Entering the European market for onions

The European market for onions is highly competitive. European countries dominate the onion market for a large part of the year. Competition from outside Europe comes from Egypt, Peru, New Zealand and Chile. It is important to stay up to date on the market dynamics. Stand out by offering off-season supply, quality, variety, sustainability or organic onions. Make sure to comply with all the legal and buyer requirements in the European market.

Contents of this page

1. What requirements and certifications must onions meet to be allowed on the European market?

Fresh onions should comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI website. You can also use the My Trade Assistant tool by Access2markets, which provides an overview of the requirements of onions per country.

What are mandatory requirements?

Mandatory requirements cover food safety and quality. In this section, we discuss several aspects that you need to consider when exporting onions to the European Union (EU). These include legal rules (such as control of contaminants and pesticide residues), quality requirements, and packaging and labelling requirements.

Control of pesticide residues

Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) of pesticides in or on food and feed of plant origin. An MRL is the highest level of pesticide residue that is legally tolerated in or on food products when pesticides are used. If a product contains more pesticide residues than allowed, it will be taken off the European market. This also applies to onions.

The EU Pesticides database provides information on the MRLs for all pesticide residues that apply to onions. For onions, there are three relevant product groups that you should take into account:

- Product code 0220020: Onions

- Product code 0220040: Spring onions, green onions and Welsh onions

- Product code 0220030: Shallots

Products that do not comply with European food legislation are reported through the Rapid Alert System for Food and Feed (RASFF). This tool allows food safety authorities to quickly exchange information on health risks associated with the food and to take immediate action to prevent the risk. For onions, most reports are related to pesticide residues. Overly high levels of pesticide residues were mostly found in spring onions, and a few in shallots. A few examples of reports of overly high levels of pesticide residues include:

- Chlorpyrifos in spring onions (MRL is 0.01 mg/kg)

- Lufenuron in spring onions (MRL is 0.01 mg/kg)

- Carbofuran in spring onions (MRL is 0.002 mg/kg)

- Dodine in spring onions (MRL is 0.01 mg/kg)

- Fluazifop-P in spring onions (MRL is 0.01 mg/kg)

- Acetamiprid in spring onions (MRL is 0.001 mg/kg)

- Ethylene oxide in ground onions and shallots (0.02 mg/kg)

- Iprodione in shallots (MRL is 0.01 mg/kg)

Last but not least: in some European countries (for example, the Netherlands and Germany), buyers use stricter MRLs than set out in European legislation. Because of this, always check with your potential buyer if there are additional MRL requirements.

Tips:

- Visit the website of the European Commission to get more information about MRLs.

- Apply Integrated Pest Management (IPM) in your production. IPM aims to grow a healthy crop by disrupting the agricultural ecosystem as little as possible. It encourages natural pest control mechanisms and tries to reduce the use of pesticides to the minimum.

Control of contaminants

Contaminants are substances that are not added to food on purpose. They might end up in food due to the different stages it goes through (production, packaging, transport, holding) or through environmental contamination. As contamination has a negative impact on the quality of food and can cause a risk to human health, the EU has set maximum levels for certain contaminants in food, through Commission Regulation (EU) 2023/915.

For bulb vegetables, which include onions, contaminants mainly concern heavy metals such as lead and cadmium. The following maximum levels of contaminants are allowed in onions:

- Cadmium: 0.030 mg/kg (the maximum level applies to the wet weight, and after washing and separating the edible part)

- Lead: 0.10 mg/kg (the maximum level applies to the wet weight, and after washing and separating the edible part)

RASFF received a few reports about lead in onions in the period from January 2020 to June 2024.

Tip:

- Read more about contaminants on the website of the European Commission.

Plant health and phytosanitary regulation

Regulation (EU) 2019/2072 requires onions to have a phytosanitary certificate before entering the EU. The exporting country's national plant protection authority issues the phytosanitary certificates. This certificate guarantees that the onions are:

- Properly inspected.

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests.

- In line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

Tips:

- Contact the National Plant Protection Organisation (NPPO) in your country to arrange a phytosanitary certificate. Only these organisations are authorised to issue phytosanitary certificates.

- Look at Annex V of Regulation (EU) 2016/2031 for an example of a phytosanitary certificate.

Product quality requirements

Onions exported to Europe have to comply with the general quality standards in the European market. There are multiple aspects that determine the quality of onions. These are set out in the product standards for onions, such as the UNECE standard for onions and the UNECE standard for shallots. Below, we give an example of the quality standard for onions.

As a minimum requirement, onions in all classes must be intact, free from flaws, defects or decay and clean, for example. More minimum requirements can be read via the standards mentioned above.

