Entering the European market for fonio

Very few European consumers know about fonio. Developing a wider presence in Europe will require farmers, processors and exporters to work together to guarantee a steady and quality supply of fonio. The next step will be connecting to specialist importers that can promote fonio as a nutritious, sustainable product.

Contents of this page

1. What requirements and certifications must fonio comply with to be allowed on the European market?

Fonio must comply with the general food safety requirements. You can find these in the CBI buyer requirements for grains, pulses and oilseeds on our market information platform. Access2Markets provides an overview of the market access requirements per country. In addition to food safety and quality, European buyers are likely to ask you to address social responsibility.

What are mandatory requirements?

Food safety: Traceability, hygiene, and control

The most important requirement for fonio grains is to make sure they are safe for consumption. Food safety and traceability should be your top priority.

As an exporter, you must make sure that unhealthy substances are absent or within the limits set by European legislation. These include pesticide residues and contaminants such as Aflatoxins. Fonio must also be free from harmful micro-organisms such as Salmonella, E.Coli and Listeria monocytogenes.

Failure to comply with food safety standards can result in stricter controls or even a temporary suspension of imports from your country. As a supplier, you must make sure to work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

Tips:

- Get acquainted with the EU food safety policy. Learn about the maximum residue levels (MRLs) for active substances used in plant protection products. This includes pesticides and active substances, that apply to fonio (use code 0500040, for millet). Look for Endosulfan β, DDT and Dieldrin, the top-3 pesticides used in fonio cultivation.

- Review the voluntary standards of the Integrated Pest Management (IPM) Coalition. This coalition consists of sustainability systems and accreditation bodies such as Rainforest Alliance and Fairtrade International (FLO). Together, they aim to reduce the use of hazardous pesticides, and to promote more sustainable alternatives. Their website provides a database of active ingredients and current restrictions.

- Use My Trade Assistant in Access2Markets to find more detailed import requirements for fonio at the country level. Type in the HS code for fonio (10084000), your country of origin and the country you are exporting to.

Labelling

In 2018, the EC approved fonio as a novel food product under Regulation (EU) 2018/2016 (pdf). The EU has recognised fonio as a traditional food. This means that exporters can sell decorticated fonio (i.e., grain removed from its bran) in the EU market.

The inclusion of fonio in the Union List of authorised foods allows you to sell fonio without restrictions. However, you must meet basic labelling requirements. For example, fonio-containing foodstuffs must be labelled as ‘decorticated fonio (Digitaria exilis) grains’.

If you are supplying fonio directly to EU retailers, you must meet the Codex General Standard for the Labelling of Prepackaged Foods. It also has to comply with Regulation (EU) No. 1169/2011 (pdf) on the provision of food information to consumers in Europe. For example, the nutritional components must be shown on the consumer packaging. Table 1 shows the typical nutritional values, as indicated in Regulation (EU) 2018/2016.

Table 1: Typical nutritional values of decorticated grains of fonio

| Component | Grams per 100 g of fonio |

| Carbohydrates | 76.1 g |

| Water | 12.4 g |

| Protein | 6.9 g |

| Fat | 1.2 g |

| Fibre | 2.2 g |

| Ash | 1.2 g |

| Phytate | < 2.1 mg/g |

Source: Regulation (EU) 2018/2016

Tip:

- Read the CBI buyer requirements for grains, pulses and oilseeds for additional information on labelling.

Packaging

The packaging of fonio grains must be suitable to protect the product. You must use packaging according to Regulation(EC) No 1935/2004 on materials and articles intended to come into contact with food.

Since the most common packaging for grains are 25 kg polythene bags, fonio exporters must observe Regulation (EU) No 10/2011. This regulation concerns plastic materials intended to come into contact with food. Multi-layered paper bags are also used to pack fonio, especially for organic fonio.

Tip:

- Talk with your buyers in Europe about their packaging needs. Explain what options you can offer. Poor packaging can result in buyers choosing a different supplier.

What additional requirements and certification do buyers often have?

Quality standards

Right now, there are no EU food-quality standards for fonio. As a general rule, food imports into the EU must be:

- safe and suitable for human consumption;

- free from abnormal flavours, odours, and living insects;

- free from filth (impurities of animal origin, including dead insects) in amounts that may represent a hazard to human health;

- free from sand.

