Entering the European market for sesame oil for food

Entering the European market requires a well thought-out strategy. While there may be different ways to compete in this market, food safety, quality and differentiation will be key factors. Consistent quality and understanding the needs of your potential buyer can make you stand out over your competitors in Mexico and oil millers in Asia. With sesame oil prices rising, cost efficiency can also help you to interest buyers.

Contents of this page

1. What requirements and certifications must sesame oil meet to be allowed on the European market?

Sesame oil must comply with the general buyer requirements for grains, pulses and oilseeds. For an overview of legal requirements, you can also use My Trade Assistant in Access2Markets. You can find a set of general and specific import requirements by using the product code for sesame oil (15155019/99), the origin and the destination country.

What are mandatory requirements?

The most important factors for exporting food-grade sesame seed oil to Europe are food safety, quality and a residue-free product.

Controlling food safety in sesame oil

Sesame oil, as a food product, must be safe for human consumption. Food safety and traceability should be your top priorities. As an oil miller and exporter, you must work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP). A monitoring and management system can help eliminate the risk of food safety incidents.

Basic practices include:

- Registering the origins of the sesame seeds

- Checking the sesame seeds before processing

- Using proper storage for sesame

- Maintaining a clean facility

- Controlling chemicals and (microbiological) contamination

- Sampling and analysing the final product

- Taking action where appropriate

You must pay attention to control the levels of pesticide residues, contaminants and micro-organisms. Some of the risks in sesame oil include pesticide residues, aflatoxin, salmonella, glycidol, 2-MCPD and 3-MCPD.

Residues must be absent or within the limits according to the European legislation on maximum residue levels (MRLs). Organic sesame oil should not contain any residues of non-organic-approved pesticides. The 2022 European Union report on pesticide residues in food showed that 12.3% of the tested sesame seeds were non-compliant or above the legal limit. The use of ethylene oxide is often a reason for recalls or rejection at the border. The European Union (EU) does not allow ethylene oxide for salmonella prevention.

The risk of glycidol, 2-MCPD and 3-MCPD has been extensively investigated by the European Food Safety Authority (EFSA). The maximum levels for contaminants in vegetable oils are established by EU Regulation 2023/915 (version 25/04/2024).

Draft regulation for mineral oil hydrocarbons

The EU Commission has proposed maximum levels for mineral oil hydrocarbons (MOH), mineral oil aromatic hydrocarbons (MOAH) and mineral oil saturated hydrocarbons (MOSH). EFSA conducted a risk assessment of MOH in food and found the highest levels in vegetable oils. In the case of sesame oil, contamination can happen, for example, due to ageing oil presses.

The new regulation will reduce the maximum level for MOAH to 2mg/kg for products with >50% fat or oil. The company Eurofins has a good summary of the upcoming changes in an update on the measures for handling MOSH/MOAH results.

Green Deal

In 2020, the EU implemented a set of policies and actions called the European Green Deal. The Green Deal aims to make the European economy more sustainable and climate-neutral by 2050. The action plan also includes a 50% reduction in the use of pesticides and a 25% increase of the share of agricultural land used for organic farming by 2030. This means that more pesticides will be banned and residue levels will drop gradually in the coming years.

Tips:

- Find out the MRLs for pesticides that are relevant for sesame seeds. Search for ‘sesame seeds’ (code number 0401040).

- Reduce the amount of pesticides by applying integrated pest management (IPM) in your production. IPM is an agricultural pest control strategy that includes growing practices and management of chemicals to grow healthy crops and minimise the use of pesticides.

- Analyse the sesame seeds you use for crushing and test your final product to check if you meet the food safety requirements for export to Europe. Make sure to use a recognised laboratory.

- Stay up to date with regulations and legal requirements. EU regulations are constantly being updated. Maintain close contact with your buyers, because they have to follow the same rules and they can also keep you up to date.

Nutrition and health claims

Mind the European guidelines when promoting the health benefits of sesame oil. You cannot promote health benefits that are not approved by the EU. Any nutritional and health claims should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation (EC) No 1924/2006 (consolidated version of 13/12/2014). General claims such as ‘healthy’ or ‘superfood’ will only be allowed if they are accompanied by a specific permitted health claim.

Tip:

- Check with the EU Register of Health Claims and the Permitted nutrition claims to see which claims are allowed to be made on the European market.

Packaging, labelling and storing

Sesame seed oil is high in vitamin E, sesamolin and sesamol (antioxidants). This makes it a stable oil, resistant to oxidation. Still, sesame oil must be stored in closed containers, protected from light, oxygen, moisture and higher temperatures to preserve shelf life.

