The European market potential for quinoa

Europe has become the world’s largest importing region of quinoa. With quinoa becoming a more common product, its growth now lies in product development and the increasing demand for healthier foods. You can find opportunities in early adopters in Western Europe and the geographic expansion towards the eastern European countries.

Contents of this page

1. Product description

Quinoa (Chenopodium quinoa) is an ancient grain crop that was originally domesticated 3,000 to 4,000 years ago in the Andean region of Bolivia and Peru. The crop is part of the Amaranthaceae family, and is not a true grass but rather a pseudo-cereal. Quinoa is mainly used for its edible seed, which is gluten-free, high in protein and a good source of fibre. Quinoa seeds have a bitter saponin coating, which is usually removed from commercial quinoa intended for human consumption.

There are over 3,000 varieties of quinoa, many of which are still grown, and several varieties are commercialised. These varieties have diverse nutritional properties, but so far, the awareness in the market of these differences is limited. The key properties for trading purposes are:

- the colour: yellow-white, red or black

- organic or non-organic cultivation

- origin or growth climate: lowland (coastal area), highland or ‘Royal Quinoa’ with denomination of origin

- seed size (‘Royal Quinoa’ is known to have a larger seed size)

- the presence of saponin (sweet or bitter quinoa)

Most varieties are cultivated in the South-American highlands (Peru, Bolivia, Ecuador). A larger quinoa type grown on the Bolivian altiplano or highlands is marketed as Royal Quinoa (Quinoa Real). Four different varieties are used to produce Royal Quinoa, which has obtained its own protected Designation of Origin (DO).

Since 2012 quinoa is traded under the Combined Nomenclature (CN) Code 1008.50.00 as QUINOA “CHENOPODIUM QUINOA”.

Image 1: White quinoa seeds

Source: Pixabay

2. What makes Europe an interesting market for quinoa?

Besides already being the largest quinoa buying region in the world, Europe still offers future growth for quinoa. The growth rate from the earlier days will not return, but the region offers a stable demand and various markets that are yet to emerge.

Europe is the largest buyer of quinoa

Europe (the European Union and EFTA) is the biggest importer of quinoa from the main quinoa producing countries Peru, Bolivia and Ecuador. The region is responsible for roughly 1/3 of the total import from these countries.

Europe has caught up with the quinoa demand in the United States, which started slightly earlier. Currently, the import is just a few hundred tonnes more than in the United States. It is important to mention that the quinoa import of the United States has decreased in the last two years, which may be a future perspective for Europe as well. In the next few years, other consumer markets such as China are also expected to expand. But for now, Europe, together with the United States, remain crucial markets when exporting significant volumes.

*other countries is calculated as export from Peru/Bolivia/Ecuador minus the import of the mentioned countries

