The European market potential for onions

Europe is a large producer of onions and therefore is a competitive market. However, there is still room for imported onions, depending on the European stock levels and harvest. Opportunities for suppliers from developing countries are available in exporting onions in the off-season, when European countries have to fill in a gap. It is therefore essential to look at this window of opportunity. The most potential markets are the large European markets, such as the United Kingdom, the Netherlands, Germany and Spain.

Contents of this page

1. Product description

This study focuses on exporting fresh onions to the European market. Onions (scientific name: Allium cepa) are known for their strong smell and sharp taste, which adds depth and richness to many dishes. Onions are crucial in European farming and food. Onions come in various types and varieties (such as red, white and yellow onions) and each type has a distinct flavour and use in dishes, which therefore satisfies diverse consumer preferences. Table 1 describes the different varieties and uses in more detail.

Onions are primarily used as an ingredient – either raw, cooked, grilled, fried or pickled – in a wide variety of dishes, such as:

- Salads

- Soups

- Stews

- Sauces

- Marinades

- Sandwiches

- Burgers

- Stir-fries

- Dressings

Fresh onions are categorised under the following Harmonised System (HS) code: 070310 – Fresh or chilled onions and shallots.

Table 1: Onion varieties, descriptions and use in the European market

| Varieties | Description | Use in the European market | Supplying countries to Europe (depends on the season) * |

| Yellow onion/brown onion | The yellow onion is the most widely used type of onion. It has a golden yellow skin and light yellow/white flesh. It has a rather strong flavour combined with a slightly sweet taste. | It can be used in many dishes, either raw, grilled or cooked. It is the best general cooking onion. For example, in salads, stews, soups, stir-fries, sauces or marinades. | The Netherlands, the United Kingdom, Germany, France, Spain, Italy, Egypt, Argentina, New Zealand, Australia, Chile. |

| Red onion | The red onion has a deep-red skin with purple/white flesh on the inside. This onion is mild, crunchy and slightly sweet and has a bitter aftertaste. It has a less intense smell after being eaten. It is commonly used in the European market. | Red onions are a good choice for raw dishes, such as guacamole, salads and sandwiches. They are also good for (stir) frying, stewing or cooking. They can be used in soups, sauces or on a burger. Because of the colour, they are used in pickled dishes as well. | The Netherlands, the United Kingdom, Ireland, Egypt, Italy, Australia, New Zealand, Spain, France, Chile. |

| Sweet onion | The sweet onion has a light-yellow skin. These onions are sweet and particularly mild (a lot less strong than other onion varieties). | They are suitable for a variety of dishes. Their mild taste makes them suitable to eat raw, for example in salads, salsas and sandwiches. | Spain, Italy, the Netherlands, Chile. |

| Shallot | The shallot is known for its refined and aromatic taste. It has a mild onion taste with hints of garlic. A shallot is small and oval with a somewhat red skin. | You can eat a shallot raw or fried. When fried, it helps to fry it slowly. Then the sugar in the shallot caramelises and becomes nice and sweet. It is often used in Asian and French cuisine. It is suitable for a wide range of dishes. For example, in dressings, vinaigrettes, soups, stews, stir-fries and salads. | France, the Netherlands, the United Kingdom, Germany, New Zealand. |

| Banana shallot (echalion) | The banana shallot is a cross between an onion and a shallot. It has an elongated shape and a rosé-golden skin. | It can be used the same as the ordinary shallot. Its shape makes it suitable for the catering industry because you can cut it into even rings. | France. |

| Spring onion/green onion | This is a young onion that is harvested before the bulb has grown. It has a small, white bulb with green tops. Both parts are edible. The flavour is soft and it looks somewhat like a leek. | It is used both raw and cooked. It is the best onion for toppings and garnishing. It is added to salads, soups, stewed vegetables, stir-fries or omelettes. It is popular in Asian cuisine. | The Netherlands, the United Kingdom, Germany, Italy, Spain, Poland, Egypt, Morocco, Senegal, Mexico. |

