Entering the European market for chia seeds

Chia is marketed through two main segments: food processors and retail packers. Because most chia is consumed raw, food safety management is a crucial aspect for suppliers. The level of competition is increasing with new suppliers from the African continent. But the level of operations and certifications is also rising, making Europe a difficult target market.

Contents of this page

1. What requirements and certifications must chia seeds comply with to be allowed on the European market?

Chia seeds must comply with the general buyer requirements for grains, pulses and oilseeds. For an overview of legal requirements, you can also use My Trade Assistant in Access2Markets using the product code for chia seeds (12079996) and the exporting and importing countries. The most important aspects for exporting chia seeds to Europe are food safety, quality and a residue free product.

What are mandatory requirements?

Food safety: traceability, hygiene and control

The most important requirement for chia seeds is to make sure it is safe for consumption. Food safety and traceability should be your top priorities. As a supplier, you must work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

Most chia seeds are consumed raw and unprocessed. This means you must pay extra attention to control the levels of pesticide residues, contaminants such as Aflatoxins and micro-organisms such as Salmonella, E.Coli and Listeria monocytogenes. Residues must be absent or within the limits according to the European legislation on Maximum Residue Levels (MRL). Organic chia should not contain any residues of non-organic-approved pesticides.

When residues in chia are not under control, the European authorities can decide to increase inspections or temporarily stop the import from your country.

Copper compounds

Residues of copper compounds are a rising issue that has caught the attention of companies and European authorities.

The problem is that chia has been categorised as a pseudocereal and not as an oilseed in the latest version of Regulation (EC) No 396/2005 on maximum residue levels of pesticides. As a result, the maximum level of copper compounds that is officially allowed is 10mg/kg. In reality, the copper residues in chia seeds reach levels of 15 to 17 mg/kg. Authorities in Europe respond differently to this issue, leading to uncertainty in the chia trade.

Green Deal

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. The Green Deal aims to make the European economy more sustainable and climate neutral by 2050. The action plan also includes a 50% reduction in the use of pesticides and an increase in the share of agricultural land used for organic farming to 25% by 2030. This means that many pesticides will be banned and residue levels will decrease gradually in the coming years.

Tips:

- Find out the Maximum Residue Levels (MRLs) for pesticides that are relevant for chia seeds. Search for “buckwheat and other pseudocereals” (code number 0500020). Note that European authorities do not use the code for oilseeds (0401000). A general default MRL of 0.01 mg/kg applies where a pesticide is not specifically mentioned.

- Reduce the amount of pesticides by applying integrated pest management (IPM) in your production. IPM is an agricultural pest control strategy that includes growing practices and management of chemicals to grow healthy crops and minimise the use of pesticides.

- Have your chia seeds pre-tested by a recognised laboratory, preferably the same laboratory as your client, to avoid differences in testing methods. Only use representative samples.

- Stay up-to-date with regulations and legal requirements. EU regulations are constantly being updated. Maintain close contact with your buyers, because they have to follow the same rules and they can also keep you up-to-date.

Novel Food

Chia seeds are a Novel Food in Europe. Novel Foods are food products that have not been consumed to a significant degree by humans in the EU before 15 May 1997. Regulation (EU) 2017/2470 (consolidated version of 31 May 2023) compiles all the authorised novel foods in the European Union to date. It includes the conditions of use for chia, the labelling requirements and product specifications for chia seeds, chia oil and partially defatted chia seed powders.

Over the years, new applications for chia have been authorised. See table 1 for the current conditions under which chia may be used.

In almost all products that are not heated at or above 120°C, the use of chia seeds is no longer limited to a maximum, including:

- fruit, nut and seed mixes;

- chia seeds as such;

- confectionery (including chocolate and chocolate products, excluding chewing gums);

- dairy products (including yoghurt) and analogues;

- edible ices;

- fruit and vegetable products (including fruit spreads, compotes with/without cereals, fruit preparations to underlay or to be mixed with dairy products, fruit desserts, mixed fruits with coconut milk for a twin pot);

- non-alcoholic beverages (including fruit juice and fruit/vegetable blend beverages);

- puddings that do not require heat treatment at or above 120°C in their manufacture, processing or preparation.

To get new uses or an extension of use for chia approved, you must submit an application and provide evidence of safe consumption. The European Commission publishes a summary of applications and notifications that have been submitted within the novel food regulation. On this website, you can also read how to submit a novel food application using the e-submission system.

