Entering the European market for mandarins

The European market for mandarins is very competitive. Both domestic and imported products compete for consumers’ attention. Exporters have to understand how the market moves and changes. This includes consumer preferences, existing brands and pricing strategies. Differentiation through quality, off-season supply, variety, taste, or packaging can help you stand out from competitors. You need to be aware that import requirements may be a challenge. The pesticide residue limits (MRLs) in particular can be difficult to meet.

Contents of this page

1. What requirements must fresh mandarins comply with to be allowed on the European market?

Fresh mandarins must meet the general requirements for fresh fruit and vegetables. You can find these requirements in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use the ‘My Trade Assistant’ tool at EUAccess2markets, which has an overview of export requirements for mandarins (HS code 08052100 or 08052900) per country.

What are mandatory requirements?

Food imported into the European Union (EU) is subject to official food controls. These controls include regular inspections that can be carried out at import (at the border) or at a further stage (for example at the premises of the importer). The control is meant to check whether the products meet the legal requirements.

If products do not comply with European food legislation, this is reported via the Rapid Alert System for Food and Feed (RASFF).

Control of pesticide residues

The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in or on food products, including fresh fruits and vegetables like mandarins. Products that contain more pesticide residues than allowed are removed from the European market.

The presence of pesticide residues is the most critical issue for mandarin suppliers who supply to Europe. Notifications in the EU’s Rapid Alert System for Food and Feed (RASFF) show that most are related to pesticides.

Chlorpyrifos was most frequently found in excessive levels in mandarins. The MRL is 0.01 mg/kg. In the last few years, there were also notifications about:

- Prochloraz – the MRL is 0.03 mg/kg;

- Fenvalerate – the MRL is 0.02 mg/kg.

Finally, one case noted excessive levels of Flusilazole and another case found excessive levels of Dimethoate.

Note that buyers in several European member states use MRLs that are stricter than the MRLs recorded in European legislation. These countries include the United Kingdom, Germany, the Netherlands and Austria.

European MRLs for mandarins are expected to become stricter in the next years. The condition is that there are alternatives for restricted pesticides. A good example is the EU Commission announcement that the MRL for the post-harvest fungicide Imazalil on citrus would be reduced. However, the main citrus-producing countries Spain, Italy and Greece successfully opposed this because there were no alternatives. As a result, the European Commission has granted Imazalil a transition period while it further evaluates its safety.

Tips:

- Check the RASFF database for the most common issues with mandarins imported into the EU. Select ‘fruits and vegetables’ under Product and enter ‘mandarins’ as Subject. You can find out more by clicking on ‘Details >>’ in the results screen for each issue.

- Consult the EU MRL database to find out about the MRLs that are relevant for mandarins.

- Reduce the use of pesticides by applying integrated pest management (IPM) in your production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

Control of contaminants

Food contaminants are substances that have not been intentionally added to food. They may become present in fresh fruit and vegetables during the stages of production, packaging, transport or holding, or as a result of environmental contamination. Contaminants can pose a health risk to consumers. To minimise these risks, the EU has set maximum levels for certain contaminants in foodstuffs.

While there are different types of possible contamination for food products, contamination for fresh fruits and vegetables is mainly heavy metals. Metals such as lead naturally occur in the environment, for example in soil and water. Pollution from human activity adds to the presence of metals in the environment. Because of this, metal residues can occur in fruit and vegetables.

For mandarins, the residue limits for lead are 0.10 mg/kg. The second residue limit applies to cadmium in mandarins. This limit is 0.050 mg/kg.

Phytosanitary regulation

European Phytosanitary regulation and the European Implementing Directive 2019/523 require mandarins to be subject to plant health inspections before being introduced into or moved within the EU.

Tips:

- Make sure that contamination of lead in mandarins remains below 0.10 mg/kg and cadmium below 0.050 mg/kg.

- Only use ISO/IEC 17025 accredited laboratories for the control of contaminants.

- Familiarise yourself with the phytosanitary rules to export to Europe that are explained in the Council Directive 2000/29/EC and the new European Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms in the European community.

Product quality requirements

Product quality is a key issue and a commercial requirement for European buyers. Several factors determine the quality of mandarins. They are listed in the available product standards for citrus fruits, such as the UNECE standards for citrus fruit.

Like other citrus fruits, fresh mandarins should be at least:

- Intact;

- Free of bruising and extensive healed overcuts;

- Sound, which means that mandarins affected by rotting or deterioration are excluded if they are unfit for consumption;

- Clean: so, free of any visible foreign matter;

- Practically free from pests;

- Free from damage caused by pests affecting the flesh;

- Free of signs of shrivelling and dehydration;

- Free of damage caused by low temperature or frost;

- Free of abnormal external moisture;

- Free of any foreign smell or taste; and

- Able to withstand transportation and handling and arrive at the destination in satisfactory condition.

