The European market potential for common dry beans

The biggest markets for common dry beans in Europe include Italy and the United Kingdom, traditional consumer groups and the dominant bean canning industry. Recent developments in convenience products and the increasing popularity of plant proteins give an optimistic view to the growth potential of dry beans. Food companies have been making beans more attractive to consumers and European buyers have become more interested in new supply sources, quality and bean diversity.

Contents of this page

1. Product description

The common bean (Phaseolus vulgaris) is native to the Americas, but has a long history of cultivation worldwide. Similar to other beans, the common bean is high in starch, protein and dietary fibre.

Dry beans are the mature seeds from a shelled bean pod which are dried after harvest. Besides their use as dry beans, some varieties are also sold as snap beans including the pod or pods with immature seeds.

In Europe, dry shelled beans are generally sold dried, pre-cooked in cans or as an ingredient in ready-made meals, salads and soups. In more specialised outlets, you can also find bean flour and extract, mostly from white beans. For canned beans, see the CBI study on exporting canned beans and pulses to Europe.

The common bean is a species with lots of varieties that include the kidney bean (named after its kidney shape), the navy bean and the pinto bean. There are many subvarieties in various sizes and colours.

This study focuses mainly on exporting dry kidney beans, the principle bean in the common dry beans category (Phaseolus vulgaris), and all subvarieties under product code HS 07133300 of the international Harmonized Commodity Description and Coding System: Kidney beans, including white pea beans (Phaseolus vulgaris).

Table 1: Typical common beans in the European market

| HS 07133300 Kidney beans, including white pea beans (Phaseolus vulgaris) | |

| Most common |

|

| Regular or specific/typical local |

|

| Less common |

|

2. What makes Europe an interesting market for common dry beans?

Common dry beans are the most popular dry bean variety in Europe

Common beans such as kidney beans are the most popular dry bean consumed in Europe. After dried peas, the common bean is also the biggest dried leguminous vegetable imported into Europe. With kidney bean varieties you will have the best chance to enter the high-volume dry bean market.

Common dry beans of the Phaseolus vulgaris species are some of the most imported dried, leguminous vegetables in Europe (excluding soybean, which is often regarded as oilseed crop). In 2020, Europe imported a value of around € 473 million of common dry beans, mainly kidney beans. With this volume kidney beans leave imports of other bean varieties far behind, such as mung beans (€ 40 million), cow peas (€ 10 million) and other beans of the Phaseolus and Vigna varieties (€ 35 million).

The varieties of common dry beans in European retail sales can be diverse, varying from red kidney beans to white navy beans and also typical European varieties such as French flageolets. All these are available both dried and in cans.

Tips:

- Make sure you can offer consistent quality and volumes when targeting high-volume markets. Most bulk dry bean buyers are experienced and have worked out an efficient, problem-free supply chain.

- Do store checks in Europe to find out which varieties are sold by different retail chains throughout Europe and how they are presented.

Underdeveloped consumption and import dependence provide opportunities for bean suppliers

Compared to many other countries in the world, the bean consumption in Europe is relatively low. The demand for beans has room to grow, especially now that they are promoted as a popular and affordable source of protein. The COVID-19 pandemic in 2020 boosted the demand for healthy, shelf-stable food such as beans. Europe’s high dependence on imported beans will provide opportunities for foreign suppliers.