Packaging must be suitable to protect the product and conform with Regulation (EC) No 1935/2004 (version 27-03-2021) on materials and articles intended to come into contact with food. Common packaging for sesame oil include:

- IBC containers (900kg)

- Drums or barrels (195/200kg)

- Canisters (27kg)

There are also smaller packaging types, but as an exporter you can choose to bottle your sesame oil in the destination country to save on shipping costs.

- Wholesale packaging, e.g. jerrycans (2.5-5L)

- Consumer packaging bottles (250-500ml)

For details on labelling, see the general requirements for grains, pulses and oilseeds. Attention must also be paid to the intended use and the traceability of the product. When selling sesame oil in consumer packaging, the rules on labelling are stricter and set by EU Regulation 1169/2011 (version 1-1-2018). All consumer products require nutritional information. For sesame products it is also mandatory to include an allergen declaration.

Figure 1: Example of an IBC container for bulk trade

Source: Cjp24, CC BY-SA 3.0, via Wikimedia Commons (2015)

Tips:

- Always discuss specific packaging requirements and preferences with your customers. Prepare yourself for different packaging preferences and make sure the packaging is of good, food-grade quality.

- Read the practical guide on food and drink labelling to see what EU Regulation 1169/2011 (version 1-1-2018) means for you as a business owner. The Fediol website Vegetableoils.eu also provides information on the labelling of vegetable oils and fats.

What additional requirements and certifications do buyers commonly have?

There is no official quality standard for sesame oil. Besides the European food safety legislation, the FAO’s Standard for edible fats and oils and Standard for named vegetable oils give some guidance. Always consult your buyer on their product specifications and preferences.

Quality standards

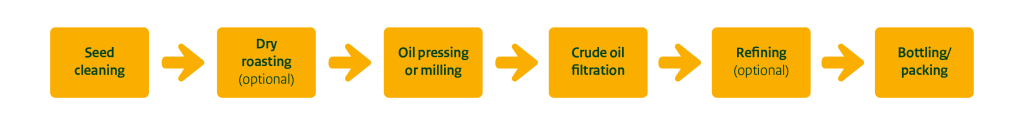

Quality specifications depend on the market channel and further processing or refining in Europe. The healthiest way to produce edible sesame oil is by cold pressing. Sesame oil can be traded as crude, filtered or refined oil. The seeds can be pressed raw, or roasted for additional flavour.

Sesame oil for food flavouring is not refined to preserve flavours. The additional oil that can be retrieved from the oil cake through solvent extraction serves as cooking oil after refining. Some manufacturers will refine the oil for the cosmetic market.

Figure 2: Steps of sesame oil processing

Source: ICI Business (2024)

Quality management

Purity, smell and flavour are important markers to define the quality of sesame oil as food ingredient. Experienced buyers are aware of adulteration in the production of sesame seed oil through blending with cheaper types of oils. Buyers further specify quality by measurable physicochemical parameters such as colour, fatty acid value, peroxide value (oxidation), refractive index and saponification values. In your product specifications you should also include the fatty acid composition.

Stable and consistent quality is very important for European buyers. Quality starts at the agricultural production and the quality of the sesame seeds. You must be on top of this, especially when sourcing with many small farmers. Buyers will sample and test several times. If the quality is not well managed, they will notice that the free fatty acid content for certain lots is higher.

Table 1: Common specification for sesame seed oil

| Peroxide value | 3.0-10.0 (max) | mEq O2/kg |

| Acid value | 4.0 (max) | mg KOH/g |

| Saponification | 185-195 | mg KOH/g |

| Refractive index (20°C) | 1.472-1.476 (approx.) | g/ml |

| Specific gravity/relative density (20°C) | 0.910-0.930 | g/ml |

| Moisture/impurities | 0.15% (max) | % |

Source: Industry sources (2024)

Tips:

- Learn the details of processing sesame oil. See abc Machinery’s description of sesame seed oil production and the right oil production process to setup sesame oil factory for business. They show the different processes to produce toasted sesame oil and refined cooking oil.

- Always check product specifications with your buyer. Also include a product data sheet and certificate of analysis when offering your sesame oil to potential clients. Compare examples from other sesame oil suppliers, for example NHR Organic Oils, AOS Products Private Limited, Gustav Heess or AMD Special Oil.

- Know exactly what you are selling. Adulteration of unpure or mixed oils can be avoided by testing. According to the FAO’s Standard for named vegetable oils, the Baudouin test should be positive for sesame seed oil. Another method, the Bellier Turbidity Temperature Test (BTTT), is explained by the Indian International Research Journal of Engineering and Technology (IRJET).