| White onion | This onion has a white skin and white interior. It has a slightly sharper taste than the yellow onion, but is still a bit sweeter. It has a high water content, which makes the onion juicy and crunchy. | White onion is perfect for use in salsas, chutneys and stir-fries. It is popular in Mexican cuisine, but used less often in Western cuisine. | Italy, Spain, India. |

| Pink onion | This is a relatively new type that is a cross between the red and yellow onion. It is not widely available, but it is becoming more popular due to its unique colour and taste (a combination of the red onion’s mild taste and the yellow onion’s sharpness). | It lends itself perfectly to pickling, to be used in many dishes. | France. |

| Pearl onion | This is a small onion variety with a white colour. | It is suitable for pickling or cooking, for example in a soup or stew. | France. |

| Roscoff onion | The Roscoff onion originates from the Roscoff region in France. It has a pink colour and a subtle sweet, crunchy and juicy taste. | It can be used raw, fried or cooked. Examples of dishes to which it can be added are salads, meat, marinades and soups. | France. |

*The list is not complete but gives an indication of important supplying countries. This information was gathered via desk research by investigating the origin of onions in large supermarket chains in four leading importing countries: the United Kingdom, the Netherlands, Germany and France (May 2024).

Figure 1: Fresh onions in a Dutch mainstream supermarket

Source: Globally Cool (May 2024)

2. What makes Europe an interesting market for onions?

The European market for fresh onions is dominated by domestic supply from within Europe. Therefore, imports of onions from outside Europe depends on the European harvest and stock. Your best opportunities for exporting onions to Europe are in the months of March, April, June and July.

Window opportunities for developing countries

The European import volume of onions has been relatively stable over the past five years. Overall, there is a slight negative compound annual growth rate (CAGR) of -1.2% over the whole period. The largest growth was recorded in 2023, when European imports increased by 17% compared to 2022 due to challenging climate conditions leading to lower harvests within Europe.

Source: UN Comtrade (May 2024)

*Developing countries following the OECD-DAC list of ODA recipients; “Rest of the world” refers to all other countries.

Figure 2 shows that there is a lot of trade within Europe when it comes to importing onions. In 2023, 75% of the onions in Europe were imported from other European countries. This is because quite a lot of European countries produce large volumes of onions themselves, which they also partly export to Europe and beyond. For example, the Netherlands produced 1,284 thousand tonnes of onions in 2023 and exported 92% of these. Overall, Europe produced 6,519 thousand tonnes of onions in 2023.

Even though Europe produces a lot of onions themselves, there is still need for imported onions, depending on the European harvest and stocks. This mainly concerns importing onions in the off-season, as there is a gap during the year that needs to be filled.

Imports from developing countries have been relatively unstable. In 2019, developing countries exported a relatively large volume of onions to Europe (508 ,000 tonnes), after which there was a significant drop in imports. However, imported onions made a comeback in 2023, when the volume increased by 110% compared to the previous year. In 2023, 423,000 tonnes of onions were imported from developing countries, which is 19% of the total imported volume.