Demand and prices have gone up during COVID-19

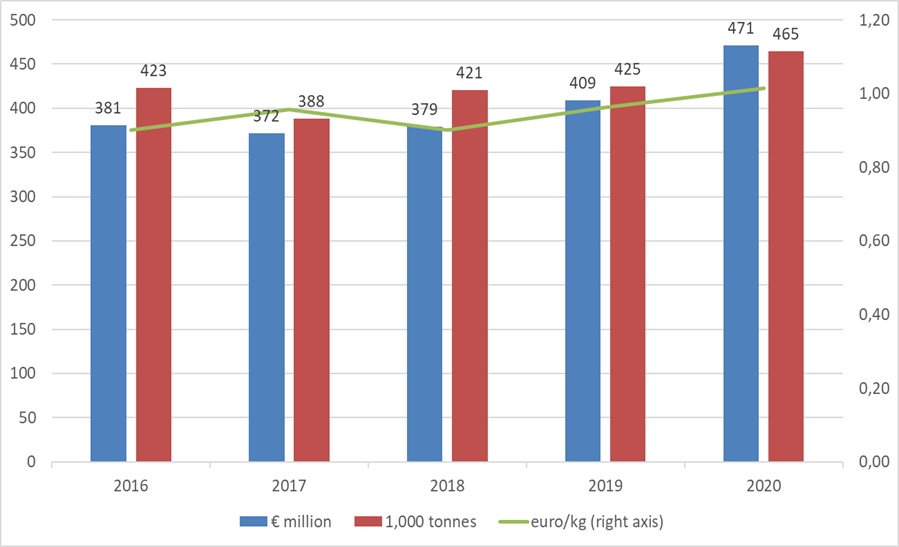

During the COVID-19 pandemic, consumer demand for preservable and healthy food has risen. This can be clearly seen in the overall 2020 growth to 465 thousand tonnes, nearly 10% more than the year before. At the same time bean prices have increased, as well as their logistical costs. In the trade statistics prices were 5% higher in 2020 than in 2019 and 10% higher compared to the years before that. In 2021, prices for dry beans and transport continue to increase: the latest USA production 2020/2021 has been ravaged by drought. The East-West shipping routes have experienced congestions, delays and poor container availability. All this has complicated logistics and pushed up freight prices.

Low pulse consumption leaves room for growth

The European consumption of common beans is low compared to the rest of the world. It also means the potential consumption is far from saturated and the sector can benefit of this underdeveloped market by creating new ways of promoting dry beans.

A rough estimate indicates an average annual consumption of 0.8 kg of common beans per capita in Europe. This is not much when considering the common bean is one of the main dry beans for human consumption in Europe. It is also a fierce contrast to the largest consuming regions, among which are western Kenya, Rwanda and Burundi, where people eat almost their body weight in beans every year: approximately 50–60 kg. Consumers in these countries depend on pulses as their principle source of protein.

In the United States, consumption of common beans is estimated somewhere between 2.9 kg per capita and almost 4.4 kg (9.62 lbs), mainly thanks to the popularity of pinto beans. It is uncertain to what extent foreign influences, for example from the United States, can change European habits. Either way, the underdeveloped consumption of kidney beans and other beans leads analysts to believe there is room for growth.

Europe depends on imports

Europe’s dry pulse production is mainly focused on dry peas and fava beans, which are often destined for animal feed. Only few common and kidney bean varieties are produced locally, which means that most of these beans are imported. A very minor volume is re-exported, making Europe a net importer of 445 thousand tonnes of kidney beans in 2020. In short, when the demand for kidney beans increases, so will imports.

Figure 2: European imports (EU-27 & UK) of common dry beans from non-European sources, in value and volume

Source: Eurostat, Access2Markets and ITC Trademap (UK data)

Tips:

- Use the Helgi Library data about beans to roughly compare different countries’ per capita consumption.

- Follow the trade talk on Pulse Pod to hear industry professionals talk about the latest developments in dry beans and other pulse crops.

Beans and bean flour are popular in new product launches

Pulses are becoming more popular as an ingredient in new product launches. The most popular bean ingredients are white beans, black beans and bean flour. Most kidney beans are still sold as canned or dry pulses, but product diversification is a good sign of a developing market. Selecting the right variety can be challenging.

Europe was a leading market for new bean-based vegetable products in the period of 2016 to 2020, according to Mintel. In the period before (2012 to 2016), beans were used in 25.7% of the new products with pulses. White beans, black beans and pinto beans are often launched as a vegetable or in prepared meals. Bean flour is popular for sandwiches, wraps, bread and bread products.

