The European market potential for chia seeds

Nutritional and health properties have made chia seeds popular in Europe. They have excellent marketing value in countries such as Germany, the United Kingdom and the Netherlands. The chia market needs stability and product development to reach its full potential. Africa could benefit as a new source of chia seeds and help stabilise the supply.

Contents of this page

1. Product description

Chia (Salvia hispanica) is a plant native to Southern Mexico and Guatemala. Its seeds are speckled blackish-brown and white and have a faint nutty aroma and a crunchy texture. The black-brown seeds are dominant, but with careful selection it is also possible to cultivate only white seeds.

Chia seeds are primarily cultivated in Latin America and Australia. In recent years, production in Africa has begun, in countries such as Uganda, Kenya and Tanzania. And even in Europe, scientists are developing varieties that can grow locally. The chia seeds are generally the same, with the exception of Nicaragua where the cultivated seeds are smaller and blacker than in other parts of the world.

Chia seeds are oilseeds and rich in omega-3 fatty acids, protein and fibre. They can be used as seeds or processed into crushed seeds, oil, defatted flour or extracted protein. In Europe, chia is considered a “Novel Food”. This means that there are certain restrictions for its use. See the information on Entering the European market for chia seeds.

It is difficult to obtain accurate market statistics on chia seeds. There is no specific Harmonised System (HS) or other code applicable to chia seeds. The European product code HS 12079996 for the import of ‘other oilseeds’ proves to be relatively reliable for the import from the main chia producing and re-exporting countries. The statistics of this study are estimates based on the supply from Paraguay, Bolivia, Argentina, Peru, Chile, Mexico, Australia, Uganda, Kenya and Tanzania.

Figure 1: chia seeds in close-up

2. What makes Europe an interesting market for chia?

The European demand for chia has been relatively stable for the past five years. More authorised uses as an ingredient should give chia more potential to grow in Europe. In supply terms, it remains an opportunistic market. For African farmers, this has been a reason to start competing with South American producers.

A market for experienced exporters with a long-term vision

The chia market remains volatile in terms of supply. Shortly after 2013, the European demand for chia seeds increased from a few thousand tonnes to approximately 19 thousand tonnes in 2016. Being a relatively new product, balancing supply and demand has been challenging. Production shortages and overproduction keep the market unbalanced. Weather conditions in South America reduce the harvest, leading to higher prices. High prices are an incentive for opportunistic growers to cultivate more chia.

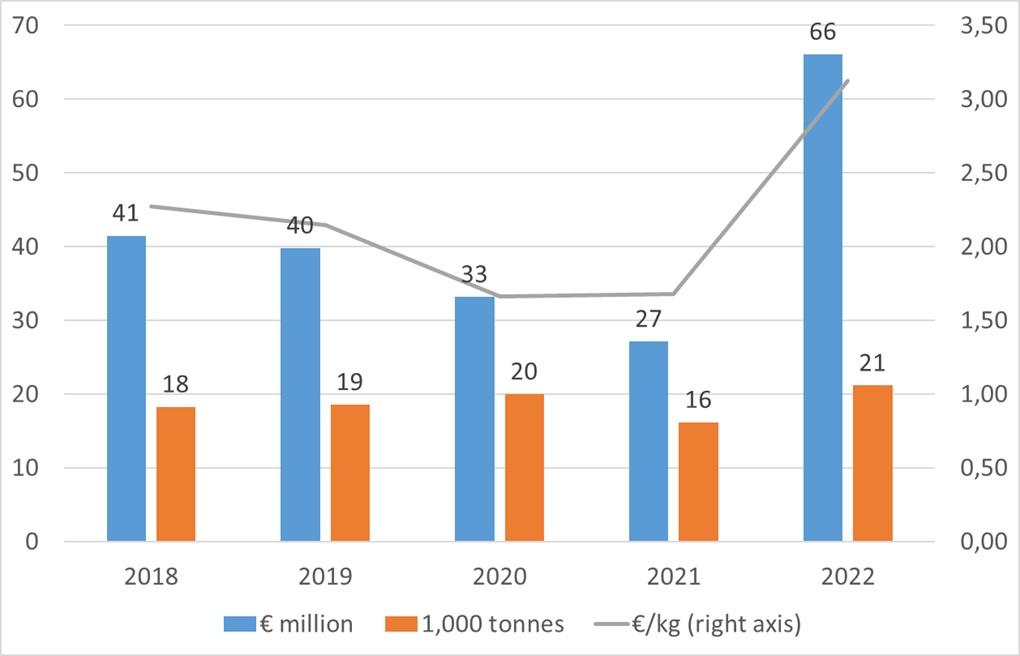

Opportunities and profitability vary from year to year. Figure 2 shows a drop in imports in 2021 due to frost, leading to crop loss in South America. The lower product availability in 2021 led to higher prices in 2022. For some producers, chia has been a very lucrative crop, but many others entered and left the business after just a few years. Chia can be profitable, but it is still a niche product. It is therefore not a product to build your entire business on.

