The European market potential for fonio

The European market for fonio has been growing slowly. There is a long way to go before fonio becomes a mainstream product, but it holds great potential to be marketed as a multi-functional grain. Consumers in France, the Netherlands, Italy and the UK are starting to value its healthy, gluten-free properties, as well as the story behind fonio.

Contents of this page

1. Product description

Fonio is an ancient grain traditionally cultivated in West Africa, in or near the Sahel region. It is a key food in countries such as Mali, Burkina Faso, Guinea, Senegal and Nigeria. Two main types of fonio are cultivated: white fonio (Digitaria exilis) and black fonio (Digitaria iburua). White fonio is the best-known type outside of Africa.

Fonio is a fast-growing crop that reaches maturity in 6 to 8 weeks after sowing. It can grow on very poor soils and in warm climates. However, the small size of its grain (1-1.5 mm) and the lack of modern post-harvesting technologies mean that it is labour-intensive to cultivate and process.

As with rice, processing fonio is a 2-step process:

1. Hulling, in which the rough grain is dehusked to produce a hulled (‘decorticated’) grain.

2. De-branning or pearling, in which the bran is removed to produce whitened fonio.

Parboiling, pre-cooking and milling can also be part of processing.

Fonio grain is used in dishes such as porridge or soup, or consumed like couscous. Fonio can also be milled or mixed with other flours to make bakery products.

While fonio has had its own code in the Harmonised System (HS 100840), there is no specific code for fonio flour or other fonio-derived products. In Europe, fonio obtained novel food status and was officially authorised for sale in December 2018 under implementing Regulation (EU) 2018/2016 (pdf).

Figure 1: Fonio grains and fonio harvesting

Source: Wikimedia Commons - adjusted photos from Jose Hernandez, Public domain; James Courtright, CC BY-SA 4.0; KAG1LP2MDIAKITE, CC BY-SA 4.0

Tips:

- Read a previous version of this market research about fonio in French (if French is your first language). Download the study via this link: Le potentiel du marché du fonio en Europe (pdf).

- Look at the graphic showing how fonio is processed on the website of CIRAD.

2. What makes Europe an interesting market for fonio?

The European market for fonio begins to grow

Even before fonio was authorised for sale in the EU in 2018, some buyers had already been importing small amounts of it since 2012. These small amounts were likely used for testing, for product development or to supply a small market segment of ethnic foods, as well as for non-food uses such as birdseed.

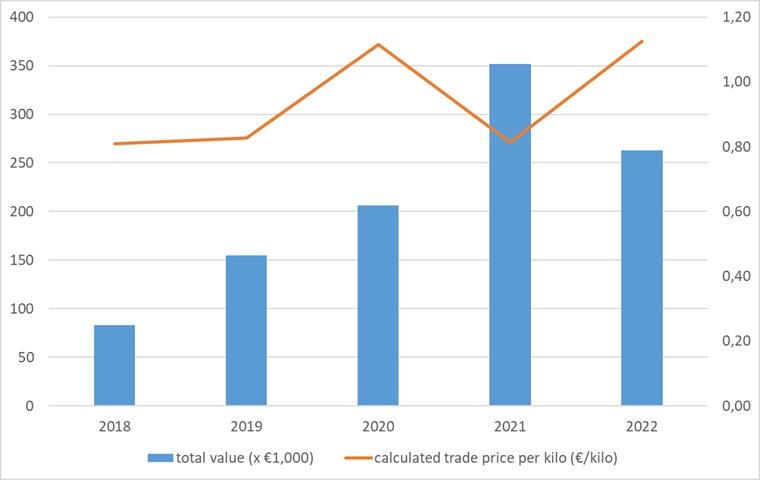

Once fonio obtained authorisation for sale, its adoption in the European market began at a steady but slow pace. Several pioneering companies started to promote fonio on the European market as an ethical and healthy food. Between 2018 and 2021, fonio imports into Europe increased from €83,000 to €352,000 (Figure 2). The lower value per kilo in 2021 could indicate larger, more cost-effective shipments. In 2022, imports slowed again to 249 tonnes, similar to the import volume in 2020.