Certifications as a guarantee

Certifications are a good indication of your compliance with food safety requirements. It gives buyers assurance, but buyers do not rely on certifications only. Your understanding of quality and food safety is crucial to gain their trust. Working according to high-quality standards and an HACCP-based food safety standard is just as important as a certification itself.

To get certified you can best implement a standard that is recognised by the Global Food Safety Initiative (GFSI). These standards are widely accepted throughout Europe. Commonly used certifications include:

- FSSC 22000 / ISO 22000 (Food Safety System Certification)

- BRCGS for Food Safety (British Retail Consortium)

- IFS Food Standard (International Featured Standard)

Tips:

- Find out which certifiers have a presence in your country. Also check with your buyer to determine which certification scheme is most relevant for your target market.

- Read the CBI tips for organising your export and CBI buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform to get more detailed insights about the advantages of certifications.

Organic certification

To market organic sesame oil in Europe, you have to use organic production methods that comply with Regulation (EU) 2018/848 (consolidated version of 21/02/2023). You can apply for an organic certificate with an accredited certifier. When you are certified, you can use the EU organic logo (see figure 1). The whole supply chain must be certified, from farmer to processor and exporter.

Companies that use organic sesame oil in beauty and care products can also get certified with the COSMOS standard.

Figure 3: The EU organic logo

Source: European Commission

Tips:

- Consider organic cultivation if your situation and location permit it. Remember that implementing organic production and becoming certified can be expensive, and there are certification costs for all actors in the supply chain.

- Check the possibilities for group certification if you are part of a small farmers group. IFOAM – Organics International provides training manuals for smallholder group certification with Internal Control Systems (ICS). They also try to make organic certification accessible for small farmers with Participatory Guarantee Systems (PGS) – although PGS still needs to be recognised by the EU. Read more about how to certify a group of smallholders in the IFOAM Position Paper on Smallholder Group Certification for Organic Production & Processing (PDF).

What are the requirements for niche markets?

European buyers are paying increasing attention to sustainability and corporate social responsibility (CSR). As a processor and exporter, you share the responsibility of ensuring a sustainable supply chain.

Sustainability and social compliance

Buyers will often have you fill out a set of documents and declarations before doing business. Or they will ask you to comply with a specific code of conduct. Applying for standards and certifications will help you fulfil the buyers’ expectations. Initiatives or certification schemes that can help improve your CSR performance:

- Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (PDF)

- Sedex Members Ethical Trade Audit (SMETA)

- GLOBALG.A.P. and its Risk Assessment on Social Practice (GRASP)

- Ethical Trading Initiative (ETI), using the ETI Base Code

Another option is a consumer label for social or sustainable conduct. This way you make it visible to consumers. Social labels include:

- Fair for Life (possible for sesame oil)

- Fairtrade International (possible for sesame seeds)

- Rainforest Alliance

Kosher and Halal certification can be relevant for specific consumer groups.

Figure 4: Example of different sesame oil products of OLVEA and their certifications

Source: OLVEA (retrieved 2024)

Tips:

- Use the ITC Standards Map to learn about the different sustainability and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct (PDF). You can also find practical tools through the amfori BSCI platform.

2. Through which channels can you get sesame oil on the European market?

The sesame oil sector has a high level of integration, but there are also opportunities to join. There are as many different types of buyers to select as there are sesame oil types in the market. Finding your niche is all about which value you can add to the supply chain.

How is the end market segmented?

Most vegetable oils are destined for the food sector (48% in 2028). This is certainly the case for sesame. Due to its higher price, sesame oil is principally used as a specialty oil for food flavouring. The oil is normally cold pressed to preserve its natural taste and nutrition. A smaller percentage is destined for the cosmetics industry.

Source: Fediol (2018)