The European market is most attractive for experienced exporters that maintain a long-term vision. Building your export network requires market knowledge and good planning. It is risky to depend on chia as a single product, so it is best to combine your chia business with other products

Tips:

- Make sure you have buyers before encouraging farmers to produce chia. It remains a niche so you should avoid production if you do not have a market for it.

- Combine different crops and try to develop a local market for chia. This way you do not depend on European demand and you can grow your export with less risks.

- Keep yourself informed about the global production forecast for chia seeds. Find a few reliable contacts in the chia trade to exchange information, for example via the Chia Seed Industry Network group on LinkedIn.

Figure 2: Estimated European chia import

in € million and 1,000 tonnes

Source: Calculations by ICI Business, based on ITC Trademap and Eurostat

A growing market for organic chia from Africa

In the past five years, several European buyers have started to source organic chia in Africa. The import of chia of African origin increased from approximately 1,200 tonnes in 2018 to 2,800 tonnes in 2022.

Chia is a crop that thrives in warm climates, such as in Paraguay and Bolivia. South America remains the largest supplier, but climatic difficulties such as drought, frost and wind make yields unpredictable. In addition, the large-scale production is mainly conventional.

Contrary to much of the production in South America, the cultivation of chia seeds in Africa is mostly realised by smallholder farms. By producing on a small scale, it is easier to manage a clean or organic crop. For importers, this is an important reason to buy chia seeds from countries such as Uganda, Kenya and Tanzania. At the same time, Africa is becoming an alternative source of chia when South American production suffers from poor harvests. African farmers can realise two harvests per year. But European traders also mention supply continuity of quality (organic) chia as one of their main challenges in sourcing from Africa.

The organic food segment is an interesting niche for healthy superfoods such as chia seeds. Organic retail sales in Europe increased by 16% during the COVID-19 pandemic in 2020. In 2021, sales increased by another 3.8%, to a total value of €54 billion. Nevertheless, as an exporter, you should remain cautious because demand in the organic segment may also decrease. Recent price inflations mean consumers are choosing cheaper, conventional food. Importers in Europe say the current organic market is down.

Source: ITC Trade Map, calculations by ICI Business

Tip:

- Convert your chia production to organic production if circumstances are favourable. With organic chia, you can cover an interesting market segment in Europe. Be aware that organic production and certification can be expensive, and that chia has been known to have fraudulent organic suppliers. You will likely compete with suppliers that do not always care too much about the organic rules.

The market has not reached its full potential

Chia is a versatile product that can be used as an ingredient in many different products. Over the years, food companies have applied for many new uses within the novel food regulation. Today, food developers can use chia seeds, oil and flour in a wide range of products. These new uses of chia are a good sign that the market is developing. For now, the demand shows little growth, but the purchased volumes are stable.

Europe has a significant power in food innovation, but chia has not yet reached its full potential in Europe. Many companies lack knowledge about chia seeds and their potential application in foodstuffs. Food manufacturers also need a stable supply, both in volume and price, to develop and introduce new products with chia on the market.

Tip:

- Keep yourself up to date on new authorised uses for chia. Check the latest publications on chia seeds (Salvia Hispanica L.) by the European Food Safety Authority (EFSA). Or find current authorised uses for chia in Regulation (EU) 2017/2470. Make sure to open the latest consolidated version as indicated in figure 4.

Figure 4: EU Regulation that includes permitted uses for novel foods, including chia seeds

Source: Commission Implementing Regulation (EU) 2017/2470.

3. Which European countries offer most opportunities for chia seeds?

Germany is the largest consumer market for chia seeds, although its direct import from origin seems to have dropped. Much of the chia import now goes through the Netherlands, which also makes it a good place to find traders. The United Kingdom and Spain follow as major markets. Consumption is also expected to increase in Italy, Poland and France.

Products developed with chia may be different in each country, but health-focused consumers represent a common driver for growth throughout Europe.

