Entering the Swiss coffee market

Switzerland is an important coffee market in Europe. There are many actors involved in the country’s coffee sector in activities like trading and roasting. Switzerland imports green coffee from many different producing countries, in part to cater for the country’s large roasting industry (of which most is exported), and also for domestic demand. Your market entry channel will vary according to the quality of your coffee and your supply capacity.

Contents of this page

1. What requirements and certification must coffee comply with to be allowed on the Swiss market?

Switzerland is not a member of the European Union (EU), but a member of the European Free Trade Association (EFTA). To facilitate free trade with the EU, Switzerland has adapted its food laws to European law. Hence they are based on EU legislation. For a complete overview of these EU requirements, refer to our study on buyer requirements for coffee or consult the specific requirements of the Swiss Federal Food Safety and Veterinary Office. Buyer requirements can be divided into:

- Mandatory requirements

- Additional requirements

- Requirements for niche markets

The highlights for these requirements are given below, specified for the Swiss market where relevant.

Legal and non-legal requirements you must comply with

Legal requirements

You must follow the legal requirements applicable to coffee. These rules mainly deal with food safety, where traceability and hygiene are the most important themes. Special attention should be given to specific sources of contamination, namely:

- Pesticides – consult the EU pesticide database or the Swiss pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide.

- Mycotoxins/mould, particularly Ochratoxin-A (OTA) – although no maximum OTA limits have been set for green coffee, green coffees / origins with high OTA levels may be characterised as ‘high risk’.

- Mineral Oil Aromatic Hydrocarbons (MOAHs) – green coffee can get contaminated with MOAHs during all stages of the supply chain. Officially there are no maximum MOAH levels established in Europe yet.

Quality requirements

In general, to determine coffee quality the coffee undergoes both a physical evaluation of green and roasted coffee, as well as a sensory evaluation of the roasted coffee.

Green coffee assessment

Green coffee is first graded and classified for quality before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s standards for green coffee grading are often used as a point of reference. However, most producing countries have and use their own grading systems.

Grading and classification is usually based on the following criteria:

- Altitude and region

- Botanical variety

- Processing method – wet/washed, dry/natural, honey, pulped naturals

- Screen size (note: screen size is important to ensure uniform roasting which improves the quality of the final product)

- Number of defects or imperfections

- Bean density

- Cup quality

Buyers in Switzerland will also do a green coffee assessment. This includes a screen size evaluation, defect count, and an assessment of bean colour, appearance and smell. This is followed by a moisture check and water activity analysis. Sample roasting is then performed, to evaluate green coffee quality and uniformity.

Sensory assessment: coffee cupping

Coffee is assessed and scored by a method called cupping. Buyers will use different protocols and standards to conduct a sensory assessment. However, the SCA recommends specific guidelines and protocols for cupping coffee. The most widely used cupping tool is the SCA’s Coffee Taster's Flavor Wheel. Some quality attributes assessed are: flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes

Note that there is no exact definition of specialty coffee within the coffee industry. The Coffee Quality Institute and the Specialty Coffee Association consider that coffees graded and cupped with scores below 80 are considered standard quality and not specialty. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Some buyers consider 80 too low and demand a cupping score of 85 or higher.

If you sell specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, adding this information to the documentation of the coffee you are exporting might add value. It is very important to be aware of the quality of your coffees, either by inquiring with local cupping experts or becoming a cupping expert yourself.

Labelling requirements

Labels of green coffee exported to Switzerland should comply with the general food labelling requirements of the European Union. The label should be written in English and should include the following information to ensure traceability of individual batches:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Example of green coffee labelling

Source: Escoffee

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Other materials, such as Grainpro or other innovative material like Videplast liners, are often used to pack specialty coffees inside jute bags. These materials have added value over traditional packaging as they preserve grain quality, avoid post-harvest loss, reduce solid waste, reduce farmer’s net carbon footprint, and facilitate chemical free storage.

Most green coffee beans of standard quality imported into Switzerland are packed in container-sized bulk flexi-bags that hold roughly 20 tonnes of green coffee beans each. The remaining green coffee is transported in traditional 60 kg jute sacks, each with a net volume of 17 tonnes to 19 tonnes of coffee. Although the 60 kg bag is the most common, some countries use bags holding 46 kg, 50 kg, 69 kg or 70 kg.

Other packaging used in transporting coffee includes polypropylene super sacks for 1 tonne of coffee, polyethylene liners for 21.6 tonnes and vacuum-packed coffee. These techniques provide two advantages in the coffee trade, namely increasing efficiency and maintaining or preserving quality.

Figure 2: Examples of coffee packing: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: raadtradingco.com, bls-bulk.com and GrainPro

Tips:

- Activate the ‘Translation’ function of your browser to make the studies available in your native language.