Europe offers stable and emerging markets

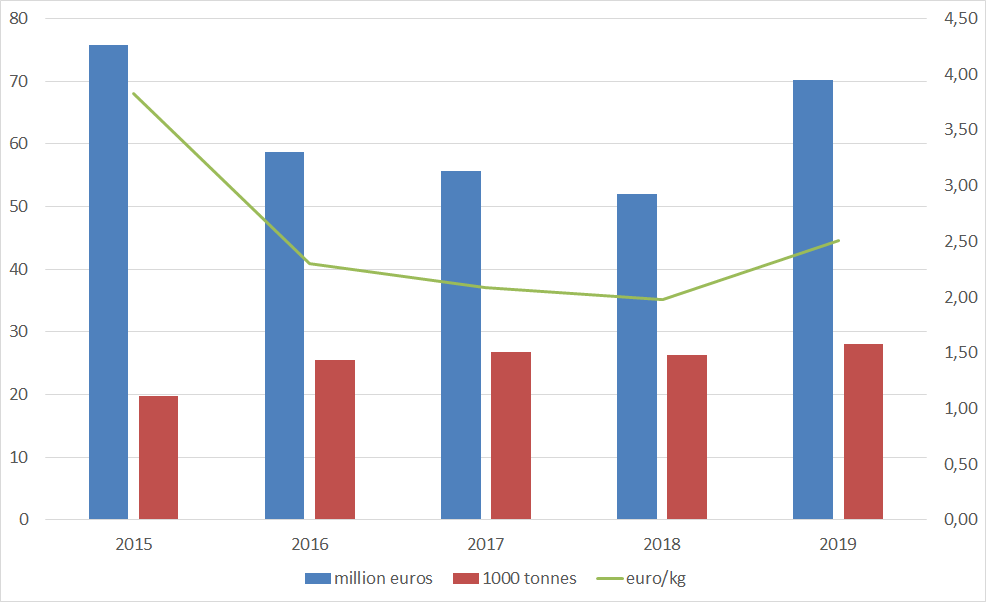

Europe has a stable, and growing import of quinoa. Despite fluctuations in supply and trade prices, the import volume has proven to be stable over the last five years, with only a slight reduction in 2018. There is still prospect for future growth.

The total European import in 2019 reached 28 thousand tonnes (European production and re-export excluded). In 2012, when quinoa obtained its own statistical code (100850), the European import was less than 6 thousand tonnes. Although import growth has slowed down, Europe still imported more in 2019 than the year before. Also, the trade value per kilo increased because production growth is slowing down and the prospect of an increased demand in Asia.

In the western part of Europe, quinoa has become a common grain and consumption is still increasing. However, the highest growth is in smaller countries such as Austria and Ireland and in emerging consumption countries such as Slovenia, Lithuania, Greece, Czech Republic and Poland. Part of the quinoa in these countries is not supplied directly from origin but through other traders in Europe, but it is a good indication that the European market still has growth potential.

Quinoa will continue to be incorporated in European diets. It is important that you maintain a broad view on the market development throughout Europe,f so you know where to find the best sales opportunities.

Figure 2: European import value and volume of quinoa with non-European origin

Source: Eurostat / Market Access Database

Tips:

- Explore the large markets with growing imports, but keep an eye also on potential growth in new markets in Central and Eastern European countries, such as Poland, the Czech Republic and Greece. Use our tips for finding buyers on the European grain, pulses and oilseeds market.

- Read the study on Entering the European market for quinoa to get better insights in your main competitors.

3. Which European countries offer most opportunities for quinoa?

The main consumer markets for quinoa include France, Germany and the United Kingdom. The Netherlands and Belgium are important as logistical hubs for quinoa distribution, and Spain has potential to combine production with re-exports. Several countries in Europe have started cultivation projects or quinoa plant breeding research. The local production has an increasing influence on the development of demand.

France: Europe’s main importer

France has been a pioneering country for (mainly organic) quinoa and still leads the imports in Europe.

Early adopters such as Ekibio and their brand Priméal, use quinoa for its vegetal and organic products. With the participation of these early adopters, France accounted for 45% of the European quinoa import in 2012. While other countries started to adopt quinoa as well, the estimated consumption in France grew to 10 thousand tonnes in 2019.

France was also one of the first European countries to cultivate quinoa, with early initiatives such as Quinoa d’Anjou. According to its founder, 250 producers will grow red or white quinoa in 2020 with a harvest target of 3 thousand tonnes. The country is currently the second biggest producer in Europe, after Spain.

Although France is gradually expanding its own production, the import keeps growing. The country has had good commercial relationships with Bolivian producers since the start. France imports the majority of its quinoa from Bolivia (3.4 thousand tonnes), although Peruvian supply is very close (3.2 thousand tonnes). Further adoption of quinoa in new product development of different healthy and organic foods will maintain a strong demand.

Germany: late bloomer with larger potential

With the largest population in Europe, Germany may have the most consumer potential for quinoa in Europe. However, quinoa has not yet been fully adopted by the German industry. Its quinoa consumption developed later than France. The first import boost came in 2014, but the growth that followed remained slower than its French neighbour.