Market segments by type and use

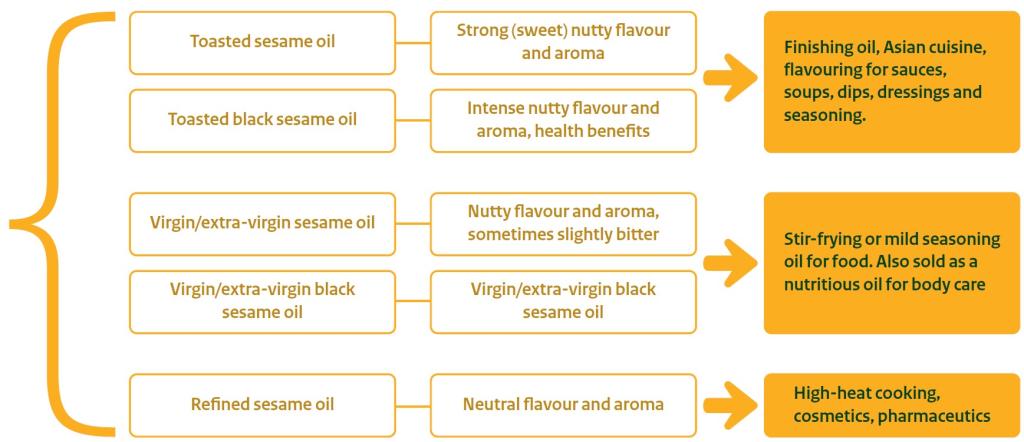

In Europe you can find toasted sesame oil, virgin or extra-virgin sesame oil, and refined sesame oil. The most popular types for food are toasted and virgin sesame oil. The oil can be pressed from white or black seeds.

Toasted sesame oil is made from roasted seeds. It has a strong nutty flavour and is popular in Asian-type cuisines. Oil from black sesame seeds is said to have the strongest flavour.

Virgin oil is pressed from raw or light-roasted seeds. It has a milder flavour and is also suitable as a cooking oil. Another use for raw seed oil is body care because of the high concentration of nutrients. Black sesame seed oil is higher in nutritional value thanks to antioxidants, potassium and calcium.

Refined sesame oil can be used for higher-temperature cooking, but is also applied by the cosmetic and pharmaceutical industry. Refined oil doesn’t have much aroma or flavour. It has no added value for culinary use and can be replaced by other refined oils.

Figure 6: Market segments for different sesame oil types in Europe

Source: ICI Business (2024)

The market segments by outlet

Edible sesame oil is popular in both home kitchens and restaurants. It can be found in a wide variety of market segments.

European consumers have several options of brands and private labels in regular supermarkets. Glass bottles of 250ml are popular in conventional retail. In Asian-oriented grocery stores you can also find different sizes of bottles and foreign brands (see figures 7 and 8). For traditional Asian brands, the flavour is key. The online segment is also growing, selling both commercial and traditional brands. Oils and dry foods are easy products to sell online.

Food service is the other big segment. Food professionals purchase sesame oil through a network of wholesalers. There are online shops and wholesalers that sell Asian food ingredients to restaurants and caterers. Cash-and-carry outlets offer a full range of cooking ingredients for professionals.

The food industry is probably the smallest segment for sesame oil. Many prepared food products need oil as a functional ingredient, but not for flavouring. Here the flavouring aspect of sesame oil is not important, and with its higher price it loses its competitiveness.

Figure 7: Examples of culinary sesame oils in Europe: private label, Asian, organic toasted and Demeter

Source: Photos by tacinte (modified by vaporous) (1) kiliweb (2, 3, 4) per Open Food Facts, collected in 2024 and modified by ICI Business

Figure 8: Examples of different Asian brands in Europe

Source: Photos by kiliweb (modified by 5m4u9) per Open Food Facts, collected in 2024 and adjusted by ICI Business

Tip:

- Visit European supermarkets and Asian shops (retail or online) to see what types of sesame products are on offer. You can compare oil types, packaging, presentation and prices. Many supermarkets have an online presence, like Rewe (Germany), Tesco, Holland&Barrett (UK), Albert Heijn and Ekoplaza (Netherlands). Wikipedia has a list of European supermarkets.

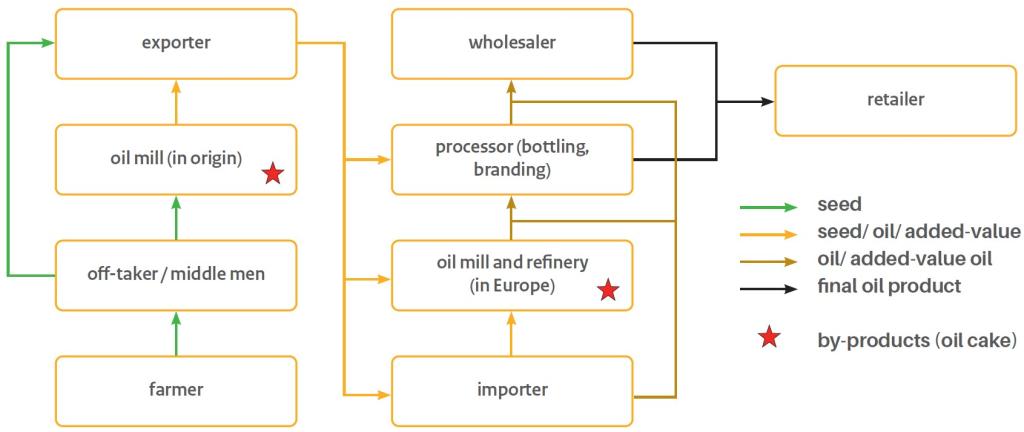

Through which channels does a product land on the end market?