- For the full buyer requirements, read the CBI study on buyer requirements for coffee in Europe or consult the specific requirements for coffee on the European Commission’s website Access2Markets.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009. Use the search tool to find the Codes containing information on Ochratoxin A and select your preferred language.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Read more about quality requirements for coffee on the website of the Coffee Quality Institute.

- Find out more about delivery and payment terms for your green coffee exports by reading our study Organising your coffee bean exports to Europe.

Additional requirements

Additional food safety requirements

Expect buyers in Switzerland to request extra food safety guarantees from you. Regarding production and handling processes, you should think of:

- Implementation of good agricultural practices (GAP): The main standard for good agricultural practices is GlobalG.A.P , a voluntary standard for certification of agricultural production processes that provide safe and traceable products. Certification organisations, such as Rainforest Alliance/UTZ, often incorporate GAP in their standards.

- Implementation of good manufacturing practices (GMP): These general principles provide guidance on post-harvest processes such as washed or natural processing, manufacturing, testing and quality assurance to ensure that the product is safe for human consumption. Your GMP plan should include guidelines about at least your processing facility and equipment as well as your warehouse and transportation.

- Implementation of a quality management system (QMS): Buyers are increasingly requiring a system based on Hazard Analysis and Critical Control Points (HACCP) as a minimum standard for green coffee production, storage and handling. Regularly checking the residue levels in your green (and roasted) coffee is an example of a measure that could be included in this system. It is particularly important to check for (and aim to prevent) Ochratoxin-A (OTA), polyaromatic hydrocarbon (PAH) and pesticide contamination, such as glyphosate contamination. Proactively obtaining certificates of analysis on a regular basis for the coffee you produce and export is recommended, preferably from a European-accredited laboratory such as Eurofins or Tüv. You may also decide to obtain ISO 9001 certification for your quality management system.

- For roasted coffee, HACCP might be required, and this must sometimes be accompanied by certification from the Global Food Safety Initiative (GFSI) such as BRC Global Standard Food Safetyhttps://www.fssc22000.com/, FSSC 22000, IFS Food or SQF Institute. Read our study on coffee roasted at origin to learn more about specific requirements for roasted coffee.

Additional sustainability requirements

Corporate responsibility and sustainability are very important throughout the European coffee sector. Coffee industry players have sustainability policies reflecting their relationship with farmers and transparency in their operations, as well as their social and environmental impact in the place of origin. Examples of these sustainable company policies or codes of conduct can be found on the websites of Ecom Trading and Sucafina.

As an exporter, adopting codes of conduct or sustainability policies related to your company’s environmental and social impact may give you a competitive advantage. In general, buyers will likely require you to comply with their code of conduct, and/or fill out supplier questionnaires regarding your sustainability practices.

Certification standards are very often part of the sustainability strategy of traders, coffee roasters and retailers. As such, a standard like Rainforest Alliance/UTZ has become increasingly important in the mainstream coffee market.

Apart from these sustainability requirements, it is important to be aware that the EU is implementing its so-called European Green Deal. This Green Deal is aimed at making Europe sustainable and climate neutral by 2050. To achieve this goal, the EU is working on legislation that requires companies to address human rights and environmental standards in their value chains, including those that trade in coffee. As with the corporate codes of conduct, companies will require you to comply with these additional requirements. The EU is also working on a European due diligence solution to stop EU-driven deforestation, which also pertains to coffee cultivation. Switzerland shares many of the sustainable development goals contained in the European Green Deal roadmap, in particular the stance to take a leading role in the fight against climate change. In their respective sustainability, environmental, energy and climate policies, Switzerland and the EU have set themselves largely equivalent levels of ambition.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Have a written plan about your food safety control. Review and update your plan when changes occur in your business operations, or at least every couple of years.

- Refer to the ITC Coffee Guide – 4th Edition. This guide contains lots of information, also about the practical aspects of coffee trade. Check the content table to see what you want to learn about.

- Find out which standards or certifications are preferred by potential buyers in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label depending on their end clients and distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this online self-assessment form by Amfori BSCI to determine your social performance. This Excel form by the Sustainable Agriculture Initiative (SAI) Platform can be used to assess your farm’s sustainability performance.

- See the list of Rainforest Alliance/UTZ registered coffee actors in Switzerland to identify interesting players. Learn which ones are certified to buy your Rainforest Alliance/UTZ certified coffee.

Niche requirements

Organic

In order to market your coffee as organic in Switzerland, it must comply with the regulations of the Swiss Organic Law. A mandatory national logo for organic products does not exist in Switzerland. However, the private label of Bio Suisse, the Swiss private organic sector association, is widely used.