The Codex Alimentarius has set quality standards for grains such as quinoa (pdf), sorghum (pdf) and whole and bran-free pearl millet (pdf). Those standards can give you an idea of the quality requirements fonio should meet.

Tip:

- Maintain strict compliance with quality standards and deliver the quality as agreed with your buyer. Being careless with your standards will give buyers a reason to claim on quality issues.

Certifications

Food safety is a priority for European food businesses. You can expect buyers to ask you for extra guarantees in the form of certification.

It is highly recommended to work with a recognised food safety management system, particularly when you are cleaning, hulling or doing other types of processing. There are various options depending on your role in the supply chain.

For agricultural production you can use GLOBALG.A.P. certification. Certifications for post-harvest or processing include BRCGS Global Food Safety Standard, FSSC 22000 and International Featured Standard (IFS). You can find the most commonly-used certification schemes within the Global Food Safety Initiative (GFSI).

If the above standards are not yet within reach, you can also start with ISO 22000 for food safety management. This is a slightly easier standard to put in place.

Tips:

- Involve your buyer in your selection of a certification scheme for your product.

- Learn about the advantages of quality certification schemes by reading CBI tips for organising your export and CBI buyer requirements for grains, pulses and oilseeds.

What are the requirements for niche markets?

Organic certification

In Europe, several importers are promoting fonio in the organic sector. This is a promising market for fonio and can be a good channel to start with.

Fonio is often cultivated using traditional methods that require little or no chemical input. However, it is only possible to sell your product as ‘organic’ in Europe if you have organic certification. This means that a certifying agency needs to verify that you are applying the methods outlined in Regulation (EU) 2018/848.

Getting an organic certification for Europe takes time and can be expensive. For small producers, there are ways to make this easier:

- Small farmers in developing countries can apply for group certification. This means that an internal control system will carry out most of the inspection work. There must be a central body responsible for marketing and group compliance.

- IFOAM – Organics International provides Training manuals for smallholder group certification. IFOAM also makes organic certification accessible for small farmers with Participatory Guarantee Systems. However, they are yet to be recognised by the European Union.

Figure 1: The EU organic logo

Source: European Commission

Tips:

- Consider organic if your situation and location permits it. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to complete the whole organic process to market organic products.

- Read more about organic certification in the CBI study on buyer requirements for grains and pulses in Europe. Find a full overview about organic farming on the EU web page Organics at a glance.

- Read more about how to certify a group of smallholders in the IFOAM Position Paper on Smallholder Group Certification for Organic Production & Processing (pdf).

Gluten-free label

Despite growing demand, the gluten-free market in Europe is still niche. By promoting your product as gluten-free, you will attract attention from consumers who buy products within this specific niche. You can only label your product as gluten-free if it contains less than 20 parts per million (ppm) or 20 mg/kg of gluten, according to the guidelines of Regulation (EU) No 828/2014.

Despite being naturally gluten-free, fonio could become contaminated with residue from other grains (e.g., wheat, rye, spelt or barley). Food operators are legally obliged to provide accurate information to consumers about the presence of gluten in food.

The Association of European Coeliac Societies (AOECS) offers the registered Crossed Grain Trademark (CGT) for gluten-free food products. To use this trademark, your product has to undergo an independent audit. It can only be used for processed food that contains fonio, and not for single-ingredient products.

Figure 2: The logo of the gluten-free AOECS Crossed Grain Trademark (CGT)

Source: The Association of European Coeliac Societies (AOECS)

Sustainability and social compliance

European buyers and authorities are focusing increasingly on Corporate Social Responsibility (CSR). They will expect suppliers to address social and environmental issues. Importers of specialty grains will likely ask you to sign a declaration or a code of conduct.

Currently, fonio buyers are committed to a positive social impact in the countries that they import from. This means that they will seek to do business with exporters who source from smallholder farmers or women’s cooperatives. Some of them will consider the food security of producing communities. This offers producers a great opportunity to build a sustainable supply chain together with buyers and establish a market advantage before fonio becomes better known in Europe.

