The European market potential for sesame oil for food

The European import value of sesame oil is increasing. It is a specialty product that fits several food trends. Developing countries play an important role in the supply. Highlighting social aspects and organic production can be interesting ways to differentiate yourself as a supplier in high-demand countries like the UK, the Netherlands, France and Germany.

Contents of this page

1. Product description

Sesame seed oil is one of the earliest oils known to men. Raw sesame seeds contain between 50% and 60% oil. There are different types of sesame oil, each with its own properties and uses.

Crude or virgin sesame oil is mechanically cold-pressed and filtered. This nutty-tasting oil is used for seasoning, for example in salads. Refined sesame oil can be used as a cooking oil or in cosmetics and pharmaceuticals. Toasted sesame oil is amber-coloured and more aromatic, and a popular ingredient for flavouring, especially in Asian cuisine.

Figure 1: Sesame plant with seed pods

Source: Franz Eugen Köhler, Köhler's Medizinal-Pflanzen, Public domain, via Wikimedia Commons, 2007

Sesame oil is both produced and imported by European businesses. It is used as a food ingredient and in the non-food industry, e.g. in cosmetics and pharmaceuticals. European buyers import sesame oil mainly for the preparation of foodstuffs (subcodes 15155019 and 15155099). The quantity of imported oil that is used in food applications in Europe varies between 60% and 100%, depending on the country. Switzerland (at 40%), France and Belgium (both at 30%) rank high in significant amounts of imported oil for industrial (non-food) uses.

This study focuses mainly on edible sesame oil for food preparations. The trade statistics in this study are based on the available figures under HS code 151550 – see codes below. For industrial uses, read about exporting sesame oil as a natural ingredient for cosmetics.

Table 1: HS codes and sub-codes for sesame seed oil

| HS-code: |

|

| Sub-codes: |

|

| |

|

Figure 2: Sesame seed oil from white and black seeds

Source: Pixabay (modified), retrieved June 2024

Tip:

- Read more about the history and processing of sesame seeds on the website of the US-based Agricultural Marketing Resource Center (AgMRC).

2. What makes Europe an interesting market for sesame oil?

The European import value of sesame oil is rising. For European buyers it can be interesting to import specialty oils instead of pressing them in Europe. Oil mills in Europe are not always specialised in pressing sesame seeds or other niche oilseeds. Importing sesame oil can also be a more efficient option. Developing countries play a central role in the production and supply of sesame seed oil.

Search for efficiency provides opportunities for sesame oil-pressing in origin

Sesame oil is a high-value oil that can be used for different culinary purposes, but the press cake has a low value. According to industry sources, there is still little high-value use for the oil cake or dried sesame flour in Europe. For some companies it is inefficient and expensive to switch a lot between different oilseeds on the same oil press. As a sesame oil producer you can help European oil companies save in efficiency and costs by selling only the oil and leaving the by-products for domestic use in your home country. Sesame press cake is suitable for feedstuffs, but you can also use it to create a local market for high-protein foods.

The sesame oil import is gaining market share in the total sesame trade. The share in trade value went up from 8% in 2019 to 11.4% in 2023. Still, most of the oil pressing is done within Europe. According to Faostat, Europe processed almost 40 thousand tonnes of oil, equal to 25% of the total sesame seed import. This shows that there is still a potential gap to expand the trade of sesame oil.

As a supplier you can combine the production of sesame oil with other oils for the local and international markets. By offering a more diverse product portfolio it will be easier to fill containers and fulfil the potential demand. In Europe you will find demand for products such as avocado oil, shea butter, olive oil, moringa oil and palm oil alternatives.

Source: Calculation based on ITC Trade Map (June 2024)

Tip:

- Get more insights into the evolution of the European industry of oilseeds, vegetable oils and meals through the website of Fediol, the federation representing the European Vegetable Oil and Proteinmeal Industry. You can also find more regular market updates on the Commodity Information Service of CMB News.

Developing countries benefit from a growing import value

Developing countries play an important role in the production and export of sesame oil. Growing sesame is often associated with small-scale farmers in dry, tropical regions. A large part of the production takes place in developing countries like Sudan, India, Myanmar and Tanzania. Oil-pressing is also common in production countries, with leading volumes in China, Myanmar, India, Nigeria, Turkey, Uganda, Sudan and Mexico.

The European import value of sesame oil has increased over the years, from €41 million in 2019 to nearly €69 million in 2023. Developing countries represent three-quarters of the total import value.

To become part of the growing demand for sesame oil, you must have a facility that meets European food safety standards and the right oil quality.

