Entering the European market for kidney beans and other common dry beans

The canning industry is a dominant channel for common dry beans in Europe. Importers and food manufacturers are the main buyers of dry beans. Most of their supply comes from large, well-organised suppliers in Canada, Argentina and the United States that trade beans as a bulk commodity. To compete with the current suppliers, you will either have to scale up your production capacity and work efficiently, or specialise in a specific variety or organic beans.

Contents of this page

1. What requirements must common dry beans comply with to be allowed on the European market?

Common dry beans must comply with the general requirements, which you can find in the buyer requirements for grains, pulses and oilseeds on the CBI market information platform. You can also use My Trade Assistant of Access2Markets that provides an overview of market access requirements for pulses per country using HS code 071333300 for kidney beans, white pea beans and other common dry beans (Phaseolus vulgaris).

What are mandatory requirements?

Food safety: Traceability, hygiene and control

To export dry beans to Europe, you have to comply with strict rules and obligations on food safety. The General Food Law, which regulates food safety in the European Union (EU), also applies to dry beans. Food safety and traceability should be your top priority. Non-compliance can lead to temporary import stops or to stricter control from your origin country. As a supplier, you must make sure to work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

You must also devote attention to the levels of pesticides, contaminants and microbiological criteria.

There are Maximum residue levels (MRLs) for pesticides that might be used on dry beans. Commonly used herbicides such as glyphosate are under observation of an assessment group of EU member states. Glyphosate is currently approved in the EU until 15 December 2022 with a MRL of 2.0 mg/kg in dry beans. Be aware that the MRLs requirements for organic dry beans and for beans used in baby food are much more stringent.

Contaminants such as Aflatoxins and Lead and micro-organisms such as Salmonella, E. coli and Listeria monocytogenes must be absent or within the limits according to European legislation. For example, for pulse crops, the maximum level for lead contamination is 0.20 mg/kg in wet weight (see table 1).

Table 1: Simplified table of EU limits for micro-organisms and contaminants

| Food category | Micro-organisms / contaminant | Sampling plan | Limits | Stage where the criterion applies | |

| n | c | ||||

| Legume vegetables, cereals and pulses | Lead | - | - | 0,20 mg/kg wet weight | - |

| Ready-to-eat foods intended for infants and ready-to-eat foods for special medical purposes | Listeria monocytogenes | 10 | 0 | Absence in 25 g | Products placed on the market during their shelf life |

| Ready-to-eat foods able to support the growth of L. monocytogenes, other than those intended for infants and for special medical purposes | 5 | 0 | 100 cfu/g | Products placed on the market during their shelf life | |

| 5 | 0 | Absence in 25 g | Before the food has left the immediate control of the food business operator who has produced it | ||

| Ready-to-eat foods unable to support the growth of L. monocytogenes, other than those intended for infants and for special medical purposes | 5 | 0 | 100 cfu/g | Products placed on the market during their shelf life | |

| Sprouted seeds (ready-to-eat) | Salmonella | 5 | 0 | Absence in 25 g | Products placed on the market during their shelf life |

n = number of units comprising the sample; c = number of sample units giving values over the limit.

*most buyers of dry pulses will maintain these limits for their imports

Sources: COMMISSION REGULATION (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs and COMMISSION REGULATION (EC) No 2073/2005 on microbiological criteria for foodstuffs

Tips:

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. Find out the MRLs for pesticides and active substances that are relevant for common dry beans by consulting the EU MRL database; search for the term “beans” (code number 0300010) or the type of pesticide.

- Reduce the pesticide levels by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

Phytosanitary control

One of the main risks for common dry beans is infestation by weevil insects, which damages the appearance of the bean and makes them unsuitable to sell as food. Beans with live insects are banned from import. Another issue is preventing the contamination of dry beans with a genetically modified (GMO) crop (often soybean or maize).

When exporting seeds of dry beans (Phaseolus vulgaris) for planting purposes, you must follow strict phytosanitary rules and include a phytosanitary certificate according to Annex XI in regulation (EU) 2019/2072.

Quality requirements

If you are planning to export dry beans to Europe, you will have to meet the right quality standards. There are no specific European standards for dry beans. Instead, it is best to follow the indications of your buyer and the International standard for certain pulses in the Codex Alimentarius, which includes quality requirements for common dry beans (Phaseolus Vulgaris).

For European buyers, dry beans must meet the following requirements:

- Dry beans must be safe and fit for human consumption

- Free from abnormal flavour, odour and living insects

- Free from dirt in amounts that may be hazardous to human health

- Seeds with serious defects: max 1%

- Maximum discolouration 3%

- Maximum moisture level 15% (in tropical climates or long-term storage) or 19% for normal commercial practice.

