The European market potential for mandarins

There are opportunities in the European market for mandarins, but competition is strong. Local produce, mainly from Spain, and imported products compete for consumer attention. Exporters must understand the dynamics of the market. This includes consumer preferences, existing brands and pricing strategies. Differentiation through quality, variety, taste and packaging can help you stand out from competitors.

Contents of this page

1. Product description

Mandarins (scientific name: Citrus reticulata) are a type of small citrus fruit, commonly eaten plain or in fruit salads. They are often treated as a separate species from oranges. However, the common orange is actually a hybrid of the mandarin and pomelo.

Mandarins have a smaller, flatter shape than that of the ball-shaped common orange. They have a sweeter and more intense flavour. Ripe mandarins are firm or slightly soft, heavy for their size, and they have a rough skin. The skin is thin and loose, making mandarins easy to peel and divide into segments. Hybrids often have a thicker and firmer peel. Mandarins are fragile and sensitive to low temperatures, so they are best suited to cultivation in tropical and subtropical regions.

Table 1: Product description for mandarins, including HS codes and commercial varieties

Harmonised System (HS) code | 080521 Fresh or dried mandarins, including tangerines and satsumas (excluding clementines) 080529 Fresh or dried wilkings and similar citrus hybrids |

| Commercial varieties | Mandarin is the collective name for easy-to-peel citrus fruits, of which three main groups are of commercial importance in Europe:

There are lots of commercial sub-varieties (hybrids) within these groups. Honey or Ponkan mandarins make up another group. These mandarins are related to tangerines. They are not common in Europe, but popular in China, India and Brazil. Similarly, Kinnow is mainly grown in Pakistan, but not consumed in Europe. |

Figure 1: Typical of the Satsuma variety

Source: OECD (2010), Citrus Fruits, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Since Spain is a particularly large supplier of clementines, this study focuses on satsumas and tangerines.

2. What makes Europe an interesting market for mandarins?

Spain is the biggest player in the European market for fresh mandarins. For this reason, the quality of the Spanish harvest has a big impact on the European market. Your best opportunities for mandarin exports to Europe are between May and November, when Spanish mandarins are not in season.

Window of opportunity for Southern Hemisphere countries

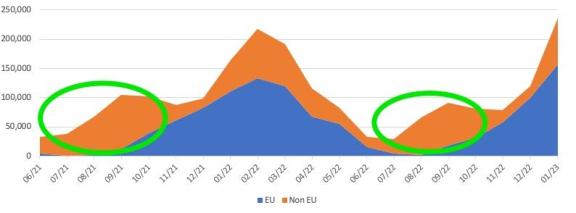

The Spanish export window (October–May) has a strong impact on mandarin availability throughout the year. However, the supply of mandarins from outside Europe is not limited to the European low season. In fact, one of the peaks in mandarin supplies from outside Europe coincides with the peak in Spanish supply in February.

Countries that benefit from counter-seasons are the countries in the Southern Hemisphere, namely South Africa, Peru, Argentina, Chile, Uruguay and Colombia. All other supplying countries, such as Turkey and Egypt, have seasons and export windows inside the Spanish window.

Figure 2: European imports of mandarins by origin, per month in million USD, June 2021 to January 2023

Source: Globally Cool, based on Trademap statistics (May 2023)

Mandarin exporters that can supply when European mandarins are not in season have the best opportunities. In other words, your best opportunities for exports to Europe are between May and November.

Europe is a large market with occasional growth

The European mandarin import volume has shown decent growth in recent years. Between 35 and 40% of the import volume comes directly from developing countries, making Europe an interesting market.

Source: UN Comtrade (May 2023)

*Developing countries following the OECD-DAC list of ODA recipients, ‘Rest of the world’ refers to all other countries.

Figure 3 reveals that, over the 2018–2022 period, European imports of mandarins grew. While there were some dips in supply due to bad weather conditions, the compound annual growth rate (CAGR) reached 4.3%. This is much better than the average citrus fruit imports by Europe in general (HS code 0805), which declined by 2.7%.