The UNECE standard recognises 3 classes: Extra Class, Class I and Class II. For fresh consumption, European buyers typically require Class I mandarins as a minimum. Mandarins in this class must be of good quality and within the following tolerances:

- A slight defect in shape;

- Alight defects in colouring, including slight sunburn;

- Slight skin defects, provided they do not affect the flesh;

- Slight skin defects that occurred during fruit formation, such as silver scurf, russets or pest damage;

- Slight healed defects due to a mechanical cause, such as hail damage, rubbing, damage from handling;

- Slight and partial detachment of the peel (or rind).

It is sufficient if 90% of a batch (measured by weight or by number) is Class I, but the remaining 9.99% of the batch should meet Class II standards. The last 0.01% is a tolerance allowed for fruit that does not meet Class II standards or fruit that is affected by decay.

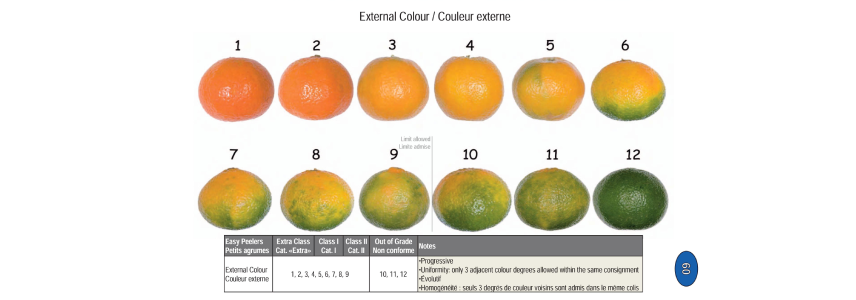

Figure 1: Example of grading mandarins (easy peelers) according to external colour

Source: OECD (2010), Citrus Fruits, International Standards for Fruit and Vegetables, OECD Publishing, Paris

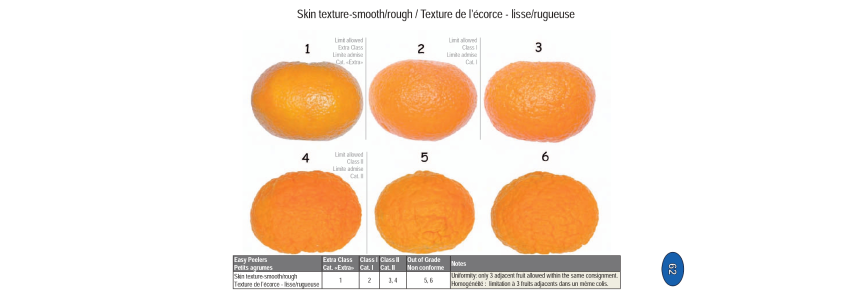

Figure 2: Example of grading mandarins (easy peelers) according to skin texture

Source: OECD (2010), Citrus Fruits, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tip:

- See the OECD International Standard for citrus fruit for more example images of mandarins in different classes.

Maturity

The maturity of mandarins is defined by 3 important parameters: juice content, colouring and sugar-acid ratio. According to the UNECE standard for citrus fruit, the minimum juice content is 33% (40% for clementines). The colouring must be typical of the mandarin variety on at least one-third of the surface of the fruit. Additionally, buyers may have specific preferences for sugar-acid ratios. This is most likely between 6.5:1 and 7.5:1.

Size

The UNECE standard for citrus fruit sets a minimum size of 45mm in diameter (see Table 1).

To make sure that the mandarins are uniform in size, a maximum difference is set for the diameter between fruits in the same package. This difference must be limited to:

- 10mm if the diameter of the smallest fruit (in the package) is less than 60mm;

- 15mm if the diameter of the smallest fruit (in the package) is between 60mm and 80mm;

- 20mm if the diameter of the smallest fruit (in the package) is between 80mm and 110mm.

There is no maximum difference in diameter for fruits larger than 110mm.

Table 1: Size codes for mandarins

| Size code | Diameter (mm) |

| 1 - XXX | 78+ |

| 1 - XX | 67–78 |

| 1 or 1 - X | 63–74 |

| 2 | 58–69 |

| 3 | 54–64 |

| 4 | 50–60 |

| 5 | 46–56 |

Source: UNECE Standard for citrus fruit

For mandarins that fall within one size class below or above the size class mentioned on the package there is a tolerance of 10%. For mandarins with size code 5, an important condition for the tolerance of smaller sized mandarins is that these mandarins must be larger than 43mm in diameter.

Packaging

Each package must be uniform and contain only mandarins of the same origin, variety or commercial type, quality and size. They should also be of the same degree of ripeness and development. Uniformity in colouring is required for the Extra Class. The part of the mandarins that is visible in the package must be representative of all mandarins in the package.