There are different types of vegetable oil businesses, varying from multinational commodity buyers to integrated importers and processors. Many companies fulfil multiple activities in the supply chain. Companies with import activities have a key role in checking product quality and food safety protocols.

Importers (multinationals)

The largest commodity traders, like Bunge, Cargill, Louis Dreyfus Company and ADM, have their priorities set on bulk oil such as palm, canola, sunflower and soybean oils. For specialty oils they can be reached through brokers.

Brokers

Brokers can facilitate your connection to large buyers. They link your product to buyers in Europe and take a commission on the sales. Their function is purely commercial, and as a supplier you will remain responsible for most of the logistical process. Brokers in vegetable oils include Agrioil, M. Themans & Co, Medara Trading, Bertuccelli Mediazioni and C.Giraud&Cie.

Importers (specialists)

Buyers who specialise in sesame oil generally have stable supply chains and often have an international presence or facilities: Olenex is a joint venture of ADM and Wilmar, specialising in edible and tropical oils. Dipasa has a presence in Europe and in Mexico, where they produce different types of sesame oil. Gustav Heess and partner company Genuino have their own processing facility in Togo, from where they can source sesame oil. OLVEA has a processing facility in Burkina Faso. Fairoils has an oil mill facility in Kenya. WepoOil [TC-VU1] is developing partnerships with technology for farm-level oil processing to increasing farmer income.

Oil millers and refineries

Import is not limited to the companies above. Even oil millers in Europe do not always press the sesame oil themselves. The choice for processing and sourcing sesame oil in the sesame-producing country is a cost-benefit issue. But quality plays a key role too. In some cases, importers use European service providers for crushing or refining sesame seeds. Among the oil millers in Europe you will find enterprises like AAK, Vantage, Kerfoot Group and Spack (organic).

For oil mills it can be more efficient to import the oil and avoid the oilcake as by-product. Import may also be more attractive when sesame oil is not a key ingredient or if a company lacks processing capacity. When a company works with many different oils, it takes a lot of effort to change production lines. A good reason for oil mills to press the oil in-house is the control they can have over the timing and the process.

Processors

Further down the supply chain companies blend, bottle and/or brand the sesame oil. Some European brands are Natur Green (a brand from Laboratorios Almond), Henry Lamotte, La Tourangelle, Bio Planète, Emil Noël, Jules Brochenin and Clearspring. Foreign brands like Kikkoman are also active in Europe. Many brands likewise have a tradition in oil milling. Companies that have consumer brands on the retail shelves need a steady and consistent supply. They need to fulfil contracts and their product cannot vary much in quality or characteristics, so reliable partnerships are important.

Processors can also be on an industrial level, blending oils or transforming them into functional ingredients such as glycerine or stearic fatty acid. For sesame oil as food ingredient this channel is less relevant. Other (cheaper) oils are preferred to produce functional ingredients and products like margarines, frying/cooking oil and oil blends.

Wholesalers

Wholesalers distribute oils for professional users as well as branded oil for retail sales. Wholesalers that represent foreign oil brands are often focused on the Asian food market: SHN Foods, Kreyenhop & Kluge and Transfood (Germany); Oriental Mart, M.A. Oriental and Sing-Kee (UK); Asia Express Food, Heuschen & Schrouff and Mooijer Seafood and Oriental Food (Netherlands). Other wholesale companies are active too: Naissance, Vehgro (organic) and Infinity Foods Wholesale.

Figure 9: Visualisation of the sesame oil supply chain

Source: ICI Business (2024)

Tip:

- Check the potential of your buyer in terms of volume, level of integration and processing activities. Get to know these companies and their priorities. Companies that may seem to be competitors can also be clients or partners.

What is the most interesting channel for you?

Be flexible in who you choose to work with. You can start by approaching oil mills and importers and build on their experience. If you produce toasted sesame oil, you can also target Asian food buyers. By offering a consistent and reliable supply, you can try building long-term partnerships with known oil brands. The most challenging will be selling your own sesame oil brand in Europe. Brand marketing takes a lot of investment – this market is currently dominated by European and a few Asian brands.

Tip:

- Meet importers of different vegetable oils and ingredients at large food trade fairs like SIAL, Anuga, Biofach (for organic) and Food Ingredients Europe. Use the exhibitor lists or databases to search for interesting companies.