Compared to 2018 and 2019, the import volumes in the 2020–2022 period clearly reached higher levels. At the same time, imports also dropped occasionally. For Europe, this was the case in 2019 and 2021. For developing countries, this was the case in 2019 and 2022. In almost all of these situations, the decline was caused by a lower mandarin availability for the European market due to reduced production volumes.

During each year in this period, imports from developing countries reached more than 33% of the total supply. This share reached 42% in 2021. Every year, between 265,000 and 425,000 tonnes of mandarins from developing countries found their way to the European market. This shows that Europe can be an interesting market for exporters from developing countries.

Tips:

- Secure your market before expanding your production and make sure you have dependable sales contacts. Finding buyers can take time, especially with the abundant supply from Spain.

- Read the CBI Tips for finding buyers and the CBI tips for doing business with European buyers of fresh fruit and vegetables.

3. Which European countries offer most opportunities for mandarins?

The United Kingdom has the largest appetite for mandarins. The country is good for an almost 20% share of the total European imports. Germany follows in second place, then France, the Netherlands and Poland. This group of countries represents more than 70% of the total European imports.

We only discuss import volumes; we do not take consumption into account as an indicator for market selection since import volumes are key in selecting priority markets for mandarin exporters.

Source: UN Comtrade (May 2023)

United Kingdom: large market for non-European suppliers

The United Kingdom is the largest importer of mandarins in Europe. Although Spain is its main supplier, the United Kingdom also imports directly from developing countries. Despite what some industry experts thought a few years ago, Brexit has not caused major changes in the United Kingdom’s supply structure. Spain has maintained its position as the largest supplier of mandarins and even expanded its share to a 38% record in 2022.

Mandarins are a popular fruit in the United Kingdom, with a 2.5–3.0 kg consumption per capita per year. They are commonly consumed during the winter months and the festive season. They are often enjoyed as a snack or used in various culinary preparations, such as salads, desserts and juices. The British also appreciate canned mandarins. Canned mandarins are imported into the United Kingdom, mostly from Spain, since the United Kingdom does not can mandarins.

In 2022, the United Kingdom imported a total volume of 196,000 tonnes, which was an increase of 13% compared to 2021. Over the period 2018–2022, the imports have developed differently to the other leading importing countries. This was particularly the case in 2020, the year when the United Kingdom left the European Union (EU). In that year, European imports boomed with a 30% increase because of good harvests that year. However, this growth was only 11% in the United Kingdom. Almost all these mandarins remained in the country for consumption.

Spain is the top supplier of mandarins to the British market (38%), followed by South Africa (29%), Morocco (19%) and Peru (9.5%). Among the countries with a more than 1% share, Spain gained the most. Its share grew from 27% in 2018 to 38% in 2022. Turkey and Peru lost the most, as their shares declined from 16% to 9.5% and from 2.0% to 1.0% respectively.

Germany: market dominated by Spanish supply

Out of the six focus countries, Germany has the lowest consumption of mandarins per capita: less than 2 kg in 2022. This consumption has been experiencing an above-average growth of more than 8% per year on average since 2018. Spain held a share of 78–84% of German mandarin imports in the 2018–2022 period. There is no other European country for which Spain is such an important supplier.

A great deal of mandarins are consumed during the festive season. They are often used in a German cake called ‘mandarinen schmand kuchen’, a kind of cheesecake. Germany is also one of the better markets for organic mandarins, since it has the largest organic food market in Europe.

Germany is the second largest destination for mandarins in Europe, with imports reaching 165,000 tonnes in 2022. With 139,000 tonnes, Spain supplies the majority, mostly consisting of the satsuma varieties. South Africa is the largest non-European supplier, importing 13,800 tonnes in 2022. Other countries that accounted for more than 1% of German mandarin imports were Turkey, Israel and Morocco.