- Moisture levels must be lower in certain climates or when transported or stored for longer periods

- Extraneous matter less than 1% (of which mineral matter <0.25% and dead insects <0.1%)

- Quality in accordance with EU regulation on contaminants, maximum residue limits (MRLs) and microbiological properties

Packaging and handling

The packaging of common dry beans must be suitable to protect the product and must be conform to the Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food. Common types of packaging for dry beans are polypropylene bags of 25kg/50kg or bulk bags of around 1 tonne. Different buyers may have different preferences.

During transportation and storage common dry beans should be kept in a dry, dark, cool and well-ventilated environment. Almost all types of beans are vulnerable to heat, moisture and infestation by weevil. Moisture may lead to mould, spoilage and self-heating.

Tips:

- Do not mix dry beans from different harvest periods. Older seeds will downgrade the entire lot.

- Make sure shipping containers are clean and protect the cargo from moisture, pests and cross-contamination. Avoiding cross-contamination is especially important for organic produce as well as for keeping your product free of GMO grains and gluten.

- Always discuss specific quality (grade, size) and packaging requirements and preferences with your customers.

- Check the cargo handbook for further information on the handling of dry beans.

What additional requirements do buyers often have?

Certifications as a guarantee

As food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in the form of certification. Food management systems and certifications that are recognised by the Global Food Safety Initiative (GFSI) are widely accepted throughout Europe.

For exporters that process beans (cleaning, drying and packing), a recognised food safety management system is often a requirement to become a supplier to European buyers. Make sure to adopt at least one HACCP-based food safety management system.

Depending on the role you play in the supply chain (production, distribution or processing), you may find one of the following certification schemes useful:

- GLOBALG.A.P. (for agricultural production);

- Food Safety System Certification 22000 (FSSC 22000 /ISO 22000);

- BRCGS for Food Safety (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Tip:

- Check with your buyer to determine which certification scheme is most relevant for your target market.

Sustainability and social compliance

European buyers are paying more and more attention to their corporate social responsibilities concerning the social and environmental impact of their business. As an exporter, you are part of the supply chain and share this responsibility.

Buyers will often have you fill in a set of documents and declarations before doing business or ask you to comply with a code of conduct. Consumer brand companies are particularly interested in showing their good conduct. For example Bonduelle, one of the largest bean canning companies in Europe, monitors the performance of corporate social responsibility (CSR) in their supply chain using the EcoVadis platform.

Applying standards and certifications will help you fulfil the expectations of buyers. Initiatives or certification schemes that can help improve your social status, are:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct;

- The Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA)

- GLOBALG.A.P. and GLOBALG.A.P. Grasp

A consumer label for fair trade practices, such as Fairtrade International and Rainforest Alliance, is a very small niche requirement for dry beans, for which you need very specific buyers.

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance using some of the practical tools in the amfori BSCI resources and implement the amfori BSCI code of conduct.

- Read about the different social programmes and initiatives in the CBI study on buyer requirements for grains, pulses and oilseeds in Europe.

The European Green Deal requires sustainable trade

In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally friendly. It will ensure a sustainable food production and address, for example, packaging and food waste. The new strategy will also favour crops that have a positive environmental impact, which is an advantage for pulses because they are known to fix nitrogen in the soil.

The EU trade agreements with dry bean supplying countries Canada, Ukraine and Mexico already include rules on sustainable development of economic, environmental and social aspects of trade – other countries are expected to follow. For dry bean suppliers, it is important to look ahead of the increasing standards and try to be on the frontline of the developments.

What are the requirements for niche markets?

Organic certification

Organic certified dry beans are part of a developing niche market. Pulses are becoming more popular as a nutritious ingredient for vegan and health-conscious consumers. For the same reason, many of these consumers prefer organic products. Several specialised European buyers are focused on the growing organic market, including Tradin Organic and Rapunzel Naturkost (social and organic).

The supply of organic dry beans does not meet the total demand. To supply organic dry beans in the European Union, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that in January 2022, the new legislation Regulation (EU) 2018/848 will come into force after a year’s delay due to COVID-19. Inspection of organic products will become stricter to prevent fraud, and producers in third countries will have to comply with the same set of rules as those producing in the European Union.

All organic products imported into the EU must have the appropriate electronic certificate of inspection (e-COI), which are issued by a control body that is recognised by the European Union. If you, your client or the inspection body does not create an electronic certificate of inspection, your products will not be released from their port of arrival in Europe.

Tips:

- Consider organic as a plus, but not as a must. Start with trials to see if you can compete in this niche market. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process to market organic products. Read more about organic certification in the study on buyer requirements for grains and pulses in Europe.