The UNECE standards define two classes for onions: Class I and Class II. For fresh consumption, European buyers mostly require Class I standard. Class I onions should be firm, solid and practically free of root tufts (for onions harvested before complete maturity, root tufts are allowed). Slight defects are allowed; however, they should not affect the general appearance of the produce, the quality, the storage quality and presentation in the package. Slight defects that are allowed include:

- a slight defect in shape;

- slight defects in colouring;

- light staining covering not more than one fifth of the bulb’s surface;

- superficial cracks in and partial absence of the outer skins, provided the flesh is protected;

- slight glassiness not exceeding the outer fleshy ring.

90% of a batch should meet the Class I requirements. This means that up to 10% of the onions in the batch are allowed to deviate from Class I requirements. 9% of the batch is allowed to meet Class II quality. No more than 1% of the batch may consist of onions that neither satisfy the Class II quality nor the minimum requirements, or of produce affected by decay. Within this 1% tolerance, the externally visible shoot growth may not exceed 1 cm in length.

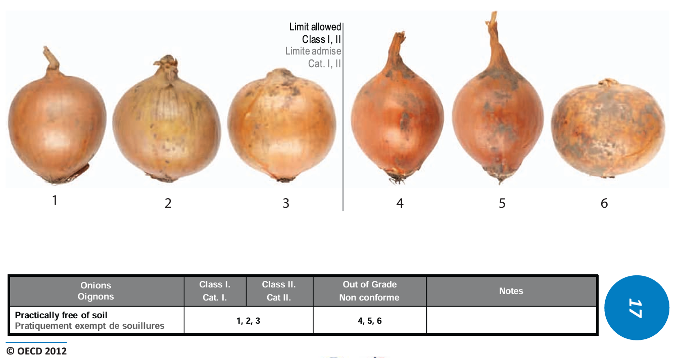

Figure 1: Example of what is considered to be a clean (free of soil) onion

Source: OECD (2012), Onions, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tip:

- See more example images of onions in different classes in the OECD International Standard for onions and the OECD International Standard for shallots.

Product size and uniformity

The UNECE standard for onions and the UNECE standard for shallots set out requirements concerning the size of onions. Size is determined by the maximum diameter of the equatorial (mid) section.

Packaging and labelling requirements

All relevant requirements for packaging and labelling are also explained in the UNECE standard for onions and the UNECE standard for shallots.

Tips:

- Make sure to discuss specific packaging requirements and preferences with your European buyers.

- For more information about packaging and labelling requirements, check our study on buyer requirements for fresh fruit and vegetables.

What additional requirements and certifications do buyers often have?

In addition to the legal requirements, European buyers often have other requirements. These include, for example, GLOBALG.A.P. certification and compliance with social and environmental standards.

Certification

Food safety is essential in the European market. That is why European buyers will ask you to show certain certifications. A common certification programme for good agricultural practices is GLOBALG.A.P. Buyers in Europe will often request this certificate, especially those that supply to supermarkets. For these buyers, it has become a minimum requirement.

Sustainability compliance

Social and environmental compliance is increasingly demanded by European buyers. This often means that you will need to sign the buyer’s code of conduct or a third-party code of conduct. You can also opt for third-party certification schemes. Examples include:

- GLOBALG.A.P. Risk Assessment on Social Practice (GRASP): a GLOBALG.A.P add-on for the evaluation of the well-being of workers at the farm level.

- Supplier Ethical Data Exchange (Sedex): a global initiative to make global supply chains more transparent. Sedex has also developed a social auditing scheme – SMETA – to help companies assess the working conditions and environmental performance in their business and supply chains.

In addition, some supermarket chains have their own certification schemes, such as Tesco’s Nurture (add-on module to GLOBALG.A.P.) and Marks & Spencer’s Field to Fork.

Tips:

- Implement at least one environmental and one social standard. See the SIFAV basket of standards developed by the Sustainability Initiative Fruit and Vegetables (SIFAV).

- See CBI’s study on organising your export of fresh fruit and vegetables to Europe for requirements related to payment and delivery terms.

Organic certification

For certain types of onions, an organic variety is available in European retail and wholesale channels. The volumes of organic onions are much lower than the volume of conventional onions. Organic certification is mainly available for yellow and red onions, shallots and sometimes spring onions. If you want to market organic onions, you should comply with Regulation (EU) 2018/848 that lays down the rules on organic production and labelling for organic products. One example of a company that sells organic onions is Dynamis France.

Tip:

- Having an organic certification is not a must for onions. Implementing organic production and getting certified is expensive. So, you should carefully consider whether offering organic-certified onions is an advantage.

2. Through which channels can you get onions on the European market?

Most onions are conventional, consumed at home and bought at supermarkets, specialised food and vegetable stores or street markets.