Table 1: Conditions under which novel foods may be used (July 2023)

|

|

Chia seeds* |

Chia oil |

Chia powder with high protein content |

Chia powder with high fibre content |

|

Bread products |

5% whole or ground chia seeds |

|

|

|

|

Baked products |

10% whole chia seeds |

|

|

|

|

Breakfast cereals |

10% whole chia seeds |

|

|

|

|

Sterilised ready-to-eat meals based on cereal grains, pseudocereal grains and/or pulses |

5% whole chia seeds |

|

|

|

|

Fats and oils |

|

10% |

|

|

|

Pure chia oil |

|

2 g/day |

|

|

|

|

2 g/day |

|

|

|

|

Unflavoured fermented milk products, including natural unflavoured buttermilk (excluding sterilised buttermilk) non-heat-treated after fermentation |

|

|

0.70% |

|

|

Unflavoured fermented milk products, heat-treated after fermentation |

|

|

0.70% |

|

|

Flavoured fermented milk products including heat-treated products |

|

|

0.70% |

|

|

Confectionery |

|

|

10% |

4% |

|

Fruit juices as defined by Directive 2001/112/EC (*1) and vegetable juices |

|

|

2.50% |

2.50% |

|

Fruit nectars as defined by Directive 2001/112/EC and vegetable nectars and similar products |

|

|

2.50% |

4% |

|

Flavoured drinks |

|

|

3% |

4% |

|

Food supplements as defined in Directive 2002/46/EC excluding food supplements for infants and young children |

|

|

7.5 g/day |

12 g/day |

Source: Regulation (EU) 2017/2470 (Consolidated version 31/05/2023). * In almost all products that are not heated at or above 120°C, chia seeds are no longer limited to a maximum use. See the list above.

Acrylamide

An existing concern of the European Food Safety Authority (EFSA) is the formation of acrylamide in chia in thermal processing. For that reason, the use of chia in heated products is still limited. But this may change in the future. For example, in April 2023, EFSA published a new proposal for defatted chia seeds with high fibre content, to be used in fine bakery wares, bread, pasta, protein products and processed fruit and vegetables. The evaluation panel decided that the moisture content in these products is sufficient to limit the formation of acrylamide during thermal processing of the food.

Table 2: Nutritional specifications of chia and chia derivatives (July 2023)

|

|

Chia seeds |

Chia oil |

Partially defatted chia seed powders with high protein content |

Partially defatted chia seed powders with high fibre content |

|

Dry matter |

90-97% |

|

|

|

|

Protein |

15-26% |

|

|

|

|

Fat |

18-39% |

|

|

|

|

Carbohydrate (*) |

18-43% |

|

|

|

|

Crude Fibre (**) |

18-43% |

|

|

|

|

Ash |

3-7% |

|

|

|

|

Acidity expressed as oleic acid |

|

≤ 2.0% |

|

|

|

Peroxide value (PV) |

|

≤ 10 meq/kg |

|

|

|

Insoluble impurities |

|

≤ 0.05% |

|

|

|

Alpha linolenic acid |

|

≥ 60% |

|

|

|

Linoleic acid |

|

15-20% |

|

|

|

Foreign matter |

|

|

0,1% |

0,1% |

|

Particle size |

|

|

≤ 130μm |

≤ 400μm |

|

Moisture |

|

|

≤ 9.0% |

≤ 9.0% |

|

Protein |

|

|

≥ 40.0% |

≥ 24.0% |

|

Fat |

|

|

≤ 17% |

≤ 12% |

|

Fibre |

|

|

≤ 30% |

≥ 50% |

Source: Regulation (EU) 2017/2470 (Consolidated version 31/05/2023). (*) Carbohydrates include the fibre value. (**) Crude fibre is the part of fibre made mainly of indigestible cellulose, pentosans and lignin.

Nutrition and health claims

Chia seeds have become a popular ingredient due to their supposed health benefits, but you cannot promote health benefits that are not approved by the European Union. Any nutrition and health claim should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation (EC) No 1924/2006 (consolidated version of 13/12/2014). General claims such as "healthy" or "superfood" will only be allowed if they are accompanied by a specific permitted health claim.

Tip:

- Check with the EU Register of Health Claims and the Permitted nutrition claims to see which claims are allowed to be made on the European market.

Packaging & labelling

Chia is most commonly packed in polypropylene or multi-layer paper bags of 25kg. In the organic trade, paper is often preferred. For larger industrial users, big bags of around 1 ton can be used.

Packaging must be suitable to protect the product and conform to Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food.