As European demand for fonio increases, the need for social certifications will also grow. But even if buyers do not ask for them, certifications can help improve your CSR performance. This will give you a competitive advantage. The main sustainability certification schemes and initiatives include:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (pdf);

- The Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA)

- GLOBALG.A.P. and GLOBALG.A.P. Grasp

- SAI Platform – Farm Sustainability Assessment FSA

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct (pdf). You can also find many practical tools on the amfori BSCI platform.

Fairtrade

A Fairtrade label can give your product a competitive advantage. This label is popular with conscious consumers that care about the origin of and the people behind the product. However, this market segment remains a niche.

To certify your product, you can apply for a fairtrade label with the Fairtrade Labelling Organisations International (FLO), or Fair for Life. Depending on whether you are involved in production, processing or export, a different standard will apply. At the moment, there are no specific standards that apply to fonio.

Tip:

- Remember to check with your buyer that there is enough demand for fair trade fonio in your target market. These labels can be expensive and the added value for fonio is not yet clear. Especially to begin with, investing in your social impact story and presentation could be a more effective way of gaining a competitive advantage.

2. Through what channels can you get fonio on the European market?

How is the end market segmented?

As a relative newcomer in the European market, fonio is a product for which the market segments have yet to develop. At present, fonio is sold mostly in grain and its consumption is often traditional. In the future these segments may be much more diverse, with more uses and a wider group of health-oriented consumers.

Table 2: Uses of fonio in different segments

| Bakery and pasta segments | Breakfast cereal | Meal replacement | Healthy snacks |

| Fonio flour and bread | Fonio flakes, pre-cooked, puffed | Fonio grains | Fonio crackers and chips |

| Gluten-free alternative for bread, pancakes or for durum wheat in pasta. | Ingredient for healthy snacks, breakfast cereal, porridge, alternative for oatmeal. | Replacement for rice, couscous or quinoa. | Ingredient for snacks for health-conscious consumers. |

Gluten-free substitute for other grains

Most fonio in Europe is sold as grain. It can be cooked in the same way as rice, couscous or quinoa. Fonio packaged for consumers is therefore likely to be placed alongside other grains for cooking on retail shelves.

Currently, fonio is often consumed by people who already know fonio, such as consumers of African descent. France is one of the countries where the most fonio is purchased, as well as other typical ethnic foods from northern Africa, such as couscous.

Fonio holds potential to become a healthy (gluten-free) substitute for mainstream grains. With the promotion of fonio as a healthy grain, pre-packaged fonio products have appeared in many organic and health-food shops. This segment is likely to grow further.

Bakery and pasta segment

The bakery industry is the main segment for most cereal grains and flour. Small and industrial bakeries each cover around 30% of the cereal flour use (mostly wheat flour), with industrial bakers winning terrain over the small ones. Due to the large number of players, there is considerable potential for fonio in the baked goods sector (see table 3). New ingredients can help small bakers to differentiate themselves. Top fonio flour producers are Obà Foods in Europe and Iya Foods in the US.

Likewise, fonio flour can be used to make pasta – a segment that is highly concentrated with just a few dominant companies and private labels. The Obà Food Group was the first to develop pasta made with 40% fonio flour.

Table 3: The European bakery sector in numbers

| Europe |

| 3,800 flour mills |

| 1,000 industrial bakers |

| 90,000 craft bakers |

Source: The European Flour Millers’ association, and the International Association of Plant Bakers (AIBI).

Source: European Flour Millers

Breakfast cereal

Fonio has not yet penetrated the European breakfast segment. In other countries, fonio is prepared as a porridge, or even as an instant breakfast cereal, such as the Choputa brand in the USA.

Similar to other grains such as wheat, oatmeal, rice and corn, fonio can be processed into breakfast cereals, such as puffed fonio or fonio flakes. According to Ceereal, the European Breakfast Cereal Association, the breakfast cereal sector includes 75 companies and represents an industrial value of 6 billion euros. In this diverse segment, there will be opportunities to innovate with fonio.

Healthy snacks

Nutritious grains are regularly used for healthy snacks. Grain flakes, puffed grains or grain flour are ideal ingredients for puffed snacks, savoury biscuits and cereal bars.

The USA-based company Yolélé recently introduced fonio chips. Another USA-based company specialising in healthy snacks is Flackers, which in 2021 introduced organic-certified flax and fonio salty crackers. In Europe, Dutch webshop Kari’s Crackers introduced fonio-chia crackers in 2022. More of these types of products are likely to appear in Europe in the next few years.

