The European market potential for exotic fruit

European consumers have a growing interest in new flavours and fruit varieties. This leads to a higher market value for exotic fruit with most imports in northern Europe. Communicating the health benefits of exotic fruit and exploring transport alternatives, can help increase the demand. Pomegranates, passion fruit, physalis and pitahaya may be in the highest demand, but other exotics like lychees, rambutan and carambola definitely have potential for growth.

Contents of this page

1. Product description

This product study covers fresh exotic fruits that are traded under the Harmonized System (HS) code 081090. In the European Union and the United Kingdom, this code is divided into 2 main categories: 08109020 and 08109075 (see Figure 1 below). See the classification and Latin names for edible fruit and nuts in My Trade Assistant by Access2Markets.

Some of these exotic fruits are relatively known in Europe and marketed in higher volumes, such as pomegranates, passion fruit and to a certain extend lychees and physalis. Other fruits such as cactus figs, medlars and cherimoya have strong regional consumption. These are most common in the Mediterranean region due to their local production. Less common exotics that are also often imported include pitahaya, rambutan and jackfruit.

See also the specific CBI product studies on promising export products for some of the mainstream exotics such as pomegranates and lychees, niche exotics like rambutan and tropical fruits that are not included in this study such as fresh mangoes, papayas, coconut or persimmons.

Figure 1: Overview of Harmonized System (HS) codes and examples of several exotic fruits in within these codes

Sources: Wikipedia by fir0002flagstaffotos (passion fruit), I, Luc Viatour (lychee), Agnieszka Kwiecień (cherimoya), Silverije (medlar), Hans B. (sapodillo plum), Abhishek Jacob (Cashew apple), Ivar Leidus (Granadilla), Freshplaza (Pitahaya) and other fruit images by Pixabay.

For HS codes see: Taric Support and My trade Assistant by Access2Markets.

2. What makes Europe an interesting market for exotic fruit?

An increasing import value is a good indication of a growing demand for new exotic fruit varieties. The best timing to supply these fruits are specific holiday seasons such as Christmas, Easter and Ramadan.

Import value of exotics increases

The value of European imports of exotic fruit has steadily increased over the last 5 years. Import values and quantities only decreased between 2019 and 2020, which can be explained by the COVID-19 pandemic. The inflation-related pressures that started at the end of 2021 created uncertainty surrounding the future consumption of exotic fruit. Nevertheless, the exotic fruit market has not shown any signs of weakening, and both import values and quantities already surpassed the pre-pandemic levels (Figure 2).

Source: ITC TradeMap

However, the value growth has exceeded volume growth. This can indicate higher prices for exotic fruit, or it may indicate that more exclusive varieties are being imported. During periods of inflation, the sector is under pressure to maintain the price levels. Despite this, the long-term growth outlook remains optimistic, influenced by factors like fruit varieties, target markets, transport modes and promotional strategies.

Data from the European Union (EU) and the United Kingdom (UK) show that the import value of exotics of the product group 08109075 experienced a growth of 8%, reaching a total value of €620 million in 2022. This is mainly explained by pomegranates, which have become a more common exotic fruit in Europe and are available throughout most of the year. Other exotic fruit of the product group 08109020 – such as fresh lychees, passion fruit, carambola and pitahaya – increased with 38% over the past 5 years to €316 million in 2022.

Besides pomegranates, purple passion fruit and physalis are sold by several major retailers year-round. Consumers are now more open to lesser-known subtropical fruits like pitahaya. Many European buyers expect pitahaya to become a year-round fruit in the next 2 years, especially the yellow and the red-red (red flesh and red skin) pitahaya. All other exotics are still considered more of a specialty.

Exotics are often in the beginning of their lifecycle; their market is not yet mature and there is room for them to grow. The time that these fruits need to develop depends on the specific variety and their promotion.

Developing countries are the main suppliers of exotic fruit

Developing countries have positioned themselves as significant suppliers of exotic fruit in Europe. Between 2018 and 2022, European imports from developing countries increased by 33%. This confirms the growing demand for exotic products that is produced almost exclusively in developing countries. European imports from within Europe grew at a more modest rate of 8%, although this is expected to increase in the coming years. Due to climate change, Mediterranean countries such as Spain, Portugal, Greece and Italy are new to the exotics market, from pomegranates and passion fruit, to pitahaya and cherimoyas.

Imports to Europe from other regions, like North America and Oceania, declined by 16% and remained almost irrelevant for the overall European trade of exotic fruit.