How is the end-market segmented?

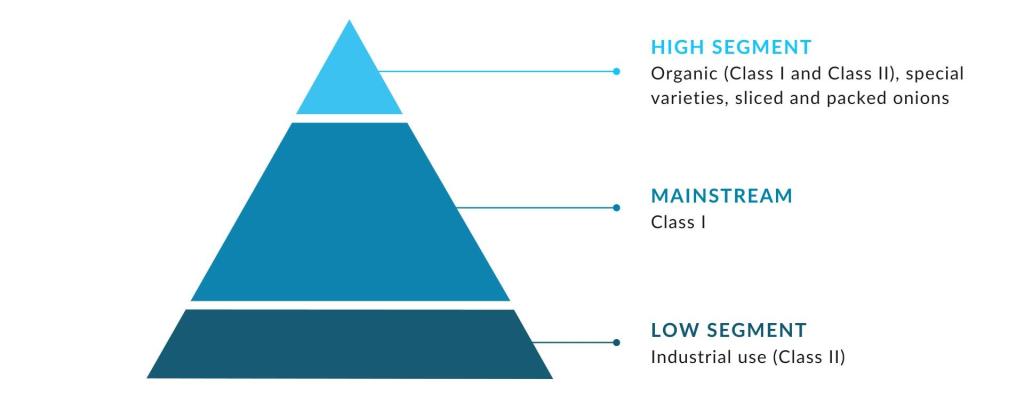

The market for onions can be divided into three quality segments: the high, mainstream and low segments, as shown in Figure 2 below.

Figure 2: Market segments for fresh onions in Europe

Source: Globally Cool (June 2024)

Food retail

Supermarkets in Europe mostly require Class I onions. Sometimes Class II onions are offered in supermarkets for the popular onion varieties (for example, yellow onions), which are then branded as the cheaper, budget option.

Organic onions are also available in several European supermarkets, although only for the most popular varieties: yellow onions, red onions, shallots and, in some cases, spring onions. For organic onions, it is also common to offer Class II quality. In the higher segment, for convenience purposes, supermarkets also offer sliced onions for the yellow and red varieties (conventional and organic).

Food service

The same segments can be found in the food service sector. The difference from supermarkets is that there is a wider variety of ready-to-use onions available in the food service sector, such as diced onions, freshly cut onion rings and peeled onions. Also, the packaging units are larger, starting from 500 grams and going up to 2 kilograms.

Food processing

Class II onions belong to the low segment and are mostly used in the food processing industry. Class II onions also end up in several food retail outlets, where they are marketed as the budget option.

Variations per EU region

Note that the shares and the offer of onions differ per European region. In eastern Europe, not many organic onions are available in supermarkets. In southern Europe, more organic onions are available, especially in the specialised organic retail stores. However, far more organic-certified onions are available in the food retail channels in western and northern Europe.

Tip:

- Focus on offering Class I onions in the European market; most buyers require this quality. Class II onions will be less rewarding. For organic onions, you do have the option to offer Class II quality.

Through which channels do onions end up on the end-market?