In Europe, fonio was initially sold in organic food shops, as well as through webshops and other specialty outlets. It even reached mainstream supermarkets, such as Carrefour in France and Jumbo in the Netherlands, but not as a regular product. Low demand and lack of promotion is preventing fonio from becoming a regular fixture on retail shelves. With recent food price increases, many consumers prefer affordable staples to specialty grains.

As long as a few pioneering importers in Europe keep up their efforts, fonio will probably continue its steady but modest growth.

Figure 2: European import value and prices of fonio from developing countries, in thousands of euros and euros per kilo

Source: ITC Trade Map

Important to know: fonio needs strong marketing

Despite its growing market share, fonio has remained rather unknown among European consumers. At this point in time, it will take a significant marketing effort to mainstream fonio.

Tips:

- Seize every opportunity to make European buyers acquainted with fonio. You can do so at specialist trade fairs such as the Free From Expo and the iba bakery trade fair, or at one of the major international food trade fairs, such as Food ingredients Europe, SIAL, Anuga and BioFach (organic).

- Look for potential buyers on trade fair exhibitor lists and trade association member lists such as COCERAL, company databases such as the organic-bio directory, and EUROPAGES. Consider that fonio is still being adopted only by front runners, and therefore these lists will mostly help you build future prospects.

- Read the CBI tips for finding buyers on the European grain, pulses and oilseeds market for more insights on how to build a client network.

A versatile grain with mainstream market potential

As a gluten-free grain, fonio can compete well with other specialty gluten-free grains such as millet, quinoa, amaranth and teff. When comparing fonio and these other grains, fonio still has an opportunity to fill a major gap in consumption. As well as being a gluten-free grain, it has also been rated as promising flour material. Fonio is a multifunctional grain that has potential in various product applications, such as an ingredient for (gluten-free) pasta and bakery products, or use in porridge or couscous.

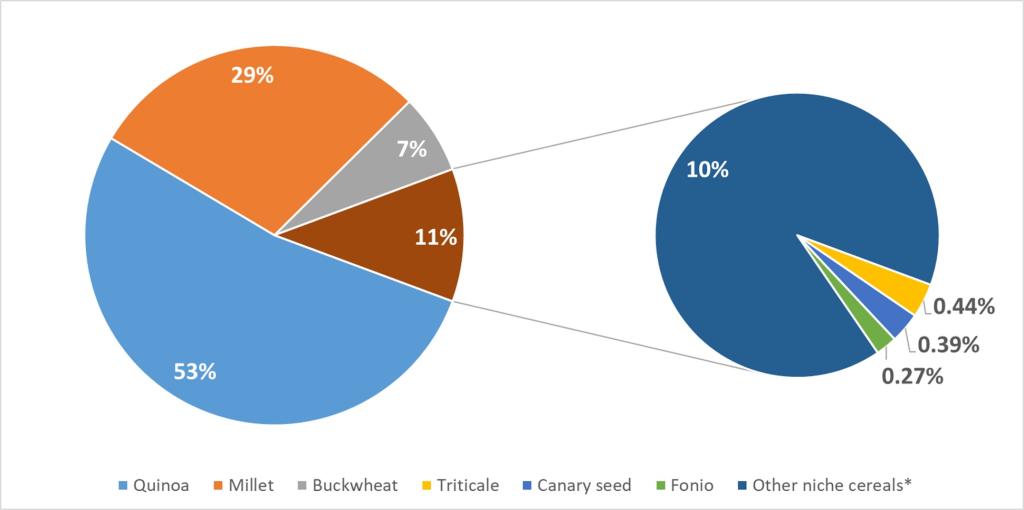

Fonio still accounts for only a small proportion of the total niche grains imported into Europe. Grains such as quinoa, buckwheat and millet are more common on the European market: in less than a decade, quinoa has become the specialty grain from the developing world with the highest import value in Europe (figure 3). This shows that promotion and creating awareness among consumers can be a powerful tool for growth. Fonio has all the right properties to follow the same growth path as quinoa. But to get there, fonio sellers will have to overcome other challenges such as providing a steady supply of quality grain.