Note that the standards of Bio Suisse are stricter with regard to agricultural production and processing than the Swiss Organic Law or EU Organic regulation. Retailer Coop, the largest seller of organic food in Switzerland, only accepts organic products with Bio Suisse label. Other organic standards used in Switzerland are Demeter and Migros Bio, the private organic label of retailer Migros. Each scheme has its own requirements, and may be demanded by specific buyers.

Fair trade

Before you can market your coffee as fair trade, an accredited certifier must audit your growing and processing facilities. The most common fair trade standard in Switzerland is Fairtrade, for which the accredited certifier is FLOCERT.

Fair for Life (certified by IMO/Ecocert) is another fair trade certification that producers may choose. This certification was developed by the Swiss BioFoundation and Institute for Marketecology (IMO) and is now universally applicable whatever the setting and location is. However, keep in mind that Fair for Life may be less known on the market. This certification standard does have the advantage of being cheaper, as the control body may combine the fair trade audit with the organic or Rainforest Alliance audit. However, you should be sure to always check the demand and interest for a specific certification with your (potential) buyer. It is a good idea to check what kind of a premium would be paid, as this is not regulated, unlike Fairtrade’s minimum price.

High-end specialty coffee

The high-end specialty coffee segment is characterised by a very high cupping score (around 84 and above), innovative processes (such as natural and honey processing), direct trade relations, and high transparency and traceability from source to consumer. This means that buyers of these coffees ask for requirements that go beyond the requirements for certification.

Besides high quality, these buyers are interested in your stories from origin; for instance about your coffee farm, the coffee growers and your processing facilities. This implies that you should know the specifics of your coffee, from soil management to the cup, from variety to processing, from external suppliers to farmers, and must be willing to share these honestly. Other than that, direct trade may result in more frequent coffee farm visits and product assessments by your buyers, as well as long-term business relations.

Tips:

- Learn more about organic farming and European organic guidelines on the European Commission website and the Organic Export Info website.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search by learning about the organic movement in your own country and inquire about support programmes or existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Find importers that specialise in organic products on the website Organic-bio.

- Try to visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair. There you will also find organic certification bodies on the exhibitors’ list.

- If you produce coffee according to a fair trade scheme, find a specialised Swiss buyer that is familiar with sustainable or fair trade products, for instance via the FLOCERT customer database.

- Use this cost calculator to estimate what costs will be involved for your organisation to become Fairtrade-certified.

- Ask quotations from different certifiers before you decide with whom you want to work. Ask for timelines and an estimation of how many days will be charged.

- Try to combine audits in case you have more than one certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

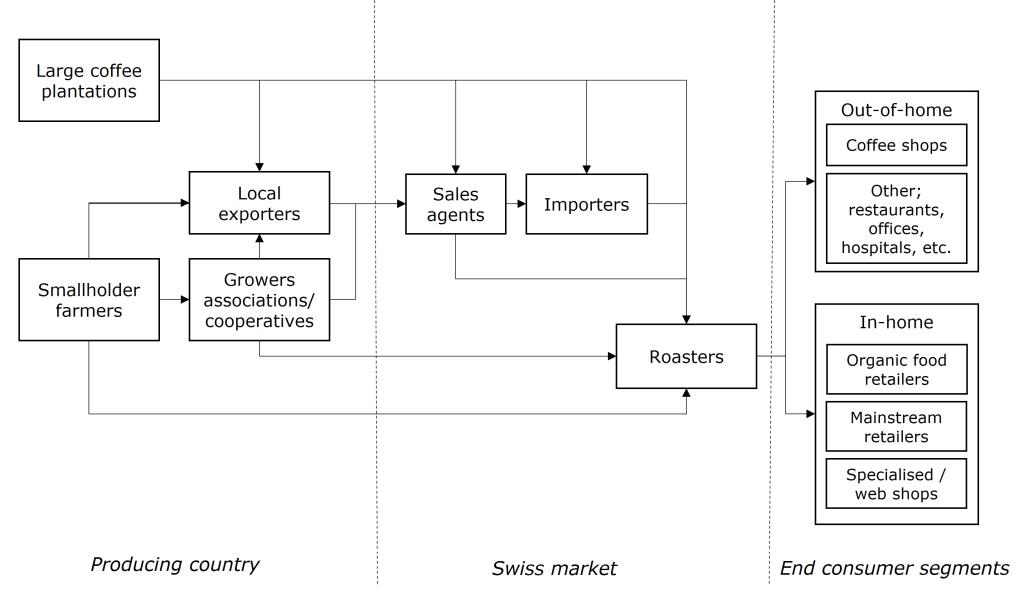

2. Through what channels can you get coffee on the Swiss market?

The Swiss end market for coffee can be segmented by quality. The high-end and upper-end segments represent a continuously growing market. Suppliers in producing countries mainly enter the Swiss market through importers or medium-sized and large roasters.

How is the end market segmented?