Figure 4: Fonio chips

Source: Open Food Facts, kiliweb; CC-SA 3.0

Tips:

- Read this Euromonitor trends article to learn about market trends in the gluten-free and other healthy foods segments in Europe.

- Expand your knowledge about healthy snacks by reading CBI’s reports about Exporting healthy snacks with grains, pulses and oilseeds to Europe.

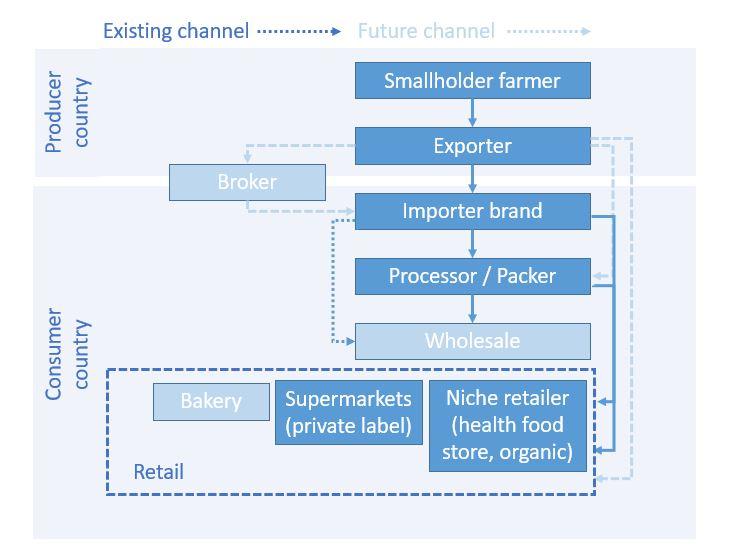

Through what channels does a product end up on the end market?

Figure 5: Current and future channels for fonio

Source: Profundo (2022)

Importers and importing brands

Goods that enter Europe have to be cleared through Customs. Only an entity based in the EU can handle import declarations. Fonio producers looking to sell their product in Europe need an import channel.

Currently, there are only a few importers of fonio. These companies tend to be socially-minded enterprises that seek to support smallholder producers. The current promoters of fonio include:

- Symfonio (Netherlands) a Dutch social enterprise that brings authentic African organic crops to market.

- Ibémi (France) fonio importer and brand.

- Aduna (UK) brand focusing on West-African health and wellness products.

- Gaia (France) importer of gluten-free grains, and a brand of cereal products.

- Gebana (Switzerland), a fonio importer promoting direct trade between producers and consumers.

- MKF GuineaFresh (Netherlands), a company importing West African products.

To raise interest among new importers that have experience with special grains, your supply must already be well organised. There must also be a basic demand from food brands or consumer groups. The number of importers will grow as fonio becomes more widely accepted throughout Europe. Companies that are known to import specialty grains and healthy food ingredients include:

- Ecoterra (Germany) importer of quinoa, amaranth, cañihua, breakfast cereals.

- Danatura Food (Germany) importer of organic certified quinoa, teff, amaranth.

- Tradin Organic (the Netherlands) importer of organic ingredients, including teff, quinoa, buckwheat, bulgur.

- Z-Company (the Netherlands) importer of natural food ingredients.

- Millets Place (the Netherlands) importer of gluten-free grains.

Tip:

- Read CBI’s factsheet about The European market potential for fonio to learn about the advantages of combining crops.

Figure 6: Retail packaging of fonio

Source: Ibémi food

Processors and food developers

The future of fonio lies in its potential for use in product development. One of the first companies to experiment with fonio is Obà Food Group, which uses fonio for making pastas. Obà also started the Novel Food approval process with the European Commission to introduce fonio to Europe.

- Obà Food Group (Italy) has developed gluten-free pastas with fonio.

- Kari’s Crackers (the Netherlands) has developed typical Norwegian crackers with organic fonio.

If fonio is to become a mainstream product, its distribution channels will have to expand. It will have to include actors that can handle larger volumes. Multinational companies, such as Unilever and Ebro Foods, use large amounts of grain for their products. These types of companies develop products to capitalise on food trends. Their marketing power can boost new ingredients, but they are also slow and tend to avoid risks.