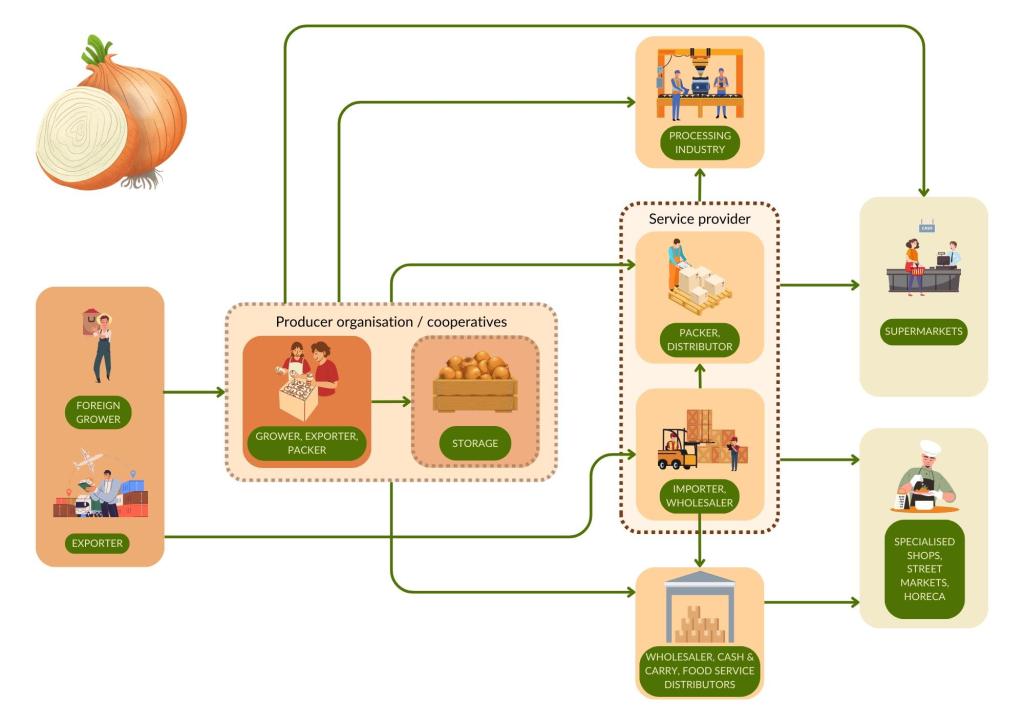

There are different channels through which onions end up on the European market. Figure 3 shows the market channels for fresh onions in the European market. The most important channels are explained in more detail.

Figure 3: Market channels for fresh onions to Europe

Source: Globally Cool (June 2024)

Producer organisations

An important channel for onions is local growers and grower organisations and cooperatives (collectively referred to as producer organisations). Depending on the organisation, producer organisations can be involved in a variety of elements of the onion supply chain, such as the growing, storage, packing, processing, distribution and marketing of onions. For example, the Dutch company Gourmet grows, selects, packs and distributes all their onions and shallots themselves. It allows them to have fully traceable products from harvest to the consumer and to guarantee fresh supplies.

Producer organisations are able to supply the local market for a large part of the year. When there are no local onions available, they purchase onions from other parts around the globe. For example, British companies P.G. Rix Farms and Stourgarden have a 3-week gap, during which they buy onions from New Zealand, Spain and Chile to complete the season. The France Allium Coopérative BCO cannot supply red, white, sweet yellow and organic onions for a short period and therefore relies on supplies from Spain, Italy, the Netherlands, New Zealand, Australia, Argentina and Egypt.

Grower organisations and cooperatives can have a broad set of clients, varying from selling directly to (large) retailers (i.e. supermarkets and specialised stores) to food manufacturers, wholesalers, restaurants and cash & carry stores. For example, Stourgarden, set up by P.G. Rix Farms to supply to retail trade, is one of the two suppliers of onions to the British supermarket chain Tesco. Moreover, all of their processed onions are supplied to Bakkavor, a leading manufacturer of fresh prepared food, which uses it as an ingredient in a wide range of products.

For a limited period throughout the year, you have the opportunity to export to producer organisations. Be aware that the onions must meet the same high quality and food safety standards as theirs, which is also requested by their customers. Other producer cooperatives include Ferme des Arches (France), La cooperative Origine Cévennes (France) and GROKA (Germany).

Wholesalers (spot market)

Another channel through which onions end up on the European market is through spot markets. Countries have their own spot markets, such as Rungismarket in France, Mercabarna in Spain, Grossmarkt Hamburg in Germany, SogeMi Mercato Agroalimentare Milano in Italy and New Spitalfields Market in the United Kingdom.

There are different types of wholesalers that offer onions on the spot market. While many offer a broad range of fruit and vegetables, some wholesalers are specialised in a few vegetables only, or specialised in organic produce. For example, Dynamis (France) is specialised in organic and biodynamic produce and the Spanish wholesaler G.V. EL ZAMORANO focuses only on selling potatoes, onions and garlic.

Wholesalers procure onions from local farmers or producer organisations, but some also buy from foreign suppliers (either European or sometimes non-European). Grupo Fernández offers Spanish onions from June until March, but imports from France and the Netherlands in April and May. Wholesalers then sell these onions to many different clients, such as other wholesalers (either domestic or EU-based), cash & carry stores, catering organisations, hotels, restaurants and cafés, central kitchens, supermarkets and schools.

In addition to wholesalers, producer organisations may also be present in spot markets. For example, the cooperative GROKA has a stand on the Gross Markt Hannover (Germany), where they supply onions and potatoes to wholesalers and market traders.

Importers

Importers and traders purchase onions from the local and European market, complemented with onions from other supplying countries to ensure a consistent supply throughout the year. They may also re-export onions. They are familiar with the requirements of different clients across Europe.

An example is Mulder Onions (the Netherlands), which is active in the trade (import and export) of onions and a few other vegetables. They supply to a broad client base, such as packaging companies, wholesalers, supermarkets and industrial peeling companies that are located all over the world. They complete the European onion range by importing fresh onions from, for example, Egypt (yellow and red onions), India (white and red onions) and Chile (yellow onions).