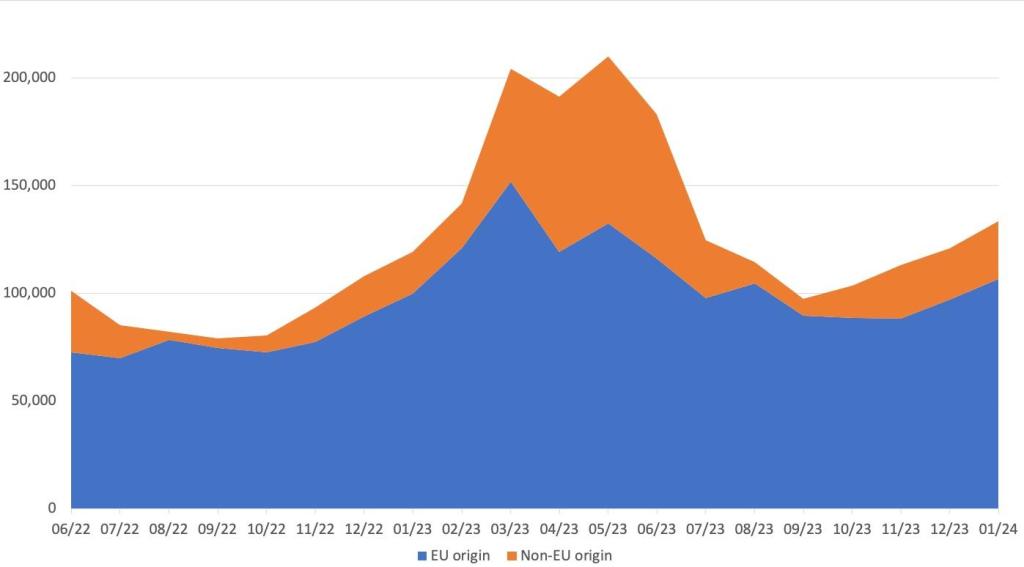

Figure 3: European imports of onions by main origins (in € thousand) per month (June 2022–January 2024)

Source: Globally Cool, based on Trademap statistics (May 2024)

To see the window of opportunity for developing countries, a distinction is made between imports of onions from EU countries versus non-EU countries (see Figure 3). In the months of March, April, June and July, there is a peak in imports of onions from non-EU countries. At the same time, imports from European countries show the same trend. This is largely due to the fact that once some European countries have imported onions from non-EU countries, they re-export these onions to other parts of Europe.

Future opportunities for suppliers from developing countries are available in exporting onions during the off-season, when European countries must fill a gap. It is therefore essential to look at the European supply window. Additionally, there are important opportunities for developing countries that export special onion varieties to Europe. For special varieties, like white onions from India, red onions from Egypt and sweet onions from Chile, imports from outside Europe remain important, although several of these types are also produced in Europe.

3. Which European countries offer the most opportunities for onions?

With a market share of almost 18%, the United Kingdom is the largest importer of onions. The Netherlands, which is an important trade hub for onions, comes second. After the Netherlands come Germany, Poland and Spain. These top five countries account for almost 60% of total European imports.

In this section, you can read more details about the European import volumes of onions. These figures are also shown in Figure 4 and further analysed in this section. These figures are crucial for suppliers of onions from developing countries to select priority markets. Typically, there is a strong relation between the production in a country and its import volume. If a country has a bad harvest one year, it will likely import more onions. This explains the typical patterns of each of the countries in the figure below.

Source: UN Comtrade (May 2024)

United Kingdom: top importing country of onions

The United Kingdom is the largest importing country of onions in Europe. In 2023, it imported a total volume of 386,000 tonnes, which is an increase of 4.8% compared to 2022. Even though there has been growth in the past few years, the import levels are still not as high as in 2019. On average, there was a decline of 4.1% in the period 2019–2023. In January 2020, the United Kingdom left the EU (Brexit), which is likely to have caused the significant decrease in 2020.

The majority of these onions are imported from other European countries (79%). Brexit has not caused any major shifts in the way onions are supplied to the country. The top suppliers to the United Kingdom were, and still are, the Netherlands and Spain. They have a share of 44% and 21% respectively. Another 21% is directly imported from developing countries, of which Egypt is the most important supplier (share of 12%), followed by China (3.3%).

As the United Kingdom is a large producer of onions, it heavily relies on its own supplies. According to Fruit Logistica’s European Statistics Handbook, it produced 345,000 tonnes of onions in 2023. In 2022, the harvest was below the level of previous years (-18%) due to harvest losses. But in 2023, harvest went back up by 8.2% compared to the previous year.

When onions are in season, they are sourced locally, and otherwise mainly on a regional (European) level. British supermarkets promote their local produce through their label or via online channels. Moreover, the United Kingdom also has a Red Tractor certified standard for British farmers, which is a food assurance standard that includes aspects like food safety, traceability and environmental protection. This standard forms the basis of sourcing specifications for, amongst others, large supermarket chains.