Source: ITC Trade Map (June 2024)

Tip:

- Produce sesame oil according to food safety standards suitable for the European market. See also the buyer requirements when entering the European market for sesame oil.

Opportunity for organic oil and fair sourcing

The European market offers opportunities for organic products. The average share of organic sesame seeds in import was around 12.5%. For sesame oil this was around 6.7%, and there is still room for growth, especially among health-minded consumers.

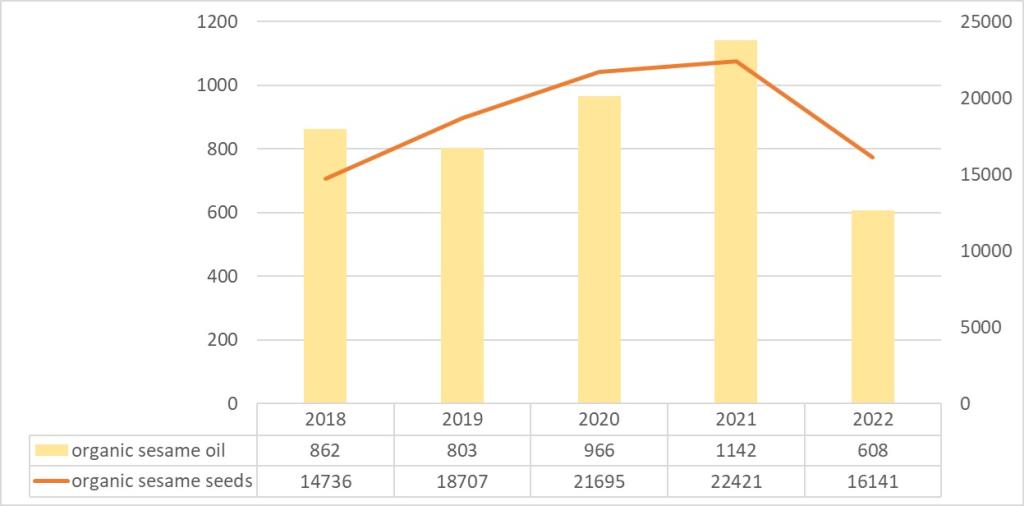

Trade figures in the European Union (EU) show a gradual growth of organic import of sesame seeds and oil between 2018 and 2021. The latest figures from 2022 show a dip in volume. This dip can be attributed to a lower product availability as well as the pressure from high organic prices. More recently (2023-2024), the demand for organic sesame has been stronger than the supply.

Some of the companies that source sesame seeds or oil in developing countries invest in fair sourcing. France is one of the countries where you can find these companies.

Figure 5: European Union import of organic sesame seeds and oil, in tonnes

Source: EU Traces (June 2024)

Tips:

- Find European companies that are specialised in organic oils or ingredients. The Organic-bio database can be a good start.

- Browse organic production and market data on the website of IFOAM Organics Europe. It provides an interactive infographic on the whole EU market.

3. Which European countries offer the most opportunities for sesame oil?

The UK, the Netherlands, France and Germany are the top import countries for food-grade sesame oil. The UK and France offer the largest end markets, while Germany is strong in processing and the Netherlands in trading. Spain is emerging, but still has little import from developing countries. A large share of Switzerland’s imports come from developing country exporters, but most of it is destined for industrial use (cosmetic or pharmaceutical).

Source: ITC Trade Map (June 2024)

Source: ITC Trade Map (June 2024)

United Kingdom

The UK is one of the biggest markets in Europe for sesame oil import. Its import value exceeded €22 million in 2023. Since the country is no longer part of the European Union (Brexit), the opportunity for direct supply from origin has increased.

Most imported sesame oil is either refined or processed, such as roasted sesame oil. There is no data on domestic oil production, but the capacity of sesame processing is considered to be lower than in countries like Germany and France.

The interest in sesame oil for food flavouring is on the rise. One of the reasons for this is the growing popularity of Asian cuisine. Considering the fact that the UK is a typical end market, it offers good opportunities for ready-to-eat oil and foreign brands. Several Asian brands are sold by stores like H-Mart, OrientalMart and Sous Chef, also online.

Nearly 50% of the UK’s sesame oil import, however, originates in Mexico (€11 million). Despite its domestic demand, Mexico produces sufficient quantities to be a net exporter of sesame seeds and oil. The UK, together with the USA, is one of the main buyers of Mexican sesame oil. Asian suppliers like China, India, Singapore, Japan and South Korea represent values between €0.4 and €2 million. Asia has a very strong local market demand to fill. It is of course possible that British companies are re-branding Mexican sesame oil as UK-based Asian brands. Consumers of Asian food may expect an Asian-looking sesame oil brand.