Source: ITC TradeMap

Seasons with peak demand for exotics

There is year-round demand for exotic fruits, especially for mainstream exotics such as pomegranates, passion fruit and physalis. However, special holidays significantly increase the demand, increasing the opportunities for a wider variety of exotics.

There are clear import peaks in December and April/May (see Figure 4). Christmas and New Year are key moments for consumers to spend extra on luxury and exotic food. Especially lychees are a typical fruit during this period, but also attractive looking fruit, such as pitahaya, carambola, granadilla, mangosteen and physalis have a peak in demand around this time.

In April and May, Easter and the end of Ramadan play an important role. May is also a period when Peru and South Africa push a high volume of pomegranates into the European market. During the European summer (July-August) the demand slows down mainly due to the availability of local in-season fruits.

When exporting exotic fruits, you must consider seasonal demand and adjust your production and supply planning. With the interest in new fruit varieties by European consumers, the peak sales seasons are a good moment to introduce new fruits, particularly those of smaller size.

Source: ITC TradeMap

Although there are still marked peaks for exotics, these have shifted from symbols of luxury to sources of health benefits. The pandemic increased the awareness on the nutritional value of food. It also created a trend of seeking alternatives to traditional medication for conditions like high blood pressure and digestive issues. This shift opens new supplying windows for exotics, but also underscores the inflation's impact on consumer preferences.

Tip:

- Follow news and developments of different exotic fruits on FreshPlaza, FreshFruitPortal, Eurofruit (Fruitnet) and Fruitrop online.

3. Which European countries offer most opportunities for exotic fruit?

Source: ITC TradeMap

Source: ITC TradeMap

The Netherlands: Best entry market for niche exotics

Most of the exotic fruit to Europe is traded through the Netherlands. This strong trade position can be a good reason to start your business by finding importers in the Netherlands.

You can find several import companies that specialise in exotics. For fruit marketers in other European countries, especially countries with a lower consumption of imported exotics, it is often easier to use trade channels in the Netherlands. Because of the dominance of Dutch trade, you will also find a wide variety of exotic fruit in the Netherlands, even though the exotic fruit consumption may be lower than in Germany or France.

The highest value consists of pomegranates, which are part of the exotic fruit group in HS code 08109075 with an import value of €235.1 million in 2022. But with €88.8 million the Netherlands is also an important importer of passion fruit, physalis, lychees and other fruit within the HS code 08109020.

Dutch imports have the highest share of non-European supply and somewhere around 80% is re-exported. Its main non-European suppliers are Colombia (€58.7 million in 2022) and Peru (€39.2 million in 2022) with purple passion fruit and pomegranates, respectively. Once exotic fruits are being introduced in mainstream market channels, direct trade may bypass Dutch importers. The Netherlands will keep playing an important role in the European distribution of niche products.

Tips:

- Find importers on the member site of the GroentenFruitHuis sector association. You can find several exotic specialists such as BUD Holland and Yex, but there are many more that are not on this list.

- Connect with Dutch traders at relevant trade events and use their experience to get to know the market. Exotic specialists such as Nature’s Pride, Roveg and BUD Holland are well-represented at the Fruit Logistica trade fair in Berlin.

Figure 7: Roveg’s exhibition of fresh exotic fruit at Fruit Logistica 2023

Source: photo taken by Dana Chahin

Germany: Popular market for pomegranates, physalis and passion fruit

Germany is one of the biggest consumers of imported exotic fruit, in particular pomegranates, physalis and passion fruit. Other exotic fruits like pitahaya are also slowly gaining popularity.

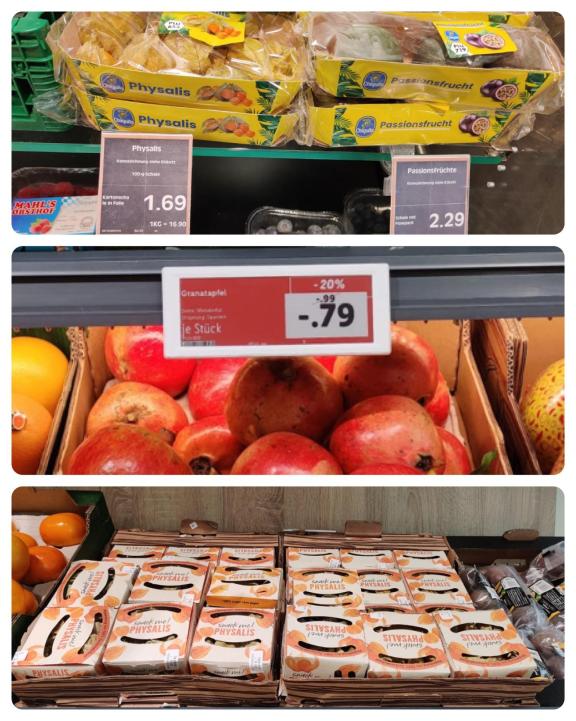

Figure 8: Pomegranates, physalis and passion fruit at German supermarkets (Feneberg and LIDL)

Source: photo taken by Dana Chahin

In 2022, Germany imported €92.3 million of pomegranates, physalis and other small exotic fruit with HS code 08109075. Other exotics with HS code 08109020 such as lychees and passion fruit amounted to 45.9 million EUR.