Figure 3: European import value of specialty grains from developing countries in 2022

Source: ITC Trade Map

*Other niche cereals includes all cereals except for wheat and meslin, rye, barley, oats, maize, rice, grain sorghum, buckwheat, millet, canary seeds, fonio, quinoa and triticale (HS-code 100890)

Important to know: new products are risky

The future of fonio in Europe is uncertain. While new products such as fonio may hold great market potential, managing its growth comes with a risk. As a supplier, you should not underestimate the risks that come with highly promoted new products. Rapidly growing demand in Europe will encourage many new suppliers, including some that are not compliant. Uncontrolled growth leads to an increase in quality issues and price fluctuations.

Tips:

- Plan for the long term and build a solid reputation with a quality product. It is better to find potential buyers before starting export-oriented production and processing.

- Comply with the necessary requirements when entering the European market for fonio, and read about the general standards for grains in the CBI study on requirements for grains, pulses and oilseeds.

Combining crops can be encouraging for European buyers

European buyers of third-country imports do not like taking risks. Since the demand for fonio in Europe remains small, it is likely that importers will want to deal with small volumes. One way of encouraging importers to buy fonio is to combine exports of fonio with other, more mainstream products. For example, you could try to find importers that already import crops that are grown together with fonio, such as millet, sorghum, sesame, groundnuts, or even kidney beans or cowpeas. Combining products is not only a good way to save on logistical costs, but you will also be less dependent on a single product.

Important to know: a steady supply is crucial to secure a market

Establishing a permanent spot for fonio in the marketplace will depend on how it is managed as an export product. Buyers will be interested in fonio if it proves to be a profitable product that is worth promoting.

Guaranteeing a steady supply of high-quality fonio is crucial to secure a market in Europe. To achieve this, challenges related to the processing of fonio must be overcome. Given the small size of the grains, fonio requires intensive manual labour. Small farmers often lack the capacity to manage large harvests. They also lack experience with European import regulations and food safety management systems. Removing sand from the product is particularly difficult. Failing to secure a reliable supply will slow down potential growth in Europe.

To improve the quality and competitiveness of fonio in Africa, CIRAD and Yolélé have been testing mechanised post-harvest techniques. As a fonio exporter, you may want to explore the possibilities to adopt these technologies.

Tips:

- Include different types of grains, seeds and pulses in your export portfolio. This will help you to diversify your range to buyers. By doing this, you will spread your risks and improve your efficiency.

- Prepare your export with the CBI tips for doing business with European buyers of grains, pulses and oilseeds. Only offer fonio to European buyers when you are fully aware of all their expectations and requirements. Make sure to present samples, supply conditions, price information, export volumes and detailed information on the production and processing processes.

3. Which European countries offer most opportunities for fonio?

Since fonio gained its novel food status in 2018, demand in Europe has been growing modestly but steadily. Pioneering companies in the Netherlands, France, Italy and the United Kingdom have been promoting fonio for several years already. But there are also opportunities in the large consumer market of Germany and consumers of organic health foods in Switzerland.

There are multiple aspects you could look at to determine the market potential for fonio in European countries. For example, you can check import data for fonio and other similar grains. You can also look at the size of the organic or gluten-free market, as well as relevant industries, such as the bakery sector.

Table 1: European markets with the most potential for fonio, based on population and import of niche cereals in 2022

Population (in millions) | Import of fonio and comparable cereals (in 1,000 euros) | ||||

| Fonio | Fonio (directly imported from developing countries) | Quinoa | Other niche cereals (HS-code 100890) | ||

| France | 68 | 104 | 101 | 15,359 | 5,567 |

| Netherlands | 18 | 83 | 83 | 10,492 | 4,827 |

| Italy | 59 | 53 | 27 | 9,168 | 15,818* |

| United Kingdom | 67 | 25 | 25 | 5,206 | 5,095 |

| Belgium | 12 | 14 | 5 | 4,052 | 12,272* |

| Switzerland | 9 | 11 | 11 | 3,405 | 3,228 |

| Poland | 38 | 10 | 0 | 1,202 | 1,877 |

| Germany | 84 | 2 | 2 | 10,665 | 8,309 |

| Spain | 48 | 8 | 8 | 5,978 | 4,912 |

Source: ITC Trade Map and national statistics

*Imports of niche cereals into Belgium and Italy underwent a sudden import peak in 2022

Source: ITC Trade Map

France – the largest fonio market in Europe

France is the biggest importer of fonio in Europe. In 2022, the country imported 115 tonnes of fonio, which is nearly half of the total fonio imports into the European Union. With the exception of 2022, fonio sales have gradually increased. France has been an early adopter of fonio and is leading the European trade.