When exporting chia seeds to Europe, powder and oil must be labelled with the correct name:

- Chia seeds (Salvia hispanica)

- Partially defatted chia seed (Salvia hispanica) powders

- Chia oil from Salvia hispanica

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements in the Codex General Standard for the Labelling of Prepackaged Foods (pdf) or Regulation (EU) No. 1169/2011 (consolidated version of 01/01/2018) on the provision of food information to consumers in Europe if your product is pre-packed for retail.

What additional requirements and certifications do buyers often have?

Quality standards

There is no official quality standard for chia seeds. Nevertheless, quality is very important to European buyers. Purity level and moisture are usually the main indicators for buyers to determine the quality. The specific quality specifications may vary from one buyer to another. Most importers demand the highest purity but will also negotiate strongly on price. Table 3 shows an indication of quality characteristics that are generally required by buyers.

Table 3: General quality standards for chia seeds

|

Purity |

mostly 99.5 to 99.9% (discuss with buyer) |

|

Moisture |

<8% |

|

Visual quality |

|

|

Free from |

|

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with your standards will give buyers a reason to submit claims on quality issues.

Certifications as a guarantee

Certifications are a good indication of your compliance with food safety requirements. They give buyers assurance, but buyers do not only rely on certifications. Your understanding of quality and food safety is crucial to gain their trust. Working according to high quality standards and a HACCP-based food safety standard is just as important as a certification itself. For example, your chia seeds must be fully traceable. When a buyer asks which pesticides have been used at the farm level, you must be able to answer that in detail.

To certify your food safety management, you can best implement a standard that is recognised by the Global Food Safety Initiative (GFSI). These standards are widely accepted throughout Europe. You can select a specific standard according to your role in the supply chain. For chia processors (cleaning and packing), a recognised HACCP food safety management system such as BRCGS or FSSC 22000 is a necessity. In production, GLOBALG.A.P. can be a good step to improve agricultural practices.

Overview of commonly used certifications:

- GLOBALG.A.P. (agricultural production)

- FSSC 22000 / ISO 22000 (Food Safety System Certification)

- BRCGS for Food Safety (British Retail Consortium)

- IFS Food Standard (International Featured Standard)

The preferred standard varies per country and buyer. For example, IFS is more common in Germany, while BRSGS is a typical UK standard. Note that FSSC is recognised by GFSI, but ISO22000 is not.

Tips:

- Find out which certifiers are present in your country. Also check with your buyer to determine which certification scheme is most relevant for your target market.

- Read the CBI tips for Organising your export and CBI Buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform to get more detailed insights about the advantages of certifications.

Organic certification

An organic label is common for ‘health’ ingredients such as chia seeds. This is why organic chia has a relatively large market share in chia sales.

To market organic chia in Europe, you have to use organic production methods that comply with Regulation (EU) 2018/848 (consolidated version of 21/02/2023). You can apply for an organic certificate with an accredited certifier. When you are certified, you can use the EU organic logo (see figure 1).

As it is a sub-tropical crop, chia is not easy to produce organically. It is especially challenging in largescale production areas where commodity crops are also grown. Although a large amount of chia is sold as organic, there are still regular problems with pesticide residues and accusations of false organic certifications. It is important to be aware that buyers will hold you responsible for any residue problems. This makes it a difficult and risky market to compete in.

Figure 1: The EU organic logo

Source: European Commission

Tips:

- Consider organic cultivation if your situation and location permit it. Remember that implementing organic production and becoming certified can be expensive.

- Check the possibilities for group certification if you are part of a small farmers group. IFOAM – Organics International provides Training manuals for smallholder group certification. They also make organic certification accessible for small farmers with Participatory Guarantee Systems – although these still need to be recognised by the European Union. Read more about how to certify a group of smallholders in the IFOAM Position Paper on Smallholder Group Certification for Organic Production & Processing (pdf).

- Always avoid certification fraud, even if your buyer insists. In the short term this may seem profitable, but you risk a trade blockade when being controlled by food authorities.

What are the requirements for niche markets?

Sustainability and social compliance

European buyers are paying increasing attention to sustainability and corporate social responsibility (CSR). As an exporter you share the responsibility for ensuring a sustainable supply chain.

Buyers will often have you fill out a set of documents and declarations before doing business. Or they will ask you to comply with a specific code of conduct. Applying standards and certifications will help you fulfil the expectations of buyers. Initiatives or certification schemes that can help improve your CSR performance are:

- Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (pdf)

- Sedex Members Ethical Trade Audit (SMETA)

- GlobalG.A.P.. and GlobalG.A.P. Grasp

- Ethical Trading Initiative (ETI), using the ETI Base Code

A consumer label for social or sustainable conduct is not yet common in the chia trade. A few companies, such as Cosecha Partners in Nicaragua, have a Fair for Life certification and label. In the future it is possible that other labels will take an interest in certifying chia seeds, such as Fairtrade International and Rainforest Alliance.