Food service

In addition to wholesalers, the food service sector (hotels, restaurants and catering organisations) relies on cash & carry and food service distributors for the supply of fruit and vegetables. Cash & carry refers to wholesale stores where businesses can buy a broad range of food and non-food articles.

An important cash & carry company is METRO, which operates in 30 countries and sells products through various channels: in wholesale stores and delivery depot, and on the online market place METRO MARKETS. Around 70% of the food is procured by the subsidiaries, while 30% is procured by its own international trading office. When fruit and vegetables are in season, subsidiaries mainly get their products from regional growers. Out of season, products are sourced globally through the Valencia Trading Office.

A food service distributor provides food and non-food products to the food service sector on a daily basis. It has large storage facilities and a fleet of trucks to deliver all kinds of food. It purchases fruit and vegetables from importers and wholesalers or directly from foreign suppliers. An example of a food service distributor is Bidfood. It sources onions from Van Gelder Groente en Fruit (Dutch wholesaler), Smits Uien (specialised in sliced onions) and Tuinderij Vers (vegetable processing company).

Tip:

- Learn about the European seasonality of onions. Producer organisations, wholesalers and importers primarily rely on European-grown onions and complement this with onions from outside Europe. It is important to be aware of Europe's off-season periods and the specific onion varieties that are required during those times.

What is the most interesting channel for you?

When choosing the most appropriate channel for you in the European market, you should make sure to search for buyers that are not completely focused on locally produced onions. As an exporter of onions from a developing country, you can supply the European market during a specific time of the year. This window of opportunity is important to consider. Other opportunities are supplying specific, niche varieties of onions.

There are several interesting channels you can look into, such as European importers and wholesalers of fruit and vegetables. This category also includes buyers that are specialised in trading onions. These buyers provide you access to different clients across Europe, including supermarket chains, and are familiar with the different requirements of these markets. Some supermarkets buy the majority of onions directly from local origin and use importers to fill in the gap. Others fully rely on an importer for the supply of onions.

For example, Van der Lans is a Dutch importer of several fruit and vegetables and distributes to various customers in Europe. They aim to supply quality onions all year round. Dutch onions are prioritised but in the period from March to July, they import onions from outside Europe, such as from Chile, Egypt, Argentina and South Africa. Their range of products is primarily aimed to supply European food retail organisations.

Alternatively, you can cooperate with grower organisations. They are experts in growing and distributing onions. They have good local market knowledge and a good distribution network and you can use their expertise to access the market more effectively. They add to their own range to be able to deliver multiple onions varieties all year round. So, they will only be interested if your supply is different from their own production. Examples include Bedfordshire growers, P.G. Rix Farms Ltd and France Allium Coopérative BCO.

Tips:

- Search the member lists of national associations, such as Holland Onion Association (the Netherlands), to find relevant traders, wholesalers and importers.

- Look at the business directories of wholesale markets, such as the business directory of Rungismarket (France) or the company search of Mercabarna (Spain) to find relevant wholesalers.

- Visit trade fairs to connect with European buyers, such as Fruit Logistica (Berlin, Germany) and Fruit Attraction (Madrid, Spain). For more tips, you can read CBI’s tips for finding European buyers on the European fresh fruit and vegetables market.

3. What competition do you face on the European onions market?

European countries like the Netherlands and Spain dominate the onion market for most of the year. For suppliers from developing countries, there are opportunities to supply onions in the off-season, when there is a gap in the supply from other countries or when you can offer particular types of onions that are less commonly produced in Europe.

Which countries are you competing with?

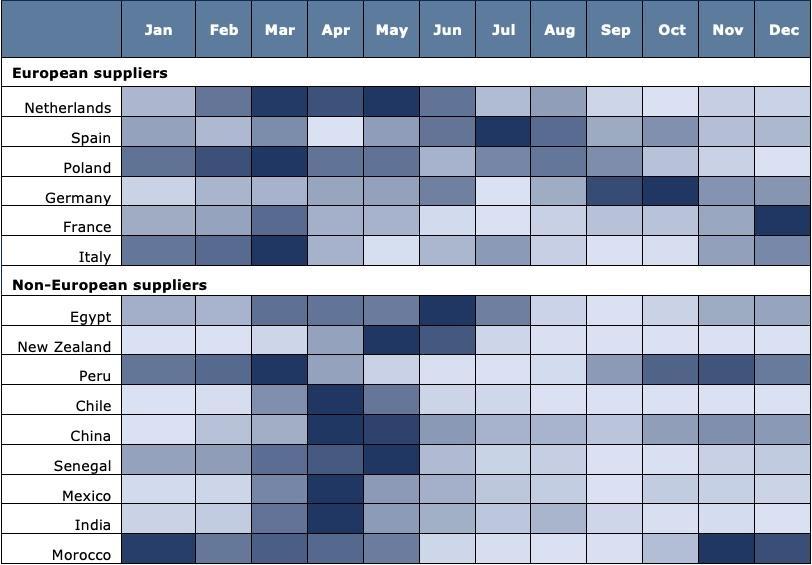

First of all, you are competing with European countries. Onions are the most grown crop in Europe. Therefore, Europe mostly consumes locally grown onions. In the off-season, Europe relies on imported onions. The season in which European countries import onions the most – either from other European countries or non-European countries – is during the months of March, April, May and June.