Source: ITC Trade Map, calculations by ICI Business

Germany: The largest market for chia seeds

Germany is the largest market for chia seeds with an estimated direct import of 4.5 thousand tonnes from producing countries. Although direct imports appear to have decreased, it is also the main market for chia re-exported by the Netherlands. Future Market Insights calculates that Germany had a revenue share in Europe of 7.3% in 2022.

Germany is a country with 83 million potential consumers and an increasing awareness of healthy diets. According to Germany Trade & Invest (GTAI,) the country’s ageing population is fuelling the demand for health & wellness products. Consumers also look for functional food to prevent or overcome conditions, including diabetes, high blood pressure, and cholesterol. Two-thirds of all Germans link their health directly to their nutrition.

Superfoods, such as chia seeds, fit very well in the modern German diet. According to the BfR Consumer Monitor on Special Superfoods (pdf), 70% of German consumers classify chia seeds as superfoods. And 33% claim to consume superfoods at least once a week. A healthy diet and pleasant taste are the most important reasons to consume superfoods.

Chia is sold in retail packages by food brands, such as Davert and Naduria, or as private label (see figure 6). The other major channel for chia is food manufacturers, and in particular, the bakery sector. The bakery sector is the third-largest segment within the German food and beverage industry and responsible for a large share of chia sales in the country. You can also expect other products with chia to emerge. The German companies Naturkost Übelhör and JatroSolutions were involved in the authorisation of chia in chocolates and in fruit spreads.

Quality and food safety requirements are probably your biggest challenge in supplying the German market. German consumers are most concerned about chemical residues. For chia seeds, an organic certification is preferred. Consumers are also more likely to trust local products. High production prices in Europe are still a bottleneck, but in the long term you may see more competition from European farmers. The university of Hohenheim has already developed a chia variety that can be cultivated locally to offer a more sustainable alternative to imported chia seeds. The company Heimat introduced “German Chia Gold”, a chia substitute obtained from the Camelina Sativa plant.

Figure 6: Organic chia seeds sold as private label in Rewe supermarket

Source: ICI Business

Tip:

- Pay extra attention to checking your chia for residues when exporting to Germany. Establish a traceable and transparent supply chain with independent sampling, counter-samples, documentation, and product specifications. Test your chia on pesticide residues using European/German laboratories (or the same lab as your buyer).

The Netherlands: Best place to find traders

The Netherlands is the main entry point for chia seeds in the European market. It is an excellent place to find trading companies or set up your distribution. Being one of the main distribution hubs, chia is also widely available in Dutch retail stores.

Dutch chia imports appear to have doubled in the past five years to an estimated 7 thousand tonnes in 2022. The higher imports compensated for the decline of direct imports by Germany. This could be due to logistical reasons, but it is also possible that Dutch traders have strengthened their position over the years. The Netherlands is home to a variety of traders. Since the country is a trade hub for chia seeds, you should expect strong price negotiations.

Chia has become a common product in the Netherlands. Most supermarkets offer chia seeds (often private label), but you can also find chia in a large number of health food web shops. The product selection is most varied in the organic food channel.

Tip:

- Include the Netherlands in your European export strategy. You can use the Netherlands as a starting point to enter the European market. Or you can create your own distribution by contracting logistical service providers.

The United Kingdom: Good market for new ingredients

The United Kingdom is a well-developed market for convenience and health food. It is a good market to introduce new ingredients. British consumers embraced chia seeds as one of the first countries in Europe.

An increasing popularity of vegan and keto diets drives the demand for chia seeds. British media are strong channels to promote healthy diets and superfoods. But the import of chia has not shown any significant growth over the past five years. Future Market Insights predicts an annual growth of 7% up to 2033. Based on the current import statistics, it is not sure if this growth will be realistic.

The future of chia in the United Kingdom will depend on the further promotion of its health benefits and new product development. Meanwhile the cost of living has increased significantly. Healthy ingredients must remain affordable. Insights from Mintel show that most British consumers pursue a healthy diet, but these diets are compromised by money saving decisions. Another insight by Technavio is relevant for chia flour: they report that the fluctuating price of superfoods is a challenge for the growth of the superfood powders market in the UK.

Currently chia is a popular ingredient for porridge. Brands that are strong promoters of chia are ChiaBia, Naturya, Moma Foods, and the Australian brand The Chia Co. As a supplier you can target these food brands, but you will most likely need an importing partner. For the UK, it makes sense to import directly from origin countries. After Brexit, trade via mainland Europe has become less attractive. To support the chia sales in the United Kingdom, you must ensure product availability and a stable price.