- Read about organic farming and European guidelines in this field on the European Union website on organic farming.

- Find importers that specialise in organic products in the International directory of organic food wholesale & supply companies. You can also visit special trade fairs for organic products, such as Biofach in Germany.

2. Through what channels can you get common dry beans on the European market?

How is the end-market segmented?

The common dry bean market is segmented in consumption type or use, such as health food, traditional/ethnic consumption and animal feed. Within the general food segment, you can find different local and imported bean varieties, most often pre-cooked and with a smaller share sold as dry beans or in food preparations.

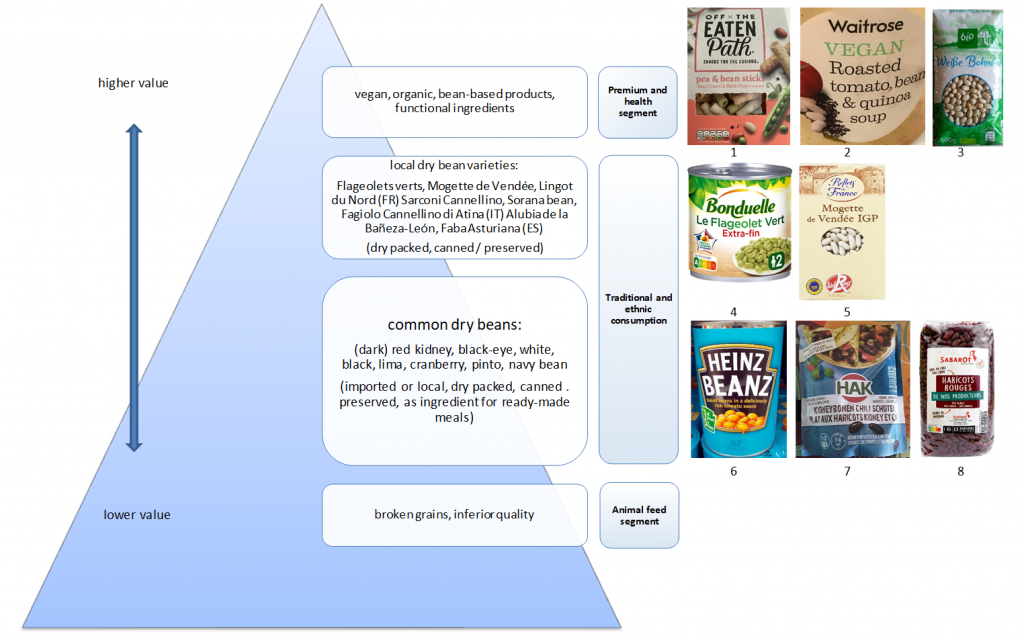

Figure 1: Market segments for dry beans in Europe

Added photos by openfoodfacts-contributors (1), kiliweb (2,4,7,8), twoflower (3), org-carrefour (5), tacinte (6) per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Beans as a health food

While many consumers consider common beans to be an old-fashioned food, it is increasing in popularity with health-conscious people. In the health food segment, beans are often purchased as a vegan and gluten-free protein source and with attention for natural and organic products. Although vegan and ‘healthy beans’ are a niche segment, it presents interesting developments and leads to innovative bean-based products. A report by Agrosynergie and the European Commission estimated that 24% of pulses are used by the food industry for protein products or as functional ingredients.

In 2018, Mintel estimated that 9% of the new product launches in Europe had a vegan claim. And in this vegan trend, pulses can no longer be ignored by mainstream food manufacturers. They are being used in pastas, bakery products, snacks and high-protein food. The University of Hohenheim reported growth between mid-2013 and mid-2017 of legumes in meat substitutes (451%), legume pasta (295%) and bean-based Snacks (128%).

Although chickpeas and lentils have become more popular ingredients over these past years than beans, beans have been used by brands such as De Rit with savoury bean sticks that are available at the Dutch Ekoplaza organic supermarket and Off the Eaten Path, which sells several bean snacks via Amazon in the UK.

The United Kingdom was most innovative in the vegan segment, surpassing the more saturated German market. In the CBI study The European market potential for common dry beans in Europe, you can see that France, the United Kingdom, Spain and Germany have been key countries for product launches containing dry beans in the past.

Traditional and ethnic consumption

The largest segment for food-grade beans is the traditional or ethnic consumption. On the one side, there are consumers looking for an affordable, basic food product, and on the other side, there is a consumer group that is driven by local heritage and quality of origin.