The mandarins must be packaged in such a way as to protect them properly, without becoming damaged in transport and handling. In more detail:

- Materials used inside the package need to be clean and not cause damage to the mandarins. Only non-toxic ink or glue can be used for printing or labelling;

- Stickers must not leave traces when removed from the mandarins;

- Only dry, new and odourless paper can be used for wrapping;

- Any substance that changes the natural characteristics of the mandarins is prohibited; and

- Packages must be free of foreign matter. An exception is a presentation where the mandarins have a short (not wooden) twig with some green leaves.

The most common packaging for mandarins in the European market is a 10 kg box with unorganised mandarins (loose). However, there are a lot of different packaging sizes and presentations. For example, an organised presentation in 2 kg boxes, loose packaged in 7 kg boxes, or 1 kg nets packed in larger boxes of 14, 15, 16, 17 or 18 kg.

Labelling requirements

The UNECE standard prescribes the following labelling requirements for mandarins:

- The word ‘mandarins’ must be put on the outside of a closed box;

- For satsumas and clementines, the common name of the species is required. The name of the variety is optional;

- For other mandarins and hybrids, the name of the variety is required.

Tips:

- Always discuss specific packaging requirements and preferences with the buyers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

- Find the legal requirements for labelling in our study on buyer requirements for fresh fruit and vegetables.

What additional requirements do buyers often have?

Certification

A third-party certified programme is an asset to your company and appreciated by new buyers. Common certification programmes for fresh mandarins are GLOBALG.A.P. for good agricultural practices and BRCGS, IFS or similar GMP (Good Manufacturing Practices), GHP (Good Hygiene Practices) and HACCP (Hazard Analysis and Critical Control Points)-based food safety management systems for packing and processing facilities.

While GLOBALG.A.P. is a certification programme focussed on fresh fruit and vegetables, the other programmes, BRCGS and IFS, are more focussed on food processing. These programmes developed modules for the fresh fruit and vegetables sector. For example, BRCGS has developed the guideline for category 5, fresh produce.

GLOBALG.A.P. is sufficient in the European mandarin market for typical producer and export activities. Any company that successfully undergoes an annual independent third-party audit and inspection receives a thirteen-digit GGN code as proof of certification. GLOBALG.A.P. covers all parts of production, harvesting, transportation, packing and shipping operations.

In any case, it is best to use a management system that is recognised by the Global Food Safety Initiative (GFSI) because these are the most widely accepted certification programmes.

Sustainability compliance

European buyers increasingly demand social and environmental compliance. This often means that the supplier must at least meet the buyer’s code of conduct or a third-party code of conduct. An example is Amfori BSCI (Business Social Compliance Initiative). Another possibility is that buyers ask for certification via a third‑party scheme.

Since you probably already have a GLOBALG.A.P. certificate, the GLOBALG.A.P. module Risk Assessment on Social Practice (GRASP) may be the best option. This module is designed to help you assess and implement good social practices in agricultural production. A new version of this module has been in place since 2022: GRASP 2.0. Another relevant additional GLOBALG.A.P. module is SPRING. This sets a standard for sustainable irrigation and groundwater use.

Transparency initiatives

The Supplier Ethical Data Exchange (SEDEX) is a global initiative to make global supply chains more transparent. SEDEX is a global, collaborative forum for buyers, suppliers and auditors to store and share information.

The aim is to manage the level of sustainability. This covers labour rights, health and safety, the environment and business ethics. SEDEX is not a certifiable scheme nor a standard‑setting body. By taking part, companies show their willingness to share data and use information to manage and improve the ethical standards in the supply chain.

SEDEX has also developed a social auditing standard, SMETA (Sedex Members Ethical Trade Audit). This auditing template helps companies to assess a supplier’s working conditions in the social, ethical and environmental fields.

Tips:

- Discover the General rules of the GRASP module and see if your organisation can reach the requirements.

- Find more information about the SMETA trade audit process in the SMETA Guidance documents.

- Implement at least one environmental and one social standard. See the Basket of standards of the IDH, the Sustainable Trade Initiative for Fruit and Vegetables.

- For more requirements such as payment and delivery terms, see our study on buyer requirements for fresh fruit and vegetables and our tips for doing business with European buyers.

What are the requirements for niche markets?

Organic certification can be a plus

The market for organic mandarins is relatively small because most mainstream food retailers do not offer organic mandarins to their customers. It remains a niche for non-European suppliers, as most of the organic citrus fruits, including mandarins, are sourced from within Europe. One example of an organic mandarin supplier is Brines Organic Fruits from Spain. To market organic products in Europe, you have to use organic production methods that comply with European legislation and apply for an organic certificate with an accredited certifier.

Tip:

- Consider organic mandarins as a plus, not as a must. Remember that it can be expensive to implement organic production and become certified. You must be prepared to comply with the whole organic process.