As a supplier from a developing country, you should familiarise yourself with the low season for onions in the United Kingdom. This is when there is an opportunity for you in the British market. According to Stourgarden, the United Kingdom has about a six-week gap in the months July and August, during which the country needs to import onions to maintain availability. This import window depends on two factors:

- Storage of the old crop: how long can it be stored for, which depends on the quality of the crop and how well it has been stored.

- New crop: how fast the new crop can be harvested, which depends on sunlight, temperature and harvest conditions.

The Netherlands: large producer and exporter of onions

The Netherlands is a large producer of onions; in terms of volume, onions are the most produced vegetable in the Netherlands. According to Fruit Logistica’s European Statistics Handbook, the Netherlands harvested 1,284 thousand tonnes of onions in 2023, which is a decline of 198,000 tonnes compared to 2022. This decline was caused by a few drawbacks in 2023, for example, onion planting was delayed and the heat and drought at the beginning of the summer required more watering. However, because of an increase in the amount of land used for growing onions (+7%, to a total of 29.3 thousand hectares), the harvested volume did not decrease further.

As local consumption in the Netherlands only amounts to a small share of the production volume, most of the onions grown here are exported across the globe. According to Mulder Onions, the Netherlands is a world leader in onions, with a global share of 15% in the global onions trade. The Netherlands exports fresh onions all year round. In 2023, the Netherlands exported 1,177 thousand tonnes of Dutch-origin onions. Thanks to an efficient supply chain and nearby European ports, the country is able to export Dutch onions within a relatively short lead time to over 130 countries.

Even though the Netherlands is a large producer of onions, it still imports a relatively large volume of onions. With a share of 13%, the Netherlands is the second largest importer in Europe. It is considered to be a trade hub for importing fruits and vegetables into the European market, and this is also the case for onions.

The volume of imported onions in the Netherlands has risen and declined significantly from year to year. In 2022, imports dropped significantly (-38%) compared to 2021, as local production output peaked that year. In contrast, in 2023, the total import volume was 276,000 tonnes, a growth of 45% compared to 2022. Overall, the trend in the imports of onions is downward (average annual decline of -4.6%).

The majority of imported onions come from intra-EU trade (57%), mostly from the neighbouring country of Belgium (share of 23%). Egypt and China are the second and third largest suppliers to the Netherlands, accounting for 19% and 12% of the total imports respectively. Together with Spain, the Netherlands holds the largest share in importing onions from developing countries (36% of the total imports).

If you want your onions to end up on the Dutch market, you need to consider the season and type of onions. For example, the Dutch supermarket chain Jumbo offers shallots from Dutch origin all year round, while sweet onions come from Spain, Peru and Mexico, depending on the month (see Table 2 for more details).

Table 2: Seasonal origin calendar for onions, example from the Dutch food retail chain Jumbo

| Yellow onion | Red onion | Sweet onion | Shallots (organic) | Spring onion | |

| January | Netherlands | Netherlands | Spain Peru | Netherlands | Morocco Senegal |

| February | Netherlands | Netherlands | Peru | Netherlands | Morocco Senegal |

| March | Netherlands | Netherlands | Peru | Netherlands | Morocco Senegal |

| April | Netherlands | Netherlands | Peru | Netherlands | Morocco Germany |

| May | Netherlands | Netherlands | Peru Mexico | Netherlands | Morocco Germany |

| June | Netherlands Egypt Argentina New Zealand | Netherlands Egypt | Mexico | Netherlands | Morocco Germany Netherlands |

| July | Netherlands Egypt Argentina New Zealand | Egypt | Mexico Spain | Netherlands | Germany Netherlands |

| August | Netherlands | Egypt | Spain | Netherlands | Germany Netherlands |

| September | Netherlands | Egypt | Spain | Netherlands | Morocco Germany Netherlands |

| October | Netherlands | Egypt | Spain | Netherlands | Morocco Germany Netherlands |

| November | Netherlands Egypt | Netherlands Egypt | Spain Peru | Netherlands | Germany Netherlands |

| December | Netherlands Egypt | Netherlands Egypt | Spain Peru | Netherlands | Morocco |

Source: www.jumbo.com

Germany: market dominated by Dutch and Spanish supply

With a market share of 12%, Germany is the third largest importer of onions in Europe, close behind the Netherlands. In the period from 2019 to 2022, there was a decrease in the imports of onions, from 294,000 tonnes in 2019 to 226,000 tonnes in 2022. In 2023, this trend reversed. Imports grew by 14% to a total volume of 258,000 tonnes. Overall, Germany saw an average decline of 3.2% in the period from 2019 to 2023.