Basic dry bean products are often imported and processed. Although dry beans are often considered out of fashion, they provide a cheap source of nutrition for many consumers. In Northern Europe, the market is strongly dominated by easy-to-cook products such as canned beans and ready-made meals and soups.

Consumers who associate dry beans with local heritage or cuisine typically look for local products. Price is less important. In traditional consumption countries such as Spain, France and Italy, there are many local common bean varieties, some with a Protected Designation of Origin or Geographical Indication (PDO/PGI), such as the Flageolet beans in France, the Cannellini beans in Italy and the protected variety Mongeta del Ganxet (PDO) in Spain.

In Northern Europe, you can also find dominant typical varieties or bean products; such as baked beans (white beans in tomato sauce) in the United Kingdom (see table 2) and Dutch brown beans, one of the most consumed beans in the Netherlands.

Table 2: Purchases of canned beans and pulses in the United Kingdom, in grams per person

| 2013 | 2014 | 2015 | 2015/2016 | 2016/2017 | 2017/2018 | 2018/2019 | |

| Baked beans in sauce | 87 | 80 | 83 | 82 | 72 | 78 | 82 |

| Other canned beans and pulses | 17 | 17 | 17 | 17 | 20 | 22 | 24 |

Source: Statista

Feed sector

The animal feed sector is an important segment for protein crops. An estimated 45% of the European production of dry pulses and protein crops other than field peas, broad/field beans and sweet lupins, is used for feed purposes. These include dry common beans, runner beans, chickpeas, lentils and dry vetches. The general quality is inferior to food-grade beans and often a left-over from European production. In import, low-grade conventional beans has to compete with cheaper soybean and is therefore less common. Therefore, the use of imported common dry beans (Phaseolus vulgaris) as feed is almost non-existent.

Tip:

- Adapt your product to the suitable segment: When supplying beans for canning or further processing, you must be price-competitive and focus on bean varieties that maintain their integrity when cooked, while for dry packed beans, size and appearance become more important. In the health segment, your principle way to differentiate is by selling organic beans. All segments work with dry beans as a raw material.

Through what channels does a product end up on the end-market?

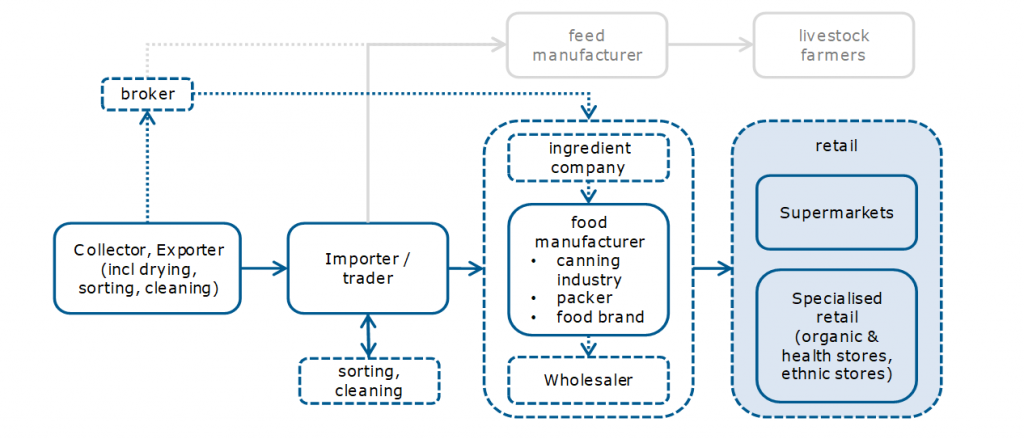

Supply chains for common dry beans are usually short and often partly integrated with large producers and food manufacturers, but importers and specialised sourcing companies still play an important role as well, especially when beans are imported from smaller suppliers.

Figure 2: Market channels for common dry beans in Europe

Importers or trader

Importers and traders that are specialised in pulses and dry ingredients belong to one of the main channels for common dry beans, especially when sourcing in developing countries or trading niche varieties. The main role of the importer is to ensure a quality and reliable supply of beans, which includes matching supply and demand, food safety and quality control, supply chain management and checking for compliance with sustainability standards.

There are importers of different sizes, varying from large, integrated trading companies such as AGT Poortman, an international importer, distributor and stockist of pulses including beans, to smaller importers such as Casibeans, which is specialised in sourcing several bean varieties.

The selling counterpart of an importing company is often a producer or a collector of beans that can secure a certain supply and has basic processing facilities (drying, cleaning and sorting).

Brokers

Brokers can act as intermediaries in the trading of dry beans. They facilitate the supply of trading companies, millers and food processors and help sell surpluses on the market. Unlike importers they do not become owners of the product; instead they take a commission from their clients on the sale of dry beans to a customer. The advantage for European buyers is that they can purchase efficiently (and low profile) despite the variations in production volumes and available qualities.