2. Through what channels can you get fresh mandarins on the European market?

Fresh mandarins enter the market through importers or wholesalers.

How is the end-market segmented?

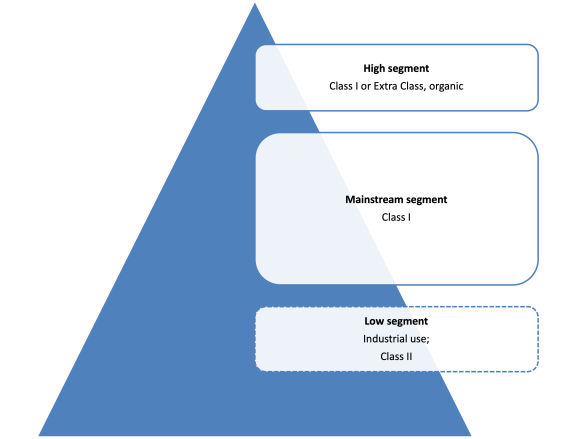

The market for fresh mandarins can be divided into three segments: the high segment, the mainstream segment and the low segment.

Figure 3: Market segments for fresh mandarins in Europe

Source: ICI Business (2023)

European supermarkets make up the largest group within the mainstream segment. Supermarkets normally require Class I or Extra Class fresh mandarins. This is the main segment of fresh mandarins. Appearance is everything for food retailers.

The food service industry is also part of the mainstream segment. Taste is more important compared to the food retail segment, since mandarins are also used for culinary purposes.

Class II mandarins are typically found in the low segment. The processing industry is the main destination for mandarins in this segment. In Europe, these lower-class mandarins may also have potential in ethnic food retail, street markets and in food service. However, it is more common that Class II mandarins find their way to countries with a high demand for these lower-priced mandarins. For example, Russia has always been an important destination for Class II mandarins.

The share of Class II mandarins is below 10% in the main mandarin-producing countries. In Turkey, this share is between 8–10%. And this percentage is even lower in European countries. However, in countries that produce fewer mandarins, this share is often much higher. For example, in Georgia the share of Class II mandarins is above 20%.

Tip:

- Focus on Class I production. Most European buyers demand Class I mandarins. Markets for Class II mandarins in Europe are less rewarding, since they are rather small and fragmented.

Through what channels do mandarins end up on the end-market?

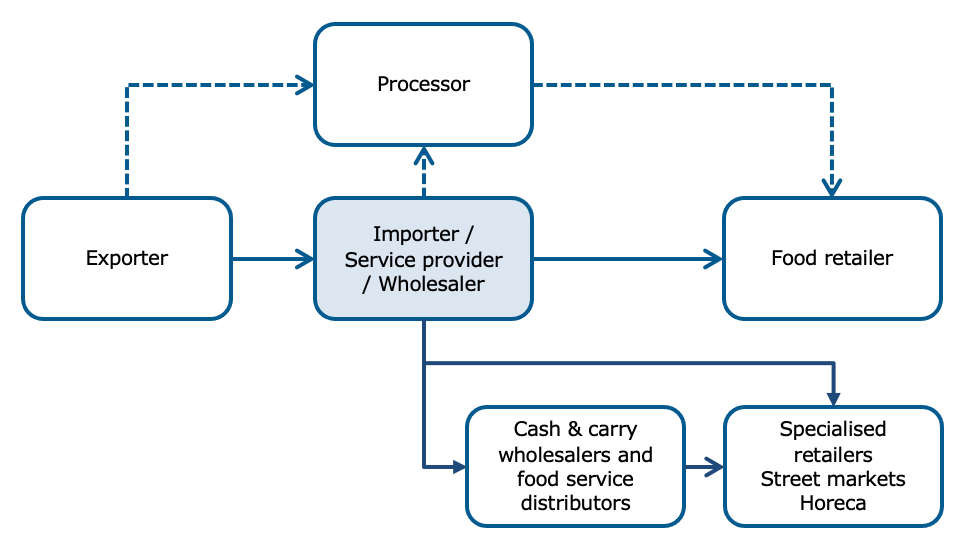

Figure 4 shows the channels needed to get mandarins to the European market.

Figure 4: Market channels for mandarins to Europe

Source: ICI Business

Importers and service providers

Importers have a central role in the distribution of mandarins. They are familiar with the different requirements of all kinds of buyers. They are also able to distribute mandarins to different market channels, such as wholesalers or supermarkets.

Some European importers have become part of the sourcing structure of large retail chains as full-service suppliers. Their main responsibility is to guarantee a reliable supply of quality produce. One example of such a company is the Dutch importer Bakker Barendrecht, which is part of the Greenyard group. Bakker Barendrecht supplies the leading Dutch supermarket Albert Heijn with mandarins and other citrus fruits. They are responsible for logistics and quality control and predict the client’s needs.