For fonio, most opportunities will be with specialised processors and brand companies. These will probably be companies with a focus on organic, health or gluten-free foods, such as:

- Ekibio (France), responsible for healthy and gluten-free brands such as “Ma vie sans gluten” and “Priméal”

- Dr. Schär (Italy), specialised in gluten-free grain products

- Hero Group (Switzerland), with healthy snacks and gluten-free brands

- Genius Foods (UK), gluten-free bakery products

- Warburtons Gluten Free (UK), a gluten-free bakery

- Harry Brot GmbH (Germany), large bakery including gluten-free bread

- Ecotone (France), formerly known as Wessanen, a leading company for organic and vegetarian food

Supermarkets (private label)

Supermarkets can contribute to developing mainstream channels for fonio. But fonio is not part of their regular offer and not often available.

Supermarkets such as Carrefour in France and Jumbo in the Netherlands have been selling their own brands of fonio. Albert Heijn has announced that they will start selling package-free dry foods, including fonio, in the city of Rotterdam. They plan to roll out the concept in other regions as well. However, these initiatives, and mainstream sales of fonio, are still very small-scale.

Niche retailers

Specialty retailers such as organic shops and health food stores in Europe have also begun putting fonio on their shelves. They sell fonio in their shops and through their webshops.

Examples of these stores are Le retour à la terre and Paranatura in France, Biona and Forest Whole Foods in the UK, and the Dutch organic food stores Ekoplaza and Odin in the Netherlands. Several of these shops package under their own private label.

Another niche market is the retail sale of ethnic or exotic products such as AlterAfrica, Saveurs du Pays and Racines in France and Africa Products Shop in the Netherlands. These shops sell fonio as a traditional product.

What is the most interesting channel for you?

Since fonio is not yet a mainstream product, you will have to find a specialised importer or an innovative food brand. The importer must be motivated and have the means to develop the market for fonio. As an exporter, you will mainly depend on the small number of specialised importers and promotors of fonio in Europe. These include companies such as Symfonio, Obà Food Group, Gaia and Ibémi, which are responsible for current imports into Europe. The USA-based Terra Ingredients also plans to sell fonio in Europe.

Because most fonio importers have already established sourcing partnerships, it can be difficult to sell to them. For that reason, you can try to focus on new importers without sourcing partners. You can target a wide range of ingredient importers if you are well-organised and have the right certifications. In some cases, a food manufacturer or brand will have its own import. But for sourcing a niche product from smallholders, most will prefer to have an importer in between.

If processing technology in the country of origin is not yet up to European standards, it is best to find a processor or processing importer. Look for grain and seed specialists with cleaning and sorting facilities such as Kremer Zaden or P. van Schelven in the Netherlands.

Tips:

- Make sure you have an effective supply chain with reliable farmers and good primary processing facilities for cleaning and hulling fonio grains. This is essential for attracting the interest of potential importers and food companies.

- Meet importers of special ingredients and gluten-free grains at large food trade fairs such as SIAL, Anuga, Biofach, Food Ingredients Europe or smaller, specific events such as the Free From Food Exhibition or iba, a leading trade fair for baking and confectionery.

3. What competition do you face on the European fonio market?

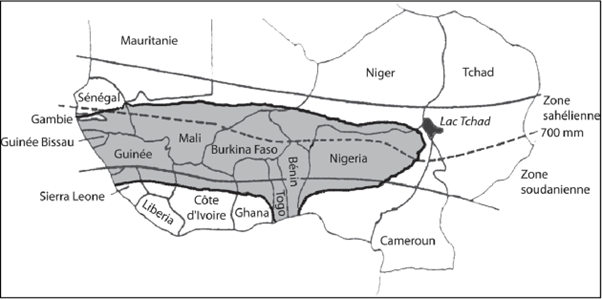

Fonio is a subsistence crop in the West Sahel region (figure 7). As an export product, it is still a niche product. Mainstreaming exports will need considerable investments and producers, processors and exporters in producing countries will have to increase their capacity.

Several projects in countries such as Burkina Faso, Guinea, Senegal and Mali are pushing the development and export of fonio. In these countries CIRAD has investigated cost-effective post-harvest technologies. At the same time, they helped farmers improve their agricultural practices. Social investors are helping to develop the fonio value chain outside of West Africa.