Innova Market Insights points out that plant-based claims on products, such as plant proteins, have increased by 62% globally between 2013 and 2017 (CAGR). At the Anuga fair in 2019, Innova said that legumes are seen as one of the top foods in people’s diets for the long term. The demand for healthy proteins and fibres is still going strong, although kidney beans are not always the first choice. For isolated proteins, peas and fava beans are the most common pulse to use in the protein industry.

Tips:

- Verify exactly which type of dry bean your buyer wants. Sometimes beans can be interchanged, but in other cases the characteristics need to be more specific. It is best to send a representative sample of your product before a large shipment.

- Understand the differences between similar beans in taste and size, for example, by comparing the white bean varieties of brands such as Camellia and Bonduelle, or by looking up bean varieties of The Bean Institute and the US Dry Bean Council.

Europe is interested in new reliable sources

European buyers are looking into new supply sources, while important suppliers, such as China, are losing market share. These changing trades create opportunities for you as a supplier, if you are able to comply with the European requirements and compete on volume and price. Countries with many smallholder farmers face extra challenges in terms of reliable and consistent exports.

Lower exports from China create opportunities for other suppliers

China has a fast developing internal market and their exports to Europe are decreasing. For example, Chinese dark red kidney beans no longer control the Italian canning market as they did before, while North-American suppliers have taken over with consistent and superior quality, and forward contracting.

European buyers admit having an interest in finding new reliable sources besides China, especially for organic beans. But they also look close to home within Europe or nearby in Ukraine. The European import of Chinese common dry beans declined by more than 50% between 2016 and 2019 to 34.4 thousand tonnes. The Chinese supply increased again in 2020 due to the stronger demand during the COVID-19 pandemic. However, freight prices exploded in 2021, so it is uncertain whether the higher trade volume will be long-term. Bean suppliers in Argentina, Ukraine, Turkey and Ethiopia have compensated for the decreasing supply from China in recent years.

Successes and failures at linking traditional suppliers to the European market

For traditional producers of beans, often smallholders, it is not easy to enter the global supply chain of kidney beans and other common beans. Small farmers must be well organised in commercial producer groups to do so. Selina Wamucii is a Kenyan company that has been bringing smallholder produce to international markets successfully, for example, trading common dry beans from Tanzania.

But projects to help build sustainable supply chains with smallholders do not always work out. A development project to link new intermediaries and bean farmers in Ethiopia to formal markets between 2008 and 2011 proved to be a complex process. Buyers are often reluctant to work with new suppliers, especially from origins they are not familiar with.

Nevertheless, buyers are also keen on new sourcing options for dry beans. As a supplier, you should try to look for those buyers more willing to work with small farmers, for example, fair-trade oriented companies, such as Rapunzel or Suma. When dealing with traditional, sceptical buyers, you must be able to assail their concerns by assuring reliable and competitive supplies.

Tips:

- Learn more about your competition in the CBI study about entering the European market for kidney beans and other common dry beans.

- Find potential buyers among the members of pulses associations, such as The Global Pulse Confederation, or searching through the exhibitors at large food trade fairs, such as Anuga and SIAL.

- Be prepared to work with forward contracts, agreeing on a fixed volume and price, but also be prepared to comply with other contractual and quality agreements. Non-compliance can have serious consequences for your reputation as exporter.

3. Which European countries offer most opportunities for common dry beans?

Traditional bean consuming countries in Europe are in the Mediterranean region, including Italy, Spain, Portugal and France. The United Kingdom leads in bean consumption in Northern Europe, a region which is generally open towards new food products and convenience. Other opportunities can be found in demand for organic beans, for example in France, and in the adoption of sustainable policies to attract large bean buying companies.