Food retail (programmes)

Most fresh mandarins are sold through food retail chains. This large-scale distribution is most dominant in the Northern, Western and Central parts of Europe.

Large food retail chains are also becoming more involved in mandarin sourcing. This is no surprise. Spain and Italy are two of Europe’s largest mandarin suppliers and both countries are relatively close to the other parts of Europe. Each retail chain tends to have a different supply structure. Some work with annual supply contracts, while others have dedicated service providers. For example, the German food retailer Lidl works with OGL Foodtrade.

Wholesalers (spot market)

Traditional fruit wholesalers cover the spot market and move with the fluctuations of trade. They supply specialised shops, street merchants, restaurants, catering and hotel chains. Typical wholesale markets are Rungis in Paris and Mercabarna in Barcelona.

Large fruit wholesalers such as Staay Food Group maintain a large international network. They offer their own cash and carry service point for fruit and vegetables.

Food service

The food service sector includes restaurants, hotels and catering services. Two types of companies supply this segment: non-specialised (cash and carry) wholesalers and food service distributors.

Cash and carry (C&C) wholesalers have a network of outlets where companies go and buy what they need. C&C stores offer a variety of products during extended operating hours. They are not open to normal consumers. C&C wholesalers are able to work with long-term contracts. For example, Metro has its own fruit and vegetable trading office in Valencia. From there, they also organise fruit and vegetable imports from outside Europe.

Food service distributors have large storage facilities with an extensive distribution network of trucks for daily deliveries. They buy products from manufacturers and importers. Sometimes they buy large-volume products from foreign exporters. One example of a food service distributor is Bidfood. Bidfood uses the services of the (originally Dutch) importer Van Gelder Groente en Fruit for its fresh fruits and vegetables.

The food service distribution industry in Europe is still marked by a relatively large number of companies that operate on a national or regional level. Nevertheless, consolidation has been an important trend in the past decade. Many of the medium-sized food service distributors have joined forces and bundled their purchasing activities.

Specialised retailers and street markets

This segment mostly uses spot market mandarins. Specialised retailers (retailers that only sell fresh fruit and vegetables) and street market sellers (a mobile version of the specialised retailer) often get their supplies directly from wholesalers.

Processors

The trade of Class II mandarins to European processors exists, but most of this processing takes place inside the countries that produce them. Therefore, trade volumes are limited.

Tips:

- Be aware of your target group and discuss the different preferences in product characteristics and presentation with your buyer. For example, for specialised retailers, individual fruit stickers or wrapping can be valuable, while other retailers may consider it a burden.

- Use your best quality mandarins for fresh exports to Europe and find other markets or local solutions for processing Class II mandarins.

What is the most interesting channel for you?

As a small and medium-sized exporter of mandarins from a specific developing country, you can supply mandarins during a certain period of the year. This particular period plays an important role in channel selection. You could stand a chance as a supplier to food retail programmes if the volume you produce over an extended period of time is large enough. However, supplying the food retail segment is very demanding.

If your volume is smaller and only available during a few months, you should focus on fresh produce wholesalers. Each potential European buyer is different in terms of supply (the countries and companies that supply the mandarins) and demand (which companies in which countries buy from them).

In any case, you can best aim at experienced citrus fruit importers who have a sound supply and sales network. This category also contains specialised importers of citrus fruits, such as Van Ooijen Citrus. Van Ooijen Citrus has established supply relations in many countries: Argentina, Uruguay, Peru, Australia, the United States, Mexico, Morocco, South Africa and Spain. Another importer with a citrus specialisation is Jaguar TFC. Jaguar TFC’s citrus supply portfolio covers virtually all continents.

Another interesting category is that of importers with a global network of partners. Some of them may also be present in your country. While some of these companies have associated growers or production contracts, others may be willing to take you on as a new supplier. This would be a unique chance to enter a foreign market.

There are also large groups of companies from developing countries that have joined forces and set up their own international sales infrastructure. Two examples from South Africa are Capefive and Fruitone. Capefive has sales offices in Hong Kong and China. Fruitone has a foreign sales office in the Netherlands. Fruitone sells mandarins from South African companies and trades in mandarins from other countries.

Last but not least: if you want to become a successful exporter to the European market, you need to have close ties with primary producers. If you do not, you will not be able to meet the European requirements because you miss direct control over your suppliers.

Tips:

- Choose your market segment carefully. The retail segment can be interesting if you have stable large volumes and can guarantee quality. With smaller volumes, you should focus on the spot market.

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

- Read CBI’s tips on how to find buyers in the European market for fresh fruit and vegetables.

3. What competition do you face on the European fresh mandarin market?

Spain dominates the European mandarin market for a large part of the year. The main opportunities for non‑European suppliers are during the off-season and during temporary shortfalls in supply from other supplying countries.

Which countries are you competing with?