France probably has the highest demand from ethnic consumers because of its close relations with French-speaking African countries. More than 227,000 citizens of Mali, Senegal and Guinea live in France, and this is a consumer group that may already be familiar with fonio. Most of France’s imports of fonio also originate in Guinea (40%), Mali (35%) and Senegal (19%).

The French Agricultural Research Centre for International Development (CIRAD) has dedicated several publications to fonio. With their research and development projects, they contributed to plant-breeding and post-harvest technologies in the fonio sector in West Africa.

Companies such as Gaia and Ibémi have played an important role in introducing and distributing fonio to new consumer groups. Gaia promotes several organic and fair-trade certified fonio products. Ibémi promotes organic fonio in France and serves more European countries through its webshop.

Most of the fonio in France is sold in specialist organic stores and webshops. After several years of strong growth, the organic market is currently under pressure. This means that the demand for fonio fell in 2022. However, there are a large number of organic food chains that offer opportunities for fonio in the coming years. The three leading organic shop groups are Biocoop, Naturalia and La Vie Claire. Other organic outlets include Bio c’Bon, Biomonde, Les Comptoirs de la bio, L’Eau Vive and La Vie Saine.

Figure 5: Fonio products in France

Source: Open Food Facts, adjusted from: kiliweb, CC-SA 3.0; kiliweb, CC-SA 3.0

Tip:

- Check whether your product already complies with the European standards of organic agriculture. Find a recognised accreditation body to get your product certified, if possible. France could be an interesting pioneer market for organic fonio.

The Netherlands – Dutch retailers early to sell fonio

At 43 tonnes in 2022, the Netherlands is the second-largest importer of fonio. The volume accounts for 17% of total imports into the European Union. The Netherlands is a new market for fonio. But as a major logistical entry point into Europe, you can expect the country to play a major role in future trade.

Because of its role as a global trade hub, many new products are quickly adopted in the Netherlands. This can be used to your advantage when marketing your fonio grains through Dutch trading channels. Symfonio, a social enterprise that supports the organic cultivation of African crops produced by women, is one of the main promoters of fonio in the Netherlands. Currently, most of the fonio imported is supplied by Burkina Faso, Togo and Guinea.

As in other European markets, fonio is often sold in organic food stores such as Ekoplaza and Odin. Alternatively, you can find it in specialist ethnic shops such as Africa Products Shop. Regular supermarkets have also started selling fonio, although it is not yet a regular product. Jumbo supermarket offered fonio temporarily under their private label brand. In early 2022, the leading food grocer Albert Heijn introduced fonio in their packaging-free concept store in Rotterdam. This is a positive development, but both fonio and the packaging-free concept still require a major change in consumer habits.

Figure 6: Fonio as private label brand in a Jumbo supermarket in the Netherlands

Photo by ICI Business

Figure 7: Fonio for the ethnic market in the Netherlands and Belgium

Photo by kiliweb per Open Food Facts; CC-SA 3.0

Tip:

- Learn about the importance of grains, seeds and pulses trade in the Netherlands (pdf) through this publication of the Royal Dutch Grain and Feed Trade Association.

Italy – large wheat-processing industry

Italy was among the first European countries to adopt fonio. The application to authorise fonio as a novel food in Europe came from the Italian Obà food group. Obà serves both the consumer and the business-to-business markets with fonio grains and flour. Pioneering companies are crucial to the promotion of fonio as a new ingredient in Italy’s traditional food market.

Italy’s fonio imports are increasing. In 2018, imports stood at just 7 tonnes (€14,000), but this had increased to 36 tonnes (€53,000 euros) by 2022. Some of this fonio finds its way into Italy through other European countries.

Italy offers good prospects for fonio and could be a good first-target market. Having a large wheat-based industry, there is interest in alternative gluten-free products in the Italian market.

Italy has a large industry that works with wheat for bread, pizzas and pastas. The country is also among the largest European markets for gluten-free products. In 2020, 23% of Italians stated they sometimes consume gluten-free food, while 6% ate gluten-free on a regular or daily basis. The Italian company Schär is one of the leading European brands for gluten-free products, but also traditional producers such as Barilla have developed gluten-free product lines. Obà produces gluten-free pastas with fonio. The demand for gluten-free ingredients will help new grains such as fonio to gain acceptance.