Figure 7: Chia is ideal for porridge free from lactose and gluten

Source: Pixabay

Tip:

- Provide stability to your buyers. Stability in supply and prices will benefit market growth in the UK. Consider, for example, offering long-term contracts or further integrating your supply chain with a partner in the UK.

Spain: A connection for South American exporters

Spain has been one of the top four importers of chia seeds. The country has strong ties with producing countries in Latin America. This makes it a logical hub for exporters from that region.

While the Netherlands offers a logistical hub for chia seeds, Spain is often the country of choice for Latin American companies. Having a common language, it is relatively easy for them to set up their business. The Cartago Group is one of the companies that has integrated South American supply with a local distribution office. Most of Spain’s recent chia imports come from Peru and Paraguay. Peru is known to re-export large volumes of chia produced in Bolivia and Paraguay. Although South American supply dominates, Uganda was also able to ship around five full container loads in 2022.

Based on the import data of 2021/2022, chia seems to have passed its peak. Consumers in Spain show an increasing interest in healthier foods such as plant-based proteins. But according to the technological centre INIA, consumers are not only looking for healthier foods, but also for more sustainable and affordable ones. This trend leads to a preference for more local products. For companies in the chia business, this requires more attention to reducing their carbon footprint, increasing their use of sustainable packaging and affordable prices.

Italy: Adding chia to a traditional food market

Italy has the fourth-largest population in Europe. While consumer habits are changing, Italy shows slow, but potential growth for chia seeds.

Italy has a traditional food culture. New ingredients may take time to get introduced, but chia could benefit from a growing awareness for healthy eating. Italy was heavily affected by the COVID-19 pandemic. Since the pandemic, 62% of Italian consumers have changed their consumption habits. A fifth of all Italians now buy healthy foods and beverages more often than before the lockdown. Unfortunately for chia exporters, this new trend goes together with a strong support for food “Made in Italy”.

Italian cuisine is rich in oils and proteins. Chia seeds can be a healthy addition for gluten-free pastas, bread and pizzas, and all kinds of other traditional Italian food. For this to happen, the market will depend on importing companies such as Almaverde Bio and Pedon.

Tip:

- Find potential food innovators that could use chia in their products at the trade fair Tuttofood and its exhibitor list.

Poland: Cost-efficient food sector with trendy developments

Poland can be a promising market for chia for various reasons. There is a growing group of consumers that tends to follow food trends. It is also an attractive country to outsource food processing.

Poland is not a frontrunner for new exotic ingredients, but Polish consumers definitely follow food trends. There is a growing appetite for vegetarian and vegan dishes and the number of innovative food companies is increasing. Several companies in the health food market, such as Ekogram, want to contribute to nutritional awareness in Poland. Another example is the company Chia Shake, which uses chia in shakes, smoothies and pudding. This may be the reason for the estimated Polish chia import of 900 tonnes in 2022. The main supplying country is Paraguay.

Although trendy foods are entering the Polish market, exporters must be aware that consumers are also price-conscious. Products are generally cheaper than in western Europe, but consumers still spend a high percentage of their income on food. When chia prices become too high, consumers may buy cheaper alternative seeds such as linseed instead.

For food brands, Poland is a cost-attractive country to outsource production. Many food companies have processing facilities in the country. The food processing industry can be another reason for the growing import of ingredients such as chia seeds.

Other markets with potential: Denmark and France

Denmark does not appear among the largest importers of chia. There is no import data available. However, the country is home to one of the pioneering companies in chia seeds, House of Originals (formerly known as Original Chia). Denmark can be your step towards the Scandinavian market.

France is a country with growth potential considering the number of inhabitants and the underdeveloped market for chia. The local cultivation by the Chia de France foundation shows that there is interest in these healthy seeds.

4. What trends offer opportunities or pose threats on the European chia market?

The attention to healthy ingredients and product development with chia as an ingredient are important trends for future market growth. As the market matures, sustainability will increase in importance. Consumers look for functional, inexpensive, healthy, and sustainable foods.

Consumer focus on healthy diet is good for chia sales

Health is one of the main reasons for chia consumption. Consumers have learned that chia can be part of a healthy diet. In their search for new, healthy ingredients, the role of (social) media should not be underestimated.

In Europe, consumer behaviour is slowly refocusing on healthier foods. According to Ingredion, consumers are focussing more on natural ingredients. They check more often the ingredient and nutritional labels. It is also the reason why chia seeds are most popular in the organic segment.