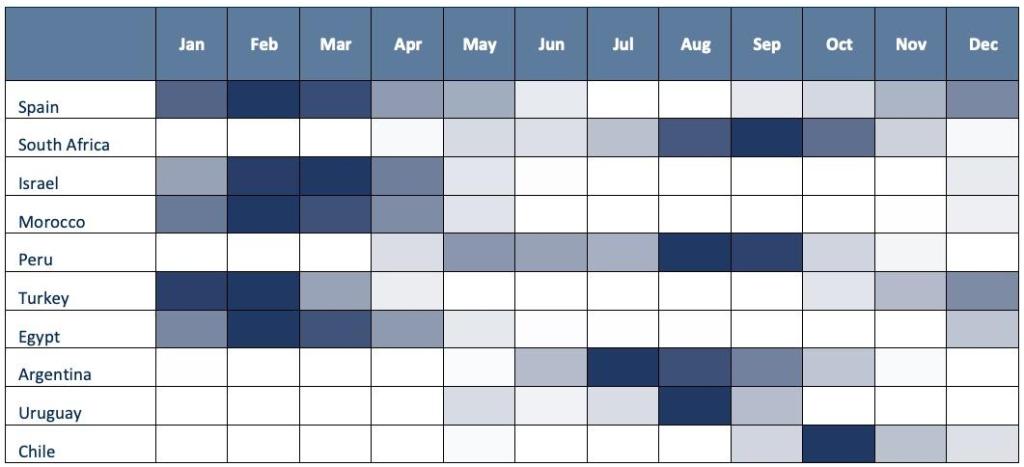

The off-season is during the months of June, July, August and September. Supply in these months is covered by South Africa, Peru, Argentina, Uruguay and Chile. This can also be seen in Figure 5.

Figure 5: Indicative supply calendar for fresh mandarins in Europe – Spain compared to the main non-European supplying countries

Source: Globally Cool, based on UN Comtrade volume data.

Over the period under review (2018–2022), South Africa in particular has increased the volume of mandarins exported to Europe considerably. Figure 6 shows this in more detail.

Source: UN Comtrade (May 2023)

South Africa

South Africa is the top non-European supplier of mandarins to Europe. Its exported volume of mandarins reached 162,000 tonnes in 2022. This represented a 15% share of the total European mandarin imports. South African citrus fruit has a good reputation among European buyers, especially in the United Kingdom and the Netherlands. Other leading destinations are the United States, Russia and the United Arab Emirates.

Traditionally, Russia and the United Arab Emirates have been the main markets for South Africa’s Class II mandarins. However, due to reduced Russian imports of European mandarins in 2022, South African suppliers faced increased competition in the Middle East market from European Class I mandarins. The latest forecast is that South African exports of mandarins will grow by almost 8% in 2023 to reach a record 560,000 tonnes.

The mandarin harvesting season in South Africa typically runs from April to August, with peak production occurring between May and July. The country’s harvest season is counter-seasonal to major mandarin-producing countries in the Northern Hemisphere. This allows South African mandarin exporters to fill gaps in the global mandarin market.

The mandarins are grown in the coastal regions of the eastern and western Cape, Kwa Zulu Natal and Limpopo areas. Between 2009 to 2019, the total cultivated area increased from 5,000 hectares to more than 16,000 hectares. This figure also includes areas where clementines (mostly Nules) are grown. Among the commercial varieties are Novas, Fairchild’s, Nadorcott, Clemenor, Morr, Orris, Leanris and Tangos.

South Africa is home to many dedicated industry associations, for example the Citrus Growers’ Association of Southern Africa (CGA). This association supports and promotes the interests of citrus producers, including mandarin growers.

Morocco

Moroccan exports of mandarins to European countries recorded 89,000 tonnes in 2022. This represents an 8.3% share of total European mandarin imports. Moroccan exports of mandarins to Europe peaked in 2021 before decreasing by 5.0% in 2022.

This decline is thought to be only the beginning of a negative trend in Moroccan production of mandarins. Moroccan production is forecast to shrink by 34% in 2023 to 900,000 tons. This is due to heat stress, water scarcity and increased input costs. Consumption and exports are expected to fall with the reduced production. Despite this large decline, Morocco is expected to remain the leading exporter in its current top markets, which are Europe (mainly the United Kingdom, France and the Netherlands), Russia and the United States.

Morocco is the home country of the Nadorcott mandarin. Producers have joined forces in the Moroccan Association of Nadorcott Producers (APNM). The largest market for Nadorcott mandarins is the United Kingdom, with a market share of 18–20% per year. In 2017, the APNM conducted a survey in British supermarkets on all competing commercial varieties of mandarins available on the shelves. The analysis focused on juice content, brix, acidity, seeds, colour, smell and taste. It showed that the Nadorcott is superior in terms of taste, appearance and having few seeds.