Colombia is Germany’s main supplier of exotic fruit, followed by Spain and Peru. Colombian suppliers have specialised in exporting physalis and purple passion fruit. About 80% of the German imports from Spain are pomegranates. The rest corresponds to exotics of the 08109020 product group, such as pitahaya and passion fruit. Peru focuses mainly on pomegranates. Physalis and granadillas are also imported from Peru, but in much smaller quantities than the imports from Colombia. Turkey is also a traditional supplier (€12 million in 2022), which can be explained by the active Turkish community in Germany and their high consumption of pomegranates.

German consumers are slowly becoming more familiar with a wider offer of exotics. The strict requirements on quality and food safety and a preference for local organic fruit are important factors that may restrict a fast growth. A possible way to reduce food safety concerns and get consumers more familiar with exotic fruit may be by exporting processed or frozen products.

The organic segment in Germany offers opportunities for growth. Some importers are interested in developing new concepts and ideas for their clients, especially in the foodservice segment. This is why your chances to succeed with organic specialised importers are higher if you can offer a wide and interesting portfolio of exotics. For importers, it is easier to sell mixed pallets of different exotics than just 1 exotic fruit.

Tips:

- Take away potential concerns of German buyers and guarantee a low-pesticide residue product. Use the Lidl standard of 33% of the legal European limit. Learn more about the German market and its specific requirements in the CBI study on Exporting fresh fruit and vegetables to Germany.

- Visit the website of the German Import Promotion Desk (IPD) for useful information about the German market. Check if your country is among the partners in the fresh produce sector and contact the corresponding team member for your country.

- Check the exotic products range of organic specialised importers from Germany, such as Bivano, Lehmann Natur (part of Bivano) and BioTropic on their websites.

France: Strong seasonal demand for lychees

France is an important market for exotic fruits. Despite the strong focus on locally produced fruits, specialised and ethnic wholesalers contribute to a significant market for imported exotics. There is an especially strong seasonal demand for lychees.

Of the €104 million of imported exotic fruit, €62.5 million consisted of fresh lychees, passion fruit, pitahaya, carambola, tamarinds, cashew apples, jackfruit and sapodilla plums (HS code 08109020). Vietnam and Madagascar are France’s main non-European suppliers, making lychees one of the most valuable fruits in this exotic import range. Peru, South Africa and Colombia are another big group of suppliers, mainly of passiflora. Pomegranates (belonging to HS 08109075) are another big segment, with Spain, Peru and Israel dominating the market.

The French market offers a combination of relevant retail and wholesale channels. Retailers with a focus on fresh products such as Grand Frais and wholesale markets such as Rungis offer opportunities for a wide range of exotic products besides the usual French assortment.

With 5 sister companies, the Kinobé Group is a leading supplier to the French market. N&K (based in the Netherlands) and Kissao (by Kinobé) are involved in sourcing exotics: from passion fruit and physalis to pomegranates and more. Smaller importers working with exotic products include Barnier (Santana) and the organic specialised importer Bonabio, both active in the Rungis wholesale market.

You can expect the consumption of exotic fruit to continue to grow, but keep in mind that there will always be the competition with local fruits.

Tips:

- Get an impression of the exotic fruit variety in France by visiting the Rungis wholesale market or check the prices of specific products (in French) in different French channels on the Market News Network of FranceAgriMer.

- If you visit France, check how Grand Frais is promoting exotic fruit. This supermarket is making good marketing efforts to familiarise consumers with exotic fruit. They also offer this information online (in French).

- Use the translate function in your web browser to understand the content of websites that are not available in English or in your language.

United Kingdom: Good market for new fruit varieties

The United Kingdom is generally a good end market for imported fresh fruit, including exotics. It offers opportunities for many different supplying countries and the import volumes from developing countries have steadily increased over the last 5 years. The development of values in relation to the Euro has slowed due to the devaluation of the British Pound since Brexit in 2016. The current pressure on prices and the cost-of-living crisis may slow down the import of higher priced exotic fruit.