Germany imported 8% of its onions directly from developing countries in 2023. Germany mostly relies on intra-EU trade (share of 84%). The remaining 8% is imported from other countries outside Europe. The leading supplier to Germany is the Netherlands, which is a large producer and trader of onions. It accounts for 37% of all onions imported to Germany. Over the past five years, its share has increased from 29% to 37%. The Netherlands is closely followed by Spain, which has a share of 36% in German onion imports.

Regarding non-European countries, Egypt and New Zealand are important suppliers. They are the third and fourth largest suppliers to Germany, both holding a share of around 6%. While imports from Egypt have remained relatively stable over the past five years, imports from New Zealand have decreased significantly, from 33,000 tonnes in 2019 to 16 tonnes in 2023.

Germany itself also cultivates onions. In 2023, its total production reached 580,000 tonnes (Fruit Logistica’s European Statistics Handbook). Onions are a popular vegetable amongst German consumers; they are the 6th most popular produce in the fruit and vegetable category in Germany. In 2022, each household purchased 8.4 kg of onions on average. Germany’s exports are relatively low compared to its production volumes (64,000 tonnes in 2023).

In Germany, wholesalers purchase the larger onions of 70mm or bigger in size. Retailers and consumers buy smaller onions, varying from 35mm to 50mm in size. In the beginning of 2024, the prices for German onions were quite high and they have continued to rise. This was partly caused by the smaller harvested volume. Organic onions have shown a steadily growth in the past few years and are characterised by a relatively low price pressure.

Figure 5: Fresh onions in a German mainstream (discount) supermarket

Source: Globally Cool (February 2024)

Poland: onion ranks first in Poland’s vegetable cultivation area

Poland is the largest importer of onions in Central and Eastern Europe, with 199,000 tonnes of imports in 2023. Poland’s imports dropped in the years 2020 and 2021 to around 160,000 tonnes, but recovered again in 2022. In the period from 2019 to 2023, there was a small average decline of 1.8%.

Similar to Germany, Poland imports a large part of its onions from other European countries (82%). A share of 7% is directly imported from developing countries (mainly from Egypt and also from Uzbekistan and Kazakhstan), and the rest comes from the rest of the world. Imports from developing countries decreased by 29% on average from 2019 to 2023, while imports from the rest of the world increased by 46%. Intra-European trade has remained relatively stable.

With a share of 67%, the Netherlands is the main supplier to Poland. The Netherlands is followed by Germany and Russia, with a share of 13% and 11% respectively. Russia only entered the top three supplying countries in 2023. In previous years, very limited amounts were imported from Russia. The increase in imports from Russia is most likely related to the low wholesale prices for onions in Russia, as they are 2.5 times lower compared to Poland.

Poland itself also cultivates a lot of onions. Onion ranks first in Poland’s vegetable cultivation area. Poland mainly produces the common onions, in many varieties. In addition, Poland grows potato onions, shallots, tree onions and Welsh onions. In 2023, its total production was 636,000 tonnes. This quantity has stayed relatively stable over the past years. In 2023, Poland exported around 151,000 tonnes of its onions (Fruit Logistica’s European Statistics Handbook).

Spain: significant rise in imports, high import share from developing countries

Spain has increased its imports of onions significantly. In 2019, Spain was the 9th largest importer in Europe, but in 2023 it entered the top five. Except for a small dip in 2022, imports have increased significantly over the past five years. The growth was especially strong in 2023 (+61%). In that year, the total imported volume reached 147,000 tonnes, as the local production output decreased due to drought that year. Whereas all other leading importing countries have seen an average decline in imports over the past five years, Spain has seen a significant increase (average annual growth rate of 16%).