Turkey

Turkish exports of mandarins to Europe recorded 64,000 tonnes in 2022. This was equal to 6.0% of the total European mandarin imports. Turkey is the favourite supplying country among Central and Eastern European buyers. Romania is the top destination for Turkish mandarins. This is followed by Poland, Bulgaria, Croatia and the Czech Republic. In Romania and Bulgaria, more than 50–70% of the mandarins come from Turkey. In Poland and the Czech Republic, this share is only about 10%.

Turkish mandarins are often priced competitively due to the lower production and labour costs in Turkey compared to European countries. Strategically located near the European continent, Turkey has a clear geographic advantage for exporting mandarins to Europe. This reduces transportation costs and time, making sure that fruits are fresh and delivered on time. This advantage and the competitive pricing is most successful in the Eastern and Central European markets.

Given the fact that most issues with pesticides take place with mandarins from Turkey, the reputation of Turkish mandarins is not good in markets with strict quality requirements, such as Western and Northern Europe.

Peru

The coastal regions of Peru offer a subtropical climate, characterised by mild winters and warm summers. This climate provides the temperature range and sunlight hours needed to produce mandarins.

Peru exported 43,000 tonnes of mandarins to Europe in 2022, which represents a 4.0% share of total European mandarin imports. While the volume in 2022 is substantial, it was a sharp drop (-38%) from the 69,000 tonnes exported in 2021. Peru’s total mandarin exports increased from 205,000 to 208,000 tonnes and the fastest growing destination was the United States.

The lower imports of mandarins from Peru in 2022 was caused by the high transport costs and the war in Ukraine. According to some reports, some citrus fruit producers were even forced to switch from mandarins and oranges to other fruit crops. The high transport costs made the American market more appealing to Peruvian exporters. This resulted in a sharp growth in mandarin exports to the United States, from 78,000 tonnes in 2021 to 127,000 tonnes in 2022.

Peruvian mandarins mainly go to two European countries: the United Kingdom and the Netherlands. These countries account for 85% of Peruvian exports of mandarins to Europe. Spain (5%), France (4%) and Ireland (3%) import relatively small volumes of mandarins from Peru. Peruvian mandarins are available when European supplies are typically low. They peak in August and September. Peruvian citrus fruits are therefore advertised as a perfect addition to the Spanish mandarin supply.

Egypt

Mandarins are the second largest group of citrus fruits grown in Egypt, after oranges. The Nubaria district, North Sinai and Ismailia are the three main areas for mandarin cultivation. Egyptian mandarins are similar to other mandarins in terms of appearance and taste. They are often prized for their sweetness and intense flavour. Egypt’s leading commercial varieties are Murcott and Fremont, as well as Clementine. In the European market, Egyptian mandarins mainly compete on price.

Egypt’s exports of mandarins to European countries reached 19,000 tonnes in 2022. This is equal to 1.8% of the total European imports. Until 2020, Egyptian exporters only exported between 5,000 and 6,000 tonnes per year to Europe. However, the annual volume has gone up considerably since 2020, reaching levels of between 19,000 and 26,000 tonnes per year. Egypt’s main trading partners in Europe are the Netherlands, France, Poland, Romania, Lithuania and the Czech Republic.

Argentina

Argentina is the sixth supplier of mandarins to the European markets. Argentina’s export volume is small compared to South Africa, Morocco, Turkey, Peru and Egypt. However, it is still impressive. For Argentina’s mandarin exporters, Europe is an important destination. Chile and Uruguay export much more than Argentina, however, they do export less to Europe. Argentina’s strength in Europe is the supply window, specifically during the month of July.

Argentinian mandarin exports reached 1,500 tonnes in 2022. This equals to a share of only 0.1% of the total European import volume. The most important destination within Europe is the United Kingdom. Argentina’s main markets for mandarins are Russia, the Philippines, Paraguay and Canada.

Reports about Argentina’s mandarin industry show that efforts have been made to adopt sustainable practices. These include responsible water management, integrated pest management and environmentally friendly packaging materials.

Tips:

- Find out which of your mandarin varieties provide the best timing for exporting to the European market.

- Build a reputation in the mandarin trade, especially if your country is not known for its mandarin production. Your production process must compete with the practices of growers in Spain and South Africa.

- Invite buyers to your farm to convince them that you manage good agricultural practices.

Which companies are you competing with?

The main countries competing for European export outside the Spanish season are South Africa and South American countries. Other successful supplying countries are Morocco and Egypt. Mandarin production in these countries is generally well-organised. The size of the operation and the product quality are key success factors. Some examples that are highlighted below illustrate practices like multinational cultivation and grower cooperation.

Capespan – South Africa

Capespan is a South African supplier of fresh produce, including a wide range of fruits and vegetables. Capespan has its headquarters in South Africa and operates in several countries. It has a strong presence in the international fruit market. Capespan has two international strategic partners to offer a year-round supply of fresh produce. One of them is the Turkish company May Fresh, which supplies fresh fruits from Turkey and surrounding countries to international markets.