Figure 5: Mandarins at Lidl in the Netherlands, June 2023

Source: Globally Cool

While the Spanish import share in the period under review remained stable, the Moroccan and South African import shares grew considerably. Between 2018–2022, their shares grew from 0.6% to 1.1% and from 5.3% to 8.4% respectively. Countries that saw their shares drop were Turkey (3.5–2.2%) and Israel (3.2–1.3%).

The largest market channel for mandarins in Germany is food retail. German retailers are among the strictest buyers in terms of requirements. This applies to several aspects, but the largest impact is the allowed level of pesticide residues. By sourcing most of their mandarins in Spain, German buyers feel that they maintain the best control of the supply chain and fruit quality, including pesticide residue levels.

France: The largest European market for Israelian mandarins

With a connection to the Mediterranean area, Spain, Israel and Morocco are logical mandarin suppliers to France. Together, the three countries hold more than 85% of French mandarin imports. France is the third largest European importing country of mandarins. In 2022, France imported 151,000 tonnes of mandarins. This was only a minor increase compared to 2018 (+0.6% growth per year, equal to 4,000 tonnes in total) and lower than the European average.

The main reason for the low growth is the French’s growing interest in clementines. While the other four top markets in Europe all experienced a decline in clementine imports, France’s imports of clementines grew by 3.7% on average per year, which is an additional 32,000 tonnes.

France is among the smaller mandarin-producing countries in Europe. However, its production only includes clementines. The production is primarily concentrated in the south-eastern region, particularly in Corsica, Var, and Alpes-Maritimes.

France is also a small (re-)exporter of mandarins in Europe. Although the export to import ratio is still low, with between 7–13% per year in the period 2018–2022, it is much larger than Germany’s ratio (3–5% per year), for example. In terms of volume, exports reached between 9,000–20,000 tonnes per year. France’s main destinations for mandarin exports are neighbouring European countries.

The balance of imports and exports remains in the country and these mandarins find their way to consumers through different channels. The most important one is food retail chains. Per capita, the consumption in France is not spectacular: it reached between 1.75 and 2 kg per year between 2018–2022. This is more than in Germany, but less than in the other countries under review.

French consumers are most interested in mandarins during the Christmas and New Year season. They mostly eat mandarins as a snack, but they also use mandarins in cakes and jams. Like the Germans, the French have a strong bakery tradition. Jams are also made at home frequently. The jam market is very developed, and several jam brands offer mandarin jams. This is also reflected in the jam market data, which shows that France makes up one-third of the European jam market.

Israel is the second-largest supplier of mandarins to France, with a share of 28% (42,000 tonnes) in 2022. This is followed by Morocco (11%) and South Africa (3.7%). Among the countries with a more than 1% share of France’s mandarin imports, the Netherlands and Egypt gained the most. Their shares grew from 0.1% to 4.2% and from 0.5% to 2.1% respectively. South Africa lost, as its share declined from 4.5% to 3.7%.

The Netherlands: Trade hub for non-European supply

The Netherlands is Europe’s number one trade hub for fruit imports. This is also reflected by the export to import ratio, which is between 41–54% per year. This means that about 50% of these mandarins are re-exported, mainly to other European countries. Fruit importers in the Netherlands often not only serve the local market, but also re-export to other European countries.

While the Dutch export to import ratio is the highest in Europe, it has shown a fluctuating downward trend in the period 2018–2022. The ratio of 41% in 2022 was the lowest in the period under review. This is because more mandarins from developing countries find their way directly to destination markets instead of going through transit countries.

It concerns, for example, mandarin imports from Turkey, Israel and Peru. While their shares in European imports went down by 1.7%, 5.2% and 10% per year respectively, their shares in Dutch imports went down much more, by 73%, 35%, and 37% per year.

Over the period 2018–2022, Dutch imports increased by 7.9% to a volume of 129,000 tonnes in 2022. Compared to the import volume of 96,000 tonnes in 2018, this came down to an absolute growth of 33,000 tonnes.