Asian cuisine is popular in the United Kingdom

“The UK's diverse population has played a significant role in driving the popularity of Asian cuisine. Individuals with cultural ties to these regions seek the taste of their homelands while others embrace the opportunity to explore new culinary territories.”

Source: ChefOnline

The Netherlands

The Netherlands is one of the main entrance points for sesame oil into the European market. Dutch buyers mainly position themselves as intermediaries, importing and exporting both crude and processed sesame oil.

In 2023 just over 4 thousand tonnes of sesame oil was imported, while 3.5 thousand tonnes was (re-)exported. Most of the (re-)exported oil is destined for Germany, where some of the refining takes place before being sold to different market channels. Through the Netherlands you can also reach the Spanish market, which is a growing buyer of sesame oil.

The remaining sesame oil was destined for the domestic market. The Dutch market is much smaller than that of the UK. But the diversity in consumers and Asian cuisine is similar. And here too, Mexico is the main supplier, followed by several Asian countries.

Because Dutch traders serve a variety of markets and clients, there are opportunities for several niche products, such as certified organic oil. In 2018-2022 the Netherlands was the largest importer of organic sesame oil, with an average annual volume of 356 tonnes.

Table 2: Sesame oil trade in the Netherlands in 2023, in tonnes (T)

| Edible/food-grade oil | Import | Export/re-export |

| Crude sesame oil | 1,684 T | 1,315 T |

| Processed/refined sesame oil | 2,358 T | 2,169 T |

Source: ITC Trade Map, 2024

Tip:

- Use the Netherlands as a distribution hub for your sesame oil. You can also find service providers that can help you out with refining, packing and warehousing your product, like Special Refining Company (SRC).

France

Sesame oil import in France is rising. The demand is growing for both gastronomic purposes and cosmetics. Food is the main market for sesame oil, and around 27% of the import in 2023 had an industrial destination.

Mexico accounted for over one-third of the non-European supply in 2023 (1.2 thousand tonnes). Burkina Faso is another relevant supplier, with 0.8 thousand tonnes in 2023.

France is a strong producer of sunflowers, rapeseed and walnuts. It also has a number of oil mills (‘huileries’). Some of them are represented by the Fédération Nationale des Industries des Corps Gras (fncg). Artisanal oil mills have grown into larger enterprises but have kept their traditional values and maintained a close relationship with the farmers. La Tourangelle and Bio Planete (organic) are among the well-known oil producers.

Because sesame is a non-European crop, and not part of traditional oil milling, there could be opportunities to supply sesame oil. Storytelling, organic quality and fair trade concepts could help your company relate to France’s oil-milling tradition.

Tip:

- Find some of the key players in flavoured oils in France through the member base of the Federation of the fatty industries (fncg).

Germany

Germany is known to be one of the biggest European players in oil pressing. According to Faostat, Germany produced an average annual volume of 13 to 14 thousand tonnes of sesame oil between 2018 and 2022.

This is why Germany has one of the highest import volumes of sesame seeds. On top of that, companies import between 2 and 3 thousand tonnes of sesame oil annually. Importing oil can be motivated by factors like price or lack of domestic capacity of specialisation. The oil comes from a variety of European and non-European sources. The main German demand is for edible or culinary sesame oil.

As a supplier you can also choose to explore the organic market. Germany has the highest retail sales for organic products in Europe. And together with the Netherlands, the German market buys the most organic sesame and organic sesame oil in Europe.

Tip:

- Visit Biofach to connect to organic buyers in Germany and other European countries. Biofach is the largest trade fair for organic products in Europe.

Spain

Spain has shown the biggest growth in recent years. Sesame oil import value increased from less than €1.7 million in 2020 to more than €8 million in 2023. Refined food-grade oil and crude sesame oil for industrial uses experienced the strongest growth. This growth is mainly attributed to imports from the Netherlands and France. The import from non-European suppliers is still low. The direct supply from developing country producers has potential to grow.

Spain is one of the biggest consumers of vegetable oils, especially olive oil and sunflower oil. In a country dominated by olive oil, sesame is a niche product. However, statistics show that the market is diversifying. The rising prices for olive oil could also make sesame oil an attractive alternative oil, although its consumer prices are still higher than olive oil.

Sesame is also promoted as a healthy oil by different media channels such as Oriental Market and El Mundo. Health food brands like Natur Green include sesame oil and are familiar at main retailers such as Carrefour and El Corte Inglés.

Source: Statista (release date May 2024)

Switzerland

Switzerland imports sesame oil much less than the main importers. However, the Swiss market is an end market that offers opportunities for direct supply. Swiss companies do not re-export imported oil. In terms of value that remains in the country, it comes in third place in Europe after the UK and France. Exporters from developing countries are responsible for a third of the Swiss import value. China and Mexico are key suppliers. Minor imported volumes are also registered from Uganda, India, Sri Lanka and Burkina Faso.