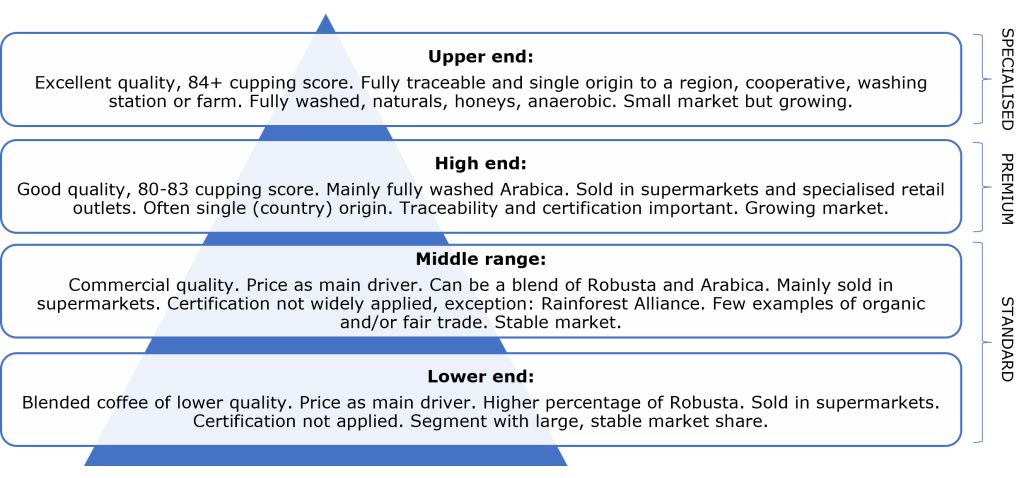

The Swiss coffee end market can be segmented as follows:

Figure 3: Coffee end market segmentation by quality

Source: ProFound

In Switzerland, supermarkets are the main sales channel for coffee. Supermarkets sell a wide variety of coffee products, ranging from low-end to high-end products. Supermarkets also sell a wide range of their own label coffee products. These products are popular as they offer the same characteristics as branded products, but usually at more affordable prices. The total share of private label products in Swiss retail reached almost 50% in 2021. The largest retailers in Switzerland are Coop and Migros.

Low end: The coffees in the low-end segment are mainstream, low-quality and mainly blended coffees. These blends are characterised by high shares of Robusta beans. Besides some mainstream brands, the lower-quality private label products from supermarkets also belong to the low-end segment. In addition, most coffee pads and instant coffee belong to this low-end segment. Coffees at the low end of the market are mainly sold in supermarkets.

Product and price example in the low-end segment, based on Coop’s retail prices in 2022, include:

| Product | Image* | Retail price (€/kg) | |

| Low-end | Prix Garantie, private label (ground coffee, UTZ-certified, 500-gram package) |

| 8.60 |

*Source of pictures: Coop

Mid-range: Mid-range coffees are commercial coffees with a consistent quality profile. This segment typically consists of blends with a higher proportion of Arabica compared to coffees in the low-end segment. The mid-range segment represents a stable coffee market, in which, often as a minimum, Rainforest Alliance certification is important. In Switzerland, this segment also contains the premium private label brands of supermarkets, as well as a wide range of Fairtrade and organic-certified coffees.

Mid-range coffees are also most often sold in supermarkets and by the food service industry. Example of mid-range products and prices, based on Coop’s retail prices in 2022, include:

| Product | Image* | Retail price (€/kg) | |

| Mid-range | Lavazza (whole beans, 1-kilogram package) |

| 15.55 |

| Coop, own-brand (whole beans, Fairtrade and organic-certified, 500 gram) |

| 17.67 | |

| Tchibo (whole beans, Fairtrade-certified, 1,000 gram) |

| 18.95 |

*Source of images: Coop

High end: These are premium coffees of good quality, mainly consisting of Arabica beans. These coffees are often single origin, tracing back to the country level. Story telling is important in this segment, especially for branding and marketing purposes. Usually, these premium coffees have packages where the origins of the product are explicitly stated, as well as other features that represent an added value for the product such as social/environmental impact. Certification is also important in this segment. Almost all coffees are certified according to Fairtrade, organic and/or other certification standards. In Switzerland, this high-end segment is large and fully integrated in the assortments of supermarkets.

Examples of high-end products and prices, based on Coop’s retail prices in 2022, include:

| Product | Image* | Retail price (€/kg) | |

| High-end | La Semeuse (whole beans, Fairtrade and organic-certified, 250-gram package) |

| 30.53 |

| La Mocca (whole beans from Honduras, Fairtrade and organic-certified, 250-gram package) |

| 30.53 |

*Source of images: Coop

Upper end: The upper-end segment consists of specialty coffees of excellent quality, with cupping scores of 84 and beyond, often from micro or nano-lots that undergo processing methods such as naturals and honeys. These are fully traceable and single origin beans that trace back to cooperatives, washing stations or estates.