Table 2: Product launches containing beans in European countries with significant bean consumption 2010–2014

| Country | 2010 | 2011 | 2012 | 2013 | 2014 | Total |

| France | 30 | 40 | 47 | 60 | 40 | 217 |

| UK | 33 | 36 | 45 | 60 | 25 | 199 |

| Spain | 11 | 11 | 22 | 63 | 38 | 145 |

| Germany | 11 | 19 | 17 | 32 | 24 | 103 |

| Italy | 6 | 9 | 3 | 27 | 18 | 63 |

| Ireland | 2 | 0 | 4 | 12 | 14 | 32 |

| Netherlands | 3 | 4 | 2 | 11 | 11 | 31 |

| Poland | 0 | 1 | 1 | 12 | 7 | 21 |

Source: Agriculture and Agri-Food Canada

Italy: Leader in importing and canning common dry beans

Italy is the largest importer of common dry beans in Europe, with € 128 million in 2020. Exporters looking into supplying to the bean processing industry will find the best chances in Europe in Italy.

Dry beans used to be an important food source for Italian consumers, but consumption has decreased over the past decades and has been partly replaced by canned beans. Typical Italian beans such as white kidney beans (cannellini) and cranberry beans (berlotti) are still popular gourmet products.

The real opportunity for exporters can be found in the processing industry. The Italian bean canning industry is a leader in Europe, making Italy the world’s biggest supplier of prepared and preserved beans. This is also the reason why Italian dry bean imports are high. The United Kingdom is the biggest market for Italian canned beans, including products such as baked navy beans. Germany comes second.

Companies such as Gruppo La Doria are crucial to maintaining Italy’s lead position in processed beans, such as canned baked beans, red kidney beans and ready-made bean soups, like traditional minestrone. The company claims to have produced 288 thousand tonnes of pulses in 2020.

Despite the processing capacity, Italy is not the most innovative country when it comes to new product development. However, Italy’s longstanding experience is expected to propel the country into a bigger role in the near future. More importantly for exporters, Italian processors depend heavily on imported beans.

Tip:

- Read the CBI study about exporting canned beans and pulses to Europe if you want to export canned beans.

United Kingdom: a broad market

The United Kingdom is an important market for kidney beans and navy beans. As an exporter you can find opportunities in different market segments such as new and healthy product launches, convenience products and traditional foods.

Kidney bean imports in the United Kingdom are relatively stable. The year 2020 was no exception with an import volume of 94.2 thousand tonnes, only slightly higher than the 5-year average. Most of this non-European supply came from Canada and the United States. Around 10 thousand tonnes were sourced in developing countries. The additional volume from European suppliers (mainly Italy) topped it off to 100 thousand tonnes.

Kidney beans are part of traditional consumption in the United Kingdom. A large community of Indian descent consumes especially red kidney beans, while navy beans are largely consumed as baked beans, a typical British dish of white beans in sauce. British and Irish people are the largest consumers of baked beans in the world, respectively 5.6 and 4.8 kg per capita per year. Baked beans were responsible for around 77% of the canned bean purchases in the United Kingdom in 2018/19. The Kraft Heinz Company is the market leader in baked beans and sets the standard, including in ethical sourcing.

Product development is an extra impulse for non-traditional consumption growth. Between 2010 and 2014, 199 products containing beans were introduced to the British market. Although many products focus on the consumer interest in convenience products, some of the innovations, such as organic kidney beans or snacks with bean flour, cater to consumers who want to eat healthier. The UK market for vegan and gluten-free products is also developing, with organisations such as Diabetes UK actively promoting pulses for their nutritious benefits.

Traditional consumption of canned and dry beans will remain as the principal market for red kidney beans and navy beans. But other market segments, such as vegan and healthy, can also be interesting to explore. In these segments, you must pay extra attention to quality and consider organic production.

Tips:

- Download the Supplier Guiding Principles of the Kraft Heinz Company to see what can be expected from a supplier of beans.

- Decide which market you are able to supply to in the United Kingdom. For example, large bulk importers and processors have more demand for big volumes of navy beans. Small and more specialised companies will be a better target for specific beans and organic beans for new and healthy product launches. Beware that product requirements for different market segments may be very different.

Spain: common beans as traditional food

Spain is an important consumer of common beans and one of the main producing countries in Europe, yet most of its dry bean supply is imported. Exporters of both white and red kidney beans have potential opportunities in Spain, thanks to the country’s cuisine, much like in Italy and the UK.