Figure 7: Fonio-growing regions

Source: Cruz et al., 2016

Which countries are you competing with?

Source: ITC Trade Map

Table 4: Average annual fonio production between 2017 and 2021, in tonnes

| Country | Production in tonnes |

| Guinea | 477,845 |

| Nigeria | 86,239 |

| Mali | 41,255 |

| Côte d'Ivoire | 19,939 |

| Burkina Faso | 10,705 |

| Niger | 5,668 |

| Senegal | 5,274 |

| Benin | 4,278 |

| Guinea-Bissau | 461 |

| Togo | no data |

Source: Faostat

Burkina Faso: active participation of fonio importers and NGOs

Burkina Faso ranks as the largest supplier of fonio to Europe. The figures for European imports from Burkina Faso fluctuate. This may be due to the fact that exports go through Togo or Benin and are registered there. Despite being a landlocked country, Burkina Faso exported at least €323,000 worth of fonio in the past five years (2018-2022).

The French company Gaia and Symfonio b.v in the Netherlands are active in the fonio trade in Burkina Faso. Gaia has set up their supply from Burkina Faso with the support of the NGO “L’Orange Bleue Afrique”. Symfonio has a collaboration with cooperatives of women to source organic fonio from Burkina Faso.

Guinea: important producer and exporter

With an average volume of 480 thousand tonnes, Guinea is West Africa’s largest fonio producer. With this significant production and sea access nearby, Guinea holds the best position to export. The country could potentially scale up exports and become one of the biggest competitors in fonio from West Africa.

In exports, Guinea has already become the second-largest exporting country to Europe. Its market share of European imports of fonio was 27% in 2022. More than 80% of Guinean fonio exported in 2022 went to France and the Netherlands. Fonio from Guinea can be found in channels for traditional food in Europe, led by companies such as MKF GuineaFresh and Saveurs du pays.

In Guinea, the fonio sector is still fragmented and less well-known than its neighbours Mali and Burkina Faso. Some sources also mention the lack of effective processing facilities as a limiting factor for growth.

Mali: potential for growth

Mali is the third-largest producer of fonio, after Guinea and Nigeria, and foreign companies see the country’s potential as one of the larger producers of fonio. According to the International Finance Corporation’s 2022 report on “Creating markets in Mali” (pdf), there is untapped potential in the fonio sector. But production also requires investment to improve yields and make processing more efficient.

In January 2022, USA-based company Yolélé Foods secured 1.90 million USD in funding from USAID to improve the Malian fonio value chain. With this grant, Yolélé aims to create almost 14,000 jobs and to significantly improve the traceability of fonio. Moreover, Yolélé is uniting forces with Mali Shi SA (Mali’s leading shea butter manufacturer) to improve the processing capacity of fonio in Mali, through a joint venture called WAAG.

The British company Aduna sources fonio in Mali. The company aims to create sustainable incomes for over 320 female farmers in Southern Mali, and to help restore degraded soils.

Just like Burkina Faso, Mali has no direct access to the sea. Fonio that leaves Mali must travel first through the Ivory Coast or Senegal before being shipped elsewhere. European imports from Mali increased to €90,000 in 2021 but fell back to €11,000 in 2022. It is not clear why imports fell.

Senegal: smaller producer with competitive logistical facilities

Although Senegal only produces small quantities of fonio (compared with Guinea, Nigeria and Mali), its location and advanced logistical facilities make it a competitive partner. Recent trends indicate that Senegal is increasing its fonio exports to Europe. In 2018, Europe imported €8,000 of fonio from Senegal. By 2022, this had increased to €54,000.

Increasing Senegal’s fonio output will depend on the support to smallholder farmers and other supply chain actors. The Belgian NGO Rikolto has been supporting smallholders in Casamance, helping them to buy agricultural tools and strengthen their position in the fonio value chain. For foreign companies such as Terra Ingredients and Yolélé, Senegal, and its port in Dakar, provide a good basis to collect and process fonio grains before shipping. Terra Ingredients by AgMotion has also built a modern facility in Dakar, Senegal.