Sustainability certifications are not common in this segment. This is because sustainability practices are often commonplace among buyers. Long-term contracts between suppliers and buyers characterise the upper-end segment, as well as higher prices. The upper-end segment is seeing growth in organic-certified coffees. This is the case as organic farming and trading addresses aspects which are complementary to high quality, such as the prohibition of synthetic inputs and ethical trade practices.

Coffees in this segment are mainly sold directly by specialty roasters, at their physical and web shops as well as at coffee events. In Switzerland, there is also an increasingly large offer of specialty coffees in retail shops.

Examples of specialised Swiss coffee web shops are Coffee Avenue and The Coffee Project. For other examples of Swiss specialty roasters and cafés, see the website European Coffee Trip. Examples of coffee events are the Switzerland coffee festival and the Swiss Coffee Connection.

Examples of coffees in the upper-end market segments sold in Swiss retail, based on Coop’s retail prices in 2022, include:

| Product | Image* | Retail price (€/kg) | |

| Upper-end | Variety: Typica Process: Anaerobic |

| 57.40 |

Variety: Sarchimor and Catimor Process: Washed |

| 45.90 |

*Source of images: Coop

Value distribution: As shown by the above examples, end-market prices for coffee vary depending on the targeted market segment. Green coffee export prices typically amount to only 5% to 25% of the end-market prices, depending on the coffee quality, the size of the lot and the supplier’s relationship with the buyer. Figure 4 below shows the value distribution of wholesale mainstream coffee (standard quality). Roasters often end up taking more than 80% of the wholesale coffee price. A coffee farmer takes about 10%.

Value distribution for specialty coffees in the high-end and upper-end segments behave differently. These prices may have reference to the international London and New York market prices but much of the coffee trade takes place on a price differential basis or outright basis. In the specialty segment, the shares of added value for farmers tend to be much higher than in the mainstream coffee market, although producing and processing specialty coffee requires substantial effort and work.

The Specialty Coffee Association provides an illustrative example of how exporters should look into their value chain, in terms of different costs and margins. You should also refer to the Specialty Coffee Transaction Guide to get an idea of the current market prices for specialty coffee. This guide quantifies anonymous contract and pricing data of importers and roasters, based on quality, quantity, and origin of the coffee purchased.

Tips:

- Learn more about mainstream Swiss supermarkets’, such as Coop, promoting of standard quality and high-quality coffees. Compare their product assortment and price levels with specialised stores, such as the Swiss web shop The Coffee Project.

- Refer to our study on trends in the coffee sector to learn more about developments within different market segments.

- Check the website of the Specialty Coffee Association (SCA) to learn more about the high-end and upper-end coffee segment, market trends and main players in the whole sector. Refer to the Swiss SCA website for more specific information about Switzerland.

Through what channels can you get coffee on the Swiss market?

As an exporter, you can use different channels to bring your coffee to the Swiss market. How you enter the market will vary according to the quality of your coffee and your supplying capacity. Bear in mind that shortened supply chains are a general trend in Europe. This means that large-scale retailers and (private label) coffee roasting companies are increasingly sourcing their green coffee directly from origin. The below figure shows the most important market channels for green coffee beans entering Switzerland.

Figure 5: Market channels for green coffee in Switzerland

Source: ProFound

Importers

Importers play a vital role in the coffee market, functioning as supply chain managers. They maintain wide portfolios from various origins, pre-finance operations, perform quality control, manage price fluctuations and establish contact between producers and roasters. In most cases, importers have long-standing relationships with their suppliers and customers.

Large-scale importers usually have minimum volume requirements starting at around 10 containers, covering a wide range of qualities, varieties and certifications. At the same time, they provide strong support on logistics, marketing and financial operations.

Green coffee is mainly imported through the Rhine River via the port of Basel and its sub-ports Kleinhüningen, Birsfelden and Auhafen Muttenz. Green coffee traders in Switzerland are located near these ports. In general, importers mainly sell the green beans to roasting companies in Switzerland.

The world’s largest green coffee importers all have trading offices in Switzerland: ECOM, Louis Dreyfus Company, Olam Food Ingredients (ofi), ED&F Man and Bernhard Rothfos Intercafé (part of Nuemann Kaffee Gruppe). Other large coffee importers with a base in Switzerland are Be Green Trading and EFICO.

Specialised importers are able to buy small and medium-sized volumes of high-quality and single origin coffees, from micro-lots to full container loads (FCL). Examples of specialised importers in Switzerland are Sucafina Specialty, Blaser Trading, Walter Matter and Coffee Ithaka (imports only certified yet mainstream qualities, only from East African countries).