The health aspect is an important driver for the consumption of quinoa and other healthy grains. The demand for organic is relatively large while the controls on residue limits are also some of the strictest in Europe. German consumers generally have more confidence in the local production of organic food. Kiel University research in Germany suggested in 2018 that large-scale quinoa cultivation in Europe would be possible in five years, but this does not mean that it will actually happen or that it will be economically attractive.

With a steadily growing demand, the import is expected to continue to increase. In 2019, Bolivia became Germany’s main supplier with 3 thousand tonnes, while the import from Peru was reduced from 2.5 to 2.2 thousand tonnes.

Netherlands: remains hub for quinoa

The Netherlands is a major trade hub for quinoa. While its market share in trade has decreased a little over the past years, the commercial interest in the quinoa value chain has increased at a global level.

The Netherlands imported a significant amount, 5.5 thousand tonnes, in 2019, most of which originated in Peru (2.4 thousand tonnes). With an export of 4.9 thousand tonnes, the country can truly call itself a trade hub. From here, most of Europe can be reached, making it an attractive market for bulk or high-volume exporters.

As quinoa is developing into a more common ingredient with larger users and food processors, some of the trade will become more direct and side-line some of the Dutch traders. Nevertheless, there are still many smaller markets to supply in Europe for which the Netherlands remains an excellent point of distribution.

The Dutch interests are also increasing in quinoa breeding, cultivation and product development. Local growers produce several hundred tonnes, and food companies such as GreenFood50 develop products from locally cultivated quinoa. The Dutch quinoa varieties are based on extensive research and seed breeding programmes by The Quinoa Company and Wageningen University and Research. Their ambition is to stimulate regional production chains all over the world. These regional chains with ‘lowland’ Dutch quinoa varieties already exist, for example in the United Kingdom and France, but also in Turkey, Argentina and South Africa. And soon, they will reach the United States, Canada and Israel. This is how the Netherlands is leaving a mark on the global production of quinoa.

United Kingdom: third largest consumption market

The United Kingdom is the third-largest consumer market. There is still a trend of increasing import, which is a positive sign for quinoa exporters.

The United Kingdom imported 4.7 thousand tonnes of quinoa in 2019, which is 40% more than in 2015 (five years ago). Peru is leading the supply with 2.5 thousand tonnes. Bolivia only plays a minor role, and the United Kingdom’s direct import is not more than a few hundred tonnes. Initiatives of domestically grown quinoa such as British Quinoa adds to the consumption. This local quinoa finds an eager demand with retailers such as Waitrose, M&S and Booths, but it is not likely that it is able to substitute imported quinoa.

With the development of Brexit (Britain leaving the European Union), the current import from EU countries such as France, Ireland, the Netherlands and Spain could be replaced with quinoa from Peru, Bolivia and Ecuador. This will depend on whether the United Kingdom and the European Union succeed in closing a trade deal.

Spain: becoming a net exporter

Spain became a net exporter of quinoa in 2018. In 2019, Spain surpassed the Netherlands in the total export volume and became Europe’s largest exporter of quinoa.

Quinoa consumption is relatively low in Spain, but producers have started to consider it as a profitable crop. In 2019, the total cultivation area in Spain was more or less 1,763 hectares with most production in Andalusia. The yield varies between 1,000 and 2,000 kg/ha for dry cultivation up to 4,400kg for irrigated cultivation. This has turned Spain in Europe’s prime producer.

As a result of the local production, the import decreased slightly after 2017, from 4 to 3.8 thousand tonnes in 2018 and 2019. The import from Peru (2.3 thousand tonnes) was higher than from Bolivia (one thousand tonnes).

Meanwhile the export increased from 1.2 thousand tonnes in 2017, to 3.1 thousand in 2018 and 5.1 thousand in 2019. Spanish exports are directed to other European countries as well as the United States. In the future, Spain could still play a role for foreign quinoa suppliers, combining local quinoa with the re-export from third countries.

Belgium: Strong import increase

Belgium shows the most import growth of the main importing countries in Europe. With a 23% increase from 2018 to 2019, the country has become more attractive for foreign suppliers.