Legumes are a fundamental part of a traditional diet in Spain, one of the largest consumers of pulses in Europe. Approximately 29% of Spain’s pulse consumption consists of beans, slightly less than chickpeas and lentils. Spanish consumers generally use white and red kidney beans in stews or salads. Changing consumer habits have decreased consumption of dry beans in favour of canned beans according to a USDA Report; their consumption volumes became similar in 2016-2017. There is no specific information on the consumption of kidney beans or other specific bean varieties.

In general, pulses (including kidney beans) continue to play an important role in traditional Spanish food, making Spain one of the main producing countries in Europe. Spain has typical local varieties, such as caparrón, a red kidney bean variety, but imported kidney beans are widely available as well. Irrigated cultivation supports 60% of Spain’s dry beans production, which is therefore more stable than chickpeas and lentils. The production of kidney beans and common dry beans (Phaseolus vulgaris) is usually between 15 and 20 thousand tonnes. This volume is much too low to fulfil the demand in Spain.

The dependence on external supply is significant: more than 50% of the demand for pulses and even up to 75% of the demand for dry beans. This scenario will continue to provide a market for exporters, although the demand is shifting gradually towards the canning industry. It is also understood by professionals that part of the pulses is re-exported after import and processing.

Most imported beans originate in Argentina. Kidney bean exporters from Latin America, such as those from Argentina and Bolivia, have an advantage due to a shared language and historic trade ties with Spain.

Table 3: Production of pulses (for human consumption) in Spain, in 1,000 tonnes

| Pulse crop | Harvest | 2016 | 2017 | 2018 | 2019 | 2020 |

| Dry beans | September - October | 17.8 | 19.7 | 17.1 | 15.1 | 17.6 |

| Chickpeas | June-July | 37.4 | 56.5 | 91.5 | 48.1 | 45.1 |

| Lentils | June-July | 29.8 | 24.4 | 42.8 | 35.7 | 46.4 |

Source: Ministerio de Agricultura, Pesca y Alimentación

Tip:

- Spain is a traditional market, so try to present beans to Spanish buyers which are similar to the beans Spanish consumers are used to. Look into some of the Spanish local varieties on Mundosabor.es (in Spanish).

France: Number one in bean-based product launches

France is among the top importers of common dry beans in Europe. French consumers have a general preference for locally produced pulses, but active promotion of pulses and bean-based product development will benefit consumption growth and keep demand up for quality foreign supply.

Recent data into the French market indicates that more than 85% of French consumers do not eat the recommended amount of lentils and pulses. This may change after the French National Health and Nutrition Programme (PNNS in French) endorsed consumption of pulses, recommending consumers to eat legumes and pulses at least twice a week. The introduced Nutri-Score labelling that informs consumers about the (un)healthy and nutritional aspects of a product, will also have an impact on the purchases of healthier food options. In 2020, 18% of the consumers say they used Nutri-Score to assess the nutritional quality of their purchase.

National promotion of pulses are a welcome helping hand to the new products being introduced in French market. France performs extremely well in product development, launching 217 new bean-based products between 2010 and 2014. This was more than any other European country, including other important consuming countries, such as the United Kingdom (199 product launches) and Spain (145 product launches).

Interest in using beans as ingredients is strong in France, but according to buyers, demand is stronger for locally produced and organic pulses. The French retail recorded the highest growth in organic food sales in Europe in 2019 (13.4%), although for pulses these sales are often strongly related with the domestic cultivation.

France produces typical local beans such as flageolets, but also a minor volume of white and dark red kidney beans. However, much of the needed volume, especially kidney beans, has to come from abroad. Argentina, Canada and the United States are the largest bean suppliers to France, but there are also varying volumes from Ethiopia, Madagascar and Myanmar. As an exporter, keep in mind that the French market favours quality over quantity.

Tip:

- When targeting the French market try standing out on quality, for example, supplying certified organic beans. Be sure to comply with the European organic legislation.