For which companies is this an interesting entry channel? The most interesting channel for you will depend on the quality of your coffee and your supply capacity in terms of volume. If you are an exporter of green coffee beans and can you offer high volumes (10 containers or more), you should look into entering the Swiss market through large importing companies. These companies usually have agents or representative offices in producing countries, which can be your first point of contact.

Specialised traders can be interesting if you have evidence of high cupping scores of at least 80, although some buyers may require scores higher than 85, plus a high degree of transparency and traceability. Keep in mind that many specialised importers prefer to work directly with producers or cooperatives.

Medium-sized and large roasters

Most large roasters buy their coffee beans from the country of origin, although they might also source through importers. Roasters usually perform analysis and cup testing to check the evenness of the roast and to identify any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Large roasters usually blend different qualities of green coffees to safeguard quality consistency. The final product is distributed to retailers and the food service industry.

Roasters can operate under their own brands and/or private label. Examples of large roasters in Switzerland are Nestlé and Delica AG. Other examples of medium-sized roasters active on the Swiss market include Blaser Café, UCC Café, Graf Kaffee and Turm Kaffee.

For which companies is this an interesting entry channel? Supplying directly to large-scale roasters is only interesting if you are able to supply large volumes at consistent quality. If you work with bulk coffees, discuss minimum quality and other requirements, such as certification, with your potential buyer.

Supplying to medium-sized roasters may also be an interesting alternative if you have a consistent and reliable quality and volume. Most medium-sized roasters will also require one or more certifications for sustainable production.

Small roasters

Although a growing number of small roasters import green coffee directly from the place of origin, the largest share of smaller roasters continues to buy their coffee via importers. This is the case as not all roasters can take on the additional responsibilities and risks involved in importing directly from the source. Importers help roasters with financial services, quality control and logistics. Nevertheless, small roasters often maintain a direct connection with their producers, as they need detailed information for storytelling in order to market the coffee to their clients (brands or consumers). Small roasters often specialise in single origins and the finest specialty coffees.

Examples of small roasters in Switzerland directly importing coffee include Vertical Coffee, Mame Coffee, Drip Roasters, Roast Rebels or Stoll-Kaffee.

For which companies is this an interesting entry channel? Supplying to small roasters is interesting for producers and exporters that offer high-quality coffees, have micro-lots, can guarantee traceability, and are willing to engage in long-term partnerships. Assess whether small or medium-sized roasters are interested in establishing direct trade relationships, and whether you have sufficient means to organise your exports.

Agents

Dealing directly with different green coffee buyers located in several markets is not always feasible. For this reason, many exporters still use agents. Agents act as intermediaries between you, coffee importers and roasters. They have vast market knowledge and know their buyers. Agents can help you assess and select interesting buyers, while they may help buyers find interesting suppliers in different countries. Some agents are independent, while others are hired to make purchases on behalf of a company.

For which company is this an interesting entry channel? If you have limited experience exporting to European countries, agents can be a big help. Agents are also interesting if you have limited quantities of coffee or if you lack the financial and logistical resources to carry out trade activities. Working with an agent is also useful if you need a trusted and reputable partner in the coffee sector. Be prepared to pay them commission for their work.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Attend trade fairs to meet potential Swiss buyers. Interesting trade fairs in Europe include SCA’s World of Coffee (every year in a different European city), Biofach (organic) and COTECA (both in Germany), Swiss Coffee Connection and the Swiss Coffee Festival. Attending such events can provide you with additional insight into the preferences of Swiss buyers with regard to origin, flavour and sustainability certification.

- Check this list on the website of the Swiss Coffee Association highlighting several specialty coffee roasters in Switzerland. For a list of traders active in Switzerland check The Swiss Coffee Trade Association website. It will help you find potential partners and learn more about the Swiss market.

- Invest in long-term relationships. Whether you are working through importers or roasters, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on buyer requirements for coffee to learn about which European market standards and requirements you need to comply with when supplying to Europe.

- See our study on how to do business with European buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

3. What competition do you face on the Swiss coffee market?

In general, competition is higher for mainstream coffee with low added value. This segment is mainly dominated by major suppliers and cooperatives which are able to deliver large quantities so they can compete on price. It is difficult for small and medium-sized companies, for example those which only export a few containers per year, to compete in this segment.

Volumes in the specialty coffee market are smaller, and the focus is more on quality, origin and sustainability. However, as the requested volumes are smaller, and more and more producers are focusing on this segment, competition can also be quite fierce. There are several competitions to identify the highest quality coffees produced worldwide, for instance the Cup of Excellence. These competitions might be an interesting entry point for this segment but it may be necessary to invest a large sum of money in order to enter this segment.