Brokers are often individuals or small companies, such as Cogeser. Despite their small company size, brokers can move significant volumes. Most of these brokers focus on bulk, but with an extensive network they can trade more specific varieties or organic dry beans as well.

Food manufacturer

The food manufacturing industry consists of canning companies, packers, processors and food brands.

There are several food companies that will buy common dry beans directly from local producers or exporters, especially companies that have beans as a core product, such as Pedon, La Doria Group (Italy), Luengo (Spain) and Sabarot (France). One of the largest processors and packers of beans in Northern Europe is Müller’s Mühle (Germany). Local suppliers are often preferred, but the European supply is insufficient to fulfil the demand.

Leading brands and canning companies are often well integrated with their suppliers and have processing plants in several countries. For example, Bonduelle (France) works with 3100 farmers and manages 56 processing facilities. These types of companies also maintain strict rules of compliance. Food manufacturers and brands also need a stable (contracted) price, reliable supply and consistent quality.

The channel of processed beans also includes specialisations, including organic brands such as La Bio Idea and ethnic food companies such as Unidex, which distribute foreign bean brands. Private label is also a common channel, which includes canning companies such as Coroos (Netherlands), Acico (Spain), but also food developers such as Schouten Food (Netherlands), a developer of plant-based foods such as a vegan bean burger. These companies supply products according to retail specifications.

Ingredient companies

While pulses are renewing their status as a health food, you can expect more companies to experiment with beans as an ingredient. This means that, in the future, there will also be more opportunities with ingredient companies that develop and commercialise bean flour and protein.

As an exporter of common dry beans, it will be interesting to follow new product developments, but to sell your dry beans you will still be dependent on the main importing channels. Common dry beans are not the first choice as a special ingredient, mainly because other pulses such as peas, fava beans, lentils and chickpeas are preferred either due to their superior protein, ease of use, availability or price.

The company Ingredion has developed a pulse protein, derived from pea, lentil and fava beans under the brand name Vitessence, and Roquette markets pea protein under the name Nutralys. The expertise of these companies is ingredient innovation, leaving the sourcing of raw materials with the experienced importers.

Tip:

- Visit the Food Ingredients Europe trade fair to get the newest insights in the use of pulses as an ingredient. You can also see examples of leading companies by tracking the plant-based protein movement on Fooddive or find ingredient companies that work with plant protein on the website of the European Vegetable Protein Association (EUVEPRO).

What is the most interesting channel for you?

The trade channels for dry beans are well developed, which means that businesses are mature and experienced. Suppliers are selected based on product quality, availability and supply stability. As an exporter, it is important to have a cleaning and bulk packing facility, or at least have access to one.

A large part of the non-European dry beans arrive in Europe through importers that are specialised in trading, such as Casibeans (Belgium) and/or managing local brands such as Sabarot (France). Importers and specialised sourcing companies can facilitate your market entry and get your product into the distribution and manufacturing channels. These are the companies you should aim for as a foreign supplier. Their role is to source the best dry beans and make sure the products meet the required standards.

If you are able to supply large volumes from your own production and work with fixed-price contracts, you can also explore the possibility of supplying through the major manufacturing channels to large canning companies such as Bonduelle (France) and processing companies such as Müller’s Mühle (Germany). You need to have excellent internal quality control and be ready for demanding clients.

Tips:

- Use the online shops of supermarkets to see what the leading brands are. To meet private label producers and their retail clients, you could spend some time at the private label trade show PLMA in the Netherlands.

- Find potential buyers by presenting your products at the major food trade fairs such as Anuga and SIAL. Both fairs also have exhibitor lists you can dive into.

3. What competition do you face on the European common dry bean market?

Generally, the strongest competition comes from large farms and producer groups, many of which can be found in Canada, the United States and Argentina. Size is the key to competing in bulk supply. Price and available quality play an important role and buyers can change supply sources annually.

Which countries are you competing with?

Canada, Argentina and the United States are major suppliers of dry beans to Europe. These countries are known for their good quality and reliability. A declining volume from China, Europe’s number four supplier, offers opportunities for both regular and new supplying countries to increase their export.

There is an increasing volume that finds its destination in Europe via processing in Turkey. Turkey is not yet among the main dry bean suppliers, but their import and export activities are increasing – for example, there is an increasing import (and re-export) of dry beans from Ethiopia. Several European buyers use Turkey as a transit hub for processing purposes. Companies such as Armada Foods provide additional grading and cleaning services which allows European buyers to source the right quality dry bean that is suitable for their market regardless their origin.