Portugal: imports replace local production

Portugal is a traditional consumer of kidney beans and Europe’s fifth-largest importer. Portuguese demand for affordable beans will continue, meaning there are especially opportunities for price competitive suppliers.

Common beans, such as red kidney beans, are the most popular pulse for consumption in Portugal, where they are used in traditional stew dishes, such as feijoada, rice dishes (arroz de feijão) and soup. The total pulse consumption was 4.7 kg of pulses per person in 2019/2020. The dry bean consumption of 2.5 kg per capita is well above the European average. However, the consumption of beans has slightly decreased in recent years while chickpea consumption has increased quicky to a 2.2 kg per capita.

In Portugal, local production has been replaced with imports. Argentina supplied more than half the demand, but Portugal is also the largest European importer of Ethiopian beans. For the past five, years Portuguese kidney beans imports have varied between 30 and 40 thousand tonnes. In spite of Portugal having extensive genetic bean resources, it will take time to revalue and increase cultivation again.

Compared to other European markets, Portuguese import value of kidney beans is relatively low in relation to its volume. Portugal’s calculated import value was €0.87 per kg in 2020, while the European average was €1.05 per kg.

Eastern Europe: Romania, Bulgaria and neighbouring markets

Pulses are part of the food culture in many Eastern European countries. Romania and Bulgaria offer good opportunities for common dry beans, but you can find similarities throughout the region. Eastern Europe’s markets are slowly diversifying in terms of suppliers and imported products, but developing local production could play an important role for future export opportunities to these countries.

With an import volume of nearly 20 thousand tonnes in 2020, Romania and Bulgaria lead the import of common dry beans in the central and eastern parts of Europe. Together with Poland, these countries also show the highest growth in the past 5 years.

Current consumption figures are not available, but Bulgaria has one of the highest bean consumptions per capita, which is expected to be similar to the 4.5 kg to 4.9 kg per capita of earlier years (2010–2013). Unlike many buyers in Western Europe, Bulgarian buyers get most of their non-EU supply from Egypt and Kyrgyzstan. Compared to Western Europe, consumers in Bulgaria and nearby countries may be more conservative and price conscious, but the region is slowly developing towards a more diverse pulse market.

When supplying common dry beans to Eastern Europe, it is important to take into account the different markets and their specifics such as main suppliers, growth and prices (see table 4).

Table 4: Import values of common dry beans from non-European suppliers in € million, and specific characteristics of different Central and Eastern European markets.

| 2016 | 2017 | 2018 | 2019 | 2020 | Growth 2016-2020 | Trade value 2020 (€/kg) | Main supplier(s) in 2020 | |

| Romania | 9.9 | 14.5 | 12.8 | 14.7 | 19.9 | 100% | 1,01 | Egypt (70%) |

| Bulgaria | 8.8 | 10.2 | 11.4 | 13.0 | 15.9 | 81% | 0,80 | Egypt, Kyrgyzstan, Argentina |

| Hungary | 17.2 | 11.9 | 17.8 | 15.4 | 14.4 | -16% | 1,59 | USA, Canada |

| Germany | 10.8 | 9.5 | 9.8 | 9.4 | 13.9 | 29% | 1,33 | USA, China, Canada |

| Poland | 4.5 | 4.2 | 7.2 | 7.5 | 10.6 | 135% | 1,37 | China, Ukraine, Argentina |

| Czech Republic | 2.9 | 3.0 | 2.5 | 2.5 | 3.5 | 24% | 1,45 | Ethiopia (60%) |

Source: ITC Trademap

The traders: Netherlands and Belgium

There is not a typical trade hub for common dry beans in Europe, as most dry beans are imported directly. But to reach niche markets, you should focus on the countries that are known for their re-exporting capacity.

The Netherlands and Belgium are traditionally important re-exporters, often to large neighbouring markets, such as Germany and France. But kidney beans are not in high demand in Germany and they also tend to be shipped directly to their end markets. Still, in some cases, these trade hubs can be interesting for you as an exporter, for example, for more exotic bean varieties with smaller demand.