New entrants to the market will face competition from already successful coffee exporters, especially due to the fact that they have already established long-term relationships with buyers. Entering the market as a newcomer requires you to have extensive knowledge of your product assortment, stable quality and volumes, and good communication skills to enable you to start building your own new relationships with buyers. If the potential buyer is not yet operating in your country of origin, it might be more difficult to establish initial contact. You may be required to supply more extensive information about the producing regions, the producing communities and traceability, for example.

Brazil is Switzerland’s largest coffee supplier

Brazil is the world’s largest coffee producer and Switzerland’s largest supplier. The coffee supplied by Brazil to Switzerland reached 49 thousand tonnes in 2021, corresponding to an average annual growth rate of 1.4% since 2017. Brazil produces both Arabica (71%) and Robusta (29%) varieties, but about 80% of exports consist of Arabica.

Brazil’s coffee-producing areas are relatively flat, which has intensified the use of mechanical pickers in the industry. This has drastically reduced labour costs in Brazil’s coffee production, but also resulted in lower quality, as machines do not distinguish between ripe and unripe cherries. Coffee prices in Brazil went down, especially in relation to other coffee-producing countries. Brazil mostly produces natural and pulped natural coffees. Low-grade Brazilian Arabica is mostly used in blends.

Although the country is mainly known for exporting large volumes of standard quality coffee, it also has a strong reputation as a producer of specialty coffees. The sector receives considerable institutional support from the Brazil Specialty Coffee Association, which aims to elevate the quality standards and enhance value in the production and marketing of Brazilian coffees. Examples of successful exporters of specialty coffees in Brazil are Burgeon and Bourbon Specialty Coffees. Large Brazilian exporter Costa Café has also started exporting specialty coffees in addition to its regular mainstream coffee exports.

Trade between Brazil and Switzerland benefits from the close economic and diplomatic relations between both countries. Brazil is the main economic partner of Switzerland in Latin America, accounting for 34% of Swiss business in the region. Also, both countries have advanced in the EFTA-Mercosur free trade agreement which is intended to facilitate agricultural exports, including coffee.

Colombian coffee stands out for its certifications

Colombia is the second-largest coffee supplier to Switzerland. Colombian exports to Switzerland increased at an average annual rate of 7.9% between 2017 and 2021. Total exports to Switzerland amounted to more than 31 thousand tonnes of green coffee in 2021.

Colombia is the world’s largest producer of washed Arabica. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee, solidifying the country’s established image and brand for high-quality coffees. The Café de Colombia trademark is a registered protected geographical indication (PGI) in Europe. Colombia is unique in this regard, as it is the only coffee-producing country to have obtained this designation.

Colombia is an important producer of certified coffees worldwide. Colombia is the second-largest producer of Rainforest Alliance-certified coffees and the largest producer of Fairtrade-certified coffees. The wide availability of certified coffees has allowed green coffee exporters to access various markets and segments in Europe. Examples of successful Colombian cooperatives or private organisations which export coffee to the international market include InConexus, Red Ecolsierra, La Maseta and Cadefihuila.

Coffee is among the top 3 Colombian products exported to Switzerland. Colombia and Switzerland have strong bilateral economic and trade relations. Since 2011, a free trade agreement has been in place between the EFTA states and Colombia and it has facilitated trade between countries, including coffee.

Vietnam: increased coffee exports

Vietnam is the world’s second-largest coffee producer, with production volumes reaching 1,740 thousand tonnes between 2020 and 2021. Switzerland imported a total of 16 thousand tonnes of green coffee from Vietnam during 2021. Between 2017 and 2021, coffee imports from Vietnam increased year on year by 5.7%.

Over 96% of Vietnamese coffee production consisted of Robusta coffees. Vietnam’s coffee production is strongly focused on creating large volumes of standard-quality coffees, mostly directed to the instant coffee market. In recent years, Vietnam’s Robusta exports have been faced with fierce competition from the Brazilian Conilon and Robusta beans from other countries, leading to slightly lower export volumes. Examples of large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and Mascopex.

Central America: important coffee supplier to the Swiss market

Central America’s product range consists of mostly Arabica varieties, although Robusta production has seen an increase in production recently, mainly in Nicaragua and Costa Rica. Panama, Costa Rica, Nicaragua, Honduras, El Salvador and Guatemala established themselves among the world’s leading specialty coffee producers and exporters. In most countries in the region, more than half of the coffee production can be classified as highest quality. Most Central American countries have the infrastructure and expertise to process coffee cleanly and consistently, focusing on high-quality Arabica. In Costa Rica, Robusta varieties were even prohibited by law until recently.

Costa Rican sustainable coffee stands out on the international market

In 2021, Costa Rica exported over 12 thousand tonnes to Switzerland, recording a year-to-year growth of 6.1% in volume since 2017. Costa Rica ranked as the fourth-largest producer in Central America with a total green coffee production of 88 thousand tonnes in its 2020/2021 crop year. According to the Foreign Agricultural Service of the USDA, the entire coffee production in Costa Rica belonged to the Arabica variety.