Canada: preferred supplier

Canada is the world’s largest producer of lentils and dry peas, but it is also a preferred country for European buyers of dry beans. Although the country is not among the largest dry bean producers, it has a solid reputation and is able to deliver a reliable and high-quality volume of dry beans for human consumption. The European import has been very steady, with 135 thousand tonnes in 2020.

Canada's largest bean crop is white pea bean (navy bean), so most of their export is directed to the United Kingdom. The United Kingdom is a large consumer market for baked beans (processed navy beans) and imported 61.6 thousand tonnes of dry beans (mostly navy beans) from Canada in 2020. However, the UK import has been declining in favour of the United States. Italy was the second largest European importer with 33.3 thousand tonnes. Canada also grows significant quantities of pinto, cranberry, black, dark red kidney, light red kidney, great northern, Dutch brown, pink and small red beans. Smaller quantities of Azuki, Kintoki and Otebo beans are grown under contract.

According to Statistics Canada, pulses are grown mostly by large farms with on average more than a thousand hectares, and the concentration of fewer, bigger farms is increasing. Ontario has the largest area of dry bean production, followed by Manitoba and Alberta. Between 80-90% of the beans grown in Ontario are exported. Organisations such as the Ontario Bean Growers invest in resources to increase yield and reduce agronomic risks.

Argentina: strong connection with Spain and Italy

Argentina has, similar to Canada, big farms that are able to produce grains and pulses on a large scale. The production consists mainly of white alubia beans and black beans. Smaller production quantities of other common bean types include cranberry beans, light red kidney and dark red kidney beans.

Its main European destination markets are Spain and Italy, which mainly import white beans. Spain purchased 40.4 thousand tonnes from Argentina in 2020, which was around 25% higher than previous years and an estimated 70% of their total import of common dry beans. Italy also imported more than usual in 2020, reaching a volume of 36.5 thousand tonnes from Argentina, 4.6 thousand tonnes more than in 2019.

However, the level of organisation and private-public cooperation is less developed than in north-America. A Harvest Trade Mission Report of the US Dry Bean Council in 2019 pointed out the risks and costs that Argentina faces in competing in the international markets due to economic instability, export tax and the lack of organised seed breeding.

United States: leading producer will struggle with European tax regime

The United States is one of the leading producers of common dry beans. According to the statistics of the United States Department of Agriculture (USDA) the production volume of dry beans (excluding chickpeas) in 2020 was approximately 1,495 thousand tonnes, after a dip in 2019 of (only) 941 thousand tonnes. The states with the largest shares of dry bean production are North Dakota (32%), Michigan (17%) and Nebraska (11%). The most popular beans are pinto beans, black beans, navy beans, kidney beans and great northern beans (see figure 4).

According to the US Dry Bean Council (USDBC), approximately 20% of American-grown beans are shipped to international markets. In 2020, around 67 thousand tonnes were imported by the European Union. Italy and the United Kingdom are relatively large buyers of American dry beans. Italy imported 27.7 thousand tonnes of mainly dark red kidney beans and navy beans and the United Kingdom imported 22.6 thousand tonnes of, almost exclusively, navy beans.

In general, the United States is a competitive, high-level player in the dry beans sector. It has the support of the US Dry Bean Council (USDBC), which conducts export promotion programs, and several research institutes that help develop new insect and disease-resistant dry bean varieties.

However, commercially, the country has lost its advantage on the European market since June 2018, after the imposed import tariff of 25% on common dry beans and kidney beans, and many other (food) products. This regulation (EU 2018/886) was a response to the US tariff increase on imports of certain steel and aluminium products from the European Union. It is unsure when these trade measures will be removed as there is no end date for them. So for now, exporters from other producing countries can benefit from this trade barrier.

Tip:

- Check out your competition from the northeast United States on the website of Northarvest Beans, selecting dealers per bean type and region, or on the supplier directory of the Michigan Bean Commission.

China: declining dominance on European market

China’s production of common dry beans is gradually increasing and was above 1.3 million tonnes for three consecutive years (2017-2019). Europe imports a small part of this production; 38.2 thousand tonnes of Europe’s import in 2020 was of Chinese origin. China is also known as one of the largest organic producers of pulses. But volumes have dropped significantly from 72.7 thousand tonnes in 2016. The reason for this is the growing internal demand in China, which leads to a lower availability for international buyers, increasing prices and causing issues in bean quality and contamination.

Italy is still China’s largest buyer, with 16.4 thousand tonnes in 2020, but imports are decreasing year-on-year. Far behind follow importers from the Netherlands, the United Kingdom and Greece, with total volumes of 3 to 3.5 thousand tonnes.