Tips:

- Use the ITC Standards Map to learn about the different sustainability and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct (pdf). You can also find practical tools through the amfori BSCI platform.

- Read about the different social programmes and initiatives in the CBI study on buyer requirements for grains and pulses in Europe.

2. Through what channels can you get chia seeds on the European market?

Chia remains a popular product with consumers of health foods. The seeds are often packed for retailers, but there is a growing potential for chia as an ingredient in the food manufacturing segment. Most chia enters the market through specialised buyers, but the number of large volume buyers is still limited.

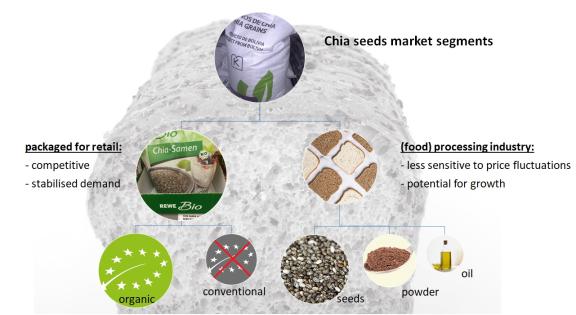

How is the end-market segmented?

The market can be roughly divided between retail packers and the (food) processing industry.

Figure 2: Market segments for chia seeds in Europe

Source: ICI Business

Packaged for retail

The main market for chia still seems to be the seeds that are packed for retail sales. Prepacked chia targets consumers that often want to add a healthy ingredient to their diet. For that reason, organic chia has a relatively large market share. Most chia is sold as whole seeds. Only a few retailers sell chia powder or chia oil. These are mostly found in specialised health food stores or online.

Retail packaging is a very competitive segment with both food brands and supermarket private labels. For chia packers there is little to differentiate besides price. Fluctuations in prices and demand have a strong impact on the segment’s dynamic. With high trade prices, supermarkets can decide to (temporarily) de-list their private label chia seeds. When this happens, the sales shift to brand packers.

Due to the recent inflation of food prices, the demand for organic products has come under pressure. Nebertheless, shops that are specialised in healthy and organic products have proven to be the most stable retail segment. Among them are retail chains such as Holland & Barrett in the UK/Europe and Ekoplaza in the Netherlands, and the international online grocer Kazidomi. Some of the online shops combine retail sales with bulk wholesale, for example Healthy Supplies and Buy Wholefoods Online in the United Kingdom.

Food processing industry

The demand from food manufacturers is more stable than the demand from retail packers, and has the potential to grow. The use of chia seeds as an ingredient in food products is important for the future market development of chia. Price is less of a concern because food manufacturers need their ingredients for production. This segment is a big market for conventional chia. Organic is not always the main reason why consumers buy food with chia as an ingredient. Preference for a brand, product type and diet also weigh on the purchase decision.

Products with chia often fulfil the needs of consumers with special diet preferences. For example, the Schnitzer brand uses chia in a gluten-free bread, suitable for consumers that are gluten-intolerant or have coeliac disease. Bakery is a relevant segment for chia use in Europe.

Whole (unprocessed) chia seeds are still the main traded ingredient. New ingredients such as high protein chia powder can create new opportunities for food manufacturers. High-protein chia powder can be used for specific products such as protein shakes or protein bars. These are popular with both vegan consumers and sports people. Chia oil is still very niche. It is often sold as an omega-3 food supplement. The allowed uses in foods are still limited, but it also has potential in the non-food sector, such as a natural ingredient for cosmetics.

Figure 3: Example of a vegan raw bar with chia

Source: ICI Business.

Tips:

- Visit European supermarkets and health shops to see what type of products are on offer with chia as an ingredient. Many have their products online, such as Rewe (Germany), Tesco, Holland&Barrett (United Kingdom), Albert Heijn and Ekoplaza (Netherlands). You can find a list of European supermarkets on Wikipedia.

- Stay within the parameters of the Novel Food regulation when developing new chia products (see the requirements above).