The supply window to the EU differs per supplying country. For example, Egypt exports most onions in the period from March until July, with a peak in June. Morocco supplies most of the onions in the months of November, December and January. Figure 4 shows the months in which each country exports its onions to Europe. The dark blue colour shows the months in which the exported values to Europe are the highest.

Figure 4: Indicative supply calendar for onions in Europe, European countries compared to main non-European supplying countries (based on monthly export volumes in 2023)

Source: Globally Cool, based on UN Comtrade monthly data for 2023

Looking at the non-European suppliers, Egypt is by far the largest exporter of onions to Europe. In addition, Peru, New Zealand and Chile are important competitors to consider. Figure 5 shows more details about these suppliers and the trend in the period from 2019 to 2023.

Source: UN Comtrade (May 2024)

Egypt: known for red onions

Egypt is the largest non-European supplier of onions to the European market. It holds a market share of 8.6%. Its exports to Europe rise and fall a lot. Egypt’s exports peaked in 2019 (244,000 tonnes), after which they dropped significantly in the period from 2020 to 2022. This was followed by strong growth in 2023, to reach a volume of 187,000 tonnes.

In 2023, there was a shortage of onions worldwide. During this time, many countries kept their onions to themselves. Egypt stood out by producing a stable onion supply and their exports increased significantly in the first half of 2023. However, in the last quarter of 2023, Egypt introduced a ban on the exports of onions, which lasted from October 2023 until the end of March 2024. Egypt faced onion shortages for the first time and stopped the exports to be able to supply its own market.

According to Fresh Plaza, for the remaining part of 2024, Egypt will have enough onions for both the local and export market. Normally, Egypt’s consumption is around 1.2 million tonnes, and it exports about 600,000 tonnes. In the 2024 season, Egypt has produced 3 million tonnes, so the surplus is 1.2 million tonnes. In 2023, Egypt exported most of its onions to the Netherlands (27%), the United Kingdom (24%) and Italy (12%).

Peru: Spain is the entry point to Europe for Peru’s sweet onions

With an exported volume of 51 million tonnes in 2023, Peru is the 10th largest supplier of onions to Europe. Peru’s exports to Europe have increased over the past five years, with an average annual growth of 5.3%. It showed a strong growth in 2023 (+64% compared to 2022). Peru benefitted from an increase in demand from Europe, combined with Egypt’s export ban on onions. Spain is by far the most important destination for Peru; 92% of the onions from Peru destined for the European market goes to Spain.

Even though Peru’s exports to Europe have risen, Peru has faced some challenges. Peru’s total exports of onions decreased by 14% in 2023. Despite international market shortages, quality standards remain high. This poses a challenge to Peruvian companies, as their onions are marked by lower-quality batches and quality issues. Yet Peru’s key strength still remains – the favourable window for onions and, in particular, sweet onions to the European market (see Figure 4).

Most of the onion production in Peru takes place in the regions of Ica, La Libertad and Arequipa. In Peru, red onions are grown the most. However, the yellow onion types are usually destined for foreign markets. In recent years, Peruvian producers have reduced their investments in onion production. A reason for this is the container crisis in 2020, higher freight costs and overproduction.

New Zealand: onions late in the off-season

For New Zealand, its exports of onions to Europe have clearly decreased. In 2019, the exported volume was 107,000 tonnes. This dropped to 44,000 tonnes in 2023, which is an average decline of 20% per year. Compared to 2022, 2023 saw a significant increase in exports (+30%). Europe is New Zealand’s largest export market for onions. Most of the onions are exported to Germany (36%) and the Netherlands (32%).

New Zealand recently ratified the New Zealand European Union Free Trade Agreement (NZ-EUFTA), which entered into force on 1 May 2024. With this agreement, the tariff of 9.6% on onions has been removed. Growers from New Zealand can benefit from this for the last half of their export season. As from 1 May 2024, they expect to export around 35,000 tonnes to the EU in the rest of 2024.

New Zealand has about 85 commercial growers, which are represented through Onions New Zealand Inc. Onions are the top fresh vegetable export of New Zealand; the country exports around 85% of its total production volume. The country can export onions all year round, but its peak to Europe runs from April until the end of June.