Figure 8: Obà Food – one of Europe’s fonio frontrunners

Source: Wikimedia Commons, Gabbri.gabbri; CC BY-SA 4.0

United Kingdom – major market for alternative grains

The United Kingdom (UK) is among the main markets for fonio. In the past five years, imports have fluctuated between 7 and 14 tonnes.

The demand for fonio in the UK relates to a number of factors. First, the UK market leads the way in the development of gluten-free alternatives. Many people rely on these products. Approximately 10% of consumers in the UK follow a gluten-free diet.

Adding to this, the UK market caters to a growing number of health-conscious consumers. Health consciousness in the UK is associated with the increase in obesity in the population in recent decades. Therefore, British consumers are increasingly looking for new healthy, high-nutrition ingredients. You can tap into this trend by reaching out to health and wellness brands, such as Aduna. Aduna currently imports fonio from women’s cooperatives in Mali to supply the UK market.

Switzerland – high purchasing power for health foods

Switzerland is located between Germany, France and Italy, three high-potential markets for fonio. Its population is much smaller, but it has more health-oriented consumers with high purchasing power than its neighbours.

Swiss people can be described as conscious consumers who value quality, health and social responsibility. The country has one of the highest per-capita consumption rates of organic foods in Europe. The Swiss organic standards comply with both EU and Swiss organic regulations. It also applies stricter criteria in terms of social responsibility, animal welfare, soil health, and biodiversity.

For a small country, the import value of niche grains in Switzerland is relatively high. The import value of fonio went up to €11,000 in 2022. Fonio is recognised as a gluten-free grain by the Association for Coeliac Disease in German-speaking Switzerland (Zöliakie). The promotion of the grain and its nutritious properties will likely result in higher sales in the coming years.

You can tap into this trend by getting in touch with Gebana, a social enterprise that in 2022 imported over 3.5 tonnes of fonio from Togo. Using a crowdfunding model to finance the import of fonio, Gebana is planning to expand its imports and facilitate direct trade between producers in Africa and consumers in Europe.

Tip:

- Get certified with Bio Suisse if you plan to sell organic fonio in Switzerland. This certification goes beyond the EU certification for organic products. Read about the differences and how to acquire Bio Suisse certification on the website of International Certification Bio Suisse AG.

Germany – underdeveloped potential fonio market

Germany currently imports negligible amounts of fonio. Even so, Germany is a market with major potential. With Europe’s largest population, it is also the largest food-consuming market.

Germany is an important producer and consumer of wheat products. Interestingly, it is also one of the largest suppliers of wheat to Western Africa. But in Germany, consumers are becoming increasingly interested in ancient grains and foods of high nutritional value. Fonio would fit perfectly in this trend, but the adoption of new grains is slow. It may take time for German consumers to include fonio in their diets. Growth in other European countries will definitely help to make fonio better known in Germany as well.

German consumers who appreciate ancient super grains are usually also focused on eating natural and clean products. This means that your fonio needs to be free of any chemical residues, and preferably organically cultivated.

Tip:

- Find relevant German and international companies in the bakery industry in the exhibitor list of iba, the leading trade fair in Germany for the bakery, pastry and snack trade. Germany also hosts for other large food fairs such as Biofach, Anuga and Food Ingredients (Fi) Europe.

4. What opportunities and threats are there in the European fonio market?

The growing cultivation of fonio in West Africa allows for a steady supply. Trends such as a growing demand for healthy superfoods and consumers’ awareness of the social and environmental impacts of food production are influencing the European market. These trends can potentially help in matching the increasing fonio supply with demand, but some risks should be taken into account.

Global focus on millets as sustainable grains

There is a growing focus on sustainable grains that can prevent famine and enhance economic prosperity. Promotion will be crucial in highlighting the important role of fonio as one of those grains.

The year 2023 has been declared the International Year of Millets (IYM 2023). This is an opportunity to raise awareness of the nutritional and health benefits of millets such as fonio. Millets can be cultivated under adverse and changing climatic conditions. The year will therefore also promote sustainable millet production. These grains can provide new sustainable market opportunities for producers and consumers if their potential is highlighted.