Contrary to most other European countries, Dutch imports consist for the largest part of non-European mandarins. The share of mandarins from developing countries was 69% in 2022, which is 10% more than the United Kingdom, the second largest destination market in Europe. The mandarins mainly come from South Africa (55,000 tonnes in 2022, 43%), Spain (17,000 tonnes, 13%), Peru (15,000 tonnes, 12%) and Morocco (13,000 tonnes, 11%).

Figure 6: Mandarins (Satsuma variety) from Peru in a Dutch open-air market, June 2023

Source: Globally Cool (June 2023)

Of the countries with a share of more than 1% of the Netherlands’ mandarin imports, Egypt and South Africa gained the most. Their shares grew from 0.7% to 2.5% and from 20% to 43% respectively. Turkey and Peru’s shares declined from 5.1% to 1.4% and from 18% to 12% respectively. In absolute terms, South Africa experienced the largest development in 2018–2022, with a growth of 35,000 tonnes, reaching a volume of 55,000 tonnes in 2022.

In terms of consumption, the Dutch consume above-average volumes of mandarins. Per capita, the consumption comes down to between 2.5–4.3 kg per year. A small part goes to the processing industry for the production of fresh juices and more.

The Netherlands is the second largest processor of citrus in Europe. Dutch consumers buy their mandarins mostly in food retail outlets. The typical packaging is a net of 1 kg.

Unlike in other European countries, there is no higher interest in mandarins during the festive season. It shows a long peak from October to February, with only a little rise around Christmas. Consumers like mandarins for their healthy characteristics and they are used to being able to buy them with a discount during the winter.

Poland: the most diversified market in terms of supply

With almost 38 million consumers, it is no surprise that Poland is in the top six European importing countries for mandarins. It is the largest importer in Central and Eastern Europe, importing 122,000 tonnes of mandarins in 2022.

In 2022, Spain exported the largest volume (64,000 tonnes) to Poland. However, its share is declining by 4.7% on average per year. In contrast, Greece experienced a sharp increase in its exports of mandarins to Poland. Its exports grew from 4,900 tonnes in 2018 to 13,000 tonnes in 2022, which is a 300% increase. This is likely due to Greece’s favourable geographical position, along with its competitive prices.

Portugal has also quickly gained market share in the period under review. Imports from Portugal were 0 in 2018, but grew to 7,000 tonnes in 2022. This is a 2.3% share.

Leading developing country suppliers to Poland are Turkey, Morocco, South Africa and Egypt. Overall, mandarin imports from developing countries increased at a faster rate (+10% per year) than European imports (+5.3%).

The exports of three developing countries grew a lot between 2018 and 2022:

- Turkey: From 4,400 tonnes (4.7%) to 41,000 tonnes (9.3%);

- South Africa: From 1,400 tonnes (1.5%) to 11,000 tonnes (3.4%);

- Egypt: From 60 tonnes (0.1%) to 2,500 tonnes (2.1%).

Polish consumers buy mandarins in food retail outlets and consume them as a snack. Supermarkets typically run promotions for mandarins during the season. This is also reflected in Google Search trends: the Polish frequently search for mandarins in relation to the terms ‘price’ and ‘discount’. There is a clear peak in online interest for mandarins, which takes place around Christmas and New Year. The consumption per capita has been growing since 2018 and reached almost 3 kg in 2022.

The Czech Republic: three out of ten mandarins come from Turkey, Croatia and Egypt

The Czech Republic does not produce mandarins, so it depends on imports to meet the demand. It is the second largest importer of mandarins in Central and Eastern Europe, although smaller than Poland. Imports of mandarins reached 28,000 tonnes in 2022. While imports remained stable, at around 37,000–40,000 tonnes per year until 2020, they dropped to 32,000 tonnes in 2021. In 2022, the Czech Republic only imported 28,000 tonnes of mandarins.