Pomegranates are the most important exotic fruit, being the main import product with HS code 08109075. This product group had an import value of €43.6 million and depended on several non-European suppliers such as Turkey, Peru, South Africa and Egypt (all are known producers of pomegranates). Other exotics, including lychees, pitahaya and passion fruit (HS code 08109020) reached an import value of €26.1 million in 2022. Colombia, South Africa, Bangladesh and Thailand mainly supply these fruits.

Traditionally the United Kingdom is a good market for new fruit varieties. The marketing of both convenience products and exclusive products usually goes well despite of a highly competitive market. For British importers, it is important that their suppliers provide them with measurable information regarding sustainability. Issues such as water usage, carbon footprint, biodiversity protection and reduction of chemical inputs are part of this information. SMETA is still required by most importers as proof of compliance with social sustainability.

British buyers often embark on fact-finding missions to try and find innovative growers for their supermarket clients. If your company does not have all the certifications (GLOBALG.A.P. and SMETA), but your product offer is interesting and convincing for their clients, their technical team might be willing to support you to get to the right standards. Relevant importers of exotic fruit include DPS and Wealmoor. HLB Tropical Fruit is an importer with offices in Germany, mostly serving the British market.

Figure 9: Tropical fruit section at Marks and Spencer, premium supermarket in the United Kingdom

Source: Dana Chahin

Tip:

- Learn more about the British market and its specific requirements in the CBI study on exporting fresh fruit and vegetables to the United Kingdom.

Italy: Producer and indirect importer of exotic fruit

Italy has a large consumer market, but most exotic fruit is produced locally or imported from other European countries. Italian fruit professionals see a positive future for exotic fruit, although it is a challenging task to introduce the Italian consumer to new fruit. Italy is a rather price-oriented market that pays less attention to premium products.

Italy and other Mediterranean countries produce a fair amount of fruit that is considered exotic in most other European countries. Among these are pomegranates, passion fruit, cactus fig, medlars, cherimoya and even some pitahaya.

Additionally, Italy imported €57.8 million of exotic fruit in 2022, with an irregular demand over the last 5 years. Up to 50% of the exotic import value concerned pomegranates and other local exotics from Spain. Exotic fruit such as lychees, passion fruit and pitahaya were imported via France and the Netherlands from developing countries and re-exported to Italy. The few successful non-European suppliers that exported directly to Italy include Peru, Thailand and Turkey. These exports are mainly pomegranate-related. Ecuador is the fourth leading non-European supplier, with direct exports of chirimoyas, granadillas, maracuja and pitahaya.

In recent years, a few Italian companies such as Spreafico and Fresh Tropical have promoted tropical fruit and more exotic fruit. This effort may feed the demand for exotic fruit as well as the direct import from different origin countries. For now, the real exotics that come from abroad are best traded via the Netherlands.

Tips:

- Get in touch with exotic fruit importers in Italy by attending the Macfrut trade fair.

- Monitor the exotic fruit market development in Italy by checking e-commerce websites that like include some exotics in their product range. Examples are FruttaWeb and Almaverde bio.

Belgium: Opportunities for re-export of lychees and pomegranates

Belgium imports a relatively large amount of exotic fruit. However, the value decreased between 2018 and 2021 and slightly recovered between 2021 and 2022. It mainly provides a transit port for sea freighted exotics, with a large volume of lychees and growing opportunities for pomegranates.

Belgium had an import value of €32.6 million in 2022, representing fresh lychees, passion fruit, pitahaya and other exotics within HS code 08109020. Belgium is a major shipping route for lychees from Madagascar to the French market. As a result, Madagascar is the main origin of exotic fruit and the import values of Belgium and France are directly linked to each other.

Other exotics under the HS code 08109075 had a lower total import value in 2022 of 19.8 million EUR. This product group mainly consists of pomegranates, which were re-exported to mostly Germany and France.

In addition to providing a logistical hub for exotic fruit, Belgium hosts specialised importers for such products like the company SpecialFruit and Starfruit. It is also the head office of Greenyard, one of the largest fruit companies in the world that actively works on moving niche products into mainstream markets.

Tip:

- Check the member list of fresh trade Belgium, the association that represents companies active in the fruit and vegetable business in Belgium.

4. Which trends offer opportunities on the European exotic fruit market?

The interest in new flavours and healthy fruit has created specific markets for exotic fruit. For exporters of exotic fruit, it is important to have an attractive and marketable selection of high-quality products. Sustainability and alternative modes of transport are key aspects to maintain growth and move products from the niche to mainstream market.