For example, Chinese dark red kidney beans no longer control the Italian canning market as they did before. Some buyers are looking for new sources with superior quality and a more reliable supply. In the organic trade, buyers are also moving away from China, due to decreasing trust in China’s compliance with organic standards.

Ethiopia: smallholders face difficulties in export to Europe

Ethiopia has managed to become one of the larger suppliers of common dry beans to Europe, mostly white pea beans. The country exported 25.6 thousand tonnes to Europe in 2020 and has showed continuous growth since 2017. Portugal is currently their most important market in Europe, importing 8.2 thousand tonnes of dry beans in 2020. For Portugal, Ethiopia is the second-largest non-European supplier after Argentina. Belgium (4.0 thousand tonnes) Italy (2.9) and Bulgaria (2.7) were also relevant importing countries of Ethiopian dry beans in 2020.

Ethiopia has potential to grow as a dry bean supplier if the value chains are further developed. The problem is that most farmers are very small and do not have access to the same modern technology or commercial cooperation as large-scale producers in developed countries. For small producers, it is more difficult to meet the quality and volume requirements of large European buyers and retailers. Another aspect that does not help the buyer’s perspective and their social compliance, is the fact that Ethiopia regularly suffers from famine.

Navy beans are traded through the Ethiopia Commodity Exchange, but Ethiopian farmers will remain dependent on external facilitators, investments and intermediaries to realise export growth. Intermediaries can combine product volumes, but besides an economy of scale, they also need export knowledge and must achieve the right quality standards. This way, Ethiopia could become a larger international source for common dry beans or promote the ethical trade of smallholder beans.

Egypt: geographical advantage

Egypt is primarily a supplier of dry beans to northern Africa and the Middle East, but it also supplies several countries in Eastern Europe such as Romania and Bulgaria, which imported 14.1 thousand and 6.2 thousand tonnes from Egypt respectively. In total, the European Union imported 22.9 thousand tonnes of common dry beans (mostly white kidney) in 2020.

Egypt is a big producer of white kidney beans. These may not have the size or attractiveness of the large white alubia beans of Argentina, but their price is very convenient for processors and low price buyers. Egypt is also ideally positioned, close to Europe, and Eastern Europe in particular. These advantages will favour the Egyptian supply in the coming years.

Tips:

- Improve your efficiency in producing, harvesting and processing dry beans. Besides quality and reliability, price is the main aspect to make a difference in bulk supply. Try to learn from growers in other countries or find help to improve your business, for example by getting advice from senior expert volunteers from PUM in the Netherlands.

- Check if there is a trade promotion organisation locally or in Europe that can help promote common dry beans from your country. Many countries organise trade fair pavilions with reduced rates and invest in building a reputation as a supply country.

- Look for typical local beans in your country that are unique to your region, to differentiate yourself and discuss with specialist buyers in Europe if they see a market for them.

Which companies are you competing with?

AGT Food and ingredients: size matters

One of the biggest companies in pulses worldwide is AGT foods, a Canadian company that buys lentils, peas, beans and chickpeas from farmers in Canada, the United States, Turkey, Australia, China and South Africa. They own over 40 international production facilities for cleaning, sizing, splitting, colour sorting and packaging and, according to the company, their production represents nearly 45% of the global market. AGT Foods is a market leader in lentils and chickpeas, but they also trade in common dry beans such as navy beans, pinto beans, dark and light kidney beans, black beans and white beans.

Their size and their international presence makes them one of the largest buyers as well as exporters of dry beans. They are able to offer farmers seed programmes and an online portal to market their crops.

Large companies such as AGT Foods focus on bulk products and are less equipped for (and less interested in) niche products, which leaves room for non-bulk suppliers.

Hensall Co-op: success through cooperation

Cooperation and scale are important for farmers of dry beans, to build marketing power. This is exactly what Hensall Co-op has achieved in becoming one of the largest non-financial co-operatives in Canada with over 6,000 member-owners and more than 30 owned locations in Ontario and Manitoba. Hensall Co-op focuses on edible dry beans and other commodities, providing crop services and full service marketing to their member farmers.

Desdelsur: integration of crops and livestock

Combining production capacity with different businesses can be a successful strategy. It is a strategy that companies such as Desdelsur (DDS) follow by integrating the production and processing of different crops with livestock.

Growing and exporting common dry beans, such as alubia, cranberry beans, black, dark and light kidney beans, is only a part of their business. By combining different business models, the company can better spread its risks, while creating synergy between different activities (for example by making their own feed for their livestock). The disadvantage of such integration is that a larger team and different professionals are needed to manage all these activities.