An explanation for this decline can be found in the sharp decline in imports from European production countries. In particular, the Spanish supply (7,700 tonnes) and the Croatian supply (2,200 tonnes) dropped.

Several countries grew in terms of market share in the Cech Republic between 2018 and 2022:

- Egypt: From 0 (0.1%) to 1,500 tonnes (5.2%);

- South Africa: From 200 tonnes (0.5%) to 900 tonnes (3.2%);

- Morocco: From 400 tonnes (1.1%) to 1,200 tonnes (4.4%).

While the challenging economic conditions since 2020 have led to lower consumer spending, there is also competition from clementines. After France (+32,000 tonnes compared to 2018), the Czech Republic registered the second largest growth for clementine imports in Europe (+6.6% per year, +3,900 tonnes). The higher imports of clementines came at the cost of imports of satsumas and tangerines.

Czech online search trends related to mandarins show that interest in mandarins is highest during the two to three weeks around Christmas and New Year. Like the Polish, the Czech who search for mandarins online are often interested in discounts at supermarkets. Czech retailers often run promotions for mandarins during the winter season. They typically consume mandarins as a snack.

Tips:

- Find potential trade partners at the Fruit Logistica in Germany or at the Fruit attraction trade fair in Spain.

- Monitor exchange rates to determine which markets offer the best purchasing power. Among the focus countries, both the United Kingdom and Poland are large markets, but neither uses the Euro as their national currency. These countries will have more purchasing power when their currency is strong.

- Use Dutch traders when you have difficulties entering different European markets. Dutch importers often have experience in trading and are familiar with the different European preferences. Dutch fruit companies have a no-nonsense mentality, so calling or visiting them often works better than e-mailing.

4. What trends offer opportunities or pose threats on the European mandarin market?

The interest in natural food increases the opportunities for residue-free mandarins. Future opportunities and threats will usually be affected by local and global production, along with changing trade barriers.

Opportunities in European markets depend on year-to-year conditions

While predicting the demand for mandarins is difficult, forecasts for production are common and are distributed around twice per year. The latest forecast foresaw a decline of 5% for the 2022–2023 winter season. While the Greek production was expected to record a plus, the Spanish production would be down due to heat and drought during summer. This is likely to have resulted in better opportunities for in-season supplies from developing countries in the 2022–2023 season.

During the peak production of the 2020–2021 and 2021–2022 seasons, the record volumes of mandarins were absorbed by consumers looking for boosts to their immune systems (because of COVID-19). However, this higher‑than-ever consumption per capita is expected to come back down.

The analysis in the latest forecast also shows that one country in particular is set to benefit from improved production volumes during the 2022–2023 season: South Africa. The main reasons for this boost are more production area and good weather. Contrary to South Africa, Morocco is suffering from heat stress, water scarcity and high input costs. Moroccan production is expected to decline by roughly a third, which comes down to a decline of 450,000 tonnes compared to the 2021–2022 season.

Prices do have some influence on the consumption of mandarins. When prices are on the high side, consumers will search for other fruits and compare prices. They will probably find a cheaper alternative. This means that higher prices will lead to lower consumption. On the other hand, when prices are low, consumers may buy more mandarins than usual. This impact is limited to situations where low prices attract new consumers. Existing consumers will likely not buy more mandarins.

Healthy lifestyle gains popularity

With the shift towards a healthier lifestyle and the growing emphasis on healthy eating, people started to consume more fresh fruits like mandarins. European consumers recognise the benefits of incorporating fruits into their diet instead of eating processed snacks or drinking fruit juices. Mandarins are a great source of essential vitamins and minerals, including vitamin C, vitamin A and potassium. They are low in calories and high in dietary fibre, making them a healthy choice for snacking.

Mandarins can be used:

- In citrus-infused beverages, or to add flavour to drinks. They can be juiced and used in cocktails, mocktails, smoothies and infused water;

- As a refreshing addition to salads, adding a sweet and tangy flavour. They pair well with greens, nuts and other fruits;

- In home-made salad dressings for a citrusy twist;

- As a natural sweetener;

- As an ingredient for marinades and glazes; and

- In sauces and condiments to enhance the flavours of savoury dishes.