Moreover, Spain is an important entry point for developing countries to access the European market. More than half of Spain’s onions are imported directly from developing countries. This is the highest share compared to other European countries. Imports from developing countries increased by 12% in the period from 2019 to 2023, while imports from European countries increased even faster (by 28% on average per year).

Latin American countries are important suppliers to Spain. With a volume of 46,000 tonnes and a share of 32%, Peru takes the first position in the Spanish market. Chile is the third largest supplier, with a 10% share. Other leading suppliers are the Netherlands (22% share, second place), France (7.4%) and Senegal (5.9%). The imports from the top suppliers have increased considerably over the past five years. The Netherlands has showed an exceptional growth, from 3,000 tonnes in 2019 to 31,000 tonnes in 2023.

Spain is also a large producer of onions. Fruit Logistica’s European Statistics Handbook mentions that Spain produced 1,147 thousand tonnes of onions in 2023. According to PROCECAM, the land area used for growing onions is getting bigger. In the 2023/2024 season, this area grew by 16% compared to the previous season. It is expected to increase further for the 2024/2025 season, as seed companies have reported a remarkable growth in sales. The last two seasons have produced outstanding commercial results. The relatively high onion prices attract more non-specialist producers.

France: import peak in the months March to June

With an imported value of 133,000 tonnes, France is the 6th largest importer of onions. Imports have been relatively stable in the period from 2019 to 2023. Imports showed a small annual decline of 2.4% on average. France imports most of its onions in the period from March until June (51% of its annual imports), with a peak in May (16% of its annual imports). When French onions are in season, retailers such as Carrefour support local production, emphasise French onions in their (online) stores and inform customers when local onions are in season (see Figure 6).

Figure 6: Seasonality of French yellow onions*

Source: Carrefour (May 2024)

*green: in season, red: out of season

According to Fruit Logistica’s European Statistics Handbook, France produced 615,000 tonnes of onions in 2023. This is an increase of 20% compared to 2022. Most of the locally produced onions are also consumed locally. France exports relatively small quantities of onions: a total of 95,000 tonnes in 2023.

For its imports, France mainly relies on other European countries (83% in 2023). The top three suppliers are nearby European countries, such as the Netherlands (35% share), Spain (18%) and Belgium (14%). Poland and Italy complete the top five suppliers. Together, these five countries account for 82% of France’s total imports of onions. Imports from the Netherlands grew by 13% on average over the past five years, while imports from Spain decreased by 16%.

The leading suppliers from developing countries are India (between 5-6% of total French imports each year), Madagascar (1.8-2.7%), Egypt (0.4%-2.3%), Chile (up to 700 tonnes per year) and Morocco (up to 500 tonnes per year).

Tips:

- Use Dutch and Spanish traders if you want to enter different European markets. They have extensive experience in trading onions in the European market and extensive market knowledge about the preferences in the different markets. Moreover, they import relatively large volumes of onions directly from developing countries.

- Keep up to date about the latest news on onions. Check, for example, Freshplaza’s global market onions article, Freshplaza’s potatoes and onions section and EastFruit.

4. Which trends offer opportunities or pose threats in the European onions market?

Sustainable agricultural production has become a top priority in Europe, and therefore is one of the most important drivers in the European onions market.

Sustainability

Sustainability is becoming more mainstream in the European fruits and vegetables sector. European buyers are showing a growing interest in sustainable produce and they appreciate transparency in the supply chain. This means that exporters who are interested in supplying the European market have better chances if they fit in with sustainability initiatives.

Sustainability is a broad term and can include multiple aspects, such as social sustainability (e.g. working conditions), environmental sustainability (e.g. water use and management, packaging) and traceability. Make sure you understand what is requested by European buyers when discussing sustainability.

In the EU, an important policy on sustainability is the Farm to Fork Strategy (part of the European Green Deal). It aims to make food systems fair, healthy and environmentally friendly.