Food publicists and social media have a strong influence on consumers. They promote chia for its omega-3 fatty acids, dietary fibres, essential minerals, polyphenols and antioxidants. All kinds of health claims find their way into households. Videos like “internal shower” or “chia water” have gone viral. These stories are often invalidated by critical media and nutritionists, but not without first contributing to an increase in the consumption of chia seeds.

Tip:

- Promote the health benefits and nutritional properties of chia seeds in your marketing, such as omega-3 fatty acids, fibres or protein content. But be careful with making health claims. A public EU Register of Nutrition and Health Claims lists all permitted nutrition claims and all authorised and non-authorised health claims in the European Union.

Product development shows potential of chia

Chia is a promising ingredient in the food industry. It can be used as both a trendy health ingredient and as a functional product. Not every food brand is familiar with chia. But applications within the European novel food regulation show a growing interest in chia derivatives and uses.

Chia is very versatile. It has excellent properties to control viscosity, stability, texture, and consistency in food products. And it is also an interesting ingredient for vegan and gluten-free consumption. Currently chia is used in a variety of products in Europe. Gluten-free bakery Schnitzer uses chia in their sourdough bread. Producers of fruit juices and shakes use it to give texture to their product, such as in the fresh smoothies in the Dutch Albert Heijn supermarket. In combination with water, chia seeds become a vegan binder of ingredients, adding consistency in the same way as egg white. See also the comparison by Rise of the Vegan.

New uses will broaden the market. For example, various uses for (partially) defatted chia flour have been approved by the European Union since 2020. As studies show, defatted chia flour can improve the antioxidant quality in cookies without reducing the technological or sensorial properties. It can also improve the nutritional value in gluten-free bread.

The company responsible for extending the authorised uses of partially defatted chia flour is Benexia. Based in Chile, Benexia is one of the most innovative companies in chia seeds. In their processing, they use advanced sterilisation technology to reduce moisture and microbiological contaminants in chia. They have developed high fibre and high protein chia powders, as well as a cold-pressed omega-3 oil. They inform their target group about the use of their ingredients through publications, such as on the smoke point of chia oil (pdf).

Innovation is an important driver for chia seeds as an ingredient. As a supplier, you can try to inspire food manufacturers in Europe with examples and inform them about the potential uses of chia seeds.

Figure 8: Products with chia seeds

Source: Photos per Open Food Facts by hangy (Harry Vital bread), alia (Brillante wholegrain rice with chia), kiliweb with additional modifications by scrypt per Open Food Facts (Céréal Bio cookies with chia) and kiliweb (AH smoothie with chia)

Tips:

- Find specialised buyers of food ingredients and additives, such as omega-3 or special flours, at the Food ingredients (Fi) trade fair or through their Exhibitor List. To meet with buyers of organic ingredients, you can visit Biofach, the largest organic trade fair in Europe.

- Stay informed about supplement and nutrition trends on the European market by visiting the websites of Nutra Ingredients and Food Ingredients First.

- Learn how to apply for new uses of chia in the technical guidance report on the submission of applications for authorisation of a novel food in the European Union. For very innovative uses or sub-products of chia, you will have to provide relevant data and research about its safety.

Sustainability becomes more important in chia marketing

Sustainability is becoming an important aspect in food sourcing, in particular for nutritious consumer products. This increases the pressure on chia farmers in South America and Africa. It also drives chia cultivation initiatives in Europe.

There is a general preference in Europe for locally-grown products. This is a trend that became more prominent during the COVID-19 pandemic. If chia can be produced locally, long-distant sea freight will be avoided. And less transport results in a lower carbon footprint. Consumers also want to support local farmers and often have more trust in their agricultural practices. For them, certified organic production from local famers is often more credible. There are already several experiments and initiatives of chia cultivation in the UK, Germany and France. On the positive side, the attention of European farmers will also help increase market demand for chia. And most of the chia demand will still depend on imports because European farmers produce much smaller volumes against high prices.

The professional level of chia suppliers is also rising. Large companies set the trend such as Olam actively committing to a sustainable supply chain for chia. Olam supports over 2,100 smallholder farmers in Peru to increase productivity and achieve organic certification through training and technical assistance. As companies increasingly highlight their sustainable ambitions, suppliers cannot stay behind. To secure your future on the European market, you will have to think about social certifications and sustainable practices. Storytelling can be a way to start doing this. See the example of the Kenyan supplier Endashata. Endashata uses storytelling to talk about empowering small-scale women farmers and their mission to improve nutrition and livelihoods in Africa.

Tip:

- Find out what trends will influence the demand of grains, pulses and oilseeds in the CBI Trends study.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research