Togo: increasing exports through partnerships

There is no formal data on the production volume of fonio in Togo. However, trade statistics show that European fonio imports from Togo are increasing. Much of this growth is probably due to cooperation between Gebana and the Togolese processing company Bodhi Foods. Bodhi Foods works with organic farmers and takes care of the processing and packing. This cooperation in the fonio sector shows how important it is to organise the supply chain when trying to enter the European market.

Nigeria: serving the domestic market

Nigeria is the second-largest producer of fonio. Its average production in the past years (2017-2021) was over 86,000 tonnes. Nigeria also has the largest population of Africa, with over 200,000 people. Most fonio is therefore sold domestically. Nigeria’s fonio exports to Europe over the past five years have been negligible. However, as an exporter, you should still consider Nigeria as a potential competitor.

Tips:

- Look for the best logistical route for your supply. Think carefully about the location for collecting and processing the grain and choose the best port for export. If your company is further away from production sites and logistical hubs, you will have to compensate in another way. For example, you can use social engagement or try to produce more efficiently to compete with exporters in better locations.

- Organise your supply chain from production to processing and packing. Without an efficient supply chain, European importers will not consider you.

Which companies are you competing with?

With distribution channels still under development, only a handful of companies are involved in the fonio trade. Prospective fonio exporters to Europe are set to compete against businesses with strong ties with West-African companies, many of which are seeking to deliver social impacts.

Companies from Guinea

La Petite Damba is a Conakry-based, family-owned company founded in 2016. The company aims to supply the international market with local Guinean products. Next to fonio, La Petite Demba exports palm oil, dried mango and powdered chilli.

As a socially-minded company, La Petite Damba is part of The Guinean Consuming Network (Le Réseau Consommons Guinée). This network and economic interest group brings together five actors and almost 5,000 small producers from all over Guinea. Because of its membership, La Petite Damba has the support of the Charente-Maritime Cooperation (CMC,pdf), the Guinean House of the Entrepreneur (MGE) and the French Embassy in Guinea.

La Petite Damba also recently received a US$ 258,000 co-investment grant from USAID’s West Africa Trade & Investment Hub. The company plans to use this investment to expand and automate its processing of fonio. The new factory, estimated to be worth US$ 1.2 million, will increase the company’s fonio storage capacity in the rural region of Fouta Djallon, Guinea.

In France, the company Saveurs du pays sells La Petite Damba’s fonio. In addition to its exports to France, La Petite Demba exports and sells its products in the Ivory Coast through P Distribution. Their products are sold in Ivorian supermarkets, including subsidiaries of French supermarket chains Casino and Bonprix.

Companies from Mali

Mali has several direct trade initiatives, including companies such as Yolélé and Farafena. These supply chains are mainly linked to the North-American market, but they may become competitors in Europe as well.

In 2017, Yolélé teamed up with SOS SAHEL to build a supply chain for fonio and help Senegalese farmers to make a living from it. They ensure the farmers make a fair income through direct trade. Using a co-investment grant from USAID’s and Prosper Africa in 2021, Yolélé entered into a partnership with Malian company Mali Shi SA. Their goal is to establish the United States as the primary destination market for fonio and to reach 2,400 metric tonnes of new exports per year by 2024, with a value of more than US$ 5 million.

The Canadian-based company Farafena collaborates with more than 850 female farmers in Mali. They source and process certified organic fonio that is traceable using blockchain technology.

Companies from Senegal

La Vivrière is a local company in Senegal that processes fonio, millet, maize and black-eyed peas from local farmers into healthy cereals. With the support of Root Capital, the company has built connections with multinational food companies. Experts from General Mills, Hershey’s and Cargill have helped improve the production capacity of its facility.

The company still lacks strong marketing and a modern website. Their communication is not yet at the same level as other companies that trade in ‘supergrains’. Even so, they have succeeded in getting some of their products onto the European market. One of their channels sells pre-cooked fonio to the company Unidex Holland.

Companies from Burkina

Initiatives in Burkina Faso have successfully led to fonio exports to Europe. One of the initiatives is Burkina Dry More. Burkina Dry More is a project that uses the mango-drying infrastructure in Burkina Faso to diversify the export to the EU. The project helps 10 mango processors to process fonio, hibiscus, ginger and livestock products. Moreover, Dry More stimulates access to markets and linkages between processors and farmers.