Convenience: easy-peel mandarins

The European market is characterised by a growing demand for convenience. Within the product group of mandarins, this is especially reflected in the growing popularity of so-called ‘easy-peelers’.

Easy-peelers are effortless to peel, making them convenient for people who want a quick and healthy snack. Overall, they taste just as good and have the same nutritional value as other mandarins. Easy‑peelers leave little or no mess, making them a popular choice for parents who want to give their children a healthy snack without the hassle of cleaning up.

One example of a mandarin producer that has successfully tapped into this market is Stargrow from South Africa. Since 2016, Stargrow successfully exports the licenced Tango variety to the European market. The Tango variety is seedless, easy to peel and tasty. For that reason, the Tango is considered a great variety and, because of this, it can be sold for relatively high prices.

More health, fewer pesticides, please!

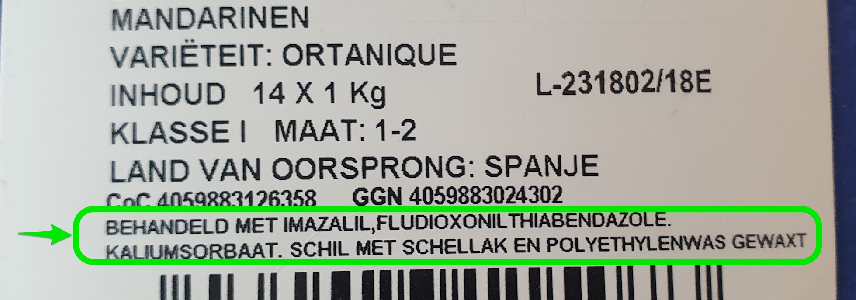

It has already been several years since the Court of Justice of the European Union confirmed the mandatory use of labelling indicating the preservatives and other chemicals used during post-harvest treatment. This requirement has drawn more attention to the presence and use of such preservatives on citrus fruits, but it did not contribute to more citrus fruits being consumed. It may have had a positive effect on the growing demand for organic citrus fruits.

Recently, several Maximum Residue Levels (MRLs) for fresh fruit and vegetables were further reduced. One of them was the reduction of MRLs for triclopyr in oranges, lemons and mandarins (August 2022) and another involved the reduction of MRLs for potassium phosphonates (2021).

The expectation is that in the near future, the pesticides MRLs will be further reduced for mandarins.

Figure 7: Product label of a net of mandarins showing the preservatives and other chemicals used in post-harvest treatment

Source: Globally Cool

Tips:

- Verify the Maximum Residue Levels (MRLs) in the European MRL database. You can search by product as well as active substances or pesticides.

- Be clear to your buyer about your chemical usage in all production stages.

- Try to diminish the use of chemicals, even if they are legally allowed. Use organic substitutes, for example.

Carbon footprint reduction

As consumers are becoming more concerned about being transparent about how their fruit and vegetables are produced, sustainability requirements in the supply chain are increasing. Some European companies have responded to this trend by developing innovative, sustainable concepts.

A good example is Euro Pool System’s initiative for the eco-friendly train connection CoolRail, which transports fresh produce from Spain to the Netherlands. Transfesa Logistics has operated the connection since 2020 and has grown every year. Since 2022, the British retailer Tesco has also been receiving Spanish citrus fruits through CoolRail, as do customers in Germany and the Nordic countries. CoolRail achieved a CO2 reduction of 70–90% per container in 2022 by recycling trays.

Tips:

- Find out what other trends influence mandarin exports by reading our study on trends for fresh fruit and vegetables in Europe.

- Discover opportunities to reduce the carbon footprint in your own operation and in the export value chain of your country. You can use a low carbon footprint as a Unique Value Proposition.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research