Interest in new fruit and flavours

There is more exchange between ethnic or traditional markets and consumers that are interested in new fruits. This increases the potential for exotic fruit and new flavours.

Food blogs contribute to the increasing number of consumers and food professionals that experiment with exotic fruits. Restaurants use exotic fruit to innovate or decorate their dishes, for example by decorating desserts with physalis or carambola. In the retail landscape fresh fruit has always played an important role and many retailers use exotic varieties to differentiate themselves and make their assortment more attractive.

Taste is important for exotic fruit to become successful. Exotic fruit is generally expensive, therefore taste and the way the consumer experiences your product are very important. You must make sure your product arrives in perfect condition and adjust your offer to the target market.

The Goldenberry Farms company from Colombia has excellent marketing messages for its exotics product range, which emphasises the taste and healthy attributes of exotic fruit. The information on their website is professionally translated into 3 languages to support their B2B clients in different markets with the positioning process of their produce.

Figure 10: Physalis at German supermarket with packaging that emphasises on the delicious taste

Source: photo taken by Dana Chahin

Tip:

- Select an attractive and diverse offer of exotic fruits. This will make your company more interesting to potential buyers and give you an advantage in combining shipments or mixing pallets.

Attention to health drives specific exotic consumption

Several exotic fruit types are well-known for being healthy. Since European consumers have embraced healthy and tasty fruit, health benefits have become one of the main drivers for market success. Some examples of exotic fruit with health benefits are:

- Pomegranate is a good source of fibre, vitamins A, C, E and K and minerals such as calcium, potassium and iron. It is popular in ethnic markets but also as an ingredient in fresh salads or flavoured water.

- Carambola is rich in antioxidants and vitamin C and low in sugar, sodium and acid. It has the potential to grow in the European market if proven health benefits are communicated effectively.

- Passion fruit and maracuja have high levels of vitamin A and C, making them a healthy fruit for direct consumption and fresh juices.

- Lychees contain high levels of antioxidants and vitamin C, which is a good selling point besides the unique taste of the fruit.

- Kumquats, a citrus fruit that is consumed with the skin, contains high levels of vitamin C and is rich in fibres and minerals.

For exporters it is important to meet the consumer expectation of a healthy product. You must supply a clean, sustainable and pesticide-free product. An organic certification can be an extra plus.

Tip:

- Check the EAT ME campaign run by the Dutch importer Nature’s Pride to promote the consumption of their exotic fruit and vegetables. When exploring the products, it is possible to filter by nutritional value. Exotics such as pomegranates, passion fruit and pitahaya are part of this campaign.

Exotics become better available and more sustainable with improved packaging

Exotics are often air-freighted, partly because of the smaller volumes that buyers need, but also to maintain the best shelf life for their clients. With the improvement in handling and packaging technology the shelf life is being extended and sea freight helps exotic fruit to become better available.

Your product can reach a wider audience once it moves from specialised channels to supermarkets and general retailers. A longer shelf life and sea freight make exotic fruit more attractive for supermarkets and more affordable for the average consumer. Sea freight fruit is increasingly preferred because of environmental reasons. Leading supermarket chains, such as Albert Heijn in the Netherlands, have stopped flying in fruit and vegetables. Other retailers, such as COOP in Switzerland, are selling airfreight products with a CO2 compensated seal (Figure 11).

Figure 11: Baby banana imported by air, CO2 compensated at COOP in Geneva, Switzerland

Source: photo taken by Dana Chahin

Pomegranates, physalis and passion fruit (the most common exotics) are examples of fruit that has become suitable for sea freight thanks to improved protective packaging and the accuracy of controlled atmosphere. Other exotics, such as pitahaya, are also being tested to be transported by sea from Ecuador. In fact, sector specialists expect pitahaya to become the next all-year-round exotic, thanks to both an increasing demand over the past few years and the current development to transport them by sea.

If the demand for your product is still small and focused on specialised channels, you will face a big challenge to sell full containers of exotics when offering sea freight. Even importers specialised in exotic fruit still find this difficult. Therefore, you must talk to your buyers and explore options such as combining the orders of different clients in one shipment.

Tips:

- Follow the latest tropicals news provided by the Global Tropicals Congress, the new meeting point for the tropical and exotic fresh produce business.

- Partner with universities or research centres to develop transport alternatives to airfreight.

- Gain further understanding of the European consumption patterns and read about which trends offer opportunities or pose threats on the European fresh fruit and vegetables market on the CBI market information platform.

- Make sure you understand the legislation on nutritional or health claims in the European Union and avoid making claims that are not allowed.

Dana Chahin and ICI Business carried out this study in partnership with Globally Cool on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research