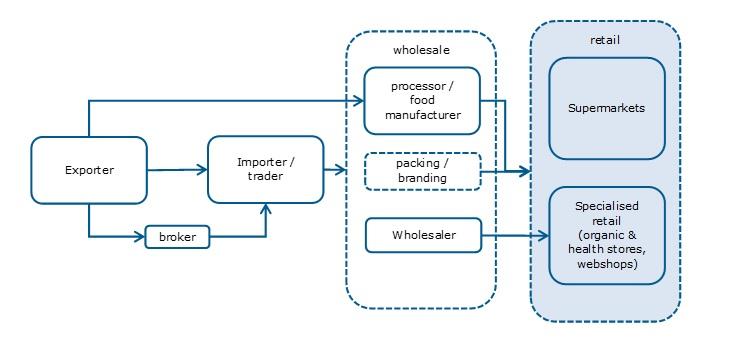

Through what channels does a product end up on the end-market?

The main channel for chia seeds in Europe is ingredient importers. They distribute chia to food manufacturers and retail packers, or they pack for retail brands themselves. Bigger brands and food manufacturers may also set up their own import line.

Importers / traders

Most of the chia in Europe is traded by companies that specialise in the import of food ingredients, such as edible seeds, nuts, dried fruits, organic and health ingredients. Importers have an important role in checking the product quality and the food safety protocols. They distribute chia seeds to smaller users or re-pack chia seeds for food brands or private label customers.

A large part of chia imports is managed by a handful of companies. But occasionally, new buyers appear that see an opportunity in importing chia. As an exporter, you must stay alert to shifts in trade and upcoming buyers.

Companies that have been steady buyers of chia seeds for several years include:

- Companies that started as chia specialists such as Acanchia (Germany);

- Importers of organic ingredients such as Naturkost Übelhör (Germany) and Tradin Organic (the Netherlands);

- Companies with a broader assortment of ingredients, such as edible seeds, nuts, dried fruits such as Rhumveld (the Netherlands), VM Trading (Germany) and Voicevale (UK);

- Suppliers of specialised ingredient solutions for the food processing industry such as Neupert Ingredients (Germany) and Royal Ingredients (the Netherlands).

Brokers

Some chia seeds are traded through brokers. These are often individuals or small companies that link your product to buyers in Europe and take a commission on the sales. Their function is purely commercial and as a supplier you will remain responsible for most of the logistical process.

Food brands and manufacturers

Food brands and manufacturers re-pack or transform chia into consumer products for retail sales. Chia remains a niche product for many food companies. Therefore, they often get their chia from ingredient importers. They form the link between trade and retailer.

Food processors that use chia include:

- Cereal and bakery manufacturers such as Harry (Germany), Céréal (Belgium/France) and Celnat (France);

- Plant-based food brands, such as Lima Food (Belgium);

- Gluten-free brands, such as Schnitzer (Germany) and Semper (Sweden).

Brands that pack chia seeds for (international) retail sales are numerous and can be found in nearly every European country. They include:

- Germany (Davert, Seeberger, Govinda, Biozentrale, Seitenbacher);

- Austria (Veríval),

- Belgium (Biotona, PuraSana);

- United Kingdom (Naturya);

- The Netherlands (TerraSana);

- Italy (Pedon);

- Spain (El Granero).

Only larger brands with a significant interest in chia would make use of international sourcing. The niche market sometimes results in integrated supply chains. One of the first large chia importers in Europe, House of Originals (Denmark, formally known as OriginalChia), has transformed itself to a consumer brand company. The company Chiabia (part of Linwoods Health Foods) was also one of the first to introduce chia to Europe, and today sells chia consumer products under its own label.

Figure 4: Market channels for chia seeds

Source: ICI Business.

Tip:

- Check the potential of your buyer in terms of volume, integration with brands and client networks. If you find a buyer with a high demand for chia, you can explore the possibility of a long-term partnership. This can benefit both you and your client.

What is the most interesting channel for you?

Chia in Europe is still part of a special ingredient market. For that reason, the main chia importers are the most logical channel to enter the European market. But as a newcomer on the market, it may take a while to find a large buyer. It is important to keep an eye on all companies with import potential. Visiting trade fairs is a good way to find and meet potential future clients.

Companies with large track records in chia such as Voicevale or Naturkost Übelhör attempt to maintain their dominant position through organising the total supply chain. They often commit to one or two large suppliers, or even integrate their business operations. Because the supply of chia is not always reliable due to climate changes, most importers will have secondary suppliers. This can be an opportunity for new exporters.

In addition to connecting to the main importers, it is always good to keep in contact with smaller buyers, including the potential importers that supply food brands and manufacturers. Food manufacturers that use chia as an ingredient are the most attractive buyers from an economic perspective. They will need a constant supply for their food product, making supply security more important than paying low prices. For food manufacturers to work directly with chia origin countries, there must be a clear advantage for them (guaranteed volumes, better traceability, lower costs, etcetera). This means that your supply chain must be flawless.