New Zealand’s competitive advantage is that it can supply onions to large producing regions and countries in the European and northern hemisphere off-season. Even though it is not a large player in the international market, it gets part of the market share because of this advantage.

Chile: supplying onions to Europe when Europe runs out of stock

In the period from 2019 to 2021, Chile had a relatively stable export of onions to Europe. In 2022, exports dropped by 30% compared to the previous years. The exported volume increased significantly in 2023 (+114%), to a total of 28,000 tonnes. Chile’s most important export markets in Europe are Spain (53% share) and the United Kingdom (26%). Europe imports most of the onions from Chile in the months from March until May.

Onions take up 9.1% of the crop growth area in Chile and are therefore the third-largest crop in the country. The surface area reached 8.608 hectares in 2022. The main producing areas are the Región Metropolitana (39%), the Región de O’Higgins (29%) and Maule (13%). Moreover, onions are the third-largest crop exported by Chile in terms of export value. The total exported value was 23 million dollars (FOB) in 2023, with a total volume of 33,000 tonnes.

Tips:

- Find out which onion varieties provide the best opportunities in the European market and also consider the timing and competition.

- Make sure to analyse your opportunities in the European market on a yearly basis. Each year can be different, depending on the market situation. Consider the production volumes, quality and stock of onions in Europe, but also stay up to date on the competitors outside Europe (production volumes, prices, export bans, free trade agreements, etc.).

Which companies are you competing with?

Outside Europe, important competitors for onions can be found in Egypt, Peru, New Zealand and Chile. Below are some examples of companies that supply onions to the European market. Quality, certifications, sustainability and off-season production are key for exporting onions to the European market.

Daltex Corporation: leading Egyptian supplier of premium onions and potatoes

Daltex Corporation is a supplier of premium Egyptian fresh produce. It is the leading exporter of Egyptian potatoes, but also offers onions. The company has multiple certifications that are necessary to supply the European market. For example, all its farms are GLOBALG.A.P. and Tesco Nurture Choice-certified. Moreover, it has a strong focus on sustainability, innovation and making a societal impact.

Daltex offers both yellow and red onions. The yellow onions are in season from April until mid-August. The red onions have a larger season, which runs from March until August.

Shuman Perú: favourable window for sweet onions

Shuman Produce Perú is part of an American company and specialises in the production of onions and garlic. It concentrates on the sweet onion variety, which is known for its low sulphur levels, high sugar content and non-spiciness. Its onions are available from July until January. The company exports to various countries all over the world, including the United Kingdom, the Netherlands and Spain. Shuman is GLOBALG.A.P.-certified and also has the GRASP add-on for the evaluation of the well-being of workers at the farm level.

Bostock New Zealand: sustainably produced onions in the late off-season

Bostock New Zealand is one of New Zealand’s largest onion growers. In addition, it produces apples, squash and grains. The company puts great emphasis on organic produce and sustainability aspects. For example, Bostock is also Fairtrade-certified. Moreover, it shows its societal responsibility by funding projects that benefit workers, local communities and the environment.

With its aim to minimise the environmental impact, it focuses on sustainable packaging. Its organic onions are packed in a fully home compostable vegetable net made from FSC-certified beechwood. Its compostable nets comply with the EU’s strict composting standards and food safety regulations.

Propal: off-season supply of onions to Europe

Propal is an experienced exporter of several fresh fruit and vegetables. It is one of the leading companies in Chile that exports avocado, but it is also strong in citrus fruit and onions. Propal exports onions to most of the leading importing countries in Europe, such as the Netherlands, Germany, the United Kingdom and Spain. It has the following certifications: HACCP, GLOBALG.A.P. and, specifically for the European market, BRC and IFS.

Tips:

- Get to know your international competitors and identify your competitive advantage over them.

- Make sure to stand out from the competition when entering the European market by defining your unique value proposition (UVP). This can be done by focusing on different aspects, for example: off-season offer, distance to the market, the onion varieties you can offer, quality and sustainability aspects.

Which products are you competing with?

Onions are a very common vegetable in the European market, available in all kinds of market channels and consumed throughout the whole year. There is not a real substitute for this vegetable. Rather, competition comes from the varieties that are available within this category and new product developments.

Each onion type has its own taste and is more suitable for a particular dish. For example, red onions are mild, crunchy and slightly sweet, have a less intense smell after being eating and are suitable for raw dishes. Spring onions consist of a white bulb and green tops, which can both be used. They are a good choice for toppings and garnishes. The more expensive variety, shallots, are known for their refined and aromatic taste and are often used in Asian and French cuisine.