3. What competition do you face on the European sesame oil market?

The vegetable oil sector is very competitive, with lots of domestic oil milling and processing activities. But for a specialty such as sesame oil, different countries are filling some gaps in the European demand. Important to note: the level of potential or future competition in sesame oil may be just as high as the actual competition.

Which countries are you competing with?

Mexico is the main supplier to Europe, followed by a number of Asian countries. The largest sesame oil producers are China, Myanmar, India and Nigeria. However, looking at the sesame production in Africa, countries like Sudan, Tanzania, Nigeria, South Sudan and Uganda also have potential to enter the sesame oil market.

Source: ITC Trade Map (2024)

Mexico: Europe’s main supplier

Mexico has established a strong position in the sesame oil sector in Europe. Their main exports come from the Mexican state of Jalisco. There are several well-developed enterprises with modern infrastructure and longtime experience in processing, like Sesajal and Dipasa. This has enabled Mexico to build a good reputation with European buyers.

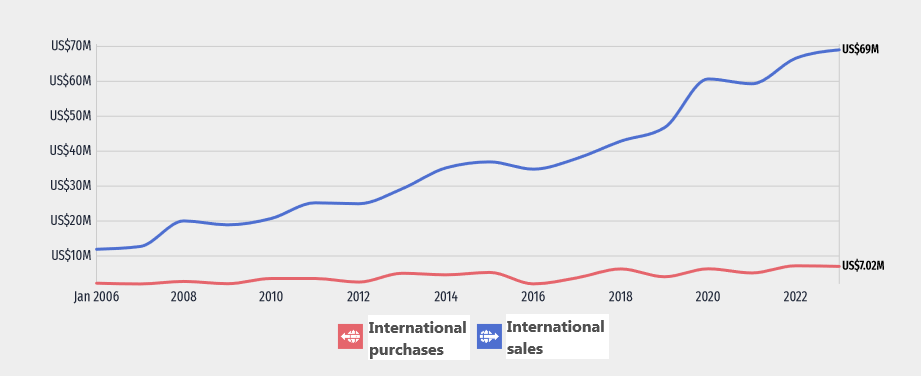

The sesame oil industry increased its international sales by 60% over 2018-2023. According to the Mexican Ministry of Economy, trade was valued at US$69 million in 2023 (see figure 11). A large part of this growth was realised by the European demand, which reached €30.9 million in 2023 (see figure 10). The main market for Mexican sesame oil remains the United States. Because Mexico has such a big market nearby, it is easier for other supply countries to compete on the European market.

Figure 11: Nett annual international trade of sesame oil according to customs data,

in US$ million

Source: Ministry of Economy, Mexico (2024)

Tip:

- Find more info about Mexico’s trade in sesame oil on Data México.

China: Number one sesame oil producer

China is the biggest producer, and possibly also the largest consumer, of sesame oil. The last known production figure (Faostat) was 268 thousand tonnes in 2021. Besides having a strong domestic demand, China is also the second-largest supplier of sesame oil to Europe after Mexico.

Enormous volumes of sesame seeds are imported to China. With an import volume of around 1 million tonnes annually, China is responsible for nearly half of the global sesame import. Another 435 thousand tonnes are being produced in the country. The scale of China’s operation makes it a competitive source for sesame oil production.

Singapore: Marketing sesame oil brands

Singapore does not have the same production capacity as China, but it is among Europe’s main suppliers of sesame oil.

Singapore seems to play a role in trading and branding sesame oil. There is a combined import volume of 3.2 thousand tonnes from Japan, China, Malaysia and India. A similar volume is exported, including to European buyers in the UK, Netherlands and France. Unlike China and Malaysia, Singapore has a free trade agreement with the EU, which allows them to export with 0% custom duties.

Surprisingly, in the trade statistics the trade is mainly documented as refined sesame oil, while the oil brands mentioned above mainly market pure toasted sesame oil.

India: Sesame oil commercialists

Sesame oil is a popular product in India. India is the largest sesame producer after Sudan, and one of the principal producers of sesame oil. There is a growing import from Europe that reached a value of €5.5 million in 2023. There is import to the Netherlands, France, the UK and Italy, but India’s main trade partners are the USA and Mexico.

Sesame oil producers in India generally use a higher-temperature extraction method. This amber-coloured sesame oil is known as gingelly oil. Under this name it is a niche product in Europe, and very attractive for Indian food enthusiasts.

Indian sesame oil manufacturers are notably putting a lot of effort into commerce. Companies like B.N. Exports Private Ltd. and Idhayam use online shops or platforms such as Amazon to reach potential consumers directly.