Coffee is one of Costa Rica’s top three agricultural exports. Costa Rica positions itself by focusing on environmental and sustainability attributes to add value and compete on quality at an international level. For example, Costa Rica has successfully developed pioneer projects for consolidating low-carbon coffee production. Also, there is a platform called Traceability & Sustainability statement where transparent information on the country’s coffee value chain can be found.

The Instituto del Café de Costa Rica (ICAFE) has overseen the country’s coffee industry. Through ICAFE and international support, Costa Rican coffee farmers developed a mechanism which allowed them to obtain greater benefits and boost their productivity. Also, the Specialty Coffee Association of Costa Rica has boosted the specialty industry through training sessions and promotion of national coffee to the global community. This social and environmental focus has led to an increase in the value of Costa Rican coffee on the international market. Examples of exporters from Costa Rica can be found here.

Guatemala: consolidated reputation as a producer of specialty coffee

Guatemala is the second-largest producer in the region with almost 230 thousand tonnes in the period 2020-2021. The country’s production is almost completely Arabica. Guatemalan coffee imports to Switzerland increased at an average annual rate of 3.9% between 2017 and 2021, amounting to almost 11 thousand tonnes in 2021.

Guatemala has a good reputation for premium and high-quality coffees. The National Coffee Association in Guatemala, ANACAFE, provides technical support to coffee farmers related to production, (post-)harvesting and sustainable practices of coffee. In 2020, Guatemala registered the third-largest organic coffee area in the Central American region, with over 10.8 thousand hectares (pp. 100-101). Guatemalan organic coffee exports have been growing at significant rates over the past years. The best-known producer region is Antigua, located in a valley between three volcanoes.

Examples of specialty coffee exporters from Guatemala are ACODIHUE and Finca Medina.

Sustainable production and quality drive Nicaragua’s exports

Nicaragua has the third-largest coffee production in Central America with 163 thousand tonnes produced in 2020/2021. Nicaragua is known for its Arabica production, which accounts for 97% of total produced coffee. Yet the country has a small production of Robusta too. In 2021, Nicaragua supplied almost 10 thousand tonnes of green coffee to Switzerland. Between 2017 and 2021, coffee exports from Nicaragua increased significantly by an annual average growth rate of 57%.

Coffee is one of Nicaragua’s most exported products. In recent years, Nicaragua has attracted more international buyers thanks to a general quality improvement and a stronger sustainable approach for coffee production and trade. Nicaraguan coffee exports have also been boosted through public-private efforts in the framework of the Association Agreement between the European Union and Central America.

Examples of Nicaraguan exporters are Cafetalera Nica-France, Beneficiadora Norteña de Café and Sajonia Estate Coffee.

Honduras is the largest coffee producer in Central America

Honduras is the largest producer in the Central American region with a recorded production of 390 thousand tonnes of coffee between 2020 and 2021. Honduras is a major Arabica producer and supplier.

In 2021, Honduras supplied 9 thousand tonnes to Switzerland which represented an average annual increase of almost 6% in coffee exports since 2017. The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees, either through certification or by actively improving coffee quality. The country has grouped coffee production and quality specifications into six different regions according to differences in microclimates and soil composition. Honduran exports of specialty organic coffees increased by 30% between 2016 and 2017 thanks to these efforts. In 2021, exports of specialty and certified coffee amounted to 54% of total exports.

A relatively large share of coffee from Honduras is organic. In 2020, about 24 thousand hectares were dedicated to organic coffee farming in Honduras (pp. 100-101), approximately 5.7% of the total land used for growing coffee. Honduras is one of the largest organic coffee suppliers to Europe.

Examples of successful exporters in Honduras are Asoprosan, Cafico, Capiro Coffee Export and Aruco.

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them too. Look into their marketing strategies, the product characteristics they highlight and their value addition approaches. Successful companies that already export to the European market from which you can learn include, for example, Bench Maji Coffee (Ethiopia), Aicasa (Peru), and Bourbon Specialty Coffees (Brazil). Another interesting exporting company to learn from is Caravela Coffee, which has a wide portfolio of specialty coffees from Latin America, facilitates contact between roasters and producers, and has set up representative offices in destination markets.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story. The auctions organised by the Cup of Excellence are one such example.

- Read this article to learn how a coffee collective in Costa Rica became carbon neutral.

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if your company size or product volume are too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive in the European market.

- Learn more about the developments in the organic sector. For specific information about coffee, refer to pages 99-101 in the 2022 edition of The World of Organic Agriculture.

- Develop long-term partnerships with your buyers, including always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability in the Swiss market. See our tips on doing business with European coffee buyers for more information.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research