The total import reached 3.4 thousand tonnes in 2019. Especially the import from Peru showed a major increase; 500 tonnes more than a year earlier. However, more than half of the imported volume is re-exported again, mainly to France. Just like the Netherlands, Belgium fulfils a logistical role and offers a good port connection for the French, Dutch and German markets. When traders in these countries switch seaports, it can also alter the trade statistics.

Tips:

- Focus on France, Germany and the United Kingdom for bulk markets. To supply additional or several smaller users of quinoa, consider finding a trader in the Netherlands or Belgium. These are countries with experienced quinoa importers with international focus.

- Visit relevant trade fairs to find potential buyers. Well-known food fairs are SIAL, Anuga and Biofach (for organic food).

4. Which trends offer opportunities on the European quinoa market?

Awareness of healthy diets remains a strong driver for nutritious grains such as quinoa. The story behind quinoa as an ancient grain addresses the consumer’s growing interest in their search for authentic food. While quinoa is becoming an increasingly common ingredient, product development will foster future growth.

Health is still good reason for buying quinoa

A growing number of consumers in Europe are becoming aware of the need for a healthy diet. Quinoa is an ideal example of a healthy ‘superfood’ that has received much media attention in the past years. Much of the growth in imports of quinoa can be attributed to consumer perception of its healthy, nutritious properties.

The demand for healthier food will continue to grow. Quinoa is not the only upcoming healthy grain on the market, but it will continue to enjoy opportunities in specific niches such as the gluten-free and vegan market. More recently, the COVID-19 crisis is being used to promote plant-based consumption, and consumers may become even more open to the protein-rich quinoa grains.

The increased attention to health, environmental and social responsibility is also leading to rapid growth of the organic sector. In the case of quinoa, the European demand has been developed by the organic sector. While the market for conventional quinoa has also expanded, a large share is still organic.

As a non-European supplier, it is crucial to supply pesticide-free or organic quinoa to keep a grip on the European health market.

Tip:

- Go to the CBI trend study for more insight into the European trends for healthy grains, as well as pulses and oilseeds.

Interest in authentic food and ancient grains

Many European consumers are prepared to try out ‘new’, authentic products. The story behind quinoa, depicting it as an ancient grain from the native Andean region, makes the product more interesting. It carries the added value of an ‘ancient grain’.

Bolivia differentiates its offer with the ‘Royal Quinoa’ variety, emphasising its origin, superior quality and size. You can use the authenticity of the product in your promotion if you are a company from the Andean region. The main producers of Royal Quinoa in the southern Altiplano of Bolivia have developed the sectorial brand “Royal Quinoa Bolivia” to nationally and internationally promote the unique origin of this quinoa variety.

However, do not expect origin or variety to be the most important commercial factor. Quinoa itself is already considered an ancient grain regardless of its true origin, and non-traditional quinoa cultivation in Europe is considered more sustainable than imported quinoa.

Tip:

- If possible, create a good story for your product, including information on such aspects as its origin, social impact and traditional cultivation.

Product development is key for quinoa

The variety of food products available on the European market is growing rapidly. Quinoa is an interesting ingredient for new products in this expanding market. It is used in grain mixes, such as rice and quinoa or quinoa and pulses, and in salads, pastas, ready-made meals and soups, bakery products, snacks and breakfast cereals.

The future growth of quinoa in Europe depends partly on the continuation of this product development. You can use this development to target different types of clients in food processing. Most of the European food brands present their new products on trade fairs, so that is a good place to see what’s new.

Developing and supplying these products as a non-European supplier is challenging, but it can be a good way to differentiate from the bulk grain trade. One of the companies that succeeded in presenting quinoa products in Europe, such as pastas and snacks, is Coronilla from Bolivia.

Tips:

- Take the time to check out important food fairs, such as SIAL, Anuga and Biofach, or specialised events for allergen-free food such as the Free From Expo, or one of the locally organised Allergy Show.

- Keep up to date on new food trends in Europe by visiting news websites, such as Food Navigator, Organic & Wellness News and Food Manufacture. When visiting Europe, check out grocery shops, online retailers and supermarkets to see which brands and what type of products are offered to consumers.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research