Other upcoming competitors: Myanmar and Africa

Europe has no official or direct import of sesame oil from Myanmar, but the country is worth mentioning as a potential competitor. Myanmar is the world’s second largest producer of sesame oil (131 thousand tonnes) and the third largest producer of sesame seeds (761 thousand tonnes in 2022). Oil extraction technology is poorly developed, and most sesame oil is produced on a small scale for local consumption. The current export goes to other Asian countries, mainly China.

The European import of sesame oil from the African continent is still small. Considering the scale of sesame production and the potential for organic farming, several African countries have the opportunity to position themselves as organic sesame oil suppliers. European buyers recognise the production capacity of sesame in Africa, but only few companies seem to have succeeded tapping into the sesame oil market.

Sudan is the world’s largest producer of sesame seeds. Other African countries like Tanzania, Nigeria, South Sudan, Ethiopia and Uganda are also among the top-10 producers. The sesame oil production in these countries is much lower than that of China, Myanmar and India. At the same time, organic import data shows that Burkina Faso and Kenya are the main suppliers of organic sesame oil to Europe after Mexico.

Burkina Faso only produced 534 tonnes of sesame oil, according to the latest Faostat data in 2021. In the same year, the EU imported 353 tonnes of organic sesame oil from there. The EU import of organic sesame oil is gradually growing, supported by integrated companies like Olvea. Other countries could also compete through this type of supply chain integration.

Source: Faostat (2024) (*Ethiopia not included; sesame oil production unknown)

Source: ITC Trade Map (2024)

Tips:

- Focus on quality and a reliable supply of sesame oil. This is more important than the untapped potential of a large production and processing capacity.

- Try to become a strong supplier in your home market before competing over an international market share. Most sesame oil production in the world is a domestic activity. Your chances on the European market will increase if you are already an experienced processor.

Which companies are you competing with?

The companies you compete with include specialised producers of sesame oil, multinational commodity suppliers and foreign brands. Despite the potential competition, there is room for differentiation or specialisation.

Sesajal: specialised in sesame products

The Mexican company Sesajal has developed products derived from oilseeds grown in Mexico. Among their specialisation is a variety of organic, virgin, toasted and flavoured sesame oil for the national and international market. For the local market they have their own brands, but their investment in innovative technology makes them competitive at an international level. Besides sesame oil, Sesajal is also one of the biggest tahini suppliers to Europe.

The company has its own sustainability programme, in which they give attention to the environment, their workers and the community. Initiatives like these are good for building a positive reputation in Europe.

Wilmar: A sesame/vegetable oil giant

Based in Singapore, Wilmar is one of the biggest multinationals in tropical oils. They are mainly active in Asia, but their presence extends to Europe and Africa with over 1,000 manufacturing plants worldwide. In Europe, Wilmar is the largest refiner of tropical oils. Market coverage, size and capital power are big advantages in the oil industry. This also helps to streamline certifications: Wilmar works with FSSC22000 for food safety and ISO14001 for environmental management, among others.

With large-scale operations, this company competes on different levels, from processing to consumer brands. In Europe you can expect competition as well. However, sesame oil remains a specialty oil and the main focus of Wilmar is the Asian market. Specialisation in smaller markets and specific products is a way to compete with these commodity multinationals.

Lee Kum Kee: The international brand from China

One of the successful sesame oil brands is Lee Kum Kee from China, selling their oil to over 100 countries. The company promotes Chinese cuisine worldwide. They provide a multitude of cooking tips and recipes. Being a traditional Asian brand makes them popular in the ethnic food channels of Europe.

Tip:

- Think about your strategy: what are your key strengths and which market suits you best? You can compete by dominance and scale of your operations, or you can specialise and innovate. Look for niches where you have a competitive advantage. For smaller suppliers it makes sense to look for specific consumer groups or to emphasise your positive impact on the community and the environment.

Which products are you competing with?

Sesame oil is a specialty in Europe. It is a popular culinary oil, especially in Asian cuisine. For flavouring, sesame is preferred over many other oils. For functional purposes there is more competition from other vegetable oils.

Finishing or flavouring oil

For Asian food, toasted sesame oil is the preferred flavour-maker. Toasted sesame oil is ideal as a finishing oil for noodles or salads. As an ingredient, sesame oil is ideal for use in marinades, salads, soups or sauces. Olive oil and butter are also popular ingredients for sauces. Overall, one of the main oils for flavouring in Europe is virgin or extra virgin olive oil, especially in the Mediterranean region. Other oils that may compete with sesame oil are walnut oil, avocado oil and flavoured oils such as truffle-flavoured olive oil and garlic-infused sunflower oil.