If you sell from stock in Europe, you can also work with wholesale volumes and sell to smaller outlets further down the value chain. But be aware that you will be competing with well-established importers and that the total market size is still limited to a large number of wholesaling traders.

Tips:

- Meet importers of special ingredients at large food trade fairs such as SIAL, Anuga, Biofach, Food Ingredients Europe. Use the exhibitor lists or databases to search for interesting companies, for example through the exhibitor lists of Biofach or Organic-bio, the international directory of organic food wholesale & supply companies.

- Become an interesting supplier for European companies through excellent production planning and product quality checks. Know what you are selling and remove any concerns of your buyer about supply continuity, quality and food safety risks.

3. What competition do you face on the European chia seeds market?

Paraguay has become the strongest competitor in terms of production volume and price. Because buyers do not want to depend on a single source, they will look for alternatives in other countries. There are still opportunities to compete, but the level on which you need to operate as a supplier is rising.

Which countries are you competing with?

Until a few years ago, Latin American countries were competing head-to-head to become the largest exporter of chia seeds. In the past five years up to 2022/2023, Paraguay has grown to be the most dominant supplier to Europe. On the African continent, Uganda has become the most successful exporter of chia.

Source: Eurostat / Market Access Database, calculations by ICI Business

Paraguay: high volume and price competitive

Paraguay has positioned itself as the largest producer and exporter of chia seeds worldwide. Chia seeds are produced in mechanised agriculture similar to commodity crops such as soy bean and maize.

Paraguay is the most competitive country with big production volumes and low prices. The total volume was estimated to be around 30,000 tonnes in 2022. In 2023, the expected yields will likely exceed 40,000 tonnes.

The export to Europe continues to grow and reached an estimated volume of 13,500 tonnes. With this volume, it has become the dominant supplier to Europe. Only two aspects can hamper the growth of Paraguayan chia seeds: climatic circumstances such as frost or drought, or the decision of buyers to source elsewhere when issues of pesticide residues occur. Paraguay has a favourable climate to produce chia seeds, but climate changes and the common use of chemicals in large-scale agriculture remain genuine risks.

Uganda: frontrunner in African supply

Uganda has become the frontrunner in chia exports from the African continent. For European buyers, it is an ideal alternative source of chia seeds when South America suffers from climatic difficulties. Unlike South America, the production in Uganda is mainly done by small-scale farmers. Chemical use is less common in Ugandan agriculture, so it has the potential to grow certified organic seeds.

Unfortunately, food safety guidelines are not always in place and local spraying against malaria may still result in residues in chia seeds.

Ugandan chia has reached the Dutch and the German markets, and recently also entered the UK market. Imports in these markets have grown steadily from 1,200 tonnes in 2018 to 2,100 tonnes in 2022. One of the companies that has included Uganda in its chia supply is the German Naturkost Übelhör.

Bolivia: professional supplier but with a challenging climate

Bolivia has a similar climate to Paraguay and produced around 15,000 tonnes in 2022. The country has shown it can scale up production. By opening new markets, such as China, Bolivia hopes to become the largest producer of chia seeds.

In reality, production and export have fluctuated over the years due to both climatic and logistical issues. Climate has been a decisive factor in the changing volumes of Bolivian chia. The crop is rain fed and increasing droughts and strong winds make chia production challenging.

Despite these fluctuations, Bolivia has established itself as one of the main suppliers to Europe. Consolidation in the sector have also given leading companies the opportunity to professionalise and implement high standards. The UK, Germany and the Netherlands were the biggest buyers of the 1,700 tonnes of imported Bolivian chia in 2022.

Peru: commercial power

Peru is not a big producer of chia seeds, but commercially, exporters know how to present themselves as chia suppliers. Peruvian exporters often buy chia from nearby countries such as Bolivia and Paraguay, which is then re-processed and shipped from Peru. This has turned Peru into one of the leading exporters of chia seeds.

The estimated chia volumes imported by Europe were between 1,200 and 2,700 tonnes during the past five years. Spain is the largest buyer of Peruvian chia. Imports to Germany and the UK have declined.

Mexico: the origin of chia seeds

Mexico is one of the origin countries for chia seeds. Their potential production volume is less than in South American countries and cultivation costs are generally higher. Their strength lies in their trade relations.

Mexico has the advantage of being close to the United States, which is a big market for chia. It is also one of the only countries that is allowed to export chia seeds to China (a benefit that Bolivia is eager to start exploiting as well). Grupo Sejum is one of the companies that profits from this trade opportunity, exporting 45 containers to China in 2021.