In 2020, the Netherlands had a similar import value of non-European common dry beans as Romania. In export the Netherlands had the highest value in Europe, re-exporting the most kidney beans and high-value beans in Europe. In volume, only the United Kingdom and Portugal are larger dry bean exporters

Tip:

- Focus on trading companies in the Netherlands and Belgium to reach potential markets and buyers that you would find difficult to supply to directly. Many of these companies can be found on international trade fairs.

4. What trends create opportunities or risks in the European common dry beans market?

Bean protein, organic and health claims further promoted

Plant protein and their associated health claims will play an important role for the future growth of beans in Europe. To benefit from the interest in the health benefits of beans, you must pay attention to the quality of your production process and consider organic certification.

In the past decades, economic wealth had boosted the consumption of meat while pulses went out of fashion. But today, beans are gradually coming back as a source of protein for vegans and flexitarians who eat little meat. The high protein content is among the most important health claims of beans and pulses, a quality that is increasingly included in the presentation of new vegan pulse products. The United Kingdom plays a leading role in vegan product launches, such as Quorn mince. When developing a bean product as replacement for meat, quality and taste are important aspects to take into mind.

Although less than 1 out of 10 bakery, snacks and cereal launches contained pulses or pulse flour between May 2020 and April 2021, according to Mintel’s food analyst, beans and other pulses are expected to play a bigger role in new healthy food products. In the global market meals (17.3%), vegetable products (16.6%) and snacks (16.3%) were the most important product categories for beans and bean ingredients between 2016 and 2020. New protein and plant-based products contain highly processed ingredients and little is known about the use of whole dry beans.

Besides the protein content, consumers are also interested in high-fibre content, gluten-free, preservative-free, additive-free and organic. About 7% of the 2018 organic crop production in Europe consisted of dry pulses, while it only had a 2% crop share in the conventional agriculture. Organic was the most common claim (24.9%) on bean product introductions from 2016 to 2020. China is the most important supplier of organic beans, but the increasing dependence on China and growing concerns of non-compliance with organic standards make buyers look for alternatives. Supplying clean, pesticide-free or organic beans is a good way to compete with traditional suppliers.

Figure 5: Organic beans with the Swedish KRAV logo, which denotes organic, biodiversity, good working conditions, and more

Photo by wolfgang8741 per Open Food Facts licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Tips:

- Make sure your product lives up to the expectations of a healthy product. Use high-quality seeds and Integrated Pest Management (IPM) for the cultivation of common dry beans for the health food market.

- Find opportunities in the ingredients market and at the Fi Food ingredients trade fair when you are able to supply high-quality bean protein or other sub-products.

New forms of convenience make common beans attractive

Canned beans have taken over a large part of the dried beans’ consumption. There is a need to make beans more attractive in easy-to-use products. Connecting to the bean processing industry can be a good next step for experienced exporters.

European consumers increasingly value good food, but convenience plays a large role in purchase decisions too. Dry beans are considered traditional and time-consuming to prepare. The canning industry has made bean preparation easier and nowadays canned beans have taken over a large part of the bean consumption, even in traditional bean consuming countries in the Mediterranean area.

Although canned beans are well established, it does not always fit with consumer perception of fresh and attractive food. Bean brands now face the challenge of making convenient attractive again. The food industry addresses the issue by using pre-cooked beans in fresh ready-made meals, salads and product mixes, and introducing new forms of packaging or preparation methods. Microwaveable and environmental packaging were important features in new bean-based product launches in previous years (2010-2014).

Northern European countries have most interest in new convenience concepts. For example, Dutch company Hak introduced a successful range of beans and bean mixes in standing pouches. The Kraft Heinz company has tried to make beans more attractive by introducing Beanz Snap Pots, a microwavable serving of beans (see figure 6), and Beanz Protein Pots, a combination of beans in tomato sauce, sausage and scrambled egg sold as a ready-made breakfast in the United Kingdom.