Cooking oil

Virgin sesame oil can be used for sautéing and frying. But for high-temperature frying and stir-frying, oils tend to be refined. This is where sesame oil loses some of its competitive advantage because the flavour becomes more neutral. In Europe, popular oils for frying are refined olive oil, sunflower oil and rapeseed oil (canola). Groundnut oil is a popular frying oil for Asian dishes instead of sesame because of its high smoking temperature. Alternatives for high-temperature cooking are ghee or special frying products that contain mixtures of oils, including soybean oil and palm oil.

Industrial ingredient

The food industry often uses other oils that are cheaper than sesame oil. As a functional oil, sesame oil has a lot of competitors. However, you can find some volumes of highly refined sesame oil in skin or hair cosmetic products and in pharmaceutical formulations of lipophilic drugs, injectables and syrups.

As a healthy oil

Sesame has some health benefits, or at least it is sometimes promoted as such. Sesame oil contains the antioxidants sesamol and sesaminol and has anti-inflammatory properties. In the healthy oil segment you can expect competition from products like coconut, linseed, avocado and chia seed oils.

Tip:

- Diversify your product portfolio and try not to depend on sesame oil alone. Find other tropical oils and ingredients. This will make you better prepared for competing products, plus give you the advantage of combining shipments with different products.

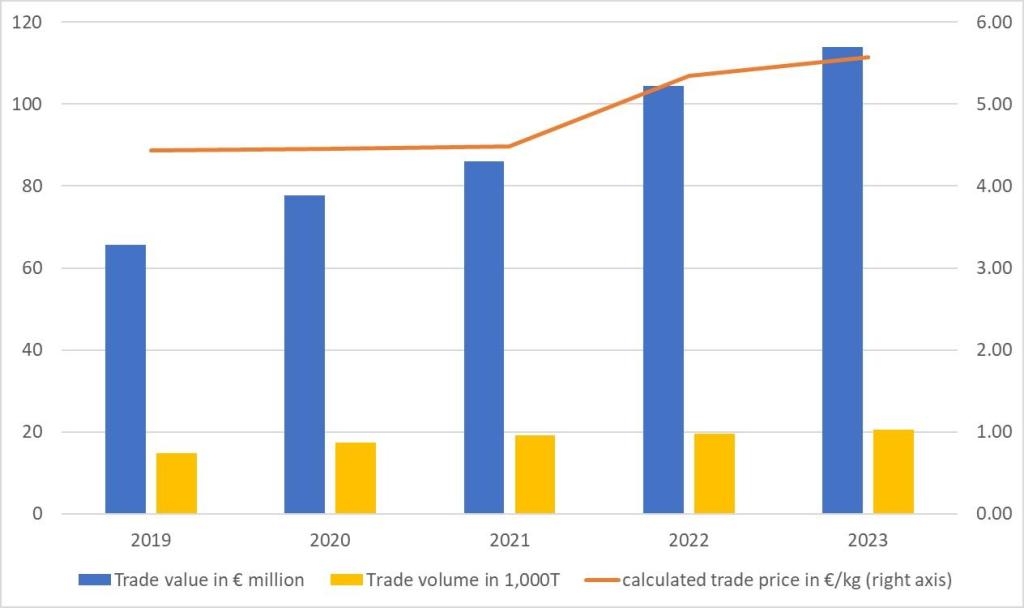

4. What are the prices of sesame oil on the European market?

The prices for sesame oil have increased in recent years (2022-2023). This is mainly due to the higher costs of sesame seeds and recently also due to high transport costs because of conflicts in the Suez Canal. The average import price in Europe was around €5.50 per litre in 2023. The trade price difference between crude sesame oil and processed or refined oil is around €1 per kg.

The margins in the supply chain vary greatly. Quality, type of process, brand and package size have a major influence on the final consumer price. Figure 15 provides only an indication of how margins are divided. It is safe to say that the costs are roughly divided into one-third in origin and two-thirds in destination. At the end of the supply chain the consumer may pay €15 per kg for a private label bottle (250ml), or €25 per kg for a branded label. For organic sesame oil the price can be higher. The larger the packaging, the lower the price. For example, the wholesaler Oliemeesters sells 190kg drums of organic and refined sesame oil for €9 per kg (price level June 2024).

Figure 14: Calculated import prices in Europe

Source: ITC Trade Map, calculations by ICI Business (2024)

Source: Industry sources, ITC Trade Map, calculations by ICI Business (2024)

Tips:

- Make realistic and detailed cost calculations. Quality, supply and demand determine the price of your sesame oil. But as a supplier you must make your own cost calculation and check if the trade price is realistic for your company.

- Find price trends for vegetable oils on FAO Markets and Trade, Business Analytiq, or in the overview of Tridge.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research