Mexico is less connected to the European market for chia seeds, but still plays a role. The fact that Mexico does not depend much on European buyers, means that exporters can choose to export to Europe when it is convenient.

Argentina: knowledgeable in chia cultivation

Argentina belongs to the larger producers of chia seeds and has given an impulse to chia cultivation in the region. A lot of agricultural knowledge for growing chia comes from Argentina and several businesses in Bolivia and Paraguay are linked to Argentinian professionals.

Although the Argentinian general trade exchange reached historic highs in 2022, chia did not seem to be one of the export products that increased in volume. Farmers clearly gave the preference to growing well-known commodities such as soybeans, wheat, maize and barley. Good profits could be made because of higher prices due to the conflict in Ukraine.

The main production of chia takes place in the province of Salta. With the right price incentives, this region in Argentina can become a fierce competitor in the chia trade.

African supply increases

European buyers increasingly look to Africa to spread risks in sourcing chia. Climate issues in South America can affect the availability of chia seeds. In many regions in Africa, farmers can get two harvests per year, and there is a potential to grow organic chia on smallholder farms. Pricewise, it can also be an interesting region, although not many suppliers are able to compete with Paraguayan prices.

Besides Uganda, European chia imports from Kenya (approx. 440 tonnes in 2022), Tanzania (250 tonnes) and indirectly from Rwanda are increasing. In Rwanda, production has picked up, but lacks (organic) certifications. According to Rwandan traders, their chia is exported through Kenya. Traceability remains an issue, so buyers will prefer exporters that have their own fields. If not, suppliers must be involved at farm level and work closely with producers.

If African suppliers can guarantee continuity in supply, they have the potential to increase their chia exports to Europe. For many farmers, chia is an opportunistic crop. When prices are high, production increases. But when low prices reduce the supply, it can be disappointing for European buyers who may decide to not continue doing business with them.

Source: Eurostat / Market Access Database, calculations by ICI Business

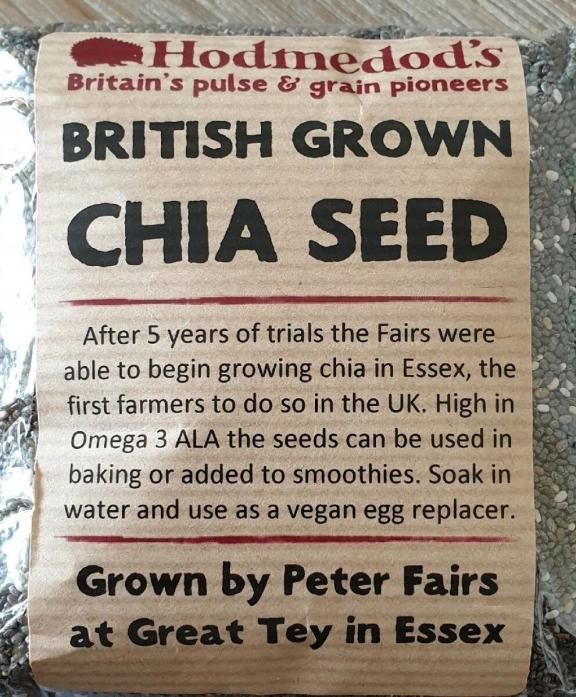

European supply in its infancy

Several initiatives in Europe are exploring the cultivation of domestic chia. These initiatives have resulted in British-grown chia from Hodmedod’s (see figure 6), the foundation of Chia de France and a new variety developed by the German University of Hohenheim. It fulfils the strong preference in Europe for locally produced foods.

According to chia traders in Europe, the prices for locally grown chia are far from competitive. In the short term, European farmers will have little impact as competitors, but this could change once the efficiency in production increases.

Figure 7: British grown chia from Hodmedod’s

Photo by kiliweb per Open Food Facts licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Tips:

- Offer stability to European buyers. If you want to become a leading supplier of chia seeds, you will need a long-term vision. You need to convince buyers that you are a reliable supplier, regardless of market fluctuations.

- Keep up to date with global chia production, especially in South America and Africa. Find reliable contacts in the production countries to get first-hand information about the expected yields and production volume. When the production falls short, it can be a good opportunity to find new clients.

- Invest in knowledge of and experience with efficient cultivation and processing techniques. This will help you get a low cost of production and become more competitive with large scale suppliers. Connect with producer groups, agronomists or local agricultural research centres to exchange experiences.

Which companies are you competing with?