Tips:

- Diversify your product assortment and/or scale up your production to become attractive to buyers and compete with leading suppliers. You can do this by working together with a number of farmers and organising sufficient capacity for the primary processing of beans. Up-to-date certifications and food safety management are a pre-condition (see requirements above).

- First become successful on your local and regional market and use this experience to expand. Use the right timing to approach European buyers with quotations. The market conditions vary year to year, and you will find the best opportunity when buyers in Europe are having difficulties in finding sufficient volumes of dry beans. Do not assume that you will always get a better price on the European market.

Which products are you competing with?

Consumers can switch easily between different types of dry beans or simply purchase the product they are most familiar with. For traditional dishes, the preference for a certain type of bean is more determined.

Consumer-packed dry beans, such as kidney beans, are most easily substituted with pre-cooked or canned beans or other dry pulses that are more convenient for cooking, such as lentils.

To avoid becoming dependent on one dry bean variety, you can include different types in your offer or even consider processing dry beans into bean flour or convenience products. Before doing so, you need to make sure to have a market for these products. The growing interest for plant protein could give a boost to the use of processed pulses. However, soy and pea protein are generally more attractive for the food industry as a nutritious ingredient than bean protein, because of their high protein content and low price.

Tip:

- Try to match your product with a specific supply channel or target group in Europe. Check with Globalpulses.com for network events and conferences where you will have an opportunity to speak with other dry bean professionals about the trends in demand.

4. What are the prices for common dry beans on the European market?

Dry bean prices vary according to the variety, quality and availability. High-quality beans such as large white beans (alubias), dark red kidney beans or cranberry beans can be sold for between 700 to 1000 euros per tonne (FOB), while bulk pinto beans and navy beans fetch around 450 to 550 euros per tonne on the export market, depending on market conditions. Based on the price history in the United States, one of the leading producers and suppliers, the average bean prices peaked in 2012, after which it gradually returned to the lower values of 500 euros per tonne (see table 2). The recent Covid-19 pandemic increased the demand for pulses, raising prices again as well as logistical costs.

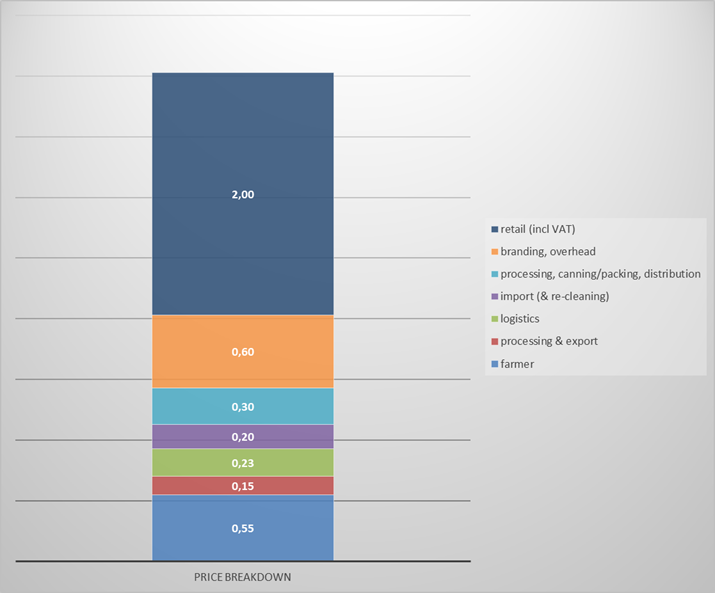

Retail prices vary little between varieties, dry and canned beans. By pre-cooking beans, additional weight is added (approximately 2.5x), which compensates for the costs of processing and canning. The highest margins (and costs) are made in the branding and retail sales of the product (see indicative price breakdown in figure 6).

Retail prices for regular dry beans in Europe vary between 2.5 and 5 euros per kilo. Canned beans go for similar prices of 2 to 5 euros per kilo. The package size makes a big difference for the final consumer price per kilo. For exporters, it is important to realise that trade prices and retail prices are not directly linked and behave in their own way.

Figure 6: Indicative breakdown of the consumer price for edible common beans, packed in smaller consumer volume, value in euros per kilo

Source: based on various sources and calculations

Tips:

- Find weekly price information for different common dry beans in the United States as a guideline using the information on market prices of the US Dry Bean Council or the Dry Edible Bean Market News Summary of the United States Department of Agriculture (USDA).

- Find information on the consumer prices in Europe for dry packed beans, canned beans and other bean products in online shops or the websites of supermarket chains, such as Tesco, Albert Heijn, Supermercados Mas or Carrefour.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research