Supermarket chains already have started to make steps towards a more sustainable supply of fruits and vegetables, including onions. For example, the French supermarket chain Carrefour has introduced the label Filière Qualité Carrefour. Fruits and vegetables that carry this label are produced with respect for the environment, by making use of agroecology. For example, onions with this label are grown without insecticides or synthetic fungicides and they have not been treated chemically after harvesting.

The Dutch supermarket chain Albert Heijn has a programme called Beter voor Natuur & Boer, via which Dutch growers commit to reducing their impact on the climate and to improving biodiversity. Growers receive a premium for their sustainability efforts and there is a purchase commitment. Certified growers also have a GlobalG.A.P. certification, including the GROW add-on.

Overall, the requirements for sustainability will become stricter, also if you are supplying onions from a developing country to Europe.

A company that has started working with several sustainability aspects is the Egyptian company Daltex Corporation. Daltex exports a variety of fruits and vegetables (including onions) to the European market. These products are certified by the GlobalG.A.P. and Tesco Nurture Choice programmes, amongst others. The company also has a fully electronic traceability system and is working on a variety of social and environmental sustainability initiatives, including water conservation, female labour participation and inclusivity.

Sustainable packaging

Sustainability also involves looking critically look at packaging and minimising the use of plastics in the supply chain. With the Plastics Strategy, the EU wants to ensure that all plastic packaging is recyclable by 2030. Moreover, the European Plastics Pact (a public-private coalition) sets targets to phase out single-use plastic products and packaging by 2025. This will also have an impact on the fresh fruits and vegetables sector, including for onions.

On a national level, governments and retailers are taking action to use less plastic packaging or use recyclable plastics. In 2022, France banned the use of plastic packaging for onions and 29 other types of fruits and vegetables. As part of the REset Plastic strategy, the supermarket chain Lidl is looking for a new, sustainable solution to package onions. In the long-term, plastic will be minimised as much as possible and replaced by biodegradable packaging, such as cartons.

Locally sourced onions

Due to the COVID-19 pandemic, the focus on sustainability and the introduction of the Farm to Fork Strategy, there is an increasing interest in consuming locally grown produce. In addition, freshness and quality are reasons for consumers to buy local and seasonal products.

Supermarkets have recognised this trend and have started to promote local products through their labels and/or online channels. For example, in the United Kingdom, the Red Tractor label promotes British onions and other produce, which can be traced back to the British farms it came from. In addition, supermarkets like Carrefour, Intermarché and Jumbo promote local onions through their online shops and sometimes also describe the seasonality, to show consumers when the local onions are available and when they offer onions from other countries.

Onions are sourced locally when possible and otherwise sourced regionally. This means that you should consider the production capabilities of different European countries. For example, the Netherlands and Spain are large producers of onions. When these locally produced onions are available in the market, importers are not likely to import onions from elsewhere. Importers will only purchase from outside Europe if the local or regional produce is not available or not in season, or if there is a competitive advantage. Importers and distributors also prefer local and regional produce because the risks of purchasing products nearby are lower.

Figure 7: British red onions, Red Tractor certified standard

Source: Globally Cool (June 2024)

Convenience

European consumers are increasingly seeking convenience in their food choices, leading to a growing demand for value-added products. This trend is driven by changing lifestyles, busy schedules and a desire for easy meal preparation. Consumers are willing to pay more for time-saving options that are convenient but not worse in quality. For onions, this means that there is a growing demand for ready-to-use onion products, such as pre-cut onions and diced onions but also processed products, like frozen onions or dehydrated onion flakes.

In Europe, especially in the United Kingdom and the Netherlands, there is a high demand for convenience products. The reason for this is that supermarkets and convenience stores have a strong position in these markets, and they offer a broad range of pre-cut and ready-to-eat fruits and vegetables.

Tips:

- Read CBI’s study on trends that offer opportunities or pose threats on the European fresh fruit and vegetables market to get more insights in the European market trends.

- Check out when there is a window of opportunity to supply onions to the European market. In Europe, there is a preference for local and regional onions. Therefore, you need to get familiar with the seasonality of onions in these markets. Use, for example, the seasonal calendar made by the Import Promotion Desk (IPD). Make sure to plan around local seasons or export when the price of local onions is high.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research