coffee Switzerland, the Swiss Secretariat for Economic Affairs and the Sustainable Trade Initiative.

Sustainability is also driven by commitments of Swiss retailers. Especially the market for certified coffees is growing because of this. In 2010, Migros became the first retailer in Switzerland to switch its entire basic coffee range to Rainforest Alliance/UTZ-certified. With its premium brand Café Royal, Migros also serves another segment of the market. Café Royal is both Fairtrade and organic-certified. It is roasted by Delica, one of the leading roasting companies in Switzerland and part of the Migros Group.

Swiss retailer Coop, on the other hand, only sources Fairtrade-certified coffee for its own-label brand products, such as Qualité & Prix. Overall, 91% of the sales of all of Coop’s own-label coffee brands is Fairtrade-certified. Only their own-label brand Prix Garantie is not Fairtrade-certified; this own-label brand is certified according to the Rainforest Alliance standard.

Coop also requires other roasters and brands that are for sale in its supermarkets to comply with sustainability standards. In 2020, only 8% of branded coffee products in Coop was certified according to either Fairtrade, Bio Suisse, EU organic, Rainforest Alliance/UTZ or 4C standards. This indicates that for exporters wanting to sell to retailers, having a certified offer becomes a minimum requirement. Examples of importers with a large offer of certified coffees include COMSA (Honduras) and Ankole Coffee Producers Cooperative Union (ACPCU, Uganda).

Tips:

- See our study on trends in coffee to learn more about current trends in the European market.

- Promote the sustainable and ethical aspects of your production process and support these claims with certification.

- Before engaging in a certification programme, make sure to check that a label has sufficient demand in your target market and whether it will be cost-beneficial for your product, always in consultation with your potential buyer.

- Refer to the statistics website of the Research Institute of Organic Agriculture (FiBL) to search for key data on organic markets in Europe and the world.

- Access the product finder from Fairtrade Switzerland for more coffee product examples that are Fairtrade-certified on the Swiss market.

- Look for sector or joint company initiatives to increase your understanding of the sustainability strategies in Belgium. Search for initiatives that match your own core strategy and values. The website of the Trade for Development Centre can be a good point of departure to search for such initiatives in Belgium.

- See our study on doing business with European coffee buyers for more tips on marketing and promoting coffee.

- Find potential business partners in Switzerland by checking the customer database of Fairtrade, which includes traders, manufacturers and/or processors, Rainforest Alliance-UTZ certified coffee supply chain actors and Swiss organic coffee importers.

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q-grader certificate to be able to cup and score your Arabica coffee according to international standards. If you produce or export Robusta coffees, it is also possible to become an R-grader.

Gustavo Ferro and Lisanne Groothuis of ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research