In addition, new product developments can be seen as competition, such as Sunions. BASF developed the first tearless onion variety, which becomes milder and sweeter during storage (instead of stronger). These onions are sold in several European markets, such as Germany, the United Kingdom, France and Spain, under the brand name Sunions.

As an alternative for fresh onions, consumers can choose more convenience and use processed onions, such as onion powder (for convenience and for adding flavour in small quantities), fried onions (for toppings in specific dishes) or frozen diced onions (ready-to-use and with a longer shelf life).

Tip:

- Learn about the different types of onions present on the European market. For example, what is the taste like, what are they used for and what is the price?

4. What are the prices of onions on the European market?

Consumer prices have a wide range, as there are several factors that influence the consumer price. Import prices can be calculated based on import values and volumes. Based on import prices, an (estimated) price breakdown can be made to show how margins can be divided through the value chain.

Consumer prices show large variety

Consumer prices for onions vary greatly, depending on factors such as the type of onion, the quality, organic versus conventional, size of consumer packages (i.e. loose, 1kg, 500g, per piece or per 2/3 pieces) and the country. Table 2 compares the consumer prices of different types of onions in large European supermarkets in May 2024.

Yellow onions are the most common onions and are the cheapest. Prices vary from €1.16 to €3.29 per kg. They are the most expensive in Germany and France. Red onions are also a popular variety. Prices are the lowest in the United Kingdom (€1.12 to €1.29 per kg) and can cost up to €4.99 per kg in France. Spring onions are the most expensive onions at €6.25 to €7.67 per kg. They are often sold in bunches of 100-120g.

The price of organic onions is significantly higher compared to conventional onions. The organic varieties can be twice as expensive. For example, the prices for organic red onions are between €2.59 and €7.11 per kg.

Table 2: Consumer prices of fresh onions in large European supermarkets, € per kg*

| United Kingdom | The Netherlands | Germany | France | |

| Conventional onions | ||||

| Yellow onions | 1.16–1.29 | 1.32–1.35 | 1.79–1.99 | 1.19–3.29 |

| Red onions | 1.12–1.29 | 1.69–2.98 | 2.99–3.18 | 1.98–4.99 |

| Sweet onions | 1.88 per 3 pieces | 4.24/1.59 per 3 pieces | 3.99–4.15 | |

| Shallots | 3.91–4.11 | 2.78 | 2.58–5.16 | 3.98–5.96 |

| Banana shallots | 4.31–4.41 | 4.73 | 4.98 | |

| Spring onions | 6.90–7.43 | 6.25–7.67 | 0.99 per bunch | |

| Organic onions | ||||

| Yellow onions | 2.23–2.50 | 3.38 | 2.65–3.05 | 2.49–2.69 |

| Red onions | 2.59–3.29 | 3.58–3.98 | 4.98 | 3.98–7.11 |

| Shallots | 5.80 | 8.95 | 4.76–7.69 | |

| Spring onions | 11.76 | |||

Source: Globally Cool (June 2024)

Import prices have gone up

Onions have become more expensive over the past five years. The average import price was €0.56 per kg in 2019 and this increased to €0.77 per kg in 2023. This upward trend in import prices was observed in most countries, with significant increases in 2023. However, the Netherlands had a different pattern, experiencing a substantial rise in prices in 2022 (caused by bad harvest that year), but maintaining the same price level in 2023.

Poland has by far the lowest average import price, at €0.45 per kg. The countries that show the highest import prices are Germany (€1.01 per kg), the United Kingdom (€0.93 per kg) and France (€0.89 per kg).

Source: Globally Cool (June 2024)

Throughout the year, prices can fluctuate due to various factors. For example, at the beginning of 2024, the onion prices were exceptionally high due to a market shortage. The European harvest fell short of expectations, boosting the demand for imported onions. However, major onion suppliers Egypt and India had to deal with export restrictions. Consequently, European importers switched to China. China suffered from delays in shipments that were caused by the Red Sea conflict, which increased the risk of spoilage. These factors drove up the prices.

Price breakdown

Margins differ based on various factors, such as the type of onions, their origin and whether they are conventional or organic. For example, shallots and spring onions are more expensive and sold in lower volumes compared to yellow onions.

In the German market, the wholesale prices for yellow onions lie between €0.60 and €1.32 per kg, depending on the origin (EU origin prices are significantly lower than those from Chile and New Zealand). German’s retail prices lie between €1.79 and €1.99 per kg. The wholesale prices for French shallots in the French market lie between €1.50 and €2.13 per kg, whereas the retail prices are between €3.98 and €5.96 per kg.

Tip:

- Check out the prices for different types of onions. For example, for the French market, you can use Réseau des Nouvelles des Marchés (RNM) to find producer, wholesale and retail prices of different types of onions, shallots and spring onions.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research