Processors in Burkina Faso get financing, thereby benefiting 3,000 farmers. Dry More also connects them with buyers in the EU, India and other markets. One of the buyers that connected with Burkina Faso processors is the Dutch social enterprise Symfonio.

Togo

The company Bodhi Foods is a fonio processor in Tongo. They work with 814 farming families from 28 cooperatives in 25 villages in the Doufelgou region. Each of these families cultivates an average of 0.8 hectares of land, on which they grow organic fonio. After harvesting, farmers deliver the fonio to Bodhi Foods, where the company's employees hull it and package it. Bodhi Foods employs 12 people all year round and another 50 during the harvest season. One of the companies that buys their fonio for the European market, is Gebana. In 2022, Gebana communicated that it had imported 3.5 tonnes of fonio from Togo.

Companies from Ghana

AMAATI Group is a Ghanian company based in Tamale, founded in 2013 (under the name Unique Quality Product Enterprise). The company works with smallholder farmers. These are especially women, engaged in the cultivation and processing of fonio. AMAATI is a social enterprise that began working with 10 landless farmers and is currently sourcing from 2,000 farmers. AMAATI markets its products as vegan and gluten-free and sells organic-certified fonio.

Tips:

- Find an efficient and high-quality processing facility of fonio grains. The companies that control the basic processing will dominate the future export market. These are the companies that will deliver reliable volumes. When setting up your own processing, look for help from NGOs or social capital investors such as Root Capital, Triodos, Oikocredit, or Prosper Africa.

- Present yourself to European buyers by creating a good website and visiting trade fairs to show your business. See also the CBI tips on finding buyers and CBI tips to do business with European buyers of grains, pulses and oilseeds.

Which products are you competing with?

As a fonio supplier, you will be competing with highly efficient grain crops as well as specialty crops. Local competition will include staples such as wheat, rice and maize. These are often cheaper to produce with higher yields. On the international market, fonio will compete with other specialty and gluten-free crops such as quinoa, teff and amaranth.

Both quinoa and fonio can be used as an alternative for rice or couscous, which are often cheaper, but less nutritious. Fonio is high in fibre, calcium and iron. Baking Business argues that fonio contains three times the amount of fibre and four times the amount of protein of brown rice. But as a crop, it also offers a sustainable opportunity for farmers, as it tolerates drought and poor soils without the need for pesticides. Fonio grains can be harvested multiple times a year.

Tips:

- Highlight the nutritional benefits of fonio on your website and other presentation tools. Also communicate the positive impact on your community and environment. The better your story, the more appealing your product will be.

- Make it easy for food brands and consumers to understand the possibilities of fonio. Find strategic partners such as food brands that can promote fonio and its different uses. Look for food brands in European stores and webshops that are already using other nutritional grains in their products.

4. What is the price of fonio?

While fonio is becoming increasingly known on the market, data on prices, especially at farmgate, remains unreliable. Back in 2007, CIRAD showed that the price of fonio depends mostly on the level of processing (pdf). While it is likely that this situation has remained the same, the only available price indication comes from Mali, where trade platform Selina Wamucii calculates a producer price for 1kg of Fonio in Mali, packed and ready for export, of around 0.86 USD.

According to the latest available trade data (2018-2022), the import value per tonne in Europe fluctuated between €810 and €1,270. This is just a rough indication of the import price without taking account of the size of the shipment. At this early stage of market development, the variation in technology, processing facilities, export volumes and logistics is a major factor for price differences between regions and countries.

Market prices will always be influenced by fluctuations in demand and supply. It is important to add that prices for relatively new ingredients in Europe are subject to strong fluctuations. When fonio is promoted as a new superfood, there may not be enough suitable suppliers for the European market, which can temporarily boost the prices upward. This is what happened to several other new ingredients in the past, such as quinoa and chia. If this will happen for fonio is still speculation.

Despite several companies that cover the value chain from sourcing to retail, the retail prices in Europe are still quite high. On the low end, fonio is sold for 8 euros per kilo (including VAT), and higher prices go up to 19 euros per kilo. The high prices and price differences can be explained due to the fact that fonio is still a niche product and lacks the large volume infrastructure. This can change over time, although retailers will always maintain a safe margin and keep the consumer price stable.

Tip:

- Create a free account on Tridge.com to obtain basic fonio market information. The paid service includes more detailed pricing and market intelligence insights.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research