Capespan plays a significant role in the production, sourcing and distribution of mandarins. Capespan collaborates with a network of trusted growers and farmers across different regions to ensure a consistent supply of high-quality mandarins. By partnering with growers who follow sustainable farming practices, Capespan aims to provide customers with premium fruit while minimising the environmental impact.

Les Domaines Agricoles – Morocco

Les Domaines Agricoles is a prominent agricultural company in Morocco, specialising in the cultivation and export of various agricultural products, including mandarins. The company has an important position in the Moroccan agricultural sector and plays a large role in the production, processing and distribution of mandarins to international markets.

Les Domaines Agricoles owns and operates extensive citrus orchards in Morocco. The company is the founding father of the Nadorcott mandarin and is the only Moroccan company that markets this mandarin under the name ‘Afourer’. Other licensed Moroccan producers are allowed to use the name ‘Nadercott’ or, under the umbrella of the Moroccan Association of Nadorcott Producers (APNM), ‘Nadorine’.

Royal Fruits – Egypt

Royal Fruits is one of Egypt’s top producers and exporters of fresh fruit and vegetables. The company has obtained GLOBALG.A.P. along with the GRASP module and BRCGS certification. This shows that the company is a serious partner for European buyers. In addition to mandarins, Royal Fruits also produces other citrus fruits such as oranges, lemons and grapefruits. The company has also started exporting grapes, strawberries and pomegranates.

The earliest mandarins are available in November. These are the commercial variety Merav. The season ends in February. Fremont and Nadorcott mandarins are available in December and January. Honey Murcott is available from January to May, but these mandarins are not exported to the European market.

Tips:

- Improve your export window and save on marketing costs by working together with other mandarin growers.

- Find strategic partnerships and create an integrated supply chain with access to packing plants and logistics.

- Make your logistics as efficient as possible and maintain a temperature of 10–14°C.

Which products are you competing with?

Mandarins mostly compete with other fresh fruits of the citrus family. The demand for mandarins is flexible and they can easily be replaced by other types of citrus fruit. When there is a scarcity of mandarins, oranges or clementines can replace mandarins. These fruits are to some extent similar in taste, size and nutritional value.

Other fruits that can serve as a replacement for mandarins as a snack are bananas, apples or kiwis. Other competing products are vegetable snacks such as cucumbers, paprikas or tomatoes.

4. What are the prices for mandarins on the European market?

Trade prices for fresh mandarins fluctuate. The balance between the supply of mandarins and the demand from consumers causes these fluctuations.

Since mandarins are seasonal fruits in the European market, their prices tend to be low during the European season and higher when mandarins are out of season and have limited availability.

The quality and grade of mandarins can significantly affect the price level. Extra Class and Class I mandarins that meet specific buyer requirements in terms of size, appearance, taste, or freshness, often lead to higher prices.

Through the season, the prices fluctuate considerably. Average ex-producer prices in Spain, for example, vary between as low as €60 per 100 kg and monthly averages of €160 per 100 kg. As an indication of prices for mandarins during the season, the following figure shows the import prices of the Netherlands per month. These prices include insurance and freight costs.

Figure 7: Import price development of mandarins to the Netherlands, per month in € per kg

Source: Globally Cool (May 2023)

The main conclusions that can be drawn from Figure 7 are:

- Early or pre-season supplies in September, October and November from South Africa receive relatively high prices;

- Mandarins from Morocco received the highest price during the start and the end of the mandarin season;

- Imports of Peruvian mandarins were expensive in the pre-season period in 2021. In 2022, Peruvian exporters suffered from low prices in the Dutch market. This also explains the sharp drop in Peruvian exports to the Netherlands in 2022;

- Mandarins from Egypt and Turkey are typically cheap, and prices showed a similar pattern in the 2021–2022 season. In the 2022–2023 season, Egyptian mandarins arrived later and at a lower price than Turkish mandarins.

The price developments are difficult to predict and depend on harvest forecasts of the main suppliers, especially Spain. Also, exchange rate developments can have an impact on the mandarin trade and on trade prices. Another factor that can play a role is the availability of other fruits. If, for example, there are low volumes of other fruits available, then prices for available mandarins will go up.

At the same time, European food retail prices remain stable and move independently from trade prices. Supermarkets work with supply contracts and therefore manage more stable price levels. This also enables supermarkets to regularly have promotions for mandarins during the season.

In terms of margins, the producer and exporter receive the largest share. Figure 8 gives an indication for a 10 kg box of premium mandarins, sold for approximately €30 in a Dutch supermarket. According to Figure 8, the margins for the various players are between 15–35%. Food retail is in the middle of that range, with a 25% margin.

Source: ICI Business (June 2023)

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research