Chia has become a market that requires well organised suppliers that can operate according to high European standards. As a company you can best compete when you are fully certified and when you control quality and traceability. Innovation in chia processing or product development are also ways to differentiate your company.

Healthy Grains S.A. - Paraguay

Paraguay is the strongest competitor in the chia seed trade. Companies such as Healthy Grains S.A. have positioned themselves as leading exporters. This particular company is fully certified with BRCGS, SMETA, EU organic, among others. They have in-house processing/cleaning and do physical, microbiological and aflatoxin analysis themselves.

A high level of compliance, combined with a large production volume and competitive pricing, make companies like these one of your bigger competitors.

Shares Uganda - Uganda

Uganda has emerged to become Europe’s second-largest supplier in 2022. Shares Uganda is one of the suppliers of chia seeds, combined with sesame and dried bird’s eye chilli peppers. The company is fully organic-certified and has FSSC22000 for food safety management. Using UV-c sterilisation and low oxygen natural fumigation, they maintain the organic integrity of their products.

Ugandan exporters are often involved in local programmes and the training and financing of farmers. In this way, they create local value and a traceable supply chain that is fit for export markets.

Benexia – Chile

Benexia is an innovative pioneer in the chia business. The company uses top processing equipment to reduce microbiological contamination and has developed several sub-products such as high-protein and high-fibre chia powders and chia oil. Benexia is vertically integrated and built a quality brand for processors as well as retailers. They can target a high-level client base that uses chia seeds as an ingredient.

Benexia is a high-quality ingredient company. But this also means they are not a strong competitor in the chia trade, especially when they are up against price-focused companies that invest less in quality management.

Tips:

- Keep up with the certification levels of your competitors. However, do not just depend on these certifications, but also show your clients that you understand what they mean.

- Diversify your product portfolio and do not depend on only chia seeds. Supply and demand fluctuate and are difficult to predict, which makes chia a risky business. The survivors among chia exporters are the companies that have diversified their supply and maintain a long-term vision.

Which products are you competing with?

Chia is a unique product considering its properties. But there are cheaper alternatives that can be used as an ingredient instead, such as linseed, hemp seed or sesame. Just like chia, linseed contains healthy omega-3 fatty acids. And sesame may be preferred in bakery products instead of chia because of its taste.

Food manufacturers make a choice of ingredients based on nutritional value, marketing value and price. In terms of price, chia is less attractive than most other oilseeds, but its marketing and nutritional value are superior. For example, online shops sell a kilo of organic chia for 10 euros, while organic linseed or flaxseed is sold for less than 7 euros.

In addition, chia has the characteristics to become a jelly-like substance when liquid is added. The high dietary fibre content and the ability to control viscosity and texture in food make chia seeds a functional ingredient. This gives it unique thickening properties for fruit shakes and marmalades.

Tip:

- Make it easy for food brands and consumers to understand the possibilities of chia seeds. Find strategic partners such as food brands that are able to promote chia and its different uses. Look for food brands in European stores and web shops that already use other nutritional seed and grain ingredients, such as quinoa, amaranth or linseed.

4. What are the prices for chia seeds on the European market?

The trade price of chia depends mainly on product availability. Climate circumstances in major producing countries can affect yields, resulting in big price fluctuations. But there is often also a difference between the expected production and the actual harvested volume.

In the 2018 to 2021 time period, the average import value per tonne fluctuated between €1,700 and €2,300. Certified organic chia is usually sold for higher prices. On average, this may be for 30% more, but this completely depends on the competition of the moment. In 2022, the production in Paraguay and Bolivia was affected by frost, leading to a shortage in the market. Trade prices almost doubled to €3,550-4,000 per tonne (FOB) for black chia and €4,200-4,600 per tonne (FOB) for light/white chia (calculations by Tridge, changed to euros by author). This sharp increase has been confirmed by European importers.

Consumers generally pay €12-15 euros per kilo and up to €35 euros per kilo, depending on the brand, retail outlet and the package size. Larger packages of >1 kilo can be priced as low as €6-8 per kilo. Retail prices vary a lot and are relatively high. This indicates that it is a product with low rotation and with a risk of fluctuating trade prices. The effect of high trade prices leads to shifts with buyers and retailers in Europe. Some retailers choose to stop selling private label chia instead of raising the price.

Source: Industry sources

Tips:

- Optimise your earnings through accurate planning. Do not produce or source much more than you can sell, but having a small stock can be convenient in times that product availability is low.

- Use your international contacts to verify price developments. Online sources such as Tridge may also provide indications, but the best sources remain trade professionals.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research