As in other European countries, most sesame oil is imported for culinary purposes. Switzerland does have a relatively high percentage of oil import for industrial uses, such as cosmetics (42% in 2023), but for developing countries the highest values concern food-grade oil: crude sesame oil (55%) and processed oil (29%).

Tip:

- Learn more about the non-food market for sesame oil in the reports on Exporting sesame seed oil as a cosmetic ingredient to Europe.

4. Which trends offer opportunities or pose threats in the European sesame oil market?

Food trends in Asian cuisines and plant protein can strengthen each other in stimulating sesame oil consumption. Consumers of Asian food value the taste of sesame oil, and the search for protein foods also increases the use of sesame seeds. In a growing market, strategic partnerships and social storytelling can contribute to a successful sesame oil business.

Popularity of Asian cuisines

Asian cuisine is popular in Europe and appeals to many types of consumers. The sales of ethnic foods are increasing with a forecasted annual growth of 7%. The enduring interest in Asian food provides room for authentic flavours such as sesame oil. At the same time, Asian ingredients fit well with the needs of plant-based lifestyles (see trend below). In Asian cuisine, toasted sesame oil is used the most. It has a stronger taste and is ideal as a finishing oil (after cooking).

Figure 9: Example of toasted sesame oil

Source: Photo by amanda888 per Open Food Facts (retrieved June 2024)

Increasing demand for plant-based food

Consumption of meat is slowly declining in Europe, and consumers are looking for other sources of protein. The plant-based food sector experienced a growth of 21% between 2020 and 2022. Rising demand for plant-based proteins can also contribute to the commercial development of sesame oil.

Sesame oil has always been the higher-valued commodity over press cake. In the search for higher-value markets for sesame protein meal and flour, sesame oil will become more cost-competitive. A more profitable sesame oil cake can cover part of the costs of pressing the oil.

The Israeli seed specialist Equinom and the Mexican company Dipasa have worked together to develop a high-protein sesame variety that contributes to the taste and texture of plant-based food and beverages. Sesame is also a tasteful source of protein next to other Asian, plant-based ingredients like soybean, dal (split pulses), tofu and tempeh.

Sesame has social importance

In many countries, sesame is cultivated by smallholder farmers. For sourcing companies it is an ideal crop to set up farmer projects and promote their social impact. In more and more food brands in Europe you can see stories of such projects and the origin of their ingredients.

So far, few companies have taken the opportunity to focus on the social aspect of sesame oil. Athi River Oils in Kenya has certified its oils with Fair for Life. The Japanese brand Kuki Sesame sources fair trade sesame in Nicaragua and uses it to make a quality sesame oil that is also sold in European shops like Tjin’s International Foodstore. Fairoils develops sourcing projects with a positive impact on local communities in Uganda, and has an oil mill facility in Kenya.

There are also several companies with fair trade sesame oil in Europe, like Huilerie Moog (Bio Planète), Huilerie Emile Noël and OLVEA.

Supply chain partners are key for setting up oil business

European companies and non-governmental organisations (NGOs) can be strong partners in setting up oil mills. In fact, several sesame oil plants in producing countries involve international partners. This shows there is interest in adding value to sesame seeds in the producing regions.

The company OLVEA has developed several partnerships with NGOs and development agencies like the Austrian Development Agency, USAID and ICCO. This has helped them organise a fair trade cooperation with farmer groups and set up an oil production site in Burkina Faso. Burkinature also emerged from an NGO project and now supplies sesame and fresh and dried mangoes to Europe. They sell sesame to Bio Planète, one of the largest organic oil mills in Europe. The company WepoOil offers a technology and a partnership for chemical-free oil pressing at farmer level.

Throughout Africa and developing countries elsewhere there is a lot of support from NGOs and development organisations to improve farmer livelihoods. For sesame companies and farmer groups, these organisations can be a great help to start adding value to their crops.

Figure 10: Video on sesame oil production by OLVEA in Burkina Faso

Source: OLVEA (YouTube), 2020

Tips:

- Try to diversify your offer by combining sesame oil with sesame seeds, flour, and possibly other seeds and oils. Diversification will make your company more flexible and more resilient to market fluctuations.

- Find partnerships with European oil companies and connect with development agencies that are active in your country. When developing a project with funding, try to connect it to the United Nations Sustainable Development Goals.

- Get a better understanding of which trends influence the demand of grains, pulses and oilseeds by reading the CBI Trends study.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research