IYM 2023, publications, supporters, and even a Fonio cook book, are contributing to the popularity of fonio and promoting its status of a sustainable and nutritious grain. The International Year of Quinoa in 2013, for example, boosted global quinoa sales. With similar international attention, fonio has the potential to become the next big food trend in Europe.

Book Launch of “The Fonio Cookbook: An Ancient Grain Rediscovered” by Pierre Thiam

“In this landmark cookbook, chef Pierre Thiam, a native of Senegal, celebrates fonio, an ancient "miracle grain" of his childhood that he believes could change the world. Grown for centuries in Africa, fonio is not only nutritious and gluten-free, but also as easy to cook as rice and quinoa.”

Source: NYU Africa House

Growing demand for healthy superfoods

Because of the nutritional value of fonio, it can tap into the superfoods market. This is a segment that is growing thanks to changing habits around the world and especially among young consumers pursuing healthy lifestyles.

Fonio grains are rich in essential amino acids for human health that are not usually present in the world’s main cereals such as wheat, rice, corn, sorghum, barley and rye. Fonio is also a good source of B vitamins, which are necessary for cell growth, development and function, as well as for energy production.

Likewise, fonio traders can benefit from the increasing demand for gluten-free grains. The gluten-free segment in Europe is expected to grow by 11.1% annually (CAGR) from 2023 to 2028. For people with coeliac disease or gluten intolerance, fonio is a great option because it lacks gluten. Additionally, fonio starch resists digestion and does not lead to a spike in blood sugar levels. This makes fonio a suitable food for persons seeking to manage diabetes.

Highlighting the nutritional benefits of fonio will help in increasing its popularity and adoption by brands promoting healthy foods. The organic food market is also a promising venue to promote fonio’s nutritional value.

Tips:

- Identify and connect with companies supplying specialised foods to the market, such as gluten-free. Gluten-Free Passport has compiled a list of major retailers, vendors and brands selling gluten-free alternatives in Europe.

- Promote awareness of fonio by involving grain specialists. For example, get the attention of experts and members of the Healthgrain Forum and seek their support in advocating fonio as a healthy grain.

Consumers are becoming more aware of the social aspects of food production

European consumers are growing increasingly concerned about the social and environmental aspects of food production. The primary target groups for fonio are ethnic-minority consumers and conscious consumers. Both groups are more concerned than average about the origin of their food. They want an authentic, honest and high-quality product.

Exporters of fonio to Europe are likely to find themselves doing business with socially-engaged entrepreneurs. These importers want to offer an attractive and responsible product to food retailers and their customers. Most current fonio importers have built their reputation by focusing on fair trade, rights for female workers and organic cultivation.

Exporters of fonio should try to highlight the positive impact of fonio. Thanks to traditional cultivation methods, fonio is a crop with a small ecological footprint. It provides opportunities for smallholder farms and can be grown organically. You can even use fonio to ensure a local food source, preserve biodiversity and improve soil fertility. The Guinean company La Petite Damba aims to empower farmers and women. In the end, positive stories about social impact will help sell the product.

Tips:

- Use social benefits to promote fonio. Show that you are engaged in a sustainable production with a positive local impact. Learn about the possible benefits of social certification standards by reading CBI’s article on social certifications.

- Explore new ways to include fonio in sustainable agriculture. For example, improve soil management by combining fonio with legume crops such as cowpeas, and read other tips about how to improve the production of fonio.

New food applications influence fonio’s popularity

Traditional and specialty grains are often used in product development. Food brands in Europe like to launch new products that include these grains, particularly if they are nutritious and gluten-free alternatives to wheat. Products such as Nairn’s multigrain oatcakes promote the nutritional benefits of rye, amaranth and quinoa.

Fonio has many potential applications and could increase its market share as an ingredient in the near future. The Italian Obà food group was one of the first in Europe to develop a gluten-free pasta using fonio. The French company Ibémi offers fonio chips on their website. In the Netherlands, Kari’s Crackers began selling fonio-chia knekkebrød (crispbread) in 2022, and another company is using fonio in its Organic African meal soup. These pioneers can become your potential clients. But more importantly, they will introduce fonio to European consumers.

Figure 9: Example of fonio in consumer products

Source: Kari's Crackers

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research