Other companies are expected to follow and even exporters in developing countries have developed similar ideas. For example, Kyaru International, a young bean exporting company from Tanzania, markets pre-cooked, farm fresh beans in standing pouches. The Australian Centre for International Agricultural Research (ACIAR) has launched a new project in six countries in East Africa to improve common bean varieties and provide shorter cooking time, higher protein and increased micronutrients (Iron and Zinc) that will promote better local health nutrition. In the long term, these developments can put these countries in a better position to expand to Europe.

However, for small, non-European companies it will be a challenge to sell convenience beans in Europe due to the well-established processors and brands that are already present. Your best chance is to build relations with these brands and bean processing companies, or with the European traders that supply them.

Figure 6: Kraft Heinz bean ‘snap pots’ as an easy, microwavable serving of beans in tomato sauce

Photo by openfoodfacts-contributors per Open Food Facts licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Tips:

- Read more about processed food in the CBI study on canned fruit and vegetables.

- Keep up to date on new food trends in Europe by visiting news sites, such as FoodNavigator, Organic & Wellness News and Food Manufacture.

Ethnic and traditional food on the rise

The integration of food cultures creates a diverse demand for beans. The wider adoption of traditional bean dishes can be an opportunity for exporters, but it also means you must match your bean variety to specific target groups and end users.

Ethnic populations as well as local traditional dishes are important drivers for the consumption of common dry beans. With the increasing integration of different nationalities, European consumers are growing more exposed to transnational dishes with beans. Examples are:

- Feijoada, a black bean dish from Brazil;

- Rajma, a spicy stew from India;

- Caparrones, a bean stew with chorizo from Spain;

- Mexican chili con carne;

- Italian minestrone soup with Berlotti beans.

The introduction of traditional cuisines can help boost the consumption of specific kidney bean varieties in your assortment. Characteristics such as taste, colour, size and single variety (not mixed) can be important for specific traditional niches. Traditional, high-quality bean varieties can always fetch a premium price as more sophisticated consumers are willing to pay for a quality product.

In the commercial interpretation of ethnic food and recipes for the masses, specific beans are sometimes replaced with beans that are cheaper and more widely available in a specific region. For example, caparrones or berlotti beans can be replaced with light red kidney beans.

Agricultural policies stimulate pulse production in Europe

The European Union has given priority to the production of protein crops that contribute to sustainable agriculture. This policy can trigger an increase in local bean production, which can be both a risk and an opportunity for exporters. It could reduce bean imports, but also re-evaluates the importance of pulses in Europe.

The Common Agricultural Policy’s (CAP) greening measures encourages the production of pulses in Europe. The reasoning behind this policy relates to:

- the role of legumes in proper soil management;

- the nutritional importance of pulses;

- the reduction of the dependence on non-European suppliers.

Many countries have supported the protein crop sector with voluntary support and direct payments from the European Union. Farmers have responded by sowing larger areas with dry pulses. In reality, it has worked out most in the fava bean production.

In 2023, the new CAP is expected to come into effect, which incorporates the sustainable ambitions of the European Green Deal and the ‘Farm to Fork’ strategy. The Farm to Fork Strategy aims to make food systems fair, healthy and environmentally friendly. It will ensure a sustainable food production and address, for example, the sustainable use of pesticides, packaging and food waste. With an organic farming action plan, the European Commission has set a target of ‘at least 25% of the EU’s agricultural land under organic farming by 2030’.

Protein crops will continue to play an important role in sustainable agriculture in Europe. The production of these crops can be expected to expand, and consumers are already paying more attention to locally produced products, a trend that has been strengthened by the recent COVID-19 pandemic. Despite these developments, foreign supply of common dry beans and kidney beans will still be necessary, as these are not in the top of most produced crops. Also the re-evaluation of beans as a nutritious food will compensate any negative effect of an increasing local supply on the imports.

Tip:

- Check our study about the trends in the European grains and pulses market for more information on which trends offer